The image guided radiotherapy market is experiencing robust growth driven by increasing adoption of precision-based cancer treatment and rapid advancements in imaging and radiation technologies. Rising cancer incidence rates, coupled with the global emphasis on improving therapeutic accuracy and minimizing collateral tissue damage, are fueling demand for integrated radiotherapy systems. Market players are focusing on enhancing imaging resolution, automation, and real-time tumor tracking to support targeted therapy delivery.

Ongoing technological convergence between imaging modalities and radiotherapy equipment has improved treatment efficiency and clinical outcomes. The future outlook remains positive as healthcare providers continue to invest in high-performance radiotherapy systems that enable adaptive treatment planning and reduce side effects.

Growth rationale is further supported by rising investments in oncology infrastructure, favorable reimbursement policies, and clinical research aimed at developing patient-specific radiation solutions Collectively, these factors are establishing a strong foundation for sustained expansion and innovation within the global image guided radiotherapy market.

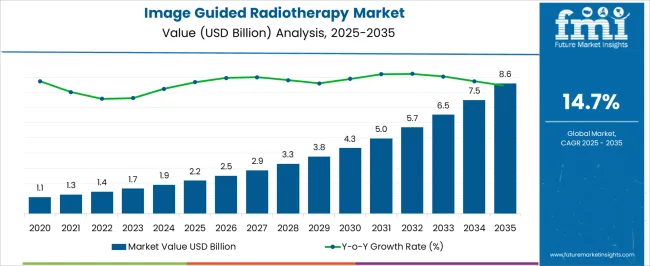

| Metric | Value |

|---|---|

| Image Guided Radiotherapy Market Estimated Value in (2025 E) | USD 2.2 billion |

| Image Guided Radiotherapy Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

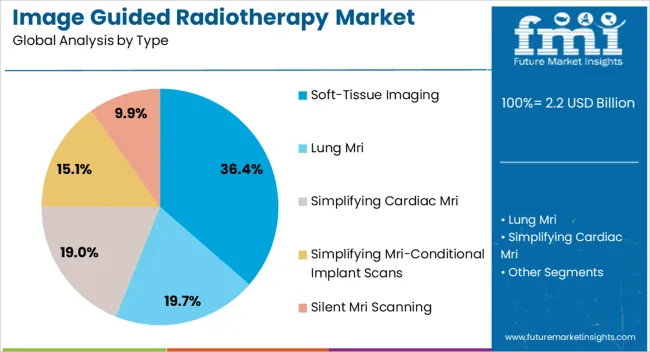

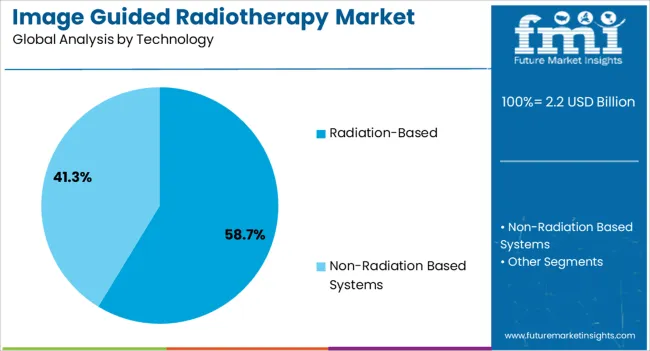

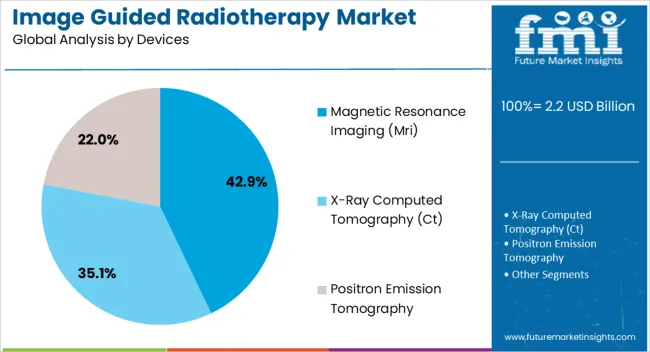

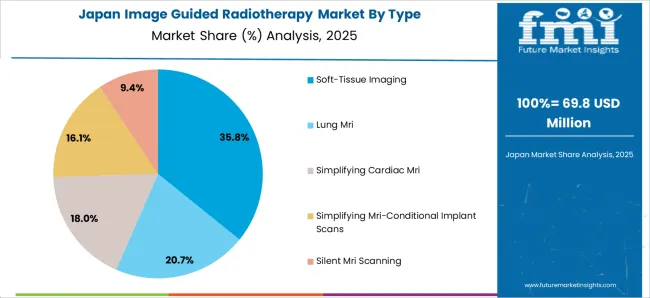

The market is segmented by Type, Technology, Devices, and End Users and region. By Type, the market is divided into Soft-Tissue Imaging, Lung Mri, Simplifying Cardiac Mri, Simplifying Mri-Conditional Implant Scans, and Silent Mri Scanning. In terms of Technology, the market is classified into Radiation-Based and Non-Radiation Based Systems. Based on Devices, the market is segmented into Magnetic Resonance Imaging (Mri), X-Ray Computed Tomography (Ct), and Positron Emission Tomography. By End Users, the market is divided into Hospitals, Smart Cancer Centers, and Research Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soft-tissue imaging segment, accounting for 36.40% of the type category, has maintained dominance due to its superior ability to visualize tumor margins and surrounding anatomy with high precision. The segment’s growth is being driven by the increasing demand for accurate localization of tumors during treatment sessions, which enhances therapeutic outcomes.

Technological advancements in image clarity and real-time imaging capabilities have strengthened its clinical relevance. Adoption has been further supported by its integration into advanced treatment systems that enable adaptive radiotherapy.

Hospitals and cancer centers are increasingly deploying soft-tissue imaging to improve patient safety and optimize dose delivery With continued innovation in imaging software and machine learning-assisted analysis, the segment is expected to sustain its market share and remain pivotal in enabling precision oncology practices.

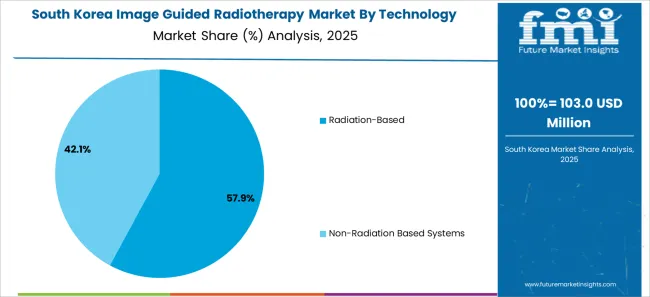

The radiation-based technology segment, holding 58.70% of the technology category, has emerged as the leading approach due to its established clinical efficacy and broad application in both curative and palliative cancer treatments. The segment’s strength lies in its ability to deliver highly controlled radiation doses guided by precise imaging data.

Widespread availability of linear accelerators and integration of real-time dose monitoring systems have further enhanced its clinical adoption. Improvements in beam modulation, image fusion, and treatment planning algorithms have optimized accuracy and safety.

Continued investments in upgrading radiotherapy facilities and training oncology specialists are expected to reinforce the segment’s leadership Growing awareness about the benefits of precision-guided radiation and supportive healthcare funding are anticipated to sustain its growth trajectory across both developed and emerging healthcare markets.

The magnetic resonance imaging (MRI) segment, representing 42.90% of the devices category, has gained prominence due to its exceptional soft-tissue contrast and non-invasive imaging capabilities that facilitate accurate tumor delineation. MRI integration in radiotherapy systems has enhanced clinicians’ ability to monitor tumor response dynamically and adjust treatment parameters in real time.

Adoption has been accelerated by the transition toward adaptive radiotherapy approaches and increasing clinical preference for imaging modalities that reduce patient exposure to ionizing radiation. Continuous advancements in MRI hardware and software have improved imaging speed and resolution, supporting high-precision therapeutic planning.

Hospital investments in hybrid MRI-guided radiotherapy units are expanding rapidly, enabling simultaneous imaging and treatment workflows With ongoing technological evolution and clinical validation, the MRI segment is expected to maintain its dominant share and remain a cornerstone of precision-guided radiotherapy solutions worldwide.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 0.9 billion |

| Market Value for 2025 | USD 1.6 billion |

| Market CAGR from 2020 to 2025 | 17.1% |

The segmented market analysis of image-guided radiotherapy is included in the following subsection. Based on comprehensive studies, the soft-tissue imaging sector is leading the type category, and the radiation-based segment is commanding the technology category.

| Attributes | Details |

|---|---|

| Top Types | Soft-Tissue Imaging |

| CAGR % 2020 to 2025 | 16.8% |

| CAGR % 2025 to End of Forecast (2035) | 14.5% |

| Attributes | Details |

|---|---|

| Top Technology | Radiation-Based |

| CAGR % 2020 to 2025 | 16.4% |

| CAGR % 2025 to End of Forecast (2035) | 14.1% |

Tables highlighting important economies such as South Korea, the United Kingdom, Japan, China, and the United States demonstrate the landscape of the image-guided radiotherapy industry.

The significant potential is revealed by a thorough investigation in South Korea, which offers plenty of opportunities for image-guided radiotherapy market expansion.

South Korea has an upward trajectory in the image-guided radiotherapy industry, which calls for more research and investment. These factors include technology breakthroughs, healthcare infrastructure, and regulatory frameworks.

| Attribute | South Korea |

|---|---|

| HCAGR (2020 to 2025) | 22.3% |

| CAGR (2025 to 2035) | 16.6% |

| Attribute | United Kingdom |

|---|---|

| HCAGR (2020 to 2025) | 19.6% |

| CAGR (2025 to 2035) | 15.7% |

| Attribute | Japan |

|---|---|

| HCAGR (2020 to 2025) | 19.3% |

| CAGR (2025 to 2035) | 15.5% |

| Attribute | China |

|---|---|

| HCAGR (2020 to 2025) | 18.9% |

| CAGR (2025 to 2035) | 15.1% |

| Attribute | United States |

|---|---|

| HCAGR (2020 to 2025) | 17.6% |

| CAGR (2025 to 2035) | 14.9% |

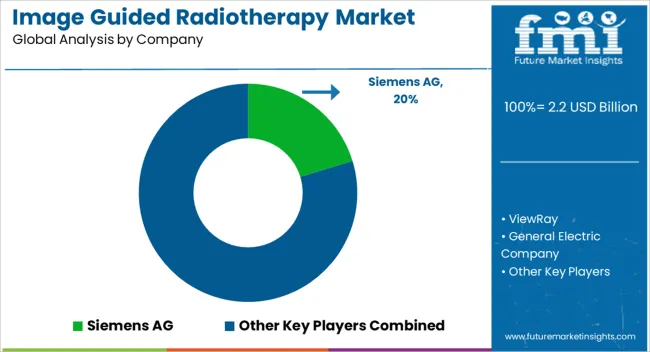

Numerous significant image-guided radiotherapy (IGRT) vendors stand out as essential contributors to innovation and development in the highly competitive market.

Prominent image-guided radiotherapy suppliers leading the way include ViewRay, General Electric Company, Hitachi, Ltd., Siemens AG, and Koninklijke Philips N.V.

The image-guided radiotherapy providers have come to be recognized as industry leaders, advancing the development of image-guided radiotherapy technology and establishing the bar for dependability and creativity.

With its advanced offerings, ViewRay faces against General Electric Company, a well-established leader recognized for its proficiency in medical imaging technologies.

Hitachi, Ltd. offers the market a wealth of knowledge and technological know-how, while Siemens AG and Koninklijke Philips N.V. provide their creative solutions for image-guided radiotherapy.

The substantial image-guided radiotherapy vendors contribute to the continuous advancement of IGRT technology by bringing unique skills and capacities to the competition scene. They ensure that the image-guided radiotherapy (IGRT) market remains competitive and dynamic by investing in research and development and being dedicated to fulfilling the changing demands of patients and healthcare professionals.

By establishing their status as leading image-guided radiotherapy (IGRT) providers, the industry leaders are navigating the market challenges and setting the path for ongoing technological and patient care breakthroughs.

Notable Breakthroughs

| Company | Details |

|---|---|

| Philips | Philips launched Zenition 10 in May 2025, adding to their line of mobile C-arms. |

| GE HealthCare | The introduction of Pixxoscan in April 2025 marked a portfolio expansion for GE HealthCare's magnetic resonance imaging (MRI) contrast agents. Clariscan (gadoteric acid) and Pixxoscan (gadobutrol), two of many prominent macrocyclic compounds, are accessible to customers. |

| GE HealthCare | GE HealthCare revealed plans in June 2025 to integrate AIR technology into its PET/MR capabilities to enhance patient comfort, simplify therapy evaluation, and increase diagnostic accuracy. |

| National Medical Products Administration (NMPA) | ViewRay's MRIdian MRI-guided radiation therapy system was authorized for sale and usage in September 2025 by the National Medical Products Administration (NMPA), China's regulatory body. |

The global image guided radiotherapy market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the image guided radiotherapy market is projected to reach USD 8.6 billion by 2035.

The image guided radiotherapy market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in image guided radiotherapy market are soft-tissue imaging, lung mri, simplifying cardiac mri, simplifying mri-conditional implant scans and silent mri scanning.

In terms of technology, radiation-based segment to command 58.7% share in the image guided radiotherapy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Image Recognition in Retail Market Size and Share Forecast Outlook 2025 to 2035

Image Intensifier Market Analysis - Size, Share & Forecast Outlook 2025 to 2035

Imagery Analytics Market Analysis – Growth & Forecast through 2034

Image Sensors Market Growth – Trends & Forecast through 2034

Image Based Barcode Reader Market Growth – Trends & Forecast 2020-2030

Image-Based Cytometer Market

Image-Guided Injectables Market Forecast and Outlook 2025 to 2035

Image Guided Systems Market is segmented by product type, application and end user from 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

InGaAs Image Sensors Market

Contact Image Sensor Market

Geospatial Imagery Analytics Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Image Sensor Market Size and Share Forecast Outlook 2025 to 2035

Guided Surgery Kits Market Size, Growth, and Forecast for 2025 to 2035

CT Guided Intervention Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

MRI-Guided Cardiac Ablation Market Size and Share Forecast Outlook 2025 to 2035

MRI Guided Neurosurgical Ablation Market Insights - Demand & Growth 2025 to 2035

Video-Guided Pericardial Access Device Market

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Automated Guided Vehicles (AGV) Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA