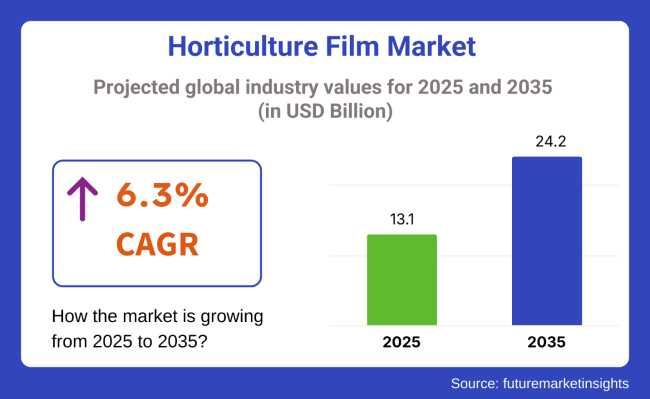

The horticulture film market is projected to grow from USD 13.1 billion in 2025 to USD 24.2 billion by 2035, registering a CAGR of 6.3% during the forecast period. Sales in 2024 reached USD 12.2 billion, reflecting the market's robust expansion driven by the increasing adoption of advanced agricultural practices.

This growth is driven by increasing demand for year-round crop production, in regions with harsh climates. Farmers are utilizing greenhouse films to ensure steady crop yields, as traditional farming practices are impacted by changing weather patterns and high temperatures.

Berry Global, a leading manufacturer specializing in horticulture films, emphasizes its commitment to sustainability and innovation. In April 2024, Berry Announces Expansion of its Leading Film Manufacturing Facility in Lewisburg, Tennessee.

“The ability to access innovative, sustainable film solutions is critical for our customers as they work to drive progress toward a circular, net-zero economy,” said Phil Stolz, EVP and General Manager, Performance Materials for Berry. "Expanding our Lewisburg facility will allow us to optimize the facility to help our films customers deliver against their ambitious sustainability goals.”

The shift towards eco-friendly and biodegradable materials is a significant driver in the horticulture film market. Manufacturers are investing in coating technologies that enhance the durability of films without compromising their composability.

Additionally, the integration of digital printing allows for customization, catering to branding needs and consumer engagement. These innovations not only meet environmental standards but also offer functional benefits to end-users.

By 2035, the horticulture film market is expected to create an incremental opportunity of USD 11.1 billion. The market's expansion is supported by regulatory measures against single-use plastics and the increasing adoption of sustainable practices by businesses. Companies that prioritize innovation, sustainability, and customization are well-positioned to capitalize on emerging opportunities in this sector.

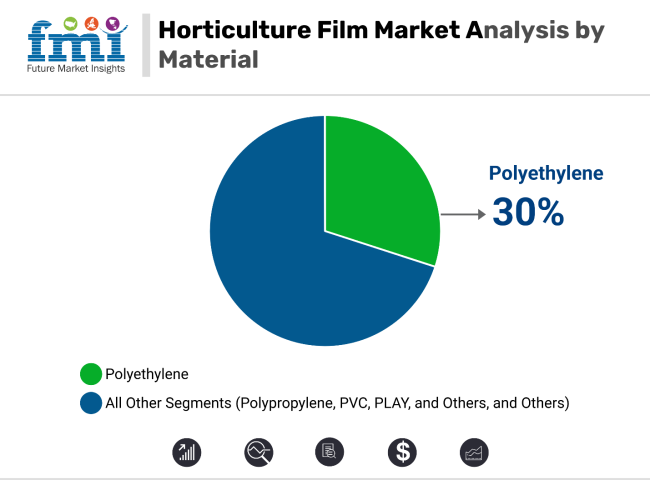

Polyethylene (PE) is projected to lead the material segment of the horticulture film market with a 30% market share by 2025, owing to its excellent balance of durability, flexibility, and affordability. Widely used in agricultural and horticultural applications, polyethylene films low-density polyethylene (LDPE) offer superior light transmission, moisture resistance, and UV stability, which are critical for plant health and productivity.

PE horticulture films are highly customizable in terms of thickness, additive composition, and optical properties, making them suitable for a range of applications including mulching, greenhouse covering, fumigation, and soil sterilization. Additionally, these films are compatible with infrared (IR) and anti-drip additives, enhancing temperature regulation and light diffusion in protected cultivation environments.

One of polyethylene’s key advantages is its recyclability and adaptability to sustainable innovations, such as biodegradable blends and multi-season-use formulations. This makes it an ideal choice as environmental regulations and eco-conscious farming practices continue to gain momentum.

Farmers and growers prefer PE films for their long lifecycle, ease of installation, and compatibility with mechanized farming systems. As global food production increasingly relies on protected agriculture and precision horticulture, polyethylene will remain a cornerstone material driving both yield optimization and operational efficiency.

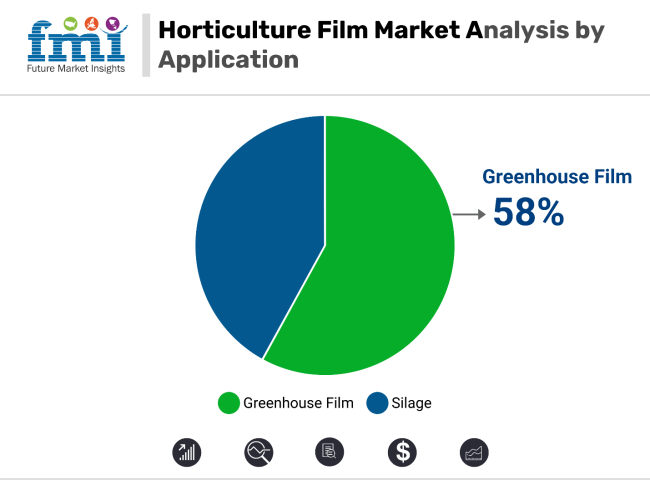

Greenhouse film is expected to dominate the application segment of the horticulture film market, capturing a 58% market share by 2025, driven by the expanding demand for controlled environment agriculture (CEA) to boost crop yields and extend growing seasons. These films act as a protective barrier, regulating temperature, humidity, and light transmission while shielding plants from harsh weather, pests, and pathogens.

The popularity of greenhouse films stems from their vital role in enhancing photosynthetic efficiency and resource utilization, particularly in regions with volatile climates or limited arable land. Technological advancements in film formulations now allow greenhouse films to incorporate features such as anti-condensation, UV-blocking, thermicity control, and infrared reflection greatly improving microclimatic conditions and plant productivity.

Used extensively in vegetable, floriculture, and nursery cultivation, greenhouse films are also integral to organic and hydroponic farming setups. With global food security and climate resilience becoming central to agricultural policies, governments are increasingly subsidizing greenhouse infrastructure, especially in emerging economies.

As urban farming, vertical agriculture, and year-round production gain traction, greenhouse films provide a scalable and cost-effective solution for maximizing land use and crop efficiency. Their continued dominance underscores their critical role in sustainable horticulture and modern agricultural practices through 2025 and beyond.

Future Market Insights Identifies the expansion of crop production, and the use of advanced technology in agriculture to be the major driving factors for the market. Financial restraints, and other external factors such as weather-related issues can act as hindrances in the market.

Expansion of Crop Production and Controlled Environments

The horticulture film market is experiencing significant growth due to the increasing demand for year-round crop production, especially in regions with harsh climates. Farmers are using greenhouse films to guarantee steady crop yields since traditional farming practices are impacted by changing weather patterns and high temperatures.

The growing demand for high-value commodities like flowers and organic vegetables, which need certain, regulated conditions to thrive well, is another factor fueling this trend. The market is also being supported by government programs and subsidies for greenhouse materials, which encourage modern agricultural practices.

Use of Advanced Technology in Agriculture

Agricultural industry is focusing more on sustainability. Horticulture films are essential for conserving water because they help greenhouses retain moisture, which reduces the need for watering. This is particularly crucial in areas with limited water supplies.

The performance of horticultural films has also increased due to technological improvements; modern films have better light transmission and heat retention qualities, which further boost crop yields. These cutting-edge films are also increasingly crucial for optimizing available space and growing conditions in urban settings, as urbanization fuels the growth of rooftop gardens and small-scale protected agriculture.

Financial and Environmental Challenges

Despite the advantages, the horticulture film market faces several restraints. The expensive initial setup costs for high-quality horticultural films are one of the main obstacles; these costs can be prohibitive, especially for small farms.

Because small-scale farmers may find it difficult to make the first investment, these expenses frequently discourage uptake. Another major obstacle is the environmental issues around the disposal of used films and plastic trash.

Improper disposal of these items can harm the environment, so the producers and legislators who care about the environment may be hesitant. Farmers are further deterred from making long-term investments in films by fluctuating raw material prices, which further complicates issues by raising manufacturing costs and perhaps causing pricing volatility.

Technical and Weather-related Issues

The horticulture film market is also constrained by competition from traditional farming methods, particularly in regions with favorable climates where open-field farming remains viable. Many farmers are hesitant to adopt new technologies, especially if the traditional methods are still working for them.

Furthermore, farmers that lack technical expertise on how to install and maintain films properly may apply them poorly and with less effectiveness, which will result in underutilization of the technology.

Another major limitation is weather-related degradation, since severe weather conditions can shorten the life of horticultural films, necessitating frequent replacements and raising the whole cost. This unpredictable wear and tear on the films makes it a less reliable long-term solution for some farmers.

Innovative trends focused at efficiency and sustainability are being observed in the horticultural film market. The production of biodegradable films from plant-based components is one noteworthy advancement that addresses environmental worries regarding plastic waste. Furthermore, films with smart technology embedded into them-such as UV-detection and self-cleaning capabilities-are improving performance and lowering maintenance.

Multi-layer films are becoming popular because they provide better insulation and light management to maximize growing conditions. These coatings are very useful for regulating temperature and conserving energy.

The growing use of colored films designed for certain crop requirements is another trend that enables better light spectrum management and encourages healthier plant growth. These developments are changing the sector by providing modern agriculture with more effective and sustainable solutions.

Durability and practicality are becoming more and more important to consumers in the horticultural film market. Even with greater initial prices, there is a significant demand for longer-lasting films as farmers look to reduce long-term expenditures and replacement frequency.

Additionally, films with anti-leak properties are becoming more and more popular since they reduce the risk of disease and improve crop health by keeping water from leaking onto plants. Specialty films designed for certain crops, such as flowers or berries, are increasingly gaining popularity as growers look for tailored solutions that enhance growth conditions.

Another noteworthy trend is the growing focus on movies that promote environmentally friendly farming practices by reducing the use of pesticides. These films can lessen the need for chemical treatments by improving plant health and protecting insects, which will appeal to customers who care about the environment and want to see more organic and sustainable farming practices.

| Countries | CAGR |

|---|---|

| USA | 5.5% |

| China | 7.3% |

| India | 7.6% |

| UK | 5.1% |

| Germany | 4.9% |

American growers have shifted toward premium multi-layer films with enhanced UV protection and longer lifespan. The focus is on films that enable year-round growing of high-value crops. Companies like GrowGuard and CropShield have introduced smart films with climate monitoring capabilities.

There's increased demand for eco-friendly and recyclable options, especially among organic farmers. Major players like AgriTech Solutions and GreenFilm USA are developing biodegradable films and implementing take-back programs for used films.

Chinese greenhouse operators are investing in higher-quality films with multi-season durability. Large-scale operations prefer films with advanced light diffusion properties. Local manufacturers like ZhongNong Films and GreenTech China are focusing on customized solutions for different climate zones. Small-scale farmers are adopting specialized films for specific crops, particularly in vegetable production. Companies are offering technical support and installation services. Leading manufacturer SinoGrow has established training centers for proper film installation and maintenance.

Indian farmers show growing interest in heat-resistant films with better moisture retention properties. The trend is stronger in regions with water scarcity. Companies like IndiaGrow and FarmShield are developing region-specific films suitable for different climatic conditions.

Small-hold farmers are increasingly adopting low-cost but durable films with basic UV protection. Companies like AgriFilm India and GrowTech are offering flexible payment terms and technical support in local languages.

British growers prefer high-performance films with enhanced heat retention properties for year-round growing. The focus is on maximizing light transmission during low-light seasons. Companies like BritGrow and ClimateShield UK are developing specialized films for the UK climate.

There's growing demand for films with anti-drip properties and improved condensation control. Leading suppliers like GrowTech UK and AgriFilm Solutions are offering comprehensive warranties and climate optimization consultancy services.

German greenhouse operators are investing in premium-quality films with advanced light diffusion and thermal properties. Energy efficiency is a key consideration. Companies such as DeutschFilm and GrowTech Germany are focusing on films that reduce heating costs.

The market shows strong preference for certified sustainable films with minimal environmental impact. Major manufacturers such as GermanGrow and EcoFilm are developing recyclable products and offering end-of-life collection services for used films.

Businesses in the horticultural film sector are implementing several strategic measures to efficiently gain market share of horticulture film market and satisfy customer demands. Offering installation and technical support in addition to their merchandise is a crucial tactic. This improves customer happiness and helps guarantee appropriate use, particularly for farmers who are unaware with greenhouse technology. Additionally, to ensure maximum performance in various climatic settings, producers are creating region-specific goods that are favorable to the climate conditions of specific places.

Another key area of focus is education, with numerous businesses developing initiatives to inform farmers about the advantages of horticulture films and how to use them correctly. This contributes to higher adoption rates, especially in areas where conventional farming practices predominate. To improve product availability and customer service, it is also essential to develop distributor networks in agricultural areas.

Businesses are providing quality assurances and warranties to foster trust while guaranteeing long-term value for clients. To address the growing environmental concerns and advance sustainability, many are also putting recycling systems into place. Credibility and product dependability are further increased by partnerships with agricultural colleges for product testing and validation.

Finally, offering financing alternatives for extensive installations enables farmers to more easily invest in cutting-edge technologies, promoting the broader integration of horticulture films into contemporary agricultural methods.

The global horticulture flm market is segmented into Product Type, Material, Application, and region.

By Product Type, the market is sub-segmented into Mulch Films, Greenhouse Films, and Ventilated Stretch Films

By Material, the market is sub-segmented into Polyethylene, Polypropylene, PVC, PLAY, and Others

By Application, the market is sub-segmented into Greenhouse Film, and Silage

By region, the market is sub-segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa

The market is valued at USD 13.1 billion in 2025.

The market is predicted to reach a size of USD 24.2 billion by 2035.

Some of the key companies manufacturing horticulture films include BASF SE, The DOW Chemical Company, Trioplast Industries AB, RPC bpi Agriculture Company.

USA, EU are strongholds, whereas China and India are presenting lucrative opportunities for manufacturers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Million Square Meters) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Million Square Meters) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 6: Global Market Volume (Million Square Meters) Forecast by Material, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: Global Market Volume (Million Square Meters) Forecast by Application, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Million Square Meters) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 12: North America Market Volume (Million Square Meters) Forecast by Product Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 14: North America Market Volume (Million Square Meters) Forecast by Material, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 16: North America Market Volume (Million Square Meters) Forecast by Application, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Million Square Meters) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 20: Latin America Market Volume (Million Square Meters) Forecast by Product Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 22: Latin America Market Volume (Million Square Meters) Forecast by Material, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 24: Latin America Market Volume (Million Square Meters) Forecast by Application, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Million Square Meters) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Europe Market Volume (Million Square Meters) Forecast by Product Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 30: Europe Market Volume (Million Square Meters) Forecast by Material, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 32: Europe Market Volume (Million Square Meters) Forecast by Application, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Million Square Meters) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 36: Asia Pacific Market Volume (Million Square Meters) Forecast by Product Type, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 38: Asia Pacific Market Volume (Million Square Meters) Forecast by Material, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 40: Asia Pacific Market Volume (Million Square Meters) Forecast by Application, 2017 to 2032

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: MEA Market Volume (Million Square Meters) Forecast by Country, 2017 to 2032

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 44: MEA Market Volume (Million Square Meters) Forecast by Product Type, 2017 to 2032

Table 45: MEA Market Value (US$ Million) Forecast by Material, 2017 to 2032

Table 46: MEA Market Volume (Million Square Meters) Forecast by Material, 2017 to 2032

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 48: MEA Market Volume (Million Square Meters) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Material, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Million Square Meters) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Volume (Million Square Meters) Analysis by Product Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 14: Global Market Volume (Million Square Meters) Analysis by Material, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 18: Global Market Volume (Million Square Meters) Analysis by Application, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 21: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Material, 2022 to 2032

Figure 23: Global Market Attractiveness by Application, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Material, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Million Square Meters) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 34: North America Market Volume (Million Square Meters) Analysis by Product Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 38: North America Market Volume (Million Square Meters) Analysis by Material, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 42: North America Market Volume (Million Square Meters) Analysis by Application, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 45: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Material, 2022 to 2032

Figure 47: North America Market Attractiveness by Application, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Material, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Million Square Meters) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 58: Latin America Market Volume (Million Square Meters) Analysis by Product Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 62: Latin America Market Volume (Million Square Meters) Analysis by Material, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 66: Latin America Market Volume (Million Square Meters) Analysis by Application, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Material, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Material, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Million Square Meters) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 82: Europe Market Volume (Million Square Meters) Analysis by Product Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 86: Europe Market Volume (Million Square Meters) Analysis by Material, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 90: Europe Market Volume (Million Square Meters) Analysis by Application, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 93: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Material, 2022 to 2032

Figure 95: Europe Market Attractiveness by Application, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Material, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Million Square Meters) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Million Square Meters) Analysis by Product Type, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Million Square Meters) Analysis by Material, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Million Square Meters) Analysis by Application, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Material, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: MEA Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 122: MEA Market Value (US$ Million) by Material, 2022 to 2032

Figure 123: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 124: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: MEA Market Volume (Million Square Meters) Analysis by Country, 2017 to 2032

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 130: MEA Market Volume (Million Square Meters) Analysis by Product Type, 2017 to 2032

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 133: MEA Market Value (US$ Million) Analysis by Material, 2017 to 2032

Figure 134: MEA Market Volume (Million Square Meters) Analysis by Material, 2017 to 2032

Figure 135: MEA Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 138: MEA Market Volume (Million Square Meters) Analysis by Application, 2017 to 2032

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 141: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 142: MEA Market Attractiveness by Material, 2022 to 2032

Figure 143: MEA Market Attractiveness by Application, 2022 to 2032

Figure 144: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Horticulture Film Production

Horticulture Lighting Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

VCI Film Market Growth – Demand, Innovations & Outlook 2024-2034

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA