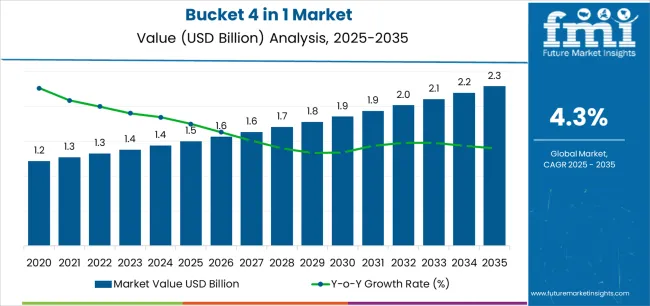

The global bucket 4 in 1 market, valued at USD 1.5 billion in 2025, is projected to reach USD 2.2 billion by 2035, expanding at a CAGR of 4.3%, driven by increasing mechanization in agriculture and construction, rising demand for versatile loader attachments, and the growing preference for multi-functional buckets that enable loading, grading, grabbing, and dozing operations across varied terrain conditions. The global bucket 4 in 1 market is positioned for substantial expansion over the next decade, driven by mechanization of agricultural operations, infrastructure development initiatives, and the growing adoption of versatile earthmoving equipment requiring multi-functional attachment solutions. The market demonstrates robust fundamentals supported by construction activity intensification, forestry sector modernization, and the transition toward compact equipment platforms that maximize operational flexibility through interchangeable attachment systems across diverse working environments.

Construction contractors and agricultural operators are implementing 4 in 1 bucket systems to achieve 25-35% improvement in operational versatility and equipment utilization compared to single-function attachments, making these multi-purpose tools essential for project cost optimization and operational efficiency. The global push toward mechanized agriculture and sustainable forestry practices accelerates demand for advanced bucket attachments that enable grading, dozing, clamping, and material handling capabilities within a single attachment, reducing equipment investment requirements and jobsite logistics complexity.

The market faces headwinds from economic cyclicality affecting construction spending, competition from specialized attachment alternatives, and price sensitivity among small contractors and agricultural operators operating with limited capital budgets. The competitive landscape is characterized by ongoing innovation in hydraulic systems, attachment quick-coupler standardization efforts, and regional manufacturers gaining market share through cost advantages and localized customer support capabilities in high-growth emerging markets.

The forecast period will witness accelerated adoption of rotating 4 in 1 bucket designs featuring hydraulic rotation mechanisms, enhanced durability through wear-resistant materials, and optimized geometry that improves material retention and breakout force performance. Geographic expansion in Asia-Pacific infrastructure corridors, Middle Eastern construction projects, and Latin American agricultural modernization programs will drive volume growth, while premium segments focused on forestry applications and heavy construction will support value expansion through technology differentiation and comprehensive after-sales support services.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.5 billion |

| Market Forecast Value (2035) | USD 2.2 billion |

| Forecast CAGR (2025-2035) | 4.3% |

The bucket 4 in 1 market grows by enabling construction contractors, agricultural operators, and forestry professionals to achieve superior operational versatility and equipment utilization while reducing capital investment requirements for specialized attachments. Equipment operators face mounting pressure to improve project economics and operational flexibility, with 4 in 1 bucket systems typically providing 30-40% reduction in attachment inventory costs compared to maintaining separate grading, dozing, clamping, and loading implements, making these multi-function tools essential for small-to-medium construction and agricultural operations.

The mechanization trend's need for versatile earthmoving capabilities creates constant demand for advanced bucket solutions that can handle grading, material handling, demolition cleanup, and land clearing applications within a single attachment platform. Infrastructure development initiatives requiring efficient site preparation, roadwork, and utility installation drive adoption of 4 in 1 buckets that enable rapid switching between different operational modes without changing attachments or requiring additional equipment mobilization.

Government infrastructure spending programs and agricultural mechanization incentives accelerate adoption in construction, forestry, and farming applications, where equipment versatility has a direct impact on project completion speed and operational profitability. The global shift toward compact construction equipment and skid steer platforms creates natural demand for multi-functional attachments that maximize the utility of smaller equipment investments. Higher initial costs compared to standard buckets and maintenance requirements for hydraulic clamping systems may limit adoption rates among price-sensitive contractors and operators in regions with limited technical support infrastructure for attachment servicing and repair.

The market is segmented by bucket type, application, and region. By bucket type, the market is divided into lightweight 4-in-1 bucket, rotating 4-in-1 bucket, and others. Based on application, the market is categorized into traditional agriculture, forestry, construction industry, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The lightweight 4-in-1 bucket segment represents the dominant force in the market, capturing approximately 52.0% of total market share in 2025. This advanced category encompasses compact designs optimized for skid steer loaders, compact track loaders, and small wheel loaders, delivering comprehensive multi-function capabilities with reduced weight penalties that preserve machine performance and fuel efficiency. The lightweight segment's market leadership stems from its exceptional compatibility with compact equipment platforms, widespread adoption in agricultural operations requiring gentle material handling, and cost-effectiveness that appeals to small contractors and farmers operating multiple machines.

The rotating 4-in-1 bucket segment maintains a substantial 31.0% market share, serving operators who require enhanced versatility through 360-degree hydraulic rotation capabilities for grading, trenching, and material placement applications in confined spaces and complex jobsite conditions. The others segment accounts for 17.0% market share, featuring specialized heavy-duty variants for mining applications, extended-reach designs for specific construction tasks, and custom configurations tailored to unique operational requirements.

Key advantages driving the lightweight 4-in-1 bucket segment include:

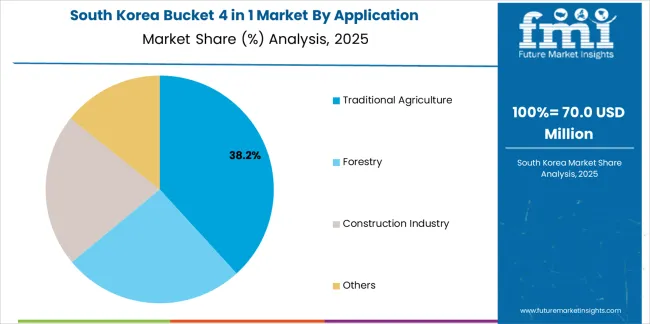

Traditional agriculture dominates the market with approximately 39.0% market share in 2025, reflecting the critical role of versatile material handling equipment in farm operations requiring feeding, manure handling, land leveling, and general maintenance tasks. The traditional agriculture segment's market leadership is reinforced by widespread adoption across livestock operations, mixed farming systems, and rural property management requiring multi-purpose equipment capabilities that maximize tractor and loader investments.

The construction industry segment represents 33.0% market share through site preparation, grading, utility work, and demolition cleanup applications demanding versatile earthmoving capabilities. Forestry applications account for 16.0% market share, encompassing logging operations, forest road maintenance, and biomass handling requiring robust clamping and material manipulation capabilities. Other applications hold 12.0% market share, including landscaping, municipal maintenance, mining support, and industrial material handling operations.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to equipment versatility and operational economics. First, construction sector growth creates increasing requirements for efficient earthmoving and material handling equipment, with global infrastructure investment growing 6-9% annually in emerging markets, requiring versatile attachment solutions that maximize equipment productivity across multiple project phases and task types. Second, agricultural mechanization trends drive farmers toward multi-functional implements, with compact tractor and loader populations increasing 7-10% annually in Asia-Pacific and Latin America as smallholder farmers transition from manual labor to mechanized operations. Third, equipment rental market expansion encourages adoption of versatile attachments, with rental operators preferring 4 in 1 buckets that serve multiple customer applications and reduce inventory requirements compared to maintaining separate specialized attachments for different rental scenarios.

Market restraints include price premiums of 40-60% compared to standard bucket attachments, creating adoption barriers for small contractors and farmers operating on limited budgets, particularly in price-sensitive emerging markets where equipment financing options may be constrained. Hydraulic system complexity introduces maintenance requirements and potential failure points, with clamping cylinders, hoses, and quick-couplers requiring periodic inspection and service that may challenge operators in remote agricultural regions lacking technical support infrastructure. Competition from specialized attachments in specific applications creates segmentation pressure, as dedicated grading blades, grapples, and loading buckets may offer superior performance for operators focused primarily on single-task applications rather than requiring multi-function versatility.

Key trends indicate accelerated adoption in India and China agricultural regions, where government mechanization programs and rising labor costs incentivize equipment investments that maximize operational capabilities per unit of capital invested. Technology advancement toward rotating bucket designs with 360-degree hydraulic cylinders, wear-resistant steel formulations extending service life, and universal quick-coupler systems enabling cross-brand compatibility are driving next-generation product development. The market thesis could face disruption if automated construction equipment and robotic agricultural systems reduce demand for operator-controlled multi-function attachments, or if modular attachment systems enable rapid tool changing that diminishes the comparative advantage of integrated 4 in 1 functionality.

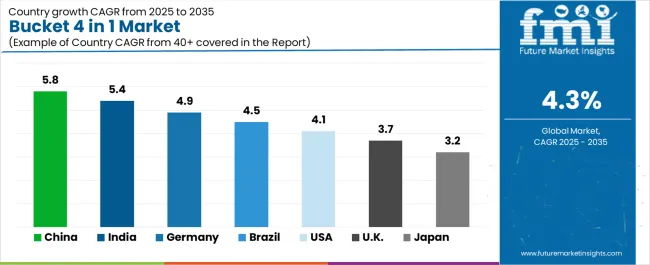

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

The market is gaining momentum worldwide, with China taking the lead thanks to aggressive infrastructure construction and agricultural mechanization programs across rural development zones and urban expansion corridors. Close behind, India benefits from government initiatives promoting farm mechanization and rural infrastructure development, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where construction activity and forestry operations strengthen its role in European equipment markets.

Brazil demonstrates robust growth through agricultural expansion and infrastructure modernization, signaling continued investment in mechanized farming equipment. The USA maintains steady expansion driven by construction recovery and equipment rental market growth. Meanwhile, the UK and Japan continue to record consistent progress through equipment fleet replacement and specialized application adoption. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the market with a CAGR of 5.8% through 2035. The country's leadership position stems from comprehensive infrastructure development initiatives, rapid agricultural mechanization programs, and massive construction activity driving demand for versatile earthmoving attachment systems. Growth is concentrated in major development regions, including Jiangsu, Shandong, Henan, and Sichuan, where infrastructure projects, agricultural operations, and construction sites are implementing multi-function bucket systems for operational efficiency and equipment utilization optimization.

Distribution channels through equipment dealers, agricultural machinery cooperatives, and construction equipment rental companies expand deployment across infrastructure corridors, farming communities, and urban development zones. The country's Rural Revitalization Strategy provides policy support for agricultural mechanization, including subsidies for modern farming equipment and attachments that improve operational efficiency.

Key market factors:

In the Punjab, Haryana, Maharashtra, and Gujarat regions, the adoption of 4 in 1 bucket systems is accelerating across agricultural operations, rural construction projects, and infrastructure development sites, driven by government mechanization programs and increasing labor costs encouraging equipment adoption. The market demonstrates strong growth momentum with a CAGR of 5.4% through 2035, linked to comprehensive farm mechanization expansion and increasing focus on infrastructure connectivity enhancement solutions.

Indian farmers and contractors are implementing multi-function bucket attachments to maximize equipment versatility while meeting operational efficiency requirements in diverse agricultural and construction applications. The country's Sub-Mission on Agricultural Mechanization creates steady demand for versatile equipment attachments, while increasing focus on rural infrastructure development drives adoption of efficient earthmoving solutions.

Germany's advanced construction and forestry sectors demonstrate sophisticated implementation of 4 in 1 bucket systems, with documented case studies showing 30-40% improvement in equipment utilization through multi-function attachment capabilities. The country's equipment infrastructure in major industrial regions, including Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Lower Saxony, showcases integration of premium bucket attachments with existing loader and excavator fleets, leveraging expertise in precision manufacturing and durable equipment design.

German contractors and forestry operators emphasize quality standards and operational reliability, creating demand for heavy-duty bucket solutions that support demanding construction applications and forestry operations. The market maintains strong growth through focus on equipment efficiency and sustainable forestry practices, with a CAGR of 4.9% through 2035.

Key development areas:

The Brazilian market leads in Latin American 4 in 1 bucket adoption based on agricultural sector growth and rural infrastructure development programs across major farming regions. The country shows solid potential with a CAGR of 4.5% through 2035, driven by mechanization of livestock operations and expanding infrastructure requirements across major agricultural regions, including Mato Grosso, Paraná, Rio Grande do Sul, and Goiás. Brazilian farmers and contractors are adopting multi-function bucket attachments for versatility in farm management, rural construction, and land clearing operations, particularly in regions requiring equipment that can handle diverse tasks throughout agricultural production cycles. Technology deployment channels through agricultural equipment dealers, machinery cooperatives, and rural supply networks expand coverage across farming communities and rural construction operations.

Leading market segments:

The USA market demonstrates mature implementation focused on construction equipment fleet optimization, agricultural mechanization, and equipment rental market expansion requiring versatile attachment solutions. The country shows steady potential with a CAGR of 4.1% through 2035, driven by construction recovery and equipment rental industry growth across major markets, including Texas, California, Florida, and the Midwest agricultural belt.

American contractors and farmers are adopting 4 in 1 bucket systems for operational flexibility in construction projects, farm operations, and landscaping applications, particularly in regions where equipment versatility reduces capital requirements and improves project economics. Technology deployment channels through equipment dealers, rental companies, and agricultural cooperatives expand coverage across construction, agricultural, and municipal maintenance applications.

Leading market segments:

The UK's bucket 4 in 1 market demonstrates steady implementation focused on construction projects, agricultural operations, and utility work requiring versatile earthmoving capabilities in confined urban environments and rural properties. The country maintains consistent growth momentum with a CAGR of 3.7% through 2035, driven by urban infrastructure development and agricultural equipment modernization across major regions including Southeast England, Midlands, Northwest, and Scotland. British contractors and farmers are implementing multi-function bucket attachments to improve operational efficiency while addressing space constraints in urban construction sites and maximizing equipment utility on agricultural holdings requiring diverse material handling capabilities.

Key market characteristics:

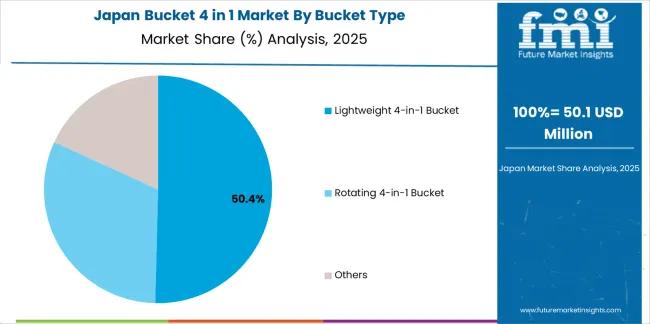

Japan's bucket 4 in 1 market demonstrates mature implementation focused on construction quality, agricultural precision, and forestry operations, with documented integration of advanced hydraulic systems and wear-resistant materials ensuring extended service life. The country maintains steady growth momentum with a CAGR of 3.2% through 2035, driven by infrastructure maintenance requirements and specialized agricultural operations across major regions, including Hokkaido, Tohoku, Kanto, and Kyushu. Japanese contractors and farmers showcase advanced deployment of premium bucket attachments featuring precise hydraulic control, optimized geometry for material retention, and durable construction suitable for demanding operational environments.

Key market characteristics:

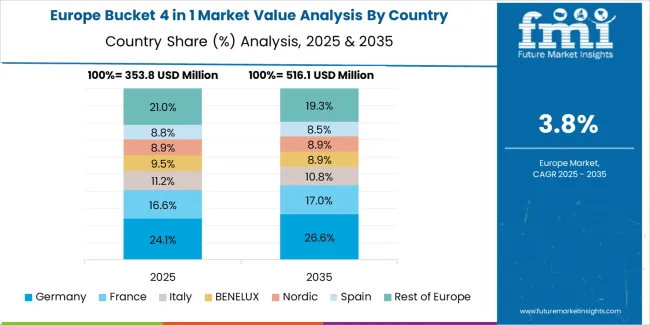

The bucket 4 in 1 market in Europe is projected to grow from USD 389.6 Million in 2025 to USD 590.7 Million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 29.5% market share in 2025, declining slightly to 28.8% by 2035, supported by its extensive construction equipment infrastructure and major industrial centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg production regions.

France follows with a 18.7% share in 2025, projected to reach 19.1% by 2035, driven by comprehensive agricultural mechanization programs and construction sector activity. The United Kingdom holds a 16.3% share in 2025, expected to decrease to 15.8% by 2035 due to market maturity and moderate construction growth. Italy commands a 12.8% share in both 2025 and 2035, backed by agricultural equipment demand and regional construction activity.

Spain accounts for 9.2% in 2025, rising to 9.6% by 2035 on agricultural expansion and infrastructure development. The Netherlands maintains 4.9% in 2025, reaching 5.1% by 2035 on intensive agricultural operations and construction activity. The Rest of Europe region is anticipated to hold 8.6% in 2025, expanding to 9.0% by 2035, attributed to increasing bucket 4 in 1 adoption in Nordic countries and emerging Central & Eastern European agricultural mechanization programs.

The Japanese bucket 4 in 1 market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of premium attachment systems with existing compact equipment infrastructure across agricultural operations, construction projects, and forestry management activities. Japan's focus on equipment reliability and operational precision drives demand for high-quality bucket attachments that support demanding construction standards and specialized agricultural requirements in intensive farming operations.

The market benefits from strong partnerships between international attachment providers and domestic equipment manufacturers including Kubota, Komatsu, and Hitachi Construction Machinery, creating comprehensive service ecosystems that prioritize product durability and technical support programs. Agricultural and construction centers in Hokkaido, Kanto, Chubu, and other major production areas showcase advanced equipment implementations where bucket attachments achieve 95% uptime reliability through preventive maintenance programs and quality component specifications.

The South Korean bucket 4 in 1 market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive dealer networks and technical support capabilities for construction and agricultural applications. The market demonstrates increasing focus on equipment modernization and agricultural mechanization, as Korean contractors and farmers increasingly demand versatile attachments that integrate with advanced compact equipment platforms deployed across construction sites and agricultural holdings.

Regional equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean equipment compatibility verification and application-specific technical assistance for construction and farming operations. The competitive landscape shows increasing collaboration between multinational attachment companies and Korean equipment dealers, creating hybrid service models that combine international product quality with local market knowledge and rapid parts availability.

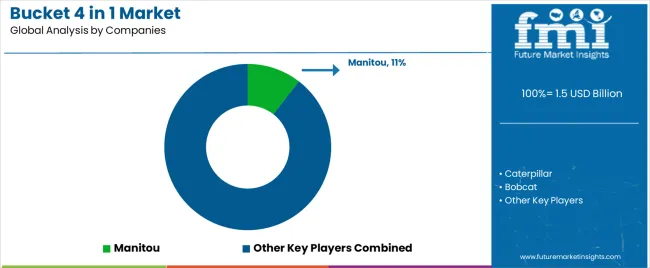

The market features approximately 25-35 meaningful players with moderate fragmentation, where the top three companies control roughly 24-30% of global market share through established dealer networks, comprehensive product portfolios, and strong brand recognition among construction contractors and agricultural operators. Competition centers on product durability, hydraulic system reliability, compatibility with multiple equipment brands, and dealer support capabilities rather than price competition alone. Manitou leads with approximately 10.5% market share through its comprehensive attachment portfolio and global distribution infrastructure.

Market leaders include Manitou, Caterpillar, and Bobcat, which maintain competitive advantages through extensive equipment dealer networks, vertical integration with loader manufacturing operations, and comprehensive attachment ranges covering multiple equipment classes and application requirements, creating one-stop-shop capabilities for construction and agricultural customers. These companies leverage research and development capabilities in hydraulic system optimization, wear-resistant materials, and quick-coupler standardization to defend market positions while expanding into emerging markets and specialized application segments including forestry operations, waste handling, and industrial material management.

Challengers encompass John Deere, Kubota, and Volvo Construction Equipment, which compete through strong agricultural and construction equipment franchises, integrated attachment offerings bundled with equipment sales, and comprehensive dealer support networks providing installation assistance and maintenance services. Product specialists, including Rata Equipment, Paladin Attachments, and Wacker Neuson, focus on specific attachment categories or regional markets, offering differentiated capabilities in custom designs, heavy-duty construction variants, and application-specific hydraulic configurations for specialized operational requirements.

Regional players and emerging attachment manufacturers create competitive pressure through cost advantages in local markets, particularly in Asia-Pacific and Latin American regions where proximity to growth markets provides logistics benefits and customer relationship advantages. Market dynamics favor companies that combine reliable product quality with comprehensive dealer support services, cross-brand compatibility through standardized quick-coupler systems, and technical resources that assist customers with proper attachment selection, hydraulic system integration, and operational training for maximizing equipment productivity and attachment service life.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 billion |

| Bucket Type | Lightweight 4-in-1 Bucket, Rotating 4-in-1 Bucket, Others |

| Application | Traditional Agriculture, Forestry, Construction Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Manitou, Caterpillar, Bobcat, John Deere, Kubota, Rata Equipment, Paladin Attachments, Wacker Neuson, Hitachi Construction Machinery, Volvo Construction Equipment, Doosan Infracore, Komatsu, CASE Construction |

| Additional Attributes | Dollar sales by bucket type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with attachment manufacturers and equipment distribution networks, installation requirements and compatibility specifications, integration with compact loader platforms and hydraulic quick-coupler systems, innovations in rotating bucket technology and wear-resistant materials, and development of specialized designs with enhanced clamping force and operational versatility capabilities. |

The global bucket 4 in 1 market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the bucket 4 in 1 market is projected to reach USD 2.3 billion by 2035.

The bucket 4 in 1 market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in bucket 4 in 1 market are lightweight 4-in-1 bucket, rotating 4-in-1 bucket and others.

In terms of application, traditional agriculture segment to command 39.0% share in the bucket 4 in 1 market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bucket Market Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Food Bucket Elevators Market

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Loader Bucket Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Attachments Market Size and Share Forecast Outlook 2025 to 2035

Backhoe Bucket Market Size and Share Forecast Outlook 2025 to 2035

Chicken Buckets Market

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Ice Transport Buckets Market

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

4-Ethylphenylboronic Acid Market Forecast and Outlook 2025 to 2035

4-Allylanisole Market Size and Share Forecast Outlook 2025 to 2035

433MHz Active RFID Reader Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

4X4 Vehicles Parts and Accessories Market Size and Share Forecast Outlook 2025 to 2035

4-Benzoylbutyric Acid Market Size and Share Forecast Outlook 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA