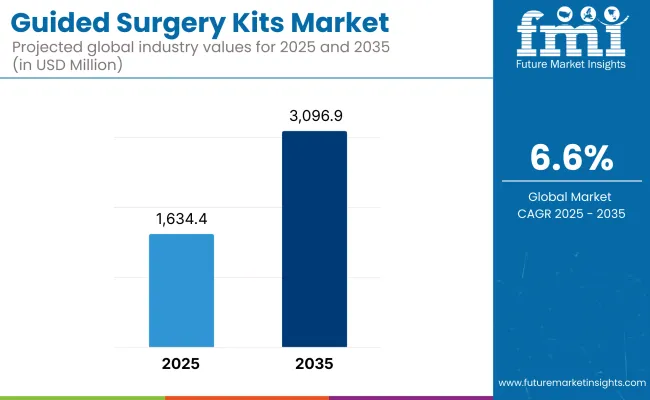

The global Guided Surgery Kits Market is projected to reach a valuation of USD 1,634.4 million by 2025 and USD 3,096.9 million by 2035. This indicates a decade-long increase of USD 1,462.5 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 6.6%, representing a 1.90X increase over the ten-year period.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 1,634.4 million |

| Projected Market Value (2035F) | USD 3,096.9 million |

| Value-based CAGR (2025 to 2035) | 6.6% |

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 1,634.4 million to USD 2,249.8 million, adding USD 615.4 million, which contributes to 42.1% of the total decade growth. The Fully Guided Surgery Kits segment will remain dominant, holding around 36.2% share of the category by 2030 due to dental clinics’ continued prioritization of precision implant placement and workflow efficiency,while Universal Guided Kits will maintain a moderate share at just above 12%.

The second half from 2030 to 2035 contributes USD 847.1 million, equal to 57.9% of the total growth, as the market advances from USD 2,249.8 million to USD 3,096.9 million. This acceleration is powered by the widespread adoption of guided surgery systems in both specialized dental service organizations and large multi-chair clinics.

Fully Guided Surgery Kits and System-Specific Kits together are expected to capture a large share exceeding 61% by the end of the decade. Pilot Drill Guided Kits are likely to maintain above 23% share, supported by cost-effective adoption in emerging markets.

From 2020 to 2024, the overall Guided Surgery Kits Market grew from USD 1,193.9 million to USD 1,551.0 million. Leading manufacturers such as Eko Health, Inc., Lapsi Health, Ai Health Highway India Pvt Ltd, and other innovators collectively account for a significant share of global revenue through procedure-specific kit solutions and digital integration with surgical navigation systems.

Key strategies deployed by these players include advancements in kit modularity, integration with guided surgery software platforms, and partnerships with dental clinics and service organizations to standardize precision implant workflows.

In 2025, the Guided Surgery Kits Market is expected to reach a value of approximately USD 1,634.4 million, driven by the shift from conventional implant placement methods to fully guided, system-specific surgical kits. Growth will be propelled by dental service providers’ investments in clinical precision, reduced surgical chair time, and improved patient outcomes.

End users particularly dental clinics are increasingly adopting kits with digitally pre-planned drilling protocols, single-use sterile components, and compatibility with intraoral scanning workflows, supporting both immediate and full-arch rehabilitation procedures. This trend aligns with the rising demand for minimally invasive and highly accurate dental implant placements across developed and emerging markets.

The market is segmented by product type, application, end-user, and region. Product type includes Fully Guided Surgery Kits, Pilot Drill Guided Kits, Universal Guided Kits, System-Specific Kits, and Others, representing the core solutions driving procedural precision and adoption across dental practices. Application classification covers Single Implant Placement, Full-Arch Rehabilitation, Immediate Implant Placement, and Others, reflecting the range of surgical scenarios supported by guided kit technologies.

Based on end user, the segmentation includes Dental Clinics, Dental Service Organizations, Hospitals, and Academic & Research Institutes, each with distinct procurement drivers and procedural requirements. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa, with market growth influenced by variations in dental infrastructure, implant adoption rates, and regulatory landscapes.

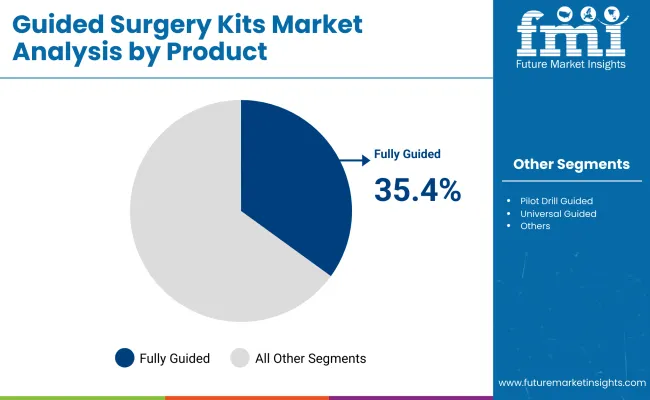

Fully Guided Surgery Kits are expected to retain a dominant position, contributing 35.4% to the market in 2025, owing to their ability to deliver highly accurate, pre-planned implant placement with minimal surgical deviation. Their adoption has been driven by the global shift toward precision dentistry and the growing integration of digital treatment planning software with guided surgery workflows.

These kits are increasingly preferred due to their capacity to reduce chair time, enhance surgical predictability, and improve patient recovery outcomes. Dental clinics and service organizations are investing in fully guided systems to standardize procedures, particularly for complex full-arch and immediate implant cases.

Industry adoption has also been supported by advancements in kit compatibility with CAD/CAM workflows, intraoral scanners, and 3D-printed surgical guides. Collectively, these factors have solidified the position of fully guided models over partial or pilot drill-only kits in high-volume, technology-driven dental practices worldwide.

| Product | Market Share (%) |

|---|---|

| Fully Guided Surgery Kits | 35.4% |

| Pilot Drill Guided Kits | 22.4% |

| Universal Guided Kits | 12.4% |

| System-Specific Kits | 24.3% |

| Others | 5.5% |

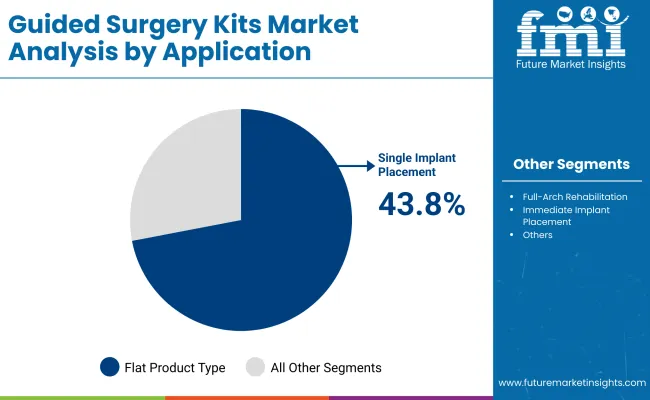

Single Implant Placement has emerged as the leading application area, projected to hold around 43.8% of the market in 2025, driven by the growing global demand for tooth replacement solutions that are minimally invasive and cost-effective. The increasing adoption of guided surgery in single implant cases stems from its ability to provide enhanced surgical accuracy, reduced chair time, and improved patient satisfaction.

Dental clinics are leveraging digital workflows from intraoral scanning to 3D-printed surgical guides to optimize single implant placement outcomes. Rising awareness among patients about the benefits of precise implant positioning, coupled with the expansion of dental implant insurance coverage in several regions, is further fueling demand.

Additionally, the growing elderly population and rising incidence of tooth loss are sustaining high procedural volumes, cementing the dominance of single implant placement over more complex, multi-unit rehabilitation cases in both developed and emerging markets.

| Application | Market Share (%) |

|---|---|

| Single Implant Placement | 43.8% |

| Full-Arch Rehabilitation | 27.8% |

| Immediate Implant Placement | 20.0% |

| Others | 8.4% |

Dental Clinics are expected to remain the largest end user segment, contributing around 51.9% of the market in 2025, driven by their critical role in delivering routine and specialized implant procedures. The majority of single and multiple implant placements are performed in clinic settings, where efficiency, accuracy, and patient turnover are key operational priorities.

The adoption of guided surgery kits in dental clinics is reinforced by the growing integration of digital planning tools, chairside 3D printing for surgical guides, and minimally invasive workflows. Investments in clinic modernization particularly in high-volume practices are enabling the deployment of advanced, fully guided and system-specific kits to enhance procedural predictability.

Additionally, favorable patient financing options and expanding dental tourism markets are supporting higher procedural volumes, cementing the position of dental clinics as the primary growth engine for guided surgery kit adoption globally.

| End User | Market Share (%) |

|---|---|

| Dental Clinics | 51.9% |

| Dental Service Organizations | 24.6% |

| Hospitals | 18.7% |

| Academic & Research Institutes | 4.8% |

The Guided Surgery Kits Market is experiencing strong growth as dental and oral surgery providers worldwide face increasing demand for precision implant placement, faster procedural workflows, and improved patient outcomes. Major growth drivers include the rising global incidence of tooth loss, expanding adoption of dental implants, and the integration of digital treatment planning with surgical execution.

Advancements such as fully guided, system-specific kits compatible with intraoral scanning and CAD/CAM workflows reduce surgical chair time, minimize procedural errors, and enhance postoperative recovery. The shift toward minimally invasive implant procedures and growing acceptance of immediate placement protocols are further accelerating uptake.

The pandemic heightened the importance of patient throughput and treatment predictability, driving clinics and dental service organizations to standardize guided surgery workflows. In regions with rapidly expanding dental infrastructure particularly in North America, Europe, and parts of Asia Pacific new clinics and technology upgrades are fueling demand for advanced guided surgery kits that combine accuracy, safety, and clinical efficiency.

Digital Integration Driving Precision Implant Procedures

The most significant growth driver in the Guided Surgery Kits Market is the rapid integration of digital treatment planning and surgical execution workflows. Advances in intraoral scanning, CAD/CAM technology, and 3D printing enable clinicians to pre-plan implant positions with high accuracy and transfer these plans directly into fully guided or system-specific surgical kits.

Dental clinics and service organizations are increasingly compelled to adopt these kits to reduce surgical chair time, minimize errors, and improve long-term implant stability. Accreditation bodies and implant manufacturers are also promoting standardized guided protocols, reinforcing adoption. As global dental implant case volumes increase, the need for reproducible, precision-driven workflows is strengthening procurement of advanced guided surgery kits.

High System Cost and Technology Adoption Barriers

Despite the clinical benefits, the high cost of fully guided surgery systems-particularly those requiring proprietary surgical kit formats, compatible implant systems, and advanced imaging-remains a significant barrier in cost-sensitive markets.

Smaller dental clinics, especially in developing regions, often delay upgrades due to the combined expense of digital planning software, CBCT imaging, and surgical kit replenishment. Infrastructure readiness, including access to digital impression equipment and trained surgical teams, adds to adoption challenges. For many practices, retrofitting existing workflows to accommodate guided protocols requires operational adjustments and additional staff training.

Convergence of Guided Surgery Kits with Comprehensive Digital Dentistry Solutions

A rapidly emerging trend is the integration of guided surgery kits into end-to-end digital dentistry ecosystems. Rather than purchasing kits as standalone procedural tools, large dental networks and advanced clinics are incorporating them into comprehensive solutions that include intraoral scanners, CBCT imaging, CAD/CAM design, and in-house 3D printing. Leading implant manufacturers are aligning kit designs with proprietary implant lines, software platforms, and training modules to drive brand loyalty and procedural consistency.

This convergence is shifting procurement decisions toward platform compatibility and clinical workflow integration rather than kit cost alone. As new dental facilities are established and existing practices undergo technology upgrades, guided surgery kits are increasingly co-specified alongside diagnostic, planning, and manufacturing technologies, positioning them as core components of a fully digital, patient-centric implant treatment pathway.

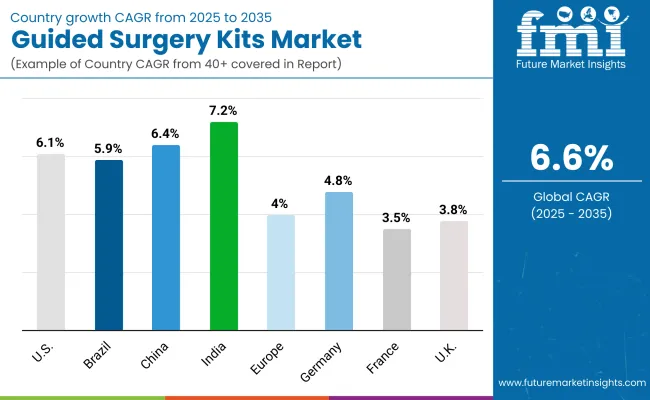

| Country | CAGR |

|---|---|

| USA | 6.1% |

| Brazil | 5.9% |

| China | 6.4% |

| India | 7.2 % |

| Europe | 4.0% |

| Germany | 4.8% |

| France | 3.5% |

| UK | 3.8% |

Asia Pacific is emerging as the fastest-growing region in the Guided Surgery Kits Market, projected to grow at a 6.2% CAGR between 2025 and 2030. Among its key markets, India is forecast to expand at a 6.0% CAGR, driven by the rapid expansion of advanced dental care facilities, growing adoption of dental implants, and increasing training in guided surgery protocols among clinicians.

China is projected to grow at a 6.4% CAGR, supported by substantial investments in digital dentistry infrastructure, rising procedural volumes, and public-private partnerships for technology adoption in oral healthcare. The region’s growth is also fueled by expanding dental tourism hubs, particularly in Southeast Asia, and the integration of digital workflows with guided implant systems in newly built clinics.

Europe is expected to grow steadily at a 5.4% CAGR through 2035. Germany is projected to grow at 4.8% CAGR, benefiting from the integration of guided surgery kits into established implantology practices and the expansion of digital dentistry training programs. France is estimated to grow at 3.5% CAGR, driven by gradual adoption in both private clinics and public dental care facilities.

The UK will see growth of 3.8% CAGR, with market expansion linked to NHS-backed modernization projects aimed at improving access to advanced implant procedures. The European market is supported by harmonized regulatory frameworks, increasing demand for minimally invasive dental solutions, and continuous professional education in guided implantology.

North America remains a mature but innovation-led market, with the USA projected to grow at a 6.1% CAGR between 2025 to 2035. Growth in the USA is driven by the replacement of conventional implant placement workflows with digitally integrated guided systems in both private practices and dental service organizations.

Increasing case volumes in full-arch rehabilitation and immediate implant placement, combined with rising patient expectations for accuracy and faster recovery, are accelerating adoption. Furthermore, dental networks are investing in standardized guided protocols to ensure clinical consistency across multiple locations, while advances in kit modularity and compatibility are making adoption more attractive for large-scale operators.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 509.2 |

| 2026 | 539.2 |

| 2027 | 571.3 |

| 2028 | 605.8 |

| 2029 | 642.6 |

| 2030 | 681.9 |

| 2031 | 723.4 |

| 2032 | 767.9 |

| 2033 | 815.8 |

| 2034 | 866.7 |

| 2035 | 920.5 |

The Guided Surgery Kits Market in the USA is forecasted to grow at a 6.1% CAGR, primarily driven by the rapid shift from freehand implant placement to digitally integrated guided workflows. Dental clinics and large dental service organizations (DSOs) are replacing conventional surgical protocols with fully guided and system-specific kits that ensure high precision, reduced chair time, and predictable outcomes. Adoption is further accelerated by the integration of CAD/CAM workflows, intraoral scanning, and 3D-printed surgical guides.

The Guided Surgery Kits Market in the United Kingdom is projected to grow at a 3.8% CAGR through 2035, supported by NHS modernization projects aimed at expanding access to advanced dental treatments. Private dental groups are also investing in digital dentistry ecosystems, integrating CBCT imaging, treatment planning software, and guided kits into a unified workflow. This trend is further reinforced by the rising number of trained implantologists and increased patient demand for minimally invasive solutions.

The Guided Surgery Kits Market in Germany is forecast to grow at a 4.8% CAGR, driven by the country’s strong implant dentistry infrastructure and widespread clinician training programs. Germany’s high procedural volumes and focus on precision-based treatment are accelerating the transition from freehand techniques to guided approaches. Furthermore, professional associations and implant manufacturers are actively promoting workshops and digital workflow adoption.

| Europe Country | 2025 |

|---|---|

| Germany | 26.8% |

| UK | 17.2% |

| France | 14.4% |

| Italy | 11.5% |

| Spain | 8.6% |

| BENELUX | 9.6% |

| Nordic Countries | 7.7% |

| Rest of Western Europe | 4.2% |

| Europe Country | 2035 |

|---|---|

| Germany | 25.8% |

| UK | 18.4% |

| France | 15.3% |

| Italy | 12.3% |

| Spain | 8.1% |

| BENELUX | 9.0% |

| Nordic Countries | 7.2% |

| Rest of Western Europe | 3.8% |

The Guided Surgery Kits Market in India is expected to grow at a 7.2% CAGR, positioning it among the faster-growing markets globally. Growth is supported by the rapid expansion of advanced dental care facilities, increased adoption of dental implants, and a surge in digital dentistry training programs.

Rising patient awareness, along with NABH accreditation standards for dental clinics, has driven the integration of guided surgical protocols in both urban and Tier 2 city practices. Indian dental service groups are increasingly deploying fully guided and system-specific kits to improve procedural precision and reduce chair time. Additionally, local distributors and global manufacturers are offering cost-effective, customizable kits compatible with domestic implant brands to suit regional budgets and preferences.

The Guided Surgery Kits Market in China is projected to grow at a 6.4% CAGR through 2035, driven by substantial investment in digital dentistry infrastructure under the “Healthy China 2030” initiative. The National Health Commission’s focus on precision-driven oral health services is accelerating adoption of guided surgery kits in top-tier hospitals and large private clinics.

Urban dental centers are shifting toward fully integrated digital workflows, combining CBCT imaging, CAD/CAM design, and surgical guides. Domestic manufacturers are scaling kit production while enhancing product compatibility with locally preferred implant systems, ensuring affordability and faster market penetration.

The Guided Surgery Kits Market in Japan is projected to reach USD 63.7 million in 2025, with Fully Guided Surgery Kits accounting for 36.1% of product use, reflecting Japan’s preference for precision and predictable clinical outcomes. Adoption is supported by the country’s high standards in dental technology integration and compliance with Japan Prosthodontic Society implant protocols.

The Ministry of Health, Labour and Welfare’s emphasis on digital workflow implementation in dental care is a major driver, alongside an aging population increasing implant demand. Local suppliers are also developing Japan-specific guided kits optimized for compact clinic layouts and ergonomic handling.

The Guided Surgery Kits Market in South Korea is estimated at USD 45.8 million in 2025, with Single Implant Placement representing the largest application share at 46.1%. This dominance is due to a high frequency of single-tooth restorations and the country’s early adoption of digital dental workflows.

Government-backed healthcare modernization initiatives and the Korean Dental Association’s promotion of guided protocols are accelerating the market shift from freehand surgery to precision-based techniques. Hospitals and dental groups are also integrating guided kits with in-house CBCT imaging and 3D printing facilities to offer same-day implant solutions.

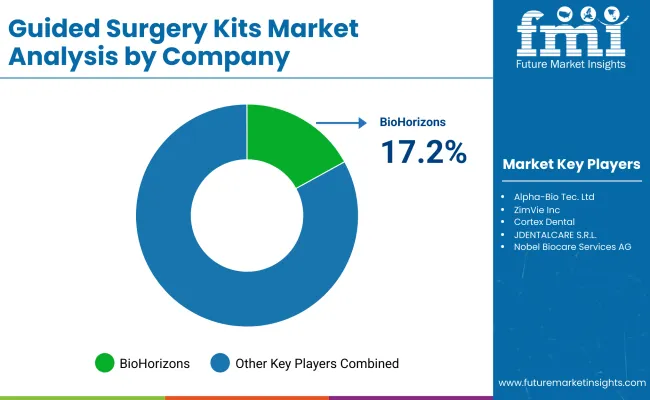

The Global Guided Surgery Kits Market is moderately competitive, with a mix of global leaders, established regional manufacturers, and emerging innovators competing across implant dentistry and oral surgery applications. Industry leaders such as BioHorizons, ZimVie Inc., Cortex Dental and Nobel Biocare Services AG hold notable market share, driven by their integration of guided kits with advanced digital dentistry platforms.

These companies are expanding their reach through strategic partnerships with dental service organizations (DSOs) and implant manufacturers, offering bundled solutions that combine guided kits with CAD/CAM treatment planning software, intraoral scanners, and 3D printing capabilities. Their strategies increasingly focus on surgical accuracy, procedural efficiency, and compatibility with multiple implant systems to maximize adoption across global clinic networks.

Established mid-sized players like Alpha-Bio Tec. Ltd, Ritter Implants and Osstem Implant cater to high-growth regional markets, offering scalable guided kit configurations tailored to the needs of multi-chair dental clinics and teaching institutions. These companies are innovating with modular kit designs, cross-brand implant compatibility, and ergonomic surgical workflows, making them attractive to practices undergoing phased digital upgrades.

Emerging participants such as ALLIANCE GLOBAL TECHNOLOGY LTD., Sweden & Martina S.p.A, Alpha-Bio Tec. Ltd and others focus on niche opportunities, including portable guided solutions, integration with teledentistry platforms, and rapid-deployment kits for mobile dental units. Their competitive edge lies in product customization, cost-effective pricing, and value-added services such as clinician training, workflow optimization, and software-assisted case planning.

As the market evolves, competitive differentiation is shifting from basic physical guide design toward fully integrated digital ecosystems leveraging AI-based treatment planning, IoT-enabled surgical tracking, and seamless interoperability with imaging, design, and manufacturing technologies in the modern dental clinic.

| Top Player | 2024 Share |

|---|---|

| BioHorizons | 17.2% |

| Others | 82.8% |

Key Developments:

| Item | Value |

|---|---|

| Market Value (2025) | USD 1634.4 million |

| Product type | Fully Guided Surgery Kits, Pilot Drill Guided Kits, Universal Guided Kits, System-Specific Kits, and Others |

| Application | Single Implant Placement, Full-Arch Rehabilitation, Immediate Implant Placement, and Others, |

| End User | Dental Clinics, Dental Service Organizations, Hospitals, and Academic & Research Institutes |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | BioHorizons Alpha-Bio Tec. Ltd, ZimVie Inc., Cortex Dental, JDENTALCARE S.R.L. , Nobel Biocare Services AG, Ritter Implants, Osstem Implant, ALLIANCE GLOBAL TECHNOLOGY LTD., Sweden & Martina S.p.A, AB Dental Devices Ltd, B&B Dental Implant Company, Adin Dental Implant Systems Ltd. and Others |

| Additional Attributes | Dollar sales by application and regions, adoption trends of digitally integrated Guided Surgery Kits, rising demand in complex full-arch rehabilitation and immediate implant placement, growing demand across dental clinics, DSOs, and hospital-based oral surgery units, increasing integration with CAD/CAM, CBCT imaging, and 3D printing for precision implant workflows. |

The Global Guided Surgery Kits Market is estimated to be valued at USD 1,634.4 million in 2025.

The market size for Guided Surgery Kits is projected to reach USD 3,096.9 million by 2035.

The Global Guided Surgery Kits Market is expected to grow at a CAGR of 6.6% during this period.

Key product types include Fully Guided Surgery Kits, Pilot Drill Guided Kits, Universal Guided Kits, System-Specific Kits, and Others.

The Single Implant Placement segment is projected to command 43.8% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CT Guided Intervention Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

MRI-Guided Cardiac Ablation Market Size and Share Forecast Outlook 2025 to 2035

MRI Guided Neurosurgical Ablation Market Insights - Demand & Growth 2025 to 2035

Image-Guided Injectables Market Forecast and Outlook 2025 to 2035

Image Guided Radiotherapy Market Size and Share Forecast Outlook 2025 to 2035

Image Guided Systems Market is segmented by product type, application and end user from 2025 to 2035

Video-Guided Pericardial Access Device Market

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Automated Guided Vehicles (AGV) Market Growth - Trends & Forecast 2025 to 2035

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Global Fluorescence Guided Surgery System Market Analysis – Size, Share & Forecast 2024-2034

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Electrosurgery Accessories Market Size and Share Forecast Outlook 2025 to 2035

Electrosurgery Devices Market Overview - Trends & Growth Forecast 2025 to 2035

Electrosurgery Generators Market Analysis - Size, Share, and Forecast 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Cardiac Surgery Devices Market Analysis – Trends & Forecast 2024-2034

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA