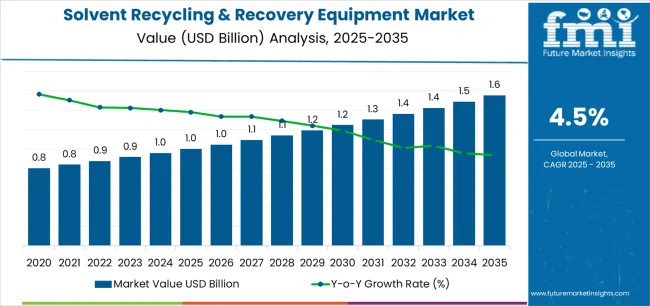

The global solvent recycling and recovery equipment market is projected to grow from USD 1.0 billion in 2025 to approximately USD 1.6 billion by 2035, recording an absolute increase of USD 558.3 million over the forecast period. This translates into a total growth of 55.3%, with the market forecast to expand at a CAGR of 4.5% between 2025 and 2035.

The overall market size is expected to grow by 1.6 times during the same period, supported by expanding environmental regulations, increasing demand for waste solvent management solutions across manufacturing facilities, and growing adoption of circular economy principles in chemical processing industries.

The steady market expansion reflects the essential role of solvent recovery technology in maintaining environmental compliance and operational cost reduction across industrial applications. Manufacturing facilities worldwide are increasingly adopting solvent recycling equipment to meet environmental regulations while reducing waste disposal costs, with advanced distillation systems and membrane-based recovery technologies creating enhanced efficiency characteristics for diverse processing environments including pharmaceutical manufacturing, paint production facilities, and chemical processing operations under demanding recovery requirements.

Production capabilities are advancing through specialized distillation technology development and automated control systems that enable precise recovery processes while reducing energy consumption and operational costs. Leading manufacturers are investing in advanced separation equipment and process optimization technologies to create recovery systems that deliver superior solvent purity, extended equipment life, and reliable performance under varying feed composition conditions. Chemical processing companies and environmental service providers are expanding their solvent recovery equipment offerings to address specific application requirements across oil and gas processing, pharmaceutical manufacturing, paint and coatings production, and general industrial solvent management applications.

Quality standards continue evolving as applications demand higher purity specifications and consistent performance under extreme operating conditions including temperature variations, chemical compatibility challenges, and prolonged operation cycles. Industry certification programs and testing protocols ensure reliable product performance while supporting market confidence in solvent recovery technology adoption across critical manufacturing processes and regulated industrial environments. Environmental compliance requirements for hazardous waste management and emission control applications are driving investments in comprehensive quality assurance systems and validation procedures throughout the equipment manufacturing supply chain.

International manufacturing coordination is supporting market development as major industrial projects require standardized solvent recovery solutions across multiple production facilities. Global chemical processing companies are establishing unified specifications for solvent management that influence worldwide procurement standards and create opportunities for specialized recovery equipment manufacturers. Environmental engineering firms are forming partnerships with equipment suppliers to develop application-specific recovery solutions tailored to emerging waste management requirements and industrial processing specifications.

Investment patterns are shifting toward integrated system solutions as manufacturing facilities seek comprehensive solvent management systems that combine high recovery efficiency with advanced process control capabilities and maintenance-friendly characteristics. Industrial companies are implementing standardized recovery equipment specifications across their facilities, while equipment manufacturers are incorporating advanced distillation and separation technologies into their system designs to ensure environmental compliance and operational efficiency. This trend toward automation and performance optimization is reshaping competitive dynamics across the industrial waste management and chemical processing value chain.

Market maturation is evident in the emergence of specialized application segments that demand unique separation characteristics and performance specifications. Pharmaceutical applications require GMP-compliant equipment designs and validated cleaning procedures under strict quality requirements, while oil and gas processing systems need equipment that maintains performance during continuous operations and provides consistent recovery rates in harsh processing environments. These specialized requirements are driving innovation in separation technologies, process control systems, and integration methodologies that extend beyond traditional solvent recovery applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.0 billion |

| Market Forecast Value (2035) | USD 1.6 billion |

| Forecast CAGR (2025-2035) | 4.5% |

| ENVIRONMENTAL REGULATION COMPLIANCE | COST REDUCTION INITIATIVES | CIRCULAR ECONOMY ADOPTION |

|---|---|---|

| Waste Management Requirements - Environmental regulations and hazardous waste disposal mandates driving adoption of effective solvent recovery solutions for chemical processing, manufacturing operations, and industrial facilities requiring certified waste reduction performance and regulatory compliance documentation. | Operational Cost Savings - Manufacturing facility improvements implementing solvent recovery technology for cost reduction, reduced waste disposal expenses, and enhanced resource utilization while maintaining productive processing environments and operational efficiency standards. | Resource Conservation - Manufacturing companies implementing circular economy principles for solvent reuse, waste minimization, and resource recovery with enhanced performance and standardized processing specifications. |

| Emission Control Standards - Industrial facility standards requiring comprehensive solvent recovery solutions for manufacturing operations, equipment installations, and facility expansions with documented performance and environmental certification requirements. | Raw Material Cost Management - Manufacturing cost reduction initiatives requiring efficient recovery solutions for solvent processing, equipment maintenance optimization, and facility operational efficiency with proven performance and reliability characteristics. | Process Optimization - Chemical processing advancement requiring specialized recovery components for industrial equipment, process automation, and facility infrastructure with enhanced performance and standardized specifications. |

| Regulatory Requirements - Environmental safety standards and solvent emission regulations requiring certified recovery performance for manufacturing facilities, equipment operations, and worker protection with comprehensive compliance documentation and testing validation. | Equipment Integration - Manufacturing system optimization requiring specialized recovery components for chemical processing equipment, industrial automation, and facility infrastructure with enhanced performance and standardized specifications. | Technology Innovation - Industrial equipment advancement requiring integrated recovery solutions for automated manufacturing systems, processing operations, and material handling applications with superior efficiency and reliability characteristics. |

| Category | Segments / Values |

|---|---|

| By Type | Fully Automatic; Semi-Automatic; Manual Systems; Continuous Operation; Batch Processing; Others |

| By Application | Oil & Gas; Chemical; Pharmaceutical; Paint & Coatings; Electronics Manufacturing; Printing Industry; Others |

| By End-User | Chemical Processing Companies; Oil & Gas Companies; Pharmaceutical Manufacturers; Environmental Service Providers; Industrial Equipment Suppliers; Others |

| By Technology | Distillation Systems; Membrane Separation; Adsorption Systems; Extraction Units; Hybrid Technologies; Others |

| By Capacity Range | Small Scale (0-50 L/hr); Medium Scale (50-500 L/hr); Large Scale (500+ L/hr); Others |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

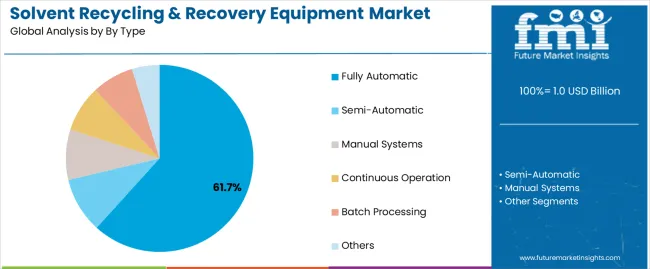

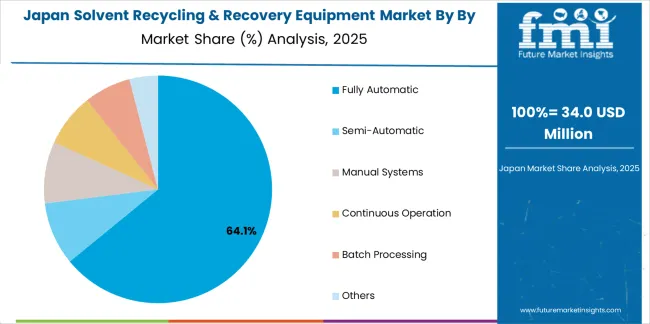

| Fully Automatic | Leader in 2025 with 61.7% market share; preferred choice for large-scale industrial operations and continuous processing applications requiring minimal operator intervention and consistent performance. Widely adopted across chemical processing and pharmaceutical manufacturing facilities. Momentum: strong growth across industrial automation and large-scale processing segments. Watchouts: higher capital investment requirements compared to semi-automatic alternatives in cost-sensitive applications. |

| Semi-Automatic | Growing segment with 32.8% share, favored for medium-scale operations and specialized applications requiring operator control and flexibility in processing parameters. Momentum: steady growth in specialized chemical processing and custom recovery applications. Watchouts: labor requirements and operational complexity compared to fully automated systems. |

| Manual Systems | Specialized segment serving small-scale operations and laboratory applications requiring precise control and batch-specific processing capabilities. Momentum: moderate growth in research facilities and specialized manufacturing operations. Watchouts: limited scalability and higher labor requirements for commercial applications. |

| Others | Includes continuous operation systems, batch processing units, and specialty configurations for unique application requirements. Momentum: selective growth in specialized processing and custom industrial applications. |

| Segment | 2025 to 2035 Outlook |

|---|---|

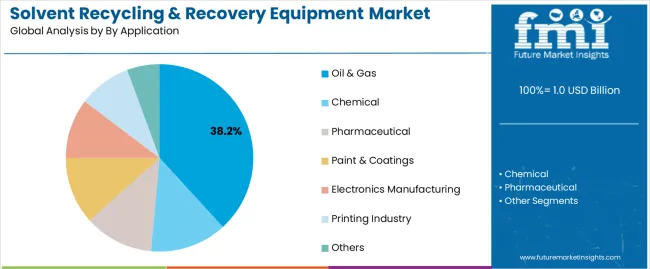

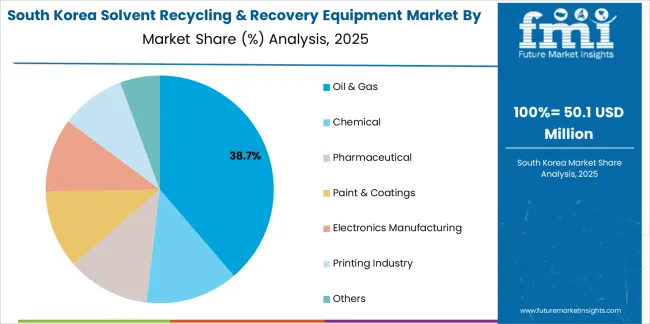

| Oil & Gas | Largest application segment in 2025 at 38.2% share, driven by extensive refinery operations and downstream processing facilities requiring effective solvent recovery for process optimization, environmental compliance, and cost reduction in hydrocarbon processing operations. Momentum: robust growth from upstream development and refinery expansion projects. Watchouts: commodity price volatility and regulatory changes affecting investment decisions. |

| Chemical | Critical segment representing 29.4% share, experiencing strong growth from specialty chemical manufacturing expansion and process intensification requiring advanced recovery solutions for diverse solvent applications. Momentum: consistent growth as chemical facilities enhance process efficiency and environmental performance. Watchouts: raw material price fluctuations and competitive pressure in commodity chemical markets. |

| Pharmaceutical | Growing segment at 18.7% share for specialized pharmaceutical manufacturing applications requiring high-purity recovery and validated processing systems under strict regulatory requirements. Momentum: excellent growth from pharmaceutical manufacturing expansion and quality compliance requirements. Watchouts: stringent regulatory validation and equipment qualification requirements limiting rapid deployment. |

| Others | Includes paint and coatings, electronics manufacturing, printing industry, and emerging industrial applications. Momentum: diverse growth opportunities across multiple industrial sectors and specialized processing applications. |

| End-User | Status & Outlook (2025 to 2035) |

|---|---|

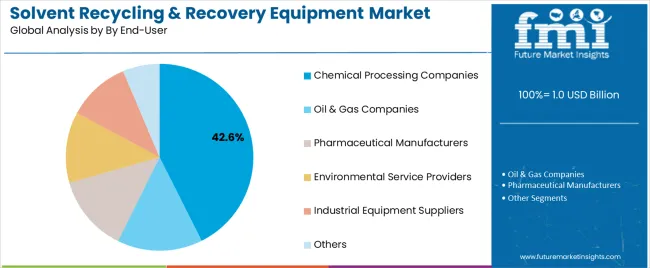

| Chemical Processing Companies | Dominant end-user in 2025 with 42.6% share for direct manufacturing applications and process optimization requirements. Provides operational efficiency, cost reduction, and environmental compliance improvements for chemical production operations. Momentum: steady growth driven by chemical industry expansion and process intensification. Watchouts: competitive pressure and capital allocation priorities across multiple facility improvement projects. |

| Oil & Gas Companies | Major end-user serving upstream and downstream operations requiring integrated solvent recovery solutions for refinery processes and field operations. Momentum: moderate growth as energy companies enhance operational efficiency and environmental performance. Watchouts: commodity price cycles and regulatory compliance costs affecting equipment investment decisions. |

| Pharmaceutical Manufacturers | Specialized end-user for high-value solvent recovery and regulatory compliance applications requiring validated equipment and documentation systems. Momentum: strong growth driven by pharmaceutical manufacturing expansion and regulatory compliance requirements. Watchouts: equipment qualification timelines and validation costs for regulated manufacturing applications. |

| Others | Includes environmental service providers, industrial equipment suppliers, and emerging end-user categories. Momentum: selective growth opportunities in specialized applications and emerging industrial sectors. |

| KEY TRENDS | DRIVERS | RESTRAINTS |

|---|---|---|

| Automation Integration - Advanced process control systems and automated operation capabilities delivering enhanced efficiency, reduced labor requirements, and consistent performance for demanding industrial applications with improved processing characteristics and extended equipment life. | Environmental Regulations across industrial facilities and manufacturing operations creating substantial demand for solvent recovery solutions supporting waste reduction, emission control, and regulatory compliance requiring effective recovery performance and environmental validation. | High Capital Investment in industrial procurement and facility upgrades limiting adoption of premium recovery systems across cost-conscious manufacturing facilities and competitive industrial applications with restricted equipment budgets. |

| Energy Efficiency - Expanding integration with heat recovery systems, optimized distillation processes, and energy management platforms enabling comprehensive energy monitoring, operational cost reduction, and performance optimization capabilities. | Cost Reduction Pressure - Industrial facility upgrades and manufacturing cost optimization requiring specialized recovery equipment for improved operational efficiency, reduced waste disposal costs, and enhanced resource utilization with superior recovery performance. | Technical Complexity - Application-specific requirements, installation procedures, and process validation affecting deployment timelines and operational capabilities for industrial facilities lacking specialized chemical engineering expertise and maintenance capabilities. |

| Process Intensification - Integration with continuous processing initiatives and modular system designs enabling compact installations, higher throughput, and optimized recovery performance for enhanced operational efficiency and reliability. | Raw Material Costs - Chemical processing operations and manufacturing facility expansions requiring efficient solvent recovery systems for cost management, resource conservation, and operational sustainability with documented performance characteristics and reliability validation. | Regulatory Compliance - Diverse industrial applications, equipment specifications, and regional requirements creating complexity for suppliers developing standardized recovery solutions across multiple chemical processing sectors and international markets. |

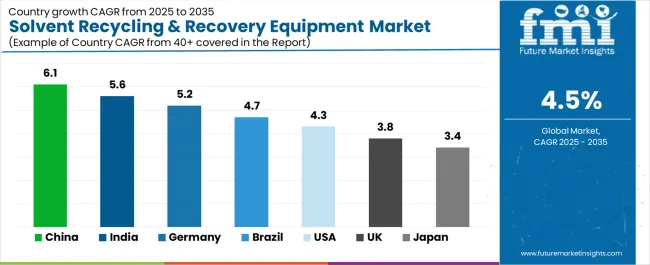

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

| United States | 4.3% |

| United Kingdom | 3.8% |

| Japan | 3.4% |

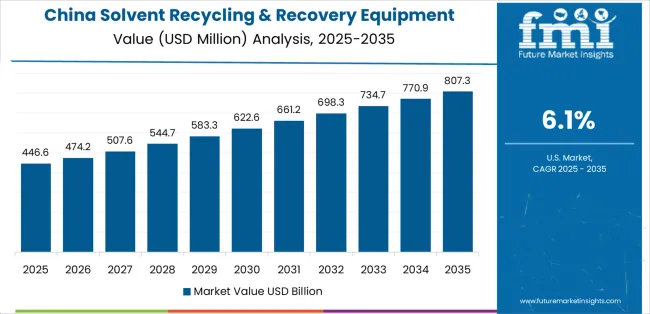

China is projected to exhibit strong growth with a market value of USD 351.2 million by 2035, driven by extensive chemical industry modernization programs and comprehensive environmental compliance initiatives creating substantial opportunities for recovery equipment suppliers across manufacturing facilities, chemical processing plants, and industrial development sectors. The country's ambitious environmental protection programs including national emission reduction initiatives and industrial waste management facility expansion are creating consistent demand for specialized solvent recovery systems. Major chemical companies and industrial equipment suppliers including Sinopec, CNPC, and specialized recovery equipment manufacturers are establishing comprehensive waste management programs to support large-scale chemical production and advanced manufacturing technology applications.

India is expanding to reach USD 147.8 million by 2035, supported by extensive chemical industry development programs and comprehensive industrial infrastructure modernization initiatives creating demand for solvent recovery solutions across diverse manufacturing facility and chemical processing application segments. The country's growing chemical manufacturing capabilities and expanding industrial infrastructure are driving demand for recovery equipment that provides exceptional efficiency while supporting advanced chemical processing system requirements. Industrial companies and manufacturing facilities are investing in solvent recovery technology to support growing production demand and environmental compliance advancement requirements.

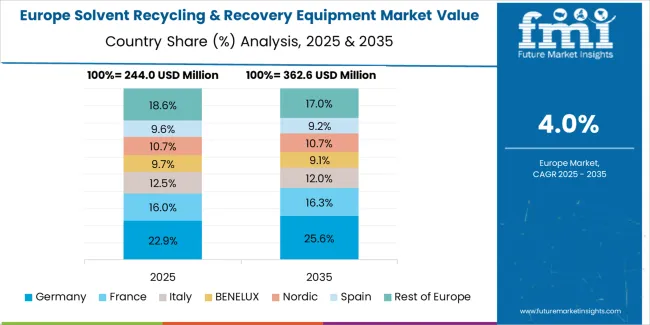

Germany is projected to reach USD 184.9 million by 2035, supported by the country's leadership in chemical engineering technology and advanced manufacturing systems requiring sophisticated solvent recovery solutions for precision chemical processing and industrial automation applications. German chemical operators are implementing cutting-edge recovery platforms that support advanced operational capabilities, precision performance, and comprehensive quality monitoring protocols. The market is characterized by focus on engineering excellence, technology innovation, and compliance with stringent environmental and safety standards.

Brazil is growing to reach USD 110.2 million by 2035, driven by industrial infrastructure development programs and increasing chemical processing capabilities creating opportunities for recovery equipment suppliers serving both industrial manufacturers and specialized environmental contractors. The country's expanding chemical sector and growing industrial infrastructure are creating demand for recovery equipment that supports diverse processing requirements while maintaining performance standards. Industrial companies and manufacturing facilities are developing technology strategies to support operational efficiency and environmental compliance advancement.

The United States is projected to reach USD 152.1 million by 2035, expanding at a CAGR of 4.3%, driven by advanced chemical processing technology innovation and specialized industrial applications supporting precision manufacturing and comprehensive automation technology applications. The country's established chemical industry tradition including major petrochemical manufacturers and processing facilities are creating demand for high-performance solvent recovery equipment that supports operational advancement and environmental standards. Manufacturers and industrial system suppliers are maintaining comprehensive development capabilities to support diverse chemical processing and environmental requirements.

The United Kingdom is growing to reach USD 120.4 million by 2035, supported by chemical processing technology heritage and established industrial engineering communities driving demand for premium solvent recovery solutions across traditional chemical systems and specialized industrial environmental applications. The country's rich chemical engineering heritage including major chemical companies and established industrial processing capabilities create demand for recovery equipment that supports both legacy system advancement and modern chemical applications.

Japan is projected to reach USD 137.3 million by 2035, driven by precision chemical processing technology tradition and established industrial leadership supporting both domestic chemical system markets and export-oriented equipment production. Japanese companies maintain sophisticated solvent recovery development capabilities, with established manufacturers continuing to lead in recovery technology and industrial equipment standards.

European solvent recycling and recovery equipment operations are increasingly concentrated between German engineering excellence and specialized manufacturing across multiple countries. German facilities dominate high-performance solvent recovery production for precision chemical processing and industrial automation applications, leveraging cutting-edge manufacturing technologies and strict quality protocols that command price premiums in global markets. British chemical technology operators maintain leadership in industrial system innovation and recovery method development, with organizations like specialized engineering companies and university research centers driving technical specifications that suppliers must meet to access major industrial contracts.

Eastern European operations in Czech Republic and Poland are capturing specialized production contracts through precision manufacturing expertise and EU compliance standards, particularly in equipment fabrication and assembly technologies for chemical applications. These facilities increasingly serve as development partners for Western European chemical programs while building their own industrial technology expertise.

The regulatory environment presents both opportunities and constraints. European environmental framework requirements create quality standards that favor established European manufacturers and chemical system operators while ensuring consistent performance specifications for critical manufacturing infrastructure and environmental applications. Brexit has created complexity for UK chemical collaboration with EU programs, driving opportunities for direct relationships between British operators and international solvent recovery equipment suppliers.

Technology collaboration accelerates as chemical companies seek technology advancement to support major industrial modernization milestones and environmental development timelines. Vertical integration increases, with major chemical system operators acquiring specialized manufacturing capabilities to secure equipment supplies and quality control for critical processing programs. Smaller industrial contractors face pressure to specialize in niche applications or risk displacement by larger, more comprehensive operations serving mainstream chemical processing and environmental requirements.

South Korean solvent recycling and recovery equipment operations reflect the country's advanced chemical processing technology capabilities and export-oriented industrial development model. Major chemical system operators including LG Chem and SK Innovation drive equipment procurement strategies for their processing facilities, establishing direct relationships with specialized solvent recovery suppliers to secure consistent quality and performance for their chemical development programs and advanced processing technology systems targeting both domestic infrastructure and international collaboration projects.

The Korean market demonstrates particular strength in integrating solvent recovery technologies into automated chemical processing platforms and advanced industrial system configurations, with engineering teams developing solutions that bridge traditional chemical recovery applications and next-generation industrial systems. This integration approach creates demand for specific performance specifications that differ from conventional applications, requiring suppliers to adapt recovery capabilities and system coordination characteristics.

Regulatory frameworks emphasize environmental compliance and chemical processing system reliability, with Korean industrial standards often exceeding international requirements for solvent recovery systems. This creates barriers for standard equipment suppliers but benefits established manufacturers who can demonstrate industrial-grade performance capabilities. The regulatory environment particularly favors suppliers with Korean chemical system qualification and comprehensive testing documentation systems.

Supply chain excellence remains critical given Korea's chemical processing focus and international collaboration dynamics. Chemical system operators increasingly pursue development partnerships with suppliers in Japan, Germany, and specialized manufacturers to ensure access to cutting-edge solvent recovery technologies while managing infrastructure risks. Investment in industrial infrastructure supports performance advancement during extended chemical development cycles.

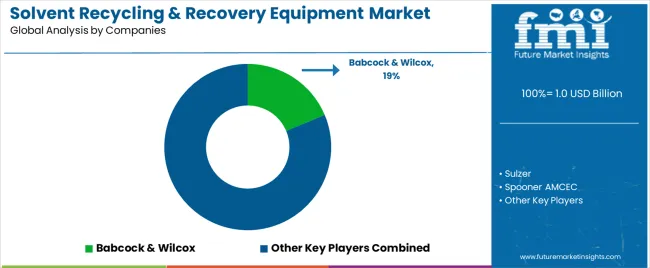

Babcock & Wilcox leads the market with 18.7% share owing to its comprehensive industrial processing equipment portfolio and established chemical industry relationships, which manufacturers use to implement integrated recovery solutions across diverse solvent processing applications. Profit pools are consolidating upstream in advanced separation technology development and downstream in application-specific solutions for chemical processing, oil and gas recovery, and specialized industrial markets where performance reliability, processing efficiency, and consistent recovery rates command substantial premiums. Value is migrating from basic recovery equipment production to specification-driven, application-ready processing systems where separation expertise, precision engineering, and reliable integration capabilities create competitive advantages.

Several archetypes define market leadership: established American industrial companies defending share through comprehensive chemical processing development and proven industrial automation support; German engineering suppliers leveraging manufacturing excellence and processing capabilities; European technology leaders with environmental expertise and precision manufacturing heritage; and emerging Asian manufacturers pursuing cost-effective production while developing advanced separation capabilities.

Switching costs - system integration, equipment compatibility validation, industrial certification - provide stability for established suppliers, while technological advancement requirements and specialized application growth create opportunities for innovative equipment manufacturers. Consolidation continues as companies seek manufacturing scale; direct industrial partnerships grow for specialized applications while traditional chemical equipment distribution remains relationship-driven. Focus areas: secure premium chemical processing and industrial automation market positions with application-specific performance specifications and technical collaboration; develop solvent recovery technology and advanced separation capabilities; explore specialized applications including pharmaceutical and electronics manufacturing requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| American Industrial Leaders | Comprehensive chemical processing expertise; proven industrial integration; established manufacturer relationships | Precision engineering; technical innovation; industrial certification support |

| German Engineering Suppliers | Manufacturing excellence; comprehensive automation development programs; established customer partnerships | Engineering collaboration focus; integrated solutions; technical consultation |

| European Technology Leaders | Environmental system expertise; precision technology leadership; trusted by major chemical programs | Industrial partnerships; application-specific specifications; automation infrastructure collaboration |

| Emerging Asian Producers | Manufacturing efficiency; competitive pricing; rapid technology development | Production scaling; technology advancement; market entry strategies |

| Industrial Distributors | Technical distribution networks; chemical processing service relationships | Industrial expertise; inventory management; technical support services |

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 billion |

| Type Segments | Fully Automatic; Semi-Automatic; Manual Systems; Continuous Operation; Batch Processing; Others |

| Applications | Oil & Gas; Chemical; Pharmaceutical; Paint & Coatings; Electronics Manufacturing; Printing Industry; Others |

| End-Users | Chemical Processing Companies; Oil & Gas Companies; Pharmaceutical Manufacturers; Environmental Service Providers; Industrial Equipment Suppliers; Others |

| Technology Segments | Distillation Systems; Membrane Separation; Adsorption Systems; Extraction Units; Hybrid Technologies; Others |

| Capacity Ranges | Small Scale (0-50 L/hr); Medium Scale (50-500 L/hr); Large Scale (500+ L/hr); Others |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Babcock & Wilcox; Sulzer; Spooner AMCEC; Wintek; HongYi; Kroeschell; Oregon Environmental Systems; NexGen Enviro Systems; Koch Modular Process Systems, LLC. (KMPS); JatroDiesel; PESCO BEAM; Innovative Flexotech; Best Technology; Neotech Equipment; EZG Manufacturing; Daetwyler Cleaning; CBG Technologies; CleanPlanet Chemical |

| Additional Attributes | Dollar sales by type and application; Regional demand trends (NA, EU, APAC); Competitive landscape; Chemical processing vs. environmental service adoption patterns; Industrial automation and solvent recovery integration; Advanced separation innovations driving efficiency enhancement, processing reliability, and environmental compliance excellence |

The global solvent recycling & recovery equipment market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the solvent recycling & recovery equipment market is projected to reach USD 1.6 billion by 2035.

The solvent recycling & recovery equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in solvent recycling & recovery equipment market are fully automatic, semi-automatic, manual systems, continuous operation, batch processing and others.

In terms of by application, oil & gas segment to command 38.2% share in the solvent recycling & recovery equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solvent-Free Natural Color Dispersions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solvent Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Green Solvents Market Growth – Trends & Forecast 2024-2034

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Aliphatic Solvent Market Growth - Trends & Forecast 2025 to 2035

Renewable Solvents Market

Food Grade Solvent Market Analysis - Size and Share Forecast Outlook 2025 to 2035

High Purity Solvents Market Growth - Trends & Forecast 2025 to 2035

Fluorinated Solvents Market

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Solvents Market Insights - Size, Share & Industry Growth 2025 to 2035

Vapor Degreasing Solvents Market

Industrial Cleaning Solvent Market Growth – Trends & Forecast 2024-2034

Electronics Cleaning Solvents Market - Growth & Demand 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Recycling Equipment And Machinery Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA