The Class 1 Truck Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A 5-year growth block analysis shows steady expansion with consistent demand, particularly driven by advancements in electric vehicle (EV) adoption and increasing demand for light-duty trucks for urban transportation and delivery.

Between 2025 and 2030, the market grows from USD 1.9 billion to USD 2.6 billion, contributing USD 0.7 billion in growth, with a CAGR of 7.8%. This early-phase growth is propelled by growing interest in eco-friendly, cost-effective, and high-performance light-duty trucks, particularly in urban areas where the demand for last-mile delivery services is increasing. The introduction of electric class 1 trucks, along with advancements in battery technology, further supports growth. From 2030 to 2035, the market continues its growth trajectory from USD 2.6 billion to USD 3.4 billion, adding USD 0.8 billion in growth, with a slightly lower CAGR of 5.6%.

This deceleration reflects the market approaching maturity in developed markets, where electric vehicle adoption has become more widespread. However, growth remains strong in emerging markets driven by increasing urbanization and rising disposable incomes. The 5-year growth block analysis reveals strong early-phase acceleration followed by steady growth as the market stabilizes and matures over time.

| Metric | Value |

|---|---|

| Class 1 Truck Market Estimated Value in (2025 E) | USD 1.9 billion |

| Class 1 Truck Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The class 1 truck market is experiencing consistent growth due to increasing demand for compact utility vehicles suited for both urban commuting and light commercial use. Rising consumer interest in fuel-efficient and maneuverable vehicles has contributed to expanded production and model diversification across manufacturers.

Technological advancements in safety systems, engine optimization, and connectivity are further supporting adoption. Regulatory support for emission standards and fuel economy targets has prompted innovation in drivetrain and material efficiency.

As vehicle ownership trends shift toward multifunctional transport solutions, class 1 trucks are becoming preferred options for small business fleets and private users alike. The outlook remains optimistic with product evolution, urbanization, and cost efficiency continuing to guide the trajectory of this segment.

The class 1 truck market is segmented by fuel, product, application, and geographic regions. By fuel, the class 1 truck market is divided into Diesel, Gasoline, Hybrid, Electric, and Others. In terms of the product, the class 1 truck market is classified into Minivan, Cargo van, SUV, and Pickup truck. Based on application, the class 1 truck market is segmented into Personal and Commercial. Regionally, the class 1 truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The diesel segment is projected to hold 41.30% of total market revenue by 2025 within the fuel category, establishing it as the dominant choice. This position is supported by diesel’s superior torque delivery, fuel economy, and extended engine life, which are highly valued in utility-focused vehicles.

Despite emerging alternatives, diesel engines continue to be relied upon in applications requiring consistent performance, especially for heavier loads or extended driving ranges. Ongoing improvements in diesel emission control technologies and fuel injection systems have helped maintain regulatory compliance while sustaining powertrain efficiency.

For fleet operators and cost-conscious consumers, diesel remains a practical and dependable option, ensuring its continued relevance in the class 1 truck category.

Within the product category, minivans are expected to contribute 33.70% of total revenue by 2025, making them the leading segment. Their strong position stems from a balance of passenger comfort, cargo flexibility, and affordability.

Minivans are often favored for their spacious interiors, sliding door convenience, and low step-in height, which enhance utility for both families and light commercial use. Manufacturers have continued to invest in refining ride quality, safety features, and design appeal to meet evolving consumer expectations.

This product type has become integral to personal and business transportation in suburban and urban environments, reinforcing its prominence in the class 1 truck market.

The personal application segment is anticipated to lead with the largest share of revenue by 2025, reflecting strong consumer demand for multi purpose, fuel efficient transportation. Class 1 trucks used for personal purposes provide an ideal blend of functionality and comfort, supporting daily commuting, family transport, and recreational activities.

Their compact size and improved drivability make them especially attractive in densely populated areas where parking and road space are limited. Furthermore, advancements in infotainment, safety integration, and driving assistance features have made these vehicles increasingly appealing to private owners.

The dominance of the personal segment is expected to persist as consumer preference continues to favor convenience, versatility, and value-driven ownership.

The class 1 truck market is growing steadily due to the increasing demand for light-duty trucks in various industries, including retail, delivery, and logistics. These trucks, with a gross vehicle weight rating (GVWR) of up to 6,000 pounds, are widely used for short-distance deliveries and urban transportation, offering enhanced maneuverability in congested areas. As e-commerce continues to drive the need for faster, more efficient delivery systems, class 1 trucks are becoming an essential part of urban logistics. Technological advancements, such as electric vehicles (EVs) and fuel-efficient engines, are also contributing to the market's expansion, as businesses seek cost-effective and environmentally friendly transport options.

The growth of the class 1 truck market is primarily driven by the increasing demand for efficient urban delivery solutions. The rise of e-commerce and the need for faster, more reliable deliveries are pushing businesses to adopt light-duty trucks for local transportation and last-mile delivery. Class 1 trucks, with their compact size and ability to navigate congested urban streets, offer flexibility and greater fuel efficiency compared to larger trucks. As consumer expectations for faster delivery times increase, the demand for class 1 trucks is anticipated to grow. The increasing trend of smaller, urban-based businesses seeking cost-effective transportation solutions further supports market growth. These trucks are particularly suited for short distances, urban environments, and areas with heavy traffic, making them the ideal choice for quick deliveries in metropolitan regions.

The class 1 truck market faces several challenges, particularly related to regulatory compliance and operational costs. Cities around the world are implementing stricter emissions standards, requiring manufacturers to develop class 1 trucks that meet environmental regulations. This adds to the cost of production, potentially raising prices for consumers and limiting accessibility, especially for small businesses. Furthermore, the rising price of fuel and ongoing maintenance requirements can significantly increase operational costs for businesses relying on these vehicles. Class 1 trucks may not always offer the cargo capacity needed for larger deliveries, prompting businesses to explore other alternatives for heavy-duty applications. To address these challenges, innovations in engine efficiency, fuel-saving technologies, and improved regulatory compliance are essential for the continued competitiveness of class 1 trucks in the market.

The class 1 truck market presents significant opportunities, particularly with the growing adoption of electric vehicles (EVs) and advancements in truck technologies. As businesses seek more energy-efficient and cost-effective solutions, electric class 1 trucks offer the potential for lower operational costs and reduced emissions. These trucks typically require less maintenance than traditional gasoline-powered vehicles and offer quieter operations, making them attractive for urban environments. The development of EV infrastructure, such as increased availability of charging stations, is further boosting the adoption of electric trucks. Technological advancements, such as telematics, fleet management systems, and autonomous driving, present opportunities for businesses to optimize fleet performance, reduce downtime, and enhance delivery efficiency. These innovations are expected to support continued growth and transformation in the class 1 truck market.

Electric class 1 trucks are gaining popularity, particularly in urban delivery applications, where shorter distances and cost-effective solutions are essential. These trucks offer the potential for reduced fuel consumption and lower maintenance requirements compared to conventional vehicles, making them increasingly attractive to businesses focused on long-term operational savings. The integration of smart technologies, including telematics, GPS tracking, and real-time data analytics, is transforming fleet management. These technologies enable operators to optimize routes, improve fuel efficiency, and enhance vehicle performance, all while reducing costs. As consumer demand for advanced, eco-friendly transportation solutions rises, the adoption of electrified and smart class 1 trucks is expected to continue, driving further market growth and innovation.

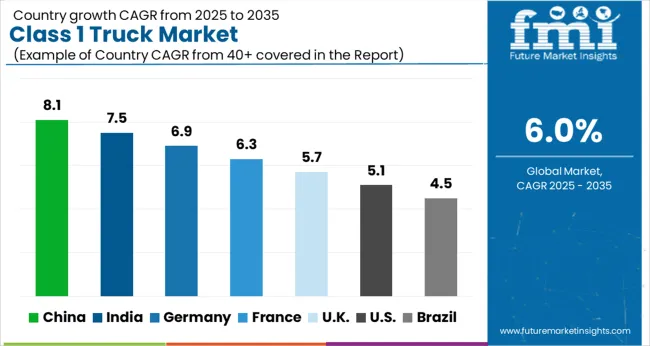

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global Class 1 truck market is projected to grow at a global CAGR of 6.0% from 2025 to 2035. China leads the market with a growth rate of 8.1%, followed by India at 7.5%. France records a growth rate of 6.3%, while the UK shows 5.7% and the USA follows at 5.1%. The market is primarily driven by the increasing demand for light-duty trucks in urban and semi-urban areas, along with growing e-commerce and logistics needs. China and India are leading the growth, supported by rapid industrialization and urban expansion. Developed markets like France, the UK, and the USA are witnessing steady growth, driven by rising demand for last-mile delivery and small commercial vehicles. The analysis spans over 40+ countries, with the leading markets shown below.

China’s Class 1 truck market is expanding at an 8.1% CAGR, driven by rapid urbanization, industrial expansion, and the increasing demand for last-mile delivery solutions. The rise of e-commerce and logistics services in China is significantly boosting the need for light-duty trucks, particularly in cities with high traffic density. As China continues to grow its infrastructure and improve its distribution networks, the demand for Class 1 trucks is set to increase. Government initiatives aimed at reducing emissions and promoting cleaner technologies are encouraging the adoption of more energy-efficient Class 1 trucks in urban areas.

The class 1 truck market in India is expected to grow at a 7.5% CAGR, supported by increasing industrial activity and rapid urbanization. The need for light-duty trucks is growing in response to the expansion of retail, logistics, and e-commerce industries. The demand for efficient transportation solutions for last-mile delivery is rising in urban and semi-urban areas. Additionally, with India’s growing middle class and increasing disposable incomes, more businesses are adopting Class 1 trucks for small-scale commercial use. Government initiatives to improve road infrastructure and encourage the use of fuel-efficient vehicles are also contributing to the growth of the market.

Demand class 1 truck in France is projected to grow at a 6.3% CAGR, driven by the increasing need for light-duty trucks in logistics, retail, and small-scale commercial applications. As e-commerce continues to grow, there is a rising demand for small trucks that can navigate urban areas and provide efficient last-mile delivery. The French government’s focus on reducing emissions and increasing fuel efficiency in transportation is further supporting the market. France’s commitment to modernizing its infrastructure and improving vehicle safety standards is encouraging the adoption of advanced Class 1 trucks with higher performance and lower environmental impact.

The Class 1 truck market in the UK is expected to grow at a 5.7% CAGR, driven by the increasing demand for small commercial vehicles in the retail and logistics sectors. The rise of e-commerce and the growing need for efficient transportation in densely populated areas are significantly boosting the market. The UK’s regulatory focus on reducing emissions and promoting cleaner transportation solutions is also contributing to the adoption of Class 1 trucks that meet stringent environmental standards. Additionally, the expansion of delivery services and the demand for last-mile solutions in urban areas are key drivers of market growth.

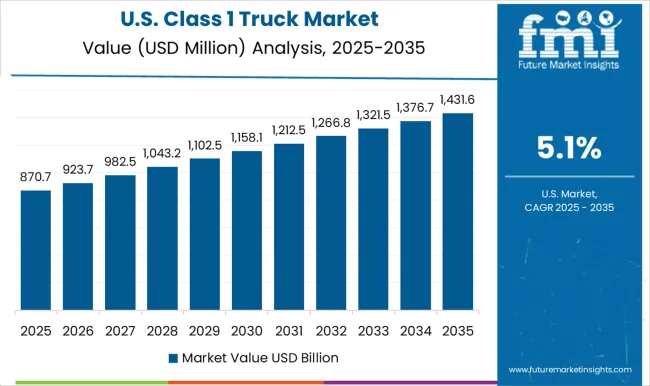

The USA Class 1 truck market is projected to grow at a 5.1% CAGR, supported by growing demand for small, light-duty trucks in the retail and logistics industries. As the need for fast, reliable last-mile delivery increases, the USA market is seeing a rise in the adoption of Class 1 trucks that can navigate urban areas efficiently. The USA government’s emphasis on fuel efficiency and emissions reduction is encouraging the use of cleaner, more energy-efficient vehicles. The continued growth of e-commerce and the shift toward more localized distribution models further contribute to the demand for Class 1 trucks in the USA.

Ford is a major leader in the market, known for its reliable and versatile Class 1 trucks such as the Ford Ranger, offering excellent performance, fuel efficiency, and modern features. General Motors competes strongly with its Chevrolet Colorado, focusing on durability, performance, and innovation, appealing to both consumer and commercial buyers. Stellantis offers a range of Class 1 trucks, including the Ram 1500, known for its ruggedness, advanced technology, and wide array of customization options.

Toyota is another key player, with its Tacoma model providing a blend of efficiency, reliability, and off-road capabilities, making it a popular choice for both personal and work-related use. Nissan delivers competitive Class 1 trucks, including the Nissan Frontier, focusing on comfort, safety, and performance in urban and off-road conditions. Honda is also a significant player, offering the Honda Ridgeline, which stands out for its unique unibody construction, smooth ride, and practicality for everyday use. Hyundai is gaining traction with its trucks, focusing on technological advancements and efficient powertrains for urban and light commercial uses. Mercedes-Benz offers premium Class 1 trucks like the X-Class, combining luxury and functionality for a more sophisticated truck experience. Volkswagen AG brings the Amarok to the market, providing a powerful and reliable option for consumers looking for both practicality and performance. Renault SA offers light-duty trucks with a focus on affordability and fuel efficiency, serving both small businesses and personal users. Tata Motors is known for its durable, affordable trucks, particularly in emerging markets, where cost-effectiveness and reliability are key.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Fuel | Diesel, Gasoline, Hybrid, Electric, and Others |

| Product | Minivan, Cargo van, SUV, and Pickup truck |

| Application | Personal and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford, General Motors, Stellantis, Toyot, Nissan, Honda, Hyundai, Mercedes, Volkswagen AG, Renault SA, and Tata Motors |

| Additional Attributes | Dollar sales by product type (pickup trucks, light-duty trucks) and end-use segments (personal use, commercial use, fleet management). Demand dynamics are driven by the increasing preference for versatile, fuel-efficient trucks in both urban and rural areas, along with advancements in truck technology and powertrains. Regional trends show significant growth in North America, Europe, and Asia-Pacific, with consumer demand shifting towards more sustainable, efficient, and feature-rich Class 1 trucks driving market expansion. |

The global class 1 truck market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the class 1 truck market is projected to reach USD 3.4 billion by 2035.

The class 1 truck market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in class 1 truck market are diesel, _minivan, _cargo van, _suv, _pickup truck, gasoline, _minivan, _cargo van, _suv, _pickup truck, hybrid, _minivan, _cargo van, _suv, _pickup truck, electric, _minivan, _cargo van, _suv, _pickup truck, others, _minivan, _cargo van, _suv and _pickup truck.

In terms of product, minivan segment to command 33.7% share in the class 1 truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

1-Step RT-PCR Kits Market Size and Share Forecast Outlook 2025 to 2035

1,3-Dibromoadamantane Market Size and Share Forecast Outlook 2025 to 2035

1,2-Ethanedithiol Market Size and Share Forecast Outlook 2025 to 2035

1,4 Butanediol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA