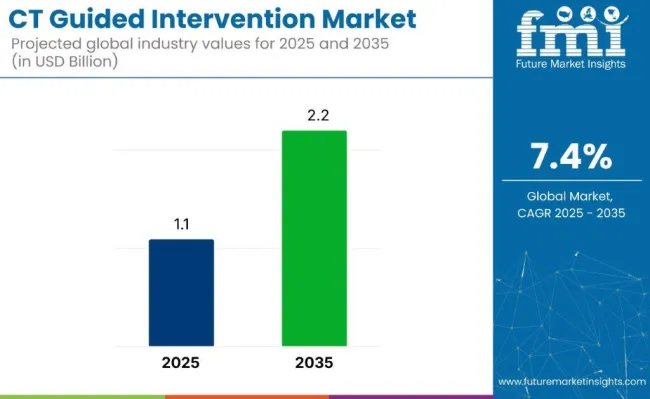

The CT guided intervention market is expected to record a valuation of USD 1.1 billion in 2025and USD 2.2 billion by 2035, at a CAGR of 7.4% during the forecast period. The growth is being driven by the increasing demand for minimally invasive procedures and advancements in CT technology, which allow for precise diagnostics and real-time guidance during interventions. The rise in the aging population, combined with a higher incidence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, is contributing to market expansion.

In the official press release on January 9, 2023, it was stated by Jan Makela, President and CEO of Imaging at GE HealthCare, that: “We’re thrilled to take this step in strengthening our interventional guidance offering for patients and customers. The Imactis CT-Navigation system is designed to improve workflow for interventional radiologists and hospitals by increasing procedural accuracy, while helping to reduce procedure time and radiation dose for both patients and physicians.

It is an innovative navigation solution for image-guided percutaneous procedures that aims to achieve better patient outcomes by reducing variability in both simple and complex procedures and improving reproducibility.” This statement underscores GE HealthCare’s commitment to enhancing interventional guidance solutions, particularly through the acquisition of Imactis, a company specializing in CT interventional guidance systems.

The industry is being influenced by ongoing innovations in CT navigation systems. Procedural accuracy is expected to be enhanced, radiation exposure is expected to be minimized, and patient outcomes are expected to improve as a result of these advancements. The integration of advanced imaging technologies and navigation systems is anticipated to play a critical role in driving industrial growth through 2035, with further developments expected to improve efficiency and reduce risks during procedures.

The CT guided intervention market is witnessing substantial growth, driven by innovations in CT navigation systems, increasing demand for tumor biopsy applications, and the dominance of hospitals in end-use sectors.

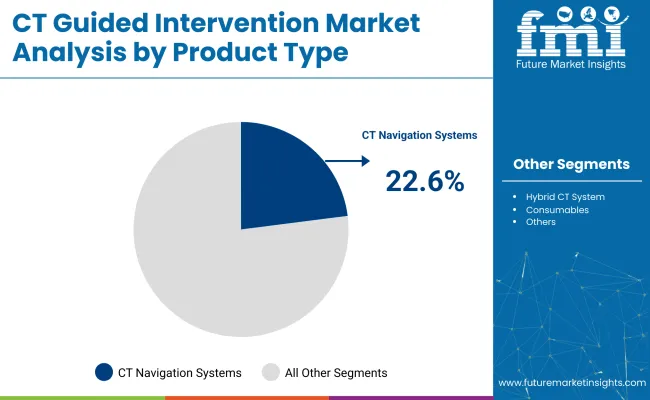

CT navigation systems are expected to hold 22.6% of the market share in 2025.

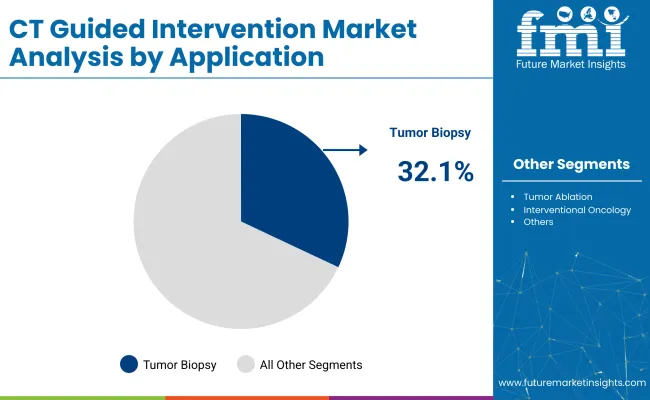

Tumor biopsy is projected to account for 32.1% of the market share in 2025. It is widely used to diagnose various types of cancer by obtaining tissue samples for further examination. Tumor biopsy procedures are increasingly being performed with the help of CT-guided intervention systems, which ensure accurate targeting of lesions.

Hospitals are projected to dominate the end-user segment, holding an estimated 48.5% market share in 2025. Most CT-guided interventions have been performed in hospitals where access to specialized staff and infrastructure remains highest.

The CT-guided intervention market is being driven by advancements in imaging technology and increasing demand for minimally invasive procedures. However, high equipment costs and limited accessibility in certain regions are limiting industrial growth.

Advancements in Imaging Technology Driving Market Growth

The CT-guided intervention industry is being significantly driven by advancements in imaging systems and the rising demand for minimally invasive procedures. High-resolution CT scanners are being used to enable precise localization of lesions, facilitating accurate needle placement during interventions.

These advancements are being applied to enhance the safety and efficacy of procedures such as biopsies, ablations, and drainage, leading to improved patient outcomes. The growing preference for minimally invasive treatments, which are associated with reduced recovery times and lower complication rates, is further driving the adoption of CT-guided interventions in clinical settings.

High Equipment Costs Limiting Market Growth Potential

Despite the benefits, challenges related to high equipment costs and limited accessibility in certain regions are being faced by the CT-guided intervention industry. The acquisition and maintenance of advanced CT imaging systems are requiring substantial financial investment, which is being considered prohibitive for healthcare facilities in resource-constrained settings.

Additionally, the availability of trained personnel to operate these sophisticated systems is being restricted in some areas, impacting the widespread implementation of CT-guided interventions. These barriers are limiting the growth potential of the industry, particularly in developing regions where healthcare infrastructure may be underdeveloped.

The CT guided intervention market is expected to grow steadily through 2035, driven by advancements in imaging technology and the increasing demand for minimally invasive procedures. Rapid expansion is being seen in emerging economies, while innovation and healthcare accessibility are being prioritized in mature landscape.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| Germany | 5.4% |

| China | 8.2% |

| Japan | 4.2% |

| India | 9.1% |

The United States CT Guided Intervention Market is expected to grow at a CAGR of 4.9% through 2035.

The Germany CT guided intervention market is projected to grow at a CAGR of 5.4% through 2035.

The China CT guided intervention market is expected to grow at a CAGR of 8.2% through 2035.

The Japan CT Guided Intervention Market is projected to grow at a CAGR of 4.2% through 2035.

The India CT Guided Intervention Market is expected to grow at a CAGR of 9.1% through 2035.

The CT-guided intervention industry is led by prominent players such as GE HealthCare, Siemens Healthineers, and Philips Healthcare, which dominate the industry with their advanced CT imaging systems and interventional solutions. These companies offer AI-powered needle guidance systems and laser-assisted technologies, which significantly enhance the precision and efficiency of CT-guided procedures.

Other key players include Canon Medical Systems, Fujifilm Holdings Corporation, and NeuroLogica Corporation, which provide specialized CT imaging solutions for interventional applications. Emerging companies such as CurveBeam AI, Koning Health, and Shenzhen Anke High-Tech Co., Ltd. are innovating with advanced CT technologies to address specific industry needs and expand their industry presence.

Recent CT Guided Intervention Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.1 billion |

| Projected Market Size (2035) | USD 2.2 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and Thousand units for volume |

| Product Types Analyzed (Segment 1) | CT Navigation Systems, Needle Guidance Systems, Needle Positioning Systems, Fluoroscopy Systems, Hybrid CT Systems, Consumables |

| Applications Analyzed (Segment 2) | Tumor Biopsy, Tumor Ablation, Percutaneous Drainage Procedures, Vertebroplasty/Kyphoplasty, Pain Management/Nerve Blocks, Interventional Oncology |

| End Users Analyzed (Segment 3) | Hospitals, Ambulatory Surgical Centers (ASCs), Cancer Research Institutes, Academic & Research Institutes, Others |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Siemens Healthineers AG, CANON MEDICAL SYSTEMS USA, INC., Koninklijke Philips N.V., GE Healthcare, BVM Medical Limited, Hologic, Becton, Dickinson and Company, Cook Medical, Boston Scientific Corporation |

| Additional Attributes | Dollar sales, share by product type and application, rising demand for tumor ablation systems, regional adoption of hybrid CT systems, growth in academic research institutes for interventional procedures |

The industry is segmented into CT navigation systems, needle guidance systems, needle positioning systems, fluoroscopy systems, hybrid CT systems, and consumables.

The industry includes tumor biopsy, tumor ablation, percutaneous drainage procedures, vertebroplasty/kyphoplasty, pain management/nerve blocks, and interventional oncology.

The industry is categorized into hospitals, ambulatory surgical centers (ASCs), cancer research institutes, academic & research institutes, and others.

The industry spans North America, Western Europe, East Asia, and South Asia.

It is expected to reach USD 2.2 billion by 2035.

It is projected to be USD 1.1 billion in 2025.

The industry is expected to grow at a CAGR of 7.4% from 2025 to 2035.

CT navigation systems are projected to hold a 22.6% share in 2025.

Tumor biopsy applications are expected to account for 32.1% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global CTNG Testing Market Analysis – Trends, Size & Forecast 2024-2034

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Actinic Keratosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Octadecanedioic Acid Market Size and Share Forecast Outlook 2025 to 2035

MCT Oil Market Size and Share Forecast Outlook 2025 to 2035

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Octreotide Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Bags Market Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ectoin-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Activated Carbon Filter Market Growth - Trends & Forecast 2025 to 2035

Analysis of the Action Figures Market by Material, Type, End-user, and Region 2025 to 2035

Active Network Management Market Analysis by Component, End Users, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA