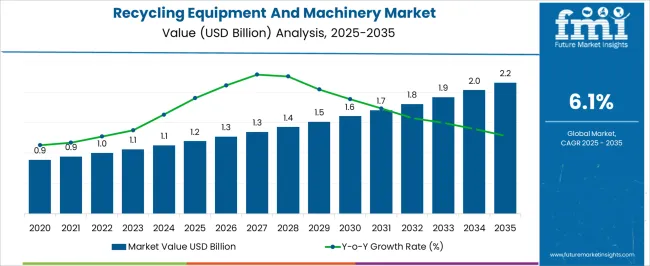

The Recycling Equipment And Machinery Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. The recycling equipment and machinery market is expected to generate an absolute increase of USD 1.0 billion and a growth multiplier of 1.83x over the decade. Supported by a steady CAGR of 6.1%, this growth is driven by rising environmental regulations, increasing waste management initiatives, and the adoption of advanced recycling technologies across industrial and municipal sectors.

During the first five years (2025 to 2030), the market will increase from USD 1.2 billion to USD 1.6 billion, adding USD 0.4 billion, which accounts for 40% of the total incremental growth, reflecting initial investments in equipment upgrades and process optimization.

The second phase (2030 to 2035) contributes USD 0.6 billion, representing 60% of incremental growth, reflecting accelerated demand as automation, AI-based sorting, and circular economy models gain traction globally. Annual increments grow from USD 0.1 billion in early years to approximately USD 0.2 billion by 2035, underscoring consistent growth driven by increasing recycling volumes and technological innovation.

Manufacturers focusing on energy-efficient machinery, modular designs, and strategic collaborations with waste management firms will be best positioned to capture value in this USD 1.0 billion growth opportunity, particularly in developed markets emphasizing sustainability mandates.

| Metric | Value |

|---|---|

| Recycling Equipment And Machinery Market Estimated Value in (2025 E) | USD 1.2 billion |

| Recycling Equipment And Machinery Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The recycling equipment and machinery market is gaining momentum due to heightened global focus on resource efficiency, extended producer responsibility (EPR) mandates, and the circular economy agenda across industrial sectors. The increasing generation of solid waste, stricter landfill regulations, and rising raw material costs are pushing manufacturers to adopt advanced recycling solutions.

Governments and municipalities are investing in mechanized sorting, shredding, and baling technologies to enhance recovery rates and reduce dependency on virgin materials. The integration of automation, AI-powered sorters, and real-time monitoring systems is further improving process throughput and operational safety.

Additionally, growing interest in decarbonization and life cycle optimization is encouraging companies to repurpose scrap and secondary materials using high-performance equipment. As industries prioritize waste valorization and environmental compliance, demand for scalable, durable, and efficient recycling machinery is expected to continue its upward trajectory.

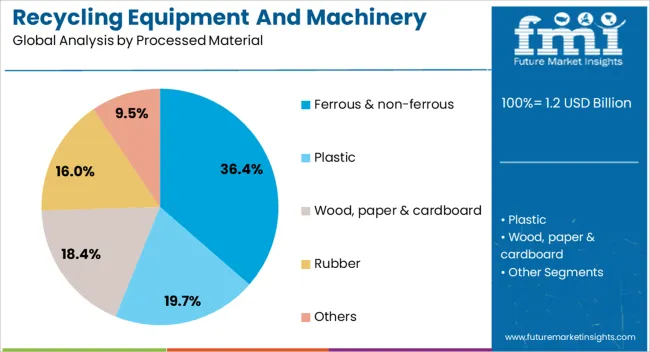

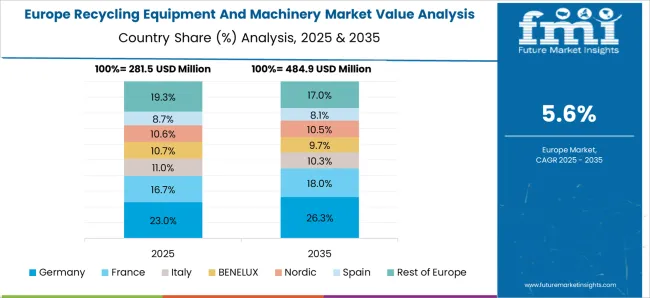

The recycling equipment and machinery market is segmented by processed material and geographic regions. By processed material, the recycling equipment and machinery market is divided into Ferrous & non-ferrous, Plastic, Wood, paper & cardboard, Rubber, and Others. Regionally, the recycling equipment and machinery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ferrous and non-ferrous materials are projected to account for 36.4% of total market revenue in 2025, positioning this segment as the largest by processed material. This leadership is being driven by the high value recovery potential and consistent supply of scrap metals from industrial, construction, and automotive sectors.

Recycling of steel, aluminum, and copper is being prioritized due to the substantial energy savings compared to primary production. Equipment designed for processing metal scrap such as shears, balers, and shredders is being increasingly adopted by recyclers to meet quality and volume requirements.

Furthermore, rising demand for secondary metals in electronics, transportation, and renewable infrastructure is enhancing the commercial viability of advanced metal recycling operations. Regulatory emphasis on sustainable resource management and reduced emissions has further incentivized investment in machinery capable of efficiently sorting, purifying, and compacting both ferrous and non-ferrous materials.

The recycling equipment and machinery market is expanding due to increasing waste generation and stricter environmental regulations. In 2024 and 2025, the demand for efficient recycling technologies in municipal and industrial sectors is growing. Opportunities exist in developing automated and AI-integrated recycling solutions. Emerging trends include advanced sorting technologies and the rise of waste-to-energy systems. However, market restraints such as high equipment costs and complexities in recycling certain materials remain challenges, limiting widespread adoption and growth.

The major growth driver for the recycling equipment and machinery market is the increasing global waste generation and stricter environmental regulations. In 2024 and 2025, governments worldwide enacted regulations requiring higher recycling rates and more efficient waste management practices. This led to increased demand for state-of-the-art recycling machinery capable of handling larger waste volumes and sorting complex materials. The push for reduced landfill usage and improved recycling infrastructure is driving the market’s expansion in both developed and developing regions.

Significant opportunities are emerging in the development of automated and AI-integrated recycling solutions. In 2025, advancements in AI-powered sorting systems were gaining traction, enabling more accurate material separation and enhancing recycling efficiency. These technologies help streamline processes and reduce human error, making recycling more cost-effective and scalable. Additionally, growing interest in automated waste management systems presents significant market potential for companies offering integrated solutions, contributing to faster processing times and improved resource recovery.

Emerging trends in the recycling equipment and machinery market include the rise of advanced sorting technologies and waste-to-energy systems. In 2024, optical and mechanical sorting systems became more widely adopted for their ability to efficiently separate recyclables from waste streams. Additionally, waste-to-energy technologies, which convert non-recyclable waste into energy, gained popularity as viable solutions for dealing with residual waste. These trends reflect the increasing focus on enhancing recycling efficiency and transforming waste into valuable resources.

The major restraints in the market include high initial equipment costs and complexities in recycling certain materials. In 2024 and 2025, the high capital expenditure required for advanced recycling machinery limited the ability of smaller companies and municipalities to upgrade their infrastructure. Additionally, recycling certain materials, such as mixed plastics and e-waste, remains technically challenging and costly. These barriers underscore the need for more affordable, versatile recycling solutions that can handle a broader range of materials to foster market growth.

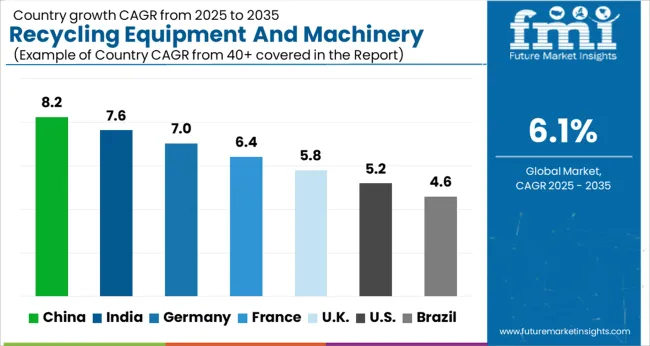

The global recycling equipment and machinery market is projected to grow at 6.1% CAGR from 2025 to 2035. China leads with 8% CAGR, driven by rapid industrialization, a growing focus on environmental sustainability, and increasing waste management demands. India follows at 8%, supported by rising urbanization, increasing waste generation, and government policies promoting recycling and waste-to-energy projects.

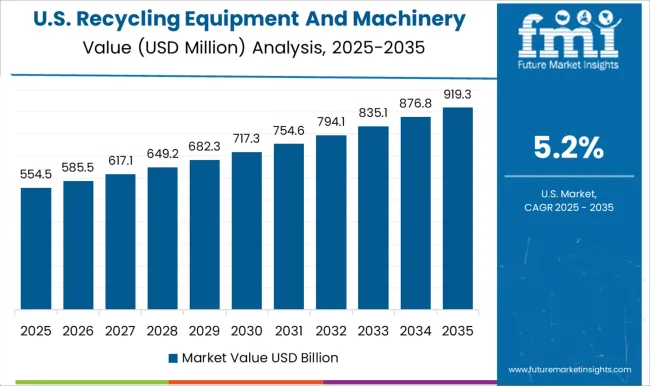

France records 6% CAGR, reflecting growing demand for advanced recycling technologies in the construction, automotive, and consumer goods sectors. The United Kingdom and the United States grow at 6% and 5%, respectively, reflecting steady demand in mature markets with an increasing focus on circular economy initiatives and waste management innovation.

Asia-Pacific leads growth due to rapid industrialization, while Europe and North America focus on technological innovation and sustainability.

The recycling equipment and machinery market in China is forecasted to grow at 8% CAGR, driven by the country’s rapid urbanization and the increasing demand for waste management solutions in both municipal and industrial sectors. China’s focus on improving waste recycling rates and reducing landfill waste accelerates the adoption of advanced recycling technologies. Government initiatives and regulations promoting recycling and waste-to-energy projects also contribute to market growth. Furthermore, the country’s growing consumer goods and automotive industries boost demand for recycling equipment used in material recovery and waste separation.

The recycling equipment and machinery market in India is projected to grow at 8% CAGR, supported by rapid industrial growth, rising waste generation, and the increasing need for effective waste management solutions. Government initiatives aimed at promoting recycling practices in urban and rural areas contribute to market demand. The growth of India’s manufacturing and automotive sectors, along with a rising awareness of environmental sustainability, further enhances the need for advanced recycling equipment and machinery to manage industrial waste, e-waste, and plastics.

The recycling equipment and machinery market in France is expected to grow at 6% CAGR, driven by increasing demand for waste recycling in the construction, automotive, and consumer goods sectors. France’s commitment to reducing carbon emissions and promoting circular economy initiatives boosts the adoption of recycling technologies. The country's growing infrastructure and environmental policies push the demand for machinery that handles construction and industrial waste, as well as consumer product recycling. The rising need for sustainable solutions in manufacturing further supports the market growth.

The recycling equipment and machinery market in the United Kingdom is projected to grow at 6% CAGR, supported by increasing demand for recycling technologies that meet sustainability goals and waste management regulations. The UK’s strong commitment to waste reduction and the adoption of circular economy practices push the demand for advanced recycling solutions in the industrial, construction, and municipal sectors. Moreover, innovations in material recovery and waste-to-energy technologies further drive market growth in the UK.

The recycling equipment and machinery market in the United States is projected to grow at 5% CAGR, reflecting steady demand for recycling solutions in a mature market. The USA focus on reducing landfill waste and increasing recycling rates drives the adoption of advanced recycling technologies. Government regulations and incentives for waste diversion, combined with a growing focus on environmental sustainability in both industrial and commercial sectors, further enhance the demand for recycling equipment. Additionally, the growing e-waste recycling sector boosts market growth.

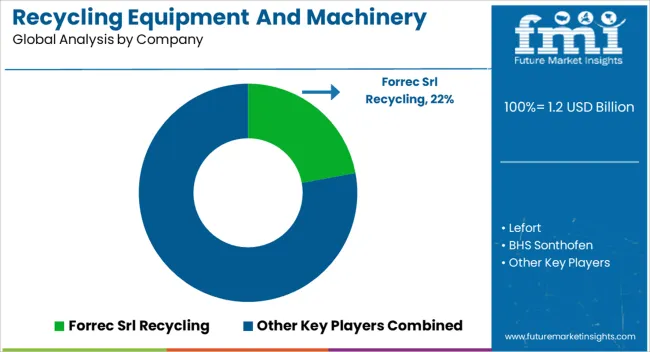

The recycling equipment and machinery market is dominated by Forrec Srl Recycling, which secures its leadership through a comprehensive range of innovative recycling solutions designed for various waste streams, including metal, plastic, and electronic waste. Forrec’s dominance is supported by its strong engineering capabilities, customized solutions, and a global network that caters to both municipal and industrial sectors.

Key players such as Lefort, BHS Sonthofen, and Mid Atlantic Waste Systems maintain significant market shares by offering specialized machinery for shredding, sorting, and processing recyclable materials, ensuring high efficiency, durability, and reduced operational costs. These companies focus on continuous innovation, providing tailored machinery that meets the evolving demands of the recycling industry.

Emerging players are expanding their presence by offering cost-effective, modular, and energy-efficient equipment designed for small to medium-sized recycling operations. Their strategies focus on improving throughput, enhancing material recovery rates, and reducing energy consumption.

Market growth is driven by increasing government regulations for waste management, rising awareness of environmental sustainability, and expanding recycling initiatives across various sectors. Technological advancements in automation, AI-driven sorting systems, and equipment designed for emerging recycling streams, such as e-waste, will continue to influence competitive dynamics and shape the future of the recycling equipment market.

Key players in the recycling equipment and machinery market, such as Metso Outotec, Bollegraaf Recycling Solutions, and SUEZ, are collaborating with technology providers to enhance the capabilities of their equipment. Partnerships with companies that specialize in sensor technology, AI, and automation are enabling manufacturers to offer next-generation recycling solutions that improve efficiency, reduce labor costs, and enhance throughput.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Processed Material | Ferrous & non-ferrous, Plastic, Wood, paper & cardboard, Rubber, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Forrec Srl Recycling, Lefort, BHS Sonthofen, and Mid Atlantic Waste Systems |

| Additional Attributes | Dollar sales by equipment type and end use, demand dynamics across municipal, industrial, and commercial sectors, regional trends in recycling infrastructure development, innovation in automation and sorting technologies, environmental impact of recycling processes, and emerging use cases in e-waste and plastic recycling applications. |

The global recycling equipment and machinery market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the recycling equipment and machinery market is projected to reach USD 2.2 billion by 2035.

The recycling equipment and machinery market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in recycling equipment and machinery market are ferrous & non-ferrous, plastic, wood, paper & cardboard, rubber and others.

In terms of , segment to command 0.0% share in the recycling equipment and machinery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Lawn And Garden Equipment Afterparts Market Size and Share Forecast Outlook 2025 to 2035

Sheep and Goat Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lawn and Garden Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ski Gear And Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Manure Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Search and Rescue Equipment (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Haying and Forage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Demand for Ventilation Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Ventilation Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA