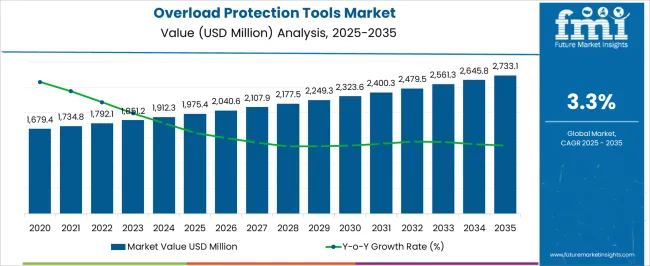

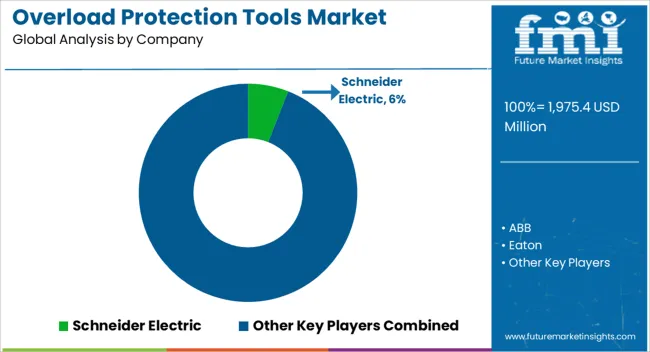

The global overload protection tools market is estimated to be valued at USD 1.98 billion in 2025 and is projected to reach USD 2.73 billion by 2035. This represents an absolute increase of USD 750 million over the forecast period, equivalent to a growth of 38.3% between 2025 and 2035. The market expansion is anticipated to occur at a CAGR of 3.3%, with the overall market size expected to grow by nearly 1.38X by the end of the decade.

The market is growing as industries place greater emphasis on equipment safety, reliability, and compliance with international standards. With the expansion of manufacturing, construction, automotive, and energy sectors, machines and electrical systems are increasingly exposed to risks of excessive load and current. Overload protection devices safeguard against equipment damage, costly downtime, and workplace hazards, making them essential for operational efficiency. Rising automation, electrification, and integration of advanced machinery further amplify demand. Additionally, stricter safety regulations, increasing adoption of smart monitoring technologies, and growing awareness of preventive maintenance are accelerating global adoption of overload protection tools.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.98 billion |

| Industry Size (2035F) | USD 2.73 billion |

| CAGR (2025 to 2035) | 3.3% |

Between 2020 and 2025, the overload protection tools market expanded from USD 1.72 billion to USD 1.98 billion, supported by increasing industrial production, infrastructure modernization, and growing awareness about electrical safety standards. The market witnessed steady adoption of electronic protection devices over conventional thermal relays, particularly in manufacturing and process industries where precise motor protection was essential for operational efficiency.

Between 2025 and 2030, the overload protection tools market is projected to expand from USD 1.98 billion to USD 2.32 billion, recording a value addition of USD 345 million during this phase. This growth trajectory is expected to be supported by increasing industrial automation across manufacturing facilities, expanding infrastructure development in emerging economies, and rising demand for motor protection systems in HVAC applications. The adoption of electronic overload relays over traditional thermal protection devices is anticipated to drive market evolution during this period.

From 2030 to 2035, the market is forecast to grow from USD 2.32 billion to USD 2.73 billion, adding another USD 405 million in value. This second phase of growth is expected to be characterized by advanced digitalization of industrial processes, integration of IoT-enabled protection systems, and stricter regulatory requirements for electrical safety standards. The increasing deployment of three-phase motor systems across industrial applications will further bolster demand for sophisticated overload protection solutions.

The growth of the overload protection tools market is being driven by several converging factors that reflect the broader industrial transformation occurring globally. Industrial automation continues to expand across manufacturing sectors, creating substantial demand for reliable motor protection systems that can ensure continuous operations while preventing costly equipment damage from electrical faults.

The increasing complexity of modern industrial processes requires more sophisticated protection mechanisms than traditional thermal relays can provide. Electronic overload relays offer enhanced accuracy, faster response times, and advanced diagnostic capabilities that align with Industry 4.0 requirements. These devices can integrate with plant-wide monitoring systems, providing real-time data on motor performance and predictive maintenance insights.

Infrastructure development in emerging economies is creating significant opportunities for overload protection tool manufacturers. New industrial facilities, commercial buildings, and infrastructure projects require comprehensive electrical protection systems from the outset. The emphasis on energy efficiency and operational reliability in these projects drives demand for advanced protection technologies.

Regulatory frameworks focusing on electrical safety standards are becoming more stringent across regions, mandating the use of certified protection devices in industrial and commercial applications. This regulatory push ensures market stability while encouraging innovation in protection technology design and functionality.

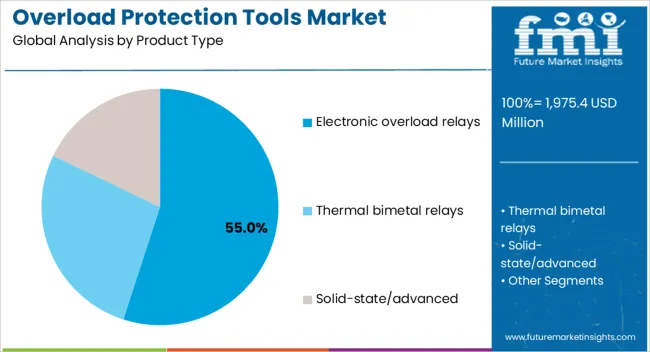

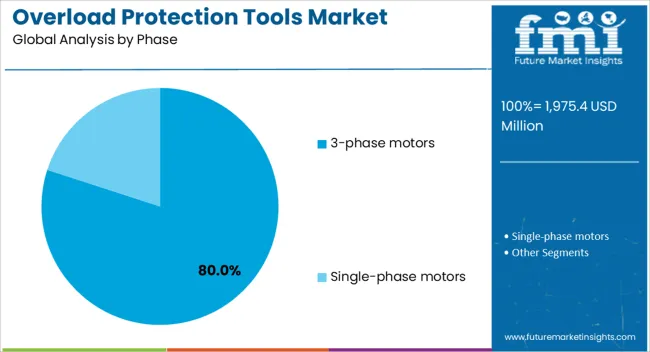

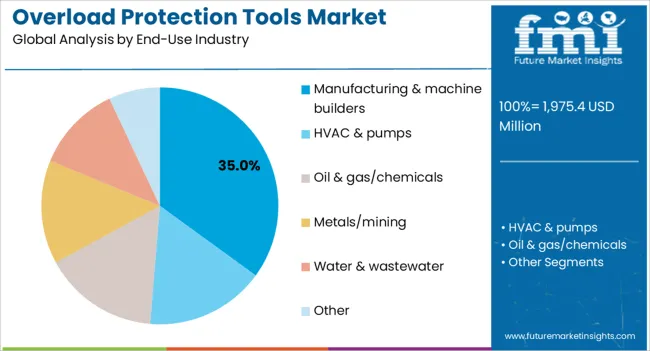

The market is segmented by product type, current range, phase, end-use industry, and region. By product type, the market is segmented into electronic overload relays, thermal bimetal relays, and solid-state/advanced protection systems. Based on current range, the market is divided into 33-100 A, ≤32 A, and >100 A. In terms of phase, the market is bifurcated into 3-phase motors and single-phase motors. By end-use industry, the market is categorized into manufacturing & machine builders, HVAC & pumps, oil & gas/chemicals, metals/mining, water & wastewater, and other. Regionally, the market is classified into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Electronic overload relays are projected to account for 55% of the global overload protection tools market in 2025, reflecting their superior performance characteristics compared to traditional thermal protection devices. These advanced systems offer precise current monitoring, adjustable trip curves, and diagnostic capabilities that align with modern industrial automation requirements.

The dominance of electronic overload relays stems from their ability to provide consistent protection across varying ambient temperatures, unlike thermal bimetal relays that can be affected by environmental conditions. Electronic devices also offer faster reset capabilities and can communicate status information to central control systems, making them ideal for automated manufacturing environments.

Industrial facilities increasingly prefer electronic overload relays for their flexibility in setting protection parameters and their compatibility with variable frequency drives (VFDs) and other advanced motor control systems. The ability to store multiple protection settings and switch between them based on operational requirements adds significant value for complex industrial applications.

Three-phase motor applications account for 80% of the overload protection tools market, reflecting the predominance of three-phase systems in industrial and commercial applications. Three-phase motors offer superior power density, efficiency, and reliability compared to single-phase alternatives, making them the preferred choice for most industrial processes.

The high market share for three-phase protection reflects the industrial nature of most motor applications requiring overload protection. Manufacturing facilities, processing plants, and infrastructure systems predominantly use three-phase motors for pumps, compressors, conveyors, and other critical equipment where reliable operation is essential.

Single-phase motor protection, representing 20% of the market, serves primarily smaller commercial applications, residential systems, and specialized equipment where three-phase power is not available or necessary. This segment includes applications such as small pumps, fans, and commercial HVAC equipment.

The manufacturing and machine builders segment is expected to represent 35% of the overload protection tools market in 2025, driven by the critical role of motor protection in automated production systems. Manufacturing facilities require reliable overload protection to prevent production disruptions and equipment damage that can result in significant financial losses.

Modern manufacturing operations depend heavily on motor-driven equipment for material handling, processing, and assembly operations. Any motor failure or unplanned shutdown can cascade through interconnected production systems, making robust overload protection essential for operational continuity. Electronic overload relays in manufacturing applications often integrate with plant-wide monitoring systems to provide early warning of potential issues.

The machine builders subsegment represents original equipment manufacturers (OEMs) who incorporate overload protection devices into their machinery designs. These applications require protection systems that can be easily configured and integrated with machine control systems while meeting various international safety standards for global market access.

The overload protection tools market is experiencing several transformative trends that are reshaping technology offerings and industry dynamics. Digitalization of industrial processes is driving demand for smart protection devices that integrate seamlessly with plant control systems, offering real-time monitoring, predictive maintenance, and enhanced safety features. Growing emphasis on energy efficiency, regulatory compliance, and workplace safety further strengthens adoption, while manufacturers increasingly focus on IoT-enabled and user-friendly solutions to gain competitive advantage.

The convergence of overload protection with Industry 4.0 initiatives is creating new opportunities for advanced functionality. Modern electronic overload relays can provide predictive maintenance data, energy consumption monitoring, and integration with enterprise resource planning (ERP) systems. This connectivity enables proactive maintenance strategies that reduce unplanned downtime and optimize equipment lifecycle costs.

Manufacturers are developing protection devices with built-in communication protocols that enable seamless integration with industrial networks. These systems can provide real-time motor performance data, historical trend analysis, and automated reporting capabilities that support data-driven decision making in industrial operations.

Growing focus on energy efficiency is influencing overload protection device design and selection criteria. Advanced electronic relays can monitor motor energy consumption and provide data for efficiency optimization programs. Some devices include features for detecting motor degradation that can impact energy efficiency before protection trip points are reached.

Sustainability considerations are also driving demand for longer-lasting protection devices with reduced environmental impact. Manufacturers are developing products with extended service lives and recyclable materials while maintaining high performance standards.

Different industrial sectors have unique requirements for overload protection that are driving product specialization. Oil and gas applications require explosion-proof housings and special certifications, while food and beverage industries need sanitary designs and special materials compatibility.

The water and wastewater treatment sector demands protection devices that can handle the corrosive environments and variable load conditions common in these applications. Mining and metals processing require ruggedized devices that can operate in harsh environmental conditions with high levels of dust, vibration, and temperature extremes.

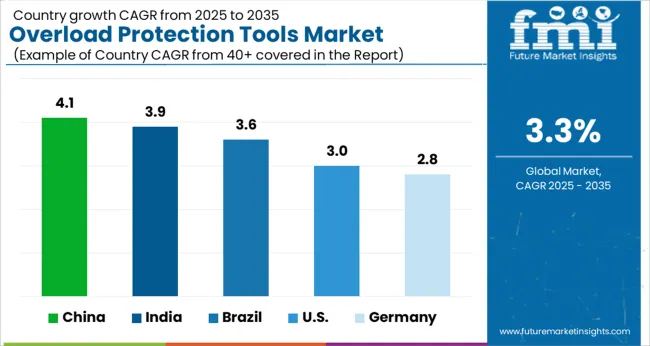

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.9% |

| Brazil | 3.6% |

| USA | 2.9% |

| Germany | 2.8% |

The revenue from overload protection tools in China is projected to grow at a CAGR of 4.1% from 2025 to 2035, the highest among major economies. The country's continued industrial expansion, infrastructure development, and manufacturing sector growth create substantial demand for motor protection systems across diverse applications.

China's position as a global manufacturing hub drives significant demand for overload protection tools in factory automation, process industries, and equipment manufacturing. The government's focus on industrial modernization and automation under the Made in China 2025 initiative supports adoption of advanced electronic protection systems over traditional thermal devices.

The rapid expansion of renewable energy infrastructure, including wind and solar installations, creates additional demand for overload protection in power generation equipment. Urban development projects and smart city initiatives contribute to growth in HVAC and building automation applications requiring sophisticated motor protection systems.

The overload protection tools market in India is expected to expand at a CAGR of 3.9% between 2025 and 2035, supported by industrial development, infrastructure investment, and increasing adoption of automated manufacturing systems. The country's Make in India initiative encourages domestic manufacturing across sectors, creating demand for reliable motor protection systems.

The expansion of India's manufacturing base, particularly in automotive, textiles, pharmaceuticals, and food processing, drives demand for overload protection tools. These industries require robust protection systems to ensure operational reliability and meet international quality standards for export markets.

India's power sector modernization and grid infrastructure development create additional opportunities for overload protection applications. Industrial facilities are increasingly adopting electronic overload relays to improve operational efficiency and reduce maintenance costs compared to traditional thermal protection systems.

The sales of overload protection tools in Brazil are projected to grow at a CAGR of 3.6% from 2025 to 2035, driven by industrial development in mining, oil and gas, and manufacturing sectors. The country's large industrial base and ongoing modernization efforts create consistent demand for motor protection systems across diverse applications.

Brazil's significant mining industry requires ruggedized overload protection systems capable of operating in harsh environmental conditions. The oil and gas sector, both onshore and offshore, demands specialized protection devices with appropriate certifications for hazardous locations. Manufacturing industries are gradually upgrading from thermal to electronic protection systems.

Infrastructure development projects, including transportation and utilities modernization, contribute to market growth. The emphasis on improving industrial competitiveness drives adoption of advanced automation technologies, including sophisticated motor protection systems that integrate with plant control networks.

The USA overload protection tools market is anticipated to rise at a CAGR of 2.9% from 2025 to 2035, reflecting a mature market with steady replacement demand and selective adoption of advanced technologies. Industrial facility upgrades and automation projects drive demand for electronic overload relays with enhanced functionality.

The USA market is characterized by high adoption of advanced electronic protection systems in manufacturing, chemical processing, and infrastructure applications. Regulatory requirements for electrical safety and environmental compliance support demand for certified protection devices with enhanced diagnostic capabilities.

Infrastructure modernization, particularly in water treatment, transportation, and power generation, creates opportunities for overload protection system upgrades. The focus on industrial competitiveness and operational efficiency drives adoption of smart protection devices that provide predictive maintenance capabilities.

Germany’s overload protection tools market is set to expand at a CAGR of 2.8% between 2025 and 2035, supported by the country's advanced manufacturing sector and emphasis on industrial automation excellence. The Industry 4.0 initiative drives demand for smart protection systems that integrate with digital manufacturing networks.

Germany's position as a global leader in manufacturing technology creates demand for sophisticated overload protection systems in machine tool, automotive, and chemical industries. The emphasis on precision manufacturing and quality requires protection devices with high accuracy and reliability standards.

The country's strong export-oriented manufacturing sector drives adoption of international standard protection systems that can meet global market requirements. Environmental regulations and energy efficiency initiatives support demand for advanced electronic protection devices with monitoring capabilities.

The overload protection tools market features established manufacturers with strong global presence and comprehensive product portfolios. Leading companies focus on technological innovation, regional market expansion, and industry-specific solution development to maintain competitive positions.

ABB, headquartered in Switzerland, maintains a strong position in the global overload protection market with comprehensive product lines serving industrial and infrastructure applications. The company's focus on digital technologies and Industry 4.0 integration supports market leadership in advanced electronic protection systems.

Eaton, with operations in Ireland and the USA, offers extensive overload protection solutions across industrial and commercial segments. The company's emphasis on energy efficiency and sustainable technologies aligns with market trends toward smart protection systems with enhanced functionality.

Schneider Electric, based in France, provides integrated protection solutions that combine overload relays with motor starters and control systems. The company's EcoStruxure platform enables digital connectivity and advanced analytics for industrial motor protection applications.

Siemens, headquartered in Germany, offers comprehensive motor protection portfolios with emphasis on industrial automation integration. The company's focus on digitalization and smart manufacturing supports development of connected protection systems.

Japanese manufacturers including Fuji Electric and Mitsubishi Electric provide technologically advanced protection solutions with emphasis on reliability and precision. These companies serve both domestic and global markets with products designed for demanding industrial applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.98 Billion |

| Product Type | Electronic Overload Relays, Thermal Bimetal Relays, Solid-State/Advanced |

| Current Range | ≤32 A, 33-100 A, >100 A |

| Phase | Three-phase Motors, Single-phase Motors |

| End-Use Industry | Manufacturing & Machine Builders, HVAC & Pumps, Oil & Gas/Chemicals, Metals/Mining, Water & Wastewater, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ABB, Eaton, Schneider Electric, Siemens, Mitsubishi Electric, Fuji Electric, Rockwell Automation, LS ELECTRIC, Lovato Electric, Telemecanique Sensors |

The global overload protection tools market is estimated to be valued at USD 1,975.4 million in 2025.

The market size for the overload protection tools market is projected to reach USD 2,733.1 million by 2035.

The overload protection tools market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in overload protection tools market are electronic overload relays, thermal bimetal relays and solid-state/advanced.

In terms of current range, 33–100 a segment to command 45.0% share in the overload protection tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Head Protection Equipment Market Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Data Protection as a Service (DPaaS) Market

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paint Protection Film Manufacturers

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Brand Protection Tools Providers

Hernia Protection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA