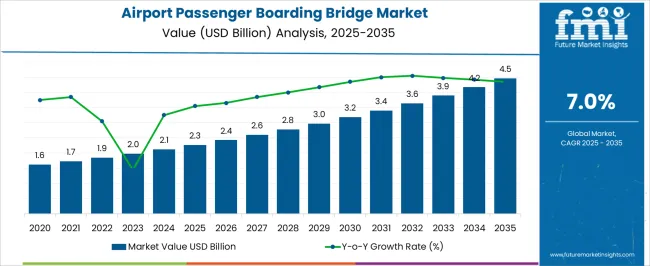

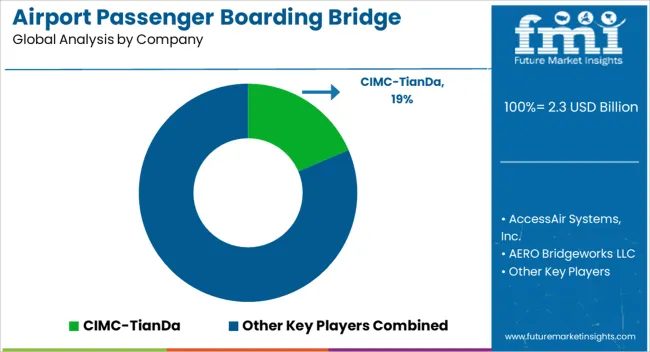

The airport passenger boarding bridge market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

This early phase captures nearly one-third of the total opportunity, reflecting rising investments in airport expansions and fleet upgrades that directly translate into increased procurement of passenger boarding bridges. Between 2030 and 2035, the market rises from usd 3.0 billion to usd 4.5 billion, unlocking usd 1.5 billion in absolute opportunity during this five-year span alone. This segment contributes more than two-thirds of the total incremental value, highlighting the acceleration in adoption during the consolidation phase. The total absolute opportunity of usd 2.2 billion from 2025 to 2035 indicates significant room for market participants to capture revenues across product upgrades, service contracts, and global deployments. With the compound effect of a 7.0% cagr, the market expansion represents consistent, data-backed growth over the decade.

| Metric | Value |

|---|---|

| Airport Passenger Boarding Bridge Market Estimated Value in (2025 E) | USD 2.3 billion |

| Airport Passenger Boarding Bridge Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

A breakpoint analysis of the airport passenger boarding bridge market, valued at USD 2.3 billion in 2025 and reaching USD 4.5 billion by 2035 at a CAGR of 7.0%, highlights two critical transition phases. The first breakpoint occurs around 2028–2029, when the market crosses USD 2.7 billion. This marks a shift from early expansion to accelerated adoption, with annual additions averaging USD 0.2 billion. Stakeholders at this stage benefit from heightened airport capacity projects and infrastructure modernization. This initial breakpoint signals when procurement volumes become large enough to drive economies of scale, supporting more competitive pricing and service bundling opportunities.

The second major breakpoint emerges after 2031, when the market surpasses USD 3.4 billion and accelerates toward USD 4.5 billion by 2035. This phase alone generates USD 1.1 billion in incremental opportunity, accounting for half of the total decade-long expansion. The rising slope in this period reflects intensified replacement demand, coupled with increased installations in mid-sized airports. Operators and manufacturers positioning themselves at this breakpoint capture greater margins from long-term contracts and retrofits. Thus, the breakpoints of 2028–2029 and 2031–2032 define key inflection points that guide capacity planning, investment timing, and competitive strategies.

The airport passenger boarding bridge market is progressing steadily, supported by the continuous expansion and modernization of airport infrastructure worldwide. Rising global air passenger traffic, driven by increasing connectivity, tourism growth, and airline fleet expansion, has intensified the demand for advanced passenger boarding solutions. Industry publications and airport development reports have highlighted the integration of boarding bridges that improve passenger comfort, reduce boarding times, and enhance operational safety.

Investments in airport terminal upgrades have prioritized the deployment of energy-efficient and technologically advanced boarding bridge systems with features such as automated alignment and enhanced climate control. Additionally, growing emphasis on passenger experience, particularly in extreme climate regions, has influenced the adoption of bridges equipped with advanced tunnel designs and climate control systems.

In the coming years, market growth is expected to be shaped by the replacement of aging infrastructure, integration of smart control systems, and increasing adoption of modular and customizable bridge configurations to meet diverse airport layouts and operational needs.

The airport passenger boarding bridge market is segmented by boarding bridge type, model type, tunnel type, docking type, foundation, technology, and geographic regions. By boarding bridge type, airport passenger boarding bridge market is divided into moving passenger boarding bridge and fixed passenger boarding bridge. In terms of model type, airport passenger boarding bridge market is classified into apron drive bridge, dual boarding system, commuter bridge, nose loader bridge, T-bridge, and over-the-wing bridge. Based on tunnel type, airport passenger boarding bridge market is segmented into air-conditioned tunnel and non air-conditioned tunnel. By docking type, airport passenger boarding bridge market is segmented into intelligent docking system and manual docking system. By foundation, airport passenger boarding bridge market is segmented into fixed, movable, hydraulic, and electro-mechanical. By technology, airport passenger boarding bridge market is segmented into hydraulic bridges, electrical bridges, and fixed tunnel bridges. Regionally, the airport passenger boarding bridge industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

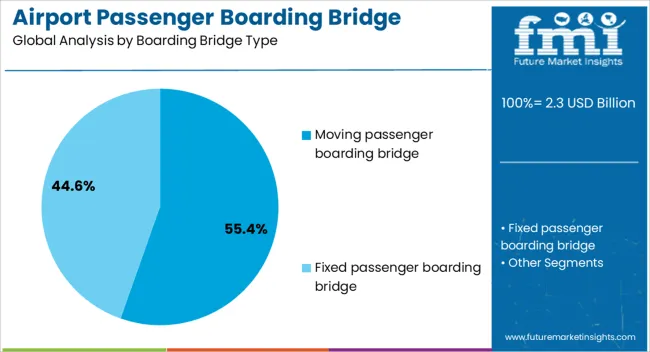

The moving passenger boarding bridge segment is projected to account for 55.4% of the market revenue in 2025, maintaining its leadership due to its flexibility in connecting aircraft of varying sizes and positions. This type’s growth has been supported by its adaptability to different aircraft door configurations, enabling efficient boarding and disembarkation processes.

Airport operational reports have indicated that moving bridges minimize passenger walking distance while optimizing turnaround times for airlines, contributing to higher operational efficiency. Additionally, advancements in automated movement controls and docking systems have enhanced safety and reduced manual intervention during positioning.

Moving bridges are particularly favored in large and medium-sized airports where multiple aircraft types operate, offering greater operational versatility. As airports continue to focus on reducing delays and improving passenger flow, the moving passenger boarding bridge segment is expected to remain the preferred choice for modern terminal operations.

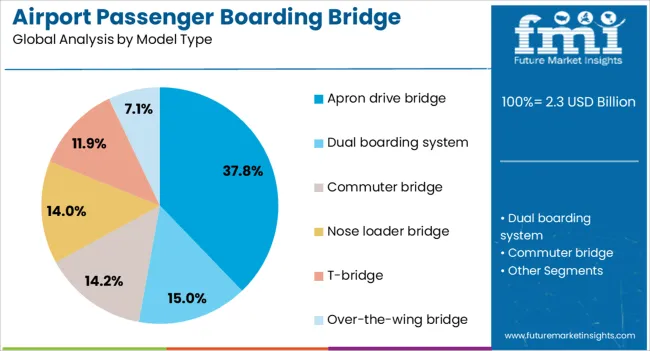

The apron drive bridge segment is projected to contribute 37.8% of the market revenue in 2025, sustaining its position as the leading model type. This segment’s growth has been driven by the widespread adoption of apron drive bridges in both new airport projects and terminal upgrades, owing to their high flexibility and ease of operation.

Engineering specifications from airport equipment manufacturers highlight that apron drive bridges can service a wide range of aircraft, from narrow-body to wide-body models, with minimal structural modifications. Their rotational capability and telescopic sections enable precise alignment with aircraft doors, enhancing passenger safety and comfort.

Furthermore, the durability and relatively low maintenance requirements of apron drive designs have contributed to their long-term cost-effectiveness. With airport operators seeking adaptable solutions that cater to diverse fleet mixes, the apron drive bridge segment is expected to retain its market dominance.

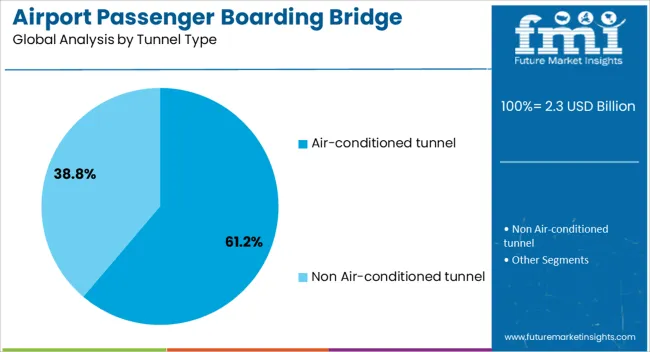

The air-conditioned tunnel segment is projected to hold 61.2% of the market revenue in 2025, reflecting strong demand for enhanced passenger comfort and protection from extreme weather conditions. This segment’s growth has been fueled by increasing expectations for climate-controlled boarding environments, particularly in regions with hot or humid climates.

Passenger satisfaction surveys and airport design guidelines have emphasized the role of air-conditioned tunnels in improving overall travel experience, reducing thermal stress, and ensuring comfort during boarding and disembarkation. Moreover, air-conditioned tunnels help maintain consistent cabin temperatures during aircraft turnaround, contributing to operational efficiency for airlines.

Airports serving international travelers have increasingly incorporated air-conditioned tunnels as part of premium service enhancements, aligning with broader goals of improving passenger amenities. As airport infrastructure investments continue to prioritize comfort, safety, and operational efficiency, the air-conditioned tunnel segment is expected to maintain its dominant market share globally.

The airport passenger boarding bridge market is expanding as global air travel demand rises and airports modernize their infrastructure. Passenger boarding bridges (PBBs), also known as jet bridges or airbridges, provide safe and efficient access between terminals and aircraft, improving passenger comfort and operational flow. Growing investments in airport expansion, modernization of terminals, and replacement of outdated ground handling systems are driving adoption. Manufacturers offering energy-efficient, automated, and modular passenger boarding bridge designs are well-positioned to benefit. Additionally, integration with smart airport technologies, such as biometric boarding, IoT-based monitoring, and predictive maintenance systems, enhances operational efficiency. The market is further supported by increasing airline fleet size, higher passenger traffic, and global trends toward seamless and contactless travel experiences.

Market growth is restrained by high installation and maintenance costs associated with passenger boarding bridges. These systems require significant capital investment in terms of design, materials, and construction, which can be a financial burden for small or regional airports. Installation involves complex civil engineering, terminal redesign, and integration with ground operations systems. Maintenance costs are also high, as regular inspections, safety checks, and replacement of moving parts are necessary to ensure reliable operation. Downtime due to maintenance or malfunction can disrupt passenger flow and airline schedules. Until cost-effective, low-maintenance, and modular solutions become widely available, high expenses will continue to challenge adoption, especially in developing regions with limited airport modernization budgets.

Market trends are influenced by technological innovation, automation, and smart integration in passenger boarding bridges. Advanced designs now feature automated docking systems, energy-efficient drive mechanisms, and ergonomic controls for improved operator safety and efficiency. Integration with biometric boarding, IoT-enabled monitoring, and predictive maintenance systems supports the smart airport model, reducing delays and improving passenger flow. Manufacturers are also developing modular and adaptable designs that accommodate different aircraft types, including wide-body, narrow-body, and regional jets. Environmentally sustainable technologies, such as energy-efficient motors and recyclable materials, further align with global airport sustainability initiatives. These trends emphasize the growing role of technology, automation, and sustainability in driving the evolution of passenger boarding bridges worldwide.

Opportunities in the airport passenger boarding bridge market are driven by increasing global air traffic and ongoing airport modernization projects. Expanding airline fleets and the growing preference for air travel in emerging economies support the need for efficient passenger boarding solutions. Major airport expansion programs in Asia-Pacific, the Middle East, and Africa create significant demand for new passenger boarding bridges. In developed markets, replacement of aging infrastructure with automated, safe, and energy-efficient systems further strengthens opportunities. Manufacturers offering customized, modular, and technologically advanced boarding bridges can collaborate with airport authorities and engineering contractors to expand their market presence. Long-term opportunities are reinforced by rising investments in aviation infrastructure and passenger-centric terminal upgrades globally.

Market growth is restrained by intense competition, regulatory requirements, and safety compliance challenges. Multiple global and regional suppliers compete on price, design flexibility, and after-sales service, affecting margins. Strict aviation safety standards and regulations governing passenger boarding bridge operation add complexity and increase certification costs. Failure to comply with international and regional standards can limit adoption or lead to costly redesigns. Additionally, long procurement cycles and reliance on government or airport authority funding slow decision-making and implementation. Until manufacturers streamline regulatory approval processes, balance cost and performance, and maintain compliance with safety and sustainability standards, adoption may remain concentrated in large-scale airport modernization projects and high-traffic regions worldwide.

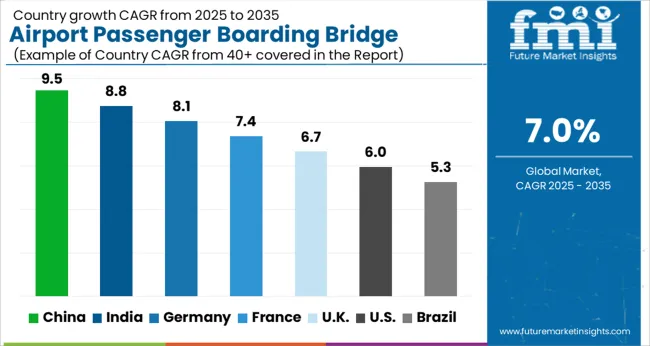

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global airport passenger boarding bridge market was projected to grow at a 7.0% CAGR through 2035, supported by expansions in air travel infrastructure and modernization of airport facilities. Among BRICS nations, China recorded 9.5% growth as large-scale aviation projects were commissioned and compliance with safety standards was reinforced, while India at 8.8% growth saw new installations and local manufacturing strengthened by rising passenger volumes. In the OECD region, Germany at 8.1% maintained strong production capacity under strict aviation regulations, while the United Kingdom at 6.7% relied on selective manufacturing and steady adoption in regional airports. The USA, expanding at 6.0%, remained a mature market with consistent replacement demand and adherence to federal aviation guidelines reported across major hubs. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The airport passenger boarding bridge market in China is growing at a CAGR of 9.5%, driven by increasing air passenger traffic, airport expansion, and modernization projects. Manufacturers supply fixed, mobile, and telescopic boarding bridges for domestic and international airports, enhancing passenger boarding efficiency and safety. Government initiatives promoting airport infrastructure, civil aviation development, and smart airport technology encourage adoption. Pilot deployments in major airports demonstrate benefits including reduced turnaround time, improved passenger convenience, and operational efficiency. Collaborations between equipment suppliers, airport authorities, and engineering firms enhance bridge design, automation, and safety features. Rising urbanization, tourism growth, and airline network expansion continue to drive the Chinese airport passenger boarding bridge market.

The market in India is growing at a CAGR of 8.8%, supported by increasing air travel, airport modernization, and private sector airport projects. Manufacturers provide telescopic, fixed, and mobile passenger boarding bridges for regional and international airports. Government initiatives promoting civil aviation growth, airport infrastructure development, and safety standards encourage adoption. Pilot projects in major airports demonstrate benefits including faster boarding processes, improved passenger comfort, and operational efficiency. Collaborations between bridge manufacturers, airport authorities, and technology providers improve automation, safety, and design standards. Rising air passenger traffic, government airport initiatives, and airline network expansion continue to drive India’s airport passenger boarding bridge market.

The market in Germany is recording a CAGR of 8.1%, driven by demand from busy international airports, airline expansion, and airport modernization initiatives. Manufacturers supply fixed, telescopic, and mobile boarding bridges for commercial airports, enhancing passenger flow and safety. Government and EU regulations promoting airport infrastructure development, safety standards, and passenger convenience encourage adoption. Pilot projects in major airports demonstrate benefits including reduced aircraft turnaround time, improved boarding efficiency, and enhanced safety. Collaborations between equipment manufacturers, airport operators, and engineering firms enhance bridge design, automation, and regulatory compliance. Germany’s focus on efficient airport operations and passenger experience supports continued market growth.

The market in the United Kingdom is growing at a CAGR of 6.7%, supported by increasing passenger traffic, airport upgrades, and airline network expansion. Manufacturers provide telescopic, fixed, and mobile boarding bridges for commercial and regional airports. Government initiatives promoting airport modernization, safety standards, and passenger convenience encourage adoption. Pilot deployments in major airports demonstrate benefits including improved boarding speed, enhanced passenger experience, and operational efficiency. Collaborations between equipment suppliers, airport authorities, and engineering companies enhance bridge automation, design, and compliance with safety regulations. Rising air travel and airport expansion continue to drive the UK airport passenger boarding bridge market.

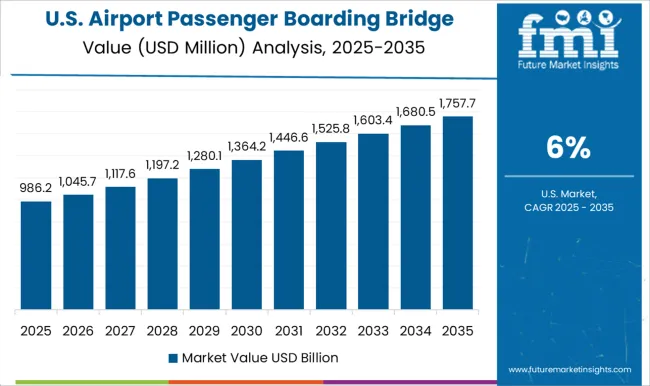

The market in the United States is expanding at a CAGR of 6.0%, driven by demand from major international airports, airline fleet expansion, and airport modernization projects. Manufacturers supply fixed, telescopic, and mobile passenger boarding bridges for commercial and regional airports. Federal initiatives promoting airport infrastructure, civil aviation safety, and smart airport technology encourage adoption. Pilot projects in busy airports demonstrate benefits including reduced aircraft turnaround time, improved passenger experience, and operational efficiency. Collaborations between bridge manufacturers, airport operators, and technology providers enhance automation, design, and compliance with regulatory standards. Growth in air travel, airport upgrades, and airline operations continue to support the USA airport passenger boarding bridge market.

CIMC-TianDa, AccessAir Systems, and AERO Bridgeworks LLC supply passenger boarding bridges (PBBs) for commercial airports, with brochures highlighting bridge length, load capacity, and telescopic extension features. Airport Equipment (a division of J&D McLennan), HÜBNER GmbH & Co. KG, and ShinMaywa Industries, Ltd. provide high-capacity PBBs for narrow-body and wide-body aircraft, with datasheets detailing canopy design, drive mechanism type, and weather resistance. TK Elevator (thyssenkrupp Elevator), FMT Aircraft AB, and ADELTE Group S.L. focus on automated and motorized boarding bridges, with brochures emphasizing operator control systems, energy efficiency, and safety interlocks.

John Bean Technologies Corp. (JBT), Jiangsu Tianyi Aviation Industry Co., Ltd., and UBS Airport Systems (UBS) deliver specialized mobile and adjustable PBBs, with technical literature presenting hydraulic lift capability, docking precision, and integration with airport gate management systems. Mitsubishi Heavy Industries, Ltd. and Oshkosh AeroTech, LLC supply modular and robust bridges for international airports, with datasheets highlighting corrosion-resistant materials, adjustable cabins, and rapid deployment for peak traffic periods. Other regional suppliers compete with cost-effective, compact boarding bridges, with brochures emphasizing simplified installation, low maintenance, and adaptability to smaller regional aircraft. Market strategies focus on automation, safety compliance, and adaptability across aircraft types.

Leading suppliers such as CIMC-TianDa and HÜBNER emphasize fully motorized, weather-resistant PBBs with precision docking and energy-efficient drives. AERO Bridgeworks and ShinMaywa differentiate through modular designs, rapid extension and retraction, and compatibility with wide-body aircraft. Observed industry patterns indicate investment in hydraulic-assisted mobility, automated alignment sensors, and enhanced operator interfaces for reduced boarding times. Product roadmaps frequently include telescopic bridges for multi-gate deployment, climate-controlled cabins, and energy-optimized drive systems. Differentiation is achieved through verified load capacity, alignment precision, and detailed technical guidance provided in brochures.

Brochures and datasheets are used to communicate bridge length, load rating, telescopic extension, drive type, operational range, and safety features. CIMC-TianDa, AccessAir, and AERO Bridgeworks literature emphasizes load handling, telescopic reach, and environmental resistance. HÜBNER, ShinMaywa, and TK Elevator brochures highlight automation features, hydraulic lift capability, and corrosion protection. JBT, UBS, and Mitsubishi datasheets provide docking accuracy, operator controls, and cabin adjustability. FMT, ADELTE, and Oshkosh materials detail modularity, energy efficiency, and rapid deployment. Tables, diagrams, and performance charts are consistently included to allow airport planners, engineers, and procurement specialists to evaluate bridge suitability efficiently. Market adoption is determined not only by operational performance but also by the clarity and technical depth of brochures, making documentation essential for competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 billion |

| Boarding Bridge Type | Moving passenger boarding bridge and Fixed passenger boarding bridge |

| Model Type | Apron drive bridge, Dual boarding system, Commuter bridge, Nose loader bridge, T-bridge, and Over-the-wing bridge |

| Tunnel Type | Air-conditioned tunnel and Non Air-conditioned tunnel |

| Docking Type | Intelligent docking system and Manual docking system |

| Foundation | Fixed, Movable, Hydraulic, and Electro-mechanical |

| Technology | Hydraulic bridges, Electrical bridges, and Fixed tunnel bridges |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CIMC-TianDa, AccessAir Systems, Inc., AERO Bridgeworks LLC, Airport Equipment (a division of J&D McLennan), HÜBNER GmbH & Co. KG, ShinMaywa Industries, Ltd., TK Elevator (thyssenkrupp Elevator), FMT Aircraft AB, ADELTE Group S.L., John Bean Technologies Corp. (JBT), Jiangsu Tianyi Aviation Industry Co., Ltd., UBS Airport Systems (UBS), Mitsubishi Heavy Industries, Ltd., and Oshkosh AeroTech, LLC |

| Additional Attributes | Dollar sales vary by bridge type, including telescopic, apron drive, and fixed boarding bridges; by structure, spanning steel and glass; by application, such as commercial aviation, cargo terminals, and military airbases; by aircraft type, covering narrow-body, wide-body, and regional aircraft; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising air passenger traffic, airport modernization, and demand for enhanced passenger safety and convenience. |

The global airport passenger boarding bridge market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the airport passenger boarding bridge market is projected to reach USD 4.5 billion by 2035.

The airport passenger boarding bridge market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in airport passenger boarding bridge market are moving passenger boarding bridge and fixed passenger boarding bridge.

In terms of model type, apron drive bridge segment to command 37.8% share in the airport passenger boarding bridge market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Airport Bus Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Lighting Market

Airport Information Display System Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Pre-book Airport Transfer Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Passenger Car Seat Market Forecast and Outlook 2025 to 2035

Passenger Ferries Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA