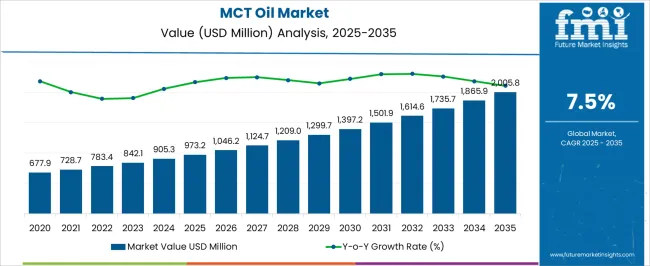

The MCT oil market is estimated to be valued at USD 973.2 million in 2025 and is projected to reach USD 2005.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. Crude coconut and palm kernel oils constitute the primary feedstocks, representing the largest proportion of production costs. Refining and fractionation processes, including enzymatic or chemical fractionation, further influence manufacturing expenditures, while investments in quality control and cold-press extraction technologies support premium product positioning and compliance with food safety standards.

Packaging and branding account for a significant segment of the value chain, particularly in retail-focused products where differentiation through organic certification, dosage form, and labeling adds both cost and perceived value. Distribution networks span direct-to-consumer channels, retail outlets, and online platforms, each with unique logistics and marketing expenditures that shape final product pricing. Operational efficiencies, including economies of scale in high-capacity production units and strategic sourcing of raw materials, mitigate cost pressures, while innovation in formulations targeting sports nutrition, ketogenic diets, and functional foods enhances market value capture.

By 2035, the market will reach USD 2,005.8 million, reflecting both volume growth and optimized value-chain integration, emphasizing the importance of cost management across procurement, processing, and distribution, combined with brand-driven differentiation to sustain profitability and competitive positioning in a growing global market.

| Metric | Value |

|---|---|

| MCT Oil Market Estimated Value in (2025 E) | USD 973.2 million |

| MCT Oil Market Forecast Value in (2035 F) | USD 2005.8 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The MCT oil market represents a specialized segment within the global functional oils and nutraceutical ingredients industry, emphasizing energy supplementation, health benefits, and dietary applications. Within the broader edible oils sector, it accounts for about 3.9%, driven by demand in dietary supplements, sports nutrition, and functional foods. In the medium-chain triglycerides segment, its share is approximately 5.1%, reflecting adoption in weight management, cognitive health, and ketogenic diet formulations. Across the nutraceutical and wellness products market, it contributes around 4.4%, supporting energy-boosting and metabolism-enhancing applications.

Within the sports nutrition and fitness food category, it represents 4.0%, highlighting its inclusion in protein powders, energy bars, and meal replacements. In the overall specialty oils and health-focused ingredients ecosystem, the market contributes about 4.2%, emphasizing bioavailability, functional benefits, and clean label positioning. Recent developments in the MCT oil market have focused on formulation versatility, extraction efficiency, and application expansion. Groundbreaking trends include incorporation into beverages, ready-to-drink supplements, and plant-based nutritional products.

Key players are collaborating with dietary supplement brands, functional food developers, and extraction technology providers to optimize purity, stability, and sensory properties. Adoption of fractionation techniques, sustainable sourcing from coconut and palm kernel oils, and microencapsulation for enhanced bioavailability is gaining traction. The product diversification into infused oils, flavored variants, and ready-to-use nutrition formulations is expanding market reach.

The MCT oil market is advancing steadily, supported by rising consumer interest in functional and health-oriented nutrition. Increased application in ketogenic diets, sports nutrition, and weight management solutions has contributed to the market’s positive trajectory. MCT oil’s fast absorption rate and potential to provide quick energy have positioned it favorably in both retail and industrial channels.

Growth is further strengthened by its expanding use in fortified foods, beverages, and dietary supplements, where clean-label and plant-derived sourcing trends are shaping procurement strategies. The current market scenario reflects a strong concentration in regions with high demand for natural energy-boosting ingredients, coupled with rising awareness of medium-chain triglyceride benefits.

Future outlook remains promising as technological advances in extraction and refinement improve quality, consistency, and cost efficiency. Market expansion is also anticipated in personal care and pharmaceutical formulations, further diversifying revenue streams and reinforcing its strategic value in the global nutraceuticals and functional food landscape.

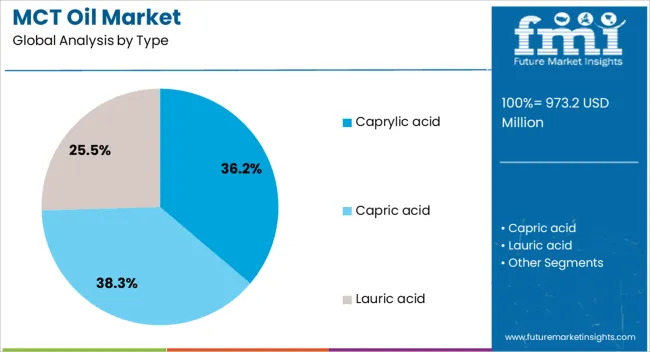

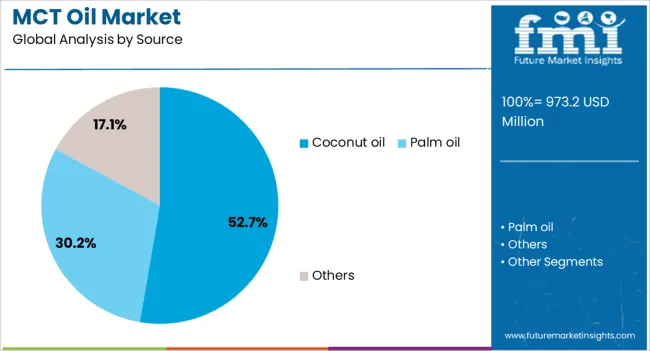

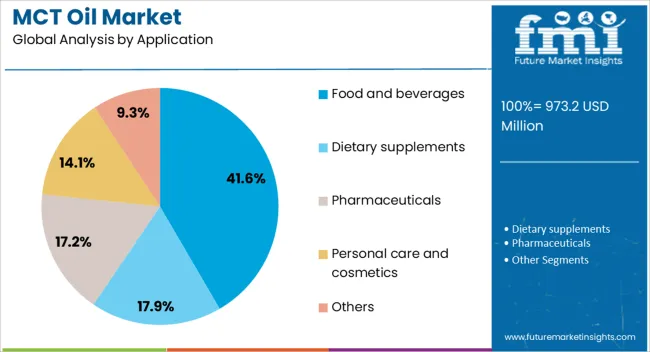

The mct oil market is segmented by type, source, application, form, and geographic regions. By type, mct oil market is divided into Caprylic acid, Capric acid, and Lauric acid. In terms of source, mct oil market is classified into Coconut oil, Palm oil, and Others. Based on application, mct oil market is segmented into Food and beverages, Dietary supplements, Pharmaceuticals, Personal care and cosmetics, and Others. By form, mct oil market is segmented into Dry and Liquid. Regionally, the mct oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The caprylic acid segment leads the type category in the MCT oil market, holding approximately 36.2% share. This dominance is driven by its superior digestibility, quick conversion into ketones, and broad compatibility across food and supplement applications. The segment benefits from increasing consumer preference for targeted MCT fractions that optimize metabolic performance.

Demand has been reinforced by its integration in performance nutrition products, medical nutrition formulas, and therapeutic diets, where caprylic acid’s antimicrobial properties add functional appeal. Industrial uptake is facilitated by its stability and neutral taste, enabling seamless incorporation into functional beverages, dairy alternatives, and energy formulations.

Supply chain stability, supported by mature processing capabilities, has further strengthened its position. With ongoing product innovation and clinical research validating its health benefits, the caprylic acid segment is expected to maintain a leading role, supported by growth in specialized nutrition markets.

The coconut oil segment dominates the source category, accounting for approximately 52.7% share of the MCT oil market. This leadership stems from the abundant availability of coconut oil in key production hubs and its naturally high concentration of medium-chain triglycerides, particularly lauric, caprylic, and capric acids. Its established role in traditional diets, combined with expanding global demand for tropical oils, has ensured a stable supply chain.

The segment benefits from strong consumer perception of coconut-derived products as natural, sustainable, and clean-label ingredients. Increased application in organic and plant-based products has further fueled its share.

Processing efficiency, coupled with favorable trade flows from Asia-Pacific producers, supports competitive pricing and consistent quality. With growing adoption across dietary supplements, functional foods, and cosmetics, coconut oil is positioned to remain the preferred source in MCT oil production, reinforced by expanding consumer awareness and favorable industry positioning.

The food and beverages segment holds approximately 41.6% share of the MCT oil market, underscoring its primary role as the dominant application area. This segment’s growth is anchored in the rising demand for functional food products that offer both energy benefits and metabolic support. MCT oil’s ease of incorporation into dairy alternatives, smoothies, coffee blends, and snack formulations has driven adoption across mainstream and niche categories.

Functional beverage manufacturers are increasingly integrating MCT oil into ready-to-drink formats, capitalizing on consumer preference for convenient nutrition. The segment also benefits from clean-label positioning, allowing brands to market both performance and wellness attributes without artificial additives.

Industrial use in bakery and culinary oils further reinforces demand. Supported by strong distribution channels and continued innovation in fortified products, the food and beverages segment is anticipated to sustain its leadership as MCT oil adoption widens in the global food industry.

The market has been witnessing rapid growth due to increasing consumer focus on health, nutrition, and functional food supplements. Medium-chain triglyceride oils are widely utilized in dietary supplements, functional beverages, meal replacements, and sports nutrition products for their ability to provide quick energy, support weight management, and enhance cognitive performance. The popularity of ketogenic, low-carb, and high-protein diets has accelerated demand for MCT oil as an easily digestible fat source. Manufacturers are introducing flavored and blended variants to increase palatability and application versatility. Growth in e-commerce, online health platforms, and direct-to-consumer distribution channels has facilitated product accessibility globally.

MCT oil is increasingly incorporated into dietary supplements, energy drinks, protein powders, and meal replacements due to its rapid absorption and metabolism. These oils are recognized for supporting weight management, improving endurance, and providing fast energy for athletes and fitness enthusiasts. Functional beverages infused with MCT oil have gained popularity in coffee, smoothies, and post-workout nutrition, enhancing consumer adoption. In the clinical nutrition sector, MCT oil is utilized for patients requiring easily digestible fats. The rise of ketogenic and low-carbohydrate diets has positioned MCT oil as a staple ingredient in nutrition planning. Manufacturers are innovating with emulsified forms, flavored variants, and blended formulations to broaden appeal. Expansion across retail, online, and health-focused channels has strengthened market penetration and product accessibility globally.

The sports and cognitive health sectors are major growth drivers for MCT oil. Athletes and active consumers are adopting MCT oil for improved endurance, rapid energy availability, and enhanced recovery. Cognitive health applications leverage MCT oil for potential neuroprotective benefits and support in ketogenic diets aimed at brain performance. Supplement formulations targeting mental clarity, focus, and energy optimization increasingly incorporate MCT oil alongside other functional compounds. Fitness-focused cafes and meal services have incorporated MCT oil into ready-to-drink products, protein bars, and smoothies, expanding its presence in lifestyle-oriented consumption. Clinical research, endorsements by health influencers, and awareness campaigns regarding MCT oil’s metabolic benefits continue to elevate consumer acceptance, reinforcing its significance across multiple health and performance-driven markets globally.

Innovation in MCT oil formulations has enhanced its versatility across food, beverages, and supplements. Manufacturers are introducing flavored, powdered, and emulsified variants to increase stability, taste, and mixability in diverse applications. Blending MCT oil with other functional ingredients, such as omega fatty acids, protein, or adaptogens, has created value-added products targeting niche consumer segments. Processing improvements in extraction and purification techniques have increased yield and reduced off-flavors, improving consumer acceptance. Sustainable sourcing of coconut and palm oil feedstocks has enabled environmentally responsible product development. Packaging innovations, such as single-serve sachets and ready-to-use liquid bottles, facilitate convenience and portability. These technological and formulation advancements continue to enhance application scope, quality, and consumer engagement within the global market.

Sustainability and regulatory compliance are shaping the market as consumers demand environmentally responsible and safe products. Sourcing from certified sustainable coconut and palm plantations ensures ethical production and addresses environmental concerns. Food-grade certifications, GRAS status, and adherence to international health and safety regulations have facilitated wider market adoption in dietary and functional applications. Vegan and plant-based alternatives are being emphasized to cater to lifestyle-driven consumer segments. Sustainable production practices, such as reduced water usage, energy-efficient processing, and eco-friendly packaging, are increasingly integrated into product development strategies. Regulatory oversight, combined with consumer preference for clean-label, natural, and ethically sourced ingredients, is strengthening market trust and driving long-term growth in the global MCT oil industry.

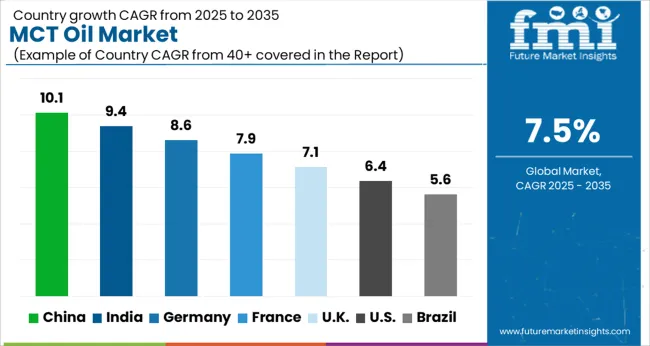

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The market is expected to register a CAGR of 7.5% between 2025 and 2035, driven by rising health awareness and growing adoption in functional foods and supplements. China emerges as a leading market with 10.1%, reflecting strong production capacity and increasing consumer interest in wellness products. India follows at 9.4%, benefiting from expanding health supplement consumption and dietary trends. Germany records 8.6%, supported by demand for high-quality and organic MCT oils. The UK shows 7.1%, influenced by wellness-focused diets and sports nutrition. The USA reaches 6.4%, reflecting growth in ketogenic and functional food segments. Market growth is shaped by innovation in extraction processes, product formulations, and distribution channels globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 10.1% CAGR, driven by increasing health consciousness, demand for functional foods, and growth in nutraceutical and sports nutrition segments. Manufacturers invested in high purity MCT oil, flavored variants, and ready-to-use formulations to cater to diverse consumer preferences. Adoption was highest among fitness enthusiasts, dietary supplement users, and functional beverage consumers. Competitive strategies included partnerships with wellness brands, regional distribution expansion, and product innovation targeting energy enhancement and weight management. E-commerce platforms and retail chains facilitated easy access, while research and development focused on purity, stability, and versatility of MCT oil applications in foods, beverages, and dietary supplements.

India demonstrated a 9.4% CAGR, supported by growing awareness of ketogenic diets, sports nutrition, and dietary supplements. Manufacturers developed high quality, flavored, and ready-to-use MCT oils suitable for beverages, cooking, and health supplements. Competitive strategies emphasized partnerships with fitness and wellness brands, regional supply networks, and consumer education programs. Adoption was highest among fitness enthusiasts, urban professionals, and dietary supplement users. Research and development targeted purity, oxidative stability, and multifunctional applications in beverages, snacks, and nutraceutical products. Expansion of online retail and wellness chains further supported market penetration, while manufacturers focused on customized offerings to meet diverse consumer preferences.

Germany progressed at an 8.6% CAGR, influenced by health and wellness awareness, functional foods, and dietary supplement consumption. Manufacturers invested in high quality, flavored, and easy-to-use MCT oil formulations. Adoption was strong among fitness enthusiasts, urban consumers, and nutraceutical users. Competitive advantage was achieved through product innovation, organic certifications, and collaboration with health brands. Research targeted oxidative stability, purity, and versatility for beverages, snacks, and functional foods. Retail chains and online platforms facilitated distribution and consumer reach. German consumers emphasized product quality, efficacy, and sustainable sourcing, which influenced manufacturer strategies and promoted premium and certified MCT oil offerings.

The United Kingdom expanded at a 7.1% CAGR, driven by functional food trends, dietary supplements, and ketogenic diet popularity. Manufacturers developed high purity, flavored, and ready-to-use MCT oil products for beverages, cooking, and nutraceutical applications. Competitive strategies included collaborations with wellness brands, online retail expansion, and product customization. Adoption was highest among fitness enthusiasts, dietary supplement users, and urban professionals seeking energy boosting and weight management benefits. Research focused on oxidative stability, purity, and versatility. E-commerce and health retail chains facilitated accessibility, while premium formulations targeting functional beverages and nutritional supplements reinforced market growth.

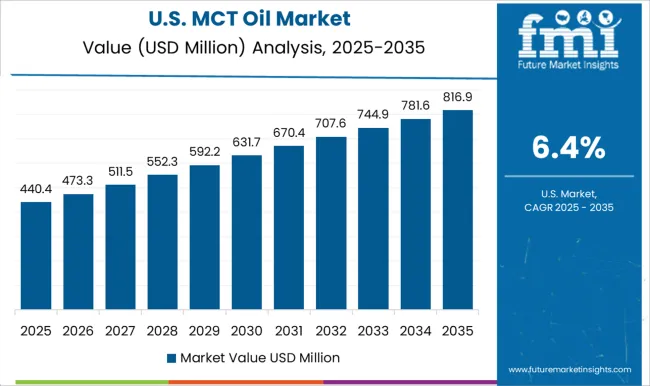

The United States grew at a 6.4% CAGR, influenced by fitness trends, ketogenic diets, and functional food consumption. Manufacturers invested in high purity, flavored, and easy-to-use MCT oil formulations for beverages, cooking, and dietary supplements. Adoption was highest among fitness enthusiasts, nutraceutical users, and urban consumers seeking energy and weight management benefits. Competitive strategies included product innovation, collaboration with wellness brands, and online and retail distribution. Research focused on oxidative stability, versatility, and high quality standards. E-commerce channels and retail partnerships enhanced market penetration, while premium and certified formulations reinforced consumer confidence and encouraged long term adoption.

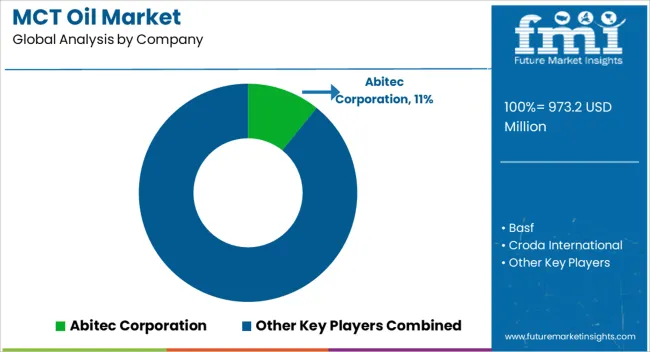

The market has been shaped by global specialty oil producers and regional edible oil manufacturers, competing on purity, versatility, and functional performance. Abitec Corporation, Croda International, and BASF have focused on high-purity medium-chain triglycerides, targeting applications in nutraceuticals, functional foods, and dietary supplements. Their strategies emphasize consistent fatty acid profiles, stability under heat, and clean flavor characteristics.

Lonza and Stepan have concentrated on supplying MCT oil for pharmaceutical and cosmetic applications, highlighting technical reliability and regulatory compliance. Regional and niche players, including IOI Oleo, KLK Oleo, Musim Mas Holdings, Wilmar International, and Oleon, have differentiated themselves through local sourcing, scalable production, and cost-efficient processing. Product brochures highlight features such as odorless, colorless formulations, high oxidative stability, and compatibility with diverse carrier oils. Kao Corporation, Nisshin Oillio Group, and Valio emphasize food-grade applications, highlighting clean labeling, digestive tolerance, and energy delivery benefits.

The brochures consistently present MCT oil as a functional ingredient suitable for beverage, cooking, and supplement formulations, with performance and safety metrics clearly indicated. Competition in the market revolves around purity, functional versatility, and supply reliability. Abitec and Croda highlight technical applications in nutraceuticals, while BASF and Stepan focus on industrial and cosmetic formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 973.2 Million |

| Type | Caprylic acid, Capric acid, and Lauric acid |

| Source | Coconut oil, Palm oil, and Others |

| Application | Food and beverages, Dietary supplements, Pharmaceuticals, Personal care and cosmetics, and Others |

| Form | Dry and Liquid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abitec Corporation, Basf, Croda International, Ioi Oleo, Kao Corporation, Klk Oleo, Lonza, Musim Mas Holdings, Nisshin Oillio Group, Oleon, Stepan, Valio, and Wilmar International Limited |

| Additional Attributes | Dollar sales by oil type and application, demand dynamics across nutraceutical, food, and cosmetic sectors, regional trends in functional ingredient adoption, innovation in extraction methods, purity, and formulation stability, environmental impact of sourcing and production, and emerging use cases in ketogenic diets, energy supplements, and skin care formulations. |

The global MCT oil market is estimated to be valued at USD 973.2 million in 2025.

The market size for the MCT oil market is projected to reach USD 2,005.8 million by 2035.

The MCT oil market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in mct oil market are caprylic acid, capric acid and lauric acid.

In terms of source, the coconut oil segment is expected to command a 52.7% share in the MCT oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA