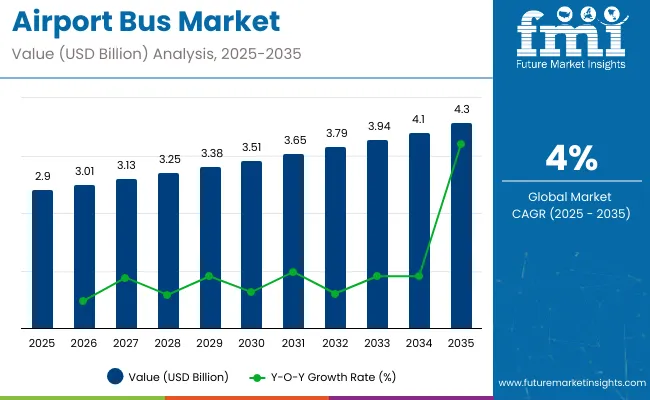

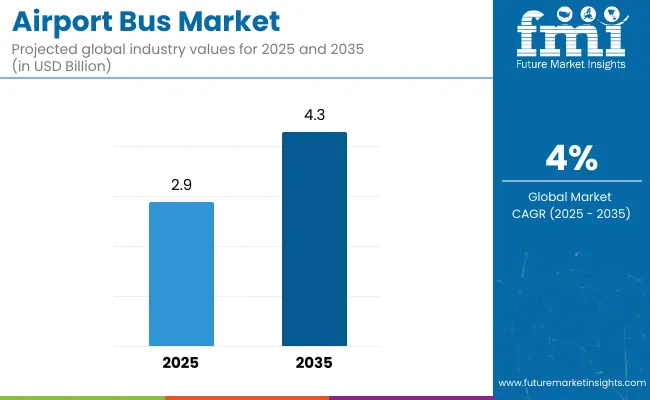

The airport bus market is valued at 2.9 billion in 2025 and will reach 4.3 billion by 2035, growing at a CAGR of 4%. Market share erosion or gain analysis reflects how competitive dynamics are shaped by technology adoption, regulatory direction, and airport modernization efforts.

| Metric | Value |

|---|---|

| Airport Bus Market Estimated Value in (2025 E) | USD 2.9 billion |

| Airport Bus Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 4% |

Established manufacturers relying on conventional diesel models face gradual share loss as procurement policies increasingly prioritize low-emission and energy-efficient fleets. The pressure to align with evolving environmental standards is likely to reshape demand patterns in developed aviation hubs.

Manufacturers introducing battery-electric and hybrid airport buses, along with digital fleet management systems and flexible cabin layouts, are positioned to capture share as airports invest in operational efficiency and improved passenger handling. Regional conditions also play a decisive role.

Airports in Europe and Asia Pacific are transitioning toward electric buses more quickly, benefiting producers with advanced platforms, while regions with limited infrastructure development may continue to support conventional buses for longer, offering incumbents some stability.

Over the forecast period, share gains are expected for companies that focus on innovation, adaptability, and compliance with stricter operational requirements, whereas supplier’s resistant to change may see gradual erosion despite the steady growth of the overall market.

The market is shaped by several related industries. Airport authorities and operators represent around 39%, as procurement of apron buses is directly tied to terminal expansion and passenger flow management. Bus and coach manufacturers contribute approximately 26%, producing low-floor, high-capacity, and electric variants tailored for airport use.

Ground handling service providers account for nearly 16%, deploying buses for passenger transfer and crew movement. Electric drivetrain and battery suppliers hold close to 11%, supporting the transition to zero-emission fleets. Maintenance and aftermarket service providers make up the remaining 8%, ensuring reliability, upgrades, and lifecycle efficiency.

The airport bus industry is transitioning toward electric and hybrid fleets in line with global airport modernization. More than 25% of new apron bus deliveries in 2024 were battery-electric models, reflecting growing adoption of sustainable transport solutions. High-capacity buses with seating for over 100 passengers are in demand at large international hubs to reduce transfer times.

Digital fleet management systems are being deployed, cutting operational delays by 10-12% through optimized scheduling and real-time monitoring. Retrofit programs for diesel-to-electric conversions are expanding, particularly in Europe and Asia. Airports are also piloting autonomous apron buses to improve efficiency and minimize ground traffic congestion.

Demand is being shaped by higher passenger throughput, which is expected to exceed 10 billion travelers annually by 2035, creating a need for efficient and flexible airport ground mobility solutions. Asia Pacific leads the market, supported by rapid airport expansions in China and India, while Europe and North America are advancing adoption of electric and hybrid buses to align with sustainability targets. Airport operators are investing in both high-capacity articulated buses and luxury transfer buses to enhance connectivity between terminals, parking zones, and aircraft stands.

Driving Force Expansion of Global Air Traffic and Airports

Growing passenger volumes and airport expansion are fueling demand for specialized buses designed for airside operations. Larger airports with multiple runways and terminals require extensive fleets to reduce turnaround times and manage passenger flows efficiently. Government funding for aviation infrastructure is also encouraging procurement of modern fleets with improved safety and accessibility features. From my perspective, as airlines add more routes and airports expand capacity, the reliance on dedicated airport buses will become more critical to seamless ground operations.

Growth Opportunity Adoption of Electric and Hybrid Buses

The shift toward sustainable ground operations are opening opportunities for electric and hybrid buses in airports. These buses reduce carbon emissions and improve cost efficiency for operators managing high-frequency services. Airports in Europe and Asia are introducing pilot projects for fully electric fleets, while hybrid buses offer transitional solutions for facilities with limited charging infrastructure. I believe suppliers providing scalable solutions tailored to airport operations will secure long-term contracts as green mobility becomes a strategic priority for global aviation hubs.

Emerging Trend Digital Fleet Management and Automation

Digitalization and automation are shaping future airport bus operations. Fleet management platforms now enable predictive scheduling, reducing passenger wait times and optimizing fuel use. Autonomous driving systems are being tested for fixed-route airport transfers, ensuring efficiency during peak hours. IoT-based monitoring of vehicle performance is allowing operators to minimize downtime and extend asset life cycles. In my opinion, airports adopting automation and digital fleet tracking will experience lower operating costs and improved service quality for passengers.

Market Challenge High Costs and Infrastructure Limitations

Airport bus procurement faces challenges due to high upfront investment and limited infrastructure for new technologies. Electric buses cost substantially more than diesel alternatives, which restricts adoption at smaller airports. Charging and maintenance infrastructure is also underdeveloped in emerging markets, slowing transition to green fleets. Operational disruptions during fleet upgrades pose further concerns. In my view, collaboration between airports, governments, and technology providers will be vital to overcome these barriers and ensure sustainable deployment.

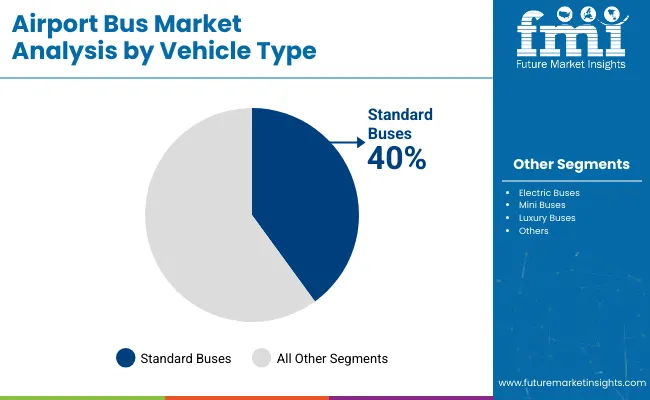

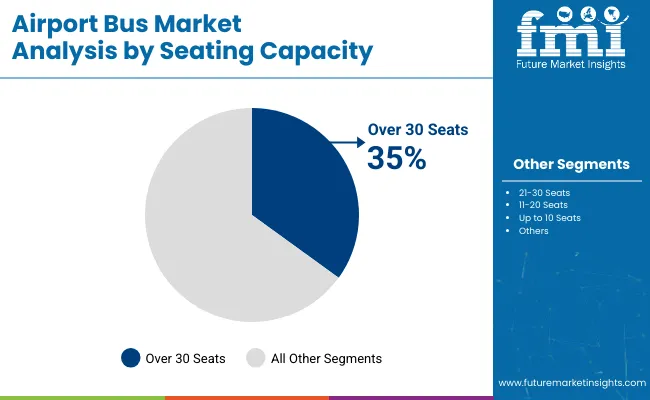

The airport shuttle bus market is shaped by vehicle size, seating capacity, propulsion preference, and application alignment. Standard buses account for 40% due to their dominance on terminal-to-parking links. Over 30-seat configurations lead capacity with 35% share, reflecting efficiency in high-traffic corridors.

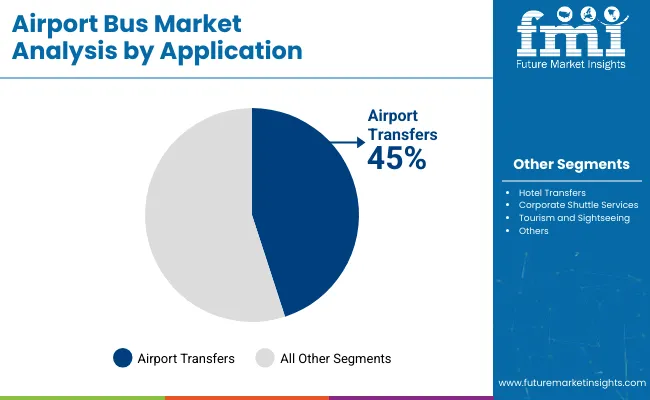

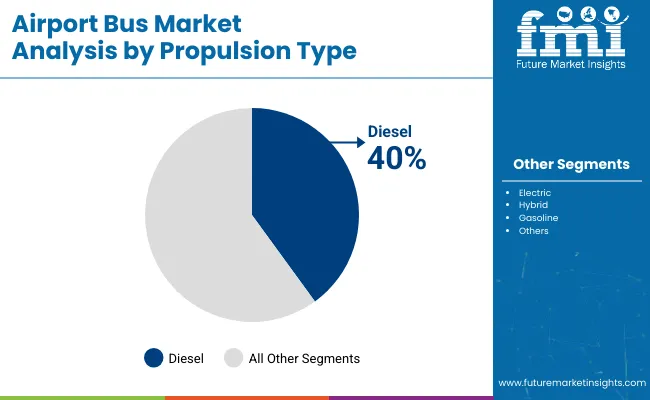

Airport transfers dominate applications at 45%, driven by predictable demand surges aligned with flight schedules. Diesel propulsion holds 40% share, though electric at 30% is expanding in replacement cycles. Fleet managers prioritize lifecycle cost, turnaround efficiency, and reliability under variable passenger throughput.

Standard buses represent 40% of the market, reflecting their deployment on primary airport corridors such as terminal connections, parking loops, and remote stand access. These vehicles are often 12-meter platforms capable of handling more than 80 passengers per trip, with layouts combining seated and standing areas. Their higher floor strength accommodates luggage racks and integrated air-conditioning systems designed for continuous operation. While electric buses are growing at 30%, standard diesel and hybrid variants remain the core for long shifts. Maintenance teams benefit from common drivetrains, enabling higher fleet utilization.

Over 30-seat buses command 35% share, meeting the needs of airports managing high-volume flows between terminals, car parks, and airside locations. Larger seating formats reduce dispatch frequency while supporting standees, achieving throughput of 100+ passengers per trip. This lowers driver hours and increases rotation efficiency compared to smaller units. Airports with seasonal peaks rely on these buses to prevent congestion at arrival gates. Medium-capacity formats (21-30 seats, 25% share) support hotel and corporate shuttle services but lack the surge absorption capacity of larger buses during high-traffic hours.

Airport transfers dominate with 45% share, as terminals, car parks, and remote stands require constant shuttle circulation. Peak scheduling aligns with flight banks, requiring rapid boarding and turnaround efficiency. High-frequency airport transfer buses typically average 8-10 loops per hour, depending on distance. Dispatchers rely on these services to stabilize curbside congestion and maintain passenger flow. Hotel transfers hold 25% share but operate at lower frequencies, while corporate services and tourism remain secondary. Investments prioritize transfer corridors due to direct impact on terminal dwell times and passenger satisfaction levels.

Diesel buses lead with 40% share, reflecting legacy fleets and the presence of established fueling infrastructure at airports. Diesel vehicles typically cover long shifts of 300-350 km daily, with minimal downtime for refueling. Their torque characteristics ensure performance under heavy luggage loads and extended idling at curbs. Electric propulsion at 30% is gaining adoption, driven by tenders for new fleets, though limited charging infrastructure constrains overnight scaling. Hybrid and gasoline buses fill niche roles but are not yet competitive with diesel’s established cost-to-range balance in airport operations.

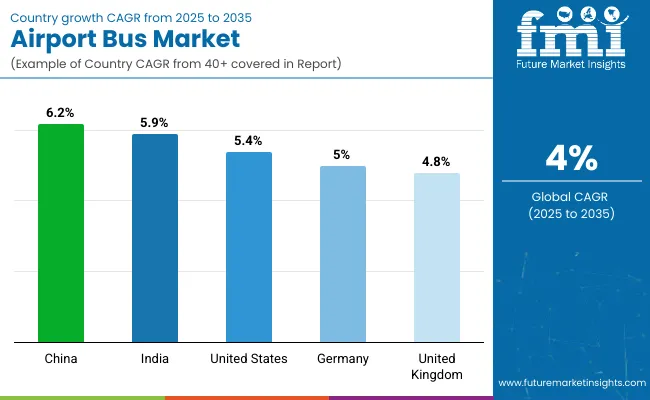

The airport bus market is set to grow steadily between 2025 and 2035, supported by rising passenger traffic, fleet modernization, and investments in airport infrastructure. China leads with a CAGR of 6.2%, outperforming the global average of 4% by +55%, driven by BRICS-led expansion of international airports and the adoption of energy-efficient bus fleets.

India follows at 5.9%, +48% above the global benchmark, supported by rapid growth in domestic aviation and government-backed programs to enhance ground transport systems. The United States records 5.4%, +35% above the global CAGR, reflecting OECD-focused investments in fleet electrification and passenger transfer efficiency.

Germany posts 5.0%, +25% over the global rate, shaped by gradual modernization of ground handling operations. The United Kingdom stands at 4.8%, +20% above global growth, reflecting selective adoption of low-emission buses and modernization of regional airports. BRICS economies are fueling demand through scale, while OECD nations emphasize sustainability, technology adoption, and operational efficiency.

The airport bus industry in China is forecasted to expand at a CAGR of 6.2%, which is above the global average of 4%. Expansion is linked to construction of new airports under the Civil Aviation Administration of China, as well as rising passenger movement at major hubs like Beijing Capital and Shanghai Pudong. Yutong and BYD dominate with deliveries of low-emission apron buses. Airport modernization programs and the shift toward electric fleets strengthen demand. The relatively high CAGR is explained by large infrastructure investment and domestic manufacturing capacity.

The demand of airport bus in India is set to grow at a CAGR of 5.9%, supported by rising passenger throughput at hubs such as Delhi, Mumbai, and Bangalore. State-owned airports and private operators are investing in apron buses to improve connectivity between terminals and aircraft stands. Tata Motors and Ashok Leyland have introduced low-floor and CNG-based buses, aligning with energy efficiency goals. The market benefits from airport privatization and new terminal developments. The CAGR reflects steady adoption driven by higher passenger volumes and modernization projects across both metro and regional airports.

The United States airport bus market is anticipated to register a CAGR of 5.4%, reflecting steady demand from major hubs like Atlanta, Chicago O’Hare, and Dallas Fort Worth. Airport authorities are upgrading fleets with ADA-compliant low-floor buses and investing in electric apron vehicles. Gillig and New Flyer lead in deliveries, while federal funding through FAA modernization programs supports procurement. Passenger mobility requirements at large airports sustain demand, and electric bus integration aligns with long-term fleet replacement cycles. The CAGR captures steady adoption focused on accessibility and electrification.

The airport bus market in Germany is projected to expand at a CAGR of 5.0%, backed by major airports such as Frankfurt, Munich, and Berlin Brandenburg. Daimler and MAN dominate apron bus supply, with models emphasizing durability and integration with automated docking systems. Investment in modern apron logistics under Fraport AG drives demand for advanced buses with passenger information systems. The CAGR reflects incremental adoption focused on modernization rather than large-scale fleet growth, driven by Europe’s high standards for passenger service and emissions reduction.

The United Kingdom airport bus market is expected to grow at a CAGR of 4.8%, supported by upgrades at Heathrow, Gatwick, and Manchester airports. The market is driven by investments in fleet electrification and expansion of inter-terminal connectivity solutions. Companies like Wrightbus and Alexander Dennis supply low-emission and electric apron buses. The focus is on efficiency, passenger comfort, and reduced turnaround times. The CAGR reflects steady growth, influenced by infrastructure upgrades and replacement of older fleets with electric and hybrid vehicles.

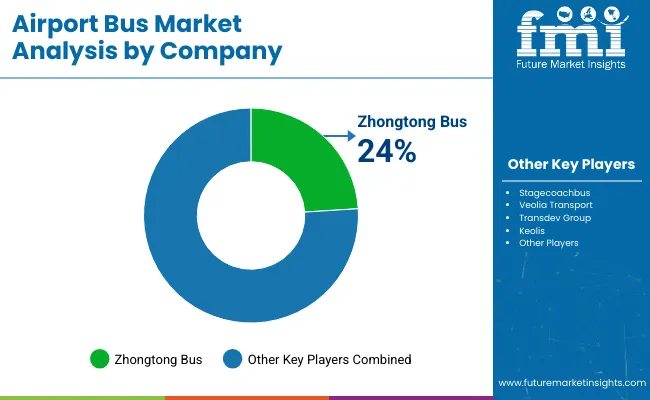

The airport bus market is driven by manufacturers and operators providing passenger transfer solutions for airports worldwide, focusing on efficiency, safety, and reliability. Zhongtong Bus is assumed to be the market leader, supported by a strong product line of low-floor and electric airport buses tailored for large passenger volumes.

Stagecoachbus and Veolia Transport maintain competitive positions through integrated transport services and fleet modernization programs aligned with airport infrastructure requirements. Transdev Group and Keolis strengthen their market presence with regional expansion strategies, focusing on optimizing passenger flow between terminals, parking areas, and aircraft stands.

Strategies across these companies are centered on delivering high-capacity, low-maintenance buses, improving passenger comfort, and aligning with airport operators to ensure smooth operations under time-critical conditions. Partnerships with airports and local authorities are being leveraged to secure long-term service contracts and enhance reliability across regional and international hubs.

Product brochures highlight low-floor airport buses, articulated passenger transfer vehicles, customizable seating layouts, luggage space optimization, and advanced air-conditioning systems. Safety features such as anti-lock braking, electronic stability control, and advanced driver assistance systems are emphasized.

Modular designs are promoted for easy customization, while extended service life and low total cost of ownership are underlined as key advantages for operators. Emphasis is placed on ease of maintenance, strong aftersales service, and adaptability to different airport sizes and operational requirements. Collectively, these companies compete on reliability, passenger handling efficiency, and integration of vehicles into wider airport logistics systems.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.9 billion |

| Projected Market Size (2035) | USD 4.3 billion |

| CAGR (2025 to 2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Vehicle Type Segments | Standard Buses, Mini Buses, Luxury Buses, Electric Buses |

| Seating Capacity Segments | Up to 10 Seats, 11-20 Seats, 21-30 Seats, Over 30 Seats |

| Application Segments | Airport Transfers, Hotel Transfers, Corporate Shuttle Services, Tourism and Sightseeing |

| Propulsion Type Segments | Diesel, Gasoline, Electric, Hybrid |

| Regions Covered | North America, Europe, South America, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, United Kingdom, France, Italy, China, India, Japan, UAE, Saudi Arabia, South Africa |

| Leading Players | Zhongtong Bus - 24%, Stagecoachbus , Veolia Transport, Transdev Group, Keolis |

| Additional Attributes | Dollar sales by vehicle type and seating capacity, demand trends across airport transfers and tourism, adoption of electric and hybrid buses, regional fleet expansion strategies, airport infrastructure integration, environmental impact of propulsion choices, and rising role of luxury and premium buses for passenger comfort. |

The airport bus market size is valued at USD 2.9 billion in 2025.

The market is projected to reach USD 4.3 billion by 2035.

The market is expected to grow at a CAGR of 4% during the forecast period.

Airport transfers hold the largest share at 45%.

Leading players include Zhongtong Bus, Stagecoachbus, Veolia Transport, Transdev Group, and Keolis.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Lighting Market

Airport Information Display System Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Pre-book Airport Transfer Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA