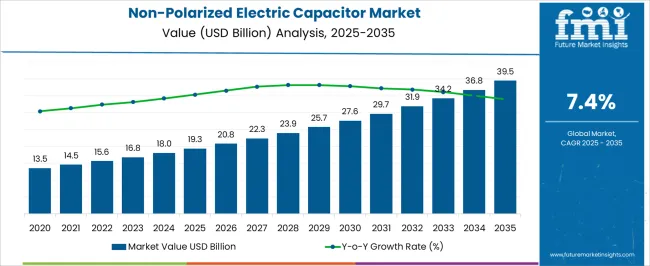

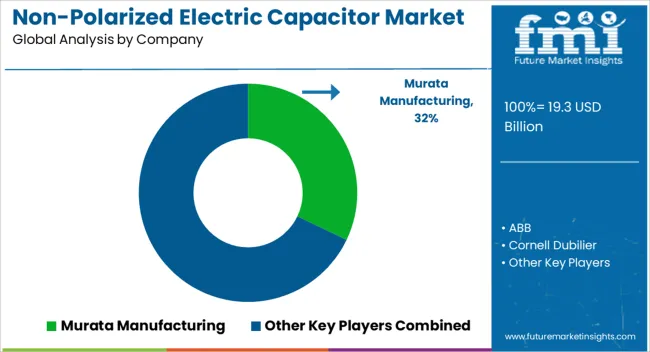

The non-polarized electric capacitor market, valued at USD 19.3 billion in 2025 and projected to reach USD 39.5 billion by 2035 at a CAGR of 7.4%, reflects steady growth across multiple capacitor technologies. Contribution by technology is expected to be diversified, with ceramic, film, and mica capacitors acting as the primary drivers, while emerging composite materials and hybrid solutions gradually enhance market share.

Ceramic capacitors are anticipated to maintain the largest contribution due to their cost efficiency, compact size, and widespread use in consumer electronics, automotive electronics, and communication systems. Film capacitors, with superior stability and long lifecycle, are projected to contribute strongly in power electronics, renewable energy integration, and industrial automation, reinforcing mid-term growth. Mica capacitors, while holding a smaller share, are expected to serve niche applications demanding precision and reliability, such as defense and aerospace. Hybrid and advanced polymer-based non-polarized capacitors are set to contribute significantly toward the latter half of the forecast, supported by rising demand for high-frequency performance and miniaturization.

The overall contribution analysis indicates a layered market where ceramic and film dominate current value, while emerging material technologies gradually uplift performance and scalability. This diversified technological base underpins the consistent expansion of the non-polarized capacitor sector.

| Metric | Value |

|---|---|

| Non-Polarized Electric Capacitor Market Estimated Value in (2025 E) | USD 19.3 billion |

| Non-Polarized Electric Capacitor Market Forecast Value in (2035 F) | USD 39.5 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The non-polarized electric capacitor market represents an important niche within the broader electrical component and passive electronic devices industry, valued for its role in AC applications, signal processing, and noise suppression. Within the global capacitor market, it holds about 4.7%, supported by demand from power electronics and consumer appliances. In the industrial electrical equipment sector, it secures 3.9%, driven by usage in lighting systems, motor run circuits, and audio equipment. Across the renewable energy and grid infrastructure segment, it accounts for 3.2%, reflecting deployment in power factor correction and energy storage enhancement. Within the automotive electronics market, the share is about 2.8%, where these capacitors are adopted in electric vehicle circuits and infotainment systems.

Its position in consumer electronics stands at 2.6%, highlighting usage in televisions, radios, and sound systems. Recent developments in this market have emphasized miniaturization, material innovation, and enhanced thermal stability. Manufacturers are introducing advanced dielectric materials, including polypropylene film and ceramic blends, to improve performance at high frequencies. The demand for compact designs with higher capacitance values has led to new production technologies. Integration with smart electronic devices and electric mobility solutions is expanding the application scope. Investments are being made in low-loss capacitors with extended lifecycles to reduce replacement frequency in industrial setups. The adoption of automated testing and digital monitoring systems is enabling better quality assurance. These advancements highlight how efficiency, durability, and multifunctionality are driving the growth of the market.

The market is experiencing steady expansion supported by the growing demand for efficient, durable, and cost-effective capacitive components across multiple industries. The current market environment reflects strong adoption in consumer electronics, industrial equipment, and automotive systems, where stable capacitance and long operational lifespans are critical.

Technological improvements in manufacturing processes, combined with the development of advanced dielectric materials, are enhancing performance and reducing production costs. The shift toward miniaturization of electronic devices has created opportunities for compact yet high-capacity non-polarized capacitors.

Additionally, the market is benefiting from increasing replacement demand in existing electronic infrastructure, alongside the rising integration of capacitors in renewable energy systems and power management applications. As advancements in circuit design and energy-efficient technologies continue, the market is positioned for sustained growth with opportunities emerging from new product designs optimized for evolving application needs.

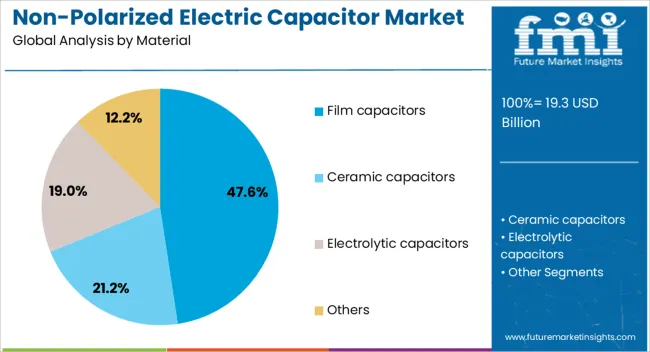

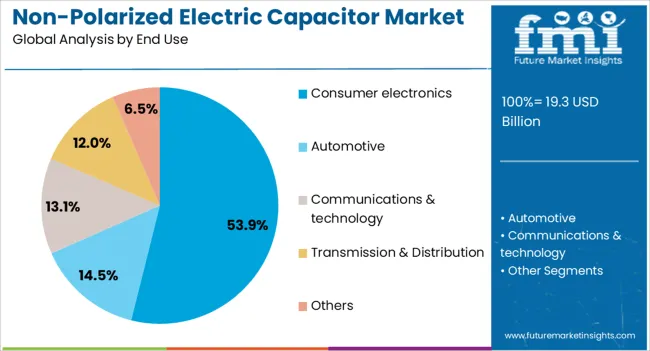

The non-polarized electric capacitor market is segmented by material, end use, and geographic regions. By material, non-polarized electric capacitor market is divided into film capacitors, ceramic capacitors, electrolytic capacitors, and others. In terms of end use, non-polarized electric capacitor market is classified into consumer electronics, automotive, communications & technology, transmission & distribution, and others. Regionally, the non-polarized electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The film capacitors segment is projected to hold 47.6% of the market revenue in 2025, making it the largest material category. This dominance is being attributed to the superior electrical characteristics of film capacitors, including low dielectric loss, high insulation resistance, and excellent stability over time.

Their robust performance in a wide range of temperatures and frequencies has encouraged adoption in both high-frequency and precision applications. The ability to offer consistent performance over extended lifespans without significant degradation has made them particularly suitable for applications demanding reliability.

The segment’s growth is further supported by advancements in metallized film technology, which enable compact designs while maintaining high performance. Ease of manufacturing and adaptability to various voltage ratings have also contributed to the widespread acceptance of film capacitors in both industrial and consumer applications, reinforcing their market leadership.

The consumer electronics segment is anticipated to account for 53.9% of the non-polarized electric capacitor market revenue in 2025, positioning it as the leading end-use sector. This leadership is being driven by the increasing incorporation of capacitors into smartphones, laptops, televisions, and other personal devices where stable performance and compact design are essential.

The rise in demand for high-speed, energy-efficient consumer devices has supported the integration of capacitors with advanced electrical characteristics to ensure reliable power delivery and noise suppression. Manufacturers are leveraging software-driven circuit optimization and component miniaturization to enhance device functionality, further increasing the need for high-quality non-polarized capacitors.

The segment has also benefited from the continuous product replacement cycles and consumer preference for technologically advanced devices. As the global demand for connected devices and smart home electronics continues to grow, the consumer electronics segment is expected to maintain its dominant position, supported by innovation and strong volume demand.

The market has evolved as demand for passive electronic components has grown across industries including automotive, consumer electronics, industrial equipment, and energy systems. Unlike polarized capacitors, these devices are suitable for alternating current applications, offering design flexibility in audio circuits, power conditioning, and motor run systems. Market expansion has been shaped by rising electronics manufacturing, increasing electrification in transportation, and renewable energy integration. Growing miniaturization trends and higher performance requirements in circuit design have further supported adoption.

The automotive sector has been a strong driver for the adoption of non-polarized capacitors. Their ability to operate under alternating current conditions makes them suitable for applications such as electric motor systems, lighting, and infotainment. With the rise of electric vehicles and hybrid technologies, capacitor use has expanded for energy storage, signal processing, and auxiliary systems. The shift toward advanced driver assistance and electrified powertrains has increased the complexity of vehicle electronics, further boosting demand. Automotive suppliers have increasingly integrated non-polarized capacitors to ensure reliability, long operational lifespans, and improved thermal performance under demanding conditions. This role in next-generation mobility has reinforced their importance within the broader electronic component landscape.

Consumer electronics and audio equipment have remained prominent application areas for non-polarized capacitors. They are widely used in loudspeaker crossovers, signal coupling, and filtering applications where alternating current compatibility is essential. The trend toward high fidelity sound systems, smart devices, and connected electronics has increased component requirements, strengthening demand in this segment. Manufacturers are focused on designing capacitors with low loss, high stability, and compact size to meet evolving product needs. The smart appliances and portable devices have expanded their usage, with integration in circuits designed for compactness and durability. The growing consumer appetite for advanced electronics ensures that non polarized capacitors remain indispensable in next generation product designs.

The industrial and energy sectors have adopted non polarized capacitors for power conditioning, motor run functions, and harmonic filtering. In industrial automation, capacitors support the performance of motors, pumps, and compressors. In renewable energy, they play a role in wind turbines and solar inverters, where durability and long service life are required for continuous operation. Energy storage and power distribution systems increasingly rely on non-polarized capacitors for efficiency improvements and voltage stability. As global infrastructure investment continues, demand for robust passive components in high power environments is expected to remain resilient. Their importance in ensuring system reliability across critical industrial processes reinforces market adoption.

Dielectric material advancements have improved the performance and reliability of non-polarized capacitors. Film capacitors, particularly those based on polypropylene and polyester, have gained preference for their thermal stability, low dielectric loss, and cost efficiency. The raw material price volatility and supply chain challenges create uncertainty for manufacturers. Competition from polarized capacitors, multilayer ceramic capacitors, and supercapacitors also pressures adoption in certain applications. The size limitations and cost sensitivity in consumer devices may restrict usage in compact designs. Manufacturers are addressing these barriers by developing miniaturized, cost effective, and high efficiency designs that meet evolving customer needs while ensuring compliance with stringent performance standards.

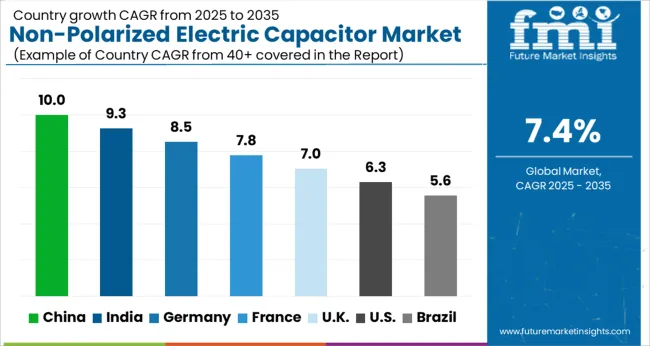

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

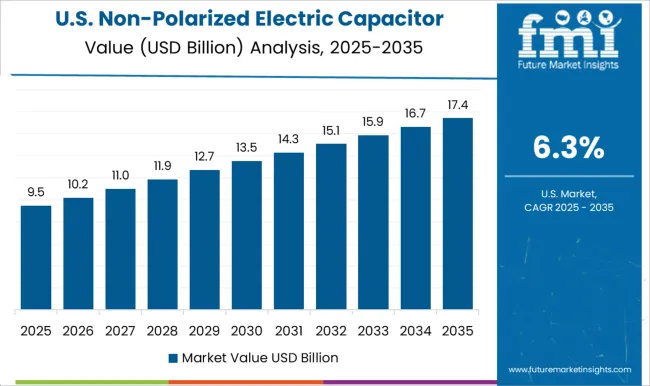

| USA | 6.3% |

| Brazil | 5.6% |

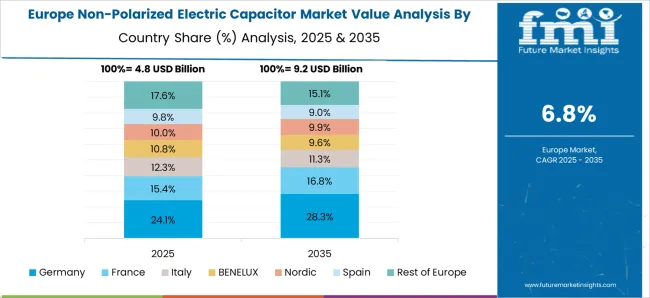

The market is expanding steadily as electronic manufacturing and energy applications adopt advanced capacitor technologies. India grows at 9.3%, supported by its expanding electronics and automotive sectors that rely heavily on capacitor integration. Germany records 8.5% growth, driven by demand for efficient electronic components in industrial and renewable energy systems. China leads with 10.0%, benefiting from large-scale production facilities and continuous innovation in capacitor technology. The United Kingdom advances at 7.0%, with adoption encouraged by upgrades in electrical infrastructure. The United States progresses at 6.3%, where applications in consumer electronics and power systems contribute significantly to growth. These dynamics highlight the widening role of capacitors in both industrial and consumer technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to rise at a CAGR of 10.0%, making it the fastest expanding market worldwide. Adoption has been stimulated by large scale consumer electronics manufacturing, electric vehicle battery packs, and industrial automation. Chinese producers have benefited from cost advantages, while global players have expanded joint ventures to secure reliable supply. It is assessed that rising adoption of renewable energy systems has also created consistent demand for non-polarized capacitors in inverter circuits and grid integration equipment. Market growth is supported by strong R and D investment in ceramic and film capacitor technologies. Partnerships between domestic firms and international suppliers are expected to reinforce China’s dominance as both a manufacturing base and consumer market for non-polarized capacitors.

The market in India is projected to advance at a CAGR of 9.3%, driven by rapid electronic manufacturing services growth and national emphasis on electric mobility. It is considered that government schemes promoting local production of semiconductors and components have boosted capacitor adoption. Domestic demand has been further reinforced by consumer appliances and automotive electrification, where capacitors are integral for motor control circuits. The role of non-polarized capacitors in LED lighting, solar inverters, and telecom infrastructure has widened market potential. International suppliers have increased their presence through joint manufacturing and distribution partnerships with Indian firms. This trajectory suggests that India will continue to expand its role as a regional hub for non-polarized capacitor production and utilization across industrial and consumer markets.

Germany is expected to record a CAGR of 8.5% in the market, supported by strong industrial automation and automotive innovation. Capacitor adoption has been shaped by the country’s advanced automotive sector, particularly in electric drivetrains and onboard power electronics. Industrial robotics and automation systems have relied on capacitors for motor control and precision power regulation, reinforcing their importance. It is judged that Germany’s emphasis on renewable integration, especially wind and solar, will sustain consistent demand for non-polarized capacitors in grid applications. Leading European manufacturers have focused on high quality film capacitors, serving automotive OEMs and industrial equipment makers. Continuous investment in R and D has kept Germany at the forefront of energy efficient component innovation, positioning the market for steady medium term expansion.

A compound annual growth rate of 7.0% has been predicted for the United Kingdom market, with expansion anchored in renewable energy and telecom sectors. Capacitors are being deployed extensively in offshore wind energy infrastructure, where reliability in harsh environments is critical. Telecom network upgrades and data center expansions have also created new capacitor demand for stable power supply and signal processing. It is assessed that U K manufacturers, though smaller in scale, have maintained competitiveness by focusing on specialized film capacitors with high performance metrics. International suppliers continue to serve U K demand through strategic distribution partnerships. The trajectory indicates that demand will remain linked to digital infrastructure growth and continued investment in energy transition projects, reinforcing capacitor market strength.

The market in the United States is forecast to expand at a CAGR of 6.3%, reflecting steady growth across defense, aerospace, and consumer electronics. Capacitors have been increasingly used in advanced radar, avionics, and satellite systems, where performance reliability is essential. It is considered that expansion in EV manufacturing and charging infrastructure has further strengthened capacitor demand. The U S has also witnessed growth in renewable capacity, particularly in solar PV installations, where capacitors play a role in energy storage and conversion. Domestic manufacturers focus on high precision film and ceramic capacitors, often supplying aerospace and defense primes. This orientation toward specialized, high value applications has kept the U S market resilient despite moderate overall growth compared with Asia.

The market is expanding as industries emphasize efficient energy storage, signal filtering, and voltage regulation across consumer electronics, automotive, industrial, and power transmission sectors. Murata Manufacturing, TDK, and Taiyo Yuden dominate the market with high-reliability capacitors tailored for compact electronic devices and communication equipment. Panasonic, Samsung Electro-Mechanics, and Kyocera AVX Components strengthen the segment by providing advanced multilayer ceramic capacitors with improved dielectric properties for next-generation electronics. ABB, Siemens, and Schneider Electric contribute by integrating non-polarized capacitors into industrial power systems, grid infrastructure, and renewable energy applications. Vishay Intertechnology, Wima, and Kemet focus on film capacitors with high voltage resistance and durability, enabling broader use in industrial automation and automotive systems.

Cornell Dubilier and Elna are recognized for their extensive portfolio in high-performance capacitors supporting energy storage and frequency management. Emerging suppliers such as Havells India and Xuansn Capacitor cater to regional and cost-sensitive markets, ensuring wider accessibility. The market is being shaped by growing demand for energy efficiency, miniaturization of electronic components, and integration with smart grid systems. With expanding applications in electric mobility, consumer electronics, and renewable energy, these players continue to strengthen innovation and competitiveness in the market.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.3 billion |

| Material | Film capacitors, Ceramic capacitors, Electrolytic capacitors, and Others |

| End Use | Consumer electronics, Automotive, Communications & technology, Transmission & Distribution, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing, ABB, Cornell Dubilier, Elna, Havells India, Kemet, Kyocera AVX Components, Panasonic, Samsung Electro-Mechanics, Schneider Electric, Siemens, Taiyo Yuden, TDK, Vishay Intertechnology, Wima, and Xuansn Capacitor |

| Additional Attributes | Dollar sales by capacitor type and application, demand dynamics across consumer electronics, industrial equipment, and automotive systems, regional trends in capacitor adoption, innovation in miniaturization, durability, and voltage handling, environmental impact of material sourcing and disposal, and emerging use cases in LED lighting, audio systems, and renewable energy integration. |

The global non-polarized electric capacitor market is estimated to be valued at USD 19.3 billion in 2025.

The market size for the non-polarized electric capacitor market is projected to reach USD 39.5 billion by 2035.

The non-polarized electric capacitor market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in non-polarized electric capacitor market are film capacitors, ceramic capacitors, electrolytic capacitors and others.

In terms of end use, consumer electronics segment to command 53.9% share in the non-polarized electric capacitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA