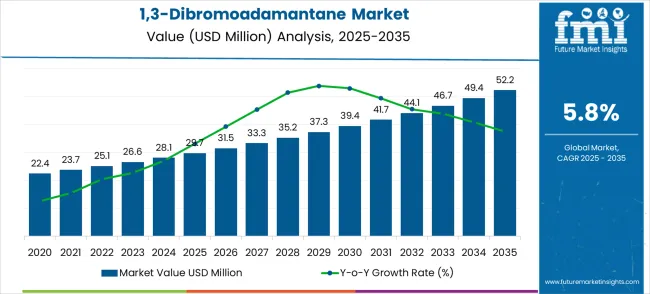

The 1,3-dibromoadamantane market is valued at USD 29.7 million in 2025 and is expected to reach USD 52.2 million by 2035, reflecting a CAGR of 5.8%. The market experiences significant absolute dollar opportunity as it moves from USD 22.4 million in 2021 to USD 29.7 million in 2025, with annual increments through USD 23.7 million, 25.1 million, 26.6 million, and 28.1 million. This early growth phase is driven by the rising use of 1,3-dibromoadamantane in pharmaceutical and chemical applications, particularly in the development of high-performance polymers and organic electronics. The compound’s use as a building block in drug synthesis, particularly in antiviral and anticancer treatments, drives steady value addition during this period.

From 2026 to 2030, the market grows from USD 29.7 million to USD 39.4 million, passing through USD 31.5 million, USD 33.3 million, USD 35.2 million, and USD 37.3 million. This phase sees expanded adoption in the specialty chemical industry, particularly in the production of flame retardants and polymer additives.

The demand for high-purity chemicals and materials continues to rise, contributing to the absolute dollar opportunity in the market. Between 2031 and 2035, the market is expected to reach USD 52.2 million, with intermediate values of USD 41.7 million, USD 44.1 million, USD 46.7 million, and USD 49.4 million. The steady adoption across pharmaceutical, electronics, and chemical industries ensures consistent growth, with significant contributions from innovative applications, positioning 1,3-dibromoadamantane for long-term expansion.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 29.7 million |

| Forecast Value in (2035F) | USD 52.2 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The chemical manufacturing market contributes about 30-35%, as 1,3-dibromoadamantane is commonly used as an intermediate in the production of specialty chemicals, organic synthesis, and chemical reagents. The pharmaceuticals market adds roughly 20-25%, with the compound being used in pharmaceutical research and development, particularly for the synthesis of antiviral agents and other bioactive molecules. The material science market accounts for about 15-18%, where 1,3-dibromoadamantane plays a role in the creation of polymeric materials and is involved in research on advanced materials and nanotechnology. The agricultural chemicals market provides approximately 10-12%, as the compound is utilized in the development of pesticides and fungicides that aid in crop protection. The electronics and semiconductor market contributes about 8-10%, where 1,3-dibromoadamantane is used in the development of semiconductors, organic electronics, and materials designed to improve conductivity and properties in electronic devices.

Market expansion is being supported by the increasing global demand for specialized chemical intermediates and the corresponding shift toward advanced dibromoadamantane solutions that can provide superior chemical performance while meeting industry requirements for high-purity synthesis and advanced material applications. Modern pharmaceutical and fine chemical manufacturers are increasingly focused on incorporating high-purity dibromoadamantane to enhance synthesis quality while satisfying demands for ultra-pure chemical intermediates and specialized pharmaceutical synthesis capabilities. Dibromoadamantane's proven ability to deliver superior chemical performance, high purity levels, and versatile synthesis applications makes it essential material for advanced pharmaceutical processes and specialty chemical manufacturing applications.

The growing emphasis on pharmaceutical innovation and advanced materials development is driving demand for high-quality dibromoadamantane products that can support distinctive synthesis capabilities and premium chemical positioning across pharmaceutical synthesis, photosensitive materials, and specialty chemical categories. Chemical manufacturer preference for compounds that combine synthesis excellence with advanced purity characteristics is creating opportunities for innovative dibromoadamantane implementations in both traditional and emerging pharmaceutical applications. The rising influence of advanced synthesis technologies and precision chemical manufacturing is also contributing to increased adoption of premium dibromoadamantane products that can provide authentic high-purity chemical characteristics.

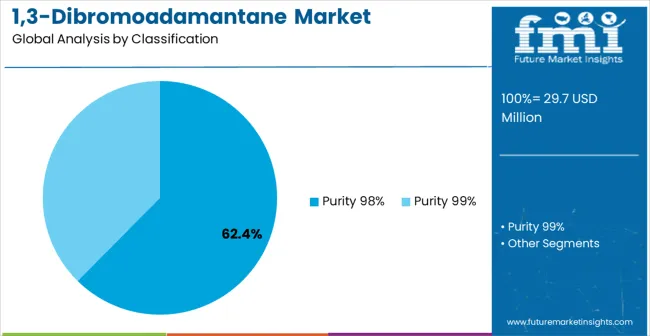

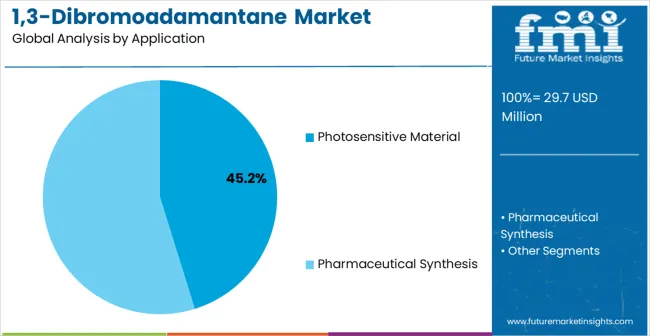

The market is segmented by purity grade, application, and region. By purity grade, the market is divided into purity 98% and purity 99%. Based on application, the market is categorized into photosensitive material, pharmaceutical synthesis, and fine chemicals. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

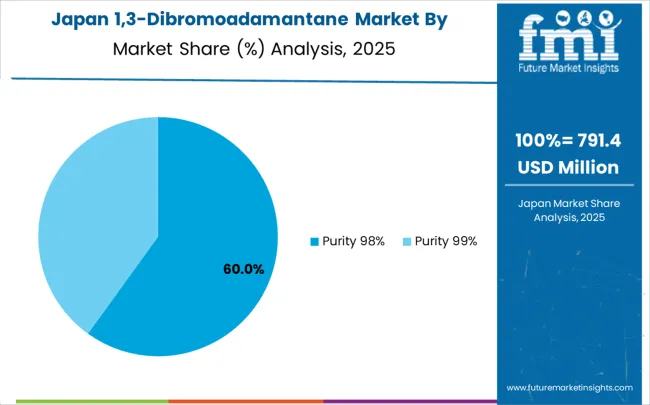

The 98% purity segment is projected to dominate the global 1,3-dibromoadamantane market in 2025, accounting for 62.4% of total demand. This grade has emerged as the industry’s preferred standard because it offers the ideal balance between cost-effectiveness and reliable performance across a wide spectrum of chemical synthesis applications. Manufacturers in the pharmaceutical and specialty chemical sectors increasingly select 98% purity 1,3-dibromoadamantane as it provides the necessary stability, consistency, and compatibility to support precise synthesis processes while keeping production costs manageable. Its standardized composition ensures reproducible outcomes, reducing batch-to-batch variability and enhancing overall efficiency in chemical operations.

This purity level also forms the backbone of modern industrial usage, particularly in large-scale pharmaceutical synthesis, where operational efficiency and regulatory compliance require dependable intermediates. Chemical producers are investing in incremental innovations to further optimize the 98% purity grade, including improvements in crystallization techniques, impurity control, and process safety, making it even more attractive to high-volume users. The segment’s dominance is also supported by its widespread compatibility with diverse synthesis systems and chemical equipment, allowing seamless integration into established workflows. With its combination of industrial scalability, consistent quality control, and affordability, the 98% purity category is expected to remain the foundation of the global dibromoadamantane market through 2035.

Photosensitive material applications are projected to account for the largest share of the global 1,3-dibromoadamantane market in 2025, representing 45.2% of total demand. This dominance underscores the compound’s central role as a high-performance chemical intermediate in the development of advanced photosensitive materials used across imaging technologies, semiconductor processing, and specialty coatings. 1,3-dibromoadamantane is particularly valued for its exceptional chemical stability, resistance to degradation under UV exposure, and compatibility with complex synthesis pathways, making it indispensable in environments that require precise light-response properties.

Material manufacturers favor it for its ability to ensure uniform performance during large-scale production, thereby enhancing process reliability and minimizing variability in final products. As demand rises for next-generation electronic devices, high-resolution imaging solutions, and specialized optical materials, the reliance on stable, high-purity intermediates such as 1,3-dibromoadamantane continues to intensify. Manufacturers are also increasingly integrating this compound into specialty formulations to meet the evolving technical requirements of miniaturized and energy-efficient devices. Its unique molecular structure supports both process innovation and long-term product durability, positioning it as a cornerstone in photosensitive material manufacturing. Going forward, this segment is expected to remain the primary driver of overall market growth, supported by rising adoption in semiconductor and optical technology ecosystems.

The 1,3-dibromoadamantane market is advancing steadily due to increasing pharmaceutical synthesis investments and growing demand for specialty chemical intermediates that emphasize superior chemical purity across pharmaceutical processing and specialty material manufacturing applications. The market faces challenges, including high chemical costs compared to alternative intermediates, technical complexity in synthesis optimization, and competition from substitute chemical compounds. Innovation in chemical purity enhancement and application-specific formulation development continues to influence market development and expansion patterns.

The growing adoption of dibromoadamantane in pharmaceutical innovation and advanced synthesis applications is enabling chemical manufacturers to develop products that provide distinctive synthesis capabilities while commanding premium positioning and enhanced purity characteristics. Advanced applications provide superior chemical performance while allowing more sophisticated synthesis development across various pharmaceutical categories and chemical segments. Manufacturers are increasingly recognizing the competitive advantages of high-purity chemical positioning for premium synthesis development and advanced pharmaceutical market penetration.

Modern dibromoadamantane suppliers are incorporating advanced purification techniques, synthesis optimization algorithms, and quality control analytics to enhance chemical purity, improve synthesis reliability, and meet pharmaceutical industry demands for consistent and high-performance chemical intermediates. These programs improve chemical performance while enabling new applications, including advanced pharmaceutical synthesis and specialized material development systems. Advanced purification integration also allows suppliers to support premium market positioning and technology leadership beyond traditional commodity chemicals.

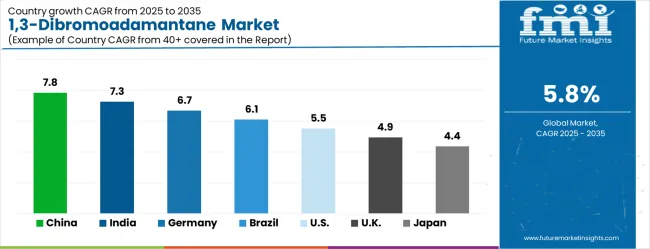

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

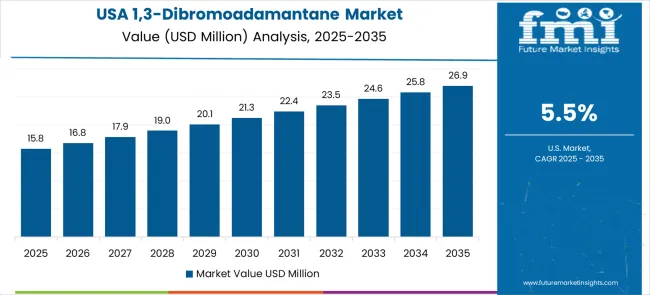

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.4% |

The 1,3-dibromoadamantane market is experiencing steady growth globally, with China leading at a 7.8% CAGR through 2035, driven by the rapidly expanding pharmaceutical manufacturing sector, massive investments in fine chemical production facilities, and increasing adoption of advanced chemical intermediate technologies. India follows at 7.3%, supported by growing pharmaceutical manufacturing, rising chemical industry investments, and expanding specialty material capabilities. Germany shows growth at 6.7%, emphasizing advanced chemical technology and premium pharmaceutical manufacturing. Brazil records 6.1%, focusing on emerging pharmaceutical applications and chemical technology development. The USA demonstrates 5.5% growth, prioritizing advanced pharmaceutical manufacturing and specialty chemical innovation. The UK exhibits 4.9% growth, supported by specialized chemical technology development and advanced pharmaceutical capabilities. Japan shows 4.4% growth, emphasizing pharmaceutical manufacturing excellence and high-quality chemical production.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

China is expected to remain at the forefront of global demand for 1,3-dibromoadamantane, driven primarily by its rapidly expanding pharmaceutical manufacturing sector and strong state-backed initiatives in fine chemical production. The market in China is projected to grow at a robust CAGR of 7.8% through 2035, supported by both domestic consumption and growing export requirements. Over the past decade, China has consistently invested in upgrading its industrial infrastructure, particularly within large chemical and pharmaceutical hubs such as Shanghai, Jiangsu, and Guangdong. These regions are now becoming key centers for the production of advanced chemical intermediates, including dibromoadamantane, which plays an important role in high-purity pharmaceutical synthesis. Strong government support is further reinforcing this trajectory, with subsidies and policy frameworks designed to accelerate adoption of next-generation chemical technologies and align domestic producers with international regulatory standards. Multinational corporations are also increasing their presence in China, partnering with local firms to establish research, production, and distribution networks that can serve both domestic and overseas markets. This creates a competitive but innovation-oriented environment where demand for premium, high-purity dibromoadamantane continues to expand. China’s scale, government backing, and technology-driven pharmaceutical sector position it as the global growth leader in this market.

India is emerging as another strong growth region for 1,3-dibromoadamantane, supported by a projected CAGR of 7.3% through 2035. Much of this momentum stems from the country’s rapidly expanding pharmaceutical manufacturing base, which has been reinforced by the “Make in India” initiative and increasing foreign direct investment into the chemical and pharma sectors. As Indian pharmaceutical companies move up the value chain from generics production toward more advanced synthesis and specialty formulations, the demand for high-quality intermediates such as dibromoadamantane is accelerating. Indian states such as Gujarat, Maharashtra, and Telangana are becoming regional hubs for chemical production, with local and multinational companies establishing modern synthesis and processing facilities. The country’s strong academic and research infrastructure is also helping foster innovation in specialty chemicals, ensuring that manufacturers can adopt advanced chemical intermediates with higher purity and performance standards. Government incentives to boost domestic API (Active Pharmaceutical Ingredient) production are reducing reliance on imports and pushing for increased adoption of premium intermediates that meet international quality benchmarks. This confluence of expanding pharmaceutical infrastructure, government-driven industrial growth, and rising technology sophistication is positioning India as one of the most promising markets for dibromoadamantane in the Asia-Pacific region.

Germany is expected to maintain a leading position within Europe’s 1,3-dibromoadamantane market, with growth projected at a CAGR of 6.7% through 2035. Germany’s chemical industry is among the most advanced globally, characterized by precision-driven synthesis, high-performance intermediates, and strong adherence to quality standards. Pharmaceutical and chemical producers in Germany place a premium on purity, making dibromoadamantane a highly valuable component for applications in both advanced synthesis and specialty chemical formulations. The country’s emphasis on R&D and continuous innovation fosters the development of customized dibromoadamantane derivatives tailored to specific pharmaceutical applications. Major companies in Germany are also increasingly integrating eco-conscious and green chemistry principles into their operations, ensuring that production aligns with European Union environmental regulations. Germany’s export-oriented chemical sector benefits from this positioning, as high-quality and reliable intermediates continue to command demand in both European and international markets. Collaborative partnerships between industry leaders, research institutions, and government initiatives are further strengthening Germany’s role as a hub for advanced chemical technologies. As pharmaceutical innovation accelerates across Europe, Germany’s capacity to deliver high-purity, performance-oriented dibromoadamantane will remain a defining factor in its strong market trajectory.

Brazil represents one of the fastest-emerging opportunities for 1,3-dibromoadamantane in Latin America, with revenue projected to grow at a CAGR of 6.1% through 2035. The expansion of Brazil’s domestic chemical industry, coupled with a strengthening pharmaceutical sector, is driving demand for advanced chemical intermediates. Brazilian producers are increasingly investing in technologies that improve synthesis efficiency, purity levels, and compliance with global quality standards. Dibromoadamantane, with its role as a key pharmaceutical intermediate, is gaining adoption not only in local drug manufacturing but also in specialty synthesis facilities that supply regional and export markets. Brazil’s chemical industry hubs, particularly São Paulo and Rio de Janeiro, are seeing growing investment from both domestic firms and multinational chemical companies seeking to establish a foothold in the Latin American market. Government-backed industrial programs and regulatory reforms are also supporting the modernization of chemical production facilities, enabling manufacturers to adopt advanced intermediates like dibromoadamantane more readily. With the country increasingly positioning itself as a regional leader in chemical and pharmaceutical innovation, the adoption of high-purity dibromoadamantane is expected to accelerate, offering Brazilian producers both domestic growth opportunities and export competitiveness across Latin America.

The United States continues to serve as a critical anchor for global growth in the 1,3-dibromoadamantane market, with revenues projected to expand at a CAGR of 5.5% through 2035. The USA pharmaceutical sector is one of the most advanced globally, characterized by large-scale manufacturing capabilities, extensive R&D investments, and a strong emphasis on innovation. This positions dibromoadamantane as an essential high-purity intermediate for both pharmaceutical synthesis and specialty chemical applications. American manufacturers prioritize product reliability and adherence to stringent FDA regulatory standards, which drives the consistent demand for advanced chemical intermediates capable of meeting these requirements. The USA also benefits from its role as a global center for chemical technology development, where collaborations between pharmaceutical companies, universities, and specialty chemical producers accelerate the adoption of cutting-edge synthesis techniques. Government support for advanced pharmaceutical manufacturing initiatives and investment in technology-driven solutions, such as continuous manufacturing, is further expanding the need for premium intermediates. With a combination of world-class research institutions, advanced production infrastructure, and an innovation-first approach, the USA market for 1,3-dibromoadamantane is expected to remain highly resilient and central to global supply chains.

The United Kingdom is expected to see stable growth in the 1,3-dibromoadamantane market, with a projected CAGR of 4.9% through 2035. British manufacturers and pharmaceutical companies have long been recognized for their emphasis on innovation, technical precision, and adherence to strict quality standards. These attributes drive consistent demand for premium intermediates such as dibromoadamantane, which play a key role in pharmaceutical synthesis and emerging specialty applications. The UK’s strong base of academic research institutions and specialized chemical development facilities supports innovation and ensures a steady pipeline of advanced synthesis technologies. While the UK market is not as large in scale as China or the USA, its focus on specialized, high-value chemical solutions makes it a vital contributor to the global dibromoadamantane landscape. The government’s continued support for pharmaceutical and chemical innovation through funding, R&D tax credits, and strategic life sciences initiatives helps market momentum. British companies are increasingly emphasizing purity optimization and synthesis efficiency, ensuring competitiveness in both domestic and international markets. This steady focus on quality, specialization, and innovation underpins the UK’s stable role in the global 1,3-dibromoadamantane industry.

The 1,3-dibromoadamantane market in Japan is projected to grow steadily at a CAGR of 4.4% through 2035, underpinned by the country’s reputation for pharmaceutical manufacturing excellence and advanced chemical expertise. Japanese manufacturers are recognized globally for their commitment to precision, purity, and high-performance chemical solutions, making dibromoadamantane a key component in domestic and export-driven pharmaceutical synthesis. The country’s chemical industry has long been associated with reliability and innovation, enabling Japanese companies to command a premium in international markets for their high-quality intermediates. At the same time, ongoing investment in next-generation synthesis technologies is reinforcing Japan’s ability to remain competitive in specialty chemical markets. Pharmaceutical companies in Japan are also leveraging their reputation for quality to strengthen global partnerships, particularly in North America and Europe, where demand for advanced intermediates continues to rise. Government initiatives aimed at bolstering pharmaceutical R&D and encouraging the adoption of advanced synthesis technologies are expected to further expand the use of dibromoadamantane. While growth rates are modest compared to emerging economies, Japan’s focus on precision-driven innovation, international market credibility, and pharmaceutical excellence ensures its continued relevance in the global dibromoadamantane landscape.

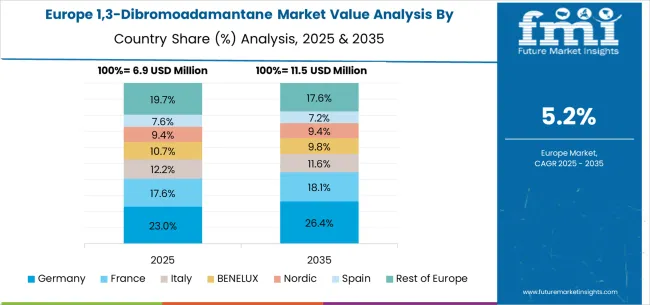

The 1,3-dibromoadamantane market in Europe is projected to grow from USD 7.6 million in 2025 to USD 13.4 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership position with a 38.2% market share in 2025, remaining stable at 38.5% by 2035, supported by its advanced chemical technology sector, pharmaceutical manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 24.3% share in 2025, projected to reach 24.6% by 2035, driven by specialized chemical technology development programs, advanced pharmaceutical capabilities, and a growing focus on high-purity synthesis solutions for premium applications. France holds a 16.9% share in 2025, expected to maintain 16.7% by 2035, supported by advanced pharmaceutical demand and chemical technology applications, but facing challenges from market competition and economic considerations. Italy commands an 11.4% share in 2025, projected to reach 11.2% by 2035, while Spain accounts for 6.1% in 2025, expected to reach 6.2% by 2035. The Netherlands maintains a 3.1% share in 2025, growing to 2.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 15.2% in 2025, declining slightly to 14.9% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced chemical markets balanced by slower growth in smaller countries implementing specialty chemical development programs.

The 1,3-dibromoadamantane market is characterized by competition among established chemical manufacturers, specialized fine chemical producers, and integrated synthesis solution suppliers. Companies are investing in advanced chemical synthesis technologies, purity enhancement systems, application-specific product development, and comprehensive technical support capabilities to deliver consistent, high-performance, and reliable dibromoadamantane products. Innovation in chemical purity optimization, synthesis efficiency enhancement, and customized application solutions is central to strengthening market position and customer satisfaction.

Matrix Fine Chemicals GmbH leads the market with a strong focus on advanced chemical synthesis innovation and comprehensive fine chemical solutions, offering sophisticated dibromoadamantane products with emphasis on chemical purity and industrial integration excellence. Anstar New Material Technology provides specialized material synthesis capabilities with a focus on pharmaceutical applications and global manufacturing networks. Chongqing maohuan Chemical delivers advanced chemical intermediate technology with a focus on innovation and premium product development. Butterfly New Materials specializes in advanced material synthesis with emphasis on technical expertise and application optimization. Hefei Heyu Chemical New Materials focuses on chemical technology and synthesis solutions. Win-Win chemical emphasizes industrial chemical expertise with a focus on synthesis integration and operational reliability. Tianjin Minxiang Biomedical concentrates on pharmaceutical-grade chemical intermediates with specialized synthesis capabilities.

The 1,3-dibromoadamantane market sits at the intersection of pharmaceutical innovation, fine chemical development, and specialty synthesis applications. With global demand driven by API production, specialty materials, and chemical intermediates, coordinated contributions across stakeholders are critical to ensure scalable production, regulatory compliance and innovation adoption.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Pharma-Tech Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 29.7 million |

| Purity Grade | Purity 98%, Purity 99% |

| Application | Photosensitive Material, Pharmaceutical Synthesis, Fine Chemicals |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Matrix Fine Chemicals GmbH, Anstar New Material Technology, Chongqing maohuan Chemical, Butterfly New Materials, Hefei Heyu Chemical New Materials, Win-Win chemical, and Tianjin Minxiang Biomedical |

| Additional Attributes | Dollar sales by purity grade and application, regional demand trends, competitive landscape, technological advancements in chemical synthesis, pharmaceutical development initiatives, purity optimization programs, and synthesis integration enhancement strategies |

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

The global 1,3-dibromoadamantane market is estimated to be valued at USD 29.7 million in 2025.

The market size for the 1,3-dibromoadamantane market is projected to reach USD 52.2 million by 2035.

The 1,3-dibromoadamantane market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in 1,3-dibromoadamantane market are purity 98% and purity 99%.

In terms of application, photosensitive material segment to command 45.2% share in the 1,3-dibromoadamantane market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA