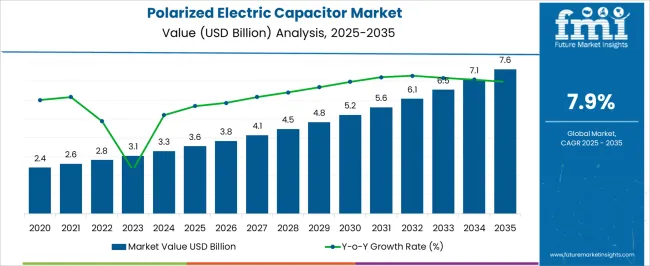

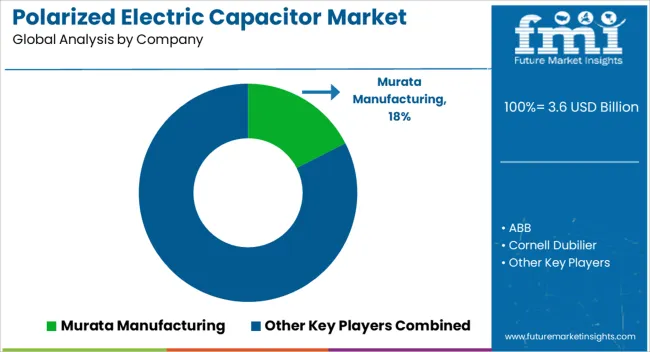

The polarized electric capacitor market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The year by year path of 3.6, 3.8, 4.1, 4.5, 4.8, and 5.2 billion through 2030 indicates disciplined compounding rather than spikes. An absolute dollar opportunity of about USD 4.0 billion is implied over the decade, with the 2025 to 2030 block adding roughly USD 1.6 billion. Momentum is expected to be anchored by DC link and smoothing roles in EV inverters, industrial motor drives, and grid tied power conversion. Tighter ESR targets, higher ripple current handling, and better heat tolerance are being prioritized by automotive and industrial OEMs, while long life ratings and AEC Q200 grade parts are being specified to stabilize field performance. Pricing power is expected to remain with qualified suppliers that control foil, electrolyte, and polymer formulations at scale. A second lift from 2030 to 2035 completes the trajectory from USD 5.2 to 7.6 billion, contributing about USD 2.4 billion or near 60 percent of the decade’s total addition.

Share gain is expected for polymer hybrids and solid polymer types in segments where low ESR, surge resilience, and compact footprints unlock higher power density, though wet aluminum formats will remain entrenched for cost sensitive filters and bulk energy storage. Tantalum and aluminum choices will be guided by lifecycle cost, safety margin, and supply reliability, with multi year agreements for high CV foil and manganese dioxide or polymer cathode materials used to hedge volatility. Demand is seen broad based across automotive electrics, renewables power electronics, telecom rectifiers, aerospace power conditioning, and medical equipment. Vendors that pair qualification depth with service programs, lifecycle documentation, and fast replacement cycles are likely to set the pace as procurement teams favor predictable delivery and standardized part platforms.

| Metric | Value |

|---|---|

| Polarized Electric Capacitor Market Estimated Value in (2025 E) | USD 3.6 billion |

| Polarized Electric Capacitor Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

Within the global capacitors market, polarized electric capacitors account for about 38% of total capacitor value. Inside the electrolytic capacitors market, the polarized category represents essentially 100%, since electrolytics are inherently polarized. Considered against the broader passive electronic components market, polarized capacitors hold roughly 14%, reflecting their portion within passives alongside non polarized capacitors, resistors, and inductors. In the power electronics components market, polarized capacitors contribute near 5%, a smaller share when measured against the full set of power conversion parts. Within the consumer electronics components market, the share is about 3%, indicating a focused but limited footprint relative to the full component mix used in devices.

The relative order of shares therefore concentrates in capacitor centric scopes at 100% and 38%, moderates within passives at 14%, and tapers in wide component domains at 5% and 3%. The step down from 38% to 14% shows the dilution that occurs when the frame expands from capacitors to all passives. The further reduction to 5% and 3% quantifies the effect of widening the lens to power electronics and then to overall consumer components. Across these parent markets, the percentages consistently position polarized capacitors as dominant within electrolytics, major within capacitors, meaningful within passives, and selective within broad electronics segments.

The polarized electric capacitor market is witnessing sustained growth driven by miniaturization trends, rising power density requirements, and the expanding use of high-frequency electronic circuits. As industries transition to more energy-efficient and compact electronic devices, polarized capacitors especially those offering higher capacitance and better volumetric efficiency are being widely adopted.

This trend is further supported by the proliferation of consumer electronics, electric vehicles, and telecommunication equipment where stable and reliable capacitance is critical. Technological innovations in material science and automated manufacturing processes have enabled cost-effective scaling of capacitor production with enhanced performance characteristics.

Additionally, the integration of polarized capacitors in advanced packaging solutions for IoT devices, wearables, and mobile electronics is accelerating the overall market demand.

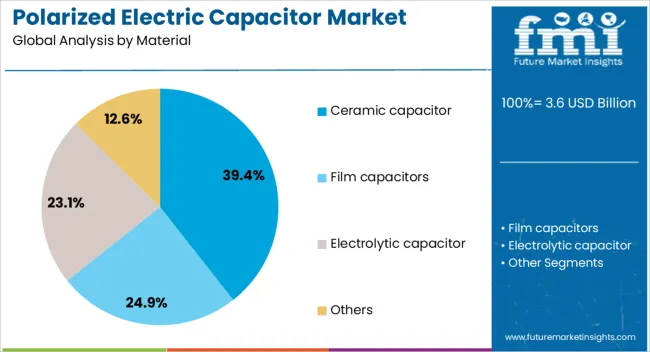

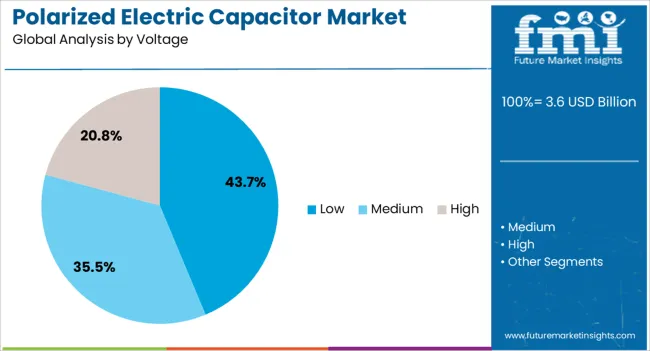

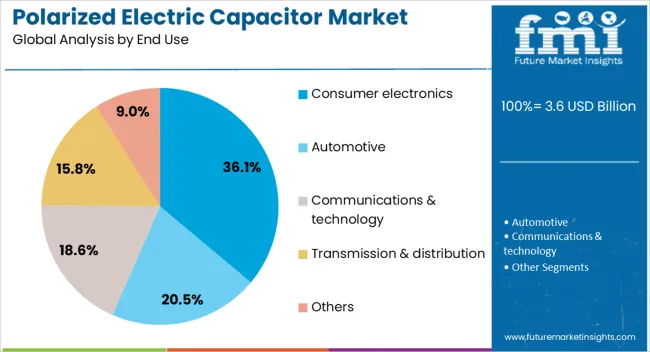

The polarized electric capacitor market is segmented by material, voltage, end use, and geographic regions. By material, polarized electric capacitor market is divided into ceramic capacitor, film capacitors, electrolytic capacitor, and others. In terms of voltage, polarized electric capacitor market is classified into low, medium, and high. Based on end use, polarized electric capacitor market is segmented into consumer electronics, automotive, communications & technology, transmission & distribution, and others. Regionally, the polarized electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ceramic capacitors are projected to lead the material segment with a 39.40% market share in 2025. Their dominance stems from their high-temperature stability, low losses at high frequencies, and superior insulation resistance, making them ideal for compact and high-speed circuits. The increasing use of multilayer ceramic capacitors (MLCCs) in smartphones, tablets, automotive electronics, and 5G infrastructure has substantially driven volume demand. Moreover, ceramic variants are favored for surface-mount technology (SMT) applications, aligning with ongoing miniaturization in electronics. Continuous advancements in dielectric materials and layer stacking techniques are enhancing the capacitance range of ceramic capacitors without compromising size, reinforcing their position across both high- and low-voltage segments.

Low voltage capacitors are estimated to hold a 43.70% share of the overall polarized electric capacitor market by 2025, making them the largest voltage-based segment. This trend is driven by the widespread integration of low-voltage electronic systems in consumer devices, automotive infotainment, industrial automation controllers, and wearable tech. These applications require high reliability and consistent performance at reduced operating voltages, characteristics well-matched by low voltage capacitors. In addition, the cost-effectiveness and design flexibility of capacitors in this range make them attractive for OEMs seeking compact solutions with dependable capacitance. The rise in smart homes, connected appliances, and digital healthcare products is expected to reinforce this segment’s leadership.

Consumer electronics is projected to account for 36.10% of the polarized electric capacitor market in 2025, establishing it as the top end-use segment. This leadership is fueled by the rapid global penetration of devices such as smartphones, laptops, gaming consoles, and smart TVs, all of which demand precise power regulation and energy storage components. Polarized capacitors are particularly suitable for managing power input/output fluctuations in compact circuits, and their role becomes even more crucial as feature-rich devices grow more power-intensive. Increased consumer demand for sleek, high-performance gadgets and the continual push toward innovation in wearables and connected devices are expected to further accelerate capacitor deployment in this sector.

The polarized electric capacitor market is advancing as power electronics, automotive platforms, telecom power, and industrial drives depend on high-capacitance, low-ESR energy storage. Opportunities are strongest in AEC-Q200 automotive programs, ORAN power shelves, PV inverters, and storage cabinets, with polymer and hybrid electrolytics reshaping design choices. Trends emphasize higher temperature ratings, surface-mount cans, rigorous qualification, and digital lifetime modeling. Challenges include material price swings, lifetime constraints, compliance costs, and competition from ceramics and film. In my opinion, leaders will pair secure sourcing with application engineering to deliver reliable, compact, and endurance-proven polarized solutions.

Demand for polarized electric capacitors has been reinforced by rapid uptake across power electronics where high capacitance density, low ESR, and strong ripple-current capability are required. DC link, snubber, and bulk storage positions in traction inverters, onboard chargers, and battery management units have relied on aluminum electrolytic, tantalum, and polymer hybrid parts. Telecom base stations, data center power shelves, industrial drives, LED drivers, and consumer power adaptors have continued to specify polarized devices for decoupling and smoothing. Medical imaging and instrumentation have also favored long-life grades. In my opinion, demand will intensify as designers prioritize compact energy storage, predictable impedance over temperature, and stable lifetime in harsh operating profiles from 5G radios to high-voltage e-mobility platforms.

Opportunities have emerged most clearly in automotive AEC-Q200 programs, where conductive polymer aluminum and tantalum grades unlock low ESR under 125–150°C profiles. Fleet electrification has required higher ripple endurance for 400 V and 800 V architectures, opening room for hybrid polymer electrolytics in DC link and auxiliary rails. Telecom and ORAN deployments have required robust bulk capacitance in rectifiers and high-efficiency power shelves, while PV inverters and stationary storage cabinets have specified long-life can types with high surge tolerance. Replacement of multi-layer ceramics in bulk roles, during tight ceramic supply, has created substitution gains. I believe vendors pairing application engineering with PPAP support, field modeling, and rapid sample cycles will secure multi-year awards across vehicle platforms and network power refresh projects.

Trends have pointed toward conductive polymer and hybrid constructions that deliver very low ESR, high ripple handling, and stable impedance across frequency. Surface-mountable can packages, stacked-chip tantalum, and compact radial formats have improved power density while simplifying automated assembly. Higher temperature ratings, moisture-robust designs, and varnish or resin encapsulation have been prioritized for under-hood zones and outdoor telecom gear. Qualification to AEC-Q200, IEC, and customer-specific test regimes has become a baseline, while digital lifetime modeling and derating tools are being supplied by leading vendors to shorten design cycles. In my opinion, the mix will shift toward polymer-rich portfolios that replace legacy wet electrolytics in space-constrained converters, without sacrificing endurance, surge robustness, or field reliability metrics demanded by automotive and industrial buyers.

Challenges have centered on raw material volatility for etched aluminum foil, conductive polymers, and tantalum powder, which pressures pricing and quote validity. Lifetime limits from electrolyte dry-out, seal integrity, and venting risks demand careful thermal design and conservative derating, particularly near heat sources. Variation across regional compliance frameworks such as RoHS and REACH, along with customer-specific endurance tests, raises qualification costs. Counterfeit risk in extended supply chains complicates traceability. Competition from film capacitors in high-reliability DC link roles and from ceramics in small-signal decoupling persists. In my assessment, success will favor producers with secure upstream sourcing, strong failure-analysis capability, and robust application support that optimizes ripple, temperature, and voltage stress in real operating duty cycles.

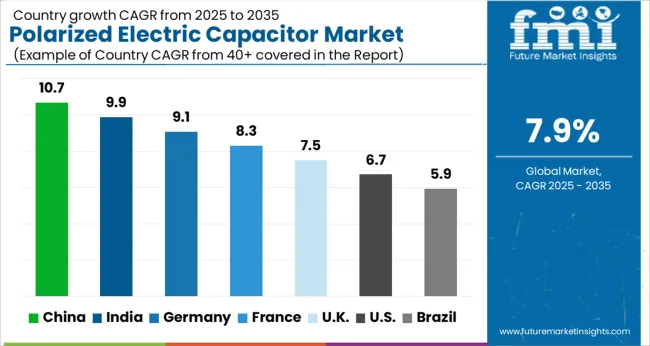

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

The global polarized electric capacitor market is projected to grow at a CAGR of 7.9% from 2025 to 2035. China leads with a growth rate of 10.7%, followed by India at 9.9%, and Germany at 9.1%. The United Kingdom records a growth rate of 7.5%, while the United States shows the slowest growth at 6.7%. Expansion is fueled by EV electrification, renewable and storage inverters, AI/data-center power supplies, and 5G/industrial IoT electronics. Technology shifts toward solid-polymer and hybrid aluminum designs, AEC-Q200-qualified automotive grades, and higher-temperature, low-ESR parts are accelerating adoption. Supply-chain localization and reliability mandates in aerospace, medical, and defense also support demand, even as materials constraints (tantalum, high-purity foil) prompt design optimization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The polarized electric capacitor market in China is projected to grow at a CAGR of 10.7%. Growth is propelled by the country’s scale in EVs, battery manufacturing, telecom infrastructure, and an expanding AI/data-center footprint that requires high-reliability bulk energy storage and DC-link capacitors. OEMs and EMS providers are shifting designs toward solid-polymer and hybrid aluminum electrolytics to achieve lower ESR, higher ripple capability, and 105–125°C operation. Domestic producers are investing in foil etching, electrolyte chemistries, and polymer lines to reduce import reliance, while automotive programs ramp AEC-Q200-qualified parts for inverters, OBCs, and 48V systems. Policy support for localized passives, plus export opportunities in appliances and industrial drives, strengthens outlook. Design wins are increasingly tied to SiC/GaN power stages, where low impedance and long life are critical in compact layouts.

The polarized electric capacitor market in India is expected to grow at a CAGR of 9.9%. Make-in-India incentives and PLI programs are catalyzing local electronics assembly across smartphones, appliances, meters, and industrial controls, each relying on polarized capacitors for smoothing and storage. EV adoption, led by two-/three-wheelers and rising bus fleets, expands demand for AEC-Q200-compliant capacitors in DC-DC converters, motor drives, and chargers. Solar and wind EPC growth, plus utility-scale storage, require long-life, high-ripple DC-link banks. Local manufacturers are upgrading to polymer and long-life aluminum lines and partnering with global suppliers for tantalum and high-purity foil. Design teams are standardizing on higher-temperature, higher-capacitance-density parts to shrink boards while meeting derating and reliability targets, particularly for harsh-climate deployments. As EMS exports scale, consistent qualification, PPAP documentation, and lot-to-lot stability become decisive differentiators.

The polarized electric capacitor market in Germany is projected to grow at a CAGR of 9.1%. Automotive Tier-1s and machinery OEMs require capacitors with exceptional lifetime, low ESR, and vibration resistance for e-powertrains, robotics, and factory drives. DC-link arrays in traction inverters and on-board chargers increasingly favor polymer and hybrid aluminum to support SiC switching, minimize thermal rise, and meet compact packaging constraints. Renewable and storage projects, plus power-quality equipment, add steady demand for long-life, high-ripple cans. Procurement emphasizes AEC-Q200, PPAP, and comprehensive reliability data (impedance drift, ripple endurance, humidity bias). EU sustainability rules are steering designs to RoHS-compliant, halogen-free, and lower-leakage solutions, while regional supply-chain resilience encourages dual-sourcing within Europe. German R&D collaborates with materials suppliers to push higher-temperature electrolytes and improved foil surface area, extending lifetime without sacrificing volumetric efficiency.

The polarized electric capacitor market in the UK is projected to grow at a CAGR of 7.5%. Demand centers on aerospace, defense, medical devices, and advanced energy projects, where reliability, traceability, and obsolescence management are paramount. Engineering teams specify polarized capacitors with elevated temperature ratings, surge robustness, and strict screening for safety-critical power modules, RF subsystems, and imaging equipment. EV supply-chain investments and grid-scale storage pilots are widening use of long-life aluminum and polymer capacitors in chargers, converters, and UPS systems. While the manufacturing base is leaner than continental Europe, design and test competencies are strong, favoring suppliers with deep FAE support, lot-level data, and custom can/form-factor options. Compliance with aerospace standards and NHS procurement expectations further elevates requirements for consistent performance across life and environment.

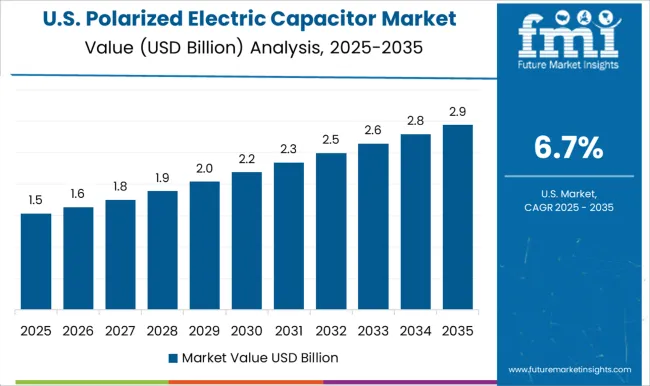

The polarized electric capacitor market in the United States is projected to grow at a CAGR of 6.7%. Growth is anchored by AI/data-center PSUs, enterprise networking, and industrial automation, where bulk storage and low-impedance decoupling stabilize high-current rails. Automotive momentum continues, but qualification cycles and long design lives temper growth versus Asia. Defense, aerospace, and medical sectors impose stringent reliability, surge, and radiation-tolerance requirements, sustaining demand for premium tantalum, hermetic, and polymer lines. Near-shoring and resilience initiatives favor suppliers with domestic or NAFTA production and robust change-control practices. Designers migrating to SiC/GaN topologies are adopting polymer and hybrid aluminum to manage ripple/ESR at higher switching frequencies, while meeting 105–125°C and long-life targets. Sustainability and end-of-life documentation are increasingly part of procurement scorecards, influencing vendor selection.

Competition in polarized electric capacitors is driven by materials science, reliability, and OEM proximity. Murata, TDK, Panasonic, Samsung Electro Mechanics, Taiyo Yuden, Vishay, KEMET, and Kyocera AVX supply aluminum electrolytic, conductive polymer, and tantalum lines that anchor automotive, industrial, and telecom designs. Cornell Dubilier and ELNA focus on high ripple and long life parts for drives, medical, and avionics. Xuansn Capacitor competes on cost and lead time in standard aluminum electrolytics. WIMA supports adjacent DC link and snubber stages around polarized sections with film elements that stabilize thermal and frequency response. ABB, Siemens, Schneider Electric, and Havells integrate polarized capacitors within power conversion, UPS, and motor control platforms, using partnerships with component makers to secure endurance at elevated temperatures and vibration.

Vendor selection is influenced by AEC Q200 qualification, ESR stability over life, surge capability, and consistent leakage across lots. Strategies emphasize polymer hybrids for lower ESR, compact footprints, and high ripple endurance near SiC and GaN switches. Automotive and rail bids are pursued with long life claims validated through 105 to 135 degree endurance testing and HALT data. Co design with inverter and charger teams is prioritized to tune capacitance, impedance, and thermal paths. Brochures highlight capacitance windows from microfarads to thousands of microfarads, voltage classes from 6.3 to 500 V DC, ripple current curves at multiple frequencies, and life calculators tied to hotspot temperature. Safety features such as pressure relief, anti vibration terminations, and flame retardant sleeves are stressed. Graphs compare impedance versus frequency and ESR drift over hours. Application notes show DC link layouts, EMI damping with series resistors, and parallel banks for fault tolerance. Clear calls to action point to PPAP support, RoHS and REACH compliance, and rapid sampling kits, presenting capacitors as verified, low risk building blocks for EV traction inverters, industrial drives, telecom power, and fast chargers.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 billion |

| Material | Ceramic capacitor, Film capacitors, Electrolytic capacitor, and Others |

| Voltage | Low, Medium, and High |

| End Use | Consumer electronics, Automotive, Communications & technology, Transmission & distribution, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing, ABB, Cornell Dubilier, ELNA, Havells, KEMET Corporation, KYOCERA AVX, Panasonic Corporation, SAMSUNG ELECTRO-MECHANICS, Schneider Electric, Siemens, TAIYO YUDEN, TDK Corporation, Vishay Intertechnology, WIMA GmbH, and Xuansn Capacitor |

| Additional Attributes | Dollar sales by product type (aluminum electrolytic, tantalum, conductive polymer), Dollar sales by form factor (SMD vs through hole), Trends in low ESR and high temperature ratings, Use in power supplies, DC link, infotainment, Growth from EV electronics and 5G networks, Regional concentration across Asia Pacific, Europe, and North America. |

The global polarized electric capacitor market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the polarized electric capacitor market is projected to reach USD 7.6 billion by 2035.

The polarized electric capacitor market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in polarized electric capacitor market are ceramic capacitor, film capacitors, electrolytic capacitor and others.

In terms of voltage, low segment to command 43.7% share in the polarized electric capacitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Polarized Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA