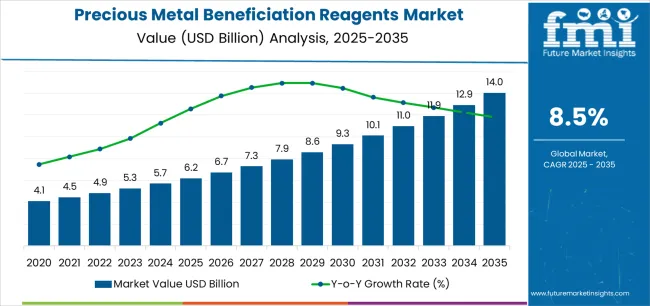

The precious metal beneficiation reagents market is poised for significant growth, projected to increase from USD 6.2 billion in 2025 to USD 14 billion by 2035, with a robust CAGR of 8.5%. The growing demand for precious metals such as gold, silver, and platinum, as well as advancements in mining technology. As the global economy continues to grow, demand for high-quality beneficiation reagents used to improve the extraction and processing efficiency of these metals will rise. The precious metal beneficiation reagents market is further supported by the growing need for sustainable and cost-effective solutions in the mining sector, alongside technological innovations in the reagent application process.

Demand for precious metal beneficiation reagents is also linked to increased exploration and extraction activities in emerging mining regions. As mining companies look to optimize operations and reduce environmental impacts, there will be a greater emphasis on the use of efficient, environmentally friendly, and high-performance reagents. The rise in demand for recyclable precious metals and the growing need for greener and more sustainable mining practices will drive further demand for advanced reagents and technologies that support these objectives, ensuring strong precious metal beneficiation reagents market demand over the next decade.

From 2025 to 2030, the market will expand from USD 6.2 billion to USD 9.3 billion, a growth of USD 3.1 billion. This period is expected to account for a substantial portion of the market’s overall growth. The demand for precious metal beneficiation reagents will be bolstered by increased mining activity, especially in emerging markets, and the growing adoption of sustainable mining practices. Enhanced extraction technologies and higher precious metal prices will drive this growth as mining operations aim to improve their efficiency and profitability.

Between 2030 and 2035, the market will continue to grow from USD 9.3 billion to USD 14 billion, adding USD 4.7 billion in value. This phase will be marked by the maturation of mining operations in developed regions and continued exploration in new, resource-rich areas. The increased focus on environmentally friendly reagents and technological innovations in beneficiation processes will also contribute to market expansion. As the global demand for precious metals remains strong, the market for beneficiation reagents will continue to thrive, benefiting from both rising resource extraction and a greater emphasis on sustainable mining practices.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.2 billion |

| Market Forecast Value (2035) | USD 14 billion |

| Forecast CAGR (2025-2035) | 8.5% |

The precious metal beneficiation reagents market is experiencing robust growth due to several key drivers, the most prominent being the increasing global demand for precious metals like gold and silver. These metals are critical in industries such as electronics, renewable energy, and jewelry, and their growing consumption is directly influencing the demand for efficient extraction methods. Beneficiation reagents, including flotation and leaching agents, are integral to improving the efficiency and sustainability of these extraction processes. As mining operations increasingly target lower-grade ores, the demand for specialized reagents to maximize yield has surged.

Advancements in mining technologies and the need for eco-friendly solutions are also driving growth. The mining industry is under increasing pressure to adopt environmentally responsible practices, and there is a growing preference for green reagents that minimize environmental impact. Regulatory frameworks governing mining waste management and chemical use are encouraging the development and adoption of more sustainable beneficiation reagents. In regions like China and India, the rapidly expanding mining sectors are also contributing to market growth. Additionally, the increased focus on precious metal recycling and secondary extraction is opening up new opportunities for beneficiation reagents, further driving market expansion.

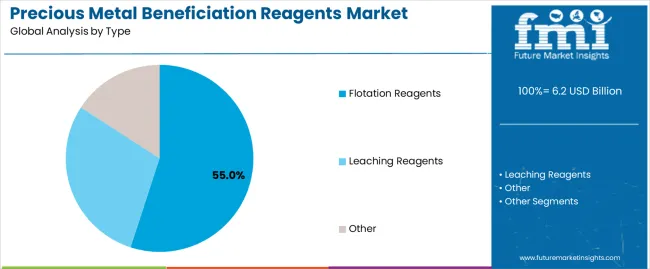

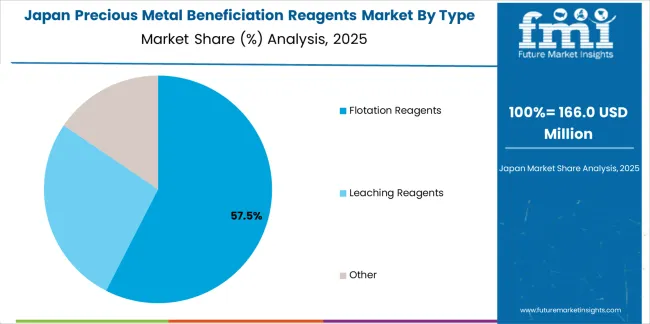

The precious metal beneficiation reagents market is segmented by type, application, and region. By type, the market is primarily divided into flotation reagents, leaching reagents, and other reagents. The flotation reagents segment holds the largest market share, driven by their widespread use in the extraction of both gold and silver from ores. Leaching reagents, particularly cyanide-based chemicals, also represent a significant share, as they are crucial for gold extraction in large-scale mining operations. Other reagents, including depressants and collectors, are used in more specialized applications but are growing in importance as extraction methods evolve.

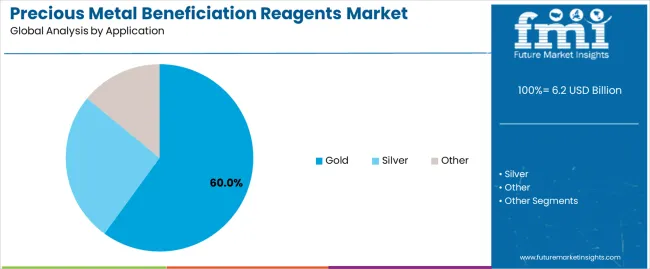

By application, the market is segmented into gold, silver, and other precious metals. The gold segment dominates, accounting for around 60% of the market share, due to the extensive demand for gold in industries such as electronics, jewelry, and renewable energy. Silver extraction also contributes significantly to market growth, particularly due to its growing use in solar energy and electronics. The other precious metals segment, including platinum and palladium, is a smaller but important contributor to the overall market. Regionally, the market shows strong growth in China, India, and Brazil, where mining activities are expanding, followed by steady demand in Europe and North America.

The flotation reagents segment is the dominant force in the Precious Metal Beneficiation Reagents Market, accounting for approximately 55% of the market share. Flotation reagents are critical in the separation and concentration of valuable minerals from ores, particularly in the extraction of gold and silver. The flotation process, which uses collectors and frothers to separate valuable metals from waste rock, is a widely adopted technique in mining operations. This method is preferred due to its efficiency and cost-effectiveness, particularly in large-scale mining operations. As mining companies continue to seek more sustainable and profitable extraction methods, the demand for flotation reagents is expected to grow, especially as new reserves of gold and silver are being extracted from lower-grade ores. Furthermore, the development of advanced flotation reagents that improve recovery rates and reduce environmental impact is contributing to the continued market dominance of the flotation segment.

The gold segment is the leading application in the Precious Metal Beneficiation Reagents Market, representing around 60% of the market share. Gold has historically been one of the most sought-after precious metals, and its demand remains high in industries such as jewelry, electronics, and renewable energy. The need for effective gold extraction methods, especially in large-scale mining operations, drives the demand for beneficiation reagents like flotation and leaching agents. Leaching reagents, particularly cyanide-based chemicals, are heavily used in the gold mining industry due to their efficiency in extracting gold from low-grade ores. As gold remains a cornerstone of the global economy, both in terms of its monetary value and industrial uses, the demand for precious metal beneficiation reagents in gold extraction will continue to drive growth in this segment. Additionally, the rising focus on sustainable mining practices is prompting the development of eco-friendly reagents that cater to the evolving needs of the gold mining sector.

The precious metal beneficiation reagents market is driven by the increasing demand for gold and silver in various industries, including electronics and jewelry, and the growing focus on sustainable mining practices. The adoption of eco-friendly reagents, especially alternatives to cyanide, is also pushing market growth. However, high reagent costs, limited access to high-quality ores, and environmental concerns around traditional chemicals are key restraints. Trends include the rising demand for green reagents, advancements in automation and AI-driven mining technologies, and the growing importance of precious metal recycling, all contributing to the market's evolution and future expansion.

What Are the Key Drivers of the Precious Metal Beneficiation Reagents Market?

The growth of the precious metal beneficiation reagents market is driven by the increasing demand for precious metals such as gold and silver in industries like electronics, jewelry, and renewable energy. As global demand for these metals grows, the need for effective and efficient extraction processes, such as those enabled by flotation and leaching reagents, rises. Flotation reagents are particularly important in separating valuable metals from ores, while leaching reagents are essential for extracting metals like gold from lower-grade ores. Additionally, the need for sustainable mining practices is driving demand for eco-friendly reagents. With stricter environmental regulations, mining companies are increasingly turning to greener alternatives to cyanide and other traditional chemicals. Another key driver is the advancements in reagent technologies, allowing for better extraction efficiencies and improved recovery rates from challenging ores. Furthermore, the expanding mining industry in emerging economies such as China, India, and Brazil is accelerating the demand for beneficiation reagents to meet the growing need for precious metals in both industrial and technological applications.

What Are the Key Restraints in the Precious Metal Beneficiation Reagents Market?

Despite the market's growth, there are several restraints that could limit its expansion. One of the main challenges is the high cost of reagents, particularly for eco-friendly alternatives. While these greener reagents are gaining traction, they are often more expensive than traditional chemicals, making it difficult for small or cost-conscious mining operations to adopt them. The availability of high-quality ores is another challenge, as many of the world’s higher-grade ore deposits are being depleted. This forces mining companies to focus on lower-grade ores, which require more advanced and expensive reagents to extract metals effectively. Additionally, environmental concerns surrounding the use of chemicals like cyanide and arsenic remain an issue for the mining industry. While there are more sustainable alternatives, the regulations governing chemical use and waste disposal in mining operations are becoming stricter, which could increase operational costs. Finally, price volatility in the precious metals market can affect demand for reagents, as fluctuations in gold and silver prices may lead to inconsistent demand for extraction chemicals.

What Are the Key Trends in the Precious Metal Beneficiation Reagents Market?

The precious metal beneficiation reagents market is being shaped by several key trends. Sustainability and eco-friendly chemicals continue to be a major focus, as the mining industry is under increasing pressure to reduce its environmental impact. Green reagents, such as cyanide-free alternatives, are gaining popularity as mining companies move toward more sustainable extraction methods. Another important trend is the growing use of automation and digitalization in mining operations. Technologies like AI, machine learning, and sensor-based monitoring systems are helping improve the efficiency of reagent usage, optimizing extraction processes, and reducing waste. Additionally, there is an increasing focus on recycling precious metals, particularly gold and silver, which has led to higher demand for reagents used in secondary metal extraction. The growing emphasis on the circular economy is contributing to this trend, as companies look to reclaim valuable materials from e-waste and other sources. As these trends evolve, the precious metal beneficiation reagents market will likely continue to expand, driven by the adoption of new, more sustainable, and efficient technologies.

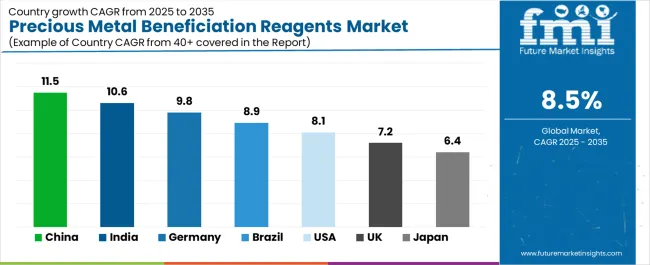

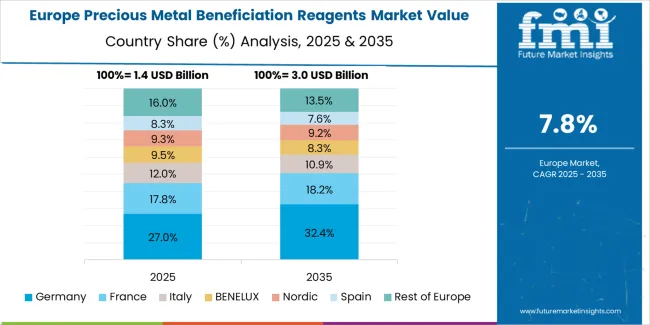

The precious metal beneficiation reagents market is growing at different rates across regions, influenced by local mining activities, technological adoption, and the demand for precious metals. China and India are expected to see the highest growth rates due to their rapidly expanding mining sectors and increasing demand for both gold and silver. In China, which is the largest consumer of gold, the demand for beneficiation reagents is driven by its substantial gold mining industry and focus on sustainable extraction methods. Germany, Brazil, and the USA continue to hold significant shares in the market, with strong mining operations and a rising demand for green reagents. Japan and the UK are experiencing steady growth, mainly due to their advanced mining technologies and emphasis on environmental regulations. As the global demand for precious metals continues to rise, these countries will continue to play a pivotal role in driving the market for precious metal beneficiation reagents.

| Country | CAGR (%) |

|---|---|

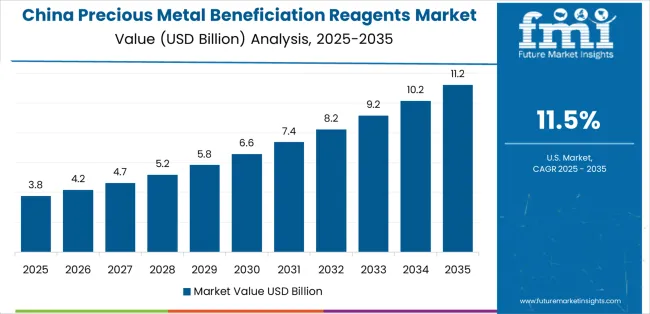

| China | 11.5 |

| India | 10.6 |

| Germany | 9.8 |

| Brazil | 8.9 |

| USA | 8.1 |

| UK | 7.2 |

| Japan | 6.4 |

China, with a CAGR of 11.5%, is the fastest-growing market for precious metal beneficiation reagents. As the largest producer and consumer of gold, China is heavily invested in improving the efficiency and sustainability of its mining operations. The country’s growing demand for gold in electronics, jewelry, and renewable energy drives the need for high-performance reagents that can support large-scale extraction processes. Additionally, environmental regulations in China are pushing mining companies to adopt more sustainable flotation and leaching reagents, which contributes to the increasing demand for eco-friendly chemical solutions. With ongoing expansion in mining operations and the continuous push toward green technologies, China is poised to lead the market in both demand and technological innovation for precious metal beneficiation reagents.

India, with a CAGR of 10.6%, is a key player in the Precious Metal Beneficiation Reagents Market, driven by the expanding mining sector and rising demand for gold and silver. India is one of the largest consumers of gold, and with growing demand in sectors like jewelry and electronics, the country is witnessing an increased need for efficient and eco-friendly extraction reagents. The market is further supported by government policies aimed at boosting the mining industry and improving the country’s overall mining efficiency. As India shifts toward more sustainable mining practices, there is also a growing focus on green reagents and reagent recycling technologies, which is expected to drive growth in the sector. Additionally, India's expanding e-commerce platforms make reagents more accessible to a broader range of mining companies, contributing to market expansion.

Germany, with a CAGR of 9.8%, continues to play a significant role in the Precious Metal Beneficiation Reagents Market, primarily due to its strong industrial base and highly advanced mining technology. The country’s mining operations are focusing on maximizing the recovery of precious metals like gold and silver from lower-grade ores, driving the demand for more efficient and sustainable flotation and leaching reagents. Germany is also at the forefront of adopting eco-friendly technologies, with a growing trend towards the development of green reagents that minimize environmental impact. Additionally, as a key European market, Germany’s strict environmental regulations are pushing for more sustainable mining practices, further driving demand for reagents that meet these standards.

Brazil, with a CAGR of 8.9%, is witnessing moderate growth in the Precious Metal Beneficiation Reagents Market. The country’s growing mining sector, particularly in gold and silver, is contributing to increased demand for effective beneficiation reagents. Brazil has a large amount of untapped mining potential, and as the country’s gold mining industry expands, the demand for leaching and flotation reagents will continue to rise. Additionally, with increasing emphasis on sustainability and environmentally responsible mining practices, Brazilian mining companies are looking for green reagents that minimize the impact on the environment. The rising tourism industry and electronics manufacturing in Brazil are also driving demand for recycled precious metals, boosting the market for secondary extraction reagents.

The USA, with a CAGR of 8.1%, remains a major player in the Precious Metal Beneficiation Reagents Market. As one of the largest consumers and producers of precious metals, the USA has a well-established mining industry, especially in gold and silver. Mining companies are increasingly investing in advanced reagent technologies to optimize extraction from low-grade ores, and the demand for flotation and leaching reagents is steadily rising. Moreover, regulatory pressures are encouraging USA mining companies to adopt eco-friendly and sustainable reagents, aligning with the country's broader environmental goals. The growing interest in recycled precious metals also creates additional opportunities for beneficiation reagents in the USA market.

The UK, with a CAGR of 7.2%, is experiencing steady growth in the Precious Metal Beneficiation Reagents Market. Although the UK has a smaller mining industry compared to other regions, it plays a crucial role in the global gold market, both in terms of trading and processing. The UK also acts as a hub for mining technology and innovation, with several mining technology companies providing advanced reagent solutions to meet the growing demand for sustainable mining practices. The increasing focus on eco-friendly chemicals and regulations in the UK is driving growth, as mining companies seek more sustainable alternatives to traditional reagents. The UK's continued leadership in the development of green mining technologies and its growing role in recycling precious metals contribute to its market expansion.

Japan, with a CAGR of 6.4%, is contributing to the growth of the Precious Metal Beneficiation Reagents Market due to its advanced mining technologies and the country’s growing focus on sustainability in mining operations. While Japan’s domestic mining activities are smaller in scale compared to countries like China or the USA, it plays a significant role in precious metal refining and recycling. The demand for effective flotation and leaching reagents is expected to increase as Japan looks to optimize precious metal extraction from both primary and secondary sources. The rising awareness of eco-friendly solutions is driving the adoption of green reagents in Japan, as companies strive to meet the country’s environmental goals and regulations in mining practices.

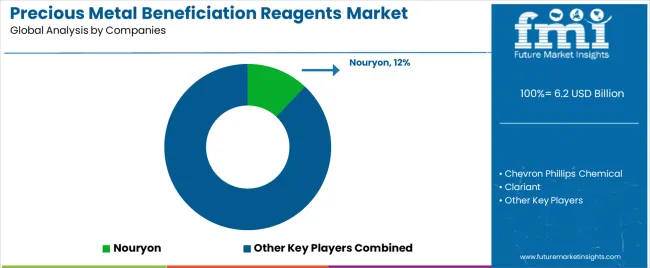

The precious metal beneficiation reagents market is highly competitive, with several major players leading the market and driving innovations in reagent technologies. The market is primarily dominated by large multinational companies that supply a wide range of flotation and leaching reagents for the extraction of gold and silver. Nouryon, holding approximately 12% of the market share, is one of the leading players in this market, offering a diverse portfolio of high-performance reagents for the precious metal industry. Other prominent players, including Chevron Phillips Chemical, Clariant, Syensqo, and Ecolab, also hold significant market shares and contribute to the development of eco-friendly reagents that cater to the growing demand for sustainable mining practices. The increasing shift toward sustainable chemicals and green mining technologies is a key area of competition, with companies investing in the development of cyanide-free and biological reagents that minimize environmental impact.

Leading companies in the precious metal beneficiation reagents market are competing on several fronts, with a strong emphasis on innovation, sustainability, and product performance. Nouryon and Clariant are at the forefront of developing and supplying green reagents that comply with environmental regulations, meeting the increasing demand for eco-friendly solutions in mining operations. These companies are leveraging their global reach and expertise in chemical manufacturing to offer high-quality reagents that improve recovery rates and reduce the environmental footprint of mining operations. Syensqo, Evonik, and BASF are investing heavily in research and development to produce more efficient and cost-effective reagents, including flotation and leaching chemicals, that improve the extraction of gold and silver from ores. Additionally, regional players like Guangxi Senhe High Technology and Henan Green Gold Mining Technology are expanding their market presence, particularly in emerging markets such as China and India, where mining operations are increasing rapidly. These regional players often focus on offering cost-effective solutions tailored to local mining needs, helping them capture a significant share of the market in these rapidly growing regions.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Type | Flotation Reagents, Leaching Reagents, Other |

| Application | Gold, Silver, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | USA, China, India, South Africa, Australia, Russia, Canada, 40+ other countries |

| Key Companies Profiled | Nouryon, Chevron Phillips Chemical, Clariant, Syensqo, Ecolab, Evonik, BASF, Kao Chemicals, Guangxi Senhe High Technology, Henan Green Gold Mining Technology, Henan Tianzhishui Chemical, Guangxi Dishengjin Mining Technology, Sandioss, Shenyang Jinyao Environmental Protection Technology |

| Additional Attributes | The market analysis includes dollar sales by type and application categories. It also covers regional adoption trends across key regions like Asia Pacific, Europe, and North America. The competitive landscape includes major manufacturers in the precious metal beneficiation reagents sector, focusing on innovations in flotation and leaching technologies. Trends in demand for gold and silver beneficiation, along with advancements in environmentally-friendly reagents, are also discussed. |

The global precious metal beneficiation reagents market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the precious metal beneficiation reagents market is projected to reach USD 14.0 billion by 2035.

The precious metal beneficiation reagents market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in precious metal beneficiation reagents market are flotation reagents, leaching reagents and other.

In terms of application, gold segment to command 60.0% share in the precious metal beneficiation reagents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Non-eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Precious Metal Nano Wires Market Size and Share Forecast Outlook 2025 to 2035

Precious Metal Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Demand for Precious Metal Plating Chemicals in EU Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA