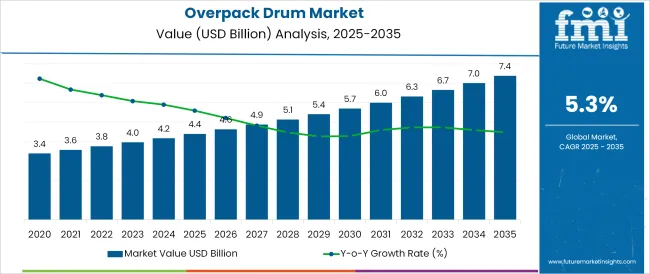

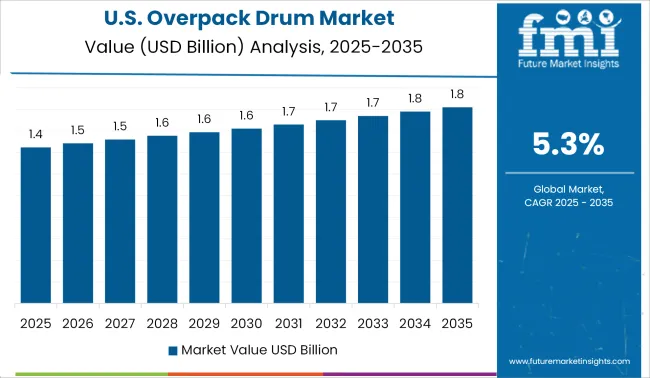

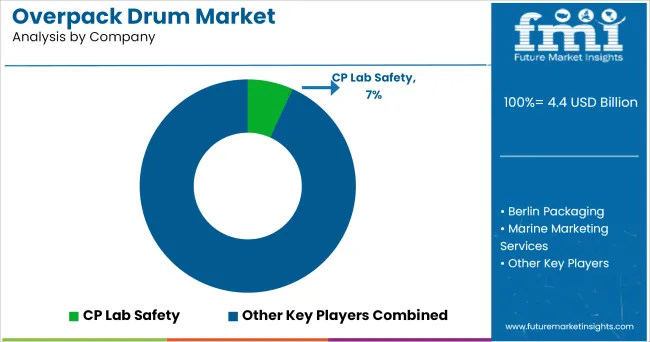

The Overpack Drum Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The overpack drum market is witnessing robust growth, supported by rising regulatory emphasis on hazardous material containment and industrial safety compliance. Industries such as chemicals, oil & gas, pharmaceuticals, and waste management are increasingly adopting overpack drums to safeguard against leakage and contamination risks during storage and transit. Global environmental protocols and stringent UN/DOT guidelines on hazardous waste packaging have further fueled the adoption of overpack drums that offer structural integrity and compatibility with diverse materials.

Technological improvements in sealing systems, corrosion resistance, and durability have enabled manufacturers to meet demanding transport safety standards. Furthermore, the shift toward spill prevention and incident containment strategies has resulted in broader usage across emergency response scenarios.

The market is expected to continue on a positive trajectory as manufacturers expand product lines with enhanced closure mechanisms, ergonomic designs, and diversified capacities to address the evolving needs of industrial and environmental safety operations.

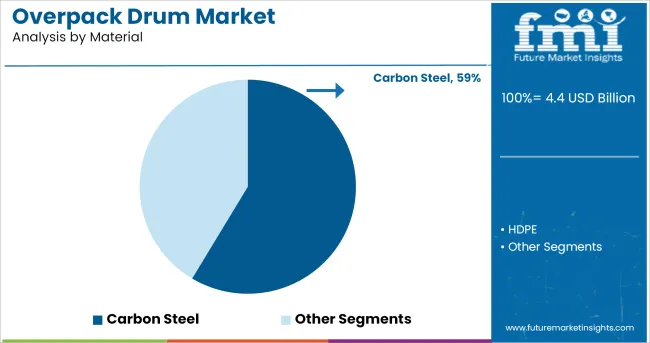

It is identified that carbon steel accounts for 58.60% of the total revenue within the material segment, making it the leading sub-category. This dominance is underpinned by carbon steel’s high tensile strength, cost-effectiveness, and excellent compatibility with hazardous substances.

Its durability against mechanical damage and structural integrity under extreme conditions has reinforced its preference for overpack drum construction. Additionally, carbon steel offers superior resistance to punctures and impact—essential in applications involving reactive, flammable, or toxic substances.

The material’s recyclability has also aligned with industry sustainability goals, further enhancing its appeal. As organizations prioritize long-term containment solutions that withstand transportation stress and rough handling, carbon steel has continued to maintain a stronghold in the overpack drum material landscape.

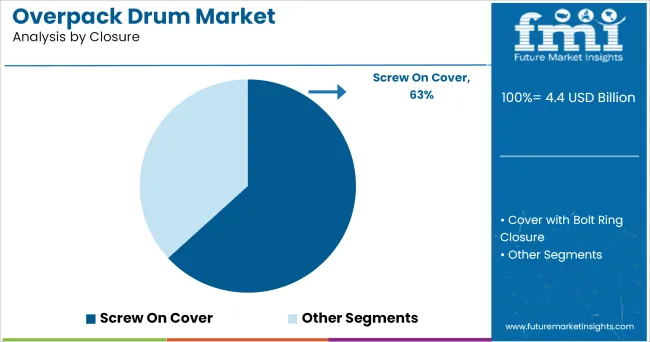

The screw on cover closure segment is projected to hold 63.20% of the overall revenue, establishing it as the dominant closure mechanism in the market. This preference is largely driven by the closure’s ability to provide a secure, leak-proof seal while allowing for repeated use without degradation.

It is widely favored for emergency spill response and secondary containment where quick, tool-less access is required. The screw-on mechanism also enhances operational safety by reducing the risk of accidental dislodging during transit.

Its compatibility with different drum sizes and ease of alignment during high-volume industrial operations have contributed to its widespread adoption. As regulatory frameworks increasingly stress tamper-evident and re-sealable packaging, the screw on cover has emerged as the most reliable and industry-preferred solution.

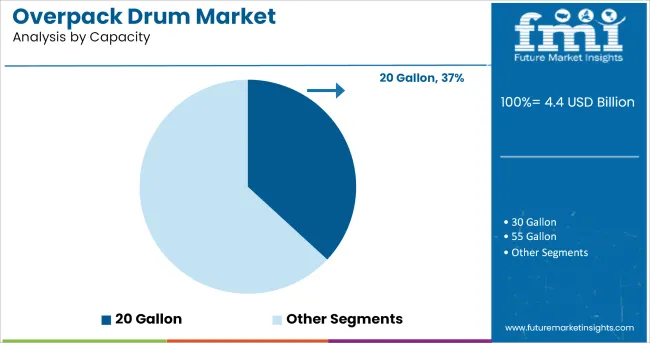

The 20 gallon segment holds 36.90% of the market within the capacity category, reflecting its prominence in medium-duty containment applications. This size is particularly suited for handling smaller quantities of hazardous or non-conforming materials where space efficiency and mobility are critical.

It is widely used in facilities requiring frequent overpacking of leaking drums, damaged containers, or laboratory waste. The 20 gallon drum’s compact design allows for convenient handling, storage, and transportation, especially in confined industrial environments or emergency response vehicles.

Additionally, its adaptability across sectors such as chemical processing, healthcare waste, and municipal spill control has driven continued demand. As operational agility and regulatory compliance remain top priorities, the 20 gallon capacity has emerged as the optimal balance between functionality, handling convenience, and storage efficiency.

The prime driving factor of the overpack drum market is incessant development in the manufacturing and industrial sector. Developing economies such as India and low cost, manufacturing countries like China are forecasted to have a comparatively higher rate of growing demand for overpack drum. Owing to these reasons developing regions such as the Asia Pacific will emerge as a focal point with a greater growth rate in the overpack drum market share.

As the industrial output is anticipated to increase with developing economies demand for industrial packaging solution such as overpack drums are anticipated to rise in the global market. As the retail demand is rising need for international trade is gaining importance more than ever. Manufacturers are relentlessly striving for innovations in terms of design, material, and more to enhance the overall user experience with overpack drums.

USA Department of Transport (DOT) and Pipeline and Hazardous Materials Safety Administration (PHMSA) has laid out certain agreements that have to be followed for shipping any dangerous material across the global market. This rating system also known as UN certified or POP (performance oriented packaging).

This has enhanced the inevitability of securing a DOT and UN rating embossed over the overpack drum to claim superior functionality and safety. End users in the global market are also looking for such label claims on the overpack drums to ensure whether the packaging material is suitable for use.

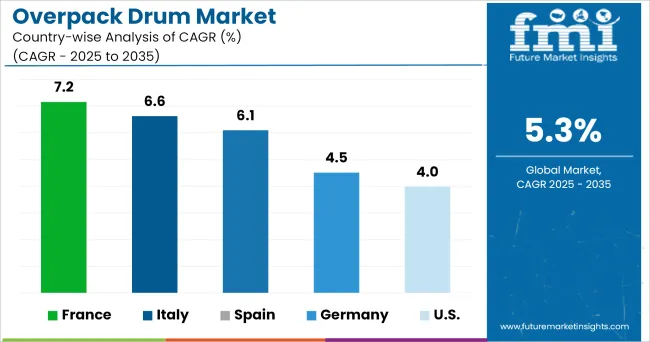

The United States is considered a hub for the trade of several commodities, owing to which packaging solutions such as overpack drums are considered a necessity. Along with this strong demand, manufacturers are continuously striving for several innovations.

USA Department of Transportation is responsible for regulating and monitoring material and overall features of overpack drums for maintaining safety assurance. United States has a high demand for overpack drums that comes from several business and government agencies, for instance, Procter & Gamble, Honeywell International Inc., The Kraft Foods Group, USA Military, and many more.

India and China are one of the prime markets that have witnessed a rapid growth in demand for packaging solutions such as overpack drums, as these countries are some of the largest manufacturers of essential commodities. A large share of the region’s production is exported to the global market, which commensurate to the demand of overpack drum for safe transport of goods across the borders.

Availability of large reserve of resources and vast coastal line brings another competitive edge for being the trade hotspot for the global market, thus becoming prominent region for the overpack drum market as well. Manufacturers are overpack drum are aiming to establish its physical presence over these hotspot of the market to gain maximum advantage.

Some of the leading manufacturers and suppliers of

Key manufacturers of overpack drums such as ENPAC are striving to enhance market penetration by publicizing the product as eco-friendly. For instance, ENPAC promotes its overpack drums to the end user by projecting the eco-friendly application which helps spillage of chemicals, oils, and others throughout the supply chain.

The companies are promoting the application of overpack drum as they state, spillage over transport or workplace could cost over USD 30,000 per incident, excluding the fee imposed by a government agency. Owing to this market penetration is anticipated to rise over time.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global overpack drum market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the overpack drum market is projected to reach USD 7.4 billion by 2035.

The overpack drum market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in overpack drum market are carbon steel and hdpe.

In terms of closure, screw on cover segment to command 63.2% share in the overpack drum market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Overpack Drum Providers

Drum Melters Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Pump Market Growth - Trends & Forecast 2025 to 2035

Drum Liner Market Analysis - Size, Share & Industry Forecast 2025 to 2035

Breaking Down Market Share in the Drum Liner Industry

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Trends - Growth, Demand & Forecast 2025 to 2035

Fiber Drums Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Landscape of Fiber Drums Market Share

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA