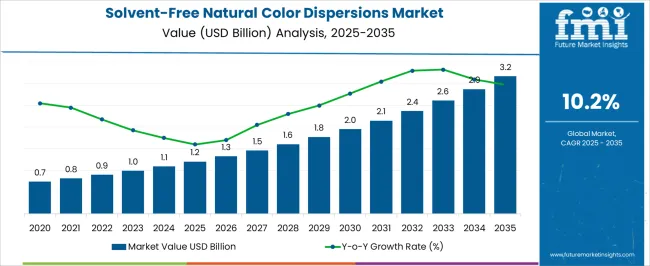

The global solvent-free natural color dispersions market is expected to be valued at USD 1.2 billion in 2025 and is projected to reach approximately USD 3.1 billion by 2035. This reflects an absolute increase of USD 1.9 billion, equivalent to a growth of 158% over the forecast period. The expansion is forecast to occur at a CAGR of 10.2%, with the market size estimated to grow by nearly 2.6X by the end of the decade.

The market is growing due to rising demand for sustainable, non-toxic, and eco-friendly coloring solutions across industries such as packaging, food, cosmetics, and textiles. Brands and manufacturers are shifting away from petroleum-based pigments toward natural alternatives to meet consumer preference for clean-label, safe products and to comply with stricter environmental and regulatory standards. Solvent-free formulations reduce volatile organic compound (VOC) emissions, improve worker safety, and support circular economy initiatives. Additionally, advancements in dispersion technologies are enhancing performance, stability, and color vibrancy, making natural options more competitive with synthetic counterparts and accelerating adoption globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 3.1 billion |

| CAGR (2025 to 2035) | 10.2% |

Between 2025 and 2030, the market is projected to expand from USD 1.2 billion to USD 2.0 billion, adding approximately USD 0.8 billion. Growth in this first phase will be supported by increasing consumer demand for clean-label food and beverage products, regulatory restrictions on synthetic colorants, and rising preference for solvent-free formulations across major food categories. Food and beverage manufacturers are adopting botanical extracts and microalgae-derived pigments to meet evolving consumer expectations while maintaining product stability and visual appeal.

From 2030 to 2035, the market is expected to grow from USD 2.0 billion to USD 3.1 billion, a further increase of USD 1.1 billion. This second phase will be shaped by advanced extraction technologies, expanded application scope in functional beverages, and growing penetration in emerging markets. Manufacturers will focus on oil-dispersible and water-dispersible systems that offer superior color stability and processing compatibility across diverse product formulations.

From 2020 to 2024, the market rose from USD 0.6 billion to USD 1.1 billion, propelled by increasing consumer awareness of synthetic additive risks, clean-label movement adoption, and food safety regulations targeting solvent residues in color additives. Manufacturers prioritized natural alternatives to synthetic colorants while developing solvent-free processing methods to reduce environmental impact and improve product safety profiles. Early adoption in beverages and confectionery established the foundation for broader market expansion.

Food and beverage consumers increasingly scrutinize ingredient lists, driving demand for recognizable, natural colorants without chemical solvents. Botanical extracts from fruits, vegetables, and plant sources offer familiar ingredient names that align with clean-label positioning. This trend accelerates adoption across beverages, confectionery, and dairy products where visual appeal remains critical for consumer acceptance.

Government agencies worldwide implement stricter regulations on synthetic color additives and solvent residues in food products. European Union directives and FDA guidelines encourage natural alternatives while limiting synthetic colorant usage in children's foods. These regulatory frameworks create market opportunities for solvent-free natural dispersions that meet safety requirements without compromising product quality.

Innovation in extraction and processing technologies enables manufacturers to produce stable, concentrated natural color dispersions without organic solvents. Microalgae cultivation, supercritical extraction, and enzymatic processing methods improve pigment yield and color stability. These advancements reduce production costs while expanding application possibilities across food and beverage categories.

The expanding functional beverage market creates demand for natural colorants that complement health-focused positioning. Plant-based pigments from botanicals and microalgae align with functional ingredient profiles while providing vibrant colors. Manufacturers leverage natural color dispersions to differentiate products in competitive beverage segments including energy drinks, plant-based alternatives, and wellness-focused formulations.

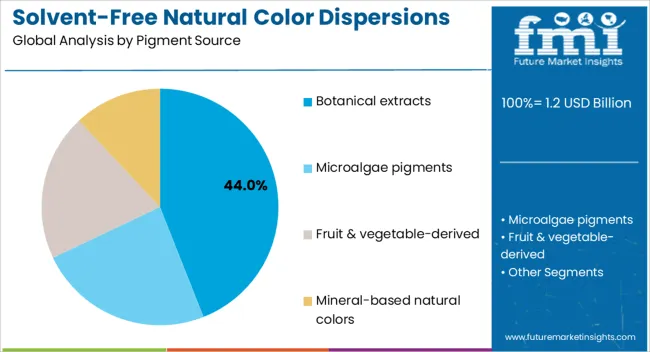

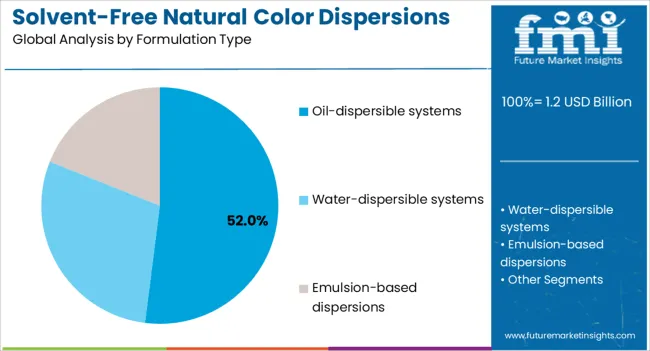

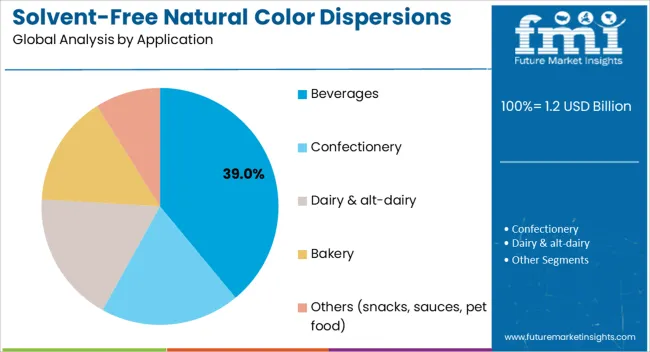

In terms of pigment source, the market is divided into botanical extracts, microalgae pigments, fruit & vegetable-derived, and mineral-based natural colors. On the basis of formulation type, the market is divided into oil-dispersible systems, water-dispersible systems, and emulsion-based dispersions. Based on application, the market is classified into beverages, confectionery, dairy & alt-dairy, and others.

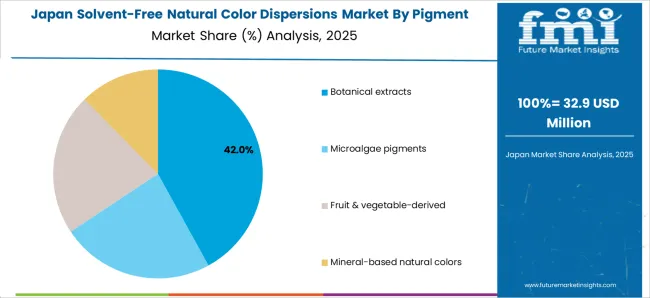

Botanical extracts command the largest market share at 44.0% in 2025, driven by their wide color spectrum availability and proven safety profiles. These extracts offer excellent compatibility with various food matrices and demonstrate superior stability in solvent-free formulations. The segment benefits from established supply chains and consumer familiarity with plant-based colorants.

Microalgae pigments account for 27.0% of the market, supported by their unique color properties and nutritional benefits. These pigments provide vibrant blues and greens that are difficult to achieve with traditional botanical sources. The segment is experiencing growth due to technological improvements in cultivation and extraction processes.

Oil-dispersible systems maintain market leadership with 52.0% share, attributed to their superior performance in fat-containing food products. These formulations provide excellent color stability and uniform distribution in various application environments. The segment benefits from technological innovations that enhance dispersibility and reduce formulation complexity.

The beverages segment leads with 39.0% market share, driven by rapid innovation in natural and functional drink categories. This segment benefits from consumer preference for visually appealing products without synthetic additives. Growth is supported by expansion in premium beverage segments and increased focus on clean-label positioning.

Solvent-free natural color dispersions are gaining traction as industries shift toward clean-label, eco-friendly, and non-toxic formulations. Growing demand from food & beverage, cosmetics, personal care, and packaging sectors is driving adoption due to consumer preference for natural ingredients over synthetic dyes. Regulatory pressures (EU REACH, FDA, and global bans on harmful solvents) accelerate the shift toward solvent-free formulations. These dispersions also enable formulation flexibility, offering vibrant, stable, and customizable color shades without introducing VOCs. Brand owners see them as a pathway to meet sustainability targets and enhance product transparency while appealing to environmentally conscious consumers.

Despite rising adoption, cost competitiveness remains a key barrier compared to synthetic colorants. Natural dispersions often require more complex sourcing and processing, raising prices for manufacturers. Technical issues such as limited heat/light stability, narrower color range, and batch-to-batch variability challenge widespread industrial use. In packaging and coatings, achieving consistent performance in terms of adhesion, durability, and long-term stability can be difficult. Scalability remains restricted by raw material availability, supply chain fragility (e.g., crop yields), and processing compatibility with existing production lines. These restraints confine solvent-free natural color dispersions to premium, sustainability-driven market segments rather than mass adoption.

Key trends include bio-based innovation where dispersions are derived from plant-based pigments, algae, and food by-products, aligning with circular economy principles. Microencapsulation and nanotechnology are being applied to improve stability, enhance dispersion, and expand the functional color palette. Integration into biodegradable and compostable packaging materials supports regulatory goals and consumer sustainability expectations. AI-driven formulation design tools are emerging to optimize pigment loadings, predict stability, and accelerate R&D cycles. Industries are also exploring closed-loop systems, where waste from food processing becomes raw material for color dispersions, promoting zero-waste manufacturing. These advancements are positioning solvent-free natural color dispersions as a next-generation sustainable alternative to synthetic dyes and solvent-based systems.

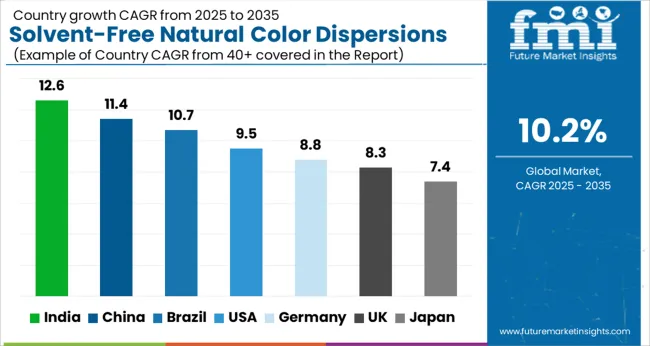

India represents the fastest-growing market for solvent-free natural color dispersions, projected to expand at 12.6% CAGR from 2025 to 2035. The country benefits from abundant raw material availability and established extraction capabilities for botanical colorants. Government policies supporting food and beverage fortification create favorable conditions for natural color adoption. The expanding processed food industry and growing export market drive demand for clean-label ingredients. Rising consumer awareness about synthetic additive risks supports market growth across urban and semi-urban regions. Traditional spice cultivation provides natural advantages for botanical extract production. Regional manufacturing clusters in Maharashtra and Gujarat integrate natural colorants into diverse food applications. Export opportunities to developed markets require natural color compliance for competitive positioning.

China's solvent-free natural color dispersions market is expected to grow at 11.4% CAGR, supported by significant investment in beverage innovation and food safety regulations. The country's large manufacturing base provides cost-effective production capabilities for natural color systems. Stringent regulations governing infant and children's food products drive adoption of natural alternatives. Export-oriented food manufacturers increasingly adopt natural colors to meet international market requirements. Urban consumer preference for premium and imported products supports natural color market expansion. E-commerce platforms facilitate distribution across tier-one and tier-two cities. Domestic manufacturers invest heavily in botanical extraction capabilities to serve growing export markets. Government support for food safety improvements drives quality enhancements throughout natural color supply chains.

Brazil solvent free natural color dispersions market demonstrates robust growth potential at 10.7% CAGR, driven by expanding confectionery and dairy export markets. The country's agricultural abundance provides competitive advantages in botanical extract production. Growing domestic processed food consumption supports natural color adoption across multiple segments. Export-oriented manufacturers adopt natural colors to meet international market standards and consumer preferences. The expanding middle class drives demand for premium food products with natural ingredients. Tropical fruit cultivation provides raw materials for açaí, annatto, and other natural pigments. Food processing clusters in São Paulo and Rio Grande do Sul integrate natural colorants across product portfolios. Government support for sustainable agriculture practices benefits botanical extract suppliers. Regional trade agreements facilitate natural colorant exports to North American and European markets.

The United States solvent free natural color dispersions market is projected to grow at 9.5% CAGR, supported by FDA consumer advocacy for "free-from" product labeling. Major food manufacturers increasingly reformulate products to eliminate synthetic additives. The functional beverage segment drives substantial demand for natural color solutions. Consumer preference for clean-label products creates market opportunities across all food categories. Retail chain requirements for natural ingredients support widespread adoption throughout the supply chain. Consumer surveys indicate growing awareness of synthetic additive risks and preference for recognizable ingredients. Food service operators adopt natural colorants to meet institutional health and wellness programs. Supply chain investments focus on domestic sourcing capabilities for key botanical raw materials. Natural product trade shows promote botanical colorant innovations and market education.

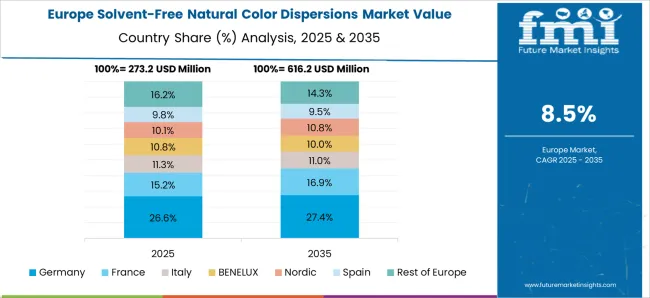

Germany solvent free natural color dispersions market exhibits steady growth at 8.8% CAGR, positioned as a technology leader in solvent-free formulation development. The country's strong regulatory compliance culture drives early adoption of natural alternatives. Advanced food processing technology enables efficient natural color integration across applications. Export-oriented food industry requires natural colors for global market access. Consumer preference for organic and natural products supports premium market positioning. Research institutions collaborate with industry to develop innovative extraction methods and improve color stability. Environmental regulations favor solvent-free processing technologies that reduce industrial waste and emissions. Manufacturing clusters in Bavaria and North Rhine-Westphalia integrate natural colors across diverse food applications. Trade associations promote natural colorant adoption through technical guidance and market education initiatives.

The United Kingdom solvent free natural color dispersions market is expected to grow at 8.3% CAGR, driven by major retailer initiatives banning synthetic and solvent-based additives. Private label manufacturers increasingly adopt natural colors to meet retailer specifications. Consumer awareness campaigns about synthetic additive risks support natural alternative adoption. The country's strong food safety culture promotes clean-label ingredient preferences. Premium product positioning in export markets requires natural color solutions. Brexit-related supply chain adjustments favor domestic and EU-based natural colorant suppliers. Consumer advocacy groups influence retail purchasing decisions through clean-label campaigns and ingredient transparency initiatives. Manufacturing investments focus on botanical extraction capabilities and supply chain localization. Food safety authorities provide regulatory guidance supporting natural colorant adoption across multiple applications.

Japan solvent free natural color dispersions market demonstrates consistent growth at 7.4% CAGR, with high adoption rates in ready-to-drink teas and functional beverages. The country's advanced food technology enables sophisticated natural color applications. Consumer preference for health-oriented products supports natural ingredient adoption. Stringent quality standards drive demand for premium natural color systems. The aging population creates opportunities in functional food segments requiring natural coloring solutions. Traditional food culture emphasizes natural ingredients and visual presentation in product development. Convenience store networks drive innovation in functional beverages with natural colorants. Manufacturing partnerships between domestic food companies and international suppliers facilitate natural colorant integration. Technology investments focus on color stability and shelf-life optimization for Japanese market preferences and consumer expectations.

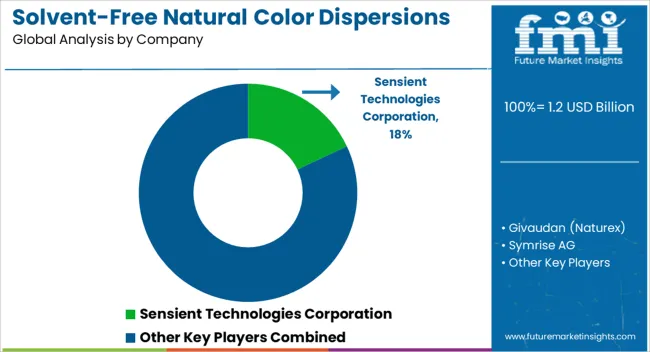

The solvent-free natural color dispersions market is becoming increasingly competitive as manufacturers accelerate innovation in extraction technologies and application development. Companies are focusing on advanced botanical sourcing networks, microalgae cultivation, and precision processing equipment to secure consistent supply and deliver high-quality, clean-label color solutions. In parallel, product development emphasizes key performance factors such as color stability, compatibility with diverse food matrices, and cost optimization, ensuring suitability across bakery, confectionery, dairy, beverage, and savory applications.

Sensient Technologies Corporation leads the global market, holding an estimated 18% share in 2025. The company’s advantage lies in its comprehensive botanical extraction expertise, long-standing relationships with multinational food producers, and significant investments in solvent-free processing systems. These strengths not only reinforce its market leadership but also position Sensient to capture additional growth as demand for natural and sustainable food coloring intensifies.

Alongside Sensient, other major competitors such as Givaudan (Naturex), Symrise AG, Chr. Hansen Holding A/S, and ADM (Wild Flavors) compete through specialized portfolios and regionally tailored strategies. These firms leverage advanced natural pigment extraction and formulation capabilities to address growing regulatory and consumer requirements for clean-label solutions.

Meanwhile, companies including Döhler Group, Kalsec Inc., Lycored Ltd., DDW Colors (part of Givaudan), and emerging innovators like Phytolon intensify competition through differentiated approaches. Their strengths lie in novel extraction techniques, microalgae-based color systems, fermentation-driven production, and unique application know-how that target niche food and beverage categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Pigment Source | Botanical extracts, Microalgae pigments, Fruit & vegetable-derived, Mineral-based natural colors |

| Formulation Type | Oil-dispersible systems, Water-dispersible systems, Emulsion-based dispersions |

| Application | Beverages, Confectionery, Dairy & alt-dairy, Bakery, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, India, Brazil |

| Key Companies Profiled | Sensient Technologies Corporation, Givaudan (Naturex), Symrise AG, Chr. Hansen Holding A/S, ADM (Wild Flavors), Döhler Group, Kalsec Inc., Lycored Ltd., DDW Colors (Givaudan), Phytolon |

| Additional Attributes | Dollar sales by color type and application segment, regional demand trends, competitive landscape, buyer preferences for liquid versus powder dispersions, integration with clean-label and natural formulation initiatives, innovations in plant-based pigments, stability enhancement, process optimization, sustainable sourcing, and functional performance improvement for food, beverage, and personal care applications |

The global solvent-free natural color dispersions market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the solvent-free natural color dispersions market is projected to reach USD 3.2 billion by 2035.

The solvent-free natural color dispersions market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in solvent-free natural color dispersions market are botanical extracts, microalgae pigments, fruit & vegetable-derived and mineral-based natural colors.

In terms of formulation type, oil-dispersible systems segment to command 52.0% share in the solvent-free natural color dispersions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA