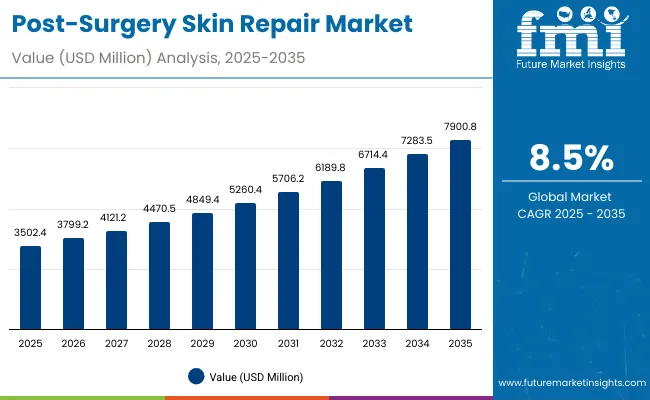

The Post-Surgery Skin Repair Market is expected to record a valuation of USD 3,502.4 million in 2025 and USD 7,900.8 million in 2035, with an increase of USD 4,398.4 million, which equals a growth of over 193% over the decade. The overall expansion represents a CAGR of 8.5% and a 2X increase in market size.

Post-Surgery Skin Repair Market Key Takeaways

| Metric | Value |

|---|---|

| Post-Surgery Skin Repair Market Estimated Value in (2025E) | USD 3,502.4 million |

| Post-Surgery Skin Repair Market Forecast Value in (2035F) | USD 7,900.8 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,502.4 million to USD 5,260.4 million, adding USD 1,758.0 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption in hospitals and clinics, driven by rising procedural volumes, the growing awareness of scar management, and medical-grade claims gaining consumer trust. Scar minimization products dominate this period as they cater to over 47% of demand, supported by established clinical validation and increasing post-operative cosmetic concerns.

The second half from 2030 to 2035 contributes USD 2,640.4 million, equal to nearly 60% of total growth, as the market jumps from USD 5,260.4 million to USD 7,900.8 million. This acceleration is powered by widespread adoption of e-commerce platforms for advanced scar repair products, innovations in silicone polymer and peptide-based formulations, and greater penetration of Centella asiatica and onion extract-based topical therapies in Asia-Pacific. Sheets and patches are gaining traction, supported by strong consumer acceptance in minimally invasive scar recovery. Digital outreach and dermatologist-tested claims further accelerate consumer confidence, pushing the market into a strong double-digit growth trajectory in emerging economies.

From 2020 to 2024, the Post-Surgery Skin Repair Market expanded steadily, moving from a smaller base toward the USD 3,502.4 million mark by 2025. During this period, the competitive landscape was dominated by established scar care brands such as Mederma and Kelo-Cote, controlling a substantial portion of clinically validated formulations. Competitive differentiation relied heavily on product efficacy claims such as "clinically proven" and "dermatologist-tested," with silicone-based technologies remaining the gold standard. Hospital and clinic distribution channels were the primary drivers of sales, representing over 50% of the global market, while retail adoption through e-commerce and pharmacies was still in the early stages. Service-based and professional-grade dermatology offerings were limited to specialized markets, contributing less than 15% of overall sales.

Demand for post-surgery skin repair products will expand to USD 3,502.4 million in 2025, and the revenue mix will shift over the decade as specialty beauty retail and e-commerce channels grow to over 40% share. Traditional scar care leaders face rising competition from cosmeceutical entrants and natural-ingredient brands offering onion extract, Centella asiatica, and peptide-based solutions. Major players are increasingly adopting hybrid strategies, combining strong clinical validation with cosmetic positioning to expand consumer acceptance. Emerging entrants specializing in fragrance-free, clean-label, and sustainable packaging are gaining traction. The competitive advantage is moving away from brand recognition alone toward multi-channel distribution, ingredient innovation, and dermatologist endorsements.

Advances in active ingredients such as silicone polymers and peptides have improved efficacy, allowing for faster healing and reduced scarring across a wide range of post-surgical applications. Clinically proven products have gained significant traction due to their ability to provide evidence-based outcomes, making them the most trusted choice among both physicians and consumers. Scar minimization products are in high demand, supported by the rise in elective surgeries, cosmetic procedures, and the overall awareness of aesthetic outcomes after surgery. Hospital-led recommendations are further boosting confidence in medical-grade products, particularly in advanced economies.

Expansion of retail and digital channels has fueled market growth. E-commerce platforms have enhanced product accessibility in Asia-Pacific, where adoption of Centella asiatica-based and natural formulations is strong. Specialty beauty retail outlets are increasingly stocking dermatologist-tested products that appeal to both post-surgical patients and general consumers seeking skin repair. Segment growth is expected to be led by clinically proven claims, hospital and clinic distribution, and scar minimization treatment areas due to their precision, safety profile, and consumer trust.

The market is segmented by treatment area, active ingredient, product type, channel, claim, and region. Treatment areas include scar minimization, skin barrier repair, bruising & redness relief, and stitch line healing, highlighting the most common post-operative concerns. Active ingredient classification covers silicone polymers, onion extract, Centella asiatica, peptides, and vitamin E, reflecting the balance between clinical efficacy and natural remedies. By product type, categories encompass gels, ointments, serums, and sheets/patches, catering to diverse consumer preferences for application formats.

Channels include hospitals/clinics, pharmacies, e-commerce, and specialty beauty retail, showing the evolving distribution landscape. Claims include clinically proven, fragrance-free, medical-grade, and dermatologist-tested, underscoring the growing importance of trust and validation. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with China, India, Japan, and the USA driving accelerated adoption.

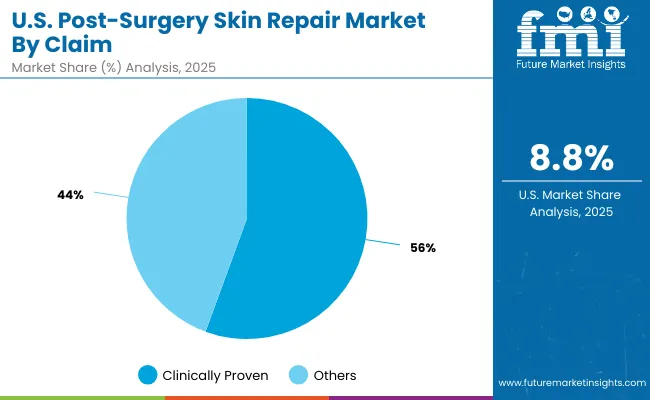

| Claim | Value Share% 2025 |

|---|---|

| Clinically proven | 55.6% |

| Others | 44.4% |

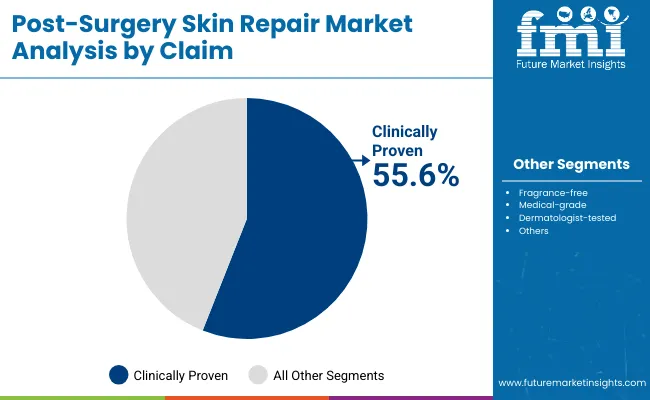

The clinically proven segment is projected to contribute 55.6% of the Post-Surgery Skin Repair Market revenue in 2025, maintaining its lead as the dominant claim category. This leadership is driven by the trust factor associated with products backed by clinical validation, as patients and physicians increasingly demand solutions supported by scientific evidence. Clinically proven scar minimization and skin repair formulations have become the first choice across hospitals, clinics, and pharmacies, where reliability and efficacy are paramount.

The segment’s growth is also supported by expanding consumer awareness around product safety and performance. With rising surgical volumes and higher emphasis on cosmetic outcomes, consumers prefer clinically validated options to ensure reduced scar visibility, faster healing, and lower risks of adverse reactions. Manufacturers are further strengthening this position by integrating advanced active ingredients such as silicone polymers and peptides into products, while promoting evidence-based marketing campaigns. As a result, the clinically proven segment is expected to retain its position as the backbone of trust and adoption in the Post-Surgery Skin Repair Market.

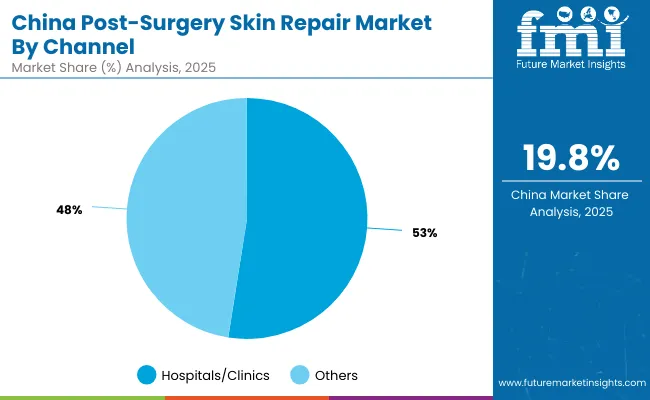

| Channel | Value Share% 2025 |

|---|---|

| Hospitals/clinics | 52.5% |

| Others | 47.5% |

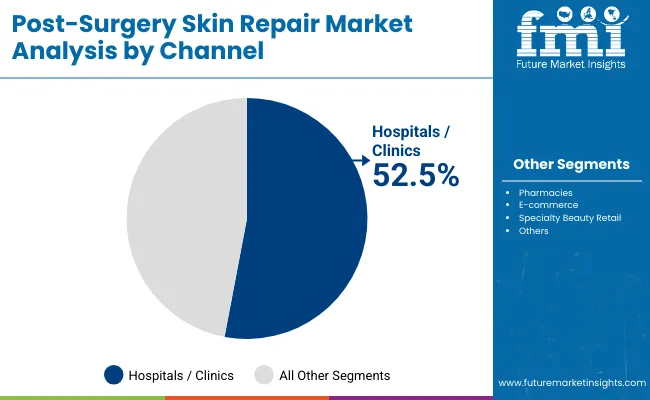

The hospitals and clinics segment is forecasted to hold 52.5% of the market share in 2025, led by its critical role in patient recovery pathways immediately after surgery. These medical settings serve as the primary distribution point for scar repair and healing products, as surgeons and dermatologists prescribe them directly to patients during post-operative care. Hospitals and clinics are favored due to their authority in recommending medically approved, evidence-based solutions, reinforcing their position as the largest distribution channel.

The segment’s growth is bolstered by increasing surgical volumes worldwide, particularly cosmetic and orthopedic procedures where scar outcomes are a key concern. Moreover, the endorsement of clinically proven, medical-grade, and dermatologist-tested products in these facilities strengthens consumer trust and encourages repeat adoption. While e-commerce and specialty retail channels are growing rapidly, hospitals and clinics are expected to remain the anchor channel of the Post-Surgery Skin Repair Market, driven by their integration into standard post-surgery care protocols.

| Treatment Area | Value Share% 2025 |

|---|---|

| Scar minimization | 47.5% |

| Others | 52.5% |

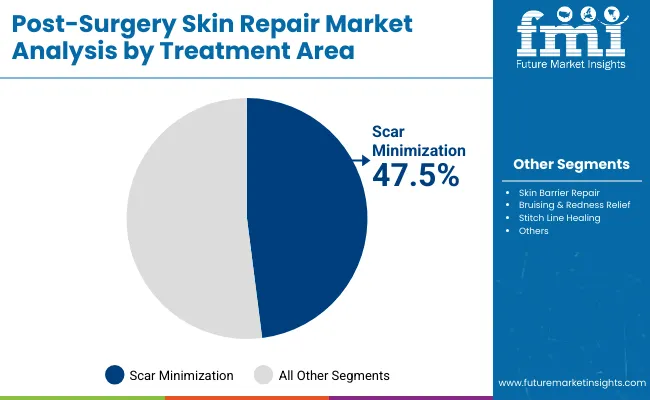

The scar minimization segment is projected to account for 47.5% of the Post-Surgery Skin Repair Market revenue in 2025, establishing it as the leading treatment area. This dominance is supported by the growing demand for advanced formulations designed to reduce scar appearance and improve skin aesthetics following surgical interventions. Scar minimization products are particularly popular in cosmetic, reconstructive, and elective surgeries, where patient satisfaction is highly dependent on visible recovery outcomes.

Its suitability across diverse surgical categories and compatibility with a wide range of active ingredients, such as silicone polymers, onion extract, and Centella asiatica, have made it the preferred choice in both developed and emerging markets. The segment’s growth is also driven by rising consumer willingness to invest in premium and medical-grade scar reduction solutions. With continuous product innovation, including transparent gels, breathable sheets, and long-lasting serums, scar minimization is expected to maintain its leadership as the primary application segment in the Post-Surgery Skin Repair Market.

Rising Elective and Cosmetic Surgeries Driving Scar Minimization Demand

One of the strongest growth drivers in the Post-Surgery Skin Repair Market is the sharp rise in elective and cosmetic procedures, particularly in regions such as the USA, China, and India. These surgeries place heightened emphasis on aesthetic recovery, where visible scar reduction is a critical determinant of patient satisfaction. Scar minimization alone contributed 47.5% of global revenue in 2025, making it the leading treatment area.

Hospitals and clinics continue to prescribe clinically proven products during recovery, reinforcing trust in brands like Mederma, Stratpharma, and Kelo-Cote. As cosmetic procedures such as rhinoplasty, breast augmentation, and reconstructive surgeries increase, especially among younger demographics, demand for advanced scar repair formulations will accelerate further. This makes scar minimization not just a therapeutic requirement but also a lifestyle-driven necessity.

Accelerated Growth in Emerging Economies Led by Asia-Pacific

Another critical driver is the extraordinary growth in emerging economies, particularly China and India, which show CAGRs of 19.8% and 22.7% respectively between 2025-2035. The adoption curve in these markets is steep due to a combination of rising surgical procedures, improved healthcare access, and cultural shifts toward aesthetic outcomes. Traditional herbal remedies, such as Centella asiatica, are being incorporated into modern scar care, making post-surgery solutions more acceptable and trusted by local consumers.

The combination of natural ingredients with medical-grade claims is uniquely boosting adoption in Asia. This regional surge not only increases volume but also diversifies demand toward multi-functional repair products that cater to both scar reduction and skin barrier healing.

Limited Reimbursement and Out-of-Pocket Nature of Purchases

A key restraint for the Post-Surgery Skin Repair Market is the lack of insurance or reimbursement coverage for most scar care and skin repair products. Unlike wound care dressings or infection-control therapies, these products are generally categorized as cosmetic or non-essential, meaning patients must pay out-of-pocket. In emerging markets, where disposable incomes remain limited, this creates affordability barriers, especially for premium brands. Even in developed economies like the USA and Germany, patients often choose lower-cost alternatives unless explicitly prescribed by physicians. This out-of-pocket nature restricts broader adoption and slows penetration beyond urban and affluent populations.

Product Saturation and Consumer Confusion Between Medical and Cosmetic Claims

Another restraint is the increasing overlap between medical-grade and cosmetic-positioned products, which creates consumer confusion and dilutes market differentiation. For example, clinically proven and dermatologist-tested products dominate global adoption, yet fragrance-free and clean-label offerings are marketed heavily in retail channels.

This saturation leads to skepticism regarding efficacy, especially as some products lack transparent clinical validation. The result is inconsistent consumer trust and uneven uptake across distribution channels. Regulatory differences between countries further complicate this, as claims considered "medical-grade" in Europe may not hold the same weight in Asia-Pacific, slowing cross-border scalability for global brands.

Shift Toward E-Commerce and Specialty Beauty Retail in Emerging Markets

While hospitals and clinics currently dominate with 52.5% share in 2025, there is a strong trend toward online and specialty retail distribution. In China, for instance, hospitals/clinics contributed USD 203.7 million in 2025, but rapid growth of platforms like Tmall and JD.com is accelerating consumer access to advanced scar care products without the need for prescriptions. Younger demographics are more willing to purchase dermatologist-tested or clinically validated products online, aided by influencer marketing and brand partnerships. Specialty beauty retail is also capitalizing on this demand by positioning scar repair solutions as part of broader skincare regimens, bridging the gap between medical necessity and cosmetic enhancement.

Innovation in Active Ingredient Blends and Multi-Functional Formulations

Another key trend is the rapid innovation in active ingredient formulations, where traditional single-ingredient gels are being replaced by multi-functional blends. Silicone polymers remain the gold standard, but products with Centella asiatica, onion extract, peptides, and Vitamin E are gaining traction for their dual role in scar repair and overall skin barrier strengthening. Brands are also developing serums and sheet patches that combine hydration, anti-redness, and scar flattening into one solution. This trend aligns with consumer expectations for convenience and multi-purpose care, especially in fast-growing markets like Japan and India, where demand for advanced yet natural formulations is rising sharply.

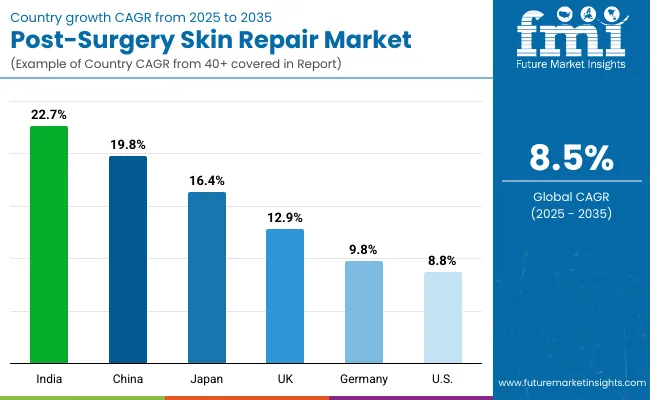

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

The Post-Surgery Skin Repair Market is experiencing highly uneven growth rates across countries, with emerging economies leading the trajectory. India stands out with the fastest expansion at a 22.7% CAGR, followed closely by China at 19.8% and Japan at 16.4%. These growth rates reflect rising surgical procedure volumes, greater access to healthcare, and increasing consumer willingness to invest in scar minimization and skin repair solutions.

In India, the rapid adoption of Centella asiatica and natural ingredient-based products resonates with cultural preferences, while in China, hospitals and clinics remain the dominant distribution channel, supported by strong physician recommendations. Japan’s high CAGR is driven by its aging population undergoing medical interventions and its cultural focus on skincare precision, where advanced formulations with peptides and silicone polymers gain strong traction.

In contrast, developed Western markets show relatively moderate yet steady growth. The USA is projected to expand at 8.8% CAGR, reflecting its maturity and high baseline, with growth sustained by innovation in clinically proven and dermatologist-tested formulations. Germany and the UK, at 9.8% and 12.9% CAGR respectively, highlight Europe’s stability, supported by regulatory emphasis on medical-grade claims and high consumer trust in evidence-based products. While their growth rates are slower than Asia-Pacific, these markets remain critical revenue drivers due to their premium pricing, brand loyalty, and established hospital and pharmacy distribution networks. Collectively, this divergence underscores a shift in market momentum toward Asia-Pacific, while Western markets continue to act as innovation and validation hubs.

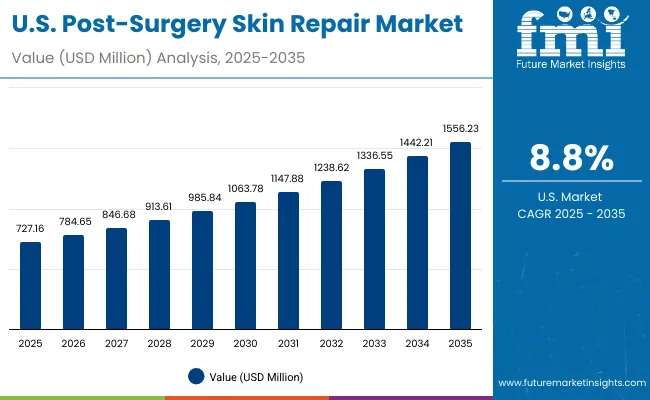

| Year | USA Post-Surgery Skin Repair Market (USD Million) |

|---|---|

| 2025 | 727.16 |

| 2026 | 784.65 |

| 2027 | 846.68 |

| 2028 | 913.61 |

| 2029 | 985.84 |

| 2030 | 1,063.78 |

| 2031 | 1,147.88 |

| 2032 | 1,238.62 |

| 2033 | 1,336.55 |

| 2034 | 1,442.21 |

| 2035 | 1,556.23 |

The Post-Surgery Skin Repair Market in the United States is projected to grow at a CAGR of 8.8%, supported by high volumes of surgical procedures and strong consumer trust in clinically validated formulations. Hospitals and clinics remain the dominant distribution channel, prescribing scar minimization products immediately after surgery, while pharmacies and e-commerce platforms are expanding reach to non-hospital patients. Clinically proven products, which represent 55.6% share in 2025, continue to be the anchor of adoption, especially for scar reduction. Growing preference for dermatologist-tested and medical-grade claims in premium retail channels is also fueling market penetration.

The Post-Surgery Skin Repair Market in the United Kingdom is expected to grow at a CAGR of 12.9%, driven by rising awareness of cosmetic outcomes and growing investments in medical-grade skincare. Hospitals and NHS-linked clinics play a critical role in patient referrals, while private cosmetic practices increasingly recommend scar minimization and skin barrier repair products. The UK market is also influenced by consumer preference for fragrance-free and clinically proven products, especially through pharmacies and specialty beauty retailers. With greater acceptance of advanced active ingredients such as silicone polymers and peptides, the UK is moving toward premium positioning in scar care solutions.

India is witnessing rapid growth in the Post-Surgery Skin Repair Market, which is forecast to expand at a CAGR of 22.7% through 2035. Growth is driven by rising surgical volumes not only in metro cities but also in tier-2 urban centers, supported by expanding healthcare infrastructure. The adoption of Centella asiatica and onion extract-based scar repair products resonates strongly with local consumers due to cultural familiarity with herbal remedies. Hospitals and clinics remain the primary distribution channel, but pharmacies and digital platforms are rapidly growing due to improved product accessibility. With consumer spending on post-operative aesthetics rising, India represents the fastest-growing global opportunity.

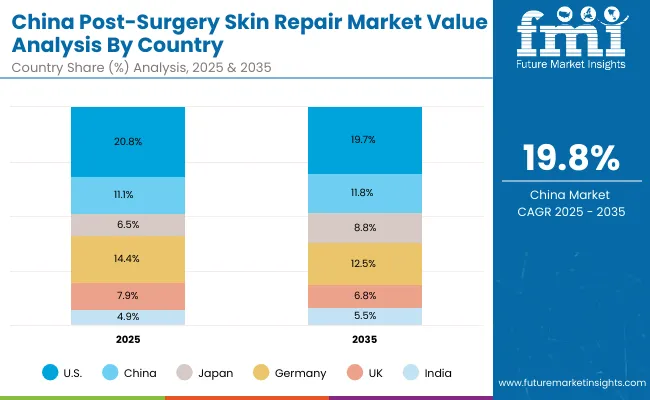

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.7% |

| China | 11.8% |

| Japan | 8.8% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

The Post-Surgery Skin Repair Market in China is expected to grow at a CAGR of 19.8%, one of the highest among leading economies. Growth is fueled by increasing hospital-based prescriptions, which contributed USD 203.7 million in 2025, and expanding digital retail channels that make products accessible nationwide. Scar minimization remains the top treatment area, supported by a surge in cosmetic surgeries and urban consumer demand for visible recovery outcomes. Domestic and international brands are investing heavily in e-commerce platforms like Tmall and JD.com, while hospitals reinforce trust through clinically proven and medical-grade recommendations. China’s large-scale consumer base and rising surgical volumes make it a critical driver of global market expansion.

| USA by Claim | Value Share% 2025 |

|---|---|

| Clinically proven | 55.6% |

| Others | 44.4% |

The Post-Surgery Skin Repair Market in the United States is projected at USD 727.16 million in 2025, growing at a CAGR of 8.8%. Clinically proven products contribute 55.6%, while others hold 44.4%, showing a strong consumer preference toward evidence-backed formulations. This dominance of clinically validated products stems from the USA healthcare ecosystem’s reliance on physician recommendations and FDA-compliant claims. Hospitals and clinics, which drive 52.5% of global channel share, remain the cornerstone of USA adoption, supported by pharmacies expanding their post-operative care offerings.

Growth in the USA is further supported by high cosmetic and reconstructive surgery volumes, where patients demand both functional and aesthetic recovery. Dermatologist-tested and medical-grade products are increasingly penetrating retail and e-commerce, appealing to consumers seeking both trust and convenience. Premium positioning by brands such as Mederma, ScarAway, and La Roche-Posay is shaping patient preference, ensuring that clinically validated formulations remain the anchor of the USA market.

| China by Channel | Value Share% 2025 |

|---|---|

| Hospitals/clinics | 52.5% |

| Others | 47.5% |

The Post-Surgery Skin Repair Market in China is valued at approximately USD 387.9 million in 2025, with hospitals and clinics leading at 52.5%, followed by other channels at 47.5%. The dominance of medical channels reflects China’s healthcare-driven adoption, where post-surgical recovery products are closely tied to physician guidance and hospital prescriptions. This dynamic ensures trust in clinically proven and medical-grade scar minimization products.

China’s rapid CAGR of 19.8% highlights its momentum as one of the fastest-growing markets globally. Cosmetic surgery demand in urban centers like Beijing, Shanghai, and Guangzhou is expanding sharply, driving scar minimization product uptake. Meanwhile, digital retail platforms such as Tmall and JD.com are accelerating access, enabling consumers to purchase trusted international and domestic brands. With younger demographics showing strong preference for dermatologist-tested and clean-label solutions, China’s market is rapidly diversifying beyond hospital channels into hybrid medical-consumer ecosystems.

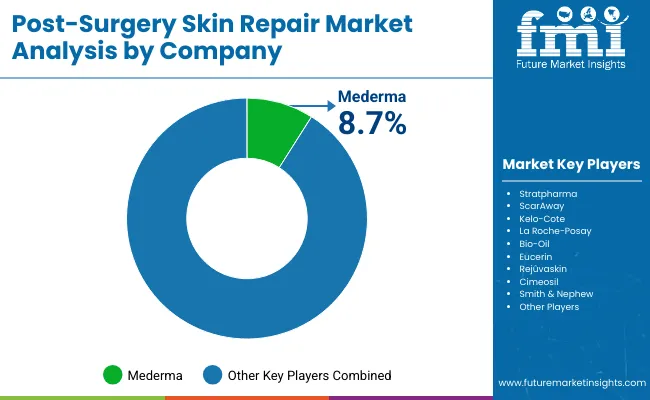

The Post-Surgery Skin Repair Market is moderately fragmented, with established global leaders, cosmeceutical innovators, and niche-focused players competing across diverse application areas. Leading companies such as Mederma, Stratpharma, and Kelo-Cote hold significant market share, driven by their clinically proven scar minimization products, robust physician endorsements, and integration into post-surgical care routines.

Their strategies emphasize evidence-based claims, hospital partnerships, and broad retail expansion, ensuring dominance in North America and Europe. Mid-sized players including La Roche-Posay, Eucerin, and Bio-Oil are catering to consumer-facing demand, with strong positioning in pharmacies, specialty beauty retail, and e-commerce. Their strength lies in hybrid branding strategies that blend cosmetic appeal with clinical validation, making them highly relevant for scar minimization and skin barrier repair in both developed and emerging markets.

Specialized providers such as Rejûvaskin, Cimeosil, and Smith & Nephew focus on targeted applications, including advanced silicone sheets, post-operative dressings, and hospital-grade scar repair systems. Their competitive advantage lies in medical-grade positioning and niche application dominance, rather than mass-market reach.

Competitive differentiation is shifting away from ingredient basics toward integrated value propositions, combining clinically proven claims, clean-label positioning, and consumer-friendly formats like patches and serums. With e-commerce expansion, dermatologist endorsements, and premium product lines, market competition is being redefined by trust, innovation, and multi-channel accessibility.

Key Developments in Post-Surgery Skin Repair Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Treatment Area | Scar minimization, Skin barrier repair, Bruising & redness relief, Stitch line healing |

| Active Ingredient | Silicone polymers, Onion extract, Centella asiatica, Peptides, Vitamin E |

| Product Type | Gels, Ointments, Serums, Sheets/patches |

| Channel | Hospitals/clinics, Pharmacies, E-commerce, Specialty beauty retail |

| Claim | Clinically proven, Fragrance-free, Medical-grade, Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, China, India, United Kingdom, Germany, Japan |

| Key Companies Profiled | Mederma, Stratpharma, ScarAway, Kelo-Cote, La Roche-Posay, Bio-Oil, Eucerin, Rejûvaskin, Cimeosil, Smith & Nephew |

| Additional Attributes | Dollar sales by claim type and treatment area, adoption trends in hospitals/clinics and e-commerce, rising demand for silicone-based and peptide-infused formulations, sector-specific growth in cosmetic and reconstructive surgeries, sales performance across premium medical-grade and retail-oriented products, regional trends influenced by higher surgical volumes in Asia-Pacific, and innovations in multi-functional scar gels, serums, and patches. |

The Post-Surgery Skin Repair Market is estimated to be valued at USD 3,502.4 million in 2025.

The market size for the Post-Surgery Skin Repair Market is projected to reach USD 7,900.8 million by 2035.

The Post-Surgery Skin Repair Market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in the Post-Surgery Skin Repair Market are gels, ointments, serums, and sheets/patches.

In terms of treatment area, scar minimization is projected to command 47.5% share in the Post-Surgery Skin Repair Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Skin Tears Treatment Market Growth – Industry Outlook & Forecast 2024-2034

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA