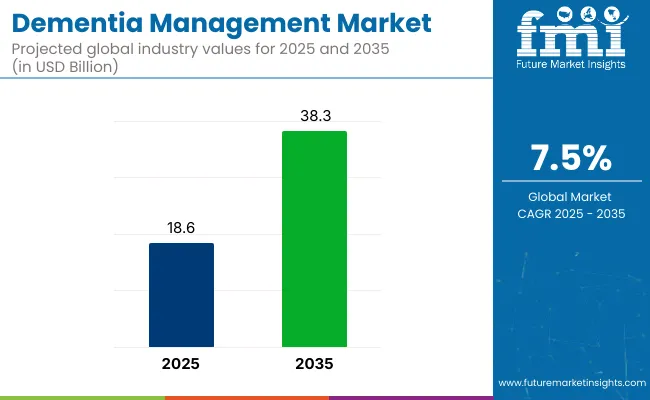

The global Dementia Management Market is estimated to be valued at USD 18.6 billion in 2025 and is projected to reach USD 38.3 billion by 2035, registering a compound annual growth rate of 7.5% over the forecast period.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 18.6 billion |

| Projected Industry Value (2035F) | USD 38.3 billion |

| CAGR (2025 to 2035) | 7.5% |

The dementia management market is rapidly evolving due to rising dementia cases, particularly among the elderly, and the growing need for early diagnosis and personalized care. Advancements in AI, wearable monitoring, and digital therapeutics are transforming care delivery, improving early detection, enabling remote supervision, and reducing caregiver burden.

Integrated care models that involve collaboration among healthcare providers, caregivers, and support services are gaining traction to ensure holistic treatment. Although the market faces challenges like high treatment costs, unequal access, and persistent stigma, growth prospects remain strong. Government support, continuous R&D, and digital health adoption are driving a shift toward proactive, patient-centric care models creating new avenues for innovation and improving the quality of life for dementia patients globally.

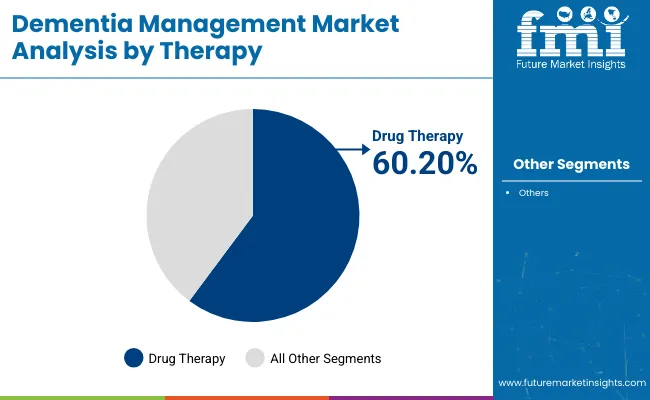

Drug Therapy is expected to hold 60.20% revenue share and remains as a dominant contributor to the dementia management market in 2025. This prominence has been driven by the clinical necessity of pharmacological treatments for managing cognitive decline and behavioral symptoms associated with progressive dementias.

The use of Cholinesterase inhibitors and NMDA receptor antagonists has remained standard protocol, particularly in Alzheimer’s care pathways. Additionally, increased investments by biopharma companies in pipeline drugs and disease-modifying therapies have enhanced innovation.

Treatment adherence has been supported by physician recommendations and established regulatory approvals. Continuous R&D efforts and government-supported access programs have also reinforced this segment's uptake. The trust in evidence-based pharmacological care has contributed to sustained market penetration, establishing this category as an indispensable component of dementia treatment plans.

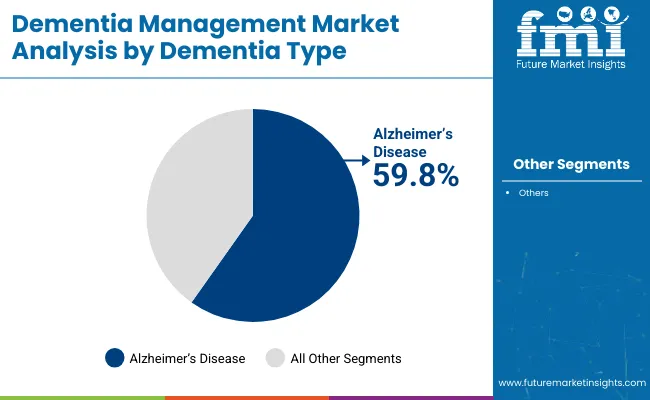

Alzheimer’s Disease accounting for 59.8% revenue share, has remained the most prominent dementia type within the market in 2025. This dominance has been attributed to its widespread prevalence globally, especially among aging populations in developed and emerging economies.

The segment has benefited from strong diagnostic awareness, long-term caregiver support frameworks, and large-scale clinical research initiatives funded by both public and private entities. Increased disease recognition, coupled with the availability of structured treatment regimens, has further solidified its lead.

Ther apeutic advancements, especially in slowing cognitive decline, have primarily focused on Alzheimer’s, thereby channeling most pharmaceutical and non-pharmaceutical innovations toward this subset. As a result, Alzheimer’s Disease Dementia has been viewed as the most clinically and commercially significant target within the dementia ecosystem.

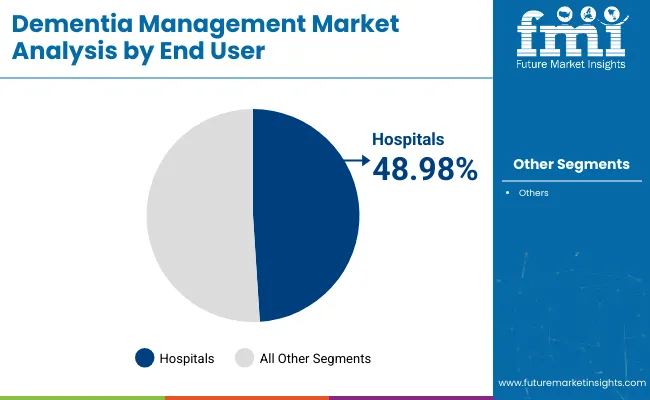

Hospital settings leads the end user segments holding 48.98% revenue share in 2025. This segment act as first-point diagnosis facility and are equipped with comprehensive cognitive assessments and along with prescribed pharmacological therapy.

Specialized neurology departments and trained clinicians have been instrumental in initiating care pathways, especially for newly diagnosed patients. Furthermore, centralized access to multidisciplinary teams neurologists, geriatricians, and psychiatrists has enhanced care coordination, improving outcomes in early and mid-stage dementia cases.

Higher funding for institutional healthcare infrastructure, especially in urban and semi-urban regions, has also contributed to this segment’s sustained dominance. The preference for structured and standardized diagnosis workflows has reinforced the position of hospitals and clinics in the overall care continuum.

High Treatment Costs and Limited Early Diagnosis Capabilities

In the field of dementia management, one major problem is the high cost for treatment and caregiving, especially long-term care at home in advanced cases of dementia. Neuroimaging services that use highly sophisticated techniques to diagnose dementia are also expensive for sufferers of the disease.

Very few patients in low-income countries can get onto more advanced use of treatment methods such as this, so early intervention and management of chronic diseases become impossible.

The instant recognition of symptoms and general availability of early diagnosis is a continuing challenge. Standardized dementia management protocols are not then available across all medical systems; this can have an impact on levels of care as well as therapeutic effects.

AI-Driven Diagnostics, Wearable Health Monitoring, and Drug Innovations

The Dementia Management Market presents significant growth opportunities, but challenges remain. Dementia screening tools based on artificial intelligence (AI) have evolved. The development of hardware-assisted programs has substantially augmented early disease detection and risk assessment. New models using machine learning techniques for speech analysis, eye movement tracking and gait recognition help in identifying potential Alzheimer's sufferers sooner.

Disease monitoring for patients is getting better and better. It is increasingly possible to measure various health variables over extended periods using wearable technologies. Examples include pharmaceutical and non-pharmaceutical intervention forms. Future developments in digital therapeutics (DTx), cognitive training apps, and virtual reality (VR)-based cognitive rehabilitation promise that we will soon see more non-drug dementia management solutions.

Pharmaceutical breakthroughs include new treatments in the fight against amyloids and tau proteins (lex), gene editing research, and regenerative medicine approaches expand the range of potential treatment options. Combined therapy strategies and precisely targeted approaches based on individual genetic predispositions are expected to end an entire era in traditional aging care services where dementia has lost all meaning.

The smart home trend has arrived, talking appliances that can remind people to take their medicine, AI “Angel”-like personal assistants which never leave your side and 100% safe home safety monitoring (for fire alarm statistics see Safe@Home).

As the United States Dementia Management Market continues on the rise, increasing dementia prevalence, substantial investment in cognitive health research and digital therapeutics advances are all helping drive its growth. The Alzheimer’s Association and the National Institute on Aging (NIA) are underwriting clinical trials, early diagnosis programs and AI-powered dementia care solutions.

Telemedicine, wearable monitoring devices and AI-driven cognitive assessment tools are increasing patient support. Home-based care services expanding and government-sponsored dementia management programs are now along the way of introduction to facilitate access for patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The Dementia Management Market in the United Kingdom is expanding due to growing government initiatives for dementia care, increasing research funding and the rise of smart healthcare solutions. The UK National Health Service (NHS) and the Dementia Research Institute are both focused on early intervention strategies, digital health solutions as well as family support programs for caregivers.

AI-powered dementia diagnostics, personalized therapy solutions and digital tools to enhance memory for dementia sufferers now proliferate markets. In addition, remote patient monitoring and applications of behavioural therapy are driving demand in the market further.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

As investment in neurological research capital, the increasing aging population and strong regulatory support for dementia-friendly healthcare systems amid the European Union's market grew more steadily. Breakthroughs in dementia diagnosis and care innovations are funded by the European Brain Research Institute (EBRI) and Horizon Europe program.

Advanced dementia treatment facilities, digital health integration and AI-assisted cognitive therapy programs is leading the way in Germany, France, and Italy. In addition, the adoption of non-pharmacological interventions - such as music and art therapy - in dementia management is expanding across Europe's care centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

The rise in the Dementia Management Market in Japan is mainly due to an aging population, strong government support for dementia research and the widespread use of robotic elderly care. To prevent and provide early intervention for dementia, the Japanese Ministry of Health, Labor and Welfare (MHLW) has set up related programs through the country.

Due to AI-powered robotic caregivers, brain training apps, as well as digital dementia risk assessment tools, patient care is being improved. In addition, the development of neuroprotective drugs and wearable health monitoring solutions is driving market growth further forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

For South Korea's Dementia Management Market, blooming government dementia awareness programmes increasing telemedicine investment and AI-assisted healthcare technology advances are all injecting impetus into wheal development. The Ministry of Health and Welfare in South Korea is calling on people to "catch the very early stage of dementia", putting an emphasis on cognitive rehabilitation programmes.

South Korea's smart-home solutions include dementia monitoring which can adapt itself to individual needs, cognitive therapy services that are tailored personally and wearable devices with built-in bio-measurement functions. Now, to top that, healthcare provision for dementia patients is involving AI-driven virtual assistants.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

The dementia management market is becoming increasingly competitive as companies invest in innovative therapies, digital health solutions, and personalized care models. Firms are prioritizing the development of disease-modifying drugs and non-pharmacological tools, including AI-driven cognitive platforms and wearable monitoring devices.

Strategic partnerships with research institutions and tech startups are accelerating product development and clinical validation. In addition, efforts are being made to expand geographic reach through regulatory approvals and localized distribution strategies.

Real-world data, caregiver-focused support services, and value-based care delivery are becoming key differentiators. This competitive shift reflects a broader industry movement toward holistic, patient-centered dementia care that integrates pharmaceutical, technological, and behavioral health interventions for better clinical and economic outcomes.

Key Development

In 2024, Eisai and Biogen's Leqembi® (lecanemab) has received Marketing Authorization from the MHRA in Great Britain. This marks the first treatment for early Alzheimer's disease (AD) in Europe to target an underlying cause. It's indicated for adult patients with mild cognitive impairment or mild dementia due to AD who are apolipoprotein E ε4 heterozygotes or non-carriers.

In 2024, The FDA has approved Eli Lilly's Kisunla™ (donanemab-azbt), a once-monthly IV infusion for adults with early symptomatic Alzheimer's disease and confirmed amyloid pathology. Kisunla is the first amyloid plaque-targeting therapy with evidence to support stopping treatment once plaques are removed, potentially lowering costs and reducing infusions.

The overall market size for the Dementia Management Market was USD 18.6 Billion in 2025.

The Dementia Management Market is expected to reach USD 38.3 Billion in 2035.

Increasing global prevalence of dementia, advancements in drug development and digital health solutions, and rising investments in elderly care services will drive market growth.

The USA, Japan, Germany, China, and the UK are key contributors.

Alzheimer’s disease Dementia and Vascular Dementia, are expected to lead in the Dementia Management Market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frontotemporal Dementia (FTD) Management Market – Trends & Future Outlook 2025 to 2035

The Dementia Care Products Market is segmented by Memory Exercise & Activity Products, Daily Reminder Products and Dining Aids from 2025 to 2035

Vascular Dementia Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel, and Region through 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA