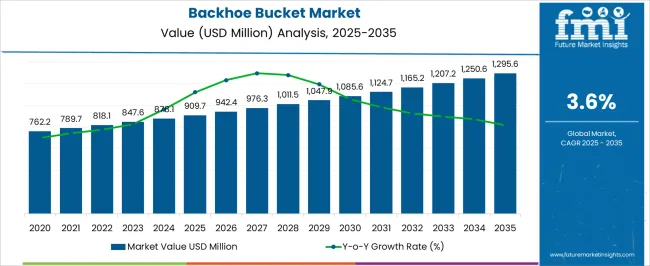

The Backhoe Bucket Market is estimated to be valued at USD 909.7 million in 2025 and is projected to reach USD 1295.6 million by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Backhoe Bucket Market Estimated Value in (2025 E) | USD 909.7 million |

| Backhoe Bucket Market Forecast Value in (2035 F) | USD 1295.6 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

The backhoe bucket market is witnessing steady growth supported by rising infrastructure development, expanding construction activity, and advancements in excavation equipment. Increasing demand for utility and earthmoving applications in both urban and rural projects has driven equipment rental and ownership rates. Manufacturers are investing in wear-resistant materials, smart mounting mechanisms, and modular design features to enhance operational efficiency and equipment lifespan.

The market is also responding to sustainability and productivity requirements by offering customizable bucket solutions compatible with different terrains and machinery types. Strong demand from emerging economies, coupled with government-backed construction and public infrastructure initiatives, continues to create long-term market opportunities.

The integration of advanced attachment technologies and growing emphasis on fuel efficiency and precision digging are further contributing to the market's upward trajectory. As construction timelines become tighter and end users demand higher performance from attachments, the backhoe bucket market is expected to witness diversified product offerings and enhanced aftermarket support globally.

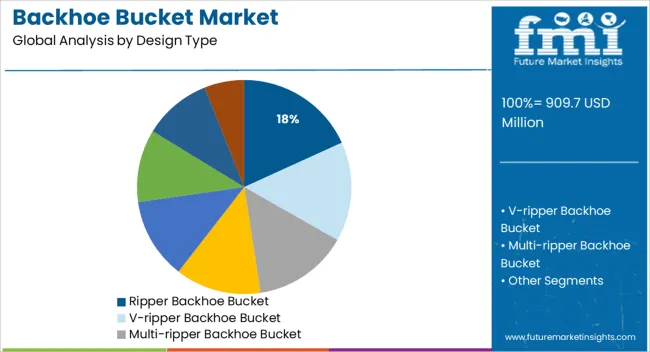

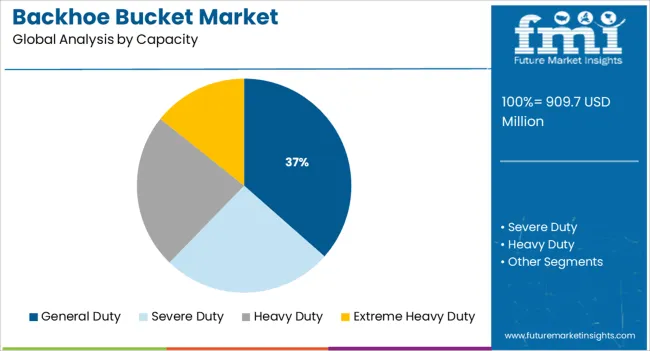

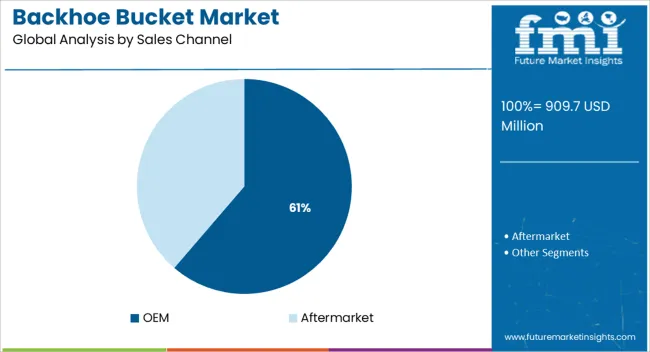

The market is segmented by Design Type, Capacity, Sales Channel, and End User and region. By Design Type, the market is divided into Ripper Backhoe Bucket, V-ripper Backhoe Bucket, Multi-ripper Backhoe Bucket, Round Bottom Backhoe Bucket, Flat Bottom Round Corner Backhoe Bucket, Flat Bottom Square Corner, Special Backhoe Bucket, and Others. In terms of Capacity, the market is classified into General Duty, Severe Duty, Heavy Duty, and Extreme Heavy Duty. Based on Sales Channel, the market is segmented into OEM and Aftermarket. By End User, the market is divided into Construction Industry, Mining Industry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ripper backhoe buckets are projected to contribute 18.2% of the revenue share by 2025 in the design type category, positioning them as a leading specialized segment. This growth is being driven by the increasing need for high-penetration excavation in hard, compacted, or frozen ground where traditional buckets face limitations.

The ripper design enables efficient fracturing and breaking of dense soil layers before full excavation, improving machine productivity and reducing wear on standard buckets. Demand from utility contractors, demolition teams, and excavation service providers has reinforced adoption, particularly in regions with rocky substrates and seasonal frost.

Manufacturers have focused on strengthening tooth profiles and structural reinforcements to extend lifespan under aggressive conditions. This design’s growing role in enhancing equipment performance and minimizing downtime has contributed to its continued demand across heavy-duty construction environments.

The general duty segment is forecasted to hold 36.5% of the revenue share in 2025 within the capacity category, affirming its role as the most widely adopted bucket class. This segment’s dominance stems from its versatility in handling everyday excavation tasks such as trenching, material handling, and light construction work.

General duty buckets are engineered to offer optimal weight distribution and sufficient breakout force, making them ideal for a broad spectrum of applications without the need for specialized configurations. Their compatibility with most standard backhoes and availability across rental fleets has reinforced market penetration.

Cost-efficiency, ease of maintenance, and lower initial investment continue to appeal to contractors and fleet operators. As infrastructure development spans diverse geographies and project types, the general duty segment remains a key component of equipment strategies aiming to balance performance and operational cost.

The OEM sales channel is expected to account for 61.3% of the total market share in 2025, establishing it as the dominant distribution segment. This is largely attributed to the bundled sales approach adopted by heavy machinery manufacturers who provide backhoe buckets as standard or optional equipment during new machine purchases.

OEMs are leveraging technical integration advantages by offering buckets engineered to match specific hydraulic and mechanical configurations, resulting in improved performance and warranty alignment. End users prefer OEM channels for assured compatibility, quality assurance, and the benefit of single-source procurement.

OEMs have also expanded their global service networks, allowing faster delivery and installation, especially in emerging markets. These factors have positioned OEMs as the most reliable and convenient channel for equipment acquisition, reinforcing their leading role in the sales strategy of the backhoe bucket market.

Analysis of the global market for backhoe buckets from 2020 to 2024 revealed a historical growth rate of less than 3.2% CAGR, with the introduction of hybrid backhoe loaders being one of the significant trends that helped the market for backhoe buckets gain traction in the past. The fuel consumption and operating expenses of hybrid electric backhoe loaders are greatly reduced. John Deere and Design works have created a new, extremely fuel-efficient electric or diesel hybrid backhoe loader that lowers costs. They don't compromise on performance and have a low impact on the environment.

A public health emergency has been declared by the World Health Organization due to the disease's rapid global expansion after the COVID-19 viral outbreak in December 2020. The backhoe bucket market will be considerably impacted in 2024 as a result of the coronavirus infection 2020 (COVID-19), which is already having an influence on markets around the world.

However, industrial production activity in significant markets has resumed as a result of infection curves flattening starting in 2025. This leads to a CAGR of 3.6% by 2035 according to FMI's Backhoe Bucket demand forecast.

The backhoe bucket market is anticipated to grow over the forecast period because to an increase in residential and commercial construction projects and supporting government initiatives like India's smart city plan.

Additionally, industrialization and globalisation are playing a significant role in economic growth, which will influence the demand for backhoe buckets on the global market during the course of the projection period. Additionally, it is anticipated that infrastructure investments in housing and road building will increase demand for backhoe buckets on the international market.

The growing number of small fleet owners of backhoe buckets actively finishing rural region development and connecting them with urban regions is expected to result in an increase in the aftermarket sector of the global backhoe bucket market over the projected period.

The forecasted expansion of the global backhoe market may be hampered by fluctuations in the pricing of mined commodities and the need for highly skilled drivers to operate advanced backhoes such as hybrid type backhoe loaders. A hybrid loader is built to harness renewable energy as it is made, minimising the amount of diesel fuel needed to run the machine.

The best tool for digging is not a loader because it can only dig up to the level of its wheel. An alternative for a backhoe loader on the back side is a backhoe bucket. The backhoe is a piece of digging equipment with an articulated two-part arm with a bucket at the end. As it is hard to operate, this hybrid combination requires a professional driver. Prices could change as a result of this hybrid combination, which could have an impact on the market for backhoe buckets individually.

India is anticipated to expand in the global backhoe bucket market at an aggressive growth rate because to the rise in mining and building projects in the future years. Due to increasing urbanisation, Europe and North America are also anticipated to experience significant growth rates, which will increase the need for backhoe buckets by the end of 2035.

Due to an increase in commercial construction projects like Silicon Park and Azizi constructions' Aura Residence in Dubai, the Middle East and Africa are anticipated to experience considerable growth in the backhoe bucket industry.

At the moment, the growth rates in Brazil and Argentina are somewhat slow. The demand for backhoe buckets could increase, nevertheless, due to increased GDP growth. Due to the rising demand for environmentally friendly backhoe buckets, South East Asia and the Pacific region is predicted to develop at a rate that is above average in the worldwide backhoe bucket market. Although just 7.8% of Australia's GDP is accounted for by the construction sector, this fact may help the backhoe market during the predicted period.

Key players operating in the Backhoe Bucket market include Solesbee's Equipment & Attachments, LLC, Harsan Engineers, OZ Excavator Buckets Pty Ltd., Whites Material Handling Ltd., Leading Edge Attachments, Inc., ERMOTEC International Pvt. Ltd., Texas Contractors Equipment, Inc., Rockland Manufacturing Company, Model Infra Corporation Private Limited and Empire Bucket, Inc.

The backhoe bucket market is very consolidated, with a small number of really big vendors holding the majority of the market share. The vast majority of market participants spend a significant amount of money on thorough research and development, often to produce new and enhanced items. The two main methods employed by the major players in the backhoe bucket market are product expansion and mergers and acquisitions.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Design Type, Capacity, Sales Channel, End User, Region |

| Regions Covered |

North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Key Countries Covered |

USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profile |

Solesbee's Equipment & Attachments, LLC; Harsan Engineers; OZ Excavator Buckets Pty Ltd.; Whites Material Handling Ltd.; Leading Edge Attachments, Inc.; ERMOTEC International Pvt. Ltd.; Texas Contractors Equipment, Inc.; Rockland Manufacturing Company; Model Infra Corporation Private Limited; Empire Bucket, Inc.; Felco Industries; Geith International; LEMAC; TAG Manufacturing |

| Customization & Pricing | Available upon Request |

The global backhoe bucket market is estimated to be valued at USD 909.7 million in 2025.

The market size for the backhoe bucket market is projected to reach USD 1,295.6 million by 2035.

The backhoe bucket market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in backhoe bucket market are ripper backhoe bucket, v-ripper backhoe bucket, multi-ripper backhoe bucket, round bottom backhoe bucket, flat bottom round corner backhoe bucket, flat bottom square corner, special backhoe bucket and others.

In terms of capacity, general duty segment to command 36.5% share in the backhoe bucket market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bucket 4 in 1 Market Size and Share Forecast Outlook 2025 to 2035

Bucket Market Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Food Bucket Elevators Market

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Loader Bucket Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Attachments Market Size and Share Forecast Outlook 2025 to 2035

Chicken Buckets Market

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Ice Transport Buckets Market

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA