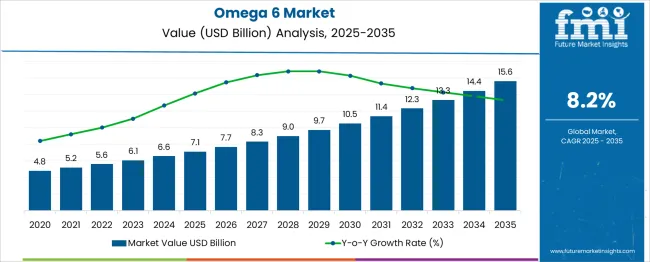

The Omega-6 Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth reflects rising interest in functional nutrition, dietary supplementation, and fortified food categories that use omega-6 fatty acids as essential ingredients for metabolic and cellular health. Between 2025 and 2030, the market is projected to increase to USD 10.5 billion, capturing a five-year absolute gain of USD 3.4 billion, roughly 40% of the entire value expansion anticipated through 2035.

Year-over-year growth remains stable, with incremental gains averaging USD 0.6–0.8 billion annually during this period.

Much of this demand is driven by growing consumer awareness of linoleic acid’s role in cardiovascular function, skin health, and hormonal regulation. Nutraceuticals and fortified edible oils continue to dominate consumption, while clinical nutrition and infant formula applications provide a secondary boost. Emerging economies in the Asia-Pacific and Latin America are contributing significantly to volume growth, supported by evolving dietary patterns and increased healthcare spending. As clean-label preferences rise, the focus is shifting toward high-purity, plant-derived omega-6 sources, creating long-term value for manufacturers aligned with transparency and quality assurance.

| Metric | Value |

|---|---|

| Omega-6 Market Estimated Value in (2025 E) | USD 7.1 billion |

| Omega-6 Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The Omega 6 market is experiencing robust expansion, driven by heightened demand for essential fatty acids in functional nutrition, therapeutic formulations, and personal health management. As scientific literature continues to support the physiological benefits of Omega 6, particularly its role in regulating metabolism, immune response, and cellular health, consumer and clinical interest has grown substantially. Regulatory approvals for safe dietary intake, combined with a surge in clean-label and plant-derived ingredient sourcing, have made Omega 6 a staple in fortified food products and nutraceuticals.

Technological advancements in oil extraction and fatty acid stabilization have improved product efficacy and shelf life, fostering broader adoption across food, beverage, and supplement formulations. Additionally, the rising prevalence of lifestyle-related disorders and increased focus on cardiovascular and joint health have propelled long-term use.

Emerging economies are also contributing to demand growth as disposable incomes rise and consumer access to fortified health products expands. Strategic investments by producers in sustainable sourcing and supply chain traceability are expected to further drive market credibility and growth.

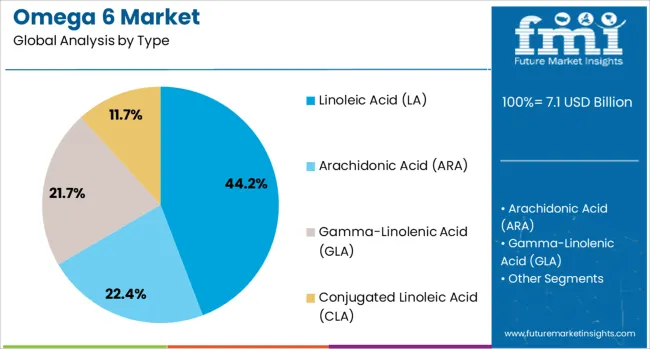

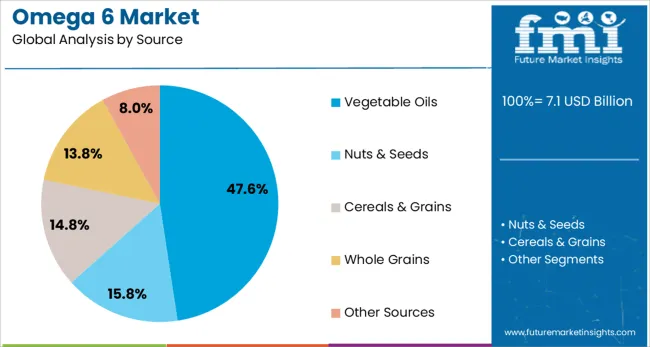

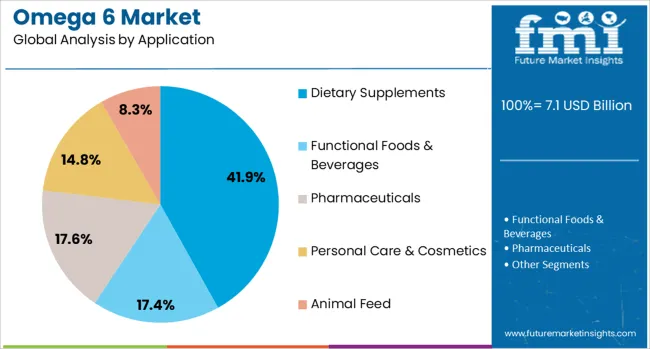

The omega-6 market is segmented by type, source, application, distribution channel, end-use industry, and geographic regions. By type, the omega-6 market is divided into Linoleic Acid (LA), Arachidonic Acid (ARA), Gamma‑Linolenic Acid (GLA), and Conjugated Linoleic Acid (CLA). In terms of source, the omega-6 market is classified into Vegetable Oils, Nuts & Seeds, Cereals & Grains, Whole Grains, and Other Sources. Based on application, the omega-6 market is segmented into Dietary Supplements, Functional Foods & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Animal Feed. By distribution channel, the omega-6 market is segmented into Retail, Online Retail, Foodservice, and Direct Sales.

By end-use industry, the omega-6 market is segmented into Human Nutrition, Pharmaceutical, Cosmetic & Personal Care, and Animal Nutrition. Regionally, the omega-6 industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The linoleic acid segment is expected to hold 44.2% of the total revenue share in the Omega 6 market in 2025, making it the leading type by a significant margin. This dominance is being driven by its critical role as a polyunsaturated omega fatty acid essential for skin barrier function, inflammation modulation, and cardiovascular support. Its high bioavailability and functional compatibility with other nutrients have made it a preferred active in dietary supplements and fortified foods.

The segment's growth is being supported by increasing consumer inclination toward natural and plant-derived health solutions, especially those backed by clinical research and safety data. The growing inclusion of linoleic acid in skincare and therapeutic nutrition products has further strengthened its market position.

Additionally, the segment has benefited from wide-scale industrial processing from cost-effective agricultural sources, enabling consistent supply and integration in diverse product categories. Regulatory endorsement of linoleic acid as a generally recognized safe (GRAS) ingredient has also reinforced its use across regional markets with rising nutritional awareness.

Vegetable oils are projected to account for 47.6% of the Omega 6 market revenue share in 2025, emerging as the dominant source category. This leadership is attributed to their widespread availability, cost-efficiency, and naturally high concentrations of Omega-6 fatty acids, particularly linoleic acid. Sunflower, soybean, corn, and safflower oils are among the most utilized sources, often preferred due to their scalability and compatibility with both food-grade and nutraceutical applications.

The segment has seen continued growth as food and supplement manufacturers seek clean-label, plant-based alternatives aligned with consumer expectations for sustainable sourcing. Vegetable oils have also been instrumental in facilitating mass-market adoption of Omega 6, especially in economies with evolving health standards and regulatory clarity on functional food ingredients.

Technological improvements in oil refining, deodorization, and cold-press extraction have elevated product quality and nutrient retention, further supporting demand. Strategic partnerships and vertical integration among oil producers, formulators, and health food brands are reinforcing the segment’s growth trajectory.

The dietary supplements segment is expected to capture 41.9% of the Omega 6 market’s revenue share in 2025, maintaining its lead as the top application. The segment’s growth is being driven by escalating consumer demand for targeted wellness solutions addressing cardiovascular health, immune resilience, and inflammatory balance. Omega-6-enriched supplements have become a mainstay in daily health regimens, particularly among aging populations and individuals seeking preventative nutrition.

The rise in e-commerce and direct-to-consumer health platforms has increased accessibility and market penetration for Omega 6 formulations in capsule, softgel, and powdered formats. Advances in formulation technology, including microencapsulation and synergistic blending with Omega 3 and antioxidants, have enhanced bioavailability and efficacy, strengthening consumer trust and repeat purchase behavior.

Increasing clinical validation of Omega-6’s role in metabolic health and hormonal regulation has further driven demand. The segment is also benefiting from rising investment by nutraceutical brands in research-based marketing and product innovation tailored to lifestyle-specific health outcomes.

Growing awareness of omega-6 fatty acids’ health benefits fuels demand across food, supplements, and animal nutrition. Expanding applications and improved formulations continue to drive steady market growth.

Consumers increasingly seek functional foods and supplements that support heart and brain health, prompting manufacturers to incorporate omega-6 fatty acids into a wide variety of products. Oils rich in omega-6, such as sunflower, safflower, and corn oil, find their way into fortified beverages, cooking oils, snack bars, and capsules. Producers focus on balancing omega-6 with omega-3 to meet evolving dietary preferences. This trend pushes companies to innovate with blends that enhance taste and stability while preserving nutritional value. As consumers become more nutrition-aware, especially in North America and Europe, fortified foods and supplements serve as convenient delivery vehicles for omega-6. This growing consumer-driven demand encourages companies to expand product portfolios, which in turn supports market expansion globally.

Omega-6 fatty acids are widely used in animal feed to improve livestock growth, reproduction, and immunity, resulting in better meat, milk, and egg quality. Feed manufacturers add omega-6-rich oils to enhance nutritional content, supporting the rising demand for high-protein animal products. Meanwhile, pharmaceutical companies explore omega-6’s role in managing inflammation and skin health, integrating it into topical creams and nutritional therapies. Research on omega-6’s health effects stimulates new applications, especially in chronic disease management. This growing interest across animal nutrition and pharmaceuticals creates additional demand streams, making omega-6 a versatile ingredient. The combined effect of these sectors’ adoption contributes to consistent market growth and drives investments in sourcing and refining omega-6 fatty acids.

Consumers and health professionals have increasingly scrutinized dietary omega‑6 to omega‑3 ratios, often exceeding 15:1 in Western diets. This imbalance is linked to inflammatory signaling and metabolic disorders, causing some to reduce intake of omega‑6-rich sources. Health claims for omega‑6 products face scrutiny in regulatory review, limiting promotional language and requiring stronger scientific validation. Manufacturers find marketing channels constrained unless they clarify dosage balance with omega‑3. Raw material buyers may opt for omega‑3-focused blends or reduce marketing emphasis on omega‑6 concentration. Educational outreach remains limited in emerging regions, suppressing uptake of omega‑6 products in functional categories. Omega‑6 producers that do not address consumer perception issues risk losing share in nutraceuticals and functional food segments where balanced fatty-acid messaging is becoming crucial

The Omega‑6 market holds significant potential in functional foods and animal nutrition segments due to its vital role in cell function, immunity, and fat metabolism. Manufacturers are incorporating linoleic acid from sunflower, soybean, and safflower oil into protein bars, meal replacements, plant-based beverages, and ready-to-eat foods. In livestock and aquaculture, Omega‑6 additives enhance feed conversion and animal health, helping producers meet quality standards. The inclusion of gamma-linolenic acid in veterinary nutrition and pet food also opens new revenue streams. Emerging markets with growing middle-class populations and dietary transitions present a prime opportunity for fortified products. Product developers that offer Omega‑6 formulations in clean-label, non-GMO, or organic-certified formats enjoy an advantage with health-conscious buyers. Additionally, integrating Omega‑6 into combined lipid delivery systems with Omega‑3 or Omega‑9 enhances product flexibility for nutrition brands. As demand grows in diverse end-use categories, the market is poised for expansion through cross-sector innovation.

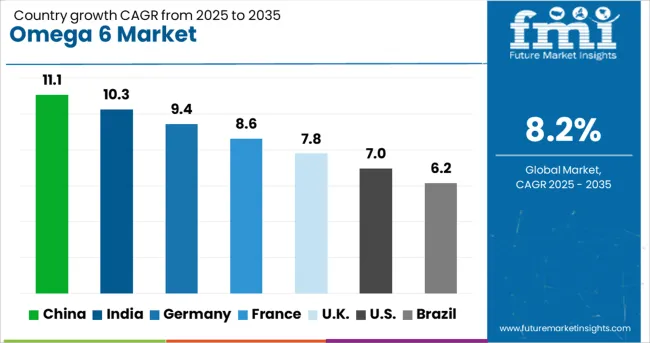

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global Omega 6 Market is expected to expand at a CAGR of 8.2% through 2035, supported by growing demand in food supplements, pharmaceuticals, and cosmetic formulations. Among BRICS nations, China leads with an 11.1% growth rate, driven by increased production capacity and rising domestic consumption. India follows with 10.3%, where agricultural processing and edible oil extraction have been scaled up. In the OECD region, Germany exhibits 9.4% growth, supported by established nutraceutical industries and stringent quality control measures. France, growing at 8.6%, has seen steady expansion due to dietary supplement demand and food fortification programs. The United Kingdom, at 7.8%, reflects ongoing use in personal care products and health food sectors. Market trends have been influenced by regulatory frameworks governing purity standards, import-export controls, and labeling requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The Omega 6 market in China is projected to grow at a CAGR of 11.1%, driven by increased incorporation in dietary supplements, infant formula, and functional foods. High-purity linoleic acid extracts have been introduced into fortified cooking oils and bakery products. Production capacity expansions have been undertaken to meet rising demands from nutraceutical manufacturers and food processors. Emulsified Omega 6 formulations are being developed for enhanced bioavailability in beverages and dairy products. Raw material sourcing from domestically grown oilseed crops has been optimized to ensure supply consistency. Packaging innovations have been adopted to extend shelf life and preserve fatty acid integrity during distribution. Quality testing protocols have been enforced to maintain compliance with national food safety regulations. Collaborative efforts between suppliers and food producers have resulted in expanded application in snack bars and ready-to-eat meals.

In India, Omega 6 market is expected to grow at a CAGR of 10.3%, fueled by increasing demand in edible oils, fortified foods, and traditional medicine formulations. Cold-pressed and refined oil varieties rich in Omega 6 fatty acids have been adopted by food processors catering to health-conscious consumers. Bulk Omega 6 fatty acid concentrates are being supplied to dietary supplement manufacturers. Packaging formats with oxygen barrier properties are being introduced to preserve product quality during storage. Demand from Ayurvedic product lines and herbal supplement producers has expanded, integrating Omega 6 as a key ingredient. Quality control measures for peroxide value and fatty acid profiles are being standardized across regional production units. Collaboration with agricultural cooperatives has ensured steady supply of oilseeds with favorable Omega 6 content.

In Germany, the Omega 6 market is growing at a CAGR of 9.4%, supported by applications in functional nutrition, dietary supplements, and pharmaceutical intermediates. Concentrated linoleic acid blends have been incorporated into fortified dairy and bakery products. Liquid Omega 6 emulsions have been utilized in beverage formulations targeting cardiovascular health. Extraction processes have been refined to reduce residual solvents and enhance purity levels. Compliance with European food safety standards has been prioritized through enhanced quality testing and traceability systems. Demand from clinical nutrition sectors and elderly care food manufacturers has increased. Packaging systems that minimize light and oxygen exposure have been implemented. Strategic partnerships between raw material suppliers and specialty food producers have been developed to broaden application scopes.

Omega 6 market in France is expanding at a CAGR of 8.6%, driven by inclusion in nutritional supplements, infant nutrition, and culinary oils. Refined Omega 6 oils with tailored fatty acid profiles have been supplied to premium food producers. Cold-extraction methods have been applied to preserve natural antioxidants and flavor profiles. Bulk Omega 6 concentrates are being delivered to pharmaceutical intermediaries and cosmeceutical manufacturers. Stability-enhancing packaging with UV protection has been adopted to maintain oil integrity. Use in bakery and confectionery sectors has grown, with customized Omega 6 blends developed for specific applications. Rigorous testing for oxidation stability and fatty acid composition has been standardized across production sites. Partnerships with oilseed cultivators have secured consistent feedstock quality.

The Omega 6 market in the United Kingdom is progressing at a CAGR of 7.8%, supported by demand from functional food manufacturers, dietary supplements, and infant nutrition product lines. Microencapsulated Omega 6 powders have been incorporated into bakery mixes and beverage powders for improved shelf life and mixing ease. Specialized Omega 6 oil blends have been developed for incorporation into meal replacement products and sports nutrition formulas. Quality assurance protocols involving peroxide value and fatty acid profile monitoring have been widely adopted. Collaboration between ingredient suppliers and food formulators has led to novel applications in ready-to-drink nutritional beverages. Packaging formats designed to protect against oxidation and light exposure have been introduced across supply chains. Market penetration efforts have been directed towards health-conscious consumers seeking balanced fatty acid intake.

The Omega-6 market is shaped by a mix of global chemical giants, nutritional innovators, and niche supplement providers catering to a wide range of end-use industries. BASF SE stands out as a dominant player, offering an extensive portfolio of omega-6 fatty acids that serve the food, cosmetics, and pharmaceutical sectors. Its success is attributed to advanced lipid extraction technologies and a robust global supply chain that ensures consistent quality and delivery.

Koninklijke DSM N.V. is another prominent supplier, producing high-purity omega-6 ingredients commonly integrated into dietary supplements, fortified foods, and clinical nutrition products. Their focus on traceability and quality assurance appeals to both health-conscious consumers and regulatory-sensitive markets. MilliporeSigma, operating under the Merck Group, plays a specialized role in supplying research-grade omega-6 derivatives for laboratory and life sciences use, while Polaris Nutritional Lipids delivers customized solutions for infant nutrition and functional food applications. Aker BioMarine brings a unique marine-based offering to the market, using sustainable krill harvesting and natural extraction techniques to cater to clean-label demands.

On the consumer side, OmegaVia is recognized for its targeted omega-6 supplement lines designed to support joint, skin, and cardiovascular health, combining formulation science with direct-to-consumer accessibility. These suppliers shape a highly diversified market, where each tier contributes value through specialization, whether it’s large-scale industrial production, bioavailability-focused nutrition, or pharma-grade applications. The market’s evolution is closely linked to rising health awareness, personalized nutrition trends, and expanding functional food categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| Type | Linoleic Acid (LA), Arachidonic Acid (ARA), Gamma‑Linolenic Acid (GLA), and Conjugated Linoleic Acid (CLA) |

| Source | Vegetable Oils, Nuts & Seeds, Cereals & Grains, Whole Grains, and Other Sources |

| Application | Dietary Supplements, Functional Foods & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Animal Feed |

| Distribution Channel | Retail, Online Retail, Foodservice, and Direct Sales |

| End-Use Industry | Human Nutrition, Pharmaceutical, Cosmetic & Personal Care, and Animal Nutrition |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASFSE, KoninklijkeDSMN.V., MilliporeSigma(MerckGroup), PolarisNutritionalLipids, AkerBiomarine, and OmegaVia |

| Additional Attributes | Dollar sales by Omega-6 types including linoleic acid, gamma-linolenic acid, and conjugated linoleic acid, by end-use in food, supplements, cosmetics, and animal feed, and by geographic region such as North America, Europe, and Asia-Pacific; demand driven by health trends and disease prevention; innovation in purified and sustainable oils; costs influenced by raw material prices; emerging applications in personalized nutrition and skincare. |

The global omega-6 market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the omega-6 market is projected to reach USD 15.6 billion by 2035.

The omega-6 market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in omega-6 market are linoleic acid (la), arachidonic acid (ara), gamma‑linolenic acid (gla) and conjugated linoleic acid (cla).

In terms of source, vegetable oils segment to command 47.6% share in the omega-6 market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA