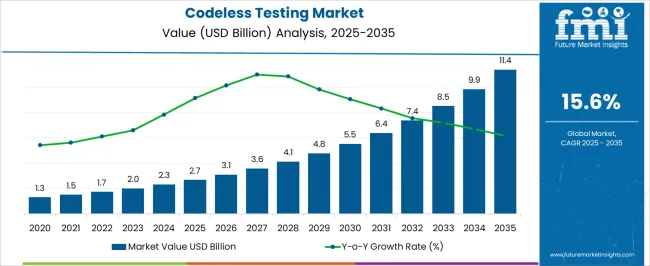

The Codeless Testing Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 11.4 billion by 2035, registering a compound annual growth rate (CAGR) of 15.6% over the forecast period.

| Metric | Value |

|---|---|

| Codeless Testing Market Estimated Value in (2025 E) | USD 2.7 billion |

| Codeless Testing Market Forecast Value in (2035 F) | USD 11.4 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

The codeless testing market is gaining momentum as enterprises seek faster, more efficient, and cost effective approaches to software testing without relying on deep programming expertise. The adoption of digital transformation initiatives and the rising complexity of applications across industries have amplified the need for testing solutions that can streamline workflows.

Enhanced usability, integration with DevOps pipelines, and AI driven automation have further propelled demand. Organizations are increasingly investing in codeless platforms to reduce dependency on skilled testers, accelerate release cycles, and ensure continuous testing across web, mobile, and API environments.

The market outlook is strongly supported by growing demand for agile methodologies, increasing adoption of cloud based applications, and the imperative to improve quality assurance processes in competitive business environments.

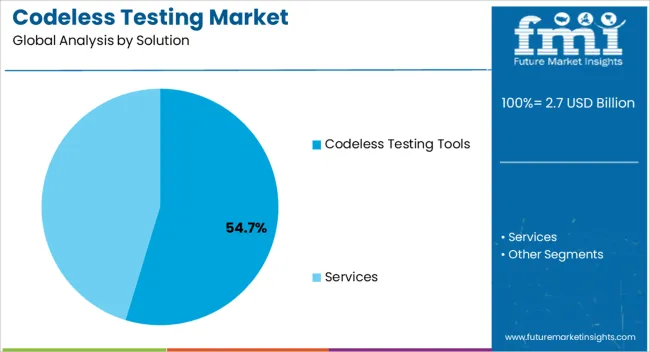

The codeless testing tools segment is expected to represent 54.70% of overall revenue by 2025 within the solution category, making it the leading segment. This dominance is attributed to the ease of use offered by drag and drop interfaces, reusable test components, and integration with popular CI and CD platforms.

These tools have enabled non technical users to participate in the testing process, reducing bottlenecks and expanding testing coverage. Cost reduction through minimized reliance on skilled programmers and improved collaboration between development and QA teams has further reinforced adoption.

As organizations prioritize speed and accuracy in software delivery, codeless testing tools continue to be the preferred choice, ensuring their leadership in the solution category.

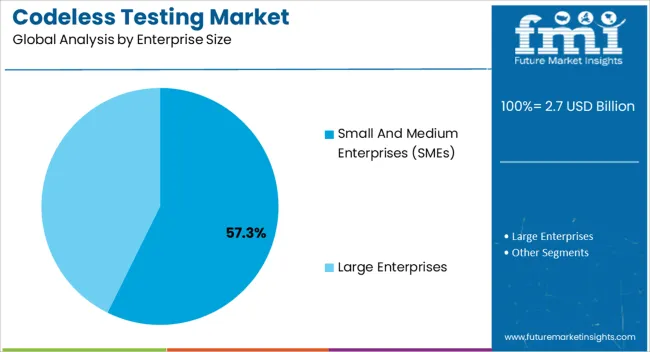

The small and medium enterprises segment is forecast to account for 57.30% of the total market by 2025 within the enterprise size category, making it the leading segment. This dominance is attributed to the growing need among SMEs to adopt cost effective testing solutions that require minimal technical expertise.

Codeless testing tools have allowed these enterprises to compete with larger counterparts by accelerating product releases and maintaining software quality without heavy investment in specialized talent. Cloud based deployment options, subscription pricing, and simplified integration have made adoption feasible for resource constrained organizations.

As SMEs continue to expand digital operations and customer facing applications, their reliance on codeless testing solutions will strengthen, solidifying their leading position in the market.

FMI has projected the global codeless testing market to witness a growth in revenue from USD 2.7 billion in 2.702.73 to USD 11.4 billion by 2.7033. Most software testing firms have progressed from manual testing to mostly computerized testing methods.

Using advanced and automated programming software, testers are able to execute test cases without any coding knowledge, rather than spending a lot of time writing code. Furthermore, codeless/scriptless testing tools enable testers with little experience with test automation to automate quickly through reusable tests.

The ease of evaluating code by non-technical teammates, as well as a decrease in time that testers devote to recurring test instances, are driving the swift development of codeless testing tools, which is projected to drive the popularity of codeless testing in the coming years.

The codeless testing market was estimated to grow at a CAGR of 13.5% over the historical period (2.7018 to 2.702.72.7).

Codeless testing solutions are highlighted by technologies such as DevOps, the Internet of Things (IoT), and artificial intelligence (AI). Rising investments in artificial intelligence technology are expected to provide growth opportunities for codeless testing because it can generate test cases based on real user data and gain insight into different user flows.

As AI automates test scenarios based on authentic user data, it helps test engineers save time when creating new test data, which is a major reason why companies prefer codeless testing solutions.

The replacement of static locators with dynamic locators is expected to make testing software more stable, resulting in faster test execution and authoring. In October 2020, IBM Corporation announced the release of its Auto AI.

It is a new set of capabilities for the company's flagship product, "Watson Studio." These new capabilities are intended to automate a number of the monotonous and complex tasks associated with optimizing, designing, and governing AI in the organization.

Several firms recently conducted worldwide research on test automation to determine where organizations were having the most difficulty. For instance, Applause stated that a survey was conducted in February 2024 with over 2,000 digital item owners, software engineers, QA, and DevOps professionals participating.

The primary finding was that substantial obstacles from conventional test automation still exist nowadays, both for firms that have spent a significant amount of resources and time in robotics and for the ones that are further behind in their computerization maturity and tactics. 41% cite a lack of proficient and/or experienced automation for testing resources as their most significant challenge.

Many skilled professionals believe that because testing cannot be customized through coding, it is less flexible. Because codeless platforms are typically aimed at small uses of web-based apps, and web pages it is not appropriate for large-scale projects or mission-critical business applications. As a result, all of these variables are anticipated to create challenges in the industry during the forecast time frame.

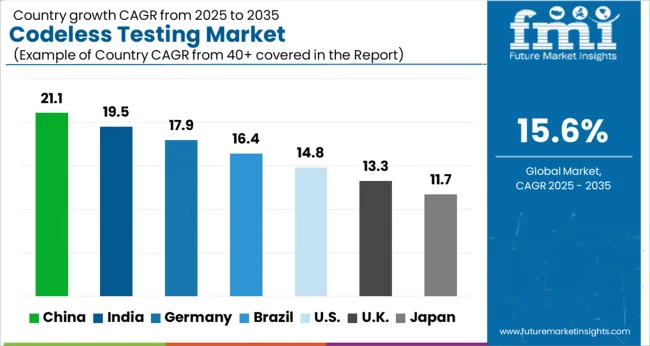

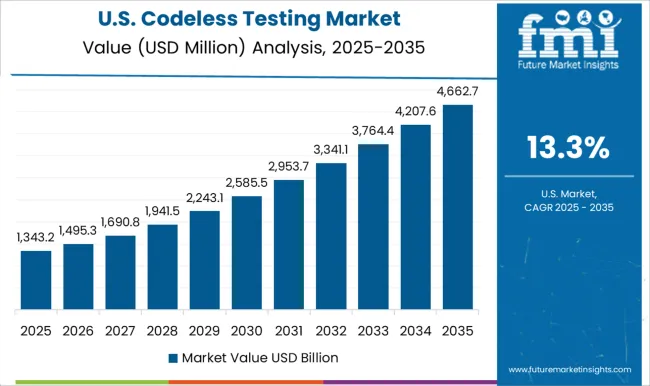

According to the report, the United States was predicted to account for a market share of 18.6% in 2025. During the forecast period, the United States is expected to remain one of the most appealing markets. This is owing to significant developments in the codeless testing market in the United States.

Tricentis, which has an important foothold in the United States, acquired TestProject, a community-powered automation evaluation platform created for agile teams, in August 2020. Tricentis intends to expand the community, assist software testers in enabling the best Android and iOS test automation practices, and devote funds to its research and development (R&D) efforts to build advanced products to supplement the demand for codeless testing as a component of its commitment to TestProject.

The codeless testing market in the United Kingdom is anticipated to expand at a CAGR of 15.8% over the forecast period. The software testing services industry is expected to grow rapidly over the next decade.

Increased software investment among United Kingdom businesses, as well as the industry's ongoing expansion of service offerings, are expected to fuel demand for codeless testing tools. Additionally, IT adoption is anticipated to continue, albeit at a much slower rate, likely encouraging investment in information technology infrastructure and generating additional industry demand.

According to the report, the United Kingdom is recognized as a primary market, with significant demand for codeless testing expected to continue throughout the projected time frame.

The codeless testing market in China is anticipated to expand at a CAGR of 16.1% over the forecast period. In China, governments are launching initiatives to accelerate the adoption of new technologies like computational intelligence and deep learning, robotics, the Internet of Things, mobile devices and web-based apps, cloud-based services, and other breakthroughs.

By 2035, China will account for more than 45% of East Asian sales of codeless testing solutions. China is the world's fastest-growing economy, and it is expected to provide a lucrative market for codeless testing vendors.

The country is experiencing rapid growth in digitization and increased connectivity. The country also has several developed SMEs that are expanding at an exponential rate to serve their large customer base, creating a favorable environment for long-term growth.

The codeless testing tools segment was estimated to account for an impressive market share of 20.4% in 2025. One of the major drivers for codeless testing solutions is the increasing adoption of cloud-based automation and testing.

Cloud-based tools for automation are cost-effective, flexible, and modular, which is why they are popular among SMEs and start-ups. Aside from that, the incorporation of machine learning and artificial intelligence in codeless testing tools is making them easier to use, which is expected to aid market growth between 2025 and 2035.

When it comes to agile advancement, software testers favor codeless automatic testing as an essential element. During the period of forecasting, these elements are expected to open up new growth opportunities for codeless testing tools.

In terms of worldwide demand for codeless testing, the IT and telecom sectors are expected to contribute more than 25% in 2025. With codeless testing, IT and telecom organizations can gain rapid feedback on the mainframe and supercharge invention without the threat of bottlenecks disrupting operations, hindering customer experiences, or affecting revenues.

Enterprises may enhance mainframe quality, speed, and effectiveness while alleviating the shortage of skilled developers, thereby drastically contributing to the development of codeless testing solutions.

To achieve a competitive edge, market participants are concentrating on innovation and strategic collaborations. For instance,

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 15.6% from 2025 to 2035 |

| Market Value in 2025 | USD 2.7 billion |

| Market Value in 2035 | USD 11.4 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Key Countries Covered |

Unites States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Segments Covered |

Solution, Application, Enterprise Size, Industry, Region |

| Key Companies Profiled |

Ranorex GmbH; Katalon, Inc.; Mabl Inc.; Usetrace; Perforce Software, Inc.; Cygnet-Infotech; Worksoft, Inc.; Testim; froglogic GmbH; Statnetics LLC; ACCELQ Inc.; QMetry Inc.; Micro Focus; Tricentis; Eggplant |

| Customization & Pricing | Available upon Request |

The global codeless testing market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the codeless testing market is projected to reach USD 11.4 billion by 2035.

The codeless testing market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in codeless testing market are codeless testing tools, services, _testing & oa services, _consulting services, _integration & implementation and _support & maintenance.

In terms of application, api testing segment to command 48.9% share in the codeless testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Codeless Payment Platform Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA