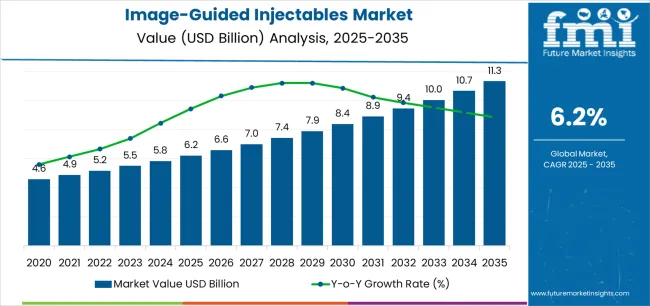

The global image-guided injectables market is valued at USD 6,200 million in 2025 and is slated to reach USD 11,315 million by 2035, recording an absolute increase of USD 5,115 million over the forecast period. This translates into a total growth of 82.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035. The overall market size is expected to grow by approximately 1.83X during the same period, supported by increasing demand for minimally invasive procedures, growing adoption of precision medicine technologies across interventional radiology and pain management sectors, and rising preference for targeted therapeutic delivery solutions in oncology applications.

The image-guided injectables market represents a specialized segment of the global medical device and interventional medicine industry, characterized by technological innovation and robust demand across hospital interventional radiology, ambulatory surgery centers, and specialty clinic channels. Market dynamics are influenced by evolving treatment paradigms toward precision-guided interventions, growing interest in real-time imaging technologies, and expanding partnerships between medical device manufacturers and healthcare providers in developed and emerging economies. Traditional blind injection techniques continue evolving as clinicians seek proven image-guided alternatives that offer enhanced procedural accuracy and reliable patient outcome characteristics.

Clinical behavior in the image-guided injectables market reflects broader healthcare trends toward precision medicine systems that provide both procedural effectiveness benefits and extended patient safety improvements. The market benefits from the growing popularity of ultrasound-guided applications, which are recognized for their superior real-time visualization and clinical compatibility across pain management and musculoskeletal injection applications. Additionally, the versatility of image-guided systems as both diagnostic and therapeutic components supports demand across multiple medical applications and specialty segments.

Regional adoption patterns vary significantly, with North American markets showing strong preference for interventional radiology implementations, while European markets demonstrate increasing adoption of ambulatory surgery center applications alongside conventional hospital systems. The medical landscape continues to evolve with sophisticated and targeted guidance products gaining traction in mainstream clinical operations, reflecting physician willingness to invest in proven imaging technology improvements and precision-oriented features.

The competitive environment features established medical device companies alongside specialized imaging guidance manufacturers that focus on unique visualization capabilities and advanced navigation methods. Clinical accuracy and procedural optimization remain critical factors for market participants, particularly as regulatory requirements and safety standards continue to evolve. Distribution strategies increasingly emphasize multi-channel approaches that combine traditional medical device supply chains with direct hospital partnerships through clinical training agreements and technology integration contracts.

Market consolidation trends indicate that larger medical device companies are acquiring specialty image-guidance developers to diversify their interventional portfolios and access specialized navigation segments. Advanced imaging integration has gained momentum as healthcare companies seek to differentiate their offerings while maintaining competitive procedural outcomes. The emergence of specialized guidance variants, including enhanced ultrasound formulations and steerable needle options, reflects changing clinical priorities and creates new market opportunities for innovative navigation system developers.

Quick Stats for Image-Guided Injectables Market(Last Updated on 29th Oct, 2025)

Between 2025 and 2030, the image-guided injectables market is projected to expand from USD 6,200 million to USD 8,450 million, resulting in a value increase of USD 2,250 million, which represents 44% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of ultrasound-guided systems, rising demand for interventional radiology solutions, and growing emphasis on precision targeting features with enhanced visualization characteristics. Healthcare facilities are expanding their imaging capabilities to address the growing demand for specialized guidance implementations, advanced navigation options, and procedure-specific offerings across clinical segments.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 6,200 million |

| Forecast Value (2035F) | USD 11,315 million |

| Forecast CAGR (2025 to 2035) | 6.20% |

From 2030 to 2035, the market is forecast to grow from USD 8,450 million to USD 11,315 million, adding another USD 2,865 million, which constitutes 56% of the overall ten-year expansion. This period is expected to be characterized by the expansion of oncology applications, the integration of innovative guidance solutions, and the development of specialized injection implementations with enhanced targeting profiles and extended procedural capabilities. The growing adoption of advanced imaging formulations will drive demand for image-guided systems with superior visualization characteristics and compatibility with modern medical technologies across clinical operations.

Between 2020 and 2025, the image-guided injectables market experienced steady growth, driven by increasing demand for ultrasound-guided systems and growing recognition of precision medicine as essential components for modern interventional care across hospital and outpatient applications. The market developed as healthcare providers recognized the potential for image-guided solutions to provide both clinical benefits and operational advantages while enabling streamlined procedural protocols. Technological advancement in imaging approaches and evidence-based development began emphasizing the critical importance of maintaining procedural accuracy and patient safety in diverse healthcare environments.

Market expansion is being supported by the increasing global demand for minimally invasive procedures and the corresponding need for guidance technologies that can provide superior targeting benefits and procedural advantages while enabling enhanced patient outcomes and extended compatibility across various interventional radiology and pain management applications.

Modern healthcare providers and interventional specialists are increasingly focused on implementing proven guidance technologies that can deliver effective precision targeting, minimize traditional procedural limitations, and provide consistent clinical performance throughout complex intervention configurations and diverse patient conditions. Image-guided injectables proven ability to deliver exceptional targeting accuracy against traditional alternatives, enable advanced clinical integration, and support modern procedural protocols makes it an essential component for contemporary interventional and specialty care operations.

The growing emphasis on precision medicine and procedural optimization is driving demand for guidance systems that can support complex intervention requirements, improve patient outcomes, and enable advanced healthcare delivery. Healthcare preference for technologies that combine effective targeting precision with proven safety and procedural enhancement benefits is creating opportunities for innovative guidance implementations. The rising influence of minimally invasive trends and clinical efficiency awareness is also contributing to increased demand for image-guided systems that can provide advanced features, seamless clinical integration, and reliable performance across extended procedural cycles.

The image-guided injectables market is poised for steady growth and clinical advancement. As healthcare facilities across North America, Europe, Asia-Pacific, and emerging markets seek technologies that deliver exceptional targeting characteristics, advanced guidance capabilities, and reliable procedural options, image-guided solutions are gaining prominence not just as specialty medical devices but as strategic enablers of precision medicine technologies and advanced interventional functionality.

Rising ultrasound-guided adoption in pain management applications and expanding interventional radiology initiatives globally amplify demand, while developers are leveraging innovations in imaging engineering, advanced guidance integration, and procedural optimization technologies.

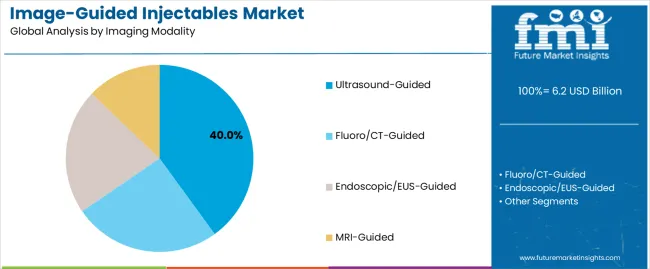

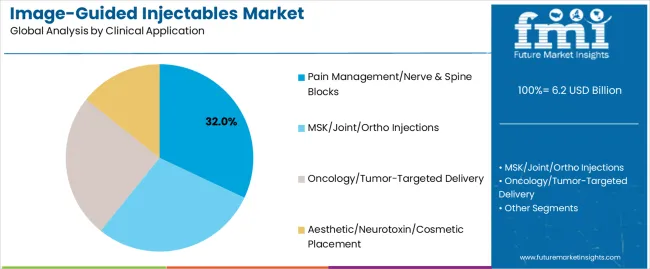

The market is segmented by imaging modality, clinical application, care setting, delivery device type, and region. By imaging modality, the market is divided into ultrasound-guided, fluoro/CT-guided, endoscopic/EUS-guided, and MRI-guided categories. By clinical application, it covers pain management/nerve & spine blocks, MSK/joint/ortho injections, oncology/tumor-targeted delivery, and aesthetic/neurotoxin/cosmetic placement segments. By care setting, it encompasses ambulatory surgery & pain centers, hospital interventional radiology, sports/ortho clinics, and oncology/other specialty suites segments. By delivery device type, it includes standard needle/syringe with guidance, steerable needle/cannula systems, microcatheter/catheter-directed injection, and injectable implants/gels/cements categories.

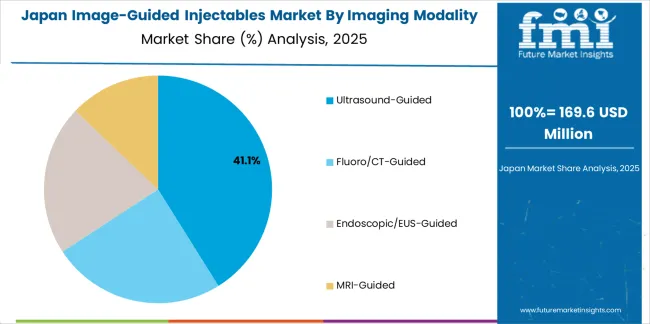

The ultrasound-guided segment is projected to account for 40% of the image-guided injectables market in 2025, reaffirming its position as the leading imaging modality category. Healthcare facilities and interventional integrators increasingly utilize ultrasound-guided implementations for their superior real-time visualization characteristics when operating across diverse procedural platforms, excellent soft tissue contrast properties, and widespread acceptance in applications ranging from basic pain management to premium oncology operations. Ultrasound-guided technology's established imaging methods and proven accuracy capabilities directly address the facility requirements for dependable guidance solutions in complex clinical environments.

This imaging modality segment forms the foundation of modern pain management adoption patterns, as it represents the implementation with the greatest market penetration and established physician acceptance across multiple procedural categories and clinical segments. Facility investments in ultrasound standardization and guidance consistency continue to strengthen adoption among interventional providers and specialty clinics. With healthcare providers prioritizing procedural accuracy and patient safety, ultrasound-guided implementations align with both functionality preferences and cost expectations, making them the central component of comprehensive guidance strategies.

Pain management and nerve & spine block applications are projected to represent 32% of image-guided injectables demand in 2025, underscoring their critical role as the primary application type for precision targeting across pain intervention operations. Healthcare facilities prefer image guidance for pain management use for their exceptional targeting characteristics, scalable procedural options, and ability to enhance therapeutic delivery while ensuring consistent clinical outcomes throughout diverse procedural platforms and patient operations. Positioned as essential precision components for modern pain management systems, image-guided solutions offer both technological advantages and procedural efficiency benefits.

The segment is supported by continuous innovation in guidance technologies and the growing availability of specialized implementations that enable diverse pain management requirements with enhanced targeting uniformity and extended patient safety capabilities. Additionally, healthcare facilities are investing in advanced technologies to support large-scale procedural integration and therapy development. As minimally invasive trends become more prevalent and precision awareness increases, pain management applications will continue to represent a major implementation market while supporting advanced clinical utilization and technology integration strategies.

The hospital interventional radiology segment is expected to capture 36% of the image-guided injectables market in 2025, driven by increasing demand for advanced imaging systems that enhance procedural outcomes while maintaining comprehensive care capabilities. Hospital interventional radiology departments are increasingly adopting image-guided systems for complex procedures, tumor targeting, and vascular interventions due to their superior precision and real-time monitoring benefits. The segment benefits from growing healthcare specialization requirements and continuous innovation in guidance formulations tailored for interventional radiology applications.

The image-guided injectables market is advancing steadily due to increasing demand for minimally invasive procedures and growing adoption of guidance technologies that provide superior targeting characteristics and procedural benefits while enabling enhanced patient outcomes across diverse interventional radiology and pain management applications. The market faces challenges, including complex regulatory requirements, evolving safety standards, and the need for specialized imaging expertise and training programs. Innovation in guidance approaches and advanced visualization systems continues to influence product development and market expansion patterns.

Expansion of Precision Medicine Technologies and Clinical Integration

The growing adoption of advanced precision medicine solutions, sophisticated guidance capabilities, and procedural outcome awareness is enabling medical device developers to produce advanced image-guided solutions with superior targeting positioning, enhanced visualization profiles, and seamless integration functionalities. Advanced precision medicine systems provide improved patient outcomes while allowing more efficient clinical workflows and reliable performance across various medical applications and procedural conditions. Developers are increasingly recognizing the competitive advantages of clinical integration capabilities for market differentiation and technology positioning.

Integration of Advanced Guidance Methods and Imaging Engineering

Modern medical device manufacturers are incorporating advanced guidance technology, imaging integration, and sophisticated procedural solutions to enhance product appeal, enable intelligent targeting features, and deliver value-added solutions to healthcare customers. These technologies improve guidance performance while enabling new market opportunities, including multi-modality imaging systems, optimized targeting treatments, and enhanced procedural characteristics. Advanced imaging integration also allows developers to support comprehensive healthcare technologies and market expansion beyond traditional guidance approaches.

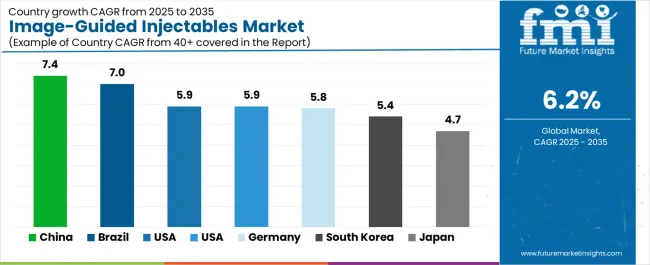

| Country | CAGR (2025 to 2035) |

|---|---|

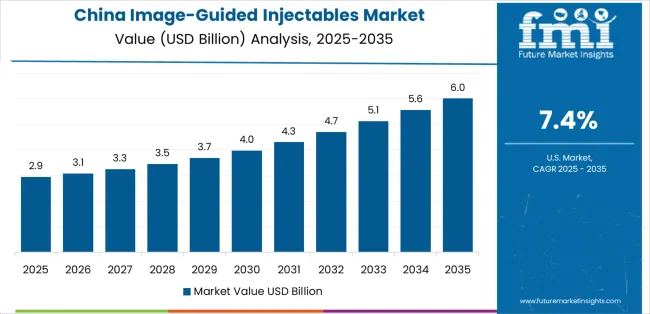

| China | 7.4% |

| Brazil | 7% |

| USA | 5.9% |

| UK | 5.9% |

| Germany | 5.8% |

| South Korea | 5.4% |

| Japan | 4.7% |

The image-guided injectables market is experiencing robust growth globally, with China leading at a 7.4% CAGR through 2035, driven by expanding healthcare infrastructure, growing interventional medicine programs, and significant investment in medical technology development. Brazil follows at 7%, supported by increasing healthcare modernization, growing clinical integration patterns, and expanding medical device infrastructure.

The USA shows growth at 5.9%, emphasizing interventional excellence and medical innovation. The UK exhibits 5.9% growth, prioritizing clinical advancement and premium medical technology development. Germany demonstrates 5.8% growth, focusing on expanding healthcare capabilities and medical technology modernization. South Korea records 5.4%, emphasizing medical innovation excellence and quality-focused clinical patterns. Japan shows 4.7% growth, supported by medical excellence initiatives and quality-focused guidance patterns.

Revenue from image-guided injectables in China is projected to exhibit robust growth with a CAGR of 7.4% through 2035, driven by expanding healthcare infrastructure capacity and rapidly growing interventional medicine supported by government initiatives promoting medical technology development. The country's improving healthcare delivery and increasing investment in medical technology infrastructure are creating substantial demand for advanced guidance implementations. Major healthcare facilities and medical device companies are establishing comprehensive imaging capabilities to serve both urban clinical demand and expanding rural healthcare markets.

Government support for healthcare modernization initiatives and medical technology development is driving demand for advanced guidance systems throughout major healthcare regions and clinical centers across the country. Strong medical device growth and an expanding network of specialty-focused providers are supporting the rapid adoption of image-guided systems among facilities seeking advanced targeting capabilities and integrated guidance technologies.

Revenue from image-guided injectables in Brazil is growing at a CAGR of 7%, driven by the country's expanding healthcare sector, growing medical technology capacity, and increasing adoption of advanced guidance technologies. The country's initiatives promoting healthcare modernization and growing medical development awareness are driving requirements for technology-integrated guidance systems. International guidance providers and domestic medical companies are establishing extensive clinical and integration capabilities to address the growing demand for advanced image-guided solutions.

Strong healthcare expansion and expanding modern medical operations are driving adoption of integrated guidance systems with superior imaging capabilities and advanced integration among large healthcare providers and progressive medical operations. Growing technology diversity and increasing healthcare enhancement adoption are supporting market expansion for advanced guidance implementations with seamless integration profiles and modern clinical delivery throughout the country's healthcare regions. Brazil's strategic healthcare position and expanding patient base make it an attractive destination for guidance development facilities serving both domestic and Latin American markets.

Revenue from image-guided injectables in the USA is growing at a CAGR of 5.9%, driven by the country's focus on medical innovation advancement, emphasis on premium clinical innovation, and strong position in medical technology development. The USA's established medical excellence capabilities and commitment to technology diversification are supporting investment in specialized guidance technologies throughout major clinical regions. Medical leaders are establishing comprehensive technology integration systems to serve domestic premium healthcare production and enhancement applications.

Innovations in guidance platforms and clinical integration capabilities are creating demand for advanced image-guided implementations with exceptional targeting properties among progressive healthcare facilities seeking enhanced technology differentiation and patient appeal. Growing premium clinical adoption and increasing focus on medical innovation are driving adoption of advanced guidance platforms with integrated imaging systems and clinical optimization across healthcare enterprises throughout the country.

Revenue from image-guided injectables in the UK is growing at a CAGR of 5.9%, driven by the country's focus on clinical advancement, emphasis on premium medical innovation, and strong position in guidance technology development. The UK's established clinical excellence capabilities and commitment to technology diversification are supporting investment in specialized guidance technologies throughout major healthcare regions. Clinical leaders are establishing comprehensive technology integration systems to serve domestic premium medical production and enhancement applications.

Innovations in imaging platforms and clinical integration capabilities are creating demand for advanced guidance implementations with exceptional procedural properties among progressive healthcare facilities seeking enhanced technology differentiation and patient appeal. Growing premium medical adoption and increasing focus on clinical innovation are driving adoption of advanced guidance platforms with integrated targeting systems and clinical optimization across medical enterprises throughout the country.

Revenue from image-guided injectables in Germany is expanding at a CAGR of 5.8%, supported by the country's medical technology heritage, strong emphasis on clinical innovation, and robust demand for advanced guidance systems in interventional and pain management applications. The nation's mature healthcare sector and technology-focused operations are driving sophisticated guidance implementations throughout the medical industry. Leading facilities and clinical specialists are investing extensively in imaging development and advanced integration technologies to serve both domestic and international markets.

Rising demand for precision medicine technologies and advanced clinical systems is creating requirements for sophisticated guidance solutions with exceptional targeting capabilities among quality-conscious facilities seeking enhanced clinical experiences and advanced integration methods. Strong medical tradition and growing investment in guidance technologies are supporting adoption of quality imaging platforms with advanced development methods and enhanced targeting profiles across clinical operations in major medical regions.

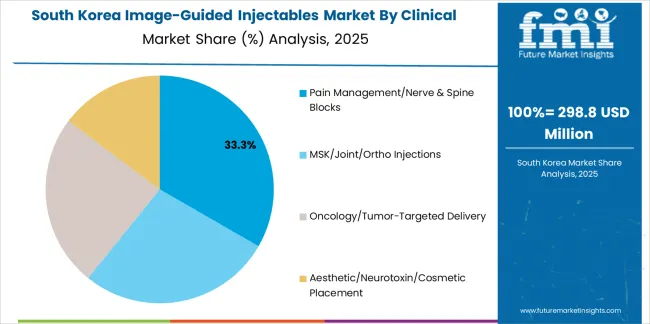

Revenue from image-guided injectables in South Korea is growing at a CAGR of 5.4%, driven by the country's expanding healthcare sector, growing technology integration capacity, and increasing adoption of advanced guidance technologies. The country's initiatives promoting medical modernization and growing clinical development awareness are driving requirements for technology-integrated guidance systems. International imaging providers and domestic medical companies are establishing extensive clinical and integration capabilities to address the growing demand for advanced guidance solutions.

Rising medical requirements and expanding clinical programs are creating opportunities for guidance adoption across medical centers, progressive providers, and modern healthcare facilities in major clinical regions. Growing focus on targeting integration and procedural improvement features is driving adoption of guidance platforms among providers seeking enhanced targeting capabilities and advanced clinical experiences.

Revenue from image-guided injectables in Japan is expanding at a CAGR of 4.7%, supported by the country's medical excellence initiatives, growing quality technology sector, and strategic emphasis on advanced clinical development. Japan's advanced quality control capabilities and integrated healthcare systems are driving demand for high-quality guidance platforms in premium applications, medical technology, and advanced clinical applications. Leading facilities are investing in specialized capabilities to serve the stringent requirements of technology-focused healthcare and premium medical providers.

Quality medical advancement and technology-focused development are creating requirements for specialized guidance solutions with superior quality integration, exceptional targeting capabilities, and advanced clinical features among quality-conscious medical operations and premium healthcare providers. Strong position in medical technology innovation is supporting adoption of advanced guidance systems with validated targeting characteristics and quality integration capabilities throughout the country's medical technology sector.

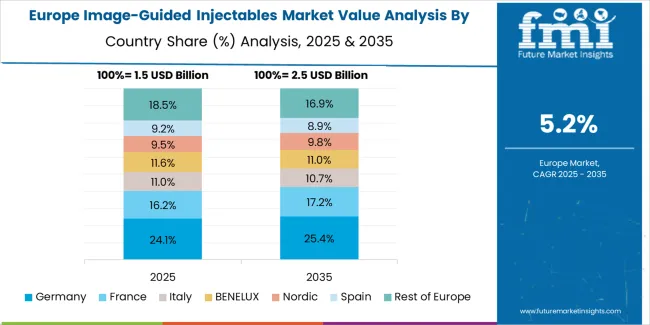

The image-guided injectables market in Europe is projected to grow from USD 1,736 million in 2025 to USD 3,168.2 million by 2035, registering a CAGR of 6.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, growing to 29% by 2035, supported by its strong medical technology culture, sophisticated interventional capabilities, and comprehensive healthcare sector serving diverse guidance applications across Europe.

France follows with a 20% share in 2025, projected to reach 20.5% by 2035, driven by robust demand for interventional technologies in clinical applications, advanced healthcare development programs, and precision medicine markets, combined with established medical infrastructure and technology integration expertise. The United Kingdom holds a 18% share in 2025, expected to reach 18.5% by 2035, supported by strong clinical technology sector and growing premium healthcare activities. Italy commands a 15% share in 2025, projected to reach 14.5% by 2035, while Spain accounts for 10% in 2025, expected to reach 9.5% by 2035. The Rest of Europe region is anticipated to maintain momentum, with its collective share moving from 8.5% to 8% by 2035, attributed to increasing medical modernization and growing technology penetration implementing advanced guidance programs.

The image-guided injectables market is characterized by competition among established medical device companies, specialized guidance manufacturers, and integrated clinical solution providers. Companies are investing in imaging technology research, guidance optimization, advanced clinical system development, and comprehensive navigation portfolios to deliver consistent, high-quality, and procedure-specific guidance solutions. Innovation in advanced imaging integration, targeting enhancement, and clinical compatibility improvement is central to strengthening market position and competitive advantage.

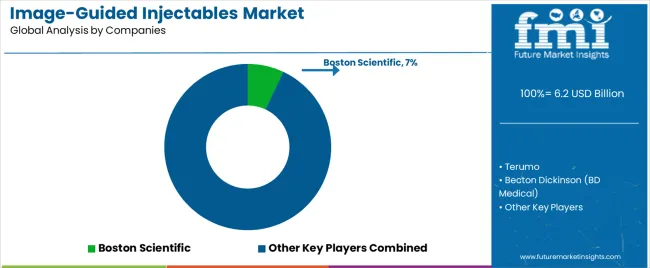

Boston Scientific leads the market with a 7% market share, offering comprehensive guidance solutions including quality imaging platforms and advanced navigation systems with a focus on premium and interventional applications. Terumo provides specialized medical device capabilities with an emphasis on advanced guidance implementations and innovative clinical solutions. Becton Dickinson delivers comprehensive healthcare services with a focus on integrated platforms and large-scale medical applications. Merit Medical specializes in advanced guidance technologies and specialized navigation implementations for premium applications. Teleflex focuses on interventional-oriented guidance integration and innovative technology solutions.

The competitive landscape is further strengthened by companies like Cook Medical, which brings expertise in advanced interventional devices, while B. Braun focuses on medical device solutions for specialized applications. Stryker Interventional Spine emphasizes spine-focused guidance systems and procedural integration, and AngioDynamics specializes in vascular intervention guidance formulations. These companies continue to invest in research and development, strategic partnerships, and manufacturing capacity expansion to maintain their market positions and capture emerging opportunities in the growing image-guided injectables sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 6,200 million |

| Imaging Modality | Ultrasound-Guided; Fluoro /CT-Guided; Endoscopic/EUS-Guided; MRI-Guided |

| Clinical Application | Pain Management/Nerve & Spine Blocks; MSK/Joint/Ortho Injections; Oncology/ Tumor -Targeted Delivery; Aesthetic/Neurotoxin/Cosmetic Placement |

| Care Setting | Ambulatory Surgery & Pain Centers ; Hospital Interventional Radiology; Sports/Ortho Clinics; Oncology/Other Specialty Suites |

| Delivery Device Type | Standard Needle/Syringe with Guidance; Steerable Needle/Cannula Systems; Microcatheter /Catheter-Directed Injection; Injectable Implants/Gels/Cements |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | USA; Germany; France; UK; Japan; China; South Korea; Brazil; and 40+ additional countries |

| Key Companies Profiled | Boston Scientific; Terumo; Becton Dickinson; Merit Medical; Teleflex; Cook Medical |

| Additional Attributes | Dollar sales by imaging modality and clinical application category; regional demand trends; competitive landscape; technological advancements in guidance engineering; advanced imaging development; targeting innovation; clinical integration protocols |

The global image-guided injectables market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the image-guided injectables market is projected to reach USD 11.3 billion by 2035.

The image-guided injectables market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in image-guided injectables market are ultrasound-guided, fluoro/ct-guided, endoscopic/eus-guided and mri-guided.

In terms of clinical application, pain management/nerve & spine blocks segment to command 32.0% share in the image-guided injectables market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microparticle Injectables Market

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Prefilled Injectables Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Biologic Injectables Market Size and Share Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA