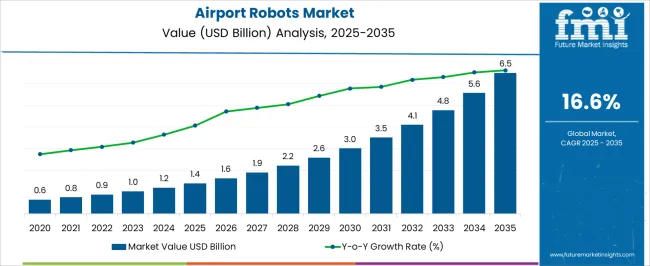

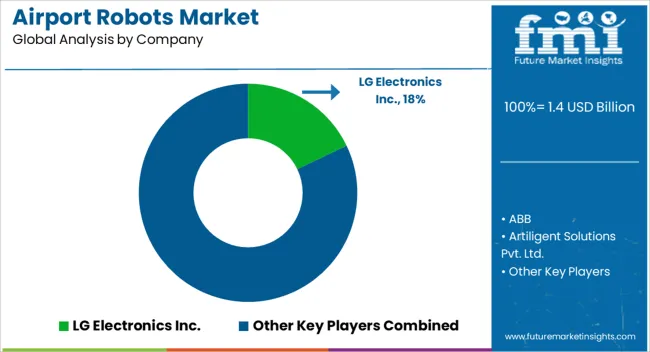

The airport robots market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 16.6% over the forecast period.

This growth represents an absolute dollar opportunity of USD 5.1 billion over the decade. The market is expected to expand rapidly, with values reaching USD 1.6 billion in 2026, USD 2.2 billion in 2029, USD 3.0 billion in 2031, and USD 5.6 billion in 2034. This rapid expansion highlights the increasing adoption of robotic solutions in airports, offering operators and investors substantial revenue potential and the opportunity to capture market share in a fast-growing segment. From an absolute dollar perspective, the yearly incremental growth accelerates significantly over the decade, starting at USD 0.2 billion in 2026 and reaching USD 0.9 billion by 2035.

Intermediate values, such as USD 2.6 billion in 2030 and USD 4.8 billion in 2033, illustrate strong upward momentum and indicate multiple entry points for investment. The predictable yet accelerating growth trajectory provides stakeholders a clear roadmap for production, deployment, and market penetration strategies. Capturing this opportunity allows businesses to benefit from both annual growth and the cumulative USD 5.1 billion market expansion in airport robotics over ten years.

| Metric | Value |

|---|---|

| Airport Robots Market Estimated Value in (2025 E) | USD 1.4 billion |

| Airport Robots Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 16.6% |

Continuing with the airport robots market, a breakpoint analysis identifies periods of significant acceleration in growth. Between 2025 and 2027, the market rises from USD 1.4 billion to USD 1.6 billion, marking the initial adoption phase where early deployments set the foundation. Another critical breakpoint occurs around 2029–2031, as the market jumps from USD 2.2 billion to USD 3.0 billion, reflecting a period of rapid expansion and higher incremental revenue. These stages are pivotal for operators and investors to scale deployment, optimize operational efficiency, and capture increasing market share during key growth phases.

The final major breakpoint is observed between 2033 and 2035, when the market surges from USD 5.6 billion to USD 6.5 billion, representing the largest absolute dollar growth in a two-year span. Intermediate years, such as 2030–2032, show steady expansion from USD 2.6 billion to USD 4.8 billion, acting as bridging periods that sustain momentum. Identifying these breakpoints allows stakeholders to strategically plan investments, expand operations, and maximize revenue potential. Focusing on these critical stages ensures capturing both incremental and cumulative market opportunities in the airport robots sector.

The airport robots market is expanding rapidly, driven by increasing automation in passenger services, operational efficiency goals, and the rising demand for contactless solutions in airport environments. Industry announcements and aviation technology reports have emphasized the role of robotics in enhancing passenger experience, reducing operational bottlenecks, and improving safety protocols. Airports worldwide are investing in robotic technologies to handle passenger guidance, cleaning, security screening, and logistical support, supported by advancements in AI, machine vision, and mobility systems.

The post-pandemic focus on minimizing human contact has further accelerated adoption, particularly in passenger-facing functions. Strategic partnerships between airports, robotics firms, and AI solution providers are contributing to faster deployment and integration of robots into existing airport workflows.

Looking ahead, market growth is expected to be fueled by continued improvements in robot autonomy, increased use of humanoid designs for interactive services, and expanding applications beyond passenger assistance into maintenance and airside operations.

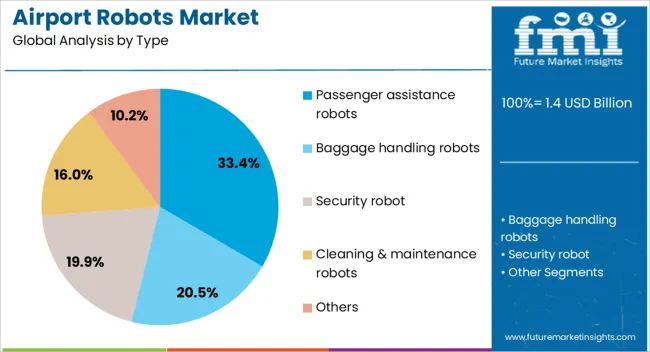

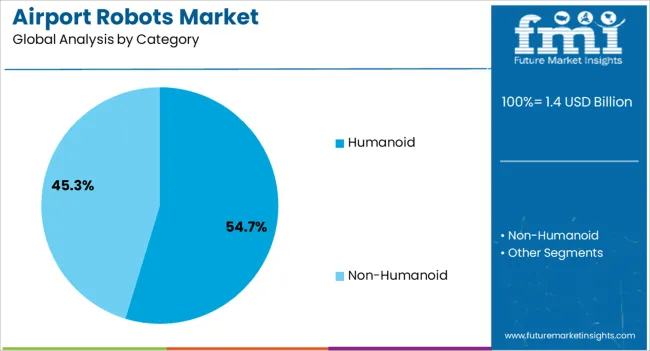

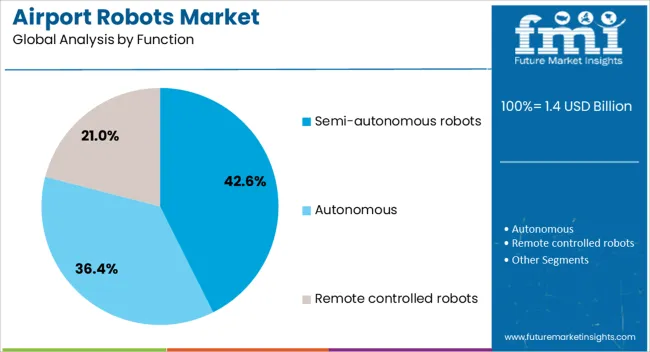

The airport robots market is segmented by type, category, function, application, and geographic regions. By type, airport robots market is divided into passenger assistance robots, baggage handling robots, security robot, cleaning & maintenance robots, and others. In terms of category, airport robots market is classified into humanoid and non-Humanoid. Based on function, airport robots market is segmented into semi-autonomous robots, autonomous, and remote controlled robots. By application, airport robots market is segmented into terminal and landside. Regionally, the airport robots industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger assistance robots segment is projected to account for 33.40% of the airport robots market revenue in 2025, maintaining its position as the leading type segment. Growth in this segment has been supported by the increasing demand for efficient passenger flow management and personalized assistance in high-traffic airports. Passenger assistance robots have been deployed to provide real-time information, guide travelers through terminals, and offer multilingual support, improving overall customer satisfaction.

Aviation industry updates have noted that these robots help reduce queue times and ease the workload of airport staff, particularly during peak travel periods. Integration with AI-powered language translation, digital wayfinding, and ticketing systems has enhanced their effectiveness. As airports continue to compete on service quality and operational efficiency, the passenger assistance robots segment is expected to see sustained adoption, especially in major international hubs and newly developed airport terminals.

The humanoid category is projected to contribute 54.7% of the airport robots market revenue in 2025, leading the market due to its ability to deliver highly interactive and intuitive services to passengers. Humanoid robots have been favored for their human-like design, which fosters familiarity and engagement, making them well-suited for customer service roles.

Industry technology showcases and airport trials have demonstrated that humanoid robots can effectively combine verbal communication, gesture recognition, and digital interfaces to assist passengers across various service points. Their adaptable design allows integration of multiple functions, from information provision to promotional activities and navigation assistance.

Moreover, their ability to interact naturally with diverse passenger demographics has strengthened their position in customer experience strategies. With ongoing developments in AI and robotics hardware, humanoid robots are expected to remain central to airport automation strategies, providing a balance between advanced functionality and user-friendly design.

The semi-autonomous robots segment is projected to hold 42.6% of the airport robots market revenue in 2025, retaining a significant share due to its balance of human oversight and robotic efficiency. Semi-autonomous systems allow for programmed task execution while enabling human operators to intervene when necessary, ensuring flexibility in complex airport environments.

Industry operations reports have indicated that semi-autonomous robots are particularly effective in tasks requiring situational adaptability, such as baggage handling, cleaning, and passenger escort services. This hybrid operational model reduces the risk of service disruptions while maintaining high productivity levels.

Additionally, semi-autonomous robots are often less costly to deploy than fully autonomous units, making them an attractive option for airports in emerging markets. As AI algorithms improve and connectivity infrastructure strengthens, semi-autonomous robots are expected to expand their capabilities, further reinforcing their role in airport service automation.

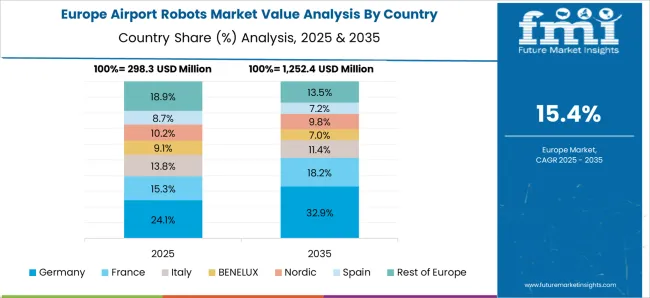

The airport robots market is expanding as airports seek to enhance operational efficiency, passenger experience, and safety through automation. Robots are deployed for tasks including baggage handling, cleaning, security, customer assistance, and delivery of food or supplies. North America and Europe lead adoption due to advanced airport infrastructure and high passenger traffic, while Asia Pacific shows strong growth potential with new airport developments and increasing traveler volumes. Providers focus on intelligent navigation, multi-task functionality, and integration with airport management systems, while technology costs, regulatory approvals, and interoperability considerations influence deployment decisions.

Ensuring consistent performance is critical for airport robot providers. Variability in navigation systems, sensors, or processing units can affect task execution, timing, and safety. Robots must operate reliably in crowded terminals, fluctuating environmental conditions, and high-traffic areas. Providers invest in rigorous testing, real-time monitoring, and predictive maintenance to prevent operational disruptions. Airports require equipment that meets safety standards, avoids collisions, and maintains service continuity. Companies delivering dependable, precise robotic solutions gain preference from airport authorities and operators, while inconsistent functionality can hinder adoption and reduce passenger confidence in automated services.

Advances in software, machine learning, and system design are improving how robots integrate into airport workflows. Robots with autonomous navigation, adaptive path planning, and centralized control can coordinate with human staff, baggage systems, and security protocols. Efficient deployment reduces manual labor, accelerates service delivery, and minimizes delays. Multi-functional robots capable of performing cleaning, delivery, or customer assistance increase utility while reducing capital expenditure. Providers that offer modular solutions compatible with existing airport infrastructure enhance scalability and ease of adoption. Effective operational integration ensures smoother passenger flow and higher throughput for airport services.

Airport robots are increasingly used across multiple service areas. Customer-facing robots assist with check-in, wayfinding, and information provision, while behind-the-scenes units support luggage transport, security patrols, and sanitation. Adoption in food and retail delivery enables passengers to receive orders directly at gates or lounges. The growth of international travel, long layovers, and heightened hygiene requirements has accelerated interest in robotic solutions. Providers offering adaptable, customizable robots that can meet diverse operational needs are positioned to capture multiple segments. Expanding applications enhance both passenger convenience and airport operational efficiency.

Deployment of airport robots is influenced by safety regulations, operational approvals, and equipment certification standards. Compliance with aviation authority guidelines, electrical and mechanical safety requirements, and cybersecurity protocols is mandatory. Supply chain considerations, including access to specialized components, sensors, and processors, affect manufacturing timelines and costs. Competition includes global robotics firms and regional technology developers offering tailored solutions. Companies that maintain regulatory adherence, secure reliable component sourcing, and provide technical support are better positioned to achieve successful implementation, while regulatory delays or inconsistent hardware availability can limit adoption and slow integration into airport operations.

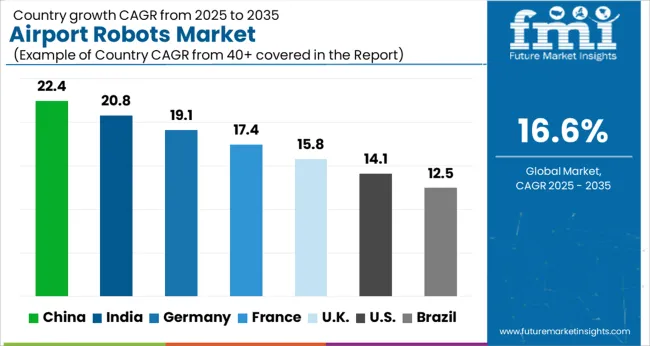

| Country | CAGR |

|---|---|

| China | 22.4% |

| India | 20.8% |

| Germany | 19.1% |

| France | 17.4% |

| UK | 15.8% |

| USA | 14.1% |

| Brazil | 12.5% |

The global airport robots market was projected to grow at a 16.6% CAGR through 2035, driven by demand for automation in passenger services, baggage handling, and security operations. Among BRICS nations, China recorded 22.4% growth as large-scale robotic deployments were executed in major airports and compliance with operational safety standards was enforced, while India at 20.8% growth saw commissioning of new robotic systems to enhance airport efficiency. In the OECD region, Germany at 19.1% maintained substantial production and integration under strict aviation regulations, while the United Kingdom at 15.8% relied on selective adoption in regional airports. The USA, expanding at 14.1%, remained a mature market with steady implementation across major hubs, supported by adherence to federal and state-level aviation and operational standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The airport robots market in China is expanding at a 22.4% CAGR, driven by rising passenger traffic, increasing automation in airport operations, and adoption of advanced robotics technologies. Airports are deploying robots for baggage handling, cleaning, security, and customer service to improve efficiency and passenger experience. Smart airports are integrating AI-powered robots to guide travelers, provide information, and streamline operations. Investments in airport modernization, including terminal expansions and digital infrastructure, are supporting rapid adoption. Collaborations between robotics manufacturers and airport authorities are ensuring reliability and customization for local needs. Both domestic and international airports are leveraging robots to reduce labor costs and enhance operational accuracy. Passenger preference for safe, contactless, and efficient services is further boosting demand. The market is expected to continue rapid growth as airports focus on technological integration and operational excellence.

The airport robots market in India is growing at a 20.8% CAGR, supported by increasing passenger traffic, government initiatives to modernize airports, and growing adoption of automation technologies. Airports are introducing robots for tasks such as cleaning, baggage handling, customer service, and security. AI and machine learning-enabled robots assist passengers by providing information, directions, and guidance. Expansion of domestic airports and introduction of new terminals are creating additional opportunities. Partnerships between robotics manufacturers and airport authorities are enhancing system integration and reliability. Focus on operational efficiency, safety, and passenger satisfaction is driving adoption. Both metro and regional airports are implementing robots to optimize services and reduce labor costs. Rapid technological innovation and rising demand for contactless airport operations are expected to sustain market growth in India.

The airport robots market in Germany is growing at a 19.1% CAGR, driven by advanced airport infrastructure, growing passenger volumes, and adoption of robotics in operational processes. Robots are deployed for tasks including baggage handling, cleaning, security, and passenger guidance. Airports focus on integrating AI and autonomous technologies to improve efficiency, reduce errors, and enhance the traveler experience. High labor costs and strict operational standards encourage adoption of robotic solutions. Smart airport initiatives and government support for digital transformation in transportation are further accelerating growth. Both major international airports and regional hubs are implementing robotic systems. Emphasis on contactless, safe, and efficient operations is supporting market expansion. The market is expected to continue growth as Germany strengthens its position in intelligent airport management.

The airport robots market in the United Kingdom is expanding at a 15.8% CAGR, supported by increasing passenger traffic, automation initiatives, and modernization of airport infrastructure. Airports are deploying robots for baggage handling, cleaning, security, and customer service to improve operational efficiency and traveler experience. AI-enabled robots provide guidance, information, and language support to passengers. Upgrades in major airports and terminal expansions are creating additional demand for robotic systems. Focus on contactless operations and cost reduction encourages adoption. Partnerships between robotics companies and airport authorities ensure reliable integration and performance. Both international hubs and regional airports are adopting robots to optimize services and reduce human workload. Market growth is expected to continue steadily as the United Kingdom strengthens airport automation and operational efficiency.

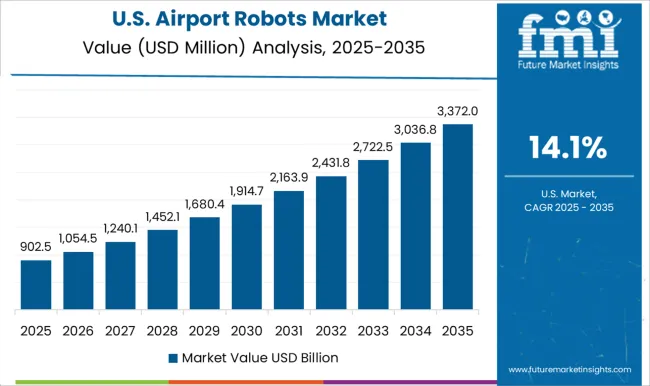

The airport robots market in the United States is growing at a 14.1% CAGR, driven by increasing passenger traffic, automation in airport operations, and integration of AI and robotics technologies. Airports are deploying robots for tasks such as cleaning, baggage handling, security, and customer service to improve operational efficiency and passenger satisfaction. Advanced AI-enabled robots guide travelers, provide information, and assist with wayfinding. Expansion of major airport terminals and modernization initiatives are driving additional demand. Emphasis on contactless operations, labor cost reduction, and operational accuracy is increasing adoption. Partnerships between robotics manufacturers and airport authorities ensure high reliability and service support. Both domestic and international airports contribute to market growth. The market is expected to continue expanding as the United States invests in smart, automated airport operations.

LG Electronics Inc., ABB, and Artiligent Solutions Pvt. Ltd. supply autonomous and semi-autonomous robots for passenger guidance, baggage handling, and security tasks, with brochures highlighting navigation systems, payload capacity, and battery life. CYBERDYNE Inc., Genrobotic Innovations, and Hitachi Ltd. provide service and cleaning robots, with datasheets detailing motion range, obstacle detection, and task-specific programming. Knightscope Inc., OMRON Corporation, and Secom Co. Ltd. focus on security and surveillance robots, with brochures emphasizing sensor arrays, AI-based monitoring, and real-time reporting capabilities. SITA, SoftBank Group Corp., and Stanley Robotics deliver integrated airport operations robots, with technical literature presenting fleet management systems, charging infrastructure, and software integration with airport IT networks.

UVD Robots, Vanderlande Industries B.V., and Yape Srl provide disinfection, logistics, and autonomous baggage sorting robots, with datasheets highlighting UV lamp intensity, conveyor interfacing, and obstacle avoidance. Other regional suppliers compete with compact, cost-efficient solutions for smaller terminals, with brochures emphasizing ease of deployment, modular software, and regulatory compliance for safety and passenger interaction. Market strategies focus on automation, safety compliance, and operational efficiency. Leading suppliers such as LG Electronics and ABB emphasize AI-enabled navigation, remote monitoring, and modular designs for multi-terminal deployment. CYBERDYNE and Hitachi differentiate through humanoid or service-oriented robots with task-specific attachments and autonomous learning capabilities.

Observed industry patterns indicate investment in collaborative robotics, integration with airport IT infrastructure, and modular software upgrades for real-time scheduling. Product roadmaps frequently include autonomous guidance robots for passengers, robotic cleaning systems, AI-driven security patrol units, and integrated fleet management platforms. Differentiation is achieved through verified payload handling, navigation precision, and detailed technical guidance provided in brochures. Brochures and datasheets are used to communicate battery life, payload capacity, navigation type, sensors used, obstacle detection, connectivity, and task-specific capabilities. LG, ABB, and Artiligent literature emphasizes path planning, multi-terminal integration, and operational uptime. CYBERDYNE, Genrobotic, and Hitachi brochures highlight humanoid design, cleaning efficiency, and autonomous task execution. Knightscope, OMRON, and Secom datasheets provide surveillance specifications, AI monitoring, and real-time alerts. SITA, SoftBank, and Stanley Robotics materials detail fleet management, software integration, and charging infrastructure.

UVD Robots, Vanderlande, and Yape datasheets present UV disinfection intensity, conveyor interfacing, and autonomous sorting performance. Tables, diagrams, and workflow charts are consistently included to allow airport operators, procurement specialists, and systems integrators to evaluate robotic solutions efficiently. Market adoption is determined not only by functionality but also by the clarity and technical depth of brochures, making documentation essential for competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Type | Passenger assistance robots, Baggage handling robots, Security robot, Cleaning & maintenance robots, and Others |

| Category | Humanoid and Non-Humanoid |

| Function | Semi-autonomous robots, Autonomous, and Remote controlled robots |

| Application | Terminal and Landside |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LG Electronics Inc., ABB, Artiligent Solutions Pvt. Ltd., CYBERDYNE Inc., Genrobotic Innovations, Hitachi Ltd., Knightscope Inc., OMRON Corporation, Secom Co. Ltd., SITA, SoftBank Group Corp., Stanley Robotics, UVD Robots, Vanderlande Industries B.V., and Yape Srl |

| Additional Attributes | Dollar sales vary by robot type, including cleaning robots, security robots, baggage handling robots, and customer service robots; by application, such as passenger assistance, facility maintenance, and logistics; by end-use, spanning commercial airports, cargo terminals, and military airbases; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing automation, efficiency needs, and enhanced passenger experience initiatives. |

The global airport robots market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the airport robots market is projected to reach USD 6.5 billion by 2035.

The airport robots market is expected to grow at a 16.6% CAGR between 2025 and 2035.

The key product types in airport robots market are passenger assistance robots, baggage handling robots, security robot, cleaning & maintenance robots and others.

In terms of category, humanoid segment to command 54.7% share in the airport robots market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Airport Bus Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Lighting Market

Airport Information Display System Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Pre-book Airport Transfer Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

SLAM Robots Market Size and Share Forecast Outlook 2025 to 2035

Micro Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Delta Robots Market

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA