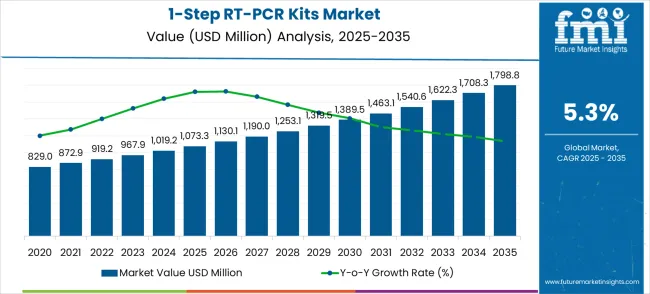

The global 1-step RT-PCR kits market embarks on a transformative decade, reaching USD 1,799 million by 2035 from its starting point of USD 1,073.3 million in 2025. This remarkable journey represents an absolute increase of USD 725.5 million over the forecast period. The first half of the decade (2025-2030) will establish foundation growth, with the market expanding to USD 1,378.2 million, adding USD 304.9 million in value. These initial years focus on consolidating pandemic-driven infrastructure and establishing sustainable diagnostic capabilities across global healthcare systems.

The latter half will witness accelerated expansion from 2030 to 2035, contributing USD 420.6 million to reach the final milestone of USD 1,799 million. This phase emphasizes technological advancement integration, expanded application development, and comprehensive market penetration across emerging therapeutic areas. The decade transformation represents a 67.6% total growth trajectory, supported by molecular diagnostics advancement, personalized medicine adoption, and infectious disease preparedness initiatives. This growth pattern positions market participants for sustained revenue expansion while addressing evolving diagnostic needs across pharmaceutical research, clinical laboratories, and point-of-care testing environments.

The 1-step RT-PCR kits market is segmented across clinical diagnostics (42%), academic and research institutions (28%), biopharmaceutical development (16%), public health and epidemiology laboratories (10%), and specialty applications such as food safety testing (4%). Clinical diagnostics dominate adoption due to the need for rapid and reliable detection of RNA viruses and pathogens. Research institutions use these kits for gene expression studies and molecular biology experiments. Biopharmaceutical companies apply them for quality control, viral load assessment, and vaccine development. Public health labs leverage 1-step RT-PCR kits for outbreak monitoring and epidemiological surveillance. Specialty applications focus on RNA detection in foodborne pathogens and environmental samples.

Emerging trends include high-throughput kits, lyophilized reagents, and automation-compatible formats. Manufacturers are innovating with enhanced enzyme stability, multiplexing capabilities, and shorter reaction times. Growth is driven by pandemic preparedness, molecular diagnostics adoption, and genomics research expansion. Collaborations between kit producers and clinical or research laboratories enable customized, reliable, and rapid detection solutions, supporting steady global market growth.

| Category | Details |

|---|---|

| Market Size | USD 1,073.3M to USD 1,798.8M |

| Growth Rate | 5.3% CAGR (2025–2035) |

| Value Addition | USD 725.5M absolute increase |

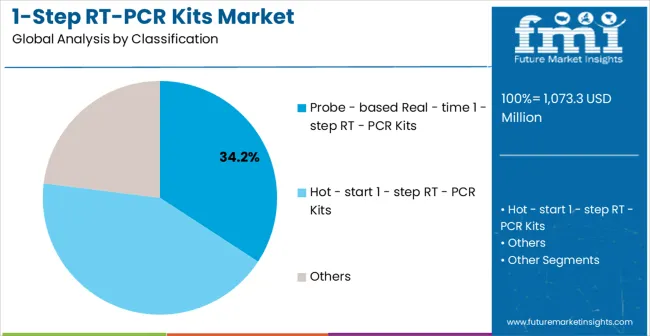

| Market Leader | Probe-based kits dominate |

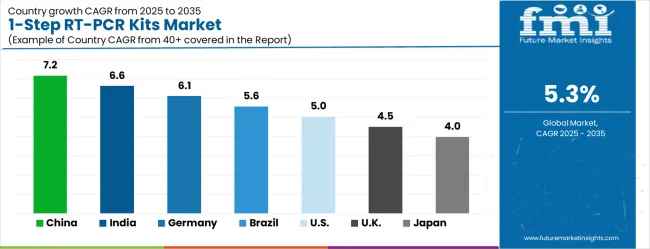

| Geographic Focus | China leads at 7.2% CAGR |

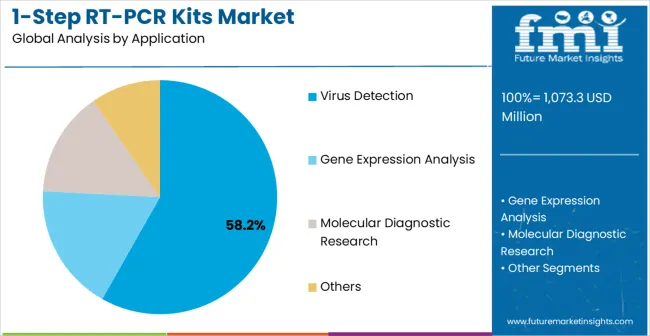

| Application Priority | Virus detection commands 58.2% |

| Technology Edge | Real-time detection preferred |

| Competitive Landscape | 15+ major players active |

The market demonstrates steady expansion driven by sustained diagnostic demand, technological advancement integration, and expanding application scope across clinical and research environments. Revenue concentration remains balanced across kit types while geographic growth varies significantly between developed and emerging markets.

Market expansion rests on three fundamental shifts:

The growth faces headwinds from budget constraints in public health systems, increasing competition from alternative molecular diagnostic technologies, and regulatory complexity surrounding new application approvals that may slow market expansion in price-sensitive segments.

Primary Classification:

Secondary Breakdown:

Regional Distribution:

Market Position: Probe-based real-time 1-step RT-PCR kits dominate through superior accuracy, quantitative capabilities, and real-time result monitoring that clinical laboratories require for reliable diagnostic outcomes. These kits integrate fluorescent probe technology enabling precise target detection and quantification during amplification cycles.

Value Drivers: Clinical laboratories prioritize probe-based systems for infectious disease testing, biomarker analysis, and quality control applications where measurement precision directly impacts patient care decisions. The technology reduces contamination risks while providing quantitative data essential for viral load monitoring and therapeutic response assessment.

Competitive Advantages: Established protocols, comprehensive reagent availability, and equipment compatibility create switching barriers while automation integration capabilities support high-throughput laboratory operations requiring consistent performance standards.

Strategic Importance: Virus detection applications represent the core market driver through sustained clinical demand for infectious disease diagnostics, pandemic preparedness maintenance, and routine screening protocols across healthcare systems globally.

Why Dominant? Clinical laboratories maintain comprehensive virus testing capabilities developed during pandemic response while expanding into seasonal pathogen monitoring, outbreak investigation, and therapeutic monitoring applications requiring reliable RT-PCR solutions.

What Drives Adoption? Healthcare systems integrate molecular diagnostics into standard care protocols while pharmaceutical companies utilize virus detection for clinical trial screening and therapeutic development programs requiring validated testing methodologies.

Where is Growth? Expansion occurs in point-of-care settings, smaller clinical laboratories, and research institutions implementing decentralized testing capabilities that require simplified RT-PCR workflows and reduced technical complexity.

Current Position: Gene expression analysis applications capture 28.7% market share through pharmaceutical research demand, biomarker development programs, and personalized medicine initiatives requiring precise RNA quantification and analysis capabilities.

Growth Catalysts: Pharmaceutical companies expand gene expression studies for drug development, biomarker validation, and therapeutic target identification while academic research institutions increase RNA analysis applications across diverse biological research programs.

Market Trajectory: The segment demonstrates above-average growth potential through expanding personalized medicine applications, increased pharmaceutical R&D investment, and growing emphasis on precision therapeutics requiring comprehensive gene expression profiling.

Future Outlook: Technology advancement enables simplified protocols that broaden gene expression analysis accessibility while expanded application areas create sustained research demand for specialized RT-PCR solutions.

Market Context: Molecular diagnostic research applications represent specialized growth opportunities through pharmaceutical development, diagnostic test creation, and therapeutic monitoring research requiring advanced RT-PCR capabilities.

Appeal Factors: Research institutions prioritize flexible kit formulations that support method development, protocol optimization, and specialized sample processing while maintaining research-grade performance standards and regulatory compliance capabilities.

Growth Drivers: Pharmaceutical companies invest in diagnostic companion development, biomarker validation studies, and therapeutic monitoring research while academic institutions expand molecular diagnostic research across diverse disease areas and therapeutic applications.

Market Challenges: Specialized requirements increase development costs while limited standardization creates protocol complexity that may restrict adoption among smaller research facilities with limited technical expertise and resources.

Growth Accelerators

Diagnostic infrastructure maintenance drives sustained market demand as healthcare systems preserve pandemic-response capabilities while integrating RT-PCR testing into routine clinical protocols. Research application diversification creates new revenue streams through pharmaceutical development programs, biomarker research initiatives, and academic studies requiring specialized RT-PCR solutions. Technology simplification enables market expansion into decentralized testing environments where reduced complexity and training requirements facilitate broader adoption across point-of-care settings and smaller laboratories.

Budget constraints in public health systems limit procurement flexibility while healthcare institutions prioritize cost-effective solutions over premium kit formulations. Competition from alternative molecular diagnostic technologies including isothermal amplification and next-generation sequencing creates market pressure for specific application areas. Regulatory complexity surrounding new application approvals delays market entry for specialized RT-PCR kits while increasing development costs that may restrict innovation investment among smaller manufacturers.

Adoption accelerates in Asia Pacific regions and pharmaceutical research segments where technology accessibility improvements and research investment growth support expanded RT-PCR implementation. Design trends favor integrated workflow solutions combining sample preparation, amplification, and result analysis into simplified protocols that reduce technical expertise requirements. Market consolidation through strategic partnerships between kit manufacturers and laboratory automation companies creates comprehensive diagnostic solutions. The thesis breaks if alternative diagnostic technologies achieve comparable accuracy at significantly lower costs or regulatory barriers prevent new application development across emerging market segments.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| United States | 5.0% |

| United Kingdom | 4.5% |

| Japan | 4.0% |

The 1-step RT-PCR kits market demonstrates global expansion with China emerging as the growth leader through comprehensive healthcare infrastructure development and research investment initiatives. India follows as a strategic growth hub benefiting from expanding pharmaceutical manufacturing capabilities and clinical research outsourcing growth. Germany represents steady European advancement where regulatory expertise and biotechnology industry strength support market development. Brazil targets emerging market opportunities through healthcare system modernization and research capacity building initiatives. The United States maintains market stability through established diagnostic infrastructure while the United Kingdom and Japan provide consistent development platforms. The China and India anchor rapid growth trajectories while developed markets ensure stability and technology advancement across the global marketplace.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China leads global 1-step RT-PCR kit adoption with comprehensive healthcare system modernization programs and extensive biotechnology industry development initiatives supported by government investment exceeding $12 billion in molecular diagnostic infrastructure. Revenue growth at 7.2% CAGR through 2035 reflects deployment across clinical laboratories in Beijing, Shanghai, and Guangzhou, where RT-PCR testing supports infectious disease monitoring and pharmaceutical research expansion. Chinese manufacturers develop domestic kit production capabilities while healthcare institutions implement standardized molecular diagnostic protocols. State-backed research programs drive technology advancement and manufacturing capacity expansion to serve growing domestic demand while establishing export capabilities across Asia Pacific markets.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, adoption of 1-step RT-PCR kits is accelerating across pharmaceutical research facilities implementing drug development programs and clinical research organizations expanding molecular diagnostic capabilities. Indian contract research organizations integrate RT-PCR testing into clinical trial protocols while domestic manufacturers develop cost-effective kit solutions for local market requirements. Revenue expansion at 6.6% CAGR through 2035 stems from pharmaceutical industry growth and healthcare infrastructure development across major metropolitan areas. Government programs promote biotechnology sector development through technology incentives and research funding that facilitate RT-PCR kit adoption across academic and commercial research facilities.

Germany maintains technological leadership with comprehensive regulatory expertise demonstrating kit validation efficiency rates exceeding 92% for European market approval processes. Hamburg, Munich, and Berlin serve as biotechnology development centers where manufacturers optimize RT-PCR formulations for clinical and research applications requiring strict quality standards. German biotechnology companies develop advanced kit chemistries while clinical laboratories implement comprehensive molecular diagnostic programs supporting healthcare system requirements. The country's extensive regulatory knowledge and quality management expertise facilitate kit development and market approval processes across European Union markets. Technology advancement programs support innovation development through academic-industry partnerships and government research funding initiatives. Revenue growth reaches 6.1% CAGR through 2035.

Brazilian healthcare institutions demonstrate growing adoption through clinical laboratories implementing molecular diagnostic capabilities and pharmaceutical companies expanding research operations across São Paulo, Rio de Janeiro, and Brasília. Government healthcare programs support diagnostic infrastructure development while academic medical centers integrate RT-PCR testing into clinical training and research protocols. The market faces challenges from budget constraints in public healthcare systems and limited technical expertise requiring comprehensive training programs. Growth potential stems from expanding pharmaceutical research activities and increasing healthcare access initiatives that create demand for cost-effective RT-PCR solutions across diverse clinical and research applications requiring reliable performance standards.

United States demonstrates market leadership through comprehensive diagnostic infrastructure and extensive pharmaceutical research capabilities supporting advanced RT-PCR application development across multiple therapeutic areas. Revenue growth at 5.0% CAGR through 2035 reflects cost-per-outcome compression under compliance and reliability constraints as clinical laboratories optimize diagnostic workflows through automated RT-PCR systems and integrated result management platforms. Houston, Boston, and San Francisco serve as biotechnology development centers where manufacturers create specialized kit formulations for pharmaceutical research and clinical diagnostic applications. Government funding supports advanced diagnostic research while healthcare institutions maintain comprehensive molecular diagnostic capabilities for clinical care and research applications.

The United Kingdom maintains steady market growth at 4.5% CAGR through 2035, characterized by medium growth potential supported by established pharmaceutical industry presence and comprehensive healthcare system infrastructure. London, Cambridge, and Oxford serve as research centers where biotechnology companies develop RT-PCR applications for drug discovery and clinical research programs. The market benefits from strong regulatory expertise and established clinical research capabilities that facilitate kit validation and commercial deployment. Healthcare system budget constraints create demand for cost-effective solutions while pharmaceutical research investment supports specialized application development. The growth scenario reflects mature market conditions with sustained demand for established RT-PCR applications rather than dramatic expansion across new market segments.

Japanese manufacturers develop sophisticated 1-step RT-PCR kits emphasizing precision engineering and quality control systems that demonstrate superior performance characteristics in demanding research and clinical applications. Tokyo, Osaka, and Yokohama serve as biotechnology development centers where companies implement advanced manufacturing processes and comprehensive quality assurance protocols. The market prioritizes technology refinement and specialized applications rather than volume growth, focusing on high-value kit formulations for pharmaceutical research and clinical diagnostic applications requiring exceptional accuracy and reliability. Revenue expansion at 4.0% CAGR through 2035 reflects mature market conditions with emphasis on technology advancement and export market development rather than domestic volume expansion.

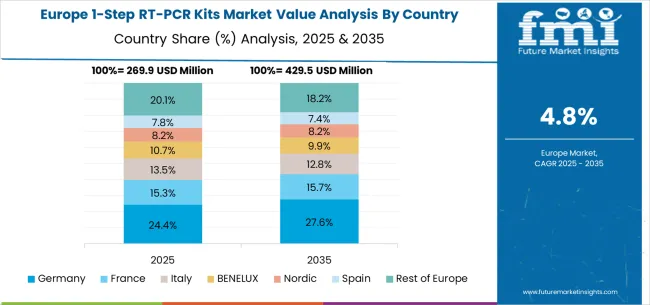

The European 1-step RT-PCR kits market reflects coordinated healthcare modernization and biotechnology industry development across member states pursuing common regulatory standards and technology advancement objectives. Germany leads through comprehensive regulatory expertise and biotechnology industry strength, while the United Kingdom maintains pharmaceutical research leadership despite post-Brexit market adjustments. France develops clinical research capabilities through academic medical centers and pharmaceutical industry partnerships, while Italy focuses on healthcare system modernization and diagnostic capacity expansion. Nordic countries emphasize healthcare technology integration and public health preparedness initiatives, while Eastern European markets demonstrate growing adoption through EU healthcare funding programs and infrastructure development initiatives. The regional market benefits from harmonized regulatory frameworks and cross-border research collaboration that accelerate technology deployment and market development across diverse application areas.

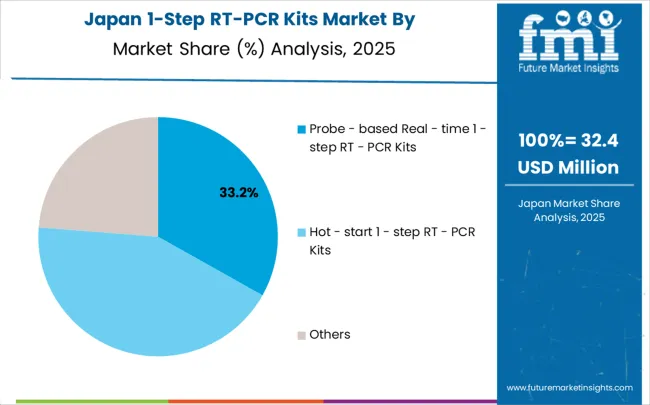

In Japan, the 1-step RT-PCR kits market is largely driven by the probe-based real-time segment, which accounts for 68% of total market revenues in 2025. The superior accuracy requirements in Japanese clinical laboratories and comprehensive quality control protocols mandated for diagnostic applications create strong preference for probe-based systems offering quantitative capabilities. Virus detection applications follow with a 45% share, primarily in clinical diagnostic laboratories implementing infectious disease monitoring and pandemic preparedness protocols. Gene expression analysis contributes 35% through pharmaceutical research facilities and academic institutions conducting biomarker research and drug development studies. Molecular diagnostic research accounts for 20% as biotechnology companies develop specialized applications for therapeutic monitoring and diagnostic test validation programs.

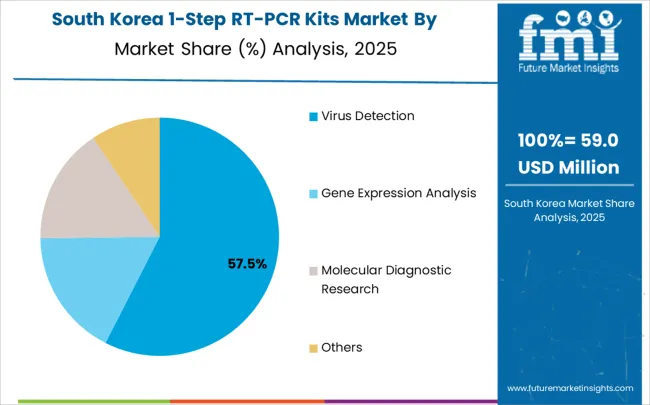

In South Korea, the market is expected to remain dominated by clinical laboratories, which hold a 52% share in 2025. These facilities serve as primary deployment platforms for RT-PCR testing where infectious disease monitoring requires reliable diagnostic capabilities and standardized protocols. Pharmaceutical research facilities and biotechnology companies each hold 28% market share, with expanding adoption in drug development programs and clinical research applications. Academic institutions account for the remaining 20%, but are gradually gaining traction in molecular diagnostic research due to government funding programs and international research collaboration initiatives supporting biotechnology sector development.

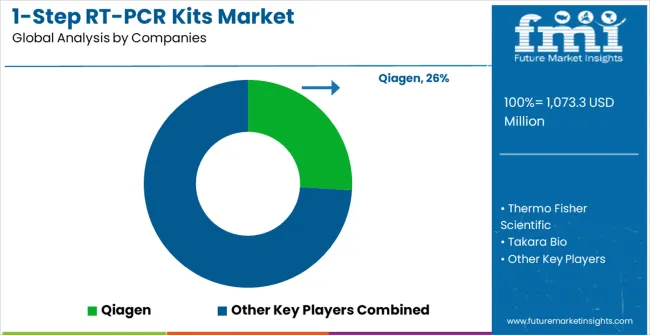

The 1-step RT-PCR kits market operates with moderate concentration among approximately 25-30 meaningful players, creating balanced competitive dynamics between established biotechnology companies and specialized diagnostic manufacturers. The top three companies control roughly 42% market share while the top five hold approximately 58%, indicating moderately fragmented competition with opportunities for market share expansion. Competition emphasizes product differentiation through kit performance, application specialization, and technical support capabilities rather than aggressive pricing strategies that could undermine product quality and research reliability.

Tier 1 - Market Leaders demonstrate comprehensive product portfolios spanning multiple kit types and application areas with established global distribution networks and extensive technical support capabilities. Qiagen leads through broad product range and strong clinical market presence, leveraging automated workflow integration and comprehensive reagent systems. Thermo Fisher Scientific competes through technology innovation and research market leadership, offering specialized formulations for pharmaceutical development and academic research applications. Takara Bio maintains strong position in Asia Pacific markets while expanding global presence through high-performance kit development and specialized applications targeting research institutions.

Tier 2 - Strong Challengers focus on specialized market segments and regional expansion through targeted product development and strategic partnerships. Bio-Rad emphasizes clinical diagnostic applications with established laboratory relationships and quality assurance capabilities. Roche leverages diagnostic platform integration and healthcare system partnerships to maintain competitive positioning across clinical market segments. Agilent Technologies targets research applications through specialized kit formulations and comprehensive technical support programs designed for pharmaceutical and academic customers.

Tier 3 - Specialized Providers compete through niche applications, regional market expertise, and cost-effective solutions targeting specific customer segments. Companies including Toyobo, Bio-Helix, Promega, New England Biolabs, and MP Biomedicals contribute specialized expertise in specific application areas, regional markets, or customer segments requiring customized solutions and dedicated technical support capabilities.

The 1-Step RT-PCR (Reverse Transcription-Polymerase Chain Reaction) kits market represents a critical foundation of molecular diagnostics and research, projected to grow from $1,073.3 million to $1,799 million at a 5.3% CAGR. This essential technology enables direct RNA detection and quantification in a single reaction, streamlining workflows for virus detection, gene expression analysis, and molecular diagnostic research. Market leadership is dominated by established life sciences companies, with significant concentration among major players like Qiagen, Thermo Fisher Scientific, and Takara Bio. The market's steady growth reflects increasing demand for rapid, accurate molecular testing across healthcare, research institutions, and biotechnology applications.

How Governments Could Strengthen Diagnostic Infrastructure?

Public Health Preparedness: Establish strategic reserves of RT-PCR kits and fund distributed testing capabilities to ensure rapid response capacity for infectious disease outbreaks, building on lessons learned from COVID-19 pandemic response.

Research Infrastructure Investment: Increase funding for academic and government research laboratories, ensuring access to high-quality RT-PCR reagents for basic research in virology, gene expression studies, and molecular diagnostics development.

Regulatory Harmonization: Streamline approval pathways for diagnostic RT-PCR kits while maintaining rigorous safety and efficacy standards, reducing time-to-market for critical diagnostic tools during health emergencies.

Manufacturing Resilience: Provide incentives for domestic production of critical reagents and enzyme components, reducing dependence on global supply chains for essential diagnostic capabilities.

Quality Assurance Programs: Fund proficiency testing and quality control programs that ensure consistent performance across laboratories using RT-PCR technology, maintaining diagnostic accuracy and reliability.

How Standards Bodies Could Enhance Market Reliability?

Performance Standardization: Develop unified standards for RT-PCR kit sensitivity, specificity, and reproducibility testing that enable reliable comparison across manufacturers and applications, particularly for probe-based and hot-start formulations.

Quality Management Systems: Establish comprehensive quality standards for manufacturing, storage, and handling of temperature-sensitive RT-PCR reagents, ensuring consistent performance from production to end-use.

Validation Protocols: Create standardized validation frameworks for different applications - virus detection requiring high sensitivity, gene expression analysis demanding broad dynamic range, and molecular diagnostic research needing robust performance across sample types.

Proficiency Testing Standards: Implement regular inter-laboratory comparison programs that validate RT-PCR performance across different kit types and applications, maintaining diagnostic confidence.

Cold Chain Management: Define temperature control standards throughout the supply chain, addressing the critical requirement for maintaining enzyme activity and reagent stability from manufacturing to laboratory use.

How Technology and Equipment Manufacturers Could Advance the Field?

Enzyme Engineering Innovation: Invest in developing more robust reverse transcriptase and polymerase enzymes with improved thermostability, broader temperature tolerance, and enhanced inhibitor resistance for challenging sample types.

Formulation Optimization: Create advanced buffer systems and stabilizers that extend shelf life, improve freeze-thaw stability, and maintain consistent performance across varying laboratory conditions and sample matrices.

Automation Compatibility: Design RT-PCR kits with standardized formats and liquid handling properties that integrate seamlessly with automated liquid handling systems and high-throughput platforms.

Multiplexing Capabilities: Develop sophisticated probe chemistries and reaction optimization that enable simultaneous detection of multiple targets without compromising sensitivity or increasing cross-reactivity risks.

Point-of-Care Adaptation: Engineer simplified RT-PCR formulations suitable for portable and point-of-care testing platforms, expanding molecular diagnostics beyond traditional laboratory settings.

How Suppliers and Distributors Could Navigate Market Complexities?

Cold Chain Excellence: Implement sophisticated temperature-controlled logistics networks with real-time monitoring, ensuring RT-PCR kit integrity throughout global distribution to research and clinical laboratories.

Application-Specific Positioning: Develop specialized product lines targeting distinct market segments - high-sensitivity kits for virus detection, broad-range formulations for gene expression analysis, and research-grade options for molecular diagnostic development.

Technical Support Infrastructure: Provide comprehensive technical support including protocol optimization, troubleshooting guidance, and application development assistance to maximize customer success across diverse research and diagnostic applications.

Regional Market Adaptation: Tailor product availability and technical support to address regional preferences and regulatory requirements, particularly in high-growth markets like China (7.2% market share) and India (6.6% market share).

Inventory Management: Maintain strategic inventory levels that balance cost efficiency with the critical need for immediate availability of temperature-sensitive reagents across diverse geographic markets.

How Investors and Financial Enablers Could Accelerate Innovation?

R&D Investment Focus: Support continued innovation in enzyme engineering, formulation chemistry, and automation compatibility that differentiate RT-PCR products in the competitive molecular diagnostics market.

Manufacturing Scale Financing: Provide growth capital for expanding production capacity to meet increasing demand from healthcare, research, and biotechnology sectors while maintaining stringent quality standards.

Strategic Acquisition Support: Enable consolidation opportunities that combine complementary technologies, expand geographic reach, or integrate vertical capabilities across the RT-PCR value chain.

Emerging Market Expansion: Fund market development initiatives in growing regions where increasing research capabilities and healthcare infrastructure drive demand for molecular diagnostic tools.

Technology Platform Development: Support development of integrated platforms that combine RT-PCR capabilities with sample preparation, automation, and data analysis to create comprehensive molecular diagnostic solutions.

The 1-Step RT-PCR kits market's steady 5.3% growth reflects its fundamental importance in molecular biology and diagnostics. Success requires maintaining technical excellence while adapting to evolving applications across virus detection, gene expression analysis, and molecular diagnostic research. The market's maturity demands focus on incremental innovation, operational efficiency, and strategic positioning across diverse end-use applications rather than disruptive technological changes.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,073.3 million |

| Kit Type | Probe-based Real-time 1-step RT-PCR Kits, Hot-start 1-step RT-PCR Kits, Standard 1-step RT-PCR Kits, Custom 1-step RT-PCR Kits |

| End-Use | Virus Detection, Gene Expression Analysis, Molecular Diagnostic Research, Agricultural Testing, Environmental Monitoring |

| Application | Clinical Diagnostics, Pharmaceutical Research, Academic Research, Point-of-Care Testing, Quality Control |

| Sample Type | Blood, Saliva, Tissue, Environmental Samples, Cell Culture |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, South Korea, India, Brazil, Australia |

| Key Companies Profiled | Qiagen, Thermo Fisher Scientific, Takara Bio, Bio-Rad, Roche, Agilent Technologies, Toyobo, Bio-Helix, Promega, New England Biolabs, MP Biomedicals |

| Additional Attributes | Dollar sales by kit type and end-use segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established biotechnology companies and specialized diagnostic manufacturers, adoption patterns across clinical and research applications, integration with automated laboratory systems and digital result management platforms, innovations in kit chemistry and workflow simplification technologies, and development of specialized applications with enhanced sensitivity capabilities. |

How big is the 1-step RT-PCR kits market in 2025?

The global 1-step RT-PCR kits market is valued at USD 1,073.3 million in 2025.

What will be the size of 1-step RT-PCR kits market in 2035? The size for the 1-step RT-PCR kits market is projected to reach USD 1,799 million by 2035.

How much will be the 1-step RT-PCR kits market growth between 2025 and 2035? The 1-step RT-PCR kits market is expected to grow at a 5.3% CAGR between 2025 and 2035.

What are the key kit type segments in the 1-step RT-PCR kits market?

The key kit type segments in the 1-step RT-PCR kits market are probe-based real-time 1-step RT-PCR kits, hot-start 1-step RT-PCR kits, standard 1-step RT-PCR kits, and custom 1-step RT-PCR kits.

Which end-use segment is expected to contribute significant share in the 1-step RT-PCR kits market in 2025?

In terms of end-use, virus detection segment is set to command 58.2% share in the 1-step RT-PCR kits market in 2025.

The global 1-step RT-PCR kits market is estimated to be valued at USD 1,073.3 million in 2025.

The market size for the 1-step RT-PCR kits market is projected to reach USD 1,798.8 million by 2035.

The 1-step RT-PCR kits market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in 1-step RT-PCR kits market are probe - based real - time 1 - step rt - PCR kits, hot - start 1 - step rt - PCR kits and others.

In terms of application, virus detection segment to command 58.2% share in the 1-step RT-PCR kits market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hip Kits Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Audio Kits Market

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

Lavage Kits Market

Organoids Kits Market

Capacitor Kits Market

Connector Kits Market

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DIY Haircut Kits Market - Trends, Growth & Forecast 2025 to 2035

EMI, Filter Kits Market

Nephelometry Kits Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Chilled Meal Kits Market

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Antibody Pair Kits Market

Skin Traction Kits Market

Grease Fitting Kits Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Guided Surgery Kits Market Size, Growth, and Forecast for 2025 to 2035

Fungal Testing Kits Market Analysis – Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA