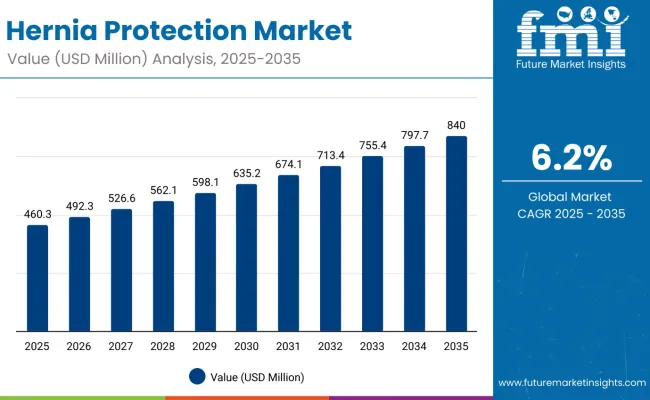

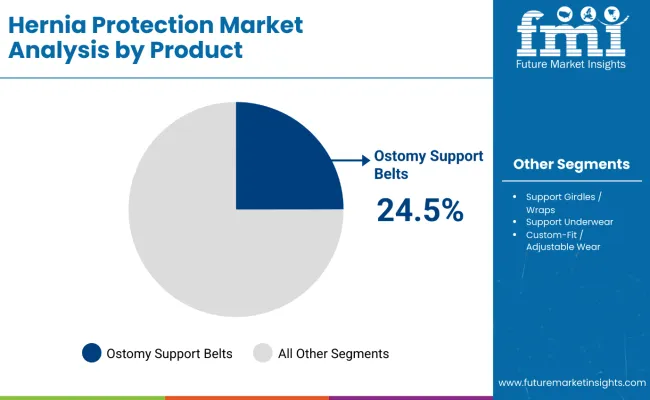

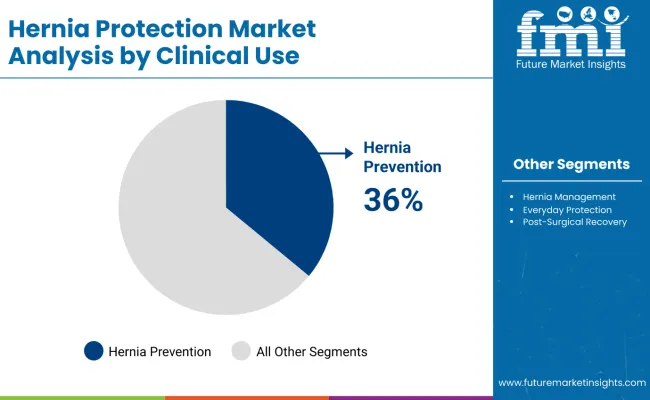

The hernia protection market is projected to grow from USD 460.3 million in 2025 to USD 840.0 million by 2035, advancing at a 6.2% CAGR. The growth is driven by increasing demand for advanced hernia protection solutions, rising consumer preference for preventive healthcare products, and the adoption of specialized hernia support devices. The ostomy support belts segment leads with 24.5% market share in 2025, attributed to their specialized design, targeted compression, and ability to provide comfort for patients with hernia complications. Hernia prevention is expected to dominate the clinical use segment, with 36.0% market share in 2025, driven by the growing focus on early intervention and preventive healthcare.

The increasing adoption of minimally invasive and laparoscopic surgery techniques is also contributing to the growth of the hernia protection market. These advanced surgical techniques, which require smaller incisions and result in shorter recovery times, have gained popularity due to their advantages in terms of reduced pain, lower infection risk, and quicker recovery periods. However, even with these benefits, the risk of hernia recurrence remains, particularly in high-risk patients. As a result, the demand for hernia protection devices, particularly mesh implants and abdominal binders, is increasing to support the healing process and prevent complications.

The growing focus on patient safety and post-operative care is another factor driving the demand for hernia protection products. Hernia recurrence can result in additional surgeries, longer recovery times, and increased healthcare costs. As healthcare providers and patients prioritize the prevention of recurrence, the need for high-quality hernia protection products, including mesh implants, support garments, and belts, is growing. These products help reduce the risk of hernia recurrence by providing additional support to the affected area during the healing process, which is especially important for patients undergoing high-risk surgeries or those with weakened abdominal muscles.

Technological advancements in hernia protection products are also contributing to the market's growth. Innovations in mesh technology, such as bioabsorbable meshes and those with enhanced biocompatibility, are improving the performance and safety of hernia repair surgeries. These advanced meshes promote better tissue integration and reduce the risk of complications, such as infection and rejection. Additionally, the development of more comfortable, lightweight, and adjustable hernia support garments and belts is increasing patient compliance during the recovery period. As these products become more effective, comfortable, and accessible, the adoption of hernia protection solutions is expected to increase.

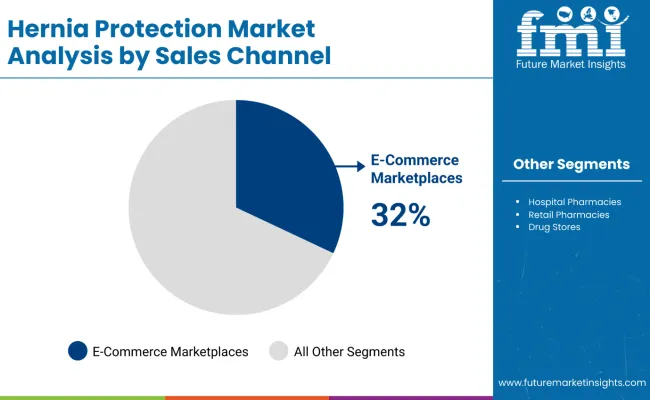

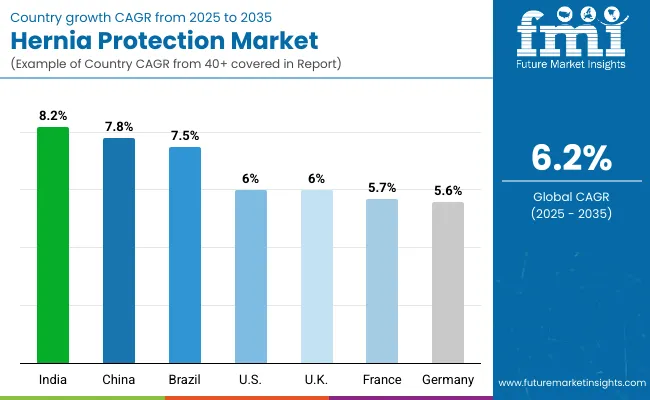

The Asia Pacific region is set to lead growth, with India (8.2% CAGR) and China (7.8% CAGR) benefiting from expanding healthcare infrastructure and an aging population. In North America, the USA and Canada show steady growth at 6.0% CAGR. Europe follows with Germany and France leading the demand. E-commerce marketplaces, representing 32.0% of sales channel share, are the primary distribution channel, reflecting the growing preference for online purchasing in healthcare. The market's competitive landscape includes key players such as Coloplast A/S, Hollister Incorporated, Convatec Group plc, and B. Braun Melsungen AG.

Hernia Protection Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 460.3 million |

| Forecast Value in (2035F) | USD 840.0 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

Between 2025 and 2030, the hernia protection market is projected to expand from USD 460.3 million to USD 635.2 million, resulting in a value increase of USD 174.9 million, which represents 46.1% of the total forecast growth for the decade. This phase of development will be shaped by increasing healthcare awareness, rising demand for preventive hernia management solutions, and growing utilization in post-surgical recovery applications. Healthcare manufacturers and medical device specialists are expanding their product development capabilities to address the growing preference for advanced hernia protection features in medical support systems.

From 2030 to 2035, the market is forecast to grow from USD 635.2 million to USD 840.0 million, adding another USD 204.8 million, which constitutes 53.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced hernia protection technologies, the integration of improved comfort and support features for premium hernia management products, and the development of specialized protection formulations for diverse applications. The growing emphasis on patient comfort and quality of life optimization will drive demand for hernia protection devices with enhanced support capabilities and improved wearability characteristics.

Between 2020 and 2024, the hernia protection market experienced steady growth, driven by increasing healthcare expenditure and growing recognition of hernia protection products' superior preventive capabilities across medical and wellness applications. The market developed as healthcare professionals recognized the potential for specialized hernia support to enhance patient outcomes while meeting modern healthcare requirements for comprehensive hernia management. Technological advancement in material science and ergonomic design began emphasizing the critical importance of maintaining protection effectiveness while extending patient comfort and improving long-term compliance rates.

The hernia protection market represents a steadily growing healthcare opportunity at the intersection of medical device technology, preventive healthcare, and patient comfort optimization, with the market projected to expand from USD 460.3 million in 2025 to USD 840.0 million by 2035 at a solid 6.2% CAGR-a 1.8X growth driven by increasing healthcare awareness, patient demand for quality of life improvement, and the integration of advanced materials into everyday medical support devices.

This convergence opportunity leverages the growing focus on preventive healthcare, the desire for comfortable medical support solutions, and advances in medical materials technology to create products that offer effective hernia management in both preventive and post-surgical contexts. Ostomy Support Belts lead with 24.5% market share due to their specialized design and targeted application, while hernia prevention applications dominate demand as healthcare systems increasingly invest in preventive care solutions. Geographic growth is strongest in India (8.2% CAGR) and China (7.8% CAGR), where healthcare infrastructure development and aging population demographics create ideal market conditions.

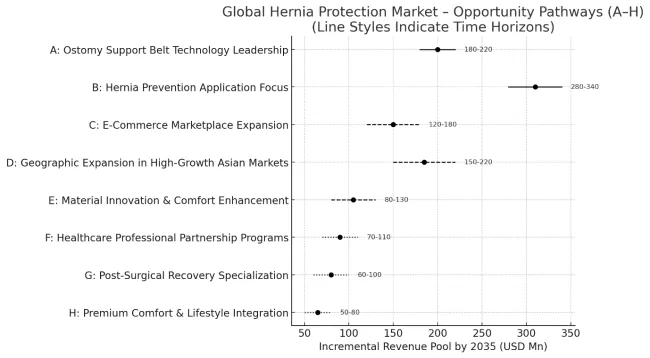

Pathway A - Ostomy Support Belt Technology Leadership. The leading product category offers specialized support for ostomy patients with hernia complications, providing targeted compression and comfort essential for daily activities. Companies developing advanced ostomy support belts with enhanced materials, improved fit systems, and integrated comfort features will capture the leading product segment. Expected revenue pool: USD 180-220 million.

Pathway B - Hernia Prevention Application Focus. The largest application segment benefits from growing healthcare emphasis on preventive care and early intervention strategies. Providers developing comprehensive prevention solutions with educational support, professional fitting services, and long-term care programs will dominate this primary market. Opportunity: USD 280-340 million.

Pathway C - E-Commerce Marketplace Expansion. Modern patients increasingly prefer online purchasing for medical devices, requiring comprehensive digital platforms with professional consultation, sizing guidance, and discreet delivery services. Companies investing in robust e-commerce capabilities, telemedicine integration, and patient education resources will create competitive differentiation and market penetration. Revenue uplift: USD 120-180 million.

Pathway D - Geographic Expansion in High-Growth Asian Markets. India and China's healthcare infrastructure development and aging population dynamics create substantial opportunities. Local distribution partnerships, culturally sensitive product design, and affordable pricing strategies enable market penetration in these high-growth regions. Pool: USD 150-220 million.

Pathway E - Material Innovation and Comfort Enhancement. Modern patients prioritize comfort, breathability, and discretion in medical devices. Developing products with advanced fabric technologies, moisture management systems, antimicrobial properties, and skin-friendly materials addresses growing comfort demands while maintaining clinical effectiveness. Expected upside: USD 80-130 million.

Pathway F - Healthcare Professional Partnership Programs. Advanced products require strong relationships with physicians, surgeons, and healthcare facilities for proper patient education and product recommendation. Systems offering professional training, patient education materials, and clinical support programs create enhanced value propositions for healthcare providers. USD 70-110 million.

Pathway G - Post-Surgical Recovery Specialization. Hospitals and surgical centers represent growing opportunities for specialized post-operative hernia support solutions with enhanced healing support and recovery optimization features. Developing products specifically designed for surgical recovery phases with medical-grade materials and clinical validation expands beyond general prevention markets. Pool: USD 60-100 million.

Pathway H - Premium Comfort and Lifestyle Integration. High-end market segments demand products that integrate seamlessly with active lifestyles while maintaining clinical effectiveness. Companies developing lifestyle-oriented variants with athletic design, advanced moisture management, and aesthetic appeal will capture premium pricing opportunities among active patients. Expected revenue: USD 50-80 million.

Market expansion is being supported by the increasing global demand for preventive healthcare solutions and the corresponding shift toward specialized hernia management technologies that can provide superior patient comfort while meeting healthcare requirements for effective hernia prevention and post-surgical support.

Modern healthcare providers and patients are increasingly focused on incorporating hernia protection products to enhance quality of life while satisfying demands for comprehensive hernia management and preventive care strategies. Hernia protection products' proven ability to deliver superior patient comfort, clinical effectiveness, and lifestyle integration makes them essential components for comprehensive hernia care programs and preventive healthcare applications.

The growing emphasis on patient-centered healthcare and preventive medicine is driving demand for high-quality hernia protection products that can support distinctive patient experiences and improved healthcare outcomes across prevention, management, and post-surgical recovery categories.

Healthcare provider preference for products that combine clinical effectiveness with patient comfort is creating opportunities for innovative hernia protection implementations in both traditional medical and emerging wellness applications. The rising influence of aging population demographics and increased surgical procedures is also contributing to increased adoption of specialized hernia protection products that can provide authentic clinical benefit characteristics.

The market is segmented by product type, clinical use, and sales channel. The demand for product type is divided into ostomy support belts, support girdles/wraps, support underwear, custom-fit/adjustable wear, and barrier rings & strips. Based on clinical use, the market is categorized into hernia prevention, hernia management, everyday protection, and post-surgical recovery applications. By sales channel, the market is divided into e-commerce marketplaces, hospital pharmacies, retail pharmacies, and drug stores.

The ostomy support belts segment is projected to account for 24.5% of the hernia protection market in 2025, reaffirming its position as the leading product category. Medical device manufacturers and healthcare providers increasingly utilize ostomy support belts for their specialized design features, targeted compression capabilities, and ease of integration in comprehensive ostomy care applications across diverse patient populations. Ostomy support belt technology's standardized sizing systems and reliable support characteristics directly address the clinical requirements for consistent hernia prevention and effective patient comfort in specialized ostomy care operations.

This product segment forms the foundation of modern ostomy care applications, as it represents the technology with the greatest specialization potential and established compatibility across multiple patient care systems. Manufacturer investments in ostomy support belt optimization and comfort enhancement continue to strengthen adoption among healthcare providers. With patients prioritizing comfort and clinical effectiveness, ostomy support belt systems align with both healthcare objectives and patient satisfaction requirements, making them the central component of comprehensive ostomy care strategies.

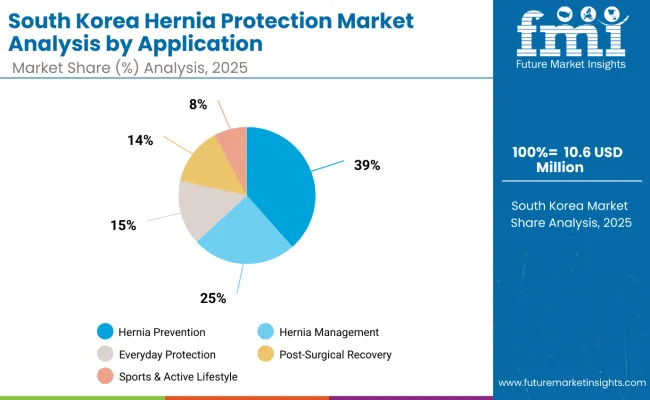

Hernia prevention applications are projected to represent the largest share of hernia protection demand in 2025 with 36.0% market share, underscoring their critical role as the primary application for preventive healthcare solutions in patient care programs and healthcare provider strategies. Other key segments include Hernia Management accounting for 25.0%, Everyday Protection representing 15.0%, Post-Surgical Recovery at 14.0%, and Sports & Active Lifestyle applications capturing 8.0% of the market.

Healthcare professionals and patients prefer hernia prevention systems for their exceptional preventive capabilities, early intervention benefits, and ability to maintain patient comfort levels while supporting modern preventive healthcare integration requirements during comprehensive care programs. Positioned as essential components for high-performance preventive healthcare installations, hernia prevention products offer both clinical advancement and patient wellness enhancement advantages.

The segment is supported by continuous growth in preventive healthcare adoption and the growing availability of affordable hernia prevention technologies that enable enhanced patient outcomes and healthcare cost optimization at the preventive care level. Additionally, healthcare systems are investing in preventive care technologies to support population health improvement and modern healthcare delivery experiences.

As preventive healthcare continues to expand and patients seek superior preventive solutions, hernia prevention applications will continue to dominate the clinical use landscape while supporting technology advancement and patient care optimization strategies.

E-commerce marketplaces applications are projected to represent the largest share of hernia protection sales channel demand in 2025 with 32.0% market share, underscoring their critical role as the primary distribution method for direct-to-consumer healthcare product sales and patient accessibility programs. Other significant distribution channels include Hospital Pharmacies accounting for approximately 28.0%, Retail Pharmacies representing 25.0%, and Drug Stores capturing 15.0% of the sales channel market.

Patients and healthcare consumers prefer e-commerce marketplace systems for their exceptional convenience features, product selection capabilities, and ability to maintain privacy levels while supporting modern healthcare purchasing integration requirements during product acquisition processes. Positioned as essential channels for high-performance healthcare product distribution, e-commerce marketplace platforms offer both accessibility advancement and patient convenience enhancement advantages.

The segment is supported by continuous growth in online healthcare purchasing and the growing availability of comprehensive e-commerce healthcare technologies that enable enhanced patient access and healthcare product optimization at the consumer level. Additionally, patients are investing in online healthcare purchasing to support convenience enhancement and modern healthcare shopping experiences. As online healthcare continues to expand and consumers seek superior purchasing solutions, e-commerce marketplace applications will continue to dominate the sales channel landscape while supporting accessibility advancement and patient convenience optimization strategies.

The hernia protection market is advancing steadily due to increasing preventive healthcare adoption and growing demand for patient comfort solutions that emphasize superior quality of life across medical and wellness applications. However, the market faces challenges, including competition from alternative treatment approaches, cost considerations in healthcare budgets, and varying patient compliance rates with protective device usage. Innovation in material technology and patient education continues to influence market development and expansion patterns.

Expansion of Advanced Material Technology Applications

The growing adoption of hernia protection products with advanced material technologies and comfort enhancement applications is enabling equipment manufacturers to develop products that provide distinctive patient experiences while commanding premium positioning and enhanced clinical effectiveness characteristics. Advanced materials provide superior comfort while allowing more sophisticated healthcare development across various patient categories and clinical segments. Manufacturers are increasingly recognizing the competitive advantages of advanced material positioning for premium product development and healthcare market penetration.

Integration of Patient Education and Support Programs

Modern hernia protection suppliers are incorporating comprehensive patient education systems, healthcare provider training programs, and long-term care support technologies to enhance treatment compliance, improve patient outcomes, and meet healthcare provider demands for comprehensive hernia management solutions. These programs improve patient adherence while enabling new applications, including preventive care education and comprehensive hernia management systems. Advanced education integration also allows suppliers to support premium market positioning and healthcare leadership beyond traditional commodity medical device products.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.2% |

| China | 7.8% |

| Brazil | 7.5% |

| USA | 6.0% |

| UK | 6.0% |

| France | 5.7% |

| Germany | 5.6% |

The hernia protection market is experiencing steady growth globally, with India leading at an 8.2% CAGR through 2035, driven by the rapidly expanding healthcare infrastructure sector, increasing healthcare awareness investments, and growing adoption of preventive healthcare solutions. China follows at 7.8%, supported by aging population demographics, rising healthcare expenditure, and expanding medical device accessibility. Brazil shows growth at 7.5%, emphasizing emerging healthcare market development and increasing medical device adoption.

The USA records 6.0% growth, focusing on advanced healthcare technology innovation and premium medical device development. The UK demonstrates 6.0% growth, prioritizing healthcare system optimization and patient care advancement. Europe exhibits 5.8% growth, supported by comprehensive healthcare systems and advanced medical device adoption. France shows 5.7% growth, emphasizing healthcare quality improvement and medical technology development. Germany demonstrates 5.6% growth, focusing on precision medical device manufacturing excellence and healthcare innovation development.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from hernia protection products in India is projected to exhibit exceptional growth with a CAGR of 8.2% through 2035, driven by the rapidly expanding healthcare infrastructure sector and substantial government investments in healthcare accessibility development across major urban and rural centers. The country's growing medical device market and increasing adoption of preventive healthcare technologies are creating substantial demand for hernia protection solutions in both clinical and consumer applications. Major healthcare providers and medical device companies are establishing comprehensive distribution and education capabilities to serve both domestic consumption and regional markets.

Revenue from hernia protection products in China is expanding at a CAGR of 7.8%, supported by aging population demographics, increasing healthcare expenditure, and expanding medical device market with modern preventive care features. The country's developing healthcare ecosystem and expanding medical technology infrastructure are driving demand for affordable hernia protection products across both urban clinical and consumer applications. International medical device companies and domestic healthcare manufacturers are establishing comprehensive production and distribution capabilities to address growing market demand for preventive healthcare solutions.

Revenue from hernia protection products in Brazil is projected to grow at a CAGR of 7.5% through 2035, supported by the country's emerging healthcare market sector, growing medical device applications, and increasing adoption of modern healthcare technologies requiring preventive care solutions. Brazilian healthcare providers and patients consistently seek innovative medical products that enhance healthcare outcomes for both clinical applications and wellness markets. The country's position as a regional healthcare hub continues to drive innovation in preventive healthcare applications and product standards.

Revenue from hernia protection products in the United States is projected to grow at a CAGR of 6.0% through 2035, supported by the country's advanced healthcare technology sector, innovation leadership capabilities, and established market for premium medical device solutions. American healthcare providers and patients prioritize innovation, clinical effectiveness, and patient experience, making hernia protection products essential components for both clinical care and patient wellness programs. The country's comprehensive healthcare ecosystem and patient care patterns support continued market development.

Revenue from hernia protection products in the United Kingdom is projected to grow at a CAGR of 6.0% through 2035, supported by the country's healthcare system optimization, advanced medical care sector, and established expertise in comprehensive patient care solutions. British healthcare providers' focus on clinical effectiveness, patient comfort, and care quality creates steady demand for hernia protection products. The country's attention to healthcare innovation and patient satisfaction drives consistent adoption across both traditional clinical and emerging wellness applications.

Revenue from hernia protection products in France is projected to grow at a CAGR of 5.7% through 2035, driven by the country's healthcare quality advancement initiatives, comprehensive medical care system, and focus on patient-centered healthcare solutions. France's sophisticated healthcare infrastructure and emphasis on clinical excellence create substantial demand for high-quality hernia protection products across both public and private healthcare sectors. Leading healthcare institutions and medical device companies are establishing comprehensive patient care strategies to serve both domestic and European markets.

Revenue from hernia protection products in Germany is projected to grow at a CAGR of 5.6% through 2035, supported by the country's precision medical device manufacturing excellence, advanced healthcare technology expertise, and established reputation for producing superior healthcare products while working to enhance clinical integration capabilities and develop next-generation patient care technologies. Germany's healthcare industry continues to benefit from its reputation for producing high-quality medical devices while focusing on innovation and manufacturing precision.

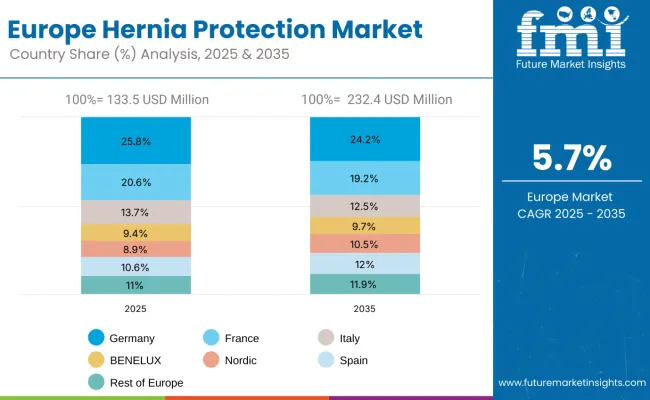

The hernia protection market in Europe is projected to grow from USD 133.5 million in 2025 to USD 232.4 million by 2035, registering a CAGR of 5.7% over the forecast period. Germany is expected to maintain its leadership position with a 25.8% market share in 2025, declining to 24.2% by 2035, supported by its advanced medical device manufacturing sector, precision healthcare product development industry, and comprehensive innovation capabilities serving European and international markets.

France follows with a 20.6% share in 2025, projected to reach 19.2% by 2035, driven by healthcare quality improvement programs, advanced medical technology applications, and growing focus on patient care solutions for premium healthcare facilities. Italy holds a 13.7% share in 2025, expected to maintain 12.5% by 2035, supported by healthcare system development and advanced medical applications, but facing challenges from market competition and economic considerations.

BENELUX commands a 9.4% share in 2025, projected to reach 9.7% by 2035, while Spain accounts for 8.9% in 2025, expected to reach 10.5% by 2035. Nordic maintains a 10.6% share in 2025, growing to 12.0% by 2035. The Rest of Europe region, including Eastern Europe, Switzerland, and Austria, is anticipated to hold 11.0% in 2025, increasing slightly to 11.9% by 2035, attributed to mixed growth patterns with strong expansion in some healthcare markets balanced by moderate growth in smaller countries implementing comprehensive healthcare development programs.

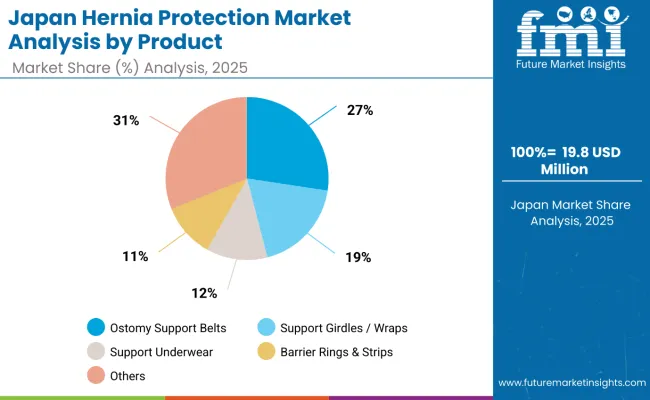

The hernia protection market in Japan is valued at USD 19.8 million in 2025, projected to grow steadily through 2035, supported by an aging population, rising incidence of abdominal surgeries, and advancements in supportive medical wearables.

Ostomy support belts are expected to lead with a 27.0% market share in 2025, projected to sustain 26.8% by 2035, reflecting continued demand from post-surgical and preventive use. Support girdles and wraps follow with a 19.0% share in 2025, projected to hold 18.9% by 2035, driven by growing usage among elderly patients for abdominal support.

Support underwear represents 12.0% in 2025, expected to maintain 12.0% by 2035, reflecting stable adoption. Barrier rings & strips account for 11.0% in 2025, projected to remain steady at 11.0% by 2035, with usage linked to specific post-operative needs. Others hold the largest share at 31.0% in 2025, expected to sustain 31.3% by 2035, highlighting the role of complementary solutions in comprehensive hernia care.

The hernia protection market in South Korea is valued at USD 10.6 million in 2025, with moderate growth projected through 2035, supported by increased surgical interventions, growing awareness of post-surgical care, and the rising adoption of lifestyle-focused support products.

Hernia prevention leads with a 39.0% market share in 2025, projected to remain strong at 38.8% by 2035, reflecting proactive healthcare approaches and patient awareness. Hernia management follows with a 25.0% share in 2025, projected to sustain 25.0% by 2035, supported by clinical adoption in rehabilitation.

Everyday protection represents 15.0% in 2025, forecast to hold 15.0% by 2035, while post-surgical recovery accounts for 14.0% in 2025, expected to remain at 14.0% by 2035, reflecting consistent adoption across surgical recovery pathways. Sports & active lifestyle applications hold 8.0% in 2025, projected to sustain 8.2% by 2035, driven by younger, health-conscious patient segments.

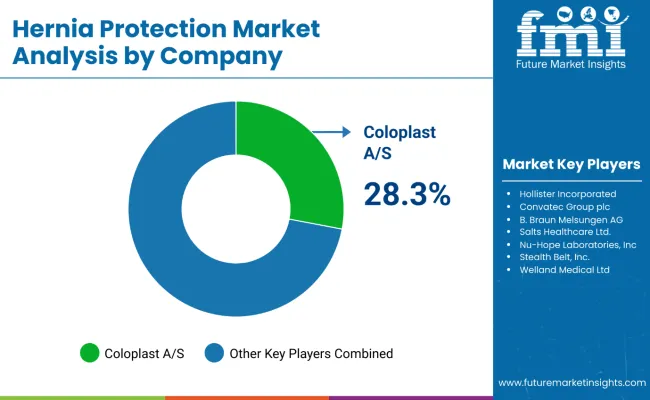

The hernia protection market is composed of 8–12 key players, with the top five companies holding 60–65% of global market share. The market is driven by increased awareness of hernia prevention, the aging population, and the growing number of surgical procedures requiring postoperative support. Competition centers on product comfort, durability, ease of use, skin compatibility, and clinical efficacy, rather than just price. Coloplast A/S leads the market with an 28.3% share, supported by its strong portfolio of postoperative hernia protection solutions, including supportive garments and hernia belts, widely recognized for their quality and comfort.

Other leading players such as Hollister Incorporated, Convatec Group plc, and B. Braun Melsungen AG maintain dominant positions by offering innovative, skin-friendly, and ergonomically designed products tailored for post-surgical hernia protection. These companies leverage their deep expertise in medical devices, extensive product ranges, and established relationships with hospitals, surgeons, and distributors to secure their place in the market.

Challengers including Salts Healthcare Ltd., Nu-Hope Laboratories Inc., and Stealth Belt Inc. focus on customized, specialized hernia protection garments for unique patient needs, including options for incisional hernia, abdominal support, and comfort in movement. Welland Medical Ltd. differentiates by offering innovative and discreet hernia protection solutions that combine performance and aesthetic appeal, further solidifying its presence in regional markets and niche applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 460.3 m illion |

| Product Type | Ostomy Support Belts, Support Girdles/Wraps, Support Underwear, Custom-Fit/Adjustable Wear, Barrier Rings & Strips |

| Clinical Use | Hernia Prevention, Hernia Management, Everyday Protection, Post-Surgical Recovery |

| Sales Channel | E-Commerce Marketplaces, Hospital Pharmacies, Retail Pharmacies, Drug Stores |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Coloplast A/S, Hollister Incorporated, Convatec Group plc, B. Braun Melsungen AG, Salts Healthcare Ltd., Nu-Hope Laboratories Inc., Stealth Belt Inc., and Welland Medical Ltd. |

| Additional Attributes | Dollar sales by product type and clinical use, regional demand trends, competitive landscape, technological advancements in material science, healthcare provider partnership initiatives, patient comfort optimization programs, and clinical effectiveness enhancement strategies |

By North America

By Europe

By East Asia

By South Asia & Pacific

By Latin America

By Middle East & Africa

The global hernia protection market is valued at USD 460.3 million in 2025.

The size for the hernia protection market is projected to reach USD 840.0 million by 2035.

The hernia protection market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product type segments in the hernia protection market are ostomy support belts, support girdles/wraps, support underwear, custom-fit/adjustable wear, and barrier rings & strips.

In terms of clinical use, hernia prevention segment is set to command the largest share in the hernia protection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hernia Mesh Devices Market Size and Share Forecast Outlook 2025 to 2035

Hernia Repair Devices Market Insights - Trends & Forecast 2025 to 2035

Ventral Hernia Treatment Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Head Protection Equipment Market Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Data Protection as a Service (DPaaS) Market

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Brand Protection Tools Providers

Market Share Breakdown of Paint Protection Film Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA