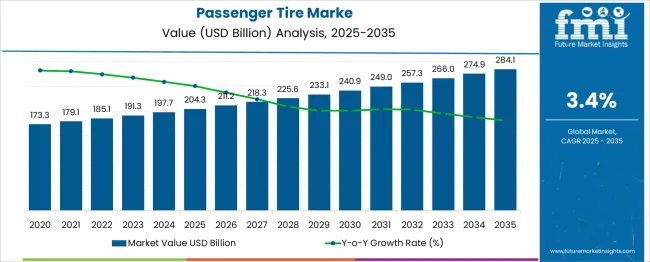

The Passenger Tire Market is estimated to be valued at USD 204.3 billion in 2025 and is projected to reach USD 284.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

This growth indicates a mature yet steadily evolving industry shaped by replacement demand, rising vehicle ownership in emerging economies, and continuous innovation in tire performance. Between 2025 and 2030, expansion will largely be driven by strong aftermarket sales, particularly in Asia-Pacific and Latin America, where road infrastructure development and growing disposable income are increasing passenger car usage. In developed economies, premium tire sales, winter tire demand, and regulatory compliance with rolling resistance and safety standards will sustain moderate growth.

From 2030 to 2035, the market is expected to strengthen through the electrification of passenger vehicles, as EV adoption creates demand for specialized tires offering low rolling resistance, noise reduction, and extended durability. The incremental growth of USD 79.8 billion over the forecast period highlights the importance of balancing cost competitiveness with performance-driven innovation. Competitive intensity will remain high, with leading manufacturers investing in smart tire technologies, sustainable raw materials, and global distribution networks.

| Metric | Value |

|---|---|

| Passenger Tire Market Estimated Value in (2025 E) | USD 204.3 billion |

| Passenger Tire Market Forecast Value in (2035 F) | USD 284.1 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

Tire manufacturers are shifting toward advanced rubber compounds, tread designs, and embedded sensor technologies to meet regulatory standards and rising consumer expectations. The growing vehicle parc, especially in emerging economies, is boosting replacement demand while original equipment demand is being shaped by OEM emphasis on energy efficiency and ride comfort.

Increasing adoption of electric vehicles and premium variants in SUVs and sedans is influencing tire design, encouraging the use of larger rim sizes and intelligent pressure-monitoring capabilities. Urbanization and expanding road infrastructure projects in the Asia Pacific and Latin America are creating favorable conditions for market expansion.

Simultaneously, fluctuating weather patterns and a preference for year-round usability have driven traction toward all-season tire categories. Strategic investments by manufacturers into R&D, sustainability in raw materials, and localized production are expected further to reinforce the future outlook of the passenger tire market.

The passenger tire market is segmented by rim size, vehicle type, season, sales channel, end use, and geographic regions. By rim size, the passenger tire market is divided into 16–18 inches, 13–15 inches, 19–21 inches, and above 21 inches. In terms of vehicle type, the passenger tire market is classified into SUV, Sedan, Hatchback, Crossover, and Electric Passenger Cars. Based on the season, the passenger tire market is segmented into All-season Tires, Summer Tires, and Winter Tires. By sales channel, the passenger tire market is segmented into OEM and Aftermarket. By end use, the passenger tire market is segmented into Private Vehicles, Taxi Fleets, and Ride Sharing Services. Regionally, the passenger tire industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 16 to 18 inches rim size segment is expected to hold 55.2% of the passenger tire market revenue share in 2025, making it the most dominant rim category. This growth has been driven by its widespread adoption across mid-range and premium vehicle models, particularly in sedans and compact SUVs.

These rim sizes offer a balanced combination of handling stability, ride comfort, and fuel efficiency, aligning with consumer demands for both performance and cost-effectiveness. The segment has benefited from increasing global production of vehicles equipped with mid-size wheels, alongside the growing preference for stylish wheel aesthetics and improved road grip.

Tire manufacturers have optimized their offerings in this size range to support enhanced tread life, reduced rolling resistance, and better braking performance. Additionally, the compatibility of 16 to 18 inch tires with a wide range of vehicles has simplified inventory and supply chain strategies for distributors, making it a favorable choice in both original equipment and aftermarket channels.

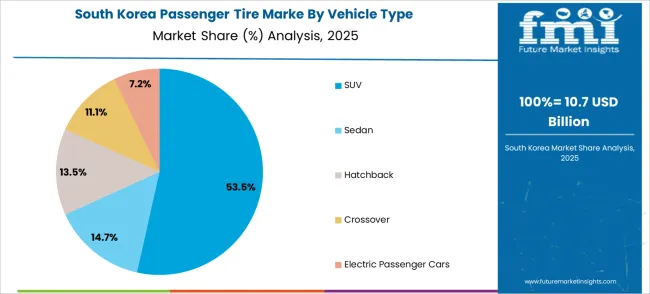

The SUV vehicle type segment is anticipated to contribute 53.8% of the total revenue share in the passenger tire market in 2025, reflecting a clear shift in consumer buying behavior toward utility vehicles. This segment’s expansion is being propelled by rising disposable incomes, improved road networks, and the perception of SUVs as safer and more versatile alternatives to smaller passenger cars.

The segment’s prominence has further been supported by the integration of comfort-oriented features and higher ground clearance, making SUV-compatible tires a necessity in both urban and off-road terrains. Tire manufacturers have responded with ruggedized sidewall construction, enhanced load-bearing capacity, and improved traction technologies tailored for SUV dynamics.

Moreover, global OEMs are increasingly prioritizing SUV models in their product portfolios, thereby pushing up demand for SUV-specific tire SKUs. Strong growth in electric and hybrid SUV variants is also influencing the adoption of low-noise and low-rolling-resistance tire technologies within this category.

The all season tires segment is projected to account for 57.5% of the passenger tire market revenue share in 2025, driven by the growing need for year-round reliability and minimal seasonal switching. This segment’s growth has been supported by its ability to deliver adequate performance in a variety of weather conditions, including light snow, rain, and dry roads, making it a preferred choice in regions with moderate climates.

Consumers are increasingly opting for all-season tires to avoid the cost and inconvenience associated with bi-annual tire changes. Technological innovations in tread pattern design and compound flexibility have enhanced the safety, durability, and comfort of all-season offerings, bringing them closer in performance to season-specific tires.

Regulatory trends favoring tire labeling, wet grip ratings, and noise reduction are also boosting adoption. The rise in personal vehicle ownership and the preference for simplified maintenance routines in densely populated urban areas are further reinforcing demand in this segment.

Premium passenger tires are gaining traction due to safety regulations, comfort needs, and performance-focused features. At the same time, all-season and low rolling resistance tires are being favored for cost efficiency, adaptability, and fuel-saving benefits, influencing OEM partnerships and material innovation.

Premium passenger tires have been observed in regions with higher vehicle ownership and a preference for performance driving. Increased adoption of radial and tubeless tires has been encouraged by their ability to deliver improved grip and enhanced ride comfort. The influence of stringent safety norms and higher expectations for braking efficiency has been shaping purchasing decisions. Growth has been aided by rising inclination toward tires with advanced tread patterns, offering superior traction in wet conditions. Manufacturers have been focusing on delivering enhanced cornering stability and reduced noise levels to appeal to consumers seeking better handling and comfort. This preference for quality and performance features is expected to dominate upcoming trends in replacement and original equipment segments.

Interest in all-season passenger tires has been reinforced by the desire for convenience and long-term cost savings. These variants have been promoted due to their adaptability across diverse road conditions without frequent seasonal replacements. Low rolling resistance tires have gained importance as automakers work toward fuel efficiency targets, influencing the supply chain to adapt to lighter materials and optimized tread designs. Partnerships between tire producers and vehicle manufacturers have been established to meet specific performance benchmarks for hybrid and compact vehicles. These strategies have been helping companies capture larger shares in OEM contracts, securing consistent revenue streams. The transition toward eco-friendly compounds without compromising durability is shaping research priorities across major tire brands.

The passenger tire market is largely driven by the consistent need for replacement tires, which accounts for a significant share of tire sales worldwide. Increased vehicle ownership, particularly in emerging markets like India, China, and Southeast Asia, has fueled demand for new and replacement tires, creating stable revenue streams for manufacturers. Seasonal requirements, wear and tear, and regulatory emphasis on tire safety contribute to shorter replacement cycles. Additionally, the trend toward premium and all-season tires for enhanced performance and safety in varying road conditions further supports this demand.

Innovation in tire technology is transforming the passenger tire market, with manufacturers focusing on low rolling resistance, improved grip, and durability to meet fuel efficiency and safety standards. The rapid adoption of electric vehicles (EVs) has accelerated the need for specialized tires that can handle higher torque, battery weight, and quieter performance requirements. Companies are investing in smart tire technologies with embedded sensors for real-time monitoring of pressure and temperature. Advanced tread compounds, silica blends, and eco-friendly materials are also being developed to meet stringent emission norms and sustainability goals. These innovations enhance tire lifespan, performance, and compatibility with next-generation mobility solutions.

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.2% |

| Germany | 3.9% |

| France | 3.5% |

| UK | 3.2% |

| USA | 2.8% |

| Brazil | 2.5% |

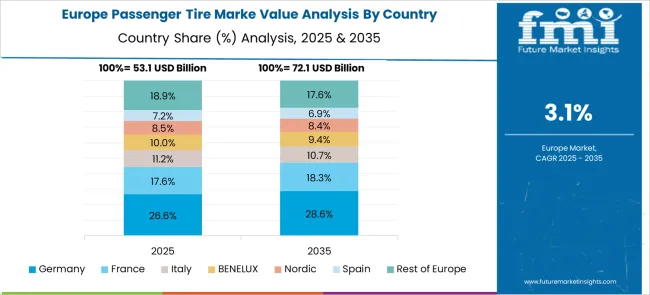

The passenger tire industry, projected to expand at a global CAGR of 3.4% through the forecast period, is witnessing notable differences in growth across major markets. China leads with a 4.5% CAGR, supported by higher automotive production and an expanding replacement tire segment. India follows with a 4.2% CAGR, influenced by growing passenger car ownership and greater preference for radial tires. Germany records a 3.9% CAGR, steady replacement demand, and emphasis on premium tire categories. Moderate expansion is being observed in France with a 3.5% CAGR, where all-season and low rolling resistance tires are gaining acceptance. The United Kingdom is growing at 3.2%, underpinned by gradual shifts in electric vehicle adoption. The United States, at 2.8% CAGR, indicates slower progress due to market maturity and extended tire replacement cycles. Emerging economies are expected to provide greater momentum compared to developed markets, creating strategic opportunities for manufacturers and distributors. The report includes an in-depth evaluation of 40+ countries, with these five serving as references.

The CAGR for the United States passenger tire market remained near 2.4% during 2020–2024, later increasing to 2.8% for 2025–2035 as vehicle electrification and demand for low rolling resistance tires intensified. Growth in the initial phase was influenced by mature replacement cycles and lower consumer preference for premium tire upgrades. The rise in CAGR for the next decade has been driven by the penetration of EV-compatible tires, advanced tread designs, and higher consumer focus on ride quality. Original equipment manufacturers collaborated with tire producers to meet efficiency norms, prompting capacity adjustments across major USA plants. Strategic imports from Mexico and Asia provided price advantages in a competitive environment, accelerating adoption in budget-sensitive segments.

The United Kingdom market posted a CAGR of 2.6% during 2020–2024, which moved up to 3.2% for 2025–2035. The earlier period saw modest progress due to extended replacement intervals and a stable vehicle ownership base. The upcoming rise in CAGR will increase fitment of all-season tires and compatibility improvements for hybrid and electric cars. Government regulations supporting eco-friendly compounds accelerated OEM sourcing strategies. Market growth is anticipated to rely on strategic alliances between retailers and automakers for integrated tire solutions. Digital retail penetration, combined with flexible service options, has expanded consumer convenience, contributing to higher tire replacement frequency over time.

Germany recorded a CAGR of 3.3% in 2020–2024, which is projected to rise to 3.9% for 2025–2035 as premium tire adoption strengthens in line with automotive technology advancements. The earlier phase showed consistent performance due to established safety norms and robust OEM alliances. The projected improvement in CAGR results from tire technologies optimized for EV and performance vehicles. Key German brands have emphasized advanced tread formulations and durability enhancements to maintain leadership in the European aftermarket. Procurement strategies from major car manufacturers reinforced demand stability, while increased emphasis on winter tire safety across EU regions contributed to additional replacement needs.

China exhibited a CAGR of 3.8% from 2020–2024, which advanced to 4.5% from 2025 to 2035 as rapid expansion in vehicle ownership persisted. Earlier trends were linked to strong OEM sourcing and growth in the aftermarket segment in Tier 2 and Tier 3 cities. The increase in CAGR for the future period is tied to the rise in electric mobility and government incentives for energy-efficient tires. Domestic manufacturers scaled up production to meet quality standards, while cross-border partnerships secured access to advanced compounds. E-commerce tire distribution has significantly expanded, enabling easier penetration of premium radial tire categories into semi-urban markets.

India’s CAGR shifted from 3.6% during 2020–2024 to 4.2% for 2025–2035, indicating the highest pace among major economies after China. The earlier phase relied on replacement demand and preference for entry-level radial tires. The future CAGR uplift is tied to wider automotive financing access, growing road infrastructure, and affordability-driven ownership models. Domestic manufacturers have expanded product portfolios featuring tubeless and all-season tires to cater to varied climates. OEM tie-ups with tire brands gained momentum, especially for compact and hybrid vehicles. Organized retail formats combined with strong digital networks provided scalability for distribution in emerging regions.

The passenger tire market is witnessing strategic advancements as leading players focus on technological innovation, energy efficiency, and tailored solutions for emerging automotive trends. Bridgestone, Michelin, and Goodyear Tire and Rubber Company continue to dominate with significant investments in radial tire technology and smart tire systems that integrate real-time monitoring for pressure, temperature, and wear. These firms are prioritizing low rolling resistance tires for electric vehicles, featuring advanced silica compounds and noise-reduction technologies to enhance range and driving comfort. Continental and Pirelli are reinforcing their leadership in the premium and ultra-high-performance segments, introducing tires optimized for luxury and sports vehicles while partnering with OEMs to comply with evolving safety and emission regulations. Both companies emphasize eco-friendly materials and adaptive tread designs that deliver superior grip and wet-weather performance.

Emerging players such as Roadbot are reshaping the competitive landscape through aggressive pricing, localized production, and e-commerce-driven distribution strategies in Asia, positioning themselves as strong challengers in value-sensitive markets. Their focus on affordable radial tires combined with service-linked packages is increasing accessibility for mass-market consumers. Across the industry, the strategic thrust toward digitalization, predictive maintenance, and material innovation is creating new benchmarks for durability, safety, and energy efficiency, ensuring competitive differentiation in a highly fragmented yet technology-driven market.

| Item | Value |

|---|---|

| Quantitative Units | USD 204.3 Billion |

| Rim Size | 16–18 inches, 13–15 inches, 19–21 inches, and Above 21 inches |

| Vehicle Type | SUV, Sedan, Hatchback, Crossover, and Electric Passenger Cars |

| Season | All-season Tires, Summer Tires, and Winter Tires |

| Sales Channel | OEM and Aftermarket |

| End Use | Private Vehicles, Taxi Fleets, and Ride Sharing Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bridgestone, Micheline, GoodyearTireandRubberCompany, Continental, Pirelli, and Roadbot |

| Additional Attributes | Dollar sales trends, share by tire type, regional demand shifts, OEM vs aftermarket contribution, pricing strategies, competitive benchmarking, raw material cost impact, EV tire adoption, and distribution channel performance to guide expansion and profitability. |

The global passenger tire market is estimated to be valued at USD 204.3 billion in 2025.

The market size for the passenger tire market is projected to reach USD 284.1 billion by 2035.

The passenger tire market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in passenger tire market are 16–18 inches, 13–15 inches, 19–21 inches and above 21 inches.

In terms of vehicle type, SUV segment to command 53.8% share in the passenger tire market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Passenger Ferries Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Passenger Security Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Assessing Passenger Boarding Bridge Market Share & Industry Trends

Passenger Car Bearing & Clutch Component Aftermarket Growth – Trends & Forecast 2024-2034

Passenger Car Seat Market Growth – Trends & Forecast 2024-2034

Used Passenger Car Sales Market

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Electric Passenger Car MRO Market Growth – Trends & Forecast 2025 to 2035

Safeguards for Passenger Transfer Area Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA