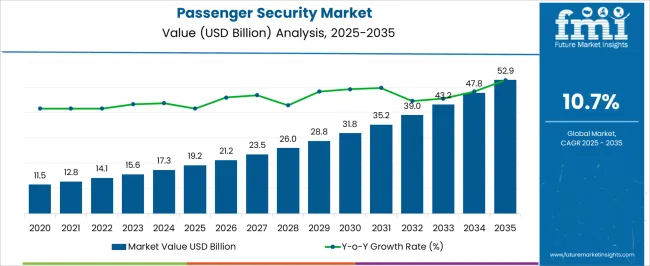

The passenger security market is estimated to be valued at USD 19.2 billion in 2025 and is projected to reach USD 52.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

Advanced screening technologies, including automated X-ray scanners, millimeter-wave body scanners, and explosive trace detection systems, are expected to account for the largest share of the market throughout the forecast period. These technologies are increasingly adopted due to their efficiency, reliability, and capability to handle higher passenger volumes without compromising security standards. Biometric authentication systems, encompassing facial recognition, fingerprint scanning, and iris recognition, exhibit a robust growth trajectory driven by the need for faster, contactless passenger verification and integration with digital identity frameworks.

Software-driven surveillance, including AI-enabled video analytics and behavior detection platforms, is emerging as a critical contributor, enabling real-time threat detection and predictive security measures across airports, railway stations, and other transport terminals. Traditional security measures, such as manual screening and metal detectors, maintain a consistent but gradually declining contribution, as airports and other transport authorities prioritize automation and advanced technology integration. The market contribution pattern indicates that high-investment, technology-intensive solutions will dominate revenue share, while incremental adoption of complementary technologies will enhance efficiency and accuracy in passenger security operations over the forecast period.

| Metric | Value |

|---|---|

| Passenger Security Market Estimated Value in (2025 E) | USD 19.2 billion |

| Passenger Security Market Forecast Value in (2035 F) | USD 52.9 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

The passenger security market is regarded as a vital segment within aviation, transportation, and public safety industries. It is estimated to hold 7.4% of the airport and aviation security systems market, reflecting adoption of screening technologies, access control, and monitoring systems. Within transportation safety and surveillance, a 5.8% share is observed, driven by growing passenger flow and risk mitigation needs. The homeland security and defense sector contributes 3.6%, emphasizing threat detection and counterterrorism measures. Smart security technologies account for 4.2%, where AI driven surveillance and biometric solutions are increasingly applied. Public infrastructure protection adds 2.9%, reflecting integration into stations, terminals, and high traffic zones.

Recent trends have been shaped by adoption of artificial intelligence, biometric identification, and advanced imaging technologies. Groundbreaking developments include full body scanners, AI based threat recognition systems, and automated baggage inspection solutions. Key players are forming strategic partnerships with airports, transit authorities, and technology providers to deploy integrated security solutions. Efforts focus on improving passenger throughput, predictive threat detection, and centralized monitoring systems. Regional growth is led by North America and Europe due to stringent aviation security regulations, while Asia-Pacific is witnessing expansion from rising air travel and transit infrastructure projects. Continuous innovation in sensor technology, analytics, and remote monitoring is strengthening safety and operational efficiency.

The market is advancing steadily, driven by heightened global emphasis on traveler safety, regulatory compliance, and the adoption of advanced security technologies in transportation hubs. Governments and operators are investing in modernized infrastructure to manage growing passenger volumes while maintaining rigorous safety protocols.

The integration of AI, biometrics, and advanced screening technologies is enhancing the accuracy and efficiency of security systems, reducing delays, and improving the passenger experience. Rising concerns over global security threats, coupled with the increasing sophistication of detection technologies, are fostering the deployment of adaptive and scalable solutions.

In addition, the expansion of air travel in emerging economies and upgrades to existing facilities in developed regions are creating sustained demand for passenger security systems The combination of regulatory mandates, public safety concerns, and technological advancements ensures the market’s continued growth trajectory, with solution providers focusing on innovation, interoperability, and real-time monitoring to meet evolving operational and security needs.

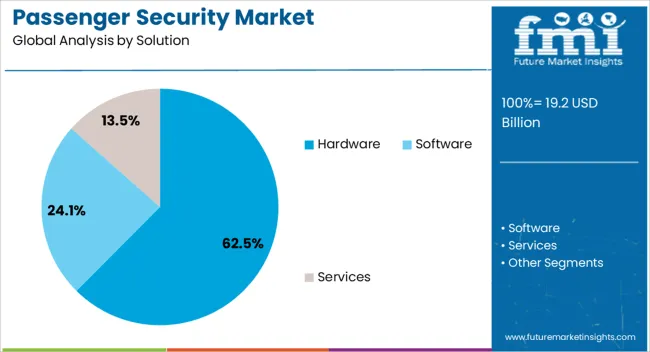

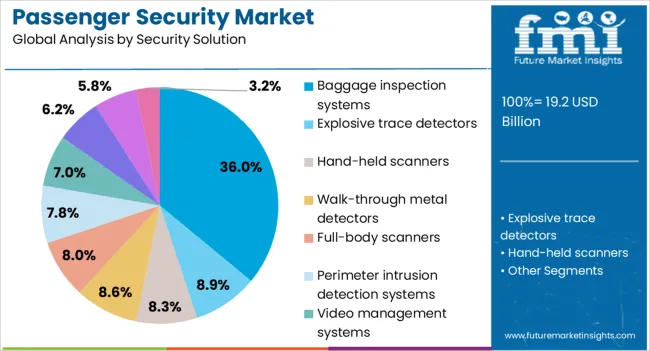

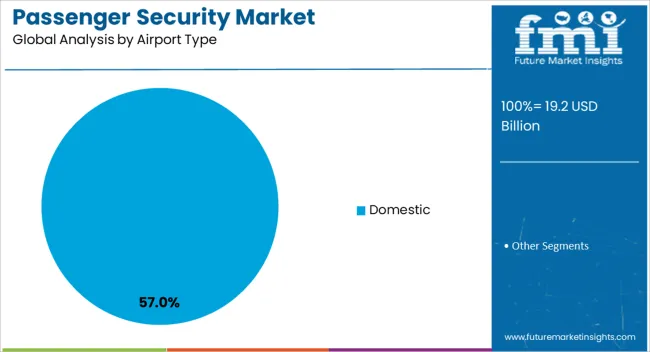

The passenger security market is segmented by solution, security solution, airport type, and geographic regions. By solution, passenger security market is divided into hardware, software, and services. In terms of security solution, passenger security market is classified into baggage inspection systems, explosive trace detectors, hand-held scanners, walk-through metal detectors, full-body scanners, perimeter intrusion detection systems, video management systems, access control/biometric systems, bar-coded boarding systems, and cybersecurity solutions. Based on airport type, passenger security market is segmented into domestic. Regionally, the passenger security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment within the solution category is projected to hold 62.45% of the passenger security market revenue share in 2025, establishing it as the leading segment. This dominance has been supported by the critical role hardware plays in physical security infrastructure, including scanners, screening systems, surveillance cameras, and access control devices. Investments in robust hardware are being prioritized to ensure operational reliability, compliance with security regulations, and the capacity to handle increasing passenger volumes. Hardware systems are being enhanced with software-driven intelligence, enabling faster updates, integration with analytics platforms, and improved interoperability. The rising need for high-throughput, accurate detection in airports and transport hubs has reinforced the importance of dependable physical equipment. Additionally, the ability of modern hardware to integrate seamlessly with emerging technologies such as biometrics and AI-based threat detection has increased its adoption As transportation hubs expand and upgrade facilities, the demand for advanced, durable, and high-performance security hardware continues to drive this segment’s leadership position.

The baggage inspection systems subsegment within the security solution category is anticipated to command 36.00% of the market revenue share in 2025, marking it as the most significant contributor in its category. Growth in this segment has been attributed to the need for efficient, accurate, and non-intrusive inspection processes that can handle large volumes of passenger luggage. Advances in imaging technologies, including computed tomography and automated threat detection algorithms, have improved the precision and speed of baggage screening. Compliance with stringent aviation security regulations has made the deployment of advanced inspection systems a necessity in both new and upgraded airport facilities. These systems also reduce human error by integrating automated analysis, leading to faster decision-making and reduced congestion in baggage handling areas The increasing complexity of security threats and the push for improved passenger convenience are further propelling the adoption of these systems, ensuring their sustained role as a critical component of modern passenger security infrastructure.

The domestic segment within the airport type category is expected to account for 57% of the market revenue share in 2025, positioning it as the dominant airport type. This leadership has been reinforced by the high frequency of domestic air travel, driven by growing connectivity between regional and metropolitan areas. Domestic airports often handle a larger number of short-haul flights, requiring efficient security operations to maintain rapid passenger throughput without compromising safety. Increased investments in upgrading security infrastructure in domestic terminals have been influenced by rising passenger expectations and regulatory oversight. The segment’s prominence is also supported by government funding initiatives aimed at enhancing security capacity in regional hubs to support tourism and business travel. The adoption of advanced screening systems, integrated surveillance networks, and biometric identification technologies in domestic facilities has further strengthened operational efficiency As domestic travel demand continues to grow, these airports remain a priority for security technology deployment, cementing their leading position in the market.

The market has expanded rapidly due to growing emphasis on traveler safety, regulatory compliance, and threat mitigation across airports, railway stations, seaports, and urban transit systems. Solutions such as access control, surveillance cameras, biometric authentication, baggage screening, and perimeter monitoring have been deployed to prevent unauthorized access, detect prohibited items, and ensure operational continuity. Rising air travel, increased mass transit usage, and high profile security incidents have reinforced the adoption of advanced technologies. Investments in integrated security management systems, AI powered analytics, and remote monitoring have enhanced threat detection and operational efficiency across passenger transport hubs globally.

Passenger security systems have been strengthened through the deployment of advanced screening and detection solutions that identify explosives, weapons, and contraband. X ray scanners, millimeter wave body scanners, and trace detection equipment have been widely used to ensure compliance with regulatory standards. Integration of AI and machine learning has enabled real time threat assessment, automated alerts, and improved detection accuracy. Baggage handling systems have been designed to reduce false alarms while maintaining operational throughput. Continuous upgrades in detection technology have increased passenger safety and minimized the risk of security breaches, creating confidence among travelers and transport authorities alike.

Biometric identification and access control systems have become integral to passenger security by enabling automated identity verification and reducing manual checks. Fingerprint, facial recognition, iris scanning, and multi factor authentication technologies have been deployed in boarding gates, VIP lounges, and restricted areas. These systems improve operational efficiency, reduce human error, and enhance throughput during peak travel periods. Integration with digital ticketing, travel management platforms, and airport management systems has streamlined security workflows. Adoption of contactless and mobile enabled authentication methods has further supported passenger convenience while maintaining stringent safety protocols.

Closed circuit television (CCTV), IP cameras, and remote monitoring systems have been extensively deployed to monitor passenger areas, perimeters, and access points. Video analytics, motion detection, and AI based behavioral monitoring allow early identification of suspicious activities. Centralized monitoring platforms provide operators with real time situational awareness and coordinated response capabilities. Integration with emergency response systems, public announcement platforms, and incident management software has enhanced incident mitigation. The combination of advanced surveillance infrastructure and predictive analytics has strengthened security enforcement while reducing operational risks, supporting both regulatory compliance and passenger confidence.

The expansion of airports, railways, and seaports has driven the need for scalable passenger security solutions that align with building design, crowd management, and operational workflows. Regulatory frameworks set by aviation and transportation authority’s mandate installation of certified screening, access, and monitoring systems. Compliance with standards related to passenger privacy, data protection, and system reliability has shaped product development and deployment strategies. Security planning now includes risk assessment, system integration, and emergency response preparedness. The combination of infrastructural expansion and regulatory enforcement has maintained steady market growth while encouraging investment in innovative security technologies.

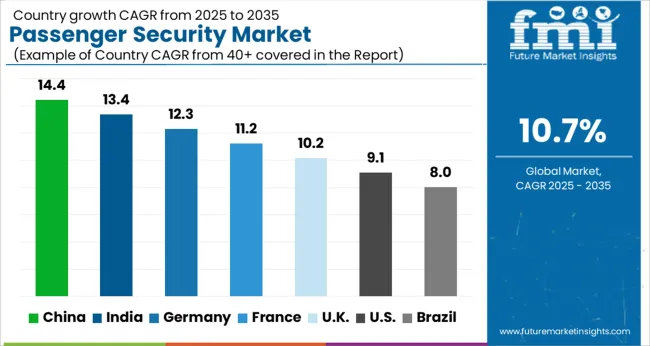

| Country | CAGR |

|---|---|

| China | 14.4% |

| India | 13.4% |

| Germany | 12.3% |

| France | 11.2% |

| UK | 10.2% |

| USA | 9.1% |

| Brazil | 8.0% |

China led the market with a forecast CAGR of 14.4%, driven by large-scale implementation in airports, railways, and urban transport hubs. India followed at 13.4%, supported by expanding public transportation infrastructure and adoption of advanced surveillance technologies. Germany recorded 12.3%, benefiting from stringent safety regulations and integration of automated security systems. The United Kingdom grew at 10.2%, focusing on technological upgrades in passenger screening and monitoring solutions. The United States registered 9.1%, sustained by continuous investments in aviation and mass transit security systems. Collectively, these countries represent a robust landscape of technological deployment, innovation, and market expansion in passenger security. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 14.4% in the market, driven by increasing air, rail, and road passenger traffic and the implementation of stringent safety regulations. Growing government investments in transport infrastructure and security systems are fostering adoption. Technological advancements such as AI-enabled surveillance, biometric verification, and integrated screening solutions enhance operational efficiency and threat detection. The market also benefits from rising awareness among transport operators about passenger safety and regulatory compliance. China’s passenger security sector is expanding due to infrastructural modernization, heightened safety concerns, and increasing deployment of smart security solutions.

India is witnessing a CAGR of 13.4% in the market, supported by rapid urbanization, expansion of airports, metro, and railway networks, and increasing focus on traveler safety. Implementation of advanced screening equipment and automated surveillance systems is rising. The government’s initiatives to strengthen security measures and ensure compliance with international standards are further driving market growth. Adoption of integrated solutions combining CCTV, X-ray, and biometric verification is increasing across major transport hubs. India presents significant growth potential, fueled by infrastructural investments, technological adoption, and rising awareness of passenger security requirements.

Germany is expected to grow at a CAGR of 12.3% in the market, propelled by stringent European safety regulations, modernization of transport infrastructure, and adoption of cutting-edge technologies. Airports, train stations, and metro systems are upgrading screening processes with AI-based surveillance, biometric identification, and real-time threat detection. The demand for automated and efficient systems is rising to reduce manual intervention and improve passenger throughput. Germany’s passenger security sector is expanding due to regulatory compliance, technological innovation, and the need for safe and efficient transport operations.

The United Kingdom is growing at a CAGR of 10.2% in the market, supported by investments in airport, railway, and bus transport security. Modernization of screening and surveillance systems, adoption of AI-driven analytics, and implementation of integrated security frameworks are key trends. The market is also influenced by rising passenger traffic and government initiatives to strengthen safety standards. The UK market presents stable growth opportunities for passenger security solutions, driven by advanced technological adoption, regulatory requirements, and heightened focus on safeguarding travelers.

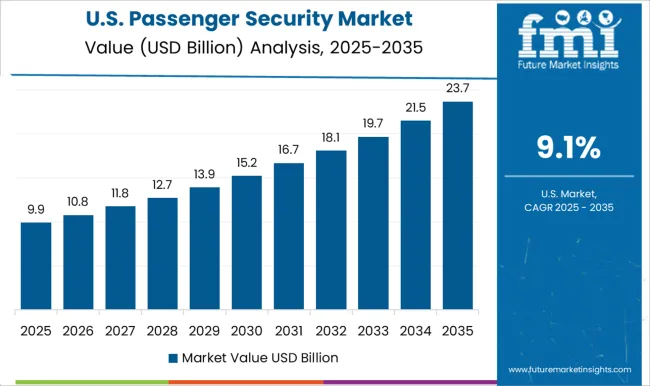

The United States is projected to expand at a CAGR of 9.1% in the market, driven by modernization of airports, railways, and urban transit systems. Advanced surveillance, biometric identification, and AI-enabled monitoring solutions are increasingly adopted to enhance security measures. Federal regulations and compliance standards also encourage deployment of sophisticated systems across transport hubs. The US market exhibits steady growth due to the need for high-performance security solutions, rising traveler volumes, and investments in next-generation screening technologies.

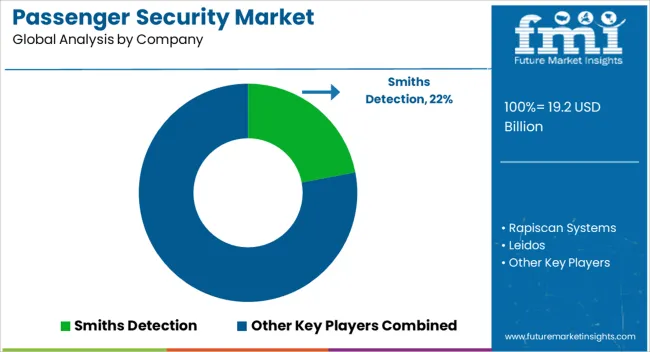

The market is dominated by firms delivering advanced screening, detection, and monitoring solutions for airports, railways, and other high-traffic transportation hubs. Smiths Detection is a key player, offering a broad portfolio of security screening equipment including X-ray scanners, explosive detection systems, and trace detection technologies, focusing on efficiency and reliability. Rapiscan Systems provides integrated passenger screening solutions, combining advanced imaging technology with automated threat recognition software to enhance safety and throughput in high-density environments. Leidos contributes through its expertise in systems integration, offering turnkey security solutions that combine hardware, software, and operational support for comprehensive passenger safety management.

Thales operates across multiple security domains, supplying sophisticated biometric identification, access control, and threat detection systems to streamline passenger processing while maintaining high safety standards. Honeywell emphasizes smart, connected solutions with AI-enabled analytics and IoT integration, enhancing real-time monitoring and operational efficiency. In addition to these leading providers, a range of other companies supports regional and specialized needs, supplying innovative screening technologies, portable detection devices, and complementary security services, collectively strengthening the global passenger security infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.2 billion |

| Solution | Hardware, Software, and Services |

| Security Solution | Baggage inspection systems, Explosive trace detectors, Hand-held scanners, Walk-through metal detectors, Full-body scanners, Perimeter intrusion detection systems, Video management systems, Access control/biometric systems, Bar-coded boarding systems, and Cybersecurity solutions |

| Airport Type | Domestic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smiths Detection, Rapiscan Systems, Leidos, Thales, Honeywell, and Other |

| Additional Attributes | Dollar sales by solution type and transportation mode, demand dynamics across aviation, rail, and public transit sectors, regional trends in security technology adoption, innovation in screening, biometrics, and threat detection, environmental impact of equipment manufacturing and disposal, and emerging use cases in automated security, smart surveillance, and passenger flow management. |

The global passenger security market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the passenger security market is projected to reach USD 52.9 billion by 2035.

The passenger security market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in passenger security market are hardware, software and services.

In terms of security solution, baggage inspection systems segment to command 36.0% share in the passenger security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Passenger Ferries Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Passenger Tire Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Assessing Passenger Boarding Bridge Market Share & Industry Trends

Passenger Car Bearing & Clutch Component Aftermarket Growth – Trends & Forecast 2024-2034

Passenger Car Seat Market Growth – Trends & Forecast 2024-2034

Used Passenger Car Sales Market

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Electric Passenger Car MRO Market Growth – Trends & Forecast 2025 to 2035

Safeguards for Passenger Transfer Area Market Size and Share Forecast Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA