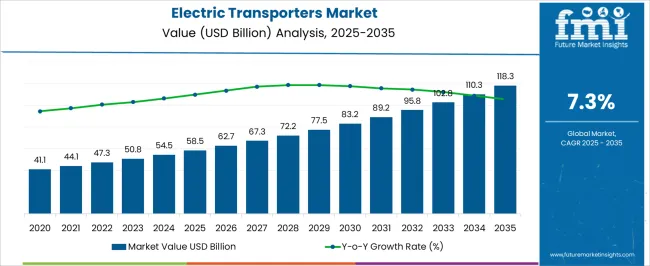

The electric transporters market, estimated at USD 58.5 billion in 2025 and expected to reach USD 118.3 billion by 2035 at a CAGR of 7.3%, reflects a diverse contribution profile across multiple technologies, with battery electric vehicles (BEVs) serving as the primary growth driver. The progressive increase in market value from USD 58.5 billion in 2025 to USD 72.2 billion by 2028 indicates the initial dominance of conventional BEV platforms, supported by enhancements in battery energy density, vehicle efficiency, and charging infrastructure, which collectively reinforce adoption across commercial and passenger transporter segments.

Hybrid electric transporter technologies contribute moderately, particularly in regions where range limitations and charging infrastructure gaps constrain full battery deployment. Their market contribution, though steady, grows incrementally from USD 62.7 billion in 2026 to USD 83.2 billion by 2030, representing the technology’s role in bridging conventional internal combustion systems with fully electric solutions. Fuel cell electric transporters, while still emerging, begin to make marginal contributions in specialized applications requiring extended range and rapid refueling, adding to the diversity of the market’s technological portfolio.

From 2030 onward, acceleration in the adoption of advanced battery management systems, lightweight materials, and powertrain optimization allows BEVs to capture an increasing share of the market, pushing the total value toward USD 118.3 billion by 2035. The contribution analysis underscores that BEVs remain the technological backbone, supported by hybrid and niche fuel cell systems, collectively driving the market’s growth and shaping the technology mix in the electric transporter ecosystem.

| Metric | Value |

|---|---|

| Electric Transporters Market Estimated Value in (2025 E) | USD 58.5 billion |

| Electric Transporters Market Forecast Value in (2035 F) | USD 118.3 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The electric transporters market represents a specialized segment within the global electric mobility and urban transport solutions industry, emphasizing efficiency, zero emissions, and operational flexibility. Within the broader electric vehicle market, it accounts for about 5.3%, driven by adoption in last-mile delivery, intra-city logistics, and small cargo transport. In the commercial and fleet mobility sector, it holds nearly 4.7%, reflecting demand from e-commerce, postal services, and municipal operations. Across the industrial and warehousing transport segment, the market captures 4.2%, supporting material handling, intra-facility movement, and on-site logistics.

Within the green and sustainable mobility solutions category, it represents 3.8%, highlighting integration with low-emission transportation initiatives. In the electric drivetrain and battery solutions sector, it secures 3.5%, emphasizing energy efficiency, battery management, and operational reliability. Recent developments in this market have focused on battery innovation, automation, and fleet management integration. Innovations include high-capacity lithium-ion and solid-state batteries, energy-efficient electric drivetrains, and lightweight chassis designs. Key players are collaborating with logistics companies, fleet operators, and urban mobility solution providers to expand deployment and optimize total cost of ownership. Adoption of IoT-enabled telematics, predictive maintenance, and route optimization software is gaining traction for enhanced operational efficiency. Additionally, modular designs, fast-charging capabilities, and smart fleet management systems are being deployed to support scalability and reliability.

Strong policy support, including incentives for zero-emission vehicles, coupled with rising consumer awareness of environmental benefits, is accelerating adoption.

The market is also benefiting from improvements in range, efficiency, and performance across vehicle categories, making electric transporters more competitive with conventional options. Growing investments in charging infrastructure, integration of smart connectivity, and increasing cost-efficiency of batteries are enabling large-scale deployment.

Urbanization trends and the demand for low-noise, low-maintenance transport solutions are further driving uptake. As technological innovation continues and economies of scale improve production economics, the Electric Transporters market is expected to sustain high growth momentum, with opportunities across both emerging and developed markets.

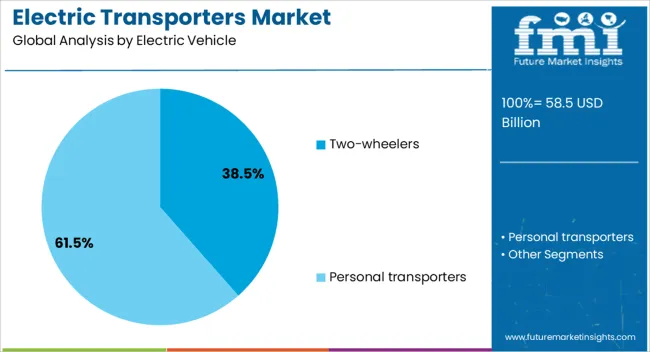

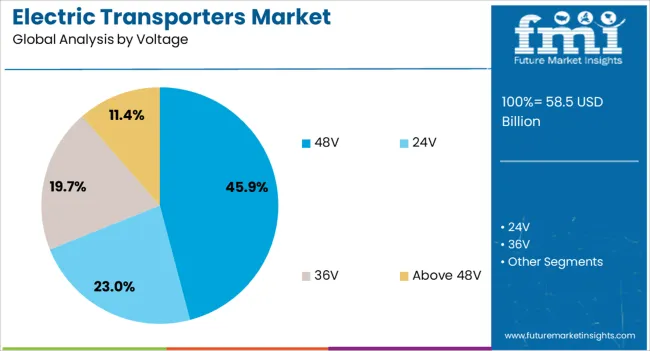

The electric transporters market is segmented by electric vehicle, voltage, battery, end use, and geographic regions. By electric vehicle, electric transporters market is divided into two-wheelers and personal transporters. In terms of voltage, electric transporters market is classified into 48V, 24V, 36V, and Above 48V.

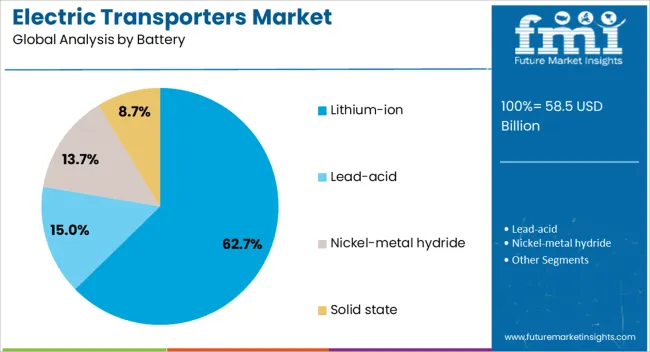

Based on battery, electric transporters market is segmented into lithium-ion, lead-acid, nickel-metal hydride, and solid state. By end use, electric transporters market is segmented into personal and commercial. Regionally, the electric transporters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Two-wheelers category within the Electric Vehicle segment is projected to account for 38.5% of the overall Electric Transporters market revenue in 2025, making it the leading segment by vehicle type. This position is being supported by the widespread adoption of electric scooters and motorcycles in urban environments, where compact size, lower running costs, and ease of maneuverability offer distinct advantages.

The ability to integrate high-performance batteries and connected features has enhanced their appeal to both individual consumers and fleet operators. Demand growth has also been influenced by congestion in metropolitan areas, where two-wheelers offer faster travel and lower parking requirements.

The relatively lower upfront cost compared to larger electric vehicles, combined with government incentives and reduced licensing requirements in many regions, has further boosted adoption. As charging networks expand and battery efficiency improves, the two-wheeler segment is expected to maintain its leadership position in the market.

The 48V subsegment in the Voltage category is anticipated to hold 45.9% of the Electric Transporters market revenue in 2025, making it the dominant voltage configuration. This leadership is being attributed to the optimal balance between performance, safety, and cost efficiency that 48V systems provide for a wide range of electric transporters.

The voltage level is well-suited for lightweight and mid-range vehicles, offering sufficient power output while maintaining manageable thermal and electrical safety profiles. Adoption has been further accelerated by its compatibility with standard charging infrastructure and cost-effective integration into existing vehicle platforms.

The ability of 48V systems to deliver consistent performance across urban and suburban usage conditions has also contributed to their popularity. As manufacturers seek scalable solutions that meet regulatory standards without significantly increasing vehicle cost, the 48V configuration is expected to remain the preferred choice for many electric transporter applications.

The Lithium-ion battery type is projected to represent 62.7% of the Electric Transporters market revenue in 2025, securing its position as the leading battery technology. This dominance is being driven by its superior energy density, longer cycle life, and relatively lower weight compared to alternative chemistries.

The fast-charging capabilities and high efficiency of lithium-ion batteries make them particularly suitable for electric transporters that require frequent use and quick turnaround times. Continued advancements in battery chemistry and manufacturing processes have reduced costs while improving safety and performance, further strengthening their market position.

The scalability of lithium-ion technology for various vehicle sizes, from two-wheelers to light commercial electric transporters, has broadened its application range. With ongoing investment in recycling and second-life applications, lithium-ion batteries are expected to remain the preferred energy storage solution in the Electric Transporters market for the foreseeable future.

The market has grown rapidly due to the rising adoption of sustainable mobility solutions in urban logistics, last mile delivery, and industrial transport. These vehicles, including electric cargo bikes, tricycles, and small vans, operate on battery power, offering low emission and energy efficient alternatives to conventional fuel powered transporters. Increasing demand for clean transportation, cost savings on fuel, and favorable government policies promoting electric mobility have driven adoption. Technological advancements in battery systems, charging infrastructure, and vehicle connectivity have enhanced performance, range, and operational reliability.

Electric transporters have been increasingly deployed for urban logistics and last mile delivery to reduce operational costs and environmental impact. E cargo bikes, electric trikes, and small vans are used by courier companies, retail chains, and e commerce operators to navigate congested city streets efficiently. These vehicles allow for quiet, low emission transportation, contributing to urban air quality improvement. Fleet operators benefit from reduced fuel costs, lower maintenance requirements, and the ability to integrate with digital logistics platforms for route optimization and real time tracking. Growing e commerce demand and stricter emission regulations have strengthened the adoption of electric transporters in last mile delivery, making them essential for sustainable urban logistics.

Industrial facilities, warehouses, airports, and commercial centers have adopted electric transporters for material handling, internal logistics, and personnel movement. These vehicles reduce operational costs, emissions, and noise pollution within closed environments or large premises. Electric transporters offer advantages in energy efficiency, maneuverability, and fleet scalability. Integration with automated scheduling systems, charging stations, and fleet management software enhances operational efficiency and minimizes downtime. The increasing focus on workplace sustainability, energy savings, and green logistics has driven the implementation of electric transporters in industrial and commercial applications. As companies aim to meet environmental goals and reduce operational costs, electric transporters are becoming core assets in modern industrial mobility solutions.

Technological innovations have improved battery energy density, motor efficiency, and vehicle connectivity in electric transporters. Lithium ion and solid state batteries offer extended range, faster charging, and longer service life. Regenerative braking systems, lightweight chassis, and aerodynamic designs enhance energy efficiency. Smart connectivity allows for real time fleet monitoring, predictive maintenance, and route optimization through integrated software platforms. Some models feature modular cargo compartments, swappable batteries, and autonomous capabilities for enhanced operational flexibility. These technological advancements increase reliability, reduce total cost of ownership, and expand the applicability of electric transporters across diverse urban, commercial, and industrial operations, driving market growth globally.

Government incentives, subsidies, and environmental regulations have significantly influenced the electric transporters market. Policies promoting zero emission vehicles, carbon reduction initiatives, and tax incentives for electric fleets have encouraged adoption across private and commercial sectors. Urban low-emission zones and stricter fuel vehicle restrictions have accelerated the shift toward battery-powered transporters. Many cities and municipalities are implementing procurement programs for electric logistics fleets, further stimulating demand. Compliance with safety, performance, and emission standards ensures vehicle reliability and market acceptance. Regulatory frameworks and supportive policies have strengthened the market, creating a favorable environment for the expansion of electric transporters across global transportation networks.

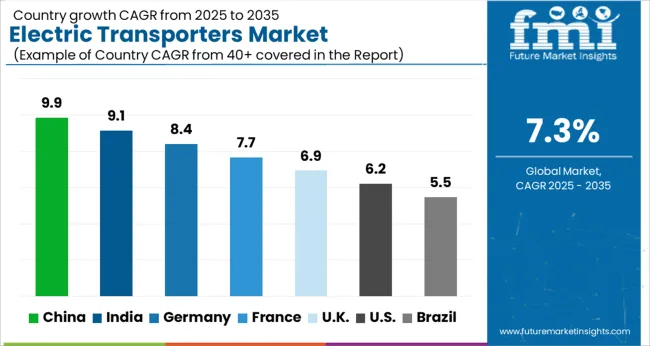

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The market is experiencing steady growth driven by the shift toward low-emission mobility solutions and logistics optimization. Germany records 8.4%, supported by adoption in urban freight and commercial fleets. India achieves 9.1%, where government incentives and rising demand for last-mile electric transporters propel market expansion. China leads with 9.9%, benefiting from large-scale deployment in delivery and public transport sectors. The United Kingdom reaches 6.9%, supported by pilot programs and infrastructure development for electric mobility. The United States reports 6.2%, with commercial and municipal adoption contributing to consistent growth. These countries represent a diversified market landscape influencing the global progression of electric transporters. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 9.9%, driven by large scale adoption in urban logistics, commercial fleets, and last mile delivery services. Government policies supporting electrification of commercial vehicles and industrial transport have accelerated market penetration. Domestic manufacturers have focused on high performance batteries, lightweight designs, and smart fleet management systems. Deployment of electric vans, three wheelers, and cargo transporters has been reinforced by industrial hubs and urban distribution centers. Export demand for Chinese electric transporters has also grown due to competitive pricing and technological advancements. The market is expected to maintain rapid expansion as infrastructure and commercial electrification continue to advance.

India is expected to grow at a CAGR of 9.1%, supported by rising adoption of electric transporters in urban logistics, industrial transport, and last mile delivery. Government incentives under FAME II and local manufacturing schemes have encouraged adoption by fleet operators. Domestic manufacturers are focusing on electric three wheelers, small vans, and cargo transporters with optimized battery capacity and low operational cost. Adoption has also been encouraged by the increasing e commerce penetration and urban delivery requirements. The market is expected to continue expanding as government support and fleet electrification initiatives drive commercial adoption across India.

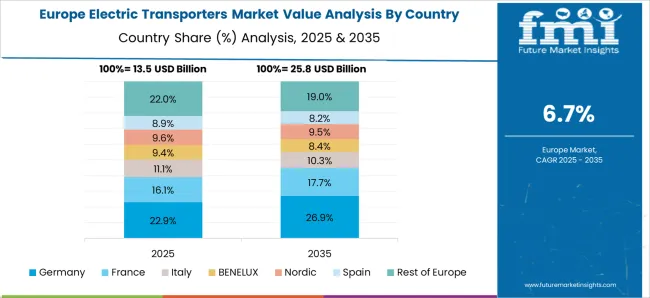

Germany is projected to grow at a CAGR of 8.4%, driven by adoption of electric transporters in urban delivery, industrial logistics, and municipal services. European Union regulations promoting zero emission transport and incentives for fleet electrification have supported market expansion. German manufacturers such as Mercedes Benz Vans and Streetscooter have focused on battery electric and hybrid transporters with advanced telematics and fleet management systems. Adoption has been reinforced by e commerce logistics, local government transport initiatives, and industrial applications. Market growth is expected to remain steady as Germany continues to prioritize green transportation and fleet electrification for commercial and municipal operations.

The United Kingdom market is anticipated to grow at a CAGR of 6.9%, influenced by urban logistics adoption, delivery fleet electrification, and government initiatives to reduce emissions. Adoption has been encouraged by regulations promoting zero emission vehicles and support for electric transport infrastructure. Domestic and imported transporters from European manufacturers are deployed for last mile delivery, municipal services, and commercial logistics. The market outlook indicates steady growth due to continued fleet electrification and urban sustainability targets. Focus on battery performance, telematics, and operational cost reduction is expected to drive adoption across commercial sectors in the U K.

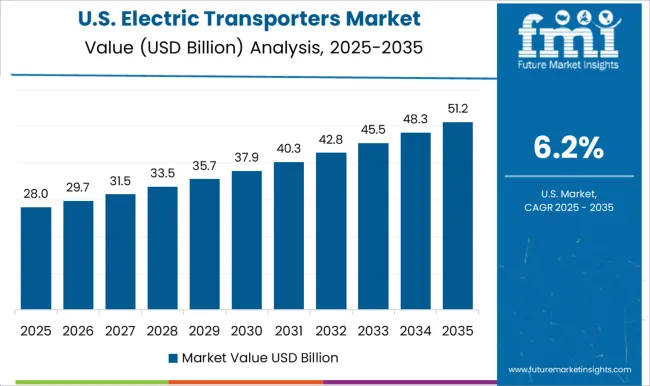

The United States market is projected to expand at a CAGR of 6.2%, supported by adoption in logistics, industrial fleets, and commercial delivery services. Fleet electrification programs by large logistics providers and government incentives have encouraged deployment. Leading manufacturers such as Tesla, Rivian, and Workhorse provide electric vans, light duty trucks, and cargo transporters with advanced battery systems and telematics. Adoption has been reinforced by e commerce growth and focus on operational cost reduction. The market is expected to maintain steady expansion, driven by commercial fleet electrification, technological advancement, and infrastructure development across the United States.

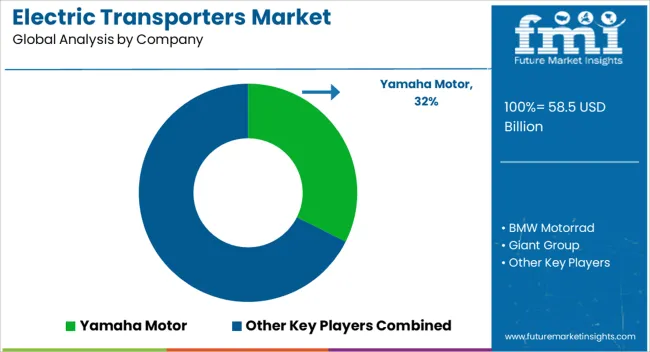

The market is witnessing rapid growth driven by urban mobility demand, emission regulations, and the shift toward sustainable transportation. Yamaha Motor and BMW Motorrad leverage strong brand equity and advanced electric drivetrain technologies to offer premium e-motorcycles and scooters, targeting both urban and high-performance segments. Harley-Davidson and Zero Motorcycles focus on high-performance electric motorcycles with extended range batteries, appealing to enthusiasts seeking power and style. Companies such as Hero MotoCorp, KYMCO, and Yadea concentrate on mass-market adoption, offering cost-effective, reliable electric scooters and commuter motorcycles optimized for daily urban use.

Niu Technologies and Segway Ninebot provide smart connectivity features, app-based fleet management, and IoT-enabled charging solutions to cater to tech-savvy consumers and micro-mobility services. Giant Group combines e-bikes with advanced battery management systems and lightweight designs to address the leisure and utility segments. Competitive differentiation in this market is driven by battery efficiency, charging infrastructure compatibility, design innovation, and integration of connected vehicle technologies. Strategic alliances with energy providers, expansion of service networks, and continuous R&D in battery chemistry, motor efficiency, and smart transportation platforms remain critical for maintaining market leadership and expanding global adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.5 Billion |

| Electric Vehicle | Two-wheelers and Personal transporters |

| Voltage | 48V, 24V, 36V, and Above 48V |

| Battery | Lithium-ion, Lead-acid, Nickel-metal hydride, and Solid state |

| End Use | Personal and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yamaha Motor, BMW Motorrad, Giant Group, Harley-Davidson, Hero MotoCorp, KYMCO, Niu Technologies, Segway Ninebot, Yadea, and Zero Motorcycles |

| Additional Attributes | Dollar sales by transporter type and application, demand dynamics across last-mile delivery, logistics, and urban mobility sectors, regional trends in electric vehicle adoption, innovation in battery efficiency, load capacity, and connectivity, environmental impact of reduced emissions and energy use, and emerging use cases in e-commerce delivery, urban freight, and shared mobility solutions. |

The global electric transporters market is estimated to be valued at USD 58.5 billion in 2025.

The market size for the electric transporters market is projected to reach USD 118.3 billion by 2035.

The electric transporters market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in electric transporters market are two-wheelers, _e-bikes, _e-scooters, _electric motorcycles, personal transporters, _skateboards and _hoverboards.

In terms of voltage, 48v segment to command 45.9% share in the electric transporters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA