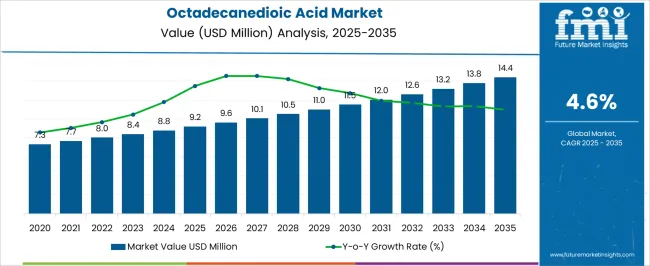

The Octadecanedioic Acid Market, estimated at USD 9.2 million in 2025 and projected to reach USD 14.4 million by 2035, with a CAGR of 4.6%, reflects the steady influence of regulatory frameworks on market dynamics. Regulatory impact is evident across multiple dimensions, beginning with raw material sourcing and chemical synthesis, which are subject to environmental and safety standards in major producing regions.

Compliance with chemical handling regulations, emission limits, and industrial waste disposal protocols contributes to controlled production growth, as manufacturers must ensure adherence to national and international legislation. The product registration and labeling requirements in key markets such as Europe, North America, and Asia-Pacific impose procedural and documentation obligations that influence market entry timelines and operational costs. These regulations affect both established suppliers and new entrants, potentially slowing commercialization while ensuring quality and safety standards.

End-use applications in pharmaceuticals, cosmetics, and polymer industries are also regulated, requiring the Octadecanedioic Acid to meet purity, toxicity, and safety thresholds, which in turn shape adoption rates and pricing structures. Over the forecast period, incremental regulatory harmonization and standardization across regions are expected to reduce market fragmentation, enabling more predictable production and distribution channels. The moderate growth trajectory indicated by the projected values suggests that while regulations impose compliance costs, they simultaneously foster market stability and long-term reliability, enabling gradual and controlled expansion of Octadecanedioic Acid consumption across diverse applications.

| Metric | Value |

|---|---|

| Octadecanedioic Acid Market Estimated Value in (2025 E) | USD 9.2 million |

| Octadecanedioic Acid Market Forecast Value in (2035 F) | USD 14.4 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

The octadecanedioic acid market represents a specialized segment within the global specialty chemicals and industrial intermediates industry, emphasizing polymer synthesis, coatings, and lubricant applications. Within the broader dicarboxylic acids sector, it accounts for about 3.1%, driven by demand in polyamide, polyester, and high-performance polymer production. In the specialty chemicals and industrial intermediates segment, its share is approximately 3.6%, reflecting adoption in adhesives, coatings, and corrosion-resistant materials. Across the lubricant additives and metalworking fluids market, it holds around 2.8%, supporting enhanced performance and stability. Within the biochemicals and renewable feedstock category, it represents 2.3%, highlighting applications in eco-friendly and sustainable chemical solutions.

In the overall polymer and industrial materials ecosystem, the market contributes about 2.0%, emphasizing versatility, performance, and functional enhancements in industrial formulations. Recent trends in the octadecanedioic acid market have focused on process optimization, renewable feedstock utilization, and application-specific enhancements. Groundbreaking developments include bio-based synthesis, high-purity formulations, and functionalized derivatives for advanced polymer and coating applications. Key players are investing in scalable production technologies, cost-effective chemical pathways, and collaborations with polymer manufacturers to develop performance-enhancing additives. Adoption of green chemistry approaches and environmentally compliant production processes is gaining traction. The research on novel applications in high-performance coatings, adhesives, and lubricants is shaping innovation strategies.

The octadecanedioic acid market is gaining momentum due to its increasing adoption as a high-performance bio-based diacid in industrial applications requiring superior thermal and chemical resistance. Derived from renewable sources, octadecanedioic acid offers a sustainable alternative to traditional petroleum-based intermediates, aligning with global environmental regulations and corporate sustainability goals.

Its compatibility with a variety of polymers and resins has expanded its usage in coatings, adhesives, lubricants, and personal care formulations. The future outlook remains favorable as manufacturers continue to invest in green chemistry and integrate bio-based raw materials into production pipelines.

Rising demand for high-durability materials in sectors like automotive, electronics, and consumer goods further supports market expansion. Additionally, the growing shift toward lightweight and eco-friendly materials in advanced manufacturing is expected to enhance the long-term prospects of octadecanedioic acid

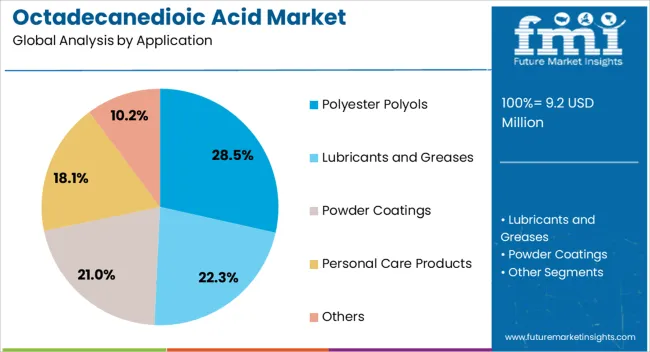

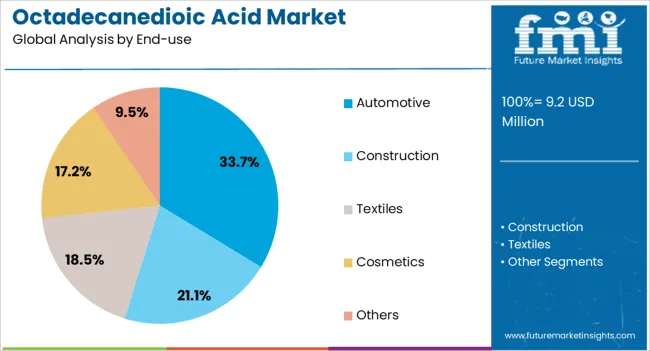

The octadecanedioic acid market is segmented by application, end-use, and geographic regions. By application, octadecanedioic acid market is divided into Polyester Polyols, Lubricants and Greases, Powder Coatings, Personal Care Products, and Others. In terms of end-use, octadecanedioic acid market is classified into Automotive, Construction, Textiles, Cosmetics, and Others. Regionally, the octadecanedioic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyester polyols segment leads the application category with a 28.5% share, driven by its essential role in producing polyurethanes used across a wide spectrum of industrial and consumer products. Octadecanedioic acid is increasingly preferred in polyester polyol synthesis due to its long-chain dicarboxylic structure, which imparts flexibility, hydrolytic stability, and low-temperature performance to the end product.

Its bio-based origin and favorable environmental profile further enhance its appeal for sustainable polyurethane applications. Demand is also bolstered by its use in the production of coatings, adhesives, and elastomers where high mechanical strength and chemical resistance are required.

As industries increasingly pursue eco-friendly formulations and high-performance materials, the adoption of octadecanedioic acid in polyester polyols is expected to grow steadily, reinforcing this segment’s leadership in the market

The automotive segment commands a dominant 33.7% share in the end-use category, reflecting its significant reliance on high-performance materials that meet durability, efficiency, and environmental standards. Octadecanedioic acid is used extensively in producing bio-based polyamides, lubricants, and coatings that contribute to vehicle lightweighting, corrosion resistance, and enhanced thermal performance.

Automakers are increasingly incorporating sustainable materials into their manufacturing processes to comply with stringent emissions and recyclability regulations, thereby driving demand for renewable chemical inputs. The trend toward electric and hybrid vehicles further accelerates the need for advanced materials with improved thermal and mechanical stability.

Continued investments in green automotive technologies and a focus on reducing lifecycle emissions are expected to sustain strong demand for octadecanedioic acid in this segment, solidifying its role in next-generation mobility solutions

The market has expanded due to its versatile applications in chemical synthesis, cosmetics, lubricants, and polymer industries. Octadecanedioic acid is a long-chain dicarboxylic acid valued for its chemical stability, hydrophobicity, and compatibility with various formulations. It is increasingly used in personal care products, including emollients and surfactants, as well as in the production of polyamides, lubricants, and corrosion-resistant coatings. Industrial demand has been influenced by growing polymerization activities, specialty chemical manufacturing, and innovations in cosmetic formulations. The adoption of bio-based and sustainable sources for octadecanedioic acid production has further strengthened market dynamics, with manufacturers focusing on high-purity grades, customized derivatives, and improved production technologies to meet industrial and consumer demand worldwide.

Octadecanedioic acid has found extensive applications in chemical synthesis and polymer production. Its use in the manufacture of polyamides, polyesters, and specialty polymers enhances material performance, chemical resistance, and flexibility. The acid serves as a building block for high-performance polymers in coatings, adhesives, and engineering plastics. Its long-chain structure contributes to the thermal stability and hydrophobic properties of polymers, improving durability and functionality. Industrial adoption has been supported by increased polymer consumption in automotive, packaging, and electronics sectors. Research and development efforts are being made to create functionalized derivatives for advanced polymer applications, making octadecanedioic acid a critical intermediate in specialty material synthesis. The reliability and adaptability of this compound have driven its inclusion in multiple industrial formulations.

In the personal care industry, octadecanedioic acid is utilized for its emollient, thickening, and stabilizing properties. It is incorporated into creams, lotions, hair care products, and surfactants to enhance texture, skin compatibility, and product stability. The growing global demand for high-quality skincare and cosmetic products has accelerated the adoption of functional ingredients such as octadecanedioic acid. Manufacturers are developing formulations that leverage its long-chain dicarboxylic properties to create smooth, non-greasy textures while maintaining stability across temperature variations. Its compatibility with other active ingredients allows formulators to innovate with multifunctional personal care products. Increasing consumer preference for clean-label, high-performance cosmetics has further strengthened its role in the market.

Octadecanedioic acid is widely used in the production of specialty lubricants, corrosion inhibitors, and surface coatings due to its hydrophobic and chemical-resistant properties. Its integration enhances the durability, thermal stability, and lubrication efficiency of industrial oils, greases, and surface coatings. The demand for high-performance lubricants in automotive, machinery, and industrial equipment sectors has driven market adoption. Additionally, coatings formulated with octadecanedioic acid improve corrosion resistance and surface protection for metal and polymer substrates. Manufacturers are increasingly developing eco-friendly and high-performance formulations, combining octadecanedioic acid with other functional additives to meet industrial standards and regulatory requirements. This diversification of applications continues to expand market opportunities across multiple industrial sectors.

North America and Europe lead the octadecanedioic acid market due to mature chemical industries, technological capabilities, and high industrial demand for specialty polymers and personal care products. Asia Pacific is witnessing rapid growth driven by expanding chemical manufacturing, rising personal care product consumption, and infrastructure development. Market players focus on innovation, R&D investment, and strategic partnerships to enhance production efficiency and product customization. Competitive dynamics are influenced by the availability of bio-based sources, production costs, and adherence to environmental regulations. As industries increasingly demand high-purity and sustainable chemical intermediates, octadecanedioic acid is positioned as a key ingredient supporting industrial and consumer applications globally.

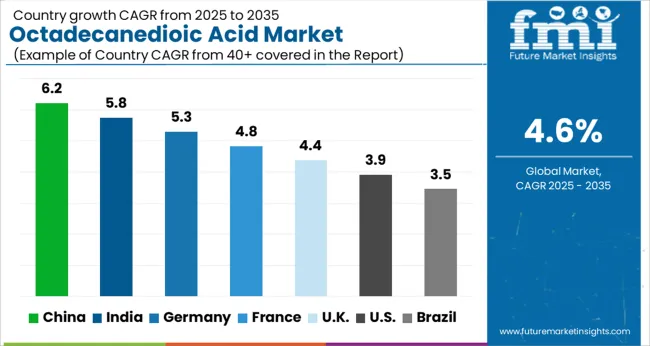

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

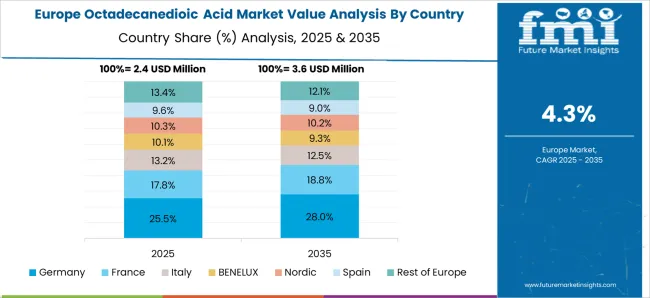

The market is projected to grow at a CAGR of 4.6% between 2025 and 2035, driven by its expanding applications in polymers, cosmetics, and chemical intermediates. China leads with 6.2%, supported by robust chemical manufacturing capabilities and growing industrial demand. India follows at 5.8%, reflecting increased utilization in specialty chemicals and pharmaceutical applications. Germany registers 5.3%, leveraging advanced production technologies and quality standards. The UK records 4.4%, with adoption driven by niche chemical industries, while the USA stands at 3.9%, reflecting steady demand across various industrial sectors. The combined performance of these markets underscores steady growth and global investment in functional chemical derivatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is experiencing a CAGR of 6.2%, driven by rising use in polymer production, specialty chemicals, and lubricant applications. Industrial demand is fueled by automotive, coatings, and chemical manufacturing sectors, which increasingly adopt octadecanedioic acid for enhanced thermal stability and polymer performance. Domestic manufacturers collaborate with global suppliers to improve product purity and production efficiency. Focus on R&D for bio-based alternatives and high-performance derivatives further strengthens market presence.

India is projected to grow at a CAGR of 5.8%, supported by increasing chemical processing activities, polymer production, and demand from coatings and lubricant industries. Manufacturers are focusing on high-purity grades and bio-based alternatives. Partnerships with multinational chemical suppliers enable technology transfer and consistent quality supply. Regulatory compliance and adoption in industrial applications ensure steady market growth.

Germany is growing at a CAGR of 5.3%, driven by adoption in high-performance polymers, chemical intermediates, and specialty industrial applications. The market emphasizes purity, thermal resistance, and chemical stability for industrial use. German chemical manufacturers focus on R&D for sustainable production processes and advanced formulations. Stringent environmental and safety regulations support the use of high-quality and compliant octadecanedioic acid products.

The United Kingdom is projected to grow at a CAGR of 4.4%, influenced by industrial chemical production, polymer manufacturing, and specialty lubricant demand. Companies adopt advanced production techniques to ensure high purity and consistent quality. Focus on sustainable and bio-based feedstocks supports market penetration. Industrial partnerships with global suppliers expand technology access and supply chain reliability.

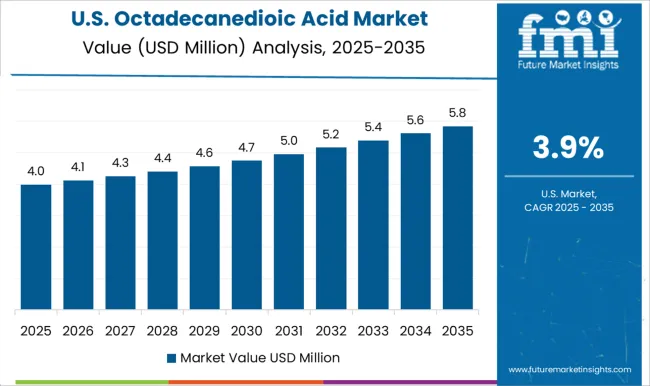

The United States is expanding at a CAGR of 3.9%, driven by adoption in polymer intermediates, coatings, and high-performance lubricant formulations. Focus on bio-based production and high-purity derivatives supports sustainable industrial applications. Strategic partnerships between domestic and international suppliers improve supply chain efficiency and innovation. Demand is particularly strong in automotive and chemical manufacturing sectors.

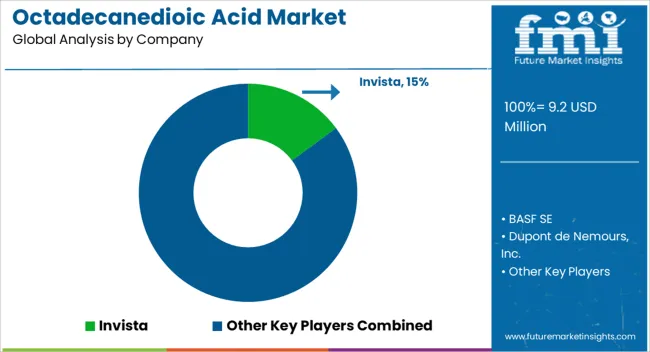

The ODA market is driven by a combination of multinational chemical giants and specialized regional manufacturers, with competition anchored in product purity, supply reliability, and application versatility. BASF SE, DuPont de Nemours, Inc., Solvay S.A., and Evonik Industries AG dominate the global segment, leveraging advanced chemical synthesis capabilities and extensive distribution networks to cater to industries such as polymers, coatings, lubricants, and cosmetics.

Their strength lies in consistent quality, regulatory compliance, and established client bases across multiple geographies. Mid-sized players such as Croda International Plc, Invista, and Tokyo Chemical Industry Co., Ltd. (TCI) focus on niche applications and technical support, providing customized ODA derivatives for specialty chemical formulations and research purposes. Regional manufacturers, including Lianyungang Ningkang Chem Co., Ltd., Hangzhou Dayangchem Co. Ltd., and Haihang Industry Co., Ltd., compete primarily on cost-effectiveness and proximity to emerging Asian markets. Smaller laboratory and research-focused suppliers like Sigma-Aldrich Corporation, Santa Cruz Biotechnology, Inc., and J&K Scientific Ltd. target high-purity ODA for biochemical and pharmaceutical applications. The market is increasingly defined by technological innovation in synthesis, product standardization, and strategic partnerships, with growth influenced by demand from polymer and personal care industries, along with evolving environmental and regulatory standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.2 Million |

| Application | Polyester Polyols, Lubricants and Greases, Powder Coatings, Personal Care Products, and Others |

| End-use | Automotive, Construction, Textiles, Cosmetics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Invista, BASF SE, Dupont de Nemours, Inc., Solvay S.A., Croda International Plc, Evonik Industries AG, Lianyungang Ningkang Chem Co., Ltd., Hangzhou Dayangchem Co. Ltd., Haihang Industry Co., Ltd., VWR International LLC, Tokyo Chemical Industry Co., Ltd. (TCI), Santa Cruz Biotechnology, Inc, Sigma-Aldrich Corporation, and J&K Scientific Ltd. |

| Additional Attributes | Dollar sales by product grade and application, demand dynamics across polymer, lubricant, and cosmetic sectors, regional trends in specialty chemical adoption, innovation in purity, synthesis efficiency, and formulation versatility, environmental impact of production and waste management, and emerging use cases in bio-based polymers, personal care formulations, and industrial lubricants. |

The global octadecanedioic acid market is estimated to be valued at USD 9.2 million in 2025.

The market size for the octadecanedioic acid market is projected to reach USD 14.4 million by 2035.

The octadecanedioic acid market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in octadecanedioic acid market are polyester polyols, lubricants and greases, powder coatings, personal care products and others.

In terms of end-use, automotive segment to command 33.7% share in the octadecanedioic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA