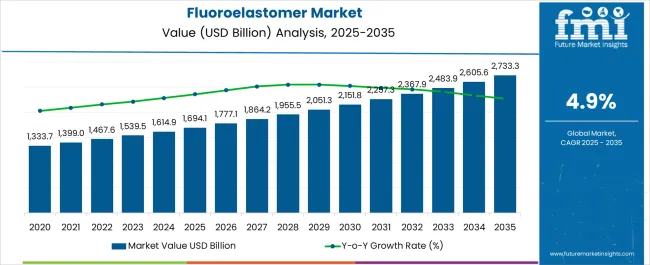

The fluoroelastomer market is estimated to be valued at USD 1694.1 billion in 2025 and is projected to reach USD 2733.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The fluoroelastomer market operates within a complex technical ecosystem where manufacturing challenges create persistent operational tensions between performance requirements and economic viability. Companies face substantial cost pressures from specialized raw materials that require fluorinated monomers, creating production expenses significantly higher than conventional elastomers. The complex manufacturing processes demand sophisticated temperature control systems and specialized equipment that increase capital investment requirements.

Raw material price volatility creates unpredictable cost structures where fluorine-based compounds experience supply constraints that affect profit margins and pricing strategies. Manufacturing facilities struggle with long lead times and high transportation costs due to the specialized nature of materials involved, requiring extensive coordination between suppliers, manufacturers, and distributors to maintain supply chain stability.

Technical performance challenges emerge when fluoroelastomers face extreme operational environments that push material properties to their limits. Gas turbine engines and advanced automotive applications are forcing fluoroelastomers toward their thermal stability boundaries, where temperatures exceeding 250°C create degradation risks that compromise seal integrity. High pressure and high temperature conditions cause deleterious effects on physical and mechanical properties, with spectroscopic analysis revealing hydrocarbon-related band deterioration and fluorocarbon band intensity reduction under aggressive aging conditions.

The carbon-fluorine bonds that provide chemical resistance begin breaking down under extreme conditions, leading to crosslinking structure damage and permanent material property changes. Engineering teams discover that traditional formulations cannot meet emerging requirements for applications where materials face simultaneous exposure to aggressive chemicals, extreme temperatures, and mechanical stress.

Supply chain vulnerabilities create market instabilities when key raw material suppliers experience disruptions or when geopolitical tensions affect fluorine availability from limited global sources. The pandemic exposed these vulnerabilities when manufacturing shutdowns in China and travel restrictions disrupted supply networks, causing production delays and material shortages.

Companies discovered that backup supplier networks were inadequate for specialized fluorinated compounds, creating single-source dependencies that amplified supply risks. Transportation challenges emerged when specialized handling requirements for fluorinated materials limited shipping options and increased logistics costs. Quality control requirements demand cold chain storage and contamination prevention measures that complicate distribution networks.

Companies invest in research to develop more sustainable fluoroelastomer variants, though these efforts require significant R&D expenditure with uncertain market acceptance. Life cycle assessment requirements force manufacturers to document environmental impact throughout production, usage, and disposal phases, adding complexity to product development and marketing processes.

| Metric | Value |

|---|---|

| Fluoroelastomer Market Estimated Value in (2025 E) | USD 1694.1 billion |

| Fluoroelastomer Market Forecast Value in (2035 F) | USD 2733.3 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The fluoroelastomer market is expanding steadily due to rising demand for high performance materials in industries where extreme temperature resistance, chemical stability, and durability are critical. The aerospace, automotive, and electronics sectors are increasingly adopting fluoroelastomers for applications in seals, gaskets, and insulation owing to their superior resistance to fuels, oils, and aggressive chemicals.

Technological advancements in material formulations are enabling improved performance under harsh operating conditions, extending product life and reliability. Regulatory emphasis on emission control and energy efficiency is further reinforcing the role of fluoroelastomers in advanced engine systems and environmental sealing applications.

With growing investments in aerospace development, electric mobility, and high precision electronics, the outlook for fluoroelastomers remains positive, supported by long term demand for advanced materials that ensure operational safety, efficiency, and compliance.

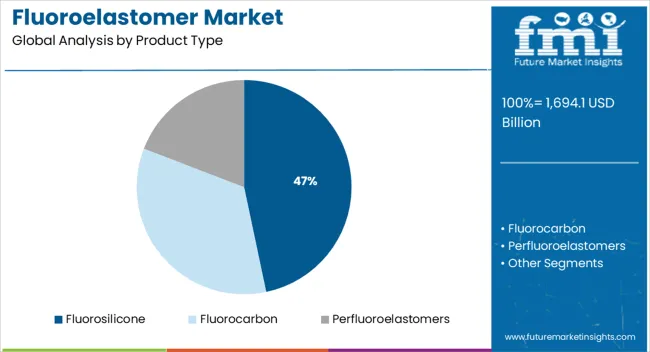

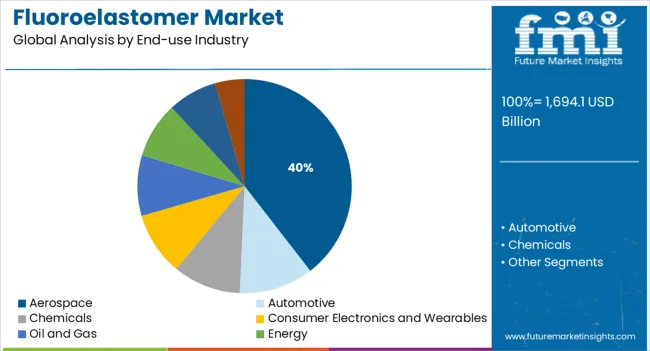

The market is segmented by Product Type and End-use Industry and region. By Product Type, the market is divided into Fluorosilicone, Fluorocarbon, and Perfluoroelastomers. In terms of End-use Industry, the market is classified into Aerospace, Automotive, Chemicals, Consumer Electronics and Wearables, Oil and Gas, Energy, Pharmaceutical and Food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fluorosilicone segment is expected to account for 46.70% of total revenue by 2025 within the product type category, making it the leading segment. Its growth is driven by superior performance in extreme temperature ranges and its resistance to fuels, oils, and solvents that are critical in high demand applications.

The material’s versatility in aerospace and automotive sealing solutions has enhanced its adoption where long term reliability is essential. Additionally, advancements in polymer formulations have improved flexibility and durability, extending service life under demanding conditions.

These attributes have solidified fluorosilicone as the preferred choice in the product type segment, particularly where both chemical and thermal resistance are paramount.

The aerospace segment is projected to hold 39.50% of the total market revenue by 2025 under the end use industry category, establishing it as the dominant segment. This leadership is attributed to the material’s critical role in ensuring sealing integrity, fuel system performance, and thermal resistance in aircraft engines and components.

Rising global air travel demand and fleet modernization programs are driving significant investments in high performance materials that meet stringent safety and regulatory requirements. Fluoroelastomers, with their proven capability to withstand aggressive operating environments, are increasingly integrated into aerospace systems to enhance efficiency and safety.

The segment’s dominance is further reinforced by the need for lightweight, durable, and compliant materials in next generation aircraft, positioning aerospace as the key driver of growth within the fluoroelastomer market.

Fluoroelastomer sales increased at a CAGR of 2.4% between 2020 and 2024. During the historical period, the fluoroelastomer business was significantly impacted due to the shutdown of the aviation and electronics sectors and constrained supply chains caused by the pandemic.

However, with the resumption of functioning of industries such as aerospace, electrical & electronics, oil & gas, energy, and others, fluoroelastomers demand is anticipated to expand at a CAGR of 4.9% over the forecast period.

Growing usage of fluoroelastomers in a variety of commercial processes, including gaskets, and O-ring seals in the petroleum, automobile, and food production sectors will boost the market during the assessment period.

Similarly, novel uses for perfluorocarbon elastomers are anticipated to open up a lot of market prospects over the next several years.

A significant factor positively influencing fluoroelastomer sales is the surging demand for fuel-efficient automobiles. Numerous automakers are altering their design strategies and emphasizing lightweight through material substitution to satisfy the growing demand for more fuel-efficient vehicles which will spur demand for materials such as fluorinated elastomers during the forecast period.

Increasing Automotive Production and Rising Demand for fuel-efficient Vehicles to Boost Market

Globally, the production of automobiles has increased dramatically during the past several years and the trend is expected to further escalate during the assessment period. Polymer composites will be more in demand due to their key characteristics, such as low weight, high strength, and elasticity.

To minimize fuel consumption, leading automakers are focusing on practical ways to shrink powertrains, engines, and engine compartments. These firms are also concentrating on different types of materials to fulfill the requirements of electric car parts.

Products from fluoroelastomers used in automotive components, such as seals, hoses, high-voltage cables, gaskets, and O-rings offer high flexibility and elasticity in higher temperatures compared to products made from other rubbers. Fluoroelastomer-based products maintain their significant properties when exposed to synthetic lubricants and harsh chemicals as well as to powertrain fluids and fuels.

Government requirements on automobile fuel economy are becoming more stringent, which is pressuring OEMs to create lightweight cars. This is increasing demand for composite materials such as fluoroelastomers. Hence, the rapid growth of the automobile industry worldwide coupled with growing demand for lightweight and fuel-efficient vehicles will play a key role in fostering fluoroelastomer sales over the projection period.

Complete Dependency on Petrochemical Feed Stocks to Constraint Market Development

Vital raw materials for the production of fluoroelastomers are petroleum-based feedstock products. Volatility in the prices of feedstock will result in price fluctuations in polymers, which, to a large extent, will directly impact the final price of the product. These raw materials, which are extensively used by end-use industries, are often generated from refinery processes and petrochemical feedstock. The production of fluoroelastomers requires a significant amount of both petrochemical and non-petrochemical feedstock.

In Europe, owing to fluctuations in crude oil & gas prices, a rise in raw material costs has been witnessed in the polymer sector in the last couple of years. This may act as a restraint for petrochemical feedstock, thereby hampering the growth of the fluoroelastomer market. Key manufacturers are facing price adjustments and restructuring to maintain profit margins and strengthen their market position.

To reduce emissions and effluents generated by the chemical industry, many governments have imposed closures and production regulations, thereby limiting the availability of pigment intermediates. This will affect the supply chain, leading to price escalations.

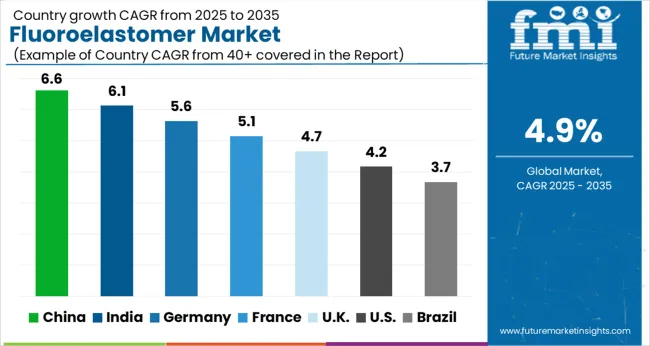

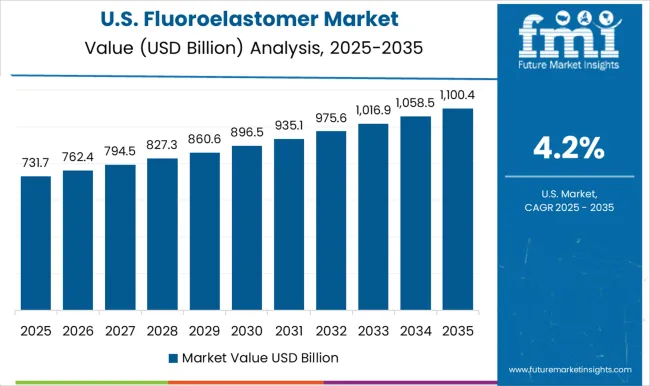

Robust Growth of Automotive and Aerospace Industries Propelling Fluoroelastomers Demand in the USA

According to Future Market Insights (FMI’s) latest analysis, the USA fluoroelastomer market is projected to expand at 4.4% CAGR during the forecast period (2025 to 2035). Currently, the USA holds around 21.5% of the total value share in the global market.

Increased investment in enhancing fluoroelastomer manufacturing capacity, implementation of stringent fuel emissions rules and regulations, and robust growth of automobile and aerospace sectors are key factors driving fluoroelastomer demand in the United States.

Over the years, rising carbon emission levels and enforcement of strict regulations have prompted the USA automotive manufacturers to shift their preference from heavy materials towards lighter ones possessing excellent heat and chemical resistance such as fluoroelastomers.

The addition of these materials has significantly reduced the overall weight of vehicles, thereby improving their fuel efficiency and reducing emission levels. Driven by this, fluoroelastomer sales across the country will continue to grow at a steady pace throughout the projection period.

Growing Popularity of Electric Vehicles Fostering Fluoroelastomer Sales in China

Currently, China accounts for a sizable value share of 20.4% of the global fluoroelastomer industry and it is expected to accelerate at around 5.8% CAGR over the next ten years. The rapid expansion of industries such as oil & gas, energy & power, pharmaceutical & food, etc. is a key factor driving demand for fluoroelastomers across China.

Similarly, due to considerable capital investments made in the coatings industry, sales of fluoroelastomers across China are expected to grow at a robust pace over the projection period.

Consequently, increasing production and sales of electric vehicles will create a conducive environment for the development of the fluoroelastomer industry in China during the projection period.

Fluorocarbon Elastomers Remain the Most Sought After Product Type in the Market

Based on product type, the market is segmented into fluorosilicone, fluorocarbon, and perfluoroelastomers. Among these, the fluorocarbon segment holds the dominating share of 73.7% of the global fluoroelastomers industry. This is attributed to the rising usage of fluorocarbons across several industries owing to their specific properties including enhanced stability, non-flammability, and hydrophobicity.

Fluorocarbon or fluorocarbon elastomer provides the highest cross-link production for a particular product. The thermal stability and mechanical properties of optimum compounds formed from fluorocarbon elastomers that are irradiated under perfect conditions are much better than those of chemical curing procedures.

Fluorocarbons are widely used in vehicle and airplane parts, which explains their domination in the market. They have become key components in the creation of seals because of their qualities, which include resistance to chemicals and heat, low compression set, and excellent aging characteristics.

Most of the Fluoroelastomer Demand Emerged from the Automotive Industry

Based on the end-use industry, the automotive segment currently dominates the global fluoroelastomers market with an impeccable market value share of 46.8%. This is attributed to the rising demand for lightweight and fuel-efficient vehicles and the growing adoption of fluoroelastomers across the thriving automotive industry worldwide.

Fluoroelastomers are frequently used in the automotive sector because of their remarkable heat resistance, sealing ability, and mechanical characteristics. Fluoroelastomer is integrated into vehicle parts including drive trains and fuel handling systems to increase fuel economy and cut pollution.

A rapid spike in growth in regions like the Asia Pacific is predicted to expand automotive manufacturing, which will elevate the demand for fluoroelastomers because they offer valuable properties.

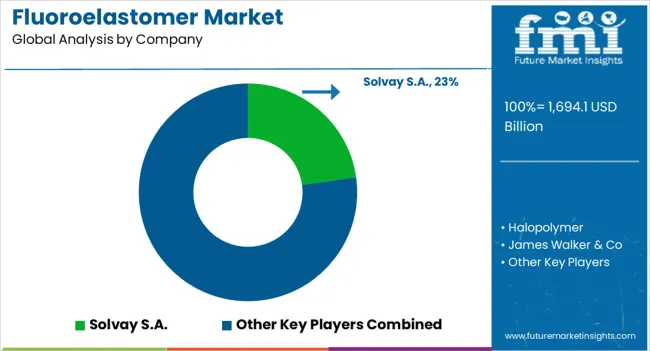

The fluoroelastomer market is shaped by established global chemical manufacturers competing through high-performance material innovations and strong downstream integration. Solvay S.A. leads with an extensive range of specialty fluoroelastomers used in automotive seals, aerospace components, and industrial equipment. The company focuses on sustainability and new formulations with lower environmental impact. The Chemours Company is a major supplier with its Viton brand, offering broad chemical and heat resistance for automotive and semiconductor applications.

Daikin Industries Ltd. and AGC Chemicals Inc. strengthen the market through advanced polymer technologies and diversified fluorochemical portfolios, emphasizing temperature endurance and long-term durability. Shin-Etsu Chemical Co. Ltd. delivers precision elastomer solutions used in electronics and industrial sealing applications. 3M Company supports demand through its Dyneon line, known for performance in harsh chemical environments.

Halopolymer OJSC and Zhejiang Fluorine Chemical New Materials Co. Ltd. supply competitive volumes from Russia and China, focusing on cost efficiency and expansion in emerging Asia-Pacific markets. James Walker & Co. specializes in engineered sealing products incorporating fluoroelastomers for oil, gas, and energy sectors.

| Attribute | Details |

|---|---|

| Current Market Size (2025) | USD 1694.1 billion |

| Projected Market Size (2035) | USD 2733.3 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.9% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD million for Value and Tons for Volume |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, ANZ, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Product Type, End-use Industry, and Region |

| Key Companies Profiled | The Chemours Company; Daikin Industries; Solvay S.A., Halopolymer OJSC, James Walker & Co., Shin-Etsu Chemical Co. Ltd., AGC Chemicals Inc., 3M Company, and Zhejiang Fluorine Chemical New Materials Co. Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunity, and Threat Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global fluoroelastomer market is estimated to be valued at USD 1,694.1 billion in 2025.

The market size for the fluoroelastomer market is projected to reach USD 2,733.3 billion by 2035.

The fluoroelastomer market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in fluoroelastomer market are fluorosilicone, fluorocarbon and perfluoroelastomers.

In terms of end-use industry, aerospace segment to command 39.5% share in the fluoroelastomer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

APAC Fluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA