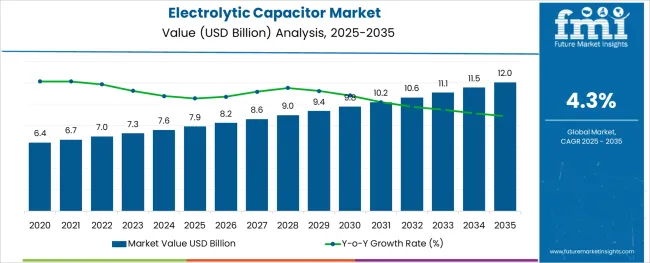

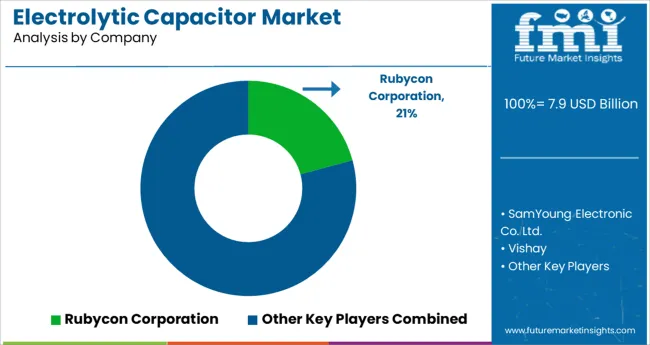

The Electrolytic Capacitor Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The electrolytic capacitor market is growing steadily, driven by increasing demand for compact and efficient electronic components across consumer electronics and industrial applications. Advancements in portable devices and smart electronics have heightened the need for capacitors that provide reliable performance in limited space.

Continuous innovation in capacitor technologies has improved durability and electrical characteristics, supporting the development of next-generation electronics. The consumer electronics sector has been a key driver due to rising penetration of smartphones, wearable devices, and home automation systems.

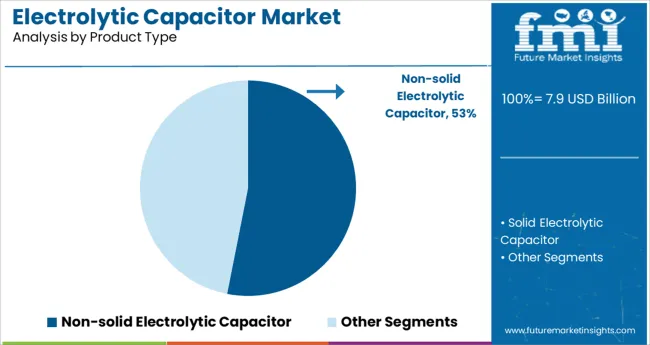

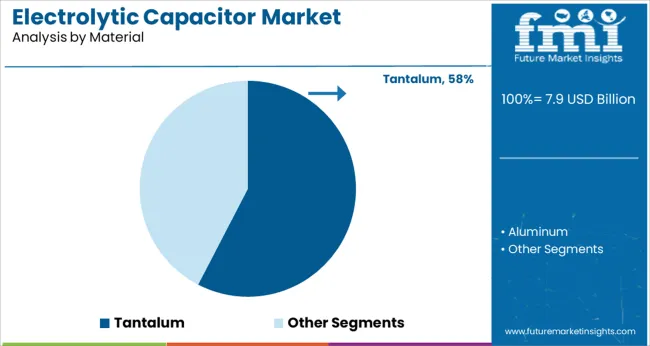

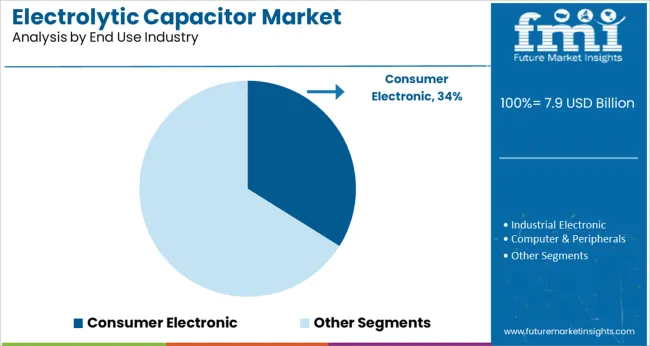

Additionally, increasing emphasis on energy efficiency and miniaturization in electronics has led to greater adoption of high-performance capacitors. The market outlook remains positive, with growth expected to be led by non-solid electrolytic capacitors, tantalum as the preferred material, and consumer electronics as the dominant end-use industry.

The market is segmented by Product Type, Material, and End Use Industry and region. By Product Type, the market is divided into Non-solid Electrolytic Capacitor and Solid Electrolytic Capacitor. In terms of Material, the market is classified into Tantalum and Aluminum.

Based on End Use Industry, the market is segmented into Consumer Electronic, Industrial Electronic, Computer & Peripherals, Telecommunication Industry, and Automotive. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Material, and End Use Industry and region. By Product Type, the market is divided into Non-solid Electrolytic Capacitor and Solid Electrolytic Capacitor. In terms of Material, the market is classified into Tantalum and Aluminum.

Based on End Use Industry, the market is segmented into Consumer Electronic, Industrial Electronic, Computer & Peripherals, Telecommunication Industry, and Automotive. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The non-solid electrolytic capacitor segment is expected to hold 53.1% of the market revenue in 2025, retaining its leading position among product types. This segment's growth is driven by its superior capacitance and voltage characteristics, making it suitable for applications requiring high reliability and stability.

These capacitors are commonly used in circuits where performance under stress and thermal stability are critical. The preference for non-solid capacitors is influenced by their proven track record in long-life applications and ability to handle high ripple currents.

As electronic devices become more complex and power-demanding, the reliance on non-solid electrolytic capacitors is expected to continue growing.

The tantalum segment is projected to contribute 57.6% of the electrolytic capacitor market revenue in 2025, maintaining its dominance as the preferred material. Tantalum capacitors are favored due to their high volumetric efficiency, excellent capacitance per volume, and stable electrical performance over a wide temperature range.

Their small size and reliability have made them ideal for compact consumer electronics and precision industrial equipment. Additionally, the material's resistance to corrosion and electrical leakage has supported its widespread use in demanding applications.

The continued development of tantalum capacitor manufacturing processes has further enhanced product quality and supply stability, reinforcing this segment’s strong market position.

The consumer electronics segment is projected to represent 33.9% of the electrolytic capacitor market revenue in 2025, leading the end-use industries. Growth in this segment has been fueled by rapid innovation and product launches in smartphones, tablets, wearable devices, and smart home systems.

The demand for compact, energy-efficient components has increased the integration of electrolytic capacitors to ensure device reliability and performance. Consumer preferences for enhanced device capabilities and longer battery life have supported the adoption of advanced capacitor technologies.

Furthermore, the expanding global middle class and increasing digital connectivity have driven sales in emerging markets. The consumer electronics segment is expected to remain a primary growth engine for electrolytic capacitors.

The electrolytic capacitor market is largely driven by the surging demand for quality capacitors, in medical electronic, telecommunication, and automotive industries. Also, deepening trend of miniaturization in the electronic devices sector and shifting end user inclination from ceramic and plastic film capacitors is estimated to bolster the demand for electrolytic capacitors in the coming years.

Demand for power is surging at a rapid pace, driven by rapid industrialization, urbanization, and growing trend of electrification, especially across emerging economies such as India, China, Australia, and others. Hence, governments worldwide are aiming at refurbishment of existing power infrastructure and development of smart grids to reduce the decrease electricity loss.

For instance, according to a report by the India Smart Grid Forum, the Government of India has announced its plan of allotting USD 129.9 Mn for developing smart grids across smart cities across India under the National Smart Grid Mission (NSGM).

As electrolytic capacitors are extensively used in smart grid circuits for declining transmission loss and improving grid stability, such developments are estimated to accelerate the sales in the global market.

Despite several advantages associated with the use of electrolytic capacitors, drawbacks such as short life, equivalent series resistance, less value tolerance, and large leakage currents among others are the factors hampering the adoption of these capacitors across various industries. This is hindering the sales of electrolytic capacitors in the market.

In addition to this, increasing shift in customer preference for using multilayered ceramic capacitors (MLCCs) in novel smartphones, entertainment systems, and other computing solution devices is further restraining the demand for electrolytic capacitors.

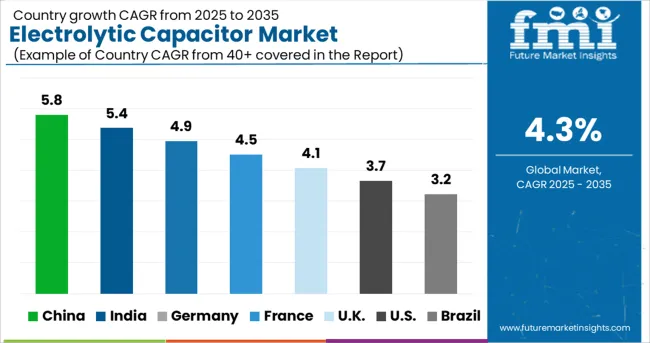

As per Future Market Insights, Asia Pacific excluding Japan is forecast to account for the lion’s share in the global electrolytic capacitor market between 2025 and 2035.

A swift rise in demand for electronic devices, such as personal computers, is being witnessed across Asia Pacific, favored by growing telecommunication sector resulting in fueling demand for components of inverter main circuits and switching mode power supplies.

Thus, key manufacturers in the market are emphasizing on launching novel products to cater to this accelerating demand. For instance, Jianghai, one of the largest Chinese manufacturers of capacitors recently announced introducing new series of capacitors including 3 new electrolytic span-in capacitors – CD_895_ZK, CD_892_ZL, and CD_891_ZJ which can be used in the primary side of switching mode power supplies.

Such new product launches are anticipated to spur the sales of electrolytic capacitors in the Asia Pacific excluding Japan.

As per FMI, Europe is projected to register steady growth in the global electrolytic capacitor market during the forecast period 2025-2035.

Surging trend of electrification across the automotive sector and growing fuel prices have resulted in accelerating the sales of electric vehicles across the countries such as Germany, the U.K., France, and others.

According to a study by the International Energy Agency, nearly 7.6 million electric vehicles were reported to be sold across Europe, out of which Germany and France account for about 395,000 and 185,000 unit sales, respectively in 2024.

As electrolytic capacitor plays a critical role in stabilizing the voltage in electronic circuits used in electric vehicles, due to its large capacitance, increasing sales of these automobiles are expected to facilitate the growth in the Europe market.

Some of the leading players in the global electrolytic capacitor market Rubycon Corporation, SamYoung Electronic Co. Ltd., Vishay, Panasonic Corporation, Lelon Electronics Corp., CapXon, Aihua, Jianghai Capacitor Co., Ltd, Nippon Chemi-Con Corporation, KEMET, and Nichicon Corp.

Leading players in the market are aiming at launching novel products and capacity expansion to gain edge in the highly competitive market

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 2% to 3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Material, End Use Industry, Region |

| Regions Covered | North America; Latin America; Europe; CIS & Russia; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Rubycon Corporation; SamYoung Electronic Co. Ltd.; Vishay; Panasonic Corporation; Lelon Electronics Corp.; CapXon; Aihua; Jianghai Capacitor Co., Ltd; Nippon Chemi-Con Corporation; KEMET; Nichicon Corp. |

| Customization | Available Upon Request |

The global electrolytic capacitor market is estimated to be valued at USD 7.9 billion in 2025.

It is projected to reach USD 12.0 billion by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are non-solid electrolytic capacitor and solid electrolytic capacitor.

tantalum segment is expected to dominate with a 57.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plug-In Aluminum Electrolytic Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Bushing Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Film Slitter Market Size and Share Forecast Outlook 2025 to 2035

Electrolytic Etching Machine Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Kits Market

Ultracapacitors Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Supercapacitors Market Report - Trends & Industry Outlook through 2034

Power Capacitors Market Report – Trends, Growth & Industry Outlook through 2034

Silicon Capacitor Market Insights - Demand & Growth Forecast 2025 to 2035

Tunable Capacitors Market

Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Discrete Capacitors Market Insights - Growth & Forecast 2025 to 2035

High Voltage Capacitors Market Size and Share Forecast Outlook 2025 to 2035

Single Layer Capacitors Market

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ultracapacitor Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterial Supercapacitors Market Size and Share Forecast Outlook 2025 to 2035

Polarized Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Ceramic Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA