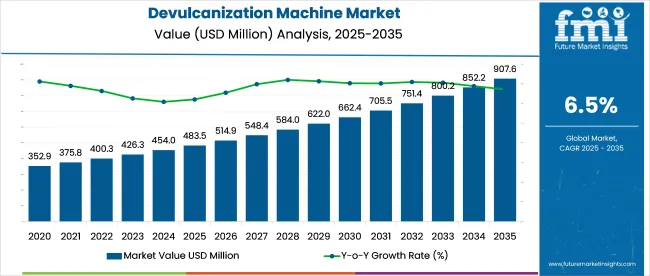

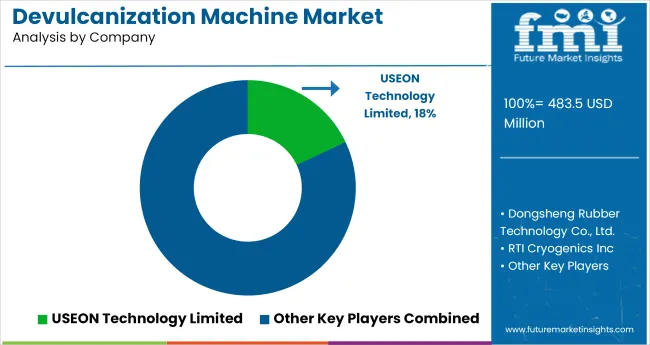

The devulcanization machine market is estimated to grow from USD 483.5 million in 2025 to USD 907.6 million by 2035, reflecting a CAGR of 6.5% during the assessment period. The devulcanization machine market is expanding rapidly as industries prioritize rubber recycling to cut costs and meet sustainability goals.

Advanced systems now recover up to 95% of cross-linked sulfur bonds while retaining the polymer backbone, making the reclaimed rubber suitable for use in tires, gaskets, and industrial flooring. Modern microwave-based machines are delivering energy efficiency gains of up to 40% compared to conventional thermal processes.

In North America, large-scale facilities are processing more than 20,000 tons of rubber annually, with AI-integrated machines improving consistency and reducing waste. Asia-Pacific has increased its devulcanization capacity by over 50% in the past year, with hybrid chemical-mechanical technologies enhancing reclaim quality by 45%.

Tire manufacturers are entering partnerships with recycling plants to track material flow using RFID-tagged tires, pushing material recovery rates above 80%. These developments are fueling demand for high-throughput, precision-controlled machinery that aligns with both ESG targets and rising circular economy benchmarks.

As of 2025, the devulcanization machine market holds a specialized yet crucial share within its broader parent markets. Within the global rubber recycling equipment market, devulcanization machines account for approximately 15% to 20%, driven by growing demand for recycled rubber feedstock. In the tire recycling market, their share stands at 10-12%, as they enable eco-friendly reprocessing of end-of-life tires.

Within the industrial machinery market, devulcanization equipment represents about 1-2%, reflecting its niche application. In the waste management equipment market, its contribution is around 3-4%, given its role in circular economy initiatives. In the sustainable manufacturing technologies market, devulcanization machines hold roughly 5-6%, reflecting increasing adoption by manufacturers seeking greener processes.

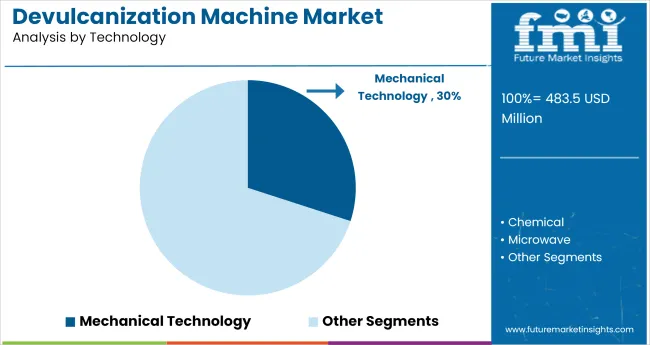

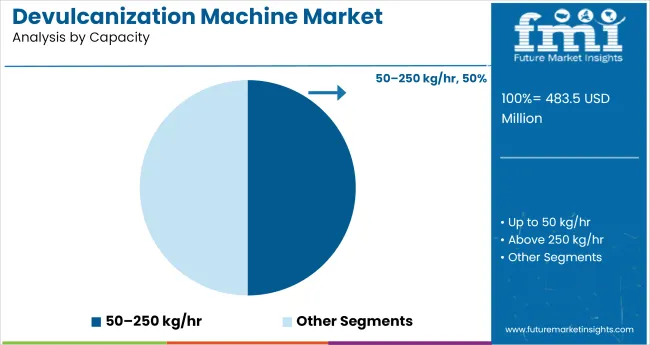

Mechanical technology is set to dominate the devulcanization technology segment with a 30% market share by 2025. Machines with a capacity range of 50-250 kg/hr will lead capacity-based sales with a 50% share.

Mechanical devulcanization is expected to account for 30% of global revenue by 2025, driven by its cost-efficiency and widespread compatibility with various rubber feedstocks. Operators prefer mechanical systems due to minimal chemical use, aligning with environmental regulations and circular economy goals.

Machines with a capacity of 50-250 kg/hr are projected to contribute 50% of market share by 2025, reflecting high demand from small and mid-sized reclaimers. This capacity range supports continuous processing while offering lower energy consumption and capital investment.

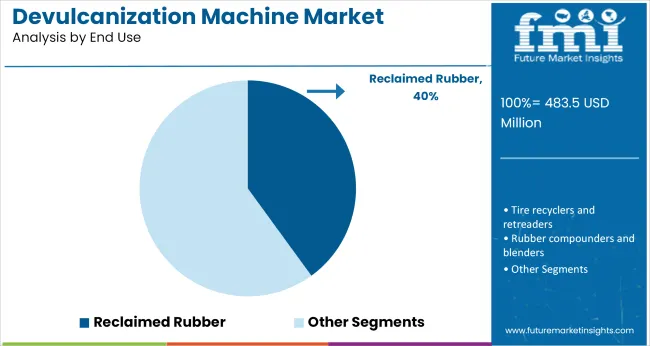

Reclaimed rubber manufacturers are anticipated to hold 40% market share by 2025, as they scale up operations to meet circular economy targets. Devulcanization machines are key tools in converting tire scrap and industrial rubber waste into high-quality secondary raw material.

The market is witnessing significant traction as sustainability regulations and circular economy targets reshape the rubber recycling industry. In 2024, over 1.2 million tons of waste rubber were processed globally using devulcanization technologies.

Energy Efficiency and Emission Control Driving Equipment Design

Manufacturers are focusing on low-emission, energy-optimized machinery to meet global environmental standards. Steam-based and microwave devulcanization systems now account for over 42% of new installations due to lower carbon output. Retrofitting with VOC scrubbers and energy recovery units is being done to meet EU and EPA mandates.

Customization and Automation Expanding Machine Utility

Automated process controls, modular layouts, and rubber-specific programming are being integrated to handle diverse feedstocks such as butyl, SBR, and NR. In 2024, over 33% of new machines featured AI-assisted process tuning for optimal devulcanization without chain degradation. Batch and continuous models are customized to meet specific throughput needs.

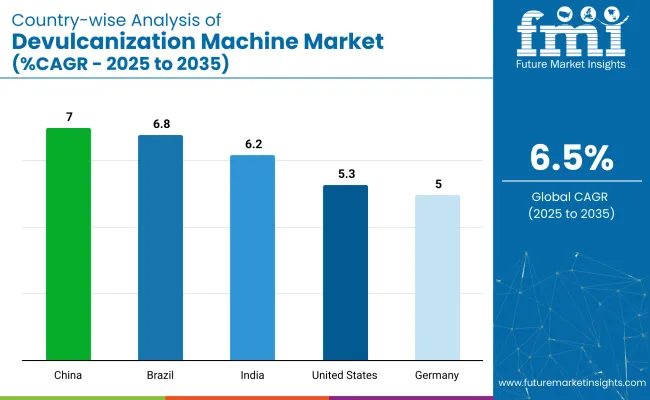

Country-wise CAGR Comparison (2025 to 2035)

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

| Brazil | 6.8% |

| India | 6.2% |

| United States | 5.3% |

| Germany | 5.0% |

The global market is expected to grow at a 6.5% CAGR from 2025 to 2035, yet country-wise growth is shaped by investment volume, end-use rubber recovery rates, and circularity mandates. China leads with a 7.0% CAGR, backed by over USD 400 million in provincial subsidies for tire recycling facilities and annual processing of 3.6 million metric tons of end-of-life rubber.

Over 70% of new devulcanization units sold in 2024 were installed in Shandong and Jiangsu provinces alone. Brazil follows at 6.8%, fueled by federal recycling credits (Reciclagem Brasil program) and 40+ operational plants targeting 150,000 tons of rubber reclamation annually.

India, growing at 6.2%, is scaling batch devulcanization units under the National Resource Efficiency Policy, with Tamil Nadu contributing 28% of the country’s reclaimed rubber capacity. In contrast, the USA (5.3%) and Germany (5.0%) reflect underperformance due to slower retrofit cycles and capped landfill diversion rates, both below 30% for industrial rubber waste.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in China is forecast to grow at a CAGR of 7.0% through 2035, driven by stringent government mandates on tire recycling under its Circular Economy Promotion Law. Over 330 million waste tires are generated annually, and major industrial zones like Shandong and Guangdong are investing in continuous devulcanization lines.

Manufacturers such as MESNAC and Huahan are deploying energy-efficient, closed-loop systems for reclaimed rubber production. Provincial subsidies and green tax credits are accelerating upgrades among tire shredders and crumb rubber plants.

Brazil is expected to grow at a CAGR of 6.8%, fueled by its 200,000+ tons annual waste tire generation and ANIP-backed tire disposal targets. Growth is concentrated in São Paulo and Minas Gerais, where rubber reclaimers are scaling operations to meet growing automotive and construction sector needs.

Local machine builders are innovating microwave and chemical devulcanization systems with improved emission control. Public tenders are including tire-derived rubber in asphalt and flooring contracts, boosting machine utilization across municipal recycling plants.

India is projected to grow at a CAGR of 6.2% through 2035, driven by policies under the EPR (Extended Producer Responsibility) framework and the expansion of its retreading and footwear sectors. Tier-2 cities are emerging as centers for decentralized devulcanization, supported by low-cost labor and availability of truck tire waste.

Domestic equipment makers in Gujarat and Punjab are offering modular, diesel-electric hybrid machines suited for mixed rubber input. Support from the Ministry of MSME is encouraging machinery upgrades in small-scale recycling clusters.

The USA market is forecast to grow at a CAGR of 5.3% through 2035, led by rising interest in sustainable rubber sourcing and high-performance recycled elastomers. Large-scale operators in California and Texas are investing in automated devulcanization lines with data monitoring and heat recovery systems.

EPA regulations on VOC emissions are shifting preference toward closed-chamber, non-chemical processes. Reclaimed rubber from devulcanized material is being used in molded parts, roofing membranes, and eco-friendly footwear components.

The market in Germany is projected to expand at a CAGR of 5.0% through 2035. Growth is supported by EU waste legislation and Germany’s strict rubber recycling directives, which require 100% recovery of post-consumer tire waste. Equipment manufacturers are developing ultrasonic and twin-screw extruder-based machines for precision control and energy efficiency.

Devulcanized rubber is gaining application in sports surfaces, automotive dampers, and sustainable building materials. Federal subsidies are being channeled into R&D for low-emission machinery.

The market is moderately fragmented, with both established global players and emerging regional firms contributing to technological innovation in rubber recycling. USEON Technology Limited and Dongsheng Rubber Technology Co., Ltd. are among the most recognized, offering continuous devulcanization systems that support high-throughput and energy efficiency.

These companies are widely adopted in the tire and industrial rubber recycling sectors. REP International and RTI Cryogenics Inc. bring specialty solutions for cold and cryogenic devulcanization, catering to industries seeking cleaner and less thermally intensive methods. MARIS and Qingdao Steady Machinery Co., Ltd. focus on twin-screw extruder-based systems, enhancing flexibility in processing various rubber feedstocks.

Recent Devulcanization Machine Industry News

In March 2024, the HEXPOL Group’s compounding division invested in a new mechanical devulcanization line at its Czech Republic facility. The installation will enable in‑house processing of cured rubber scrap, producing several thousand tons of reclaimed rubber annually and advancing its circular economy strategy.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 483.5 million |

| Projected Market Size (2035) | USD 907.6 million |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Technologies Analyzed (Segment 1) | Mechanical, Chemical, Microwave, Others (Ultrasonic, Organic) |

| Capacities Analyzed (Segment 2) | Up to 50 kg/ hr, 50 - 250 kg/ hr, Above 250 kg/ hr |

| End Uses Analyzed (Segment 3) | Reclaimed Rubber Manufacturers, Tire Recyclers & Retreaders, Rubber Compounders & Blenders, Industrial Rubber Goods Manufacturers, Other Specialized Processors |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | USEON Technology Limited, Dongsheng Rubber Technology Co., Ltd., RTI Cryogenics Inc, REP International, MARIS, Chun Cheong Rubber Machinery Co., Ltd., Qingdao Steady Machinery Co., Ltd., FONMAR, Julong |

| Additional Attributes | Dollar sales by technology and capacity, growing tire recycling initiatives, rising demand for sustainable rubber processing, and equipment upgrades driven by industrial-scale reclamation projects. |

The market is segmented by technology into mechanical, chemical, microwave, and others including ultrasonic and organic methods.

In terms of capacity, the market is divided into units handling up to 50 kg/hr, 50 to 250 kg/hr, and above 250 kg/hr.

Key end users include reclaimed rubber, tire recyclers and retreaders, rubber compounders and blenders, industrial rubber goods, and other specialized processors.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 483.5 million in 2025.

The market is projected to reach USD 907.6 million by 2035, growing at a CAGR of 6.5%.

Mechanical technology leads the market with a 30% share in 2025.

Machines with a capacity of 50-250 kg/hr hold the top position with a 50% share in 2025.

China is forecast to lead with a CAGR of 7.0% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Machine Learning As A Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA