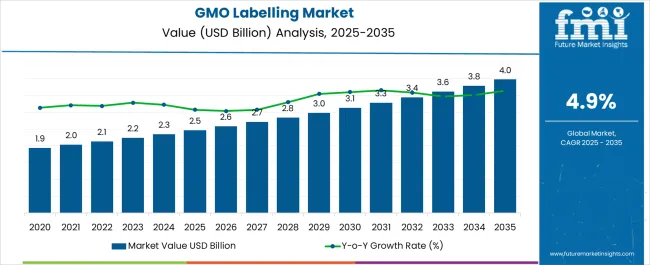

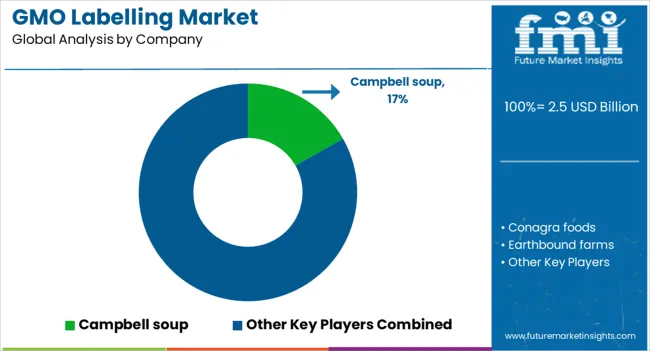

The GMO Labelling Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| GMO Labelling Market Estimated Value in (2025 E) | USD 2.5 billion |

| GMO Labelling Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The GMO labelling market is experiencing significant growth, driven by increasing consumer demand for transparency in food sourcing and heightened awareness of genetically modified organisms in global food supply chains. Regulatory frameworks across multiple regions are mandating clear labelling practices to ensure consumers are informed about product composition, which is accelerating adoption. Food manufacturers and retailers are under rising pressure to comply with international labelling standards, enhancing accountability and brand trust.

Technological advancements in traceability solutions, digital printing, and packaging innovations are further supporting the efficiency of GMO labelling practices. Heightened consumer concerns regarding food safety, sustainability, and ethical sourcing are influencing purchasing behavior, creating new opportunities for companies adopting transparent labelling strategies.

Governments and non-governmental organizations are also strengthening their role in shaping public discourse, further fueling demand for standardized GMO labelling systems As consumer awareness increases and food industry regulation continues to evolve, the market is positioned for sustained expansion, with strong opportunities for technology providers, retailers, and food producers to align with consumer expectations and compliance requirements.

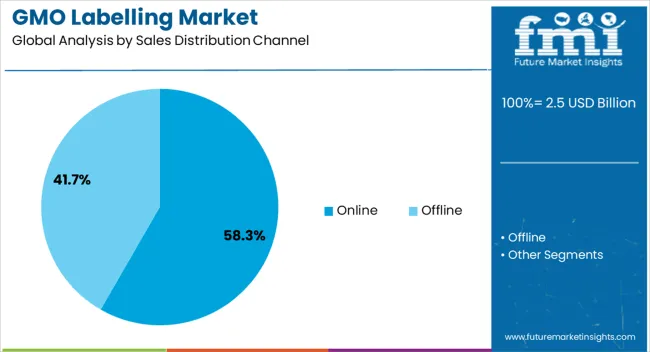

The gmo labelling market is segmented by sales distribution channel, and geographic regions. By sales distribution channel, gmo labelling market is divided into Online and Offline. Regionally, the gmo labelling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The online sales distribution channel is projected to account for 58.3% of the GMO labelling market revenue share in 2025, establishing it as the leading sales channel. This dominance is being driven by the growing influence of e-commerce platforms and digital marketplaces, where consumer preference for transparency and product information is particularly strong. Online platforms provide consumers with detailed ingredient and labelling disclosures, enabling informed decision-making and reinforcing demand for GMO-labelled products.

The segment’s growth is further supported by the rapid expansion of direct-to-consumer models, where food brands prioritize clear labelling to strengthen brand reputation and build consumer trust. Convenience, wide product availability, and accessibility to comparative labelling details are additional factors contributing to online sales leadership.

Increasing integration of blockchain-based traceability systems and QR code-enabled packaging in online retail is also enhancing transparency and reinforcing compliance with regulatory standards As consumer reliance on digital channels continues to rise, the online sales distribution channel is expected to remain the most influential driver of GMO labelling adoption in the market.

In 2025, the market for GMO labeling has a value of $1,061.4 million. From 2025 to 2025, the GMO labeling market is projected to expand at a CAGR of 4.5%. In 2025, the market for GMO labeling was expected to be valued at USD 1265.78 Million.

The National Academy of Sciences asserts that customers must be aware of whether the items they buy contain transgenic elements in order to weigh the dangers and advantages of their choice. This has been a major driver of market expansion.

Consumer attitudes toward food goods are always changing. FMO food producers are putting a lot of effort into meeting the needs of GMO labeling as consumers become more aware of healthy edible products in order to maintain a devoted customer base. This is yet another important factor that is anticipated to increase the industry throughout the coming years.

After a law supporting the labeling of GMO foods was passed, the American market for GMO labeling is rapidly expanding. Consumer need for increased transparency on the food they are eating has been the driving force behind this.

All food products that contain GMOs must now be clearly labeled as such by law. As a result, many businesses have altered the components of their products or reformulated them to eliminate the use of GMOs.

The market for GMO-free goods is likely to expand as more customers become aware of the problem of GMOs in their food. Customers will have more options as a result, and businesses will face pressure to acquire non-GM ingredients.

While some base the amount on the overall food item, most mandatory labeling rules are based on the percentage of GMOs in any one ingredient in a food product. The 0.9% level is used by countries with the strictest regulations, such as the European Union, Saudi Arabia, Turkey, and Australia. Others permit a higher level of GMO incorporation, with Japan allowing 5% and South Korea allowing 3%. In Australia and New Zealand, unless the entire product is genetically modified, GMO ingredients must be disclosed in the ingredient panel. According to the organization Food Standards Australia New Zealand, in that situation, the details must be listed next to the name. The GMO labeling criterion is higher in South Korea, where anything less than 3% is regarded as accidental.

According to a recent study, supermarkets are to blame for the market for GMO labeling expanding. When stores were located in states with obligatory GMO labeling legislation, they were more likely to sell products with GMO

labels, according to the University of California, Berkeley study that examined data from more than 9,000 products in the USA.

According to Michele Simon, the study's primary author, stores are responding to customer demand for genetically modified foods (GMOs). We expect to see many more products on shop shelves wearing these labels as additional states approve mandatory GMO labeling laws, she said.

The study is being released as the American argument for requiring GMO labeling rages on.

According to a recent study, supermarkets are to blame for the market for GMO labeling expanding. When stores were located in states with obligatory GMO labeling legislation, they were more likely to sell products with GMO labels, according to the University of California, Berkeley study that examined data from more than 9,000 products in the USA.

According to FMI, stores are responding to customer demand for genetically modified foods (GMOs). We expect to see many more products on shop shelves wearing these labels as additional states approve mandatory GMO labeling laws.

To satisfy consumers' growing demand for GMO labeling and to maintain their market dominance, the majority of businesses are concentrating on innovation and new product launches.

In order to fulfill evolving consumer expectations and seize the largest market possible, businesses in the GMO labeling sector are constantly producing new sorts of products. Additionally, businesses are focusing on growing their distribution networks in order to enter new markets.

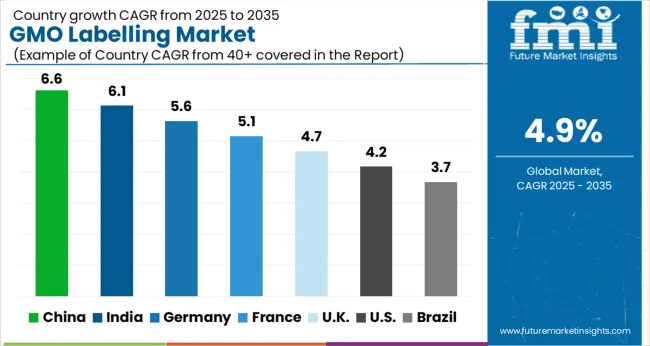

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

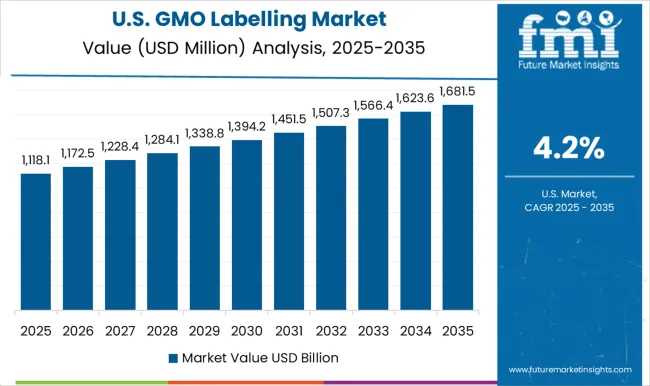

| USA | 4.2% |

| Brazil | 3.7% |

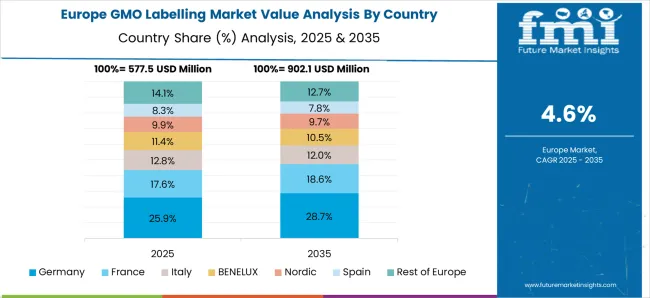

The GMO Labelling Market is expected to register a CAGR of 4.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.6%, followed by India at 6.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.7%, yet still underscores a broadly positive trajectory for the global GMO Labelling Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.6%. The USA GMO Labelling Market is estimated to be valued at USD 907.8 million in 2025 and is anticipated to reach a valuation of USD 1.4 billion by 2035. Sales are projected to rise at a CAGR of 4.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 126.5 million and USD 64.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Sales Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Campbell soup, Conagra foods, Earthbound farms, General Mills, Danone, Nature path foods, Ingredion incorporated, Organic Valley, and Kerry ingredients |

| Additional Attributes |

The global gmo labelling market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the gmo labelling market is projected to reach USD 4.0 billion by 2035.

The gmo labelling market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in gmo labelling market are online, _company websites, _e-tailing companies, offline, _supermarkets and _retail shops.

In terms of , segment to command 0.0% share in the gmo labelling market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA