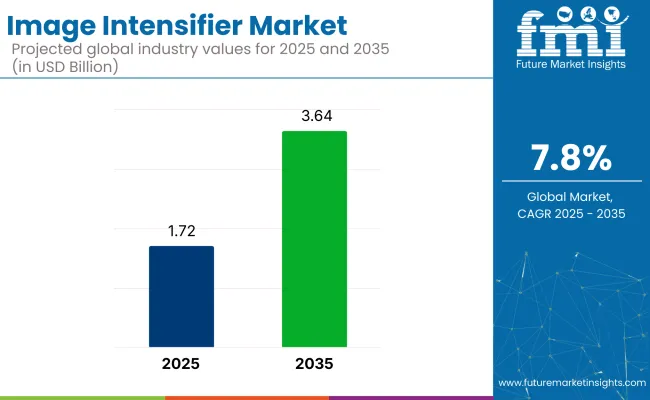

The global image intensifier market is projected to grow from USD 1.72 billion in 2025 to USD 3.64 billion by 2035, registering a CAGR of 7.8% during the forecast period. The growth is being driven by rising demand for advanced imaging technologies in medical diagnostics, radiology, surgical procedures, and emergency medicine.

Image enhancer are increasingly being used to enhance image quality in low-light environments, contributing to better visibility and more accurate diagnostics. The need for high-quality imaging in healthcare settings such as hospitals and clinics is propelling the adoption of these technologies.

The market holds a niche but a share within its parent markets. In the optical imaging market, it accounts for approximately 4-6% of the total market share, as image intensifiers are crucial for low-light and night-time optical applications. Within the night vision systems industry, the share is much higher, around 20-25%, due to their central role in enhancing visibility in low-light environments.

The military and defense electronics industry sees image intensifiers contributing to about 8-10% of the share, primarily for tactical operations and surveillance. In the medical imaging, their share is about 2-3%, used in certain diagnostic equipment. The security and surveillance equipment industry has a more modest share of about 5-7%, driven by their use in low-light surveillance settings.

“Expansion into the USA market presents a significant opportunity to strengthen our position as a global leader in image intensifier tubes. This new capacity will also enable us to meet customers' demand for large-volume, high-performance products manufactured in the USA,” said Jérôme Cerisier, CEO of Exosens.

This stipulates the strategic importance of expanding reach and enhancing capacity to meet the growing demand for image enhancer technologies. Top players like GE Healthcare, Philips Healthcare, and Canon Medical Systems are heavily investing in R&D to innovate and offer n-performance imaging solutions.

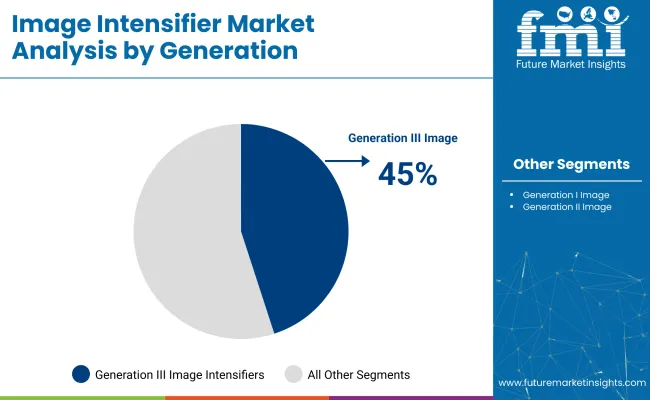

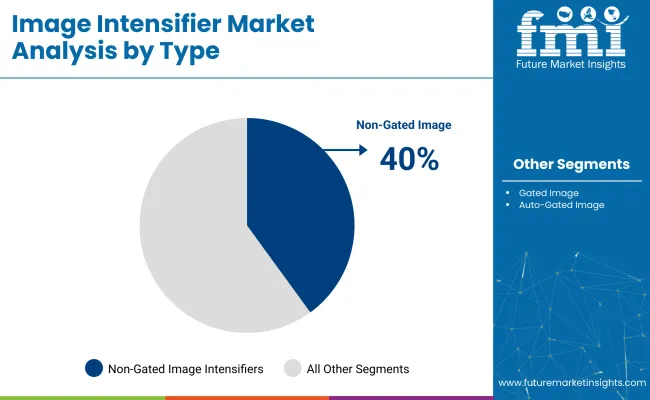

The market is being driven by investments in Generation III, non-gated image intensifiers, compact intensifiers, and night vision goggles. These technologies are fueling advancements in military, security, and industrial applications. Increasing demand for better visibility in low-light conditions is shaping this growth trajectory.

Generation III segment is projected to dominate the industry with an estimated 45% share in 2025.

Non-gated are forecasted to capture 40% of the industry share by 2025, because of their cost-efficiency and high performance in commercial and industrial applications.

25 mm to 37 mm diameter segment are projected to hold 35% of the industry share in 2025.

Night vision goggles are projected to account for 20% of the application industry in 2025.

The industry is being driven by increasing demand across defense, medical, and industrial sectors. Technological advancements and growing security concerns are propelling expansion. However, competition from alternative imaging technologies and regulatory complexities are limiting growth.

Surge in Growth Driven by Rising Demand Across Defense, Medical, and Industrial Sectors

Growth Slowed by Intense Competition from Alternative Imaging Technologies and Complex Regulations

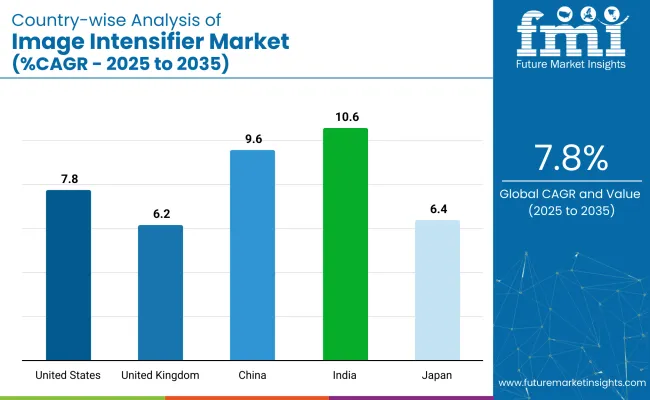

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.8% |

| United Kingdom | 6.2% |

| China | 9.6% |

| India | 10.6% |

| Japan | 6.4% |

In the global context, the industry presents a progressive growth landscape across various regions. India stands out with the highest CAGR (10.6%), fuelled by rapid healthcare infrastructure expansion, rising diagnostic imaging demand, and increased medical tourism.

This positions India as one of the fastest-growing industries globally, particularly within the BRICS group. China, with a 9.6% CAGR, follows closely, benefiting from strong government support and technological advancements in medical devices, positioning it as a key player in the BRICS group as well.

The United States and United Kingdom, both members of the OECD, show more moderate growth at 7.8% and 6.2% CAGR, respectively. These developed nations are characterized by stable, mature healthcare systems with continued demand for advanced imaging technologies, but their growth rates are slower compared to emerging industries. Japan, also in the OECD, indicates steady growth at 6.4%, driven by the aging population and increasing healthcare needs.

The industry in United States is projected to grow at a CAGR of 7.8% through 2035, driven by healthcare investments, technological advancements, and increasing demand for medical imaging solutions.

The United Kingdom industry is expected to grow at a CAGR of 6.2% through 2035. Growth is being supported by increasing demand for advanced diagnostic imaging technologies in hospitals and healthcare centers.

The China market is projected to grow at a CAGR of 9.6% through 2035. Growth is driven by rapid healthcare modernization, increasing government spending on medical infrastructure, and expanding urban healthcare facilities.

The market in India is expected to grow at a CAGR of 10.6% through 2035. Growth is being fueled by rising healthcare investments, urbanization, and demand for affordable diagnostic imaging solutions.

The market in Japan is projected to grow at a CAGR of 6.4% through 2035.Growth is being driven by the aging population, healthcare modernization, and technological advancements in diagnostic imaging systems.

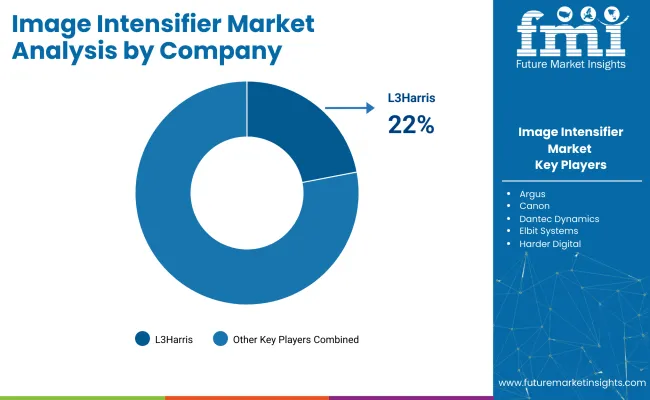

The key players such as L3Harris Technologies, Thales Group, Siemens AG, Canon Medical Systems, FLIR Systems (Armasight), and PHOTONIS Technologies SAS dominate the industry through extensive research and development, global distribution networks, and a full range of product offerings. For instance, L3Harris Technologies has introduced next-generation image enhancer tubes with improved sensitivity and resolution.

Rising companies like Alpha Optics Systems Inc., JSC Katod, and Photek Ltd focus on specialized segments and regional leaders. Emerging firms such as TAK Technologies Pvt. Ltd., ProxiVision GmbH, and DEP Technologies, which cater to specific regional needs and offer competitive pricing.

Recent Industry Developments in the Image Intensifier

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.72 billion |

| Projected Market Size (2035) | USD 3.64 billion |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and millions of units |

| Generation Types Analyzed (Segment 1) | Generation I; Generation II; Generation III |

| Types of Image Intensifiers (Segment 2) | Gated image intensifiers; Non-gated image intensifiers; Auto-gated image intensifiers |

| Diameter Types Analyzed (Segment 3) | 18 mm; 18 mm to 25 mm; 25 mm to 37 mm; ≥ 37 mm |

| Applications Covered (Segment 4) | Night vision devices; Goggles; Binoculars; Monoculars; Camera systems; Scientific imaging; X-ray imaging; Others |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; United Kingdom; France; Spain; Italy; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE |

| Key Players Influencing the Industry | Argus; L3Harris; Canon; Dantec Dynamics; Elbit Systems; Hamamatsu Photonics; Harder Digital |

| Additional Attributes | Dollar sales by generation type (I, II, III); Product-type revenue share (gated vs non-gated); Growth of military vs medical application segments; Technological advancements in resolution & image quality; Regional patterns in adoption rates for night vision, scientific imaging, and X-ray applications |

Generation I, Generation II, and Generation III.

Gated image intensifiers, non-gated image intensifiers, and auto-gated image intensifiers.

18 mm, 18 mm to 25 mm, 25 mm to 37 mm, and ≥ 37 mm.

Night vision devices (goggles, binoculars, monoculars, camera systems), scientific imaging, X-ray imaging, and other applications.

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industry is expected to reach USD 3.64 billion by 2035.

The industry is projected to be valued at USD 1.72 billion in 2025.

The industry is projected to grow at a CAGR of 7.8% from 2025 to 2035.

Generation III are projected to dominate the industry with a 45% share in 2025.

India is expected to be the fastest-growing country, with a projected CAGR of 10.65%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Image-Guided Injectables Market Forecast and Outlook 2025 to 2035

Image Guided Radiotherapy Market Size and Share Forecast Outlook 2025 to 2035

Image Recognition in Retail Market Size and Share Forecast Outlook 2025 to 2035

Image Guided Systems Market is segmented by product type, application and end user from 2025 to 2035

Imagery Analytics Market Analysis – Growth & Forecast through 2034

Image Sensors Market Growth – Trends & Forecast through 2034

Image Based Barcode Reader Market Growth – Trends & Forecast 2020-2030

Image-Based Cytometer Market

AI Image Editor Market Forecast and Outlook 2025 to 2035

InGaAs Image Sensors Market

Contact Image Sensor Market

Geospatial Imagery Analytics Market Size and Share Forecast Outlook 2025 to 2035

Distance Measurement Image Sensor Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Intensifiers Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA