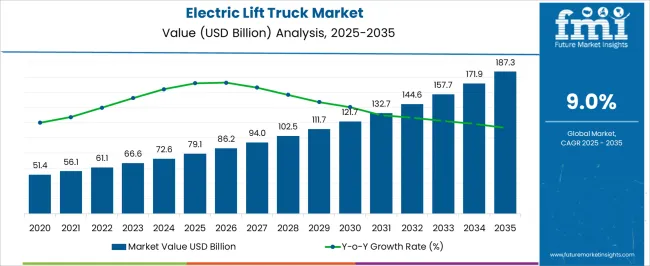

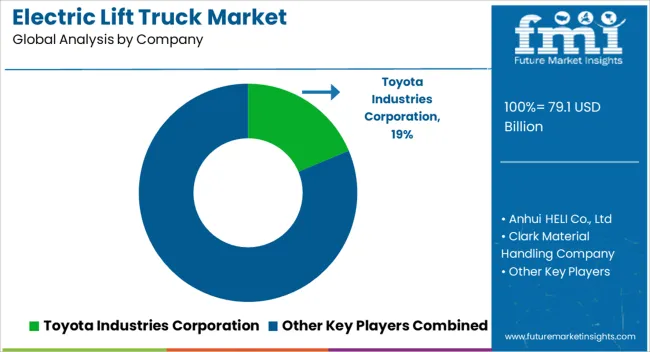

The electric lift truck market is estimated at USD 79.1 billion in 2025 and is projected to reach USD 187.3 billion by 2035, reflecting a CAGR of 9.0%. The market is fundamentally shaped by contributions from different technology segments, primarily battery-electric lift trucks, fuel cell-powered trucks, and hybrid variants. Battery-electric technology dominates the market due to its established infrastructure, lower operational costs, and growing preference for zero-emission solutions in warehouses and manufacturing facilities.

Incremental improvements in lithium-ion battery efficiency, charging cycles, and energy density are driving adoption, enabling longer operating hours and reducing downtime. Fuel cell-powered lift trucks, though currently a smaller contributor, are gaining traction in large-scale distribution centers and heavy-duty applications where rapid refueling and continuous operation are critical. The adoption of hybrid lift trucks remains limited but provides niche value by combining internal combustion engines with electric drives for flexible performance under varying load conditions. The year-on-year growth indicates that battery-electric solutions will increasingly dominate, contributing more than 70% of market value by mid-decade, while fuel cell technology is expected to grow at a higher CAGR due to targeted deployments in regions with hydrogen infrastructure.

By 2035, technology-driven contributions will continue to shape market dynamics, with battery-electric lift trucks solidifying market leadership, fuel cell variants establishing specialized applications, and hybrids supporting transitional use cases. Technological innovation, cost optimization, and regulatory pressure for clean energy will collectively determine the relative contribution of each technology segment, driving overall market expansion and diversification.

| Metric | Value |

|---|---|

| Electric Lift Truck Market Estimated Value in (2025 E) | USD 79.1 billion |

| Electric Lift Truck Market Forecast Value in (2035 F) | USD 187.3 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The market is experiencing significant growth as industries increasingly prioritize sustainability, operational efficiency, and regulatory compliance. The transition from internal combustion engine lift trucks to electric variants has been driven by growing pressure to reduce carbon emissions and enhance workplace safety. Regulatory shifts encouraging zero-emission equipment adoption across warehouses, ports, and factories are contributing to strong demand.

Investor presentations and logistics industry news indicate that technological advances in lithium-ion battery systems, faster charging capabilities, and lower total cost of ownership are positioning electric lift trucks as a long-term solution for material handling operations. Enterprises are increasingly integrating fleet management software and automation into electric models, further enhancing their appeal.

As e-commerce and supply chain digitization continue to evolve, demand for scalable and energy-efficient lifting solutions is expected to grow. Ongoing investments in smart logistics infrastructure and green warehousing initiatives globally are also playing a key role in shaping the future landscape of the electric lift truck market.

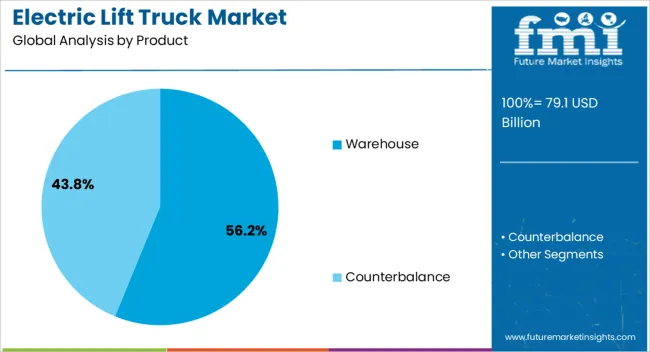

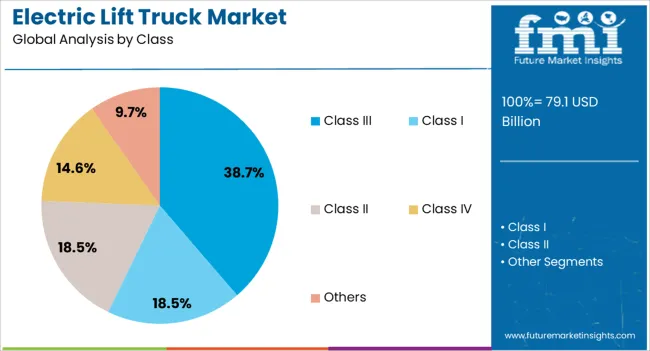

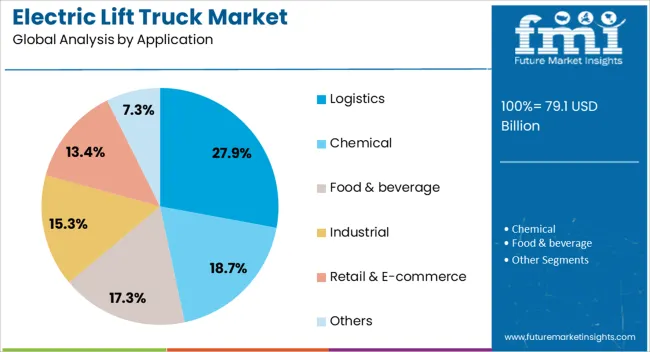

The electric lift truck market is segmented by product, class, application, and geographic regions. By product, the electric lift truck market is divided into Warehouse and Counterbalance. In terms of class, the electric lift truck market is classified into Class III, Class I, Class II, Class IV, and Others. Based on application, the electric lift truck market is segmented into Logistics, Chemical, Food & beverage, Industrial, Retail & E-commerce, and Others.

Regionally, the electric lift truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The warehouse product segment is expected to account for 56.2% of the Electric Lift Truck market revenue share in 2025, making it the leading product category. This leadership has been driven by the widespread deployment of electric lift trucks in indoor and controlled environments, where low noise levels and zero emissions are essential. Companies across retail, manufacturing, and logistics have adopted electric models for warehousing operations due to the reduced maintenance needs and improved energy efficiency.

Annual reports from equipment manufacturers indicate that the compact design and maneuverability of electric lift trucks make them highly suitable for narrow-aisle warehouses. The shift toward 24/7 operations in distribution centers has also contributed to the popularity of electric units, which can be recharged during non-peak hours.

Additionally, warehousing facilities are increasingly focusing on green certifications, further incentivizing the use of electric-powered equipment. These factors have collectively supported the warehouse segment’s dominant position in the market.

The Class III segment is projected to hold 38.7% of the electric lift truck market revenue share in 2025, emerging as the most prominent class segment. This growth has been attributed to the increasing use of electric pallet jacks and walkie stackers in material handling applications that require efficient and precise movement of goods over short distances. These trucks are favored for their ergonomic design and ease of operation, which enhance worker productivity and safety.

Industry publications and press briefings from logistics providers have emphasized the suitability of Class III trucks in retail and food distribution sectors, where high-volume throughput and quick turnaround times are critical. Their compatibility with battery swapping and opportunity charging has enabled uninterrupted operations, especially in multi-shift environments.

Furthermore, regulatory trends favoring low-emission material handling equipment have accelerated the shift toward electric models in this category. These operational and compliance advantages have contributed to the segment’s sustained market leadership.

The logistics application segment is anticipated to capture 27.9% of the market revenue share in 2025, establishing itself as the leading application area. The rapid expansion of third-party logistics, e-commerce fulfillment centers, and transportation hubs has influenced the growth of this segment. As observed in logistics industry forums and investor statements, operators are adopting electric lift trucks to meet sustainability targets while maintaining high service levels.

The need for fast, reliable, and emissions-free movement of goods across docks and sorting facilities has increased demand for electric models equipped with fleet management features. Enhanced data visibility, lower operating costs, and reduced noise levels have made these trucks ideal for high-density logistics operations.

Furthermore, the integration of digital technologies such as telematics and predictive maintenance tools in electric lift trucks has improved asset utilization and operational planning.

The market has been expanding due to increasing adoption of battery-powered material handling solutions in warehouses, logistics, and industrial facilities. Electric lift trucks provide energy-efficient, low-emission alternatives to conventional diesel or LPG-powered forklifts. Growth has been supported by the integration of lithium-ion batteries, telematics, and automation technologies, which enable precise load handling, real-time monitoring, and optimized operational efficiency. Rising demand for sustainable logistics operations, cost-effective fleet management, and safe material handling practices has reinforced adoption globally, making electric lift trucks a critical component of modern industrial and commercial operations.

Technological innovations have strengthened the electric lift truck market through improved battery and drive systems. Lithium-ion battery integration has replaced traditional lead-acid units, providing faster charging, longer life cycles, and higher energy density. Regenerative braking systems have been implemented to recover energy during operation, enhancing overall efficiency. Brushless AC drive motors have been deployed to reduce maintenance requirements while increasing torque and operational reliability. Advanced telematics platforms allow real-time fleet monitoring, predictive maintenance, and performance optimization, while operator assistance features such as load sensing and automatic speed adjustment improve safety and productivity. Modular battery packs and automated charging stations have facilitated fleet scalability, reducing downtime and operational costs. Collectively, these technological improvements have elevated electric lift trucks as a reliable and efficient solution for modern material handling operations across diverse industries globally.

Environmental regulations and sustainability initiatives have significantly influenced the adoption of electric lift trucks. Stricter emissions standards in North America, Europe, and Asia have encouraged warehouses and manufacturing facilities to replace diesel and LPG forklifts with zero-emission electric alternatives. Government incentives and funding programs for green logistics and energy-efficient equipment have accelerated fleet electrification. Workplace safety guidelines have also promoted electric lift trucks due to lower noise levels, reduced heat emissions, and absence of combustion fumes, which improve indoor air quality. Compliance with sustainability targets and corporate environmental policies has reinforced procurement decisions. As companies increasingly aim to reduce carbon footprints and operational costs, regulatory and environmental drivers have become pivotal in supporting the widespread adoption of electric lift trucks in logistics, warehousing, and industrial sectors globally.

Industrial and logistics operations have emerged as primary consumers of electric lift trucks due to high operational efficiency and safety benefits. Warehousing, distribution centers, and manufacturing facilities rely on electric lift trucks for indoor and short-distance material handling, where emissions-free operations are critical. Automated warehouses have leveraged electric lift trucks integrated with guidance systems, sensors, and fleet management platforms for efficient operations. Companies handling perishable goods, electronics, or pharmaceuticals have preferred electric lift trucks due to reduced vibration, precise control, and energy efficiency. Maintenance requirements are minimized compared to internal combustion alternatives, reducing operational downtime and total cost of ownership. Industrial and logistics demand has reinforced market growth, positioning electric lift trucks as essential solutions for modern, automated, and sustainable material handling systems.

The truck market has been strengthened by integration with automation and fleet management solutions. Automated guided vehicles (AGVs) and semi-automated lift trucks allow optimized load transport, route planning, and reduced labor dependency. IoT-enabled fleet management systems provide real-time data on battery status, utilization, and maintenance schedules, enabling predictive interventions and improved asset longevity. Integration with warehouse management systems facilitates coordinated operations, inventory control, and load allocation. Safety enhancements such as collision avoidance sensors, operator alert systems, and speed regulation have been incorporated to prevent accidents and enhance productivity. The expansion of smart warehouses, e-commerce distribution centers, and automated industrial facilities has accelerated adoption of connected electric lift truck fleets, reinforcing their role in driving operational efficiency, energy savings, and sustainable material handling globally.

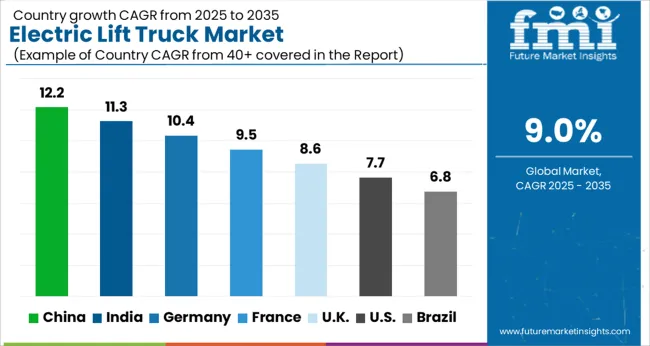

The market is projected to grow at a CAGR of 9.0% from 2025 to 2035, fueled by increasing warehouse automation, adoption of eco-friendly logistics solutions, and advancements in battery technologies. China leads with a 12.2% CAGR, advancing through large-scale deployment of electric material handling equipment and supportive industrial policies. India follows at 11.3%, scaling rapidly with expanding e-commerce and logistics infrastructure. Germany, at 10.4%, benefits from strong industrial automation and technological expertise in material handling solutions. The UK, growing at 8.6%, focuses on modernizing warehouse operations and energy-efficient fleets. The USA, at 7.7%, maintains steady demand from logistics operators and manufacturing sectors adopting electric lift solutions. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to grow at a CAGR of 12.2% in the market from 2025 to 2035, supported by rapid industrial expansion and increasing warehouse automation. Adoption of battery-electric trucks is rising due to energy efficiency initiatives and government incentives for low-emission industrial equipment. Domestic manufacturers are investing in advanced lithium-ion battery technologies, telematics integration, and smart fleet solutions. Logistics and e-commerce sectors are driving demand for electric material handling solutions, while retrofitting traditional fleets with electric trucks is gaining traction.

India is anticipated to grow at a CAGR of 11.3% in the market over 2025–2035, driven by modernization of logistics hubs and industrial warehouses. Rising energy costs and environmental regulations are prompting fleet electrification. Manufacturers are investing in battery technology, safety features, and fleet management software to cater to the expanding demand. E-commerce, automotive, and FMCG sectors are adopting electric lift trucks to improve efficiency and reduce operating costs.

Germany is forecast to expand at a CAGR of 10.4% in the industry between 2025 and 2035, propelled by the emphasis on sustainable industrial operations and energy-efficient warehouse solutions. Demand for lithium-ion powered trucks is increasing as companies upgrade traditional fleets. Manufacturing and logistics sectors are implementing smart fleet technologies to optimize operational efficiency. Strategic partnerships between truck manufacturers and warehouse solution providers are accelerating technology adoption.

The United Kingdom is expected to grow at a CAGR of 8.6% in the market from 2025 to 2035, driven by warehouse modernization and industrial electrification initiatives. Environmental regulations and low-emission zones are encouraging adoption of battery-powered trucks. Key logistics and retail sectors are prioritizing electrification to reduce operating costs and improve sustainability. Advanced telematics and safety features are increasingly integrated into fleets.

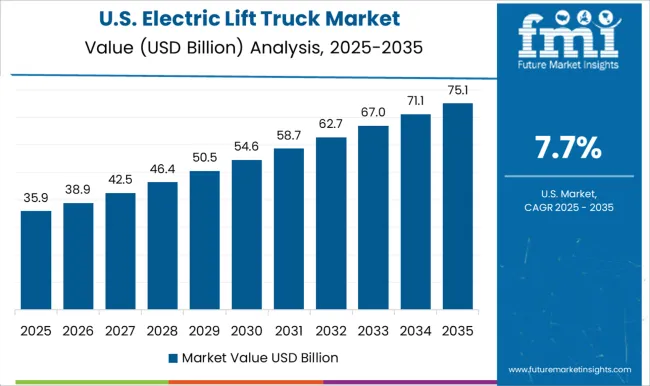

The United States is forecast to grow at a CAGR of 7.7% in the market during 2025–2035, driven by warehouse automation and logistics optimization. Adoption of electric trucks is supported by tax incentives, low-emission initiatives, and rising demand for energy-efficient industrial vehicles. Manufacturers are focusing on lithium-ion batteries, telematics solutions, and ergonomic designs to meet operational efficiency goals. E-commerce and manufacturing industries are key growth drivers.

The market is dominated by established manufacturers delivering high-performance, energy-efficient material handling solutions for warehouses, logistics centers, and industrial facilities. Toyota Industries Corporation remains a key leader, offering advanced electric forklifts with optimized battery performance and ergonomic designs, ensuring operational efficiency across multiple sectors. Crown Equipment Corporation focuses on innovation-driven models with intelligent control systems and safety features tailored for heavy-duty warehouse applications. KION GROUP AG and Komatsu Ltd. provide a comprehensive range of electric lift trucks, integrating automation-ready technologies and energy-efficient components to reduce operational costs.

Hyster-Yale Materials Handling, Inc. and Doosan Industrial Vehicle America Corp. emphasize versatility and durability, supplying both standard and customized solutions for various industrial applications. Anhui HELI Co., Ltd., Hangcha Group Co., Ltd., and Lonking Holdings Limited are emerging players delivering competitive pricing with robust design, targeting growing markets in Asia and Europe. Manufacturers like Clark Material Handling Company, Mitsubishi Logisnext Co., Ltd., and Manitou Group focus on ergonomic designs, battery management systems, and low-maintenance solutions to enhance user experience and minimize downtime. Strategic approaches include continuous R&D, strategic alliances, and localized production to expand market presence. The market features high entry barriers due to capital-intensive production, strict safety regulations, and the need for technological expertise, which solidifies the position of leading players while encouraging innovation-focused entrants.

| Item | Value |

|---|---|

| Quantitative Units | USD 79.1 Billion |

| Product | Warehouse and Counterbalance |

| Class | Class III, Class I, Class II, Class IV, and Others |

| Application | Logistics, Chemical, Food & beverage, Industrial, Retail & E-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Industries Corporation, Anhui HELI Co., Ltd, Clark Material Handling Company, Crown Equipment Corporation, Combilift Material Handling Solutions, Doosan Industrial Vehicle America Corp., Godrej and Boyce Group, Hangcha Group Co., Ltd., Hyster-Yale Materials Handling, Inc., Hubtex Maschinenbau GmbH & Co. KG, KION GROUP AG, Komatsu Ltd., Konecranes, Lonking Holdings Limited, Manitou Group, Mitsubishi Logisnext Co., Ltd., and Paletrans Forklifts |

| Additional Attributes | Dollar sales by truck type and load capacity, demand dynamics across warehousing, manufacturing, and logistics sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in battery technology, energy-efficient motors, and automated guidance systems, environmental impact of reduced emissions, battery lifecycle management, and energy consumption, and emerging use cases in autonomous warehouse operations, cold storage logistics, and smart material handling solutions. |

The global electric lift truck market is estimated to be valued at USD 79.1 billion in 2025.

The market size for the electric lift truck market is projected to reach USD 187.3 billion by 2035.

The electric lift truck market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in electric lift truck market are warehouse and counterbalance.

In terms of class, class iii segment to command 38.7% share in the electric lift truck market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Lift Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA