The Bucket market is experiencing robust growth, driven by the increasing demand for efficient and durable storage and transportation solutions across industrial, commercial, and household applications. Rising adoption of lightweight, cost-effective, and corrosion-resistant materials is fueling market expansion, particularly in sectors such as paints and coatings, food processing, and chemicals. Advancements in material engineering and manufacturing processes have enhanced the performance, durability, and recyclability of buckets, making them increasingly suitable for multi-purpose use.

Growing awareness of environmental sustainability and regulatory emphasis on recyclable materials have further accelerated the adoption of plastic and other lightweight materials. The need for standardized and ergonomically designed containers that facilitate safe handling, storage, and transportation is shaping market dynamics.

Additionally, evolving packaging requirements and the increasing preference for ready-to-use solutions in industrial and consumer sectors are boosting demand As industries continue to prioritize operational efficiency, safety, and sustainability, the Bucket market is expected to witness sustained growth, supported by technological advancements in materials, design, and production processes.

| Metric | Value |

|---|---|

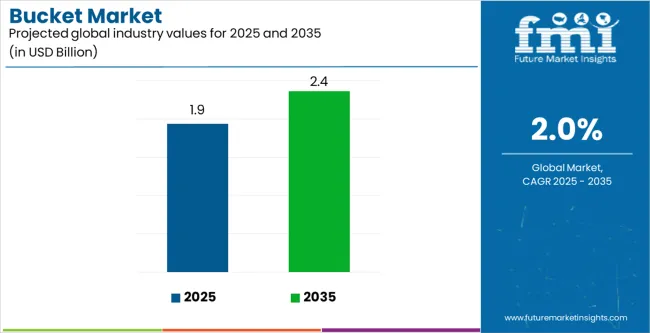

| Bucket Market Estimated Value in (2025 E) | USD 1.9 billion |

| Bucket Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 2.0% |

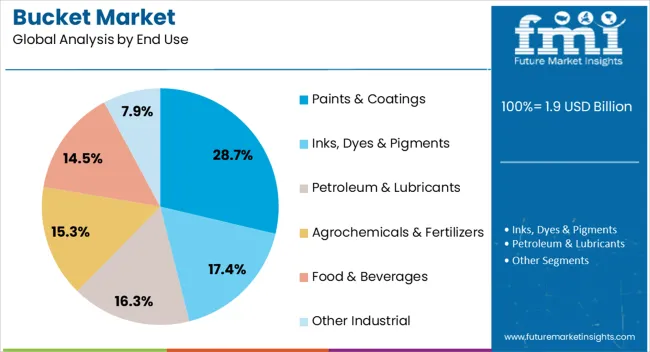

The market is segmented by Material, Product Type, and End Use and region. By Material, the market is divided into Plastic and Metal. In terms of Product Type, the market is classified into Open Top/Head and Close Top/Head. Based on End Use, the market is segmented into Paints & Coatings, Inks, Dyes & Pigments, Petroleum & Lubricants, Agrochemicals & Fertilizers, Food & Beverages, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

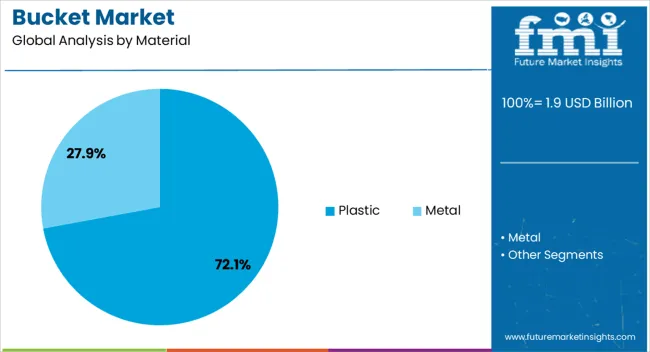

The plastic material segment is projected to hold 72.1% of the market revenue in 2025, establishing it as the leading material type. Growth in this segment is being driven by the lightweight, cost-effective, and durable properties of plastic, which make it highly suitable for industrial and consumer applications. Plastic buckets offer excellent resistance to corrosion, chemicals, and moisture, enhancing their performance and lifespan.

The ability to manufacture them in various shapes, sizes, and colors further improves usability and market appeal. Advancements in polymer technology have allowed for improved structural integrity and recyclability, which aligns with environmental regulations and sustainability goals. The ease of mass production and scalability of plastic buckets reduces manufacturing costs while meeting high-volume demand.

Additionally, compatibility with automated filling and packaging systems strengthens their adoption in industries such as paints and coatings, chemicals, and food processing As organizations continue to seek cost-efficient, reliable, and versatile containers, the plastic material segment is expected to maintain its market leadership, supported by ongoing technological innovation and sustainability initiatives.

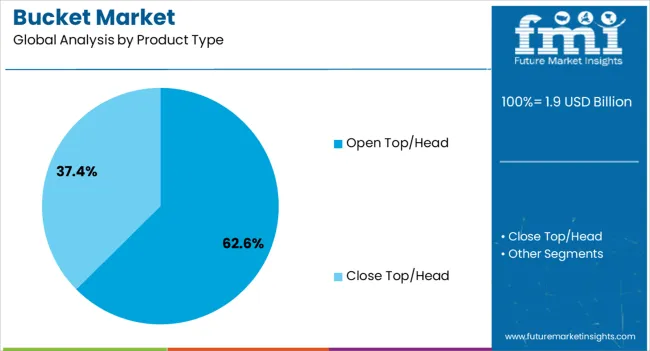

The open top/head product type segment is anticipated to account for 62.6% of the market revenue in 2025, making it the leading product type. This segment is being driven by the need for easy accessibility and efficient handling of bulk materials, which is particularly critical in paints, coatings, chemicals, and other industrial applications. Open top buckets allow for rapid filling, dispensing, and cleaning, improving operational efficiency and productivity.

Their compatibility with lids, sealing systems, and stacking designs enhances storage and transport convenience. The durability and structural strength provided by advanced manufacturing techniques ensure reliability even under heavy load and repeated use.

Increasing adoption in industries requiring frequent access to materials, combined with ergonomic design features, has strengthened the market position of this product type As manufacturing facilities and commercial operations continue to prioritize workflow efficiency and safety, the open top/head segment is expected to maintain its dominance, reinforced by ongoing demand for user-friendly, versatile, and high-performance containers.

The paints and coatings end use segment is projected to hold 28.7% of the market revenue in 2025, establishing it as the leading end-use industry. Growth is being driven by the rising demand for packaging solutions that can store and transport liquid and viscous materials safely while minimizing contamination and spillage. Buckets in this segment are required to meet stringent quality standards for chemical resistance, durability, and secure sealing.

The ability to customize bucket sizes, shapes, and materials according to specific paint and coating formulations enhances operational efficiency and product performance. Increasing industrial construction activities, home improvement projects, and the growing paints and coatings market have further accelerated adoption.

Manufacturers are prioritizing lightweight, reusable, and recyclable bucket designs to reduce costs and environmental impact As the paints and coatings industry continues to expand globally, the demand for high-quality buckets that provide safety, efficiency, and compliance is expected to remain a primary driver of market growth, reinforcing this segment’s leading position.

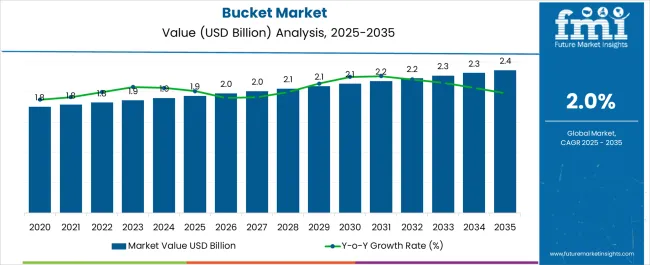

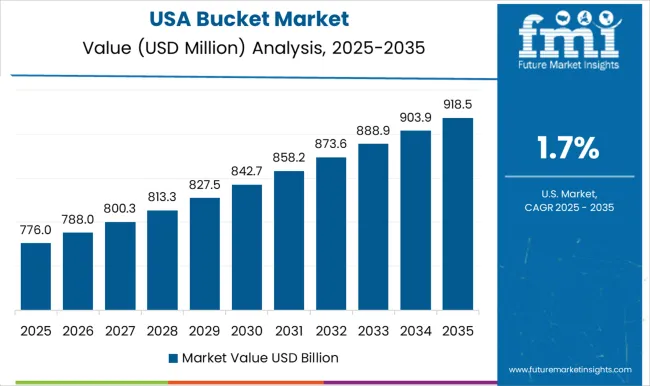

In 2020, the global bucket market showed a potential worth USD 1.8 billion, according to Future Market Insights. From 2020 to 2025, bucket sales inclined at a 3.5% CAGR, experiencing linear expansion.

| Historical CAGR | 3.5% |

|---|---|

| Forecast CAGR | 2% |

Several market phenomena, including a rise in industrial activity, the development of infrastructure, and demand from industries like agriculture and construction probably caused the market evolution.

With a predicted CAGR of 2%, projections for the future trajectory point of the bucket market led to a reduction in growth. Economic volatility, shifting consumer tastes, and regulation changes that affect market dynamics could all impact this adjustment.

The bucket market is broadened further, albeit more slowly, due to perpetual demand from various end-user sectors worldwide, even with the predicted slowdown in growth.

The below section shows the leading segment. Based on the material, the plastic segment is accounted to hold a market share of 72.1% in 2025. Based on product type, the open top/head segment is accounted to hold a market share of 62.6% in 2025.

Plastic buckets are preferred over metal or wooden ones as they are lighter in weight and easier to handle and transport.

Better accessibility is provided with open top/head buckets, making loading and unloading items simple without the need for extra opening mechanisms.

| Category | Market Share in 2025 |

|---|---|

| Plastic | 72.1% |

| Open Top/Head | 62.6% |

Based on material, the plastic sector is accounted to hold a market share of 72.1% in 2025. The popularity of plastic buckets can be ascribed to several things, including their durability, corrosion resistance, and capacity to withstand chemicals.

Plastic buckets are successively less expensive than equivalents made of wood or metal. Plastic buckets are mostly preferred by various industries, including agriculture and construction as they are adaptable and suitable for a wide range of uses.

Based on product type, the open top/head sector is accounted to hold a market share of 62.6% in 2025. Open top/head buckets are used because they are convenient and readily accessible, making both quick and easy in loading and emptying materials.

Open top/head buckets are widely used in the construction, waste management, and agricultural industries and for jobs that require quick material handling.

The table mentions the top five countries ranked by revenue, with India holding the top position.

India is the market leader in buckets because of its wide usage in various industries, including rural development, agriculture, and construction. The demand for buckets remains constant due to infrastructural developments, rising urbanization, and the focus on agricultural output.

The developing economy and the vast population of 1.42 billion in India further propel the market by positioning it as a major participant in the global bucket industry.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR through 2035 |

|---|---|

| United States | 1.9% |

| Germany | 1.6% |

| China | 4.6% |

| Thailand | 4.3% |

| India | 6% |

The bucket market is predominantly utilized in infrastructure development projects in the United States. The market substantially includes the construction of roads, bridges, commercial buildings, and residential complexes.

Buckets are commonly employed for excavation, material handling, and transportation on construction sites across the country.

The bucket market finds significant usage in manufacturing and industrial applications. Industries like automotive, engineering, and manufacturing largely rely on buckets for material handling, storage, and transportation within their production processes.

Buckets are essential for handling raw materials, components, and finished products in these sectors.

The booming construction sector upsurges the demand for buckets in the country. With rapid urbanization and infrastructure development projects underway, buckets are extensively used in construction activities such as excavation, concrete mixing, and debris removal.

The construction of residential complexes, commercial buildings, and transportation infrastructure fuels the widespread usage of buckets across China.

In Thailand, the bucket market is predominantly utilized in agriculture and farming activities. Buckets are essential tools for irrigation, harvesting, and livestock feeding on farms across the country.

Buckets are utilized in aquaculture, horticulture, and other agricultural practices to facilitate various farming operations efficiently.

Rural development initiatives and construction projects majorly require buckets for their usage. With ongoing efforts for improvement in rural infrastructure, buckets play a compelling role in activities such as road construction, water supply projects, and sanitation programs.

Buckets are widely utilized in urban construction projects, real estate development, and infrastructure upgrades in rapidly growing cities across the country.

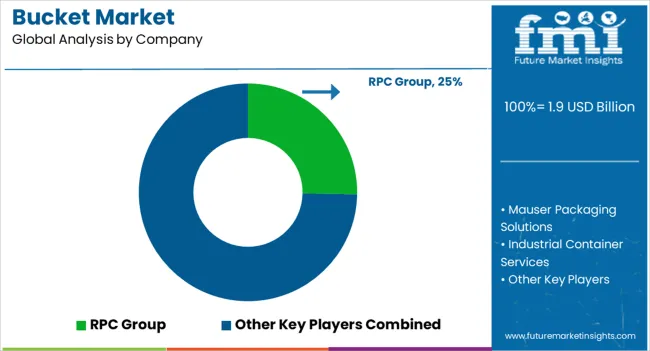

The bucket market is very competitive, with many companies, from large multinationals to small-town producers. Lucrative opportunities are available for market players who invest in bucket market technology for improving features that frequently compete on product quality, cost, innovation, and distribution networks.

Smaller regional businesses concentrate on specialized products or niche markets for establishing their presence, whereas multinational corporations utilize their worldwide reach and ample resources for sustaining a substantial market share.

Diversified companies frequently use partnerships, mergers, and acquisitions for bolstering their market position and product offerings, hence cherishing a dynamic and competitive landscape in the bucket market.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.9 billion |

| Projected Market Valuation in 2035 | USD 2.7 billion |

| Value-based CAGR 2025 to 2035 | 2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Material, Product Type, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | RPC Group; Mauser Packaging Solutions; Industrial Container Services; C.L. Smith; Affordable Buckets; Encore Plastics Corporation; FDL Packaging Group |

The global bucket market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the bucket market is projected to reach USD 2.4 billion by 2035.

The bucket market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in bucket market are plastic and metal.

In terms of product type, open top/head segment to command 62.6% share in the bucket market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bucket 4 in 1 Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Food Bucket Elevators Market

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Loader Bucket Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Attachments Market Size and Share Forecast Outlook 2025 to 2035

Backhoe Bucket Market Size and Share Forecast Outlook 2025 to 2035

Chicken Buckets Market

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Ice Transport Buckets Market

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA