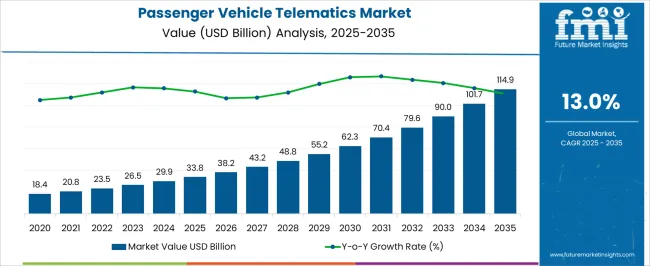

The passenger vehicle telematics market is projected to grow from USD 33.8 billion in 2025 to USD 114.9 billion by 2035, advancing at a CAGR of 13%. The 10-year growth comparison shows steady progress with values rising to 38.2 billion in 2026, 43.2 billion in 2027, and 48.8 billion by 2028. Demand is being driven by the increasing need for connectivity, real-time data tracking, remote diagnostics, and advanced driver-assistance systems (ADAS). This steady rise reflects a growing focus on enhancing in-vehicle experiences and fleet management capabilities, with a clear trajectory toward widespread adoption as essential for modern passenger vehicles.

By 2030, the market is expected to reach 62.3 billion, progressing to 70.4 billion in 2031 and 79.6 billion in 2033, then 90.0 billion in 2034. The final stretch to 114.9 billion in 2035 underscores the deepening integration of telematics in electric vehicles (EVs), autonomous driving systems, and connected infrastructure. Rapid acceleration reflects broader trends in automotive technology, where data-centric vehicles are becoming integral. The comparison indicates strong growth potential, with telematics viewed as a key enabler of automotive connectivity and performance optimization across a wide range of consumer and commercial vehicles.

| Metric | Value |

|---|---|

| Passenger Vehicle Telematics Market Estimated Value in (2025 E) | USD 33.8 billion |

| Passenger Vehicle Telematics Market Forecast Value in (2035 F) | USD 114.9 billion |

| Forecast CAGR (2025 to 2035) | 13.0% |

The passenger vehicle telematics segment is estimated to contribute about 35% of the automotive telematics market, roughly 27% of the connected vehicle market, close to 22% of the in-vehicle infotainment market, nearly 18% of the vehicle electronics market, and around 10% of the automotive safety systems market. These proportions total approximately 112% across the listed parent categories. This indicates the substantial role passenger vehicle telematics plays in enhancing vehicle connectivity, safety, and user experience.

The integration of telematics systems allows for real-time data transmission, navigation, remote diagnostics, and infotainment, which directly improve operational efficiency, driving experience, and safety for both consumers and manufacturers. Analysts view telematics as a core component of modern vehicle design, where it serves as the enabler for driver assistance systems, over-the-air updates, and advanced navigation services. Demand has been bolstered by increasing consumer expectations for smarter vehicles and by regulatory requirements for enhanced safety features.

The rise of electric vehicles and autonomous driving technologies further supports the adoption of telematics systems, ensuring that their role in automotive ecosystems will only grow. As such, the passenger vehicle telematics market is seen as an integral part of the broader automotive technology landscape, with its continued evolution set to shape future vehicle design, safety protocols, and user interface standards across the industry.

The passenger vehicle telematics market is experiencing substantial growth, driven by the integration of advanced connectivity solutions to enhance safety, security, and user experience in modern vehicles. Increasing regulatory mandates for safety features, coupled with the rising demand for connected car services, are accelerating adoption across global markets. Advancements in communication networks, particularly the expansion of 4G LTE and the rollout of 5G, are enabling faster data transfer and improved real-time analytics capabilities.

Original equipment manufacturers are focusing on embedding telematics systems during production to meet consumer demand for seamless navigation, infotainment, and emergency assistance services. The market is also benefiting from the rise of usage-based insurance models and fleet management solutions that rely heavily on telematics data.

As consumers increasingly value predictive maintenance, driver assistance features, and vehicle tracking, the market is poised for further expansion. With technology innovation and supportive regulatory frameworks, telematics is expected to become a standard feature in passenger vehicles, driving sustained growth in the coming years.

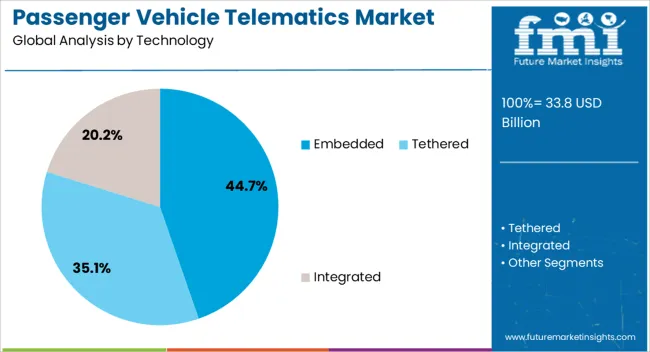

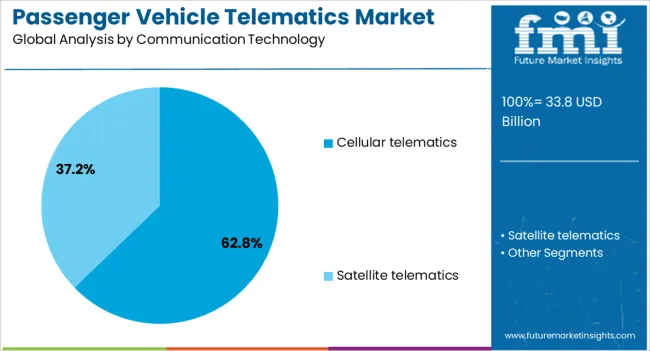

The passenger vehicle telematics market is segmented by technology, communication technology, service offering, and geographic regions. By technology, passenger vehicle telematics market is divided into Embedded, Tethered, and Integrated. In terms of communication technology, passenger vehicle telematics market is classified into Cellular telematics and Satellite telematics.

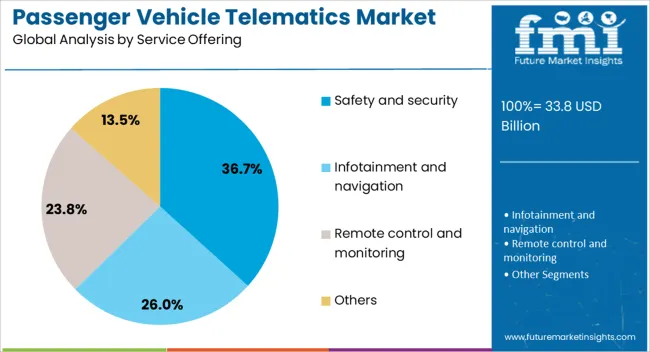

Based on service offering, passenger vehicle telematics market is segmented into Safety and security, Infotainment and navigation, Remote control and monitoring, and Others. Regionally, the passenger vehicle telematics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The embedded technology segment is projected to hold 44.7% of the passenger vehicle telematics market revenue share in 2025, making it the leading technology type. This leadership is being driven by the seamless integration of telematics hardware and software into vehicles during manufacturing, ensuring reliability, security, and consistent performance. Embedded systems offer advantages such as always-on connectivity, enhanced data protection, and compatibility with advanced driver assistance systems, which are increasingly important for meeting safety and regulatory requirements.

The absence of dependency on external devices ensures uninterrupted access to critical services, including emergency response, navigation, and real-time diagnostics. Automakers are prioritizing embedded solutions to maintain brand differentiation and deliver a unified customer experience.

Additionally, embedded telematics is better positioned to leverage evolving communication technologies like 5G, enabling richer data applications and faster processing With growing consumer expectations for built-in digital services and the need for manufacturers to comply with telematics-related regulations, this segment is expected to maintain its dominance in the global market.

The cellular telematics segment is anticipated to account for 62.8% of the passenger vehicle telematics market revenue share in 2025, establishing itself as the dominant communication technology. This prominence is being reinforced by the reliability, speed, and broad coverage provided by cellular networks, enabling real-time communication between vehicles, infrastructure, and service platforms.

The deployment of 4G LTE networks and the rapid adoption of 5G technology are enhancing telematics applications, supporting high-bandwidth services such as video streaming, remote diagnostics, and advanced navigation. Cellular connectivity offers a scalable and future-proof solution for automakers seeking to deliver consistent service quality across regions.

The ability to transmit data securely over long distances is making cellular telematics essential for safety features, over-the-air software updates, and vehicle-to-everything communications. As connected and autonomous vehicle initiatives expand, cellular telematics is expected to remain the backbone of in-vehicle connectivity, ensuring reliable performance for both safety-critical and infotainment services in passenger vehicles.

The safety and security service offering segment is expected to capture 36.7% of the passenger vehicle telematics market revenue share in 2025, making it the leading service category. Its leadership is being driven by increasing regulatory emphasis on mandatory safety features, as well as growing consumer demand for enhanced vehicle protection. Services such as automatic crash notification, stolen vehicle tracking, and emergency assistance are becoming essential components of modern telematics systems.

Automakers and telematics providers are enhancing these services with AI-powered predictive safety alerts and real-time monitoring to improve driver and passenger protection. The rising adoption of safety-focused telematics is also linked to insurance incentives, as insurers offer premium discounts for vehicles equipped with advanced monitoring and security features.

Growing concerns about road safety, coupled with advancements in location tracking accuracy and data analytics, are further supporting the expansion of this segment. As the automotive industry continues to prioritize occupant safety, the demand for telematics-based safety and security solutions is expected to remain strong and drive sustained market leadership.

The passenger vehicle telematics market is expected to grow as demand for connectivity, safety features, and real-time data increases across the automotive industry. Demand is reinforced by in-vehicle navigation, infotainment systems, and driver assistance systems that enhance the user experience. Opportunities are opening in the integration of AI for predictive maintenance, remote diagnostics, and personalized services. Trends indicate a move toward 5G integration and smarter in-car experiences. Challenges remain with data privacy concerns, integration complexities, and competition from alternative connectivity solutions.

Demand for passenger vehicle telematics is growing as consumers seek more connected, smarter, and safer driving experiences. Telematics solutions are being integrated into infotainment, navigation, fleet management, and driver assistance systems that offer real-time traffic, vehicle health diagnostics, and safety alerts. The rise in demand for features like remote vehicle monitoring, emergency response systems, and navigation-based routing is reinforcing growth. Demand will come from the mid-range and high-end segments, where premium features and customization are prioritized by consumers looking for enhanced driving comfort and safety.

Opportunities are opening with the integration of artificial intelligence (AI) and machine learning for predictive maintenance, route optimization, and personalized driving experiences. AI-enabled telematics systems can monitor vehicle performance, detect issues before they cause breakdowns, and recommend maintenance services. This data-driven approach is increasingly valuable for fleet operators, rental agencies, and consumers. Opportunities lie in offering connected services that improve vehicle uptime, provide seamless integration with mobile apps, and create a personalized driving experience. These features will play a significant role in driving adoption in both the consumer and commercial vehicle markets.

Trends in the passenger vehicle telematics market are focusing on the integration of 5G connectivity to enhance communication between vehicles and the infrastructure around them. This will enable faster data transmission, support real-time decision-making, and allow for advanced in-car experiences, such as live streaming, remote vehicle control, and highly responsive navigation systems. There is also a shift toward enhanced infotainment systems, which offer a richer, more interactive user experience. 5G will be the key enabler for next-gen telematics, allowing vehicles to become more integrated into the larger connected ecosystem, paving the way for more sophisticated autonomous driving features in the future.

Challenges in the market stem from growing concerns around data privacy, as telematics systems collect and transmit vast amounts of personal information. Regulatory pressures and consumer awareness regarding data protection may slow adoption in certain regions. Integration with existing vehicle systems, cloud platforms, and third-party services can also be complex, resulting in delays and higher costs for manufacturers. Competition from alternative connectivity solutions, such as Wi-Fi-based or Bluetooth-based platforms, may limit telematics growth in certain price-sensitive market segments.

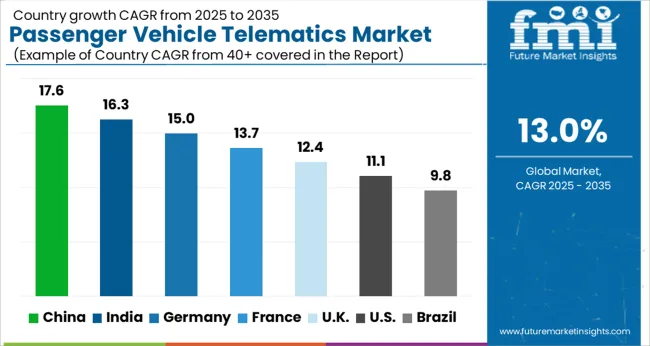

| Country | CAGR |

|---|---|

| China | 17.6% |

| India | 16.3% |

| Germany | 15.0% |

| France | 13.7% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The global passenger vehicle telematics market is projected to grow at 13% from 2025 to 2035. China leads at 17.6%, followed by India 16.3% and France 13.7%; the United Kingdom 12.4% and United States 11.1% follow. Demand is driven by the increasing adoption of connected vehicle features, including navigation, real-time diagnostics, driver assistance systems, and fleet management. The rise of electric vehicles (EVs), coupled with the push for advanced safety systems and the increasing reliance on data-driven insights, is accelerating growth. Asia is expected to lead in terms of volume production, while Europe and the USA are focusing on premium features, regulatory compliance, and service-based business models. The market will continue to grow, driven by innovations in 5G, AI, and vehicle-to-everything (V2X) communication technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

Top Flywheel Energy Storage Market Dynamics

The passenger vehicle telematics market in China is expected to expand at 17.6%. The rapid growth of the automotive sector in China, driven by the government's support for electric vehicles (EVs) and smart cities, is propelling the demand for telematics systems. OEMs are increasingly incorporating telematics into vehicles for real-time diagnostics, in-vehicle infotainment, navigation, and advanced driver assistance systems (ADAS). Moreover, the rise of connected and autonomous vehicles (CAVs) is expected to significantly boost demand for V2X communication technologies. As China continues to push forward with its smart mobility agenda, the telematics market is set to benefit from the integration of 5G and AI, which will drive further innovation and expansion.

The passenger vehicle telematics market in India is projected to grow at 16.3%. The market is being driven by increasing vehicle sales, rising demand for safety features such as ADAS, and government initiatives promoting electric mobility. The integration of telematics into passenger vehicles for real-time monitoring, vehicle health diagnostics, navigation, and location-based services is becoming a key trend in India. Fleet management and vehicle tracking systems are gaining traction, especially in logistics and transportation sectors, which are increasingly adopting connected technologies to improve efficiency. With the growing adoption of smartphones and mobile apps in India, telematics solutions are expected to gain further popularity.

The passenger vehicle telematics market in France is anticipated to rise at 13.7%. As European Union regulations on vehicle safety and emissions become stricter, France is seeing growing adoption of telematics in passenger vehicles for real-time diagnostics, predictive maintenance, and fleet management. The demand for connected services such as infotainment, vehicle tracking, and over-the-air (OTA) updates is increasing, particularly in the luxury vehicle segment. French OEMs are increasingly integrating telematics features into their vehicles to improve driver assistance, navigation, and overall user experience. Additionally, the growth of shared mobility platforms and EV adoption is further contributing to the market expansion.

The passenger vehicle telematics market in the UK is expected to expand at 12.4%. The UK automotive market is witnessing a shift toward connected and electric vehicles, which is driving the adoption of telematics solutions. As the demand for real-time diagnostics, driver assistance, and safety features such as lane-keeping assist and emergency braking increases, OEMs are integrating more telematics technology into their vehicles. Additionally, the rise in fleet management systems and mobility services in the UK is contributing to the growth of the telematics market. The UK government’s push for smart mobility, along with advancements in 5G networks, will further accelerate telematics adoption.

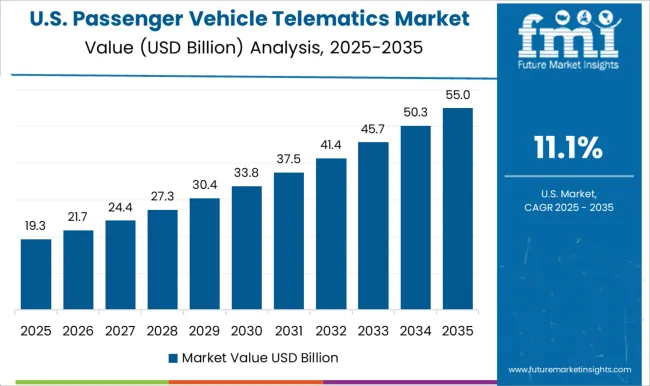

The passenger vehicle telematics market in the United States is projected to grow at 11.1%. The USA automotive market is seeing a rapid increase in connected vehicle features, including infotainment systems, real-time diagnostics, and driver assistance systems. The widespread adoption of EVs and autonomous vehicles (AVs) is further accelerating the demand for advanced telematics solutions. As the automotive industry shifts towards electrification, data-driven features such as predictive maintenance, in-vehicle services, and V2X communication are becoming essential. Additionally, increasing consumer interest in safety and convenience is driving OEMs to integrate more telematics functions into their vehicles.

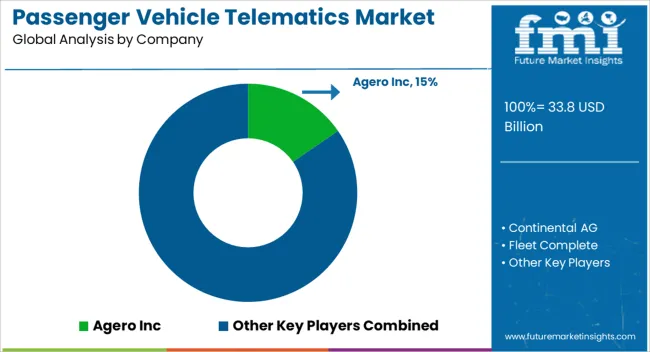

The passenger vehicle telematics market is shaped by competition among global technology providers, automotive OEMs, and specialized telematics solution companies. Leading players such as Continental, Harman International, Bosch, Delphi Technologies, and Verizon Telematics dominate through integrated platforms that combine connectivity, navigation, infotainment, safety, and vehicle diagnostics. Competition is driven by the ability to deliver secure, reliable, and real-time data services that enhance vehicle performance, driver convenience, and fleet management capabilities.

Differentiation is achieved through advanced software algorithms, cloud-based services, AI integration, cybersecurity measures, and compatibility with electric and autonomous vehicles. Strategic partnerships with automakers, investments in 5G connectivity, and regional deployment of telematics control units intensify rivalry. Mid-sized and niche players focus on specialized solutions, such as usage-based insurance, predictive maintenance, and fleet analytics, adding depth to the market dynamics. Regulatory compliance, data privacy, and service scalability further influence competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.8 Billion |

| Technology | Embedded, Tethered, and Integrated |

| Communication Technology | Cellular telematics and Satellite telematics |

| Service Offering | Safety and security, Infotainment and navigation, Remote control and monitoring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agero Inc, Continental AG, Fleet Complete, Geotab Inc, LG Electronics, MiX Telematics, Octo Telematics, OnStar Corporation, Qualcomm Incorporated, and Verizon Connect |

| Additional Attributes | Dollar sales by application (navigation, safety & security, infotainment, vehicle diagnostics, fleet management), Dollar sales by connectivity type (embedded, integrated, tethered), Trends in 5G adoption, data security, and autonomous driving integration, Role in improving vehicle performance, safety, and customer experience, Growth driven by connected vehicles and smart city infrastructure, Regional demand across North America, Europe, Asia Pacific. |

The global passenger vehicle telematics market is estimated to be valued at USD 33.8 billion in 2025.

The market size for the passenger vehicle telematics market is projected to reach USD 114.9 billion by 2035.

The passenger vehicle telematics market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in passenger vehicle telematics market are embedded, tethered and integrated.

In terms of communication technology, cellular telematics segment to command 62.8% share in the passenger vehicle telematics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passenger Car Seat Market Forecast and Outlook 2025 to 2035

Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Passenger Ferries Market Size and Share Forecast Outlook 2025 to 2035

Passenger Security Market Size and Share Forecast Outlook 2025 to 2035

Passenger Tire Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Assessing Passenger Boarding Bridge Market Share & Industry Trends

Passenger Car Bearing & Clutch Component Aftermarket Growth – Trends & Forecast 2024-2034

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Used Passenger Car Sales Market

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Electric Passenger Car MRO Market Growth – Trends & Forecast 2025 to 2035

Safeguards for Passenger Transfer Area Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA