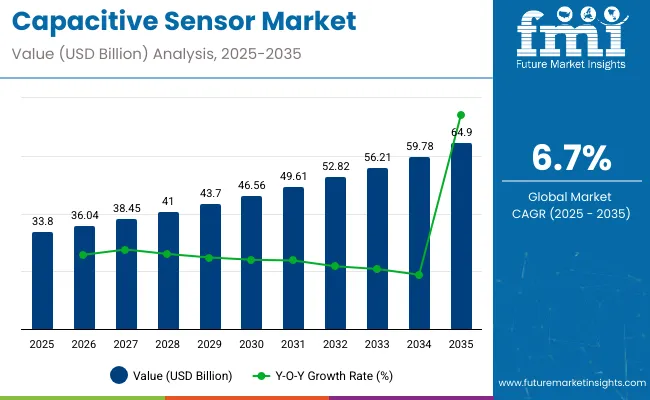

The global capacitive sensor market is projected to expand from USD 33.80 billion in 2025 to approximately USD 64.90 billion by 2035, reflecting a CAGR of 6.7% over the forecast period. In 2024, the market stood at USD 31.67 billion, with 6.5% year-on-year growth expected in 2025. The consistent demand for touch-based and proximity sensing solutions across consumer, automotive, healthcare, and industrial markets is driving this momentum.

Capacitive sensors are valued for their high precision, durability, and ability to function in compact, low-power devices. Manufacturers are continuously enhancing product designs to support multi-touch, gesture control, and touchless operation. In 2024, major players introduced thin-film capacitive panels with improved water resistance and wear durability to meet demands in rugged and outdoor environments. The rise of touchless interfaces in automotive controls and public displays is also fueling adoption of advanced capacitive sensing technologies.

Another key innovation is the integration of projected capacitive technology (PCT) into large-format interactive displays and industrial interfaces. Recent deployments in 2024 showed that PCT can now support air gestures, stylus interaction, and multi-user environments, boosting adoption in sectors such as education, retail, and corporate collaboration. These advancements are improving user experience and enabling intuitive control in a broadening range of applications.

Geographically, North America leads the market due to established R&D capabilities and rapid adoption of high-performance sensing solutions. The Asia Pacific region is emerging as the fastest-growing market, driven by booming electronics manufacturing and automotive innovation in China, India, and South Korea. Globally, capacitive sensors are poised to benefit from trends toward IoT integration, smart infrastructure, and the growing demand for contactless human-machine interfaces. With sustained product innovation and expanding applications, the market is set for strong growth through 2035.

| Attributes | Description |

|---|---|

| Estimated Capacitive Sensor Market Size (2025E) | USD 33.80 Billion |

| Projected Capacitive Sensor Market Value (2035F) | USD 64.90 Billion |

| Value-based CAGR (2025 to 2035) | 6.70% |

Capacitive sensors are increasingly integrated with smart technologies such as AI-driven signal processing, IoT connectivity, and advanced touch interfaces. These innovations enhance performance in applications ranging from consumer electronics to industrial automation. Several leading companies are leveraging these technologies to improve sensitivity, durability, and system intelligence.

Government regulations in the capacitive sensor market primarily focus on safety, electromagnetic compatibility, environmental impact, and product reliability. These rules ensure that capacitive sensors meet industry standards and do not interfere with other electronic systems while maintaining user safety and environmental responsibility.

The below table presents the expected CAGR for the global Capacitive Sensor market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly higher growth rate of 5.9% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 5.3% (2024 to 2034) |

| H2, 2024 | 5.9% (2024 to 2034) |

| H1, 2025 | 6.7% (2025 to 2035) |

| H2, 2025 | 7.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 6.7% in the first half and remain relatively moderate at 7.0% in the second half. In the first half H1 the market witnessed a decrease of 60 BPS while in the second half H2, the market witnessed an increase of 30 BPS.

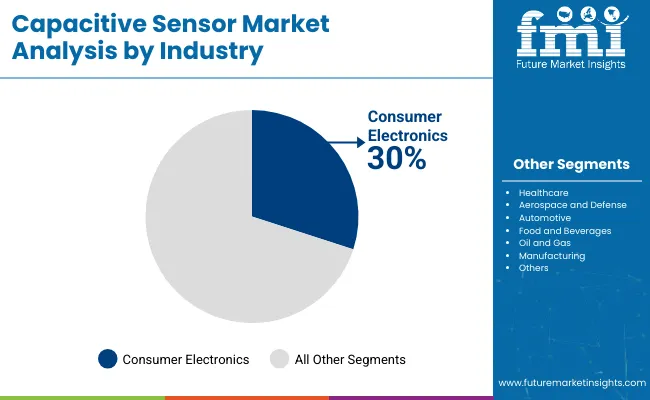

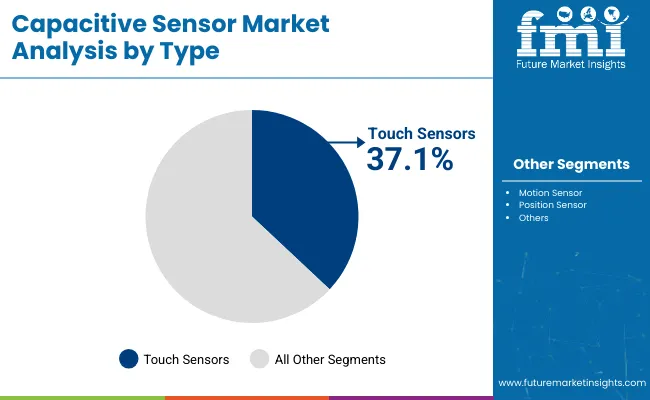

The capacitive sensor market is seeing robust growth, supported by rising adoption in consumer electronics and touch-enabled interfaces. In 2025, the consumer electronics segment is expected to capture around 30% market share, growing at 7.2% CAGR. Meanwhile, touch sensors will dominate by type with a projected 37.1% share. Increasing demand for intuitive and responsive interfaces drives this expansion.

The consumer electronics segment is projected to secure around 30% share of the capacitive sensor market in 2025. A 7.2% CAGR is expected between 2025 and 2035. Growth is driven by rising demand for smartphones, wearables, smart home devices, and touch-enabled appliances. Capacitive sensors power these products with features like multi-touch, gesture recognition, proximity sensing, and fingerprint scanning.

The segment benefits from increasing sales of smart gadgets in markets such as China, India, and South Korea. Manufacturers like Synaptics, NXP Semiconductors, Atmel (Microchip), and Alps Electric are leading product innovation. The growing use of AI-powered interfaces and IoT-enabled devices further supports this trend.

Advances in flexible displays, wearable tech, and AR/VR devices will keep demand high. Consumer brands are also emphasizing sleek, bezel-less designs, where capacitive touch is critical. With global electronics markets expanding, the consumer electronics segment will continue driving capacitive sensor growth through 2035.

Touch sensors are forecasted to capture 37.1% market share in the capacitive sensor market by 2025. These sensors enable intuitive, interactive user experiences in smartphones, industrial controls, automotive displays, ATMs, and medical devices.

Demand for multi-touch, gesture recognition, and pressure sensitivity has fueled growth. Touch sensors are being adopted across sectors for durability, high responsiveness, and aesthetic design. Major companies such as Synaptics, Cypress Semiconductor, Analog Devices, and Texas Instruments are driving innovation in this space.

Applications in healthcare kiosks, industrial automation panels, and smart home appliances are increasing. The rise of edge computing and AI-powered interfaces supports advanced touch functions. Flexible displays and transparent conductive films also expand sensor use. Growing consumer expectations for responsive and seamless device interaction keep the segment dominant. Touch sensors’ leadership will remain strong through 2025, as manufacturers focus on further enhancing accuracy, durability, and customization.

The increasing adoption of touchscreen-based devices in mobile phones, tablets, laptops, and smart home applications, the market for the capacitive sensor is largely driven by that. Consumers prefer capacitive sensors over resistive sensors due to greater sensitivity, multi-touch and durability advantages, and because they enable sleeker designs.

Moreover, the expanding deployment of capacitive sensing technology in smart wearables, smart devices, and infotainment systems is driving the growth of the armored cable market. Flexible displays, edge-to-edge devices and other best of breed developments are doing wonders for the consumer electronics space, however capacitive sensors are a critical factor in maximizing user experience.

In addition, the growing integration of high-resolution displays and gesture controls in various sectors including mobile gaming consoles, automotive infotainment systems and industrial touchscreens is further expected to fuel global demand for capacitive sensors.

The sensors are also becoming common in the automotive space, particularly in Advanced Driver Assistance Systems (ADAS), touch-based dashboards, and gesture recognition for controls inside the cabin.

In contemporary cars, the physical buttons have been replaced by sophisticated capacitive touch sensors that form the basis of the infotainment, climate control, and steering-mounted functions that make up human-machine interface (HMI) for vehicles.

Furthermore, the use of capacitive sensors in seat occupation detection, proximity sensing in keyless entry systems and driver monitoring systems enhances safety and comfort. Rising demand for autonomous and semi-autonomous vehicles coupled with the advancements in human-machine interaction (HMI) technologies would also contribute to the increasing uptake of capacitive sensors in automotive domain.

Increasing Industry 4.0 adoption and (IOT) Internet based automation technologies are one of the major factor driving the capacitive sensor market in various industrial applications. Examples: Capacitive sensors have become popular in HMI-based human-machine interfaces (HMIs), object detection, level sensing, proximity detection in smart factories.

The growing trend of predictive maintenance and real-time monitoring in industrial automation will only contribute to the increasing demand for capacitive sensors, as they have the advantages of non-contact sensing, high precision, and resistance to environmental contaminants.

In addition, capacitive sensors also play an important role in industrial robotics, smart packaging, and manufacturing lines that require efficiency and safety in processes. As IoT and artificial intelligence (AI) continue to develop, creating smarter and more responsive industrial infrastructure, capacitive sensors are emerging as key components systems in 21st century factories and warehouses.

The capacitive sensor market faces its own challenges, mainly in terms of the performance issues posed in extreme environmental conditions like very high humidity, very high/low temperature, and EMI (electromagnetic interference). In industrial and outdoor applications, capacitive sensors are extremely sensitive to changes in external conditions, which may cause phenomena such as signal shift and false triggering, leading to decreased validity of detection.

For example, excessive moisture builds up on the sensors in a high-humidity environment can lead to false touch activations, and complete sensor failure. Then again, exposing automotive and aerospace applications to extreme cold or heat can impair the reliability of capacitive touch panels.

Furthermore, industrial environments often exhibit high levels of electromagnetic interference that can interfere with the operation of sensors, requiring extra shielding and extensive calibration work, which in turn increases total costs and the complexity of solution deployment.

The global Capacitive Sensor industry recorded a CAGR of 6.7% during the historical period between 2020 and 2024. The growth of Capacitive Sensor industry was positive as it reached a value of USD 31670.0 million in 2024 from USD 19047.6 million in 2020.

Over the extended period from 2020 to 2024, the capacitive sensor market is expected to witness steady growth due to increased adoption in consumer electronics, automotive touch interfaces, and industrial automation.

Demand was also driven by the rising popularity of smartphones, tablets, and smart wearables, as well as our collective automotive digitization and IoT expansion. That's not how it was halted in July 2020 because of COVID-19 pandemic-related supply chain disruptions that temporarily impacted production and sensor availability.

In terms of the future, the decades along 2025 to 2035 are anticipated to see a considerable surge in demand, with the drivers of this growth being advancements in human-machine interfaces (HMIs), expanded adoption of capacitive sensors in advanced driver assistance systems (ADAS), and trends in industrial automation.

Moreover, the increasing demand for gesture recognition, biometric sensing, and capacitive proximity detection will considerably drive market growth. An increasing demand for AI-driven smart touch interfaces and flexible displays is also expected to boost demand. On the whole, the CAGR expected for 2025 to 2035 is likely to be higher than that of 2020 to 2024, as the technology matures and various industries adopt it intensively.

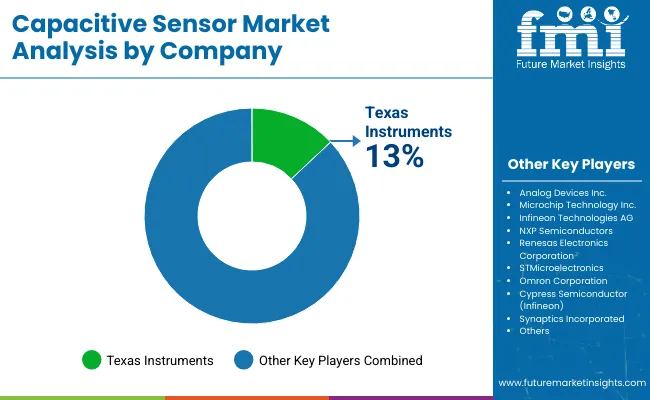

Tier 1 such as Texas Instruments, Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors. Considering their extensive in-house R&D capabilities, diversified product portfolios, and global customer reach across varied industry segments, these companies have gained a majority share of the capacitive sensor market.

They provide high-resolution capacitive sensing solutions for consumer electronics, automotive, industrial automation, and IoT applications. They are leading the market with their robust manufacturing capabilities as well as high-volume production in collaboration with top OEMs.

This keeps them at the forefront of evolving applications, including flexible displays and smart surfaces based on new low power, AI-ready and ultra-thin capacitive sensors. These players also track significant investments in sensor fusion technologies, facilitating seamless integration with AI-driven interfaces and edge computing devices.

Tier 2 players are Microchip Technology Inc. Renesas Electronics Corporation; STMicroelectronics; Omron Corporation. These companies show robust regional market dominance as well as expertise in vertical-specific sensor applications.

They compete with Tier 1 players but target sub-segments like automotive safety systems, industrial robotics, and medical electronics. For instance, Renesas and STMicroelectronics are focused on automotive capacitive touch sensors & HMI applications, Omron specializes in industrial automation and healthcare sensing solutions.

They have strategic partnerships and develop customized sensor solutions for automotive, aerospace, and healthcare applications. This gives them a competitive advantage in niche markets around the world, especially in the Asia-Pacific and European markets, due to their cost-effective and energy-efficient sensor solutions.

The Tier 3 includes Cypress Semiconductor (Infineon), Synaptics Incorporated. These are smaller but they are more specialized in capacitive sensor technology.

And now we have Cypress Semiconductor, part of Infineon, which develops high-performance capacitive touch controllers for mobile devices, embedded systems, and more. Synaptics Incorporated Synaptics specializes in touch solutions for laptops, gaming peripherals and biometric solutions. To stand out, these companies invest in applications: AI-based touch sensing, gesture control and biometric security.

The second one, they focus on low-power, high-precision capacitive sensing solutions for both wearables and next-gen human-machine interface (HMI) devices. In comparison to Tier 1 and Tier 2 players, they hold less market share but are strong players in high-growth imperfect markets.

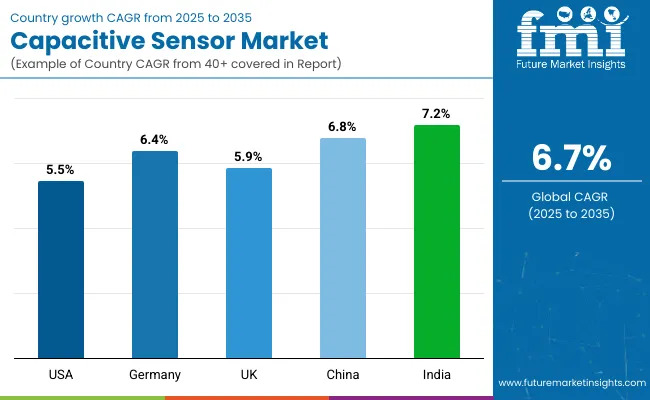

The section below covers the industry analysis for the Capacitive Sensor market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 60.2% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 7.2% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| Germany | 6.4% |

| UK | 5.9% |

| China | 6.8% |

| india | 7.2% |

Consumer electronics, automotive, healthcare and industrial automation are driving this significant capacitive sensors market. It includes world class semiconductor manufacturers, R& D centers, and innovation centers to lead progress in capacitive sensing technology.

With the increasing penetration of smartphones, tablets, wearables, and interactive displays, the demand for high-sensitivity, multi-touch capacitive sensors is also getting stronger. The automotive segment is another key growth driver, given the number of capacitive sensors installed in advanced driver assistance systems (ADAS), gesture control systems, and touch-centric infotainment systems.

Mature implementations of AI derived insights using intelligent sensors across industrial automation, robotics and healthcare are further aiding the growth of the sensor data analytics market. The capacitive sensors industry within the USA market is represented by technological professional owing to early adoption of emerging technologies, thus the global capacitive sensors innovation is led by the USA market.

Germany is among the leading countries for capacitive sensors owing to its strong automotive sector, industrial automation, and Industry 4.0. The adoption of capacitive touch-based HMIs, gesture controls, and driver assistance systems in vehicles has been fueled by automobile giants like BMW, Volkswagen, and Mercedes-Benz.

Germany’s strong manufacturing industry with particular attention to smart factories, robotics and real-time monitoring systems also draws heavily from capacitive sensing solutions. The country is also at the forefront of medical technology, with capacitive sensors allowing precise, touchless control systems in surgical and diagnostic equipment.

Demand is also surging due to the push for energy-efficient and miniaturized sensors to meet sustainability objectives. Germany is a key market for capacitive sensor proliferation, with strong government backing for automated industrial systems.

The capacitive sensor market in the region is anticipated to witness significant growth in the coming few years owing to the increasing demand for consumer electronics and the growing number of smartphone users along with smart city development projects in the countries.

It has now become one of the biggest smartphone markets in the world, and smartphone makers are now forced to include good quality capacitive touchscreens and fingerprint sensors in low-end and high-end models alike. The effort is towards making good quality capacitive touchscreen a mainstay of all slabs.

The rise of electric vehicles (EV) and connected cars are also creating demand for capacitive touch interfaces and gesture recognition systems in the India automotive market. Global sensor makers are also drawn by government initiatives such as Make in India and incentives offered for domestic electronics manufacturing.

Overall, acceptance of capacitive sensors in ATMs, Kiosks, and different electronic payment frameworks are developing which is in lined with the evolution of Indian market from contacting technology and advanced foundation insight.

The capacitive sensor market includes both large and small players. The major players in the market include Texas Instruments, Analog Devices, Infineon Technologies, and NXP Semiconductors who have increased their market share due to better R&D capabilities and large-scale production and agreements/partnerships with OEMs.

With consumer electronics, automotive, healthcare, and industrial automation being the application sectors, the competition is getting fiercer as companies invest in capacitive sensors shrunk down, Compatible with AI algorithms, and multi-purpose. Moreover, regional players and new entrants are focusing on economical and application-specific solutions to capture a larger market share.

The majority of growth strategies involve strategic mergers, acquisitions, and collaborations, with a focus on our expansion into emerging markets such as India and Southeast Asia. Also, for next-gen devices, competition is rising in flex and ultra-thin capacitive sensors.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 33.80 Billion |

| Projected Market Size (2035) | USD 64.90 Billion |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | Touch Sensor, Motion Sensor, Position Sensor |

| Industries Analyzed (Segment 2) | Healthcare, Aerospace and Defense, Automotive, Consumer Electronics, Food and Beverages, Oil and Gas, Manufacturing |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the Capacitive Sensor Market | Fujitsu Limited, Omron Corporation, TE Connectivity Ltd, Renesas Electronics Corporation, NXP Semiconductors N.V., Baumer Electric AG, Infineon Technologies AG, Texas Instruments Inc., STMicroelectronics N.V., Microchip Technology Inc. |

| Additional Attributes | Market size in dollar sales and CAGR, share by sensor type (touch, position, motion), application trends (consumer electronics, automotive, industrial), regional dollar sales, competitive dollar sales, material trends, tech advancements, regulatory landscape. |

In terms of Type, the segment is segregated into Touch Sensor, Motion Sensor and Position Sensor.

In terms of Distribution Channel is distributed into Healthcare, Aerospace and Defense, Automotive, Consumer Electronics, Food and Beverages, Oil and Gas and Manufacturing.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Capacitive Sensor industry is projected to witness CAGR of 6.7% between 2025 and 2035.

The global Capacitive Sensor industry stood at USD 33.80 billion in 2025.

The global Capacitive Sensor industry is anticipated to reach USD 64.90 billion by 2035 end.

East Asia is set to record the highest CAGR of 7.5% in the assessment period.

The key players operating in the global Capacitive Sensor industry include Texas Instruments, Analog Devices Inc., Microchip Technology Inc., Infineon Technologies AG, NXP Semiconductors. and others.

Table 1: Global Capacitive Sensor Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Capacitive Sensor Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Capacitive Sensor Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 4: Global Capacitive Sensor Market Volume (Units) Forecast by Type, 2017 to 2032

Table 5: Global Capacitive Sensor Market Value (US$ Million) Forecast by Industry, 2017 to 2032

Table 6: Global Capacitive Sensor Market Volume (Units) Forecast by Industry, 2017 to 2032

Table 7: North America Capacitive Sensor Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Capacitive Sensor Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Capacitive Sensor Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 10: North America Capacitive Sensor Market Volume (Units) Forecast by Type, 2017 to 2032

Table 11: North America Capacitive Sensor Market Value (US$ Million) Forecast by Industry, 2017 to 2032

Table 12: North America Capacitive Sensor Market Volume (Units) Forecast by Industry, 2017 to 2032

Table 13: Latin America Capacitive Sensor Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Capacitive Sensor Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Capacitive Sensor Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 16: Latin America Capacitive Sensor Market Volume (Units) Forecast by Type, 2017 to 2032

Table 17: Latin America Capacitive Sensor Market Value (US$ Million) Forecast by Industry, 2017 to 2032

Table 18: Latin America Capacitive Sensor Market Volume (Units) Forecast by Industry, 2017 to 2032

Table 19: Europe Capacitive Sensor Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Capacitive Sensor Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Capacitive Sensor Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 22: Europe Capacitive Sensor Market Volume (Units) Forecast by Type, 2017 to 2032

Table 23: Europe Capacitive Sensor Market Value (US$ Million) Forecast by Industry, 2017 to 2032

Table 24: Europe Capacitive Sensor Market Volume (Units) Forecast by Industry, 2017 to 2032

Table 25: Asia Pacific Capacitive Sensor Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Asia Pacific Capacitive Sensor Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Asia Pacific Capacitive Sensor Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 28: Asia Pacific Capacitive Sensor Market Volume (Units) Forecast by Type, 2017 to 2032

Table 29: Asia Pacific Capacitive Sensor Market Value (US$ Million) Forecast by Industry, 2017 to 2032

Table 30: Asia Pacific Capacitive Sensor Market Volume (Units) Forecast by Industry, 2017 to 2032

Table 31: Middle East & Africa Capacitive Sensor Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: Middle East & Africa Capacitive Sensor Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: Middle East & Africa Capacitive Sensor Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 34: Middle East & Africa Capacitive Sensor Market Volume (Units) Forecast by Type, 2017 to 2032

Table 35: Middle East & Africa Capacitive Sensor Market Value (US$ Million) Forecast by Industry, 2017 to 2032

Table 36: Middle East & Africa Capacitive Sensor Market Volume (Units) Forecast by Industry, 2017 to 2032

Figure 1: Global Capacitive Sensor Market Value (US$ Million) by Type, 2022 to 2032

Figure 2: Global Capacitive Sensor Market Value (US$ Million) by Industry, 2022 to 2032

Figure 3: Global Capacitive Sensor Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Capacitive Sensor Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Capacitive Sensor Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Capacitive Sensor Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Capacitive Sensor Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Capacitive Sensor Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 9: Global Capacitive Sensor Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 10: Global Capacitive Sensor Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 11: Global Capacitive Sensor Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 12: Global Capacitive Sensor Market Value (US$ Million) Analysis by Industry, 2017 to 2032

Figure 13: Global Capacitive Sensor Market Volume (Units) Analysis by Industry, 2017 to 2032

Figure 14: Global Capacitive Sensor Market Value Share (%) and BPS Analysis by Industry, 2022 to 2032

Figure 15: Global Capacitive Sensor Market Y-o-Y Growth (%) Projections by Industry, 2022 to 2032

Figure 16: Global Capacitive Sensor Market Attractiveness by Type, 2022 to 2032

Figure 17: Global Capacitive Sensor Market Attractiveness by Industry, 2022 to 2032

Figure 18: Global Capacitive Sensor Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Capacitive Sensor Market Value (US$ Million) by Type, 2022 to 2032

Figure 20: North America Capacitive Sensor Market Value (US$ Million) by Industry, 2022 to 2032

Figure 21: North America Capacitive Sensor Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Capacitive Sensor Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Capacitive Sensor Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Capacitive Sensor Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Capacitive Sensor Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Capacitive Sensor Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 27: North America Capacitive Sensor Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 28: North America Capacitive Sensor Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 29: North America Capacitive Sensor Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 30: North America Capacitive Sensor Market Value (US$ Million) Analysis by Industry, 2017 to 2032

Figure 31: North America Capacitive Sensor Market Volume (Units) Analysis by Industry, 2017 to 2032

Figure 32: North America Capacitive Sensor Market Value Share (%) and BPS Analysis by Industry, 2022 to 2032

Figure 33: North America Capacitive Sensor Market Y-o-Y Growth (%) Projections by Industry, 2022 to 2032

Figure 34: North America Capacitive Sensor Market Attractiveness by Type, 2022 to 2032

Figure 35: North America Capacitive Sensor Market Attractiveness by Industry, 2022 to 2032

Figure 36: North America Capacitive Sensor Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Capacitive Sensor Market Value (US$ Million) by Type, 2022 to 2032

Figure 38: Latin America Capacitive Sensor Market Value (US$ Million) by Industry, 2022 to 2032

Figure 39: Latin America Capacitive Sensor Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Capacitive Sensor Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Capacitive Sensor Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Capacitive Sensor Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Capacitive Sensor Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Capacitive Sensor Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 45: Latin America Capacitive Sensor Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 46: Latin America Capacitive Sensor Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 47: Latin America Capacitive Sensor Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 48: Latin America Capacitive Sensor Market Value (US$ Million) Analysis by Industry, 2017 to 2032

Figure 49: Latin America Capacitive Sensor Market Volume (Units) Analysis by Industry, 2017 to 2032

Figure 50: Latin America Capacitive Sensor Market Value Share (%) and BPS Analysis by Industry, 2022 to 2032

Figure 51: Latin America Capacitive Sensor Market Y-o-Y Growth (%) Projections by Industry, 2022 to 2032

Figure 52: Latin America Capacitive Sensor Market Attractiveness by Type, 2022 to 2032

Figure 53: Latin America Capacitive Sensor Market Attractiveness by Industry, 2022 to 2032

Figure 54: Latin America Capacitive Sensor Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Capacitive Sensor Market Value (US$ Million) by Type, 2022 to 2032

Figure 56: Europe Capacitive Sensor Market Value (US$ Million) by Industry, 2022 to 2032

Figure 57: Europe Capacitive Sensor Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Capacitive Sensor Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Capacitive Sensor Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Capacitive Sensor Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Capacitive Sensor Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Capacitive Sensor Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 63: Europe Capacitive Sensor Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 64: Europe Capacitive Sensor Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 65: Europe Capacitive Sensor Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 66: Europe Capacitive Sensor Market Value (US$ Million) Analysis by Industry, 2017 to 2032

Figure 67: Europe Capacitive Sensor Market Volume (Units) Analysis by Industry, 2017 to 2032

Figure 68: Europe Capacitive Sensor Market Value Share (%) and BPS Analysis by Industry, 2022 to 2032

Figure 69: Europe Capacitive Sensor Market Y-o-Y Growth (%) Projections by Industry, 2022 to 2032

Figure 70: Europe Capacitive Sensor Market Attractiveness by Type, 2022 to 2032

Figure 71: Europe Capacitive Sensor Market Attractiveness by Industry, 2022 to 2032

Figure 72: Europe Capacitive Sensor Market Attractiveness by Country, 2022 to 2032

Figure 73: Asia Pacific Capacitive Sensor Market Value (US$ Million) by Type, 2022 to 2032

Figure 74: Asia Pacific Capacitive Sensor Market Value (US$ Million) by Industry, 2022 to 2032

Figure 75: Asia Pacific Capacitive Sensor Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: Asia Pacific Capacitive Sensor Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: Asia Pacific Capacitive Sensor Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: Asia Pacific Capacitive Sensor Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: Asia Pacific Capacitive Sensor Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: Asia Pacific Capacitive Sensor Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 81: Asia Pacific Capacitive Sensor Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 82: Asia Pacific Capacitive Sensor Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 83: Asia Pacific Capacitive Sensor Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 84: Asia Pacific Capacitive Sensor Market Value (US$ Million) Analysis by Industry, 2017 to 2032

Figure 85: Asia Pacific Capacitive Sensor Market Volume (Units) Analysis by Industry, 2017 to 2032

Figure 86: Asia Pacific Capacitive Sensor Market Value Share (%) and BPS Analysis by Industry, 2022 to 2032

Figure 87: Asia Pacific Capacitive Sensor Market Y-o-Y Growth (%) Projections by Industry, 2022 to 2032

Figure 88: Asia Pacific Capacitive Sensor Market Attractiveness by Type, 2022 to 2032

Figure 89: Asia Pacific Capacitive Sensor Market Attractiveness by Industry, 2022 to 2032

Figure 90: Asia Pacific Capacitive Sensor Market Attractiveness by Country, 2022 to 2032

Figure 91: Middle East & Africa Capacitive Sensor Market Value (US$ Million) by Type, 2022 to 2032

Figure 92: Middle East & Africa Capacitive Sensor Market Value (US$ Million) by Industry, 2022 to 2032

Figure 93: Middle East & Africa Capacitive Sensor Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: Middle East & Africa Capacitive Sensor Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: Middle East & Africa Capacitive Sensor Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: Middle East & Africa Capacitive Sensor Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: Middle East & Africa Capacitive Sensor Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: Middle East & Africa Capacitive Sensor Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 99: Middle East & Africa Capacitive Sensor Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 100: Middle East & Africa Capacitive Sensor Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 101: Middle East & Africa Capacitive Sensor Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 102: Middle East & Africa Capacitive Sensor Market Value (US$ Million) Analysis by Industry, 2017 to 2032

Figure 103: Middle East & Africa Capacitive Sensor Market Volume (Units) Analysis by Industry, 2017 to 2032

Figure 104: Middle East & Africa Capacitive Sensor Market Value Share (%) and BPS Analysis by Industry, 2022 to 2032

Figure 105: Middle East & Africa Capacitive Sensor Market Y-o-Y Growth (%) Projections by Industry, 2022 to 2032

Figure 106: Middle East & Africa Capacitive Sensor Market Attractiveness by Type, 2022 to 2032

Figure 107: Middle East & Africa Capacitive Sensor Market Attractiveness by Industry, 2022 to 2032

Figure 108: Middle East & Africa Capacitive Sensor Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Capacitive Touchscreen Market Insights – Growth & Forecast through 2034

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA