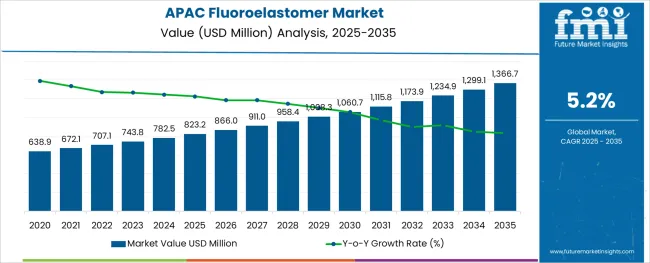

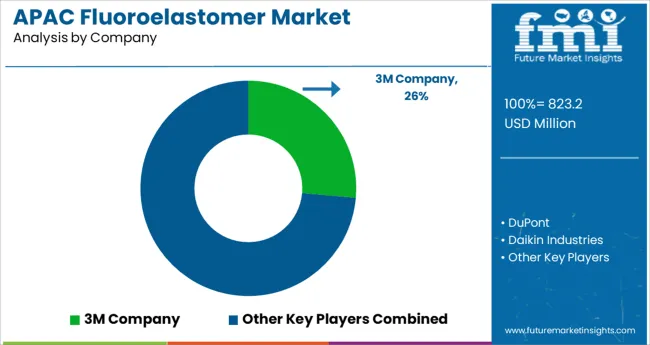

The APAC Fluoroelastomer Market is estimated to be valued at USD 823.2 million in 2025 and is projected to reach USD 1,366.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The APAC fluoroelastomer market is experiencing robust growth driven by increasing demand for high performance sealing solutions in automotive, aerospace, and industrial sectors. The region's expanding manufacturing base, particularly in China, India, and Southeast Asia, has accelerated adoption of fluoroelastomers due to their superior resistance to heat, chemicals, and oil.

As regulatory standards for emission control and material durability become more stringent, fluoroelastomers are being increasingly integrated into critical engine components and industrial machinery. Technological advancements in polymer formulations and the growing preference for lightweight and durable materials are further supporting market expansion.

With rising investments in infrastructure, transportation, and energy sectors across APAC, the demand for reliable sealing materials with high thermal and chemical stability is expected to remain strong, positioning fluoroelastomers as an essential solution in modern engineering applications.

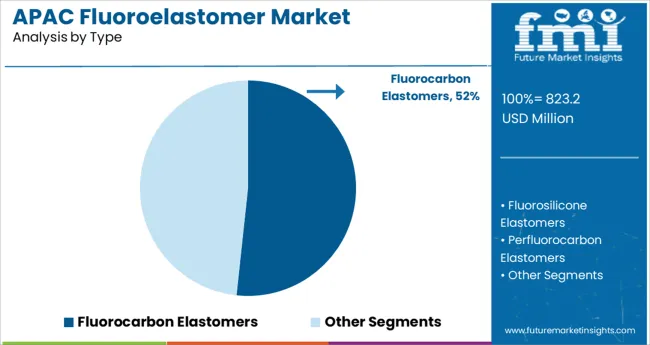

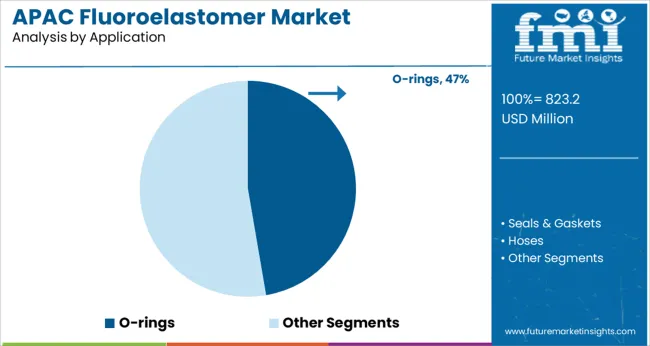

The market is segmented by Type, Application, and End-Use Industry and region. By Type, the market is divided into Fluorocarbon Elastomers, Fluorosilicone Elastomers, and Perfluorocarbon Elastomers.In terms of Application, the market is classified into O-rings, Seals & Gaskets, Hoses, Complex Molding Parts, and Others. Based on End-Use Industry, the market is segmented into Automotive, Industrial, Aerospace, Semiconductor, Oil & Gas, Pharmaceutical & Food, Energy & Power, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fluorocarbon elastomers segment is projected to account for 51.70% of total revenue by 2025 within the type category, establishing it as the dominant segment. This prominence is attributed to its exceptional resistance to high temperatures, aggressive fuels, and harsh chemical environments, making it the preferred choice in automotive and industrial applications.

The material's excellent compression set resistance and low permeability have reinforced its use in dynamic sealing systems where durability and performance are critical. Manufacturers across APAC have increasingly adopted fluorocarbon elastomers to comply with environmental regulations and extend component life under demanding operating conditions.

As end users prioritize long term efficiency and reduced maintenance, this type continues to lead the market based on its technical superiority and broad industrial applicability.

The O rings segment is expected to contribute 47.30% of the total market revenue by 2025 under the application category, highlighting its leadership in the segment. This dominance is supported by the widespread use of O rings in automotive, aerospace, chemical processing, and manufacturing industries, where they serve as essential components for fluid and gas sealing.

Their ability to maintain integrity under extreme temperature and pressure conditions has made them indispensable in machinery and engine systems. The APAC region's strong growth in automotive production and heavy industrial activities has intensified the need for reliable sealing components, driving increased demand for fluoroelastomer based O rings.

As industries pursue operational safety, efficiency, and emission control, the demand for high performance O rings continues to position this application at the forefront of the regional fluoroelastomer market.

The market of Fluoroelastomer witnessed a CAGR of 4.6% over the historical period of 2020 and 2024. Significant growth of various end-use industries, Fluoroelastomer has led to an increased demand for Fluoroelastomer over the historical period. Automotive and industrial industry are the largest consumers fluoroelastomers APACly, and due to the COVID 19 crisis as these industries have seen a significant decline in their growth. Supply and production from these industries is get decline. After the pandemic situation is recoverd and production and supply chain is get back to the track which lead to growth in the market.

However as per the current survey conducted by FMI, the forecast growth outlook for the Fluoroelastomer is to remain around 5.2% for the period of 2025 and 2035. Application in various end-use industries such as use of fluoroelastomers in medical, automotive, and electrical industries. Increasing production of end-use products that use Fluoroelastomer as a composite material is expected to drive the demand for Fluoroelastomer over the forecast period.

For instance, demand for automotive products is increasing APACly, with around 5%-7% annual growth. Increasing production to meet APAC demand is linked to a rise in demand for Fluoroelastomer.

Rising Demand from various end-use industries

Fluoroelastomers are employed in specialised items like hoses and gaskets that are needed by industries like automotive and aerospace. They serve as the jacketing materials in fibre optic cables as well. Fluoroelastomers are used by the oil and gas industry as contamination and sealing solutions in harsh conditions. The sector for fluoroelastomers is currently experiencing strong expansion, attributable to rising aerospace investment. Fluoroelastomers are widely used in the aerospace industry for insulation and a variety of other applications.

To meet the rising demand for more fuel-efficient automobiles, a number of automotive manufacturers are altering the designs of their vehicles and putting more of an emphasis on lightweighting through the use of alternative materials. As a result, the size of the power train, engine, and engine compartments is being reduced by automobile manufacturers. To increase fuel efficiency in addition to these, the modern air management system is also included.

Incompatibility of fluoroelastomers with certain ester solvents

The greatest barrier to the overall expansion of the fluoroelastomers sector is thought to be the incompatibility of fluoroelastomers with certain ester solvents, such as ethyl acetate, amines, and organic acids that are heavily used in the chemical industries.

During the anticipated period, it is also anticipated that variations in overall performance with regard to the relevant application and end-user will restrain the market expansion for fluoroelastomers. When exposed to extreme temperatures, some fluoroelastomers quickly disintegrate and release hydrogen fluoride gas. Additionally, it is believed that the non-biodegradable quality is the main factor limiting the market's expansion for fluoroelastomers.

Rising Demand of fluoroelastomers is creating ample growth opportunities

During the projection period, manufacturers are leaning toward creating fluoroelastomers that are industry-specific and built with properties like exceptional heat and chemical resistance. Such initiatives are improving fluoroelastomers' overall performance, which is increasing their application in end-user industries, including the pharmaceutical and food processing sectors.

It is predicted that the field will see new prospects when existing fluoroelastomers are improved for better performance. A large number of businesses have begun producing fluoroelastomers that are approved for use in food and pharmaceuticals. In 2020, AGC Chemical obtained Food Contact Notifications from the US FDA (Food and Drug Association) for three of its fluoroelastomer products: namely, the AFLAS Series 100S, 100H, and 150P.

The use of fluoroelastomers in the automobile industry is being driven by the growing development of the sector and the growing investments in it. because they are also used in the manufacturing of some automobile parts.

Rising Demand from various end-use industries

Fluoroelastomers are employed in specialised items like hoses and gaskets that are needed by industries like automotive and aerospace. They serve as the jacketing materials in fibre optic cables as well. Fluoroelastomers are used by the oil and gas industry as contamination and sealing solutions in harsh conditions. The sector for fluoroelastomers is currently experiencing strong expansion, attributable to rising aerospace investment. Fluoroelastomers are widely used in the aerospace industry for insulation and a variety of other applications.

To meet the rising demand for more fuel-efficient automobiles, a number of automotive manufacturers are altering the designs of their vehicles and putting more of an emphasis on lightweighting through the use of alternative materials. As a result, the size of the power train, engine, and engine compartments is being reduced by automobile manufacturers. To increase fuel efficiency in addition to these, the modern air management system is also included.

Incompatibility of fluoroelastomers with certain ester solvents

The greatest barrier to the overall expansion of the fluoroelastomers sector is thought to be the incompatibility of fluoroelastomers with certain ester solvents, such as ethyl acetate, amines, and organic acids that are heavily used in the chemical industries.

During the anticipated period, it is also anticipated that variations in overall performance with regard to the relevant application and end-user will restrain the market expansion for fluoroelastomers. When exposed to extreme temperatures, some fluoroelastomers quickly disintegrate and release hydrogen fluoride gas. Additionally, it is believed that the non-biodegradable quality is the main factor limiting the market's expansion for fluoroelastomers.

Rising Demand of fluoroelastomers is creating ample growth opportunities

During the projection period, manufacturers are leaning toward creating fluoroelastomers that are industry-specific and built with properties like exceptional heat and chemical resistance. Such initiatives are improving fluoroelastomers' overall performance, which is increasing their application in end-user industries, including the pharmaceutical and food processing sectors.

It is predicted that the field will see new prospects when existing fluoroelastomers are improved for better performance. A large number of businesses have begun producing fluoroelastomers that are approved for use in food and pharmaceuticals. In 2020, AGC Chemical obtained Food Contact Notifications from the US FDA (Food and Drug Association) for three of its fluoroelastomer products: namely, the AFLAS Series 100S, 100H, and 150P.

The use of fluoroelastomers in the automobile industry is being driven by the growing development of the sector and the growing investments in it. because they are also used in the manufacturing of some automobile parts.

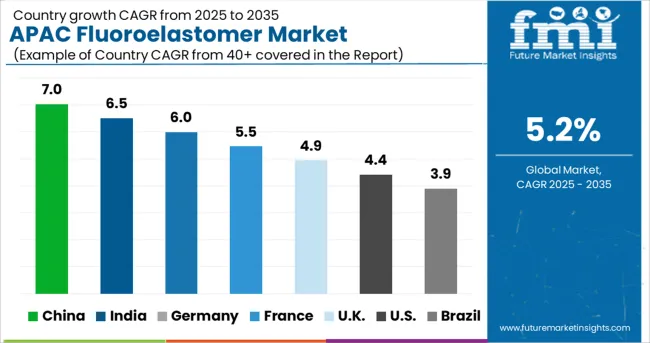

China is manufacturing hub for automotive industry and China is expected to remain one of the prominent consumers of Fluoroelastomers APACly owing to the increasing demand for Fluoroelastomer from oil & gas, pharmaceutical & food, energy & power and others end-use industries. The country is expected to account for nearly 60%-65% value share in the market.

Significant increase in the demand from industrial and oil & gas sector is bolstering the growth of Fluoroelastomer demand. China is increasing their EV’s production site to fulfil the demand of EV’s APACly which create the adequate environment for fluoroelastomer market.

India is likely to emerge as one of the strongest markets for future automotive sales. With the expanding manufacturing base and soaring investments in advanced technologies for industrial production, the automotive industry is likely to display positive growth & is likely to bring about a new era of automobiles. India accounted for 15%-18% value share in the market.

India are becoming more & more stringent regarding tp emission standards.The Indian government has said that the BS6 emission standards will be put into effect by April 2024, making it necessary for automakers to create BS6-compliant engines and use high-performance materials like fluoroelastomers for fuel interface components and other elements to cut emissions.

This growth in India is primarily attributable to the increasing presence of Fluoroelastomer manufacturers and the increasing adoption of Fluoroelastomer among various end-user industries.

Based on type, the APAC Fluoroelastomer market is segmented into Fluorocarbon Elastomers, Fluorosilicone Elastomers and Perfluorocarbon Elastomers. Fluorocarbon Elastomers segment is anticipated to remain one of the key types in the market, accounting for more than 80% of the APAC sales of Fluoroelastomer in 2025 and is expected to continue its dominance in the APAC Fluoroelastomer market during the forecast period.

O-rings, gaskets, shafts, fuel hoses, joints, and other electrical connector parts that are subjected to extreme temperatures and pressure variations during flights are typical applications for FKM in the aerospace industry, fluorocarbon elastomers synthetic rubbers help power high-performance engines that combine oil and chemicals with high temperatures. This growth is primarily attributable to its increased use in the manufacture of components for use in harsh environments and its lower cost than the competition.

Based on end-use industry, the APAC fluoroelastomer market is categorised into automotive, industrial, aerospace, semiconductor, oil & gas, pharmaceutical & food, energy & power, and others. The automotive sector is expected to remain a top consumer of fluoroelastomers and to witness a significant growth rate of 12% over the forecast period.

Fluoroelastomers are anticipated to be used primarily by the automobile industry, both in terms of volume and dollar value. The automotive sector uses the majority of the fluoroelastomers that are produced. Components for vehicles' drive trains and fuel management systems are made from fluoroelastomers. Because they contribute to lowering emissions and improving fuel efficiency, they are preferred over traditional rubber.

As a result, with increased automotive industry development projects around the world, the automotive sector is expected to remain a major consumer of fluoroelastomers.

The introduction of sustainable products will reduce the carbon footprint, and major manufacturers are investing in R&D to develop novel products with improved applications. Companies are concentrating on geographical and capacity expansions in emerging markets to strengthen their position in the market. Leading companies are also concentrating on lanching new products and acquiring businesses to broaden their customer base.

For instance:

in April 2020, Greene Tweed, a provider elastomers, launched a new-generation ultra-flow temperature and chemical-resistant fluroelastomer.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Tons for Volume |

| Key Countries Covered | China, India, Japan, ASEAN, Oceania |

| Key Segments Covered | Product Type, Application, End-Use Industry, and Region |

| Key Companies Profiled | 3M company; DuPont; Daikin Industries; Honeywell International Inc.,; The Chemours Company; Solvay SA; Fluorochemicals Limited; Dongyue Group; Halopolymer OJSC; James Walker & Co.; Shin-Etsu Chemicals; Viton; Tecnoflon; Dyneons; AFLAS; Gujarat Fluorochemicals Ltd; FKM & Elasftor, Shin-Etsu Chemical Co., Ltd; SIFEL; Shanghai 3F New Materials Co., Ltd; Dynamix; Eagle Elastomers Inc; Shanghi Fluoron Chemicals Co.; Precision Polymer Engineering/IDEX; Marco Rubber & Plastics, LLC; Asahi Glass company Ltd., etc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global apac fluoroelastomer market is estimated to be valued at USD 823.2 million in 2025.

It is projected to reach USD 1,366.7 million by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are fluorocarbon elastomers, fluorosilicone elastomers and perfluorocarbon elastomers.

o-rings segment is expected to dominate with a 47.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

APAC Wiper Blade Industry Size and Share Forecast Outlook 2025 to 2035

APAC Waste Heat Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Fluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

APAC Commercial Glazing System Market Size and Share Forecast Outlook 2025 to 2035

APAC Solar Micro Inverters Market Analysis – Share, Size, and Forecast 2025 to 2035

APAC Automotive Telematics Market Growth - Trends & Forecast 2025 to 2035

APAC Biocomposites Market Growth - Trends & Forecast 2025 to 2035

APAC Savory Ingredients Market Analysis – Trends & Forecast 2016-2026

Capacitor Bushing Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Film Slitter Market Size and Share Forecast Outlook 2025 to 2035

Capacitance Meter Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Capacitive Touchscreen Market Insights – Growth & Forecast through 2034

Capacitor Kits Market

Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultracapacitors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA