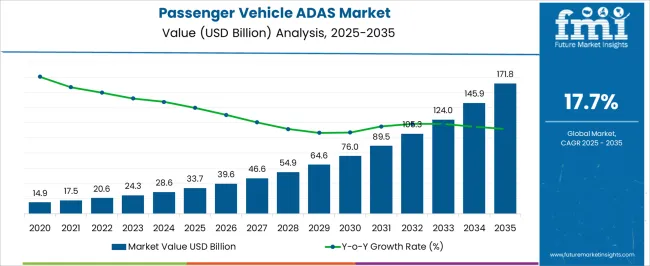

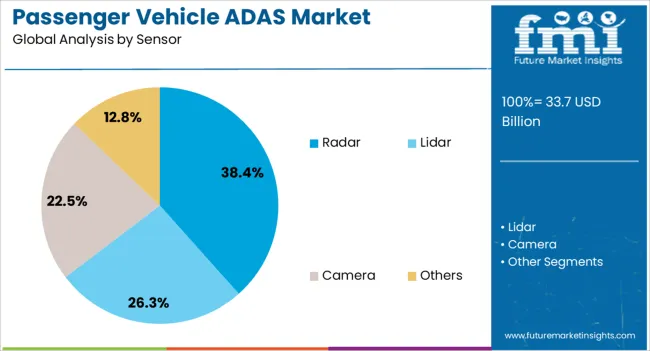

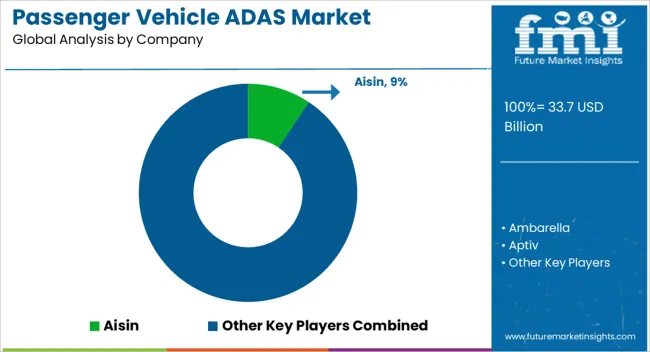

The passenger vehicle ADAS market is estimated to be valued at USD 33.7 billion in 2025 and is projected to reach USD 171.8 billion by 2035, registering a compound annual growth rate (CAGR) of 17.7% over the forecast period. Core technologies such as adaptive cruise control, automatic emergency braking, and lane keeping assist dominate early revenue streams due to regulatory encouragement and mandatory integration in several regions. These safety-focused technologies form the foundation of ADAS adoption and are expected to maintain strong market contribution through the forecast period. Advanced sensing technologies, including radar, lidar, and camera-based systems, represent significant cost and value contributors within the ecosystem.

Radar and camera modules currently hold higher penetration due to cost efficiency and integration ease, whereas lidar, though more expensive, is anticipated to expand its role in enhancing precision for higher-level automation. Additionally, driver monitoring systems and traffic sign recognition features are expected to gain traction, contributing to incremental growth and differentiation among vehicle manufacturers. Integration platforms, such as centralized electronic control units and AI-based perception software, are expected to account for rising value contributions, particularly from 2028 onwards, as vehicles shift toward Level 3 and Level 4 automation. By 2035, the distribution of contributions will reflect a balanced synergy between safety, sensing hardware, and intelligent processing, positioning ADAS as a critical enabler of semi-autonomous passenger vehicles.

| Metric | Value |

|---|---|

| Passenger Vehicle ADAS Market Estimated Value in (2025 E) | USD 33.7 billion |

| Passenger Vehicle ADAS Market Forecast Value in (2035 F) | USD 171.8 billion |

| Forecast CAGR (2025 to 2035) | 17.7% |

The passenger vehicle ADAS market has been positioned as a critical segment within global automotive electronics and safety systems, highlighting its role in advancing driver assistance and accident prevention. Within the overall passenger vehicle market, ADAS technologies hold around 6.8%, driven by the rising integration of safety features in mid and premium models. In the automotive electronics sector, this segment contributes nearly 8.1%, reflecting the growing share of semiconductors and sensors in vehicles.

Across the intelligent mobility and connected car industry, ADAS accounts for about 7.4%, underpinned by demand for collision avoidance and automated braking. Within the automotive sensors market, passenger vehicle ADAS represents 9.0%, showcasing reliance on radar, lidar, and camera technologies. In the advanced driver assistance and autonomous driving ecosystem, this segment makes up approximately 10.2%, indicating its pivotal role in the gradual automation of driving functions.

Recent developments in the passenger vehicle ADAS market have centered on integration, cost optimization, and system intelligence. Groundbreaking trends include the deployment of multi-sensor fusion platforms that combine radar, lidar, and vision systems for higher accuracy. Key automakers and Tier 1 suppliers are collaborating with AI software companies to advance real-time data processing, enabling predictive driver assistance functions. The use of over-the-air updates has emerged as a strategy to enhance feature sets post-purchase, extending product life cycles. Partnerships with mapping and telematics providers are being pursued to refine adaptive cruise control and lane centering. The cost-effective ADAS packages are being introduced in compact and mass-market passenger cars, broadening adoption beyond luxury models.

The passenger vehicle ADAS market is progressing rapidly, driven by regulatory mandates for safety enhancements, increasing consumer demand for advanced driving features, and ongoing technological integration in vehicle design. Rising urbanization and the growing complexity of traffic environments have accelerated the adoption of driver-assistance systems as a preventive safety measure.

Automakers are incorporating ADAS features across mid-range and premium models, supported by falling sensor costs and advancements in artificial intelligence-based perception systems. The current market landscape reflects an increasing shift toward partial automation, with adaptive functionalities improving driving convenience and reducing human error.

Future growth is expected to be reinforced by the gradual evolution toward higher levels of autonomous driving, coupled with supportive infrastructure developments and connected vehicle ecosystems. With rising awareness of road safety and the growing acceptance of semi-autonomous features, the market is well-positioned for sustained expansion over the coming years.

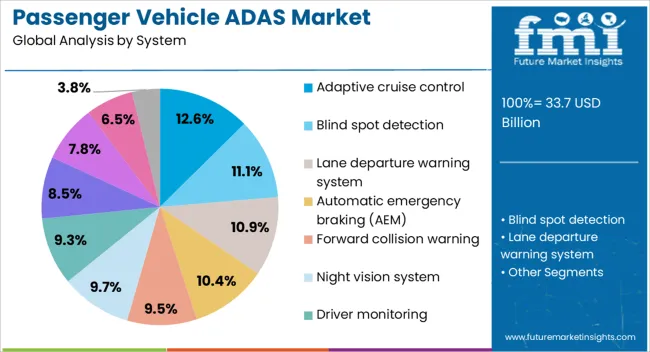

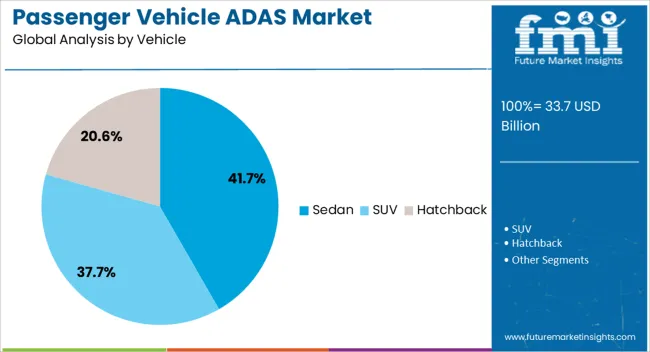

The passenger vehicle ADAS market is segmented by system, sensor, vehicle, distribution channel, and geographic regions. By system, the passenger vehicle ADAS market is divided into Adaptive cruise control, Blind spot detection, Lane departure warning system, Automatic emergency braking (AEB), Forward collision warning, Night vision system, Driver monitoring, Tire pressure monitoring system, Head-up display, Park assist system, and Others. In terms of sensors, the passenger vehicle ADAS market is classified into Radar, Lidar, Camera, and Others. Based on vehicle, the passenger vehicle ADAS market is segmented into Sedan, SUV, and Hatchback. By distribution channel, the passenger vehicle ADAS market is segmented into OEM and Aftermarket. Regionally, the passenger vehicle ADAS industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adaptive cruise control segment accounts for approximately 12.6% share of the system category within the passenger vehicle ADAS market. This segment’s presence is reinforced by the integration of real-time speed modulation and vehicle-to-vehicle distance management, which enhance driver comfort and safety. The functionality operates through sensor-based detection and automated throttle/brake adjustments, enabling a smoother driving experience in variable traffic conditions.

Growth in this segment has been supported by regulatory encouragement of collision avoidance technologies and increased consumer preference for comfort-oriented features in long-distance and highway driving. Automakers are standardizing adaptive cruise control in mid-tier vehicle models, supported by declining production costs and greater platform compatibility.

The segment is expected to benefit from continuous improvements in radar and camera fusion technologies, which enhance accuracy in complex environments. As part of the broader path toward autonomous driving, adaptive cruise control is projected to retain a critical role in market evolution.

The radar segment dominates the sensor category with approximately 38.4% share, owing to its reliability, accuracy, and all-weather operational capability in ADAS functionalities. Radar technology’s ability to detect objects at various distances and speeds with minimal performance degradation in poor visibility has made it a preferred choice for key applications such as collision warning, adaptive cruise control, and blind spot detection.

Its cost-effectiveness compared to lidar and robustness against environmental interference have further strengthened its adoption. Increased production scalability and the integration of radar modules into multi-sensor fusion systems have enhanced performance in complex driving scenarios.

The segment’s growth is also influenced by technological innovations that improve resolution and range while reducing component size, enabling broader use across vehicle classes. With regulatory push for mandatory ADAS features and automakers expanding sensor deployment, radar technology is expected to maintain its leading position in the coming years.

The sedan segment holds approximately 41.7% share of the passenger vehicle ADAS market in the vehicle category, supported by the strong global sales volume of sedans in both developed and emerging markets. This vehicle type has historically been an early adopter of advanced driver-assistance technologies, with manufacturers prioritizing ADAS integration to enhance brand value and safety credentials.

Higher adoption rates in sedans are linked to their appeal among urban commuters and fleet operators, where comfort and safety features contribute to customer preference. Automakers have utilized sedan platforms as a cost-efficient testbed for new ADAS functionalities before scaling them to other vehicle types.

Additionally, sedan models often align with regulatory safety requirements in regions that are early adopters of ADAS mandates. With consistent demand for sedans and the integration of enhanced driver-assistance features as standard offerings, this segment is expected to sustain its significant share through the forecast period.

The market has been gaining traction with rising focus on road safety, government regulations, and consumer demand for convenience features. Automakers are integrating advanced driver assistance technologies such as adaptive cruise control, blind spot detection, and lane departure warning across multiple segments. Enhanced sensor technologies, AI-driven systems, and vehicle connectivity have made ADAS more reliable and accessible. While luxury cars have led early adoption, increasing regulatory pressure and cost-effective integration are bringing these features into mid-range vehicles. Industry collaborations, technological innovation, and growing consumer expectations are expected to shape the future expansion of the market globally.

Regulatory mandates are driving large-scale deployment of ADAS technologies in passenger vehicles. Authorities across North America and Europe have made advanced safety features such as autonomous emergency braking and lane-keeping assistance mandatory in new vehicle models. Insurance incentives and safety ratings are also boosting demand as ADAS-equipped vehicles provide cost benefits for owners. Governments in emerging economies are aligning with global road safety frameworks, further expanding adoption. Compliance pressure on automakers has accelerated the integration of ADAS even in mid-segment vehicles, widening accessibility. These policies have positioned ADAS not as luxury add-ons but as essential safety features, reshaping consumer perceptions and automotive design strategies worldwide.

Technological progress in sensors, AI, and processing systems has strengthened ADAS reliability and efficiency. Modern radar, LiDAR, and camera modules allow precise environmental mapping, object detection, and hazard prediction. AI-driven algorithms combined with machine learning capabilities enhance driver monitoring and improve decision-making during critical scenarios. Sensor fusion technology integrates multiple data points, creating accurate situational awareness for advanced functions. Over-the-air updates ensure systems remain current with evolving road conditions and software refinements. These innovations have lowered costs, enabling broader integration beyond premium vehicles. The continuous refinement of sensor accuracy and intelligent processing is creating a strong pathway for future automation in passenger vehicles.

Consumer interest in ADAS-equipped vehicles has been growing as safety and comfort become important purchase criteria. Drivers prefer features like adaptive cruise control, automated parking, and blind spot detection that enhance both convenience and accident prevention. The increasing availability of such technologies in mid-range cars has boosted market penetration. Automakers are marketing ADAS as essential for safer driving, influencing buying decisions significantly. Digital dashboards and infotainment integration have made user interaction with these features more intuitive. Rising disposable incomes and greater awareness of vehicle safety ratings are fueling adoption. Consumer demand is shaping market dynamics by pushing manufacturers to prioritize ADAS in vehicle design strategies.

Strategic partnerships across the automotive ecosystem are accelerating ADAS development. Automakers are collaborating with technology providers, semiconductor companies, and AI firms to enhance system capabilities. Startups are contributing innovations in computer vision, driver monitoring, and edge computing, while chip manufacturers are delivering high-performance processors to support advanced algorithms.

Industry collaboration has enabled scalability and cost optimization, supporting adoption across diverse passenger vehicle categories. The transition toward higher automation levels is being built upon existing ADAS technologies, creating a pathway toward semi-autonomous and autonomous driving. Collaborative R&D efforts are expected to intensify, driving competition and shaping the long-term growth of the global market.

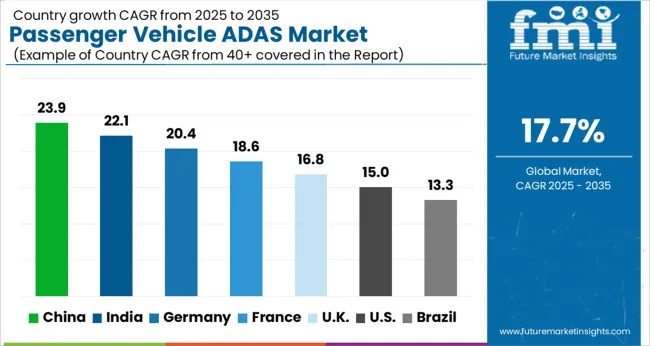

| Country | CAGR |

|---|---|

| China | 23.9% |

| India | 22.1% |

| Germany | 20.4% |

| France | 18.6% |

| UK | 16.8% |

| USA | 15.0% |

| Brazil | 13.3% |

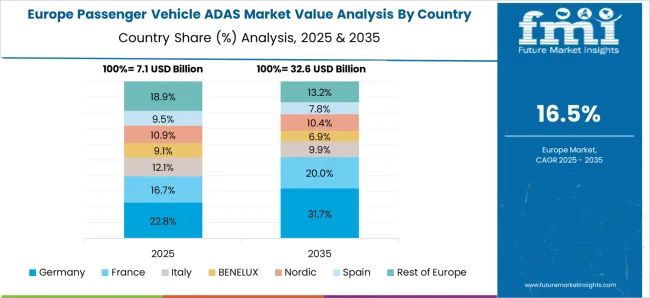

The market is projected to expand at a CAGR of 17.7% from 2025 to 2035, influenced by increasing adoption of safety technologies and regulatory frameworks mandating advanced driver assistance systems. China leads with 23.9%, reflecting rapid automotive innovation and integration of ADAS features across vehicle categories. India follows at 22.1%, supported by rising vehicle sales and government focus on road safety enhancements. Germany records 20.4%, driven by strong demand for premium vehicles equipped with advanced safety solutions. The UK stands at 16.8%, while the USA records 15.0%, both supported by steady integration of lane assistance, adaptive cruise control, and collision avoidance systems. Advances in sensor technologies, AI-based decision-making, and partnerships between automakers and tech firms are expected to shape global market growth. This report includes insights on 40+ countries; the top markets are shown here for reference.

China witnessed a strong expansion with a 23.9% CAGR, driven by regulatory mandates for vehicle safety and increasing consumer awareness regarding advanced driving technologies. Leading automakers integrated adaptive cruise control, lane departure warning, and automatic emergency braking in mid-range and premium vehicles. Local suppliers collaborated with global technology firms to build advanced driver assistance systems tailored for domestic demand. Consumer adoption increased due to improved affordability and government support for intelligent mobility. Automakers focused on cost optimization, large-scale deployment, and AI-driven innovations in safety systems.

India progressed with a CAGR of 22.1%, supported by rising demand for safety features and growing penetration of connected vehicles. Automakers introduced ADAS in premium and upper mid-segment passenger cars, while local suppliers emphasized cost-effective component development. Adoption was influenced by road safety awareness, stricter regulations, and increasing interest in automated driving technologies. Competitive strategies centered around collaborations with global technology providers and localized manufacturing to reduce system costs. Consumer demand grew for adaptive cruise control, blind spot detection, and driver monitoring systems. Automakers emphasized after-sales training and consumer education to promote feature adoption.

Germany expanded at a CAGR of 20.4%, influenced by strong automotive engineering standards and consumer demand for advanced vehicle safety. Premium automakers adopted adaptive lighting, lane keeping assistance, and advanced parking systems as standard in new models. Research and development emphasized AI-driven perception systems and sensor fusion to enhance driving automation. Partnerships between automakers and Tier 1 suppliers accelerated innovation and integration into mass-market segments. Consumers demanded advanced safety technologies as essential features, creating competitive differentiation for automakers. Strong export demand for vehicles equipped with ADAS further boosted domestic adoption.

The United Kingdom registered a 16.8% CAGR, supported by regulatory frameworks and strong consumer interest in connected driving features. Automakers introduced ADAS in mid-range models to broaden accessibility. Collaborations between domestic OEMs and global suppliers enhanced feature adoption in compact and electric vehicles. Demand for safety systems such as adaptive cruise control, automatic emergency braking, and lane assistance grew consistently. Research investments in autonomous driving technology also accelerated ADAS penetration. Government support for vehicle safety policies promoted automaker compliance, ensuring faster deployment across new vehicle models.

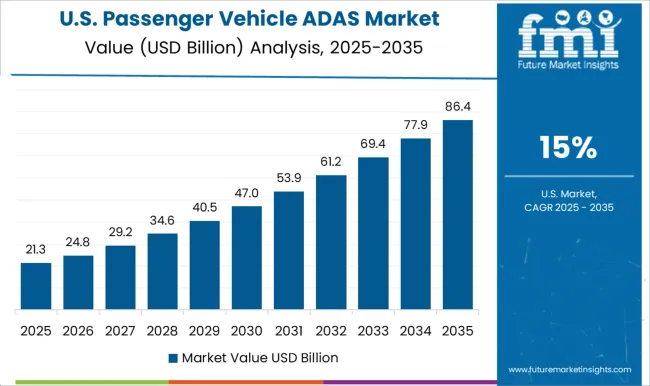

The United States achieved a 15.0% CAGR, driven by consumer demand for advanced safety features and a strong focus on autonomous vehicle development. Automakers integrated ADAS in mainstream passenger vehicles, expanding beyond luxury models. Competitive strategies emphasized collaborations with technology firms for AI-based perception systems and cloud-enabled safety solutions. Adoption was influenced by federal safety recommendations, insurance incentives, and growing consumer awareness. Automakers prioritized systems such as lane keeping assist, pedestrian detection, and driver monitoring. E-commerce platforms and dealerships promoted ADAS features as part of vehicle marketing, accelerating consumer acceptance.

The market has been shaped by global automotive technology leaders competing on safety, precision, and intelligent mobility. Bosch, Continental, and Denso have focused on integrating radar, camera, and sensor technologies into scalable platforms, enabling adaptive cruise control, lane keeping, and collision avoidance. Their strategies emphasize system reliability, real-time processing, and compliance with international safety regulations. Aptiv and Valeo have targeted modular ADAS solutions, highlighting flexibility for multiple vehicle models and cost effectiveness for high volume production.

Specialists such as Mobileye and Ambarella have differentiated themselves through advanced vision systems and AI-driven processing. Mobileye emphasizes camera-based perception and autonomous-ready software, while Ambarella highlights low-power, high-performance semiconductor platforms. Aisin and Autoliv have concentrated on braking and restraint integration, ensuring ADAS systems directly enhance occupant safety.

Product brochures showcase features such as 360-degree monitoring, driver alerts, and seamless integration with onboard electronics, projecting both safety assurance and driving comfort. Competition in the market revolves around processing speed, system scalability, and real-world reliability. Bosch and Continental highlight full-stack safety integration, while Mobileye and Ambarella position themselves as leaders in vision intelligence. Valeo and Aptiv focus on adaptability and cost efficiency for mass market vehicles. Autoliv emphasizes lifesaving restraint technologies linked with ADAS activation. Brochures serve as critical communication tools, emphasizing precision, ease of integration, and safety outcomes. The market has evolved where technological sophistication, regulatory compliance, and user trust shape customer preference, positioning ADAS as a defining feature of modern passenger vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.7 Billion |

| System | Adaptive cruise control, Blind spot detection, Lane departure warning system, Automatic emergency braking (AEM), Forward collision warning, Night vision system, Driver monitoring, Tire pressure monitoring system, Head-up display, Park assist system, and Others |

| Sensor | Radar, Lidar, Camera, and Others |

| Vehicle | Sedan, SUV, and Hatchback |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aisin, Ambarella, Aptiv, Autoliv, Bosch, Continental, Denso, Mobileye, and Valeo |

| Additional Attributes | Dollar sales by ADAS feature and vehicle category, demand dynamics across compact, mid-size, and luxury passenger vehicles, regional trends in safety and driver assistance adoption, innovation in sensors, AI algorithms, and real-time processing, environmental impact of electronic component production and energy use, and emerging use cases in semi-autonomous driving, connected vehicles, and intelligent traffic management systems. |

The global passenger vehicle ADAS market is estimated to be valued at USD 33.7 billion in 2025.

The market size for the passenger vehicle ADAS market is projected to reach USD 171.8 billion by 2035.

The passenger vehicle ADAS market is expected to grow at a 17.7% CAGR between 2025 and 2035.

The key product types in passenger vehicle ADAS market are adaptive cruise control, blind spot detection, lane departure warning system, automatic emergency braking (AEM), forward collision warning, night vision system, driver monitoring, tire pressure monitoring system, head-up display, park assist system and others.

In terms of sensor, radar segment to command 38.4% share in the passenger vehicle adas market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passenger Car Seat Market Forecast and Outlook 2025 to 2035

Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Passenger Ferries Market Size and Share Forecast Outlook 2025 to 2035

Passenger Security Market Size and Share Forecast Outlook 2025 to 2035

Passenger Tire Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Assessing Passenger Boarding Bridge Market Share & Industry Trends

Passenger Car Bearing & Clutch Component Aftermarket Growth – Trends & Forecast 2024-2034

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Used Passenger Car Sales Market

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Electric Passenger Car MRO Market Growth – Trends & Forecast 2025 to 2035

Safeguards for Passenger Transfer Area Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA