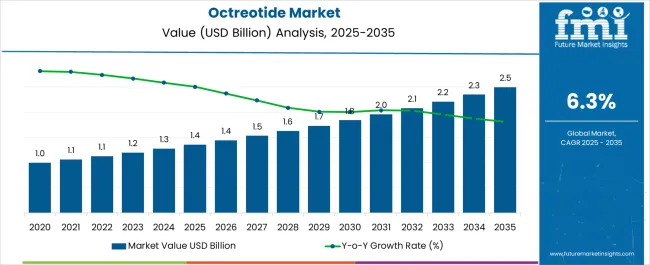

The Octreotide Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Octreotide Market Estimated Value in (2025 E) | USD 1.4 billion |

| Octreotide Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The octreotide market is witnessing consistent growth, driven by its widespread application in managing hormone-related disorders and certain types of cancer. Its increasing adoption is being supported by the rising prevalence of acromegaly, neuroendocrine tumors, and gastrointestinal conditions where octreotide demonstrates strong therapeutic efficacy. Growing awareness among healthcare providers regarding the effectiveness of somatostatin analogs in controlling hormone secretion is further influencing market expansion.

Technological advancements in drug formulation, including long-acting release versions, are improving patient compliance and enhancing treatment outcomes. Investments in healthcare infrastructure, particularly in emerging economies, are expanding access to specialty drugs, thereby contributing to wider availability of octreotide therapies.

Additionally, the growing focus on precision medicine and the development of novel delivery systems are strengthening the position of octreotide as a preferred treatment option in specialized care With the rising demand for targeted therapies, coupled with the continuous burden of hormone-related disorders globally, the market is anticipated to expand steadily over the forecast period, supported by innovation and broader clinical acceptance.

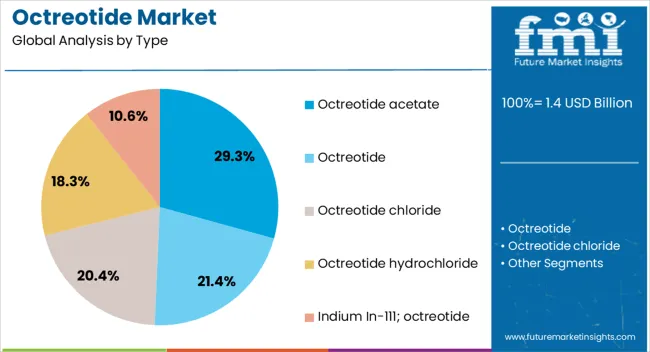

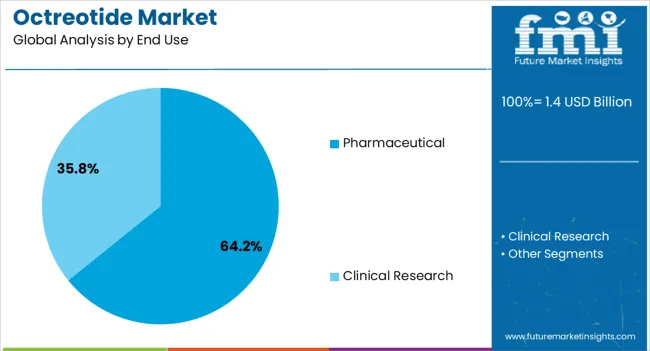

The octreotide market is segmented by type, end use, and geographic regions. By type, octreotide market is divided into Octreotide acetate, Octreotide, Octreotide chloride, Octreotide hydrochloride, and Indium In-111; octreotide. In terms of end use, octreotide market is classified into Pharmaceutical and Clinical Research. Regionally, the octreotide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The octreotide acetate segment is projected to hold 29.3% of the octreotide market revenue share in 2025, making it the leading type. This dominance is being supported by its established role as a key therapeutic formulation for managing conditions such as acromegaly, carcinoid syndrome, and vasoactive intestinal peptide tumors. Its ability to provide effective symptom control and improve quality of life has reinforced its widespread use across treatment regimens.

The segment is benefiting from strong clinical acceptance due to consistent efficacy, safety profile, and availability in both immediate and long-acting formulations. Pharmaceutical companies are investing in enhancing delivery mechanisms of octreotide acetate to reduce dosing frequency, which improves patient adherence and outcomes.

Broader accessibility in hospital and specialty pharmacy channels is also supporting its market presence As demand rises for effective treatments for hormone-secreting tumors and related disorders, the segment’s position is expected to strengthen further, supported by continued advancements in drug delivery systems and expansion into emerging healthcare markets.

The pharmaceutical end use segment is anticipated to account for 64.2% of the octreotide market revenue share in 2025, positioning it as the dominant end use category. This leadership is being driven by the high demand for octreotide within hospital and specialty care settings, where it is widely prescribed for managing complex endocrine and oncological conditions. The segment’s growth is being reinforced by increasing patient populations requiring long-term management of hormone-related diseases and the rising prevalence of neuroendocrine tumors globally.

Pharmaceutical companies are prioritizing the development of advanced octreotide formulations, including depot injections and extended-release versions, to enhance treatment convenience and therapeutic consistency. Strong regulatory support for the use of somatostatin analogs in approved indications has further strengthened its clinical adoption.

Expanding access to specialty drugs through improved healthcare infrastructure, especially in developing economies, is also contributing to higher usage within this end use category With the continued emphasis on personalized medicine and oncology therapeutics, the pharmaceutical segment is expected to remain the largest contributor to market revenue.

Octreotide are amino acid monomer which is attached to amide group. The octreotide acts similar to the hormone somatostatin. Octreotide basically lowers the variety of hormone such as insulin, glucagon, growth hormone and others, Octreotide reduces chemical messengers such as gastrin, vasoactive intestinal peptide that cause disease symptoms. Octreotide depending upon the severity generally severe diarrhea, acromegaly as well as for treating flushing in patients with tumors.

Octreotride is also used to reduction of the side effects from cancer chemotherapy. The global Octreotide market was estimated to be around USA USD 1.6 Billion. in 2025 .The estimated CAGR for Octreotide market from 2025 to 2025 was approximately 5%. The use of octreotide is expected to grow because of increase in number of people diagnosed with cancer, diarrhea and tumors.

The global demand for octreotide is driven by growing number of people under the diagnosis of cancer. In 2025, there were estimated 14.1 million cases of cancer .It is estimated that by 2035, the number of people suffering from cancer will be around 24 million. These estimate shows that the demand for treatment drugs such as octreotide will grow. It is forecasted that around 2200 children die every day due to severe diarrhea, more than Aids, malaria and measles combined.

Henceforth it is important to tackle these world challenges by supplying adequate octreotide drugs for the diseased. The use of octreotide in radiolabelling will substantially increase the demand for Octreotide.

The increasing popularity of generic drugs might affect the consumption of branded drugs. The availability of generic drugs is expected to grow because of cost factor and hence will affect the overall Pharmaceutical industry if not restructured according to the market and consumer needs.

The important restraining factor for Octreotide Market is the lack research of Octreotide for the treatment of children, pregnant and lactating women. The use of Octreotide is based on risk factor analysis hence might affect the consumption of Octreotide.

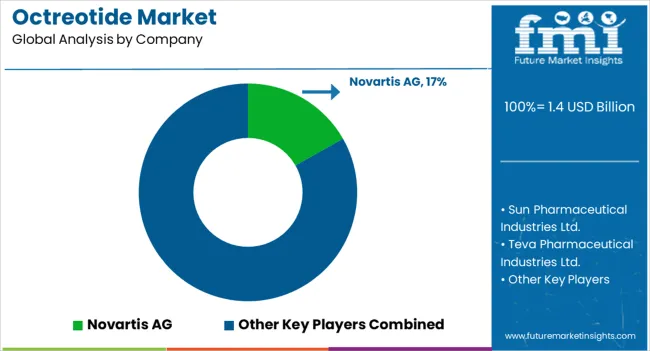

Some of the Octreotide producers are Novartis pharmaceuticals corp., App pharmaceuticals llc, Bedford laboratories div ben venue laboratories Inc., Sun pharmaceutical industries ltd., Sinopharm A-THINK Pharmaceutical Co., Ltd., Teva parenteral medicines Inc., Neiss Labs Pvt. Ltd., Samarth Pharma Pvt. Ltd. J.B. Chemicals and Pharmaceuticals Ltd and others

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

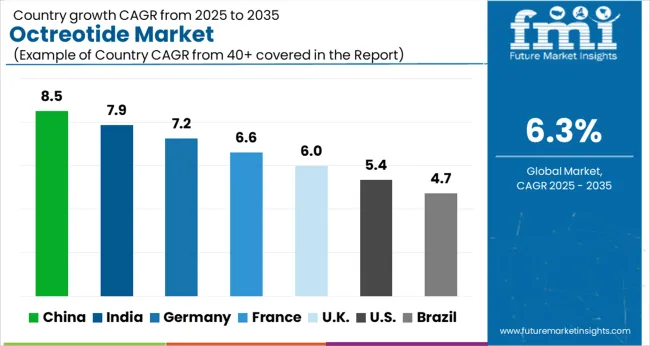

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The Octreotide Market is expected to register a CAGR of 6.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.5%, followed by India at 7.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Octreotide Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.2%. The USA Octreotide Market is estimated to be valued at USD 466.2 million in 2025 and is anticipated to reach a valuation of USD 785.4 million by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 72.7 million and USD 38.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Type | Octreotide acetate, Octreotide, Octreotide chloride, Octreotide hydrochloride, and Indium In-111; octreotide |

| End Use | Pharmaceutical and Clinical Research |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novartis AG, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Mylan N.V., Ipsen Pharma, Chengdu Tiantaishan Pharmaceutical Co., Ltd., Sandoz International GmbH, Fresenius Kabi AG, Camurus AB, and Bachem Holding AG |

The global octreotide market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the octreotide market is projected to reach USD 2.5 billion by 2035.

The octreotide market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in octreotide market are octreotide acetate, octreotide, octreotide chloride, octreotide hydrochloride and indium in-111; octreotide.

In terms of end use, pharmaceutical segment to command 64.2% share in the octreotide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA