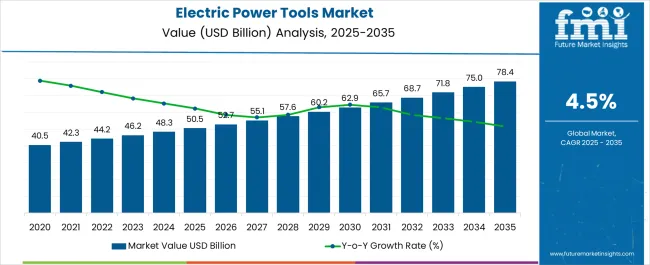

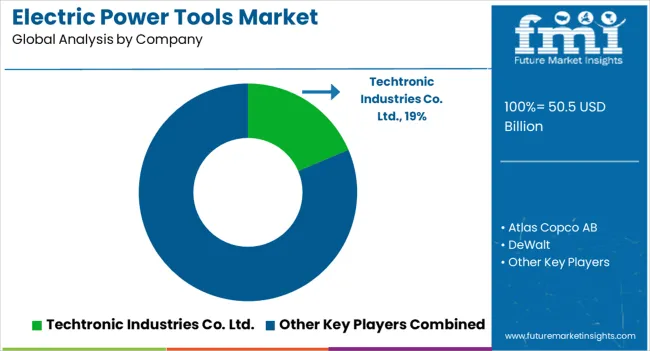

The electric power tools market is estimated to be valued at USD 50.5 billion in 2025 and is projected to reach USD 78.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Between 2024 and 2029, the market rises from USD 40.5 billion to USD 52.7 billion, contributing USD 12.2 billion or nearly one-third of the total projected growth. This period benefits from increasing adoption of cordless and battery-powered tools, driven by advancements in lithium-ion technology, rising DIY culture, and growing applications in residential remodeling and construction.

From 2030 to 2034, the market expands from USD 55.1 billion to USD 68.7 billion, an increase of USD 13.6 billion, supported by rising industrial automation, demand for precision-driven equipment, and the expansion of e-commerce platforms that broaden access to advanced tools. The growing professional segment in automotive repair, aerospace maintenance, and metalworking also accelerates sales. In the final phase from 2035 to 2039, the market advances from USD 71.8 billion to USD 78.4 billion, adding USD 6.6 billion, with growth supported by the adoption of smart and connected power tools integrated with IoT and AI-enabLED diagnostics, which enhance efficiency and safety. Overall, the electric power tools market is positioned for steady expansion, shaped by technological advancements, industrial demand, and evolving consumer preferences for versatile and durable tools.

| Metric | Value |

|---|---|

| Electric Power Tools Market Estimated Value in (2025 E) | USD 50.5 billion |

| Electric Power Tools Market Forecast Value in (2035 F) | USD 78.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The current market landscape reflects a shift toward high-efficiency tools capable of delivering precision, reduced downtime, and greater user comfort. Technological advancements, including brushless motors, ergonomic designs, and integrated sensors, have significantly improved tool performance while also addressing energy efficiency and safety. The rising trend of automation in manufacturing and the growing preference for do-it-yourself activities in residential settings are further contributing to market growth.

With industries prioritizing speed, consistency, and operational safety, the integration of electric tools that offer high power output and require less maintenance is being strongly favored. The future outlook remains positive, supported by innovation in smart tools with connectivity features and increasing investments in infrastructure and housing projects across both developed and emerging economies.

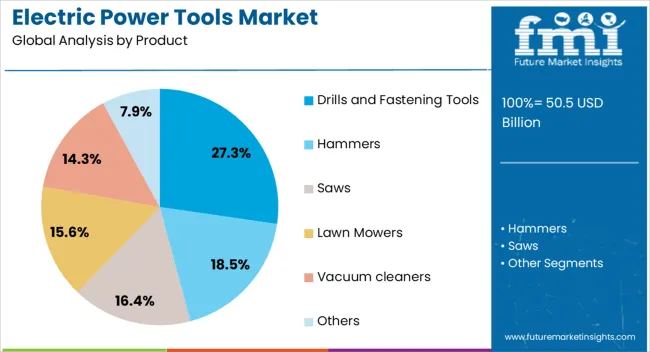

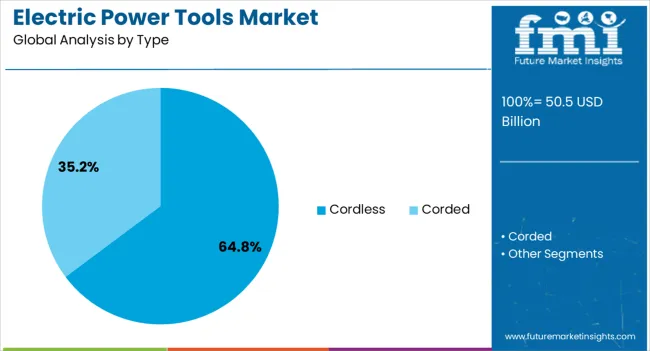

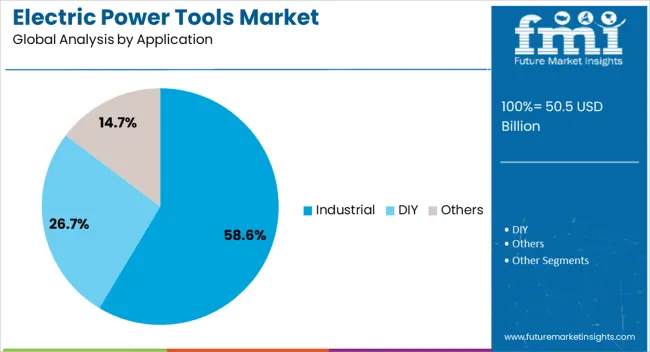

The electric power tools market is segmented by product, type, application, and geographic regions. By product, the electric power tools market is divided into Drills and Fastening Tools, Hammers, Saws, Lawn Mowers, Vacuum cleaners, and Others. In terms of type, the electric power tools market is classified into Cordless and Corded. Based on application, the electric power tools market is segmented into Industrial, DIY, and Others. Regionally, the electric power tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Drills and fastening tools are projected to hold 27.3% of the electric power tools market revenue share in 2025, making this product category the leading segment. This position is being supported by the critical role these tools play across core applications such as metal fabrication, woodwork, construction, and equipment maintenance.

Their versatility, combined with advancements in torque control and battery management, has made them highly reliable for precision-driven tasks. The adoption of these tools has been reinforced by the growing demand from both industrial and residential users seeking compact, lightweight, and high-efficiency solutions.

The increasing need for faster assembly and disassembly processes in production and fieldwork has also contributed to their popularity. As end users continue to demand enhanced mobility, ease of use, and reduced operational fatigue, the segment is expected to sustain its momentum through ongoing enhancements in tool design and functionality.

The cordless type is expected to account for 64.8% of the electric power tools market revenue share in 2025, making it the most dominant type category. This growth is being attributed to the enhanced convenience, portability, and flexibility that cordless tools offer across a wide range of operating environments. The advancement of lithium-ion battery technology has significantly improved runtime, power delivery, and charging speed, making these tools more dependable for prolonged usage.

Their application has expanded across indoor, outdoor, and remote job sites where unrestricted movement is essential. The reduced need for external power sources and the elimination of cables have increased safety, minimized downtime, and improved workflow efficiency.

Cordless tools have become especially preferred in sectors that require frequent repositioning and mobility, contributing to the segment’s leading market position As battery technology continues to evolve, further improvements in tool lifespan and performance are expected to drive sustained adoption.

The Industrial application segment is anticipated to capture 58.6% of the electric power tools market revenue share in 2025, making it the leading end-use category. The rising demand for electric tools in manufacturing, fabrication, construction, and heavy engineering sectors is driving this prominence. These industries require high-performance tools that support consistent output, safety, and operational durability.

Electric power tools are being increasingly adopted in production environments to enhance productivity while reducing physical effort and tool maintenance. Their ability to perform intensive operations with precision and reduced noise levels supports widespread industrial usage. Additionally, the push toward automation and lean manufacturing has encouraged companies to integrate efficient and low-maintenance equipment.

With factories and job sites emphasizing reduced downtime and worker safety, the preference for electric over pneumatic tools has become more apparent. Continued investment in industrial infrastructure is expected to reinforce the dominance of this application segment in the years ahead.

The electric power tools market is driven by growing DIY demand, professional applications in construction, and the popularity of cordless tools. E-commerce expansion is further broadening market access, propelling consistent growth across diverse sectors.

The electric power tools market is experiencing increased demand from the DIY sector, driven by a growing interest in home improvement projects. Consumers are becoming more inclined to invest in high-quality power tools to tackle home repairs and renovations. This shift is fueled by the rise in homeownership, with individuals seeking professional-level results without the cost of hiring experts. Easy access to instructional content, such as online tutorials, is empowering homeowners to take on more advanced projects. The availability of affordable, high-performance tools is further boosting market demand, with cordless and battery-powered tools being particularly popular for their convenience and versatility.

The construction industry is a major driver for the electric power tools market, with tools essential for heavy-duty tasks such as drilling, cutting, and grinding. Increased construction activity across residential, commercial, and infrastructure sectors is significantly contributing to the market's expansion. Electric power tools are integral for improving efficiency and reducing the time needed to complete complex tasks. As construction projects become larger and more complex, the demand for specialized power tools continues to rise. Additionally, there is an increasing need for durable, high-powered tools that can withstand the harsh conditions of construction environments, further fueling market growth.

Cordless electric power tools are gaining popularity due to their portability and ease of use, which are driving demand in both professional and DIY markets. The absence of cords allows for greater flexibility and mobility, making them ideal for outdoor and remote job sites. As battery technology improves, cordless tools are becoming more powerful, extending their appeal beyond basic household tasks to professional applications. This shift is especially noticeable in tools like drills, saws, and impact drivers, where high performance and long battery life are key requirements. The convenience offered by cordless models is pushing traditional corded tools into the background in many applications.

The rise of e-commerce is playing a pivotal role in expanding the electric power tools market. Online retail platforms allow consumers to easily access a wide variety of tools from multiple brands, with the convenience of home delivery. This is especially beneficial for DIY enthusiasts who might not have access to local hardware stores or specialized tool retailers. E-commerce platforms provide access to product reviews, tutorials, and detailed product information, helping consumers make informed purchasing decisions. The growing trend of online shopping is expanding the customer base for electric power tools, enabling manufacturers to reach global markets more effectively.

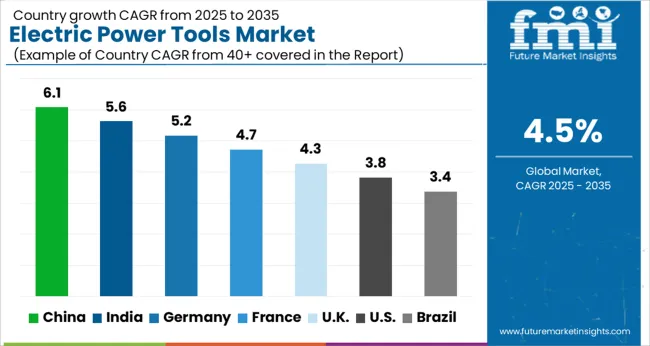

The electric power tools market is projected to grow at a global CAGR of 4.5% from 2025 to 2035, driven by increasing demand across sectors like construction, automotive, and home improvement. China leads with a CAGR of 6.1%, supported by robust construction activities, high demand for industrial tools, and growing DIY trends in urban areas. India follows at 5.6%, fueled by rising disposable incomes, expanding infrastructure projects, and increased interest in home improvement. Germany records a CAGR of 5.2%, supported by the country’s advanced manufacturing sector and strong adoption of automated solutions in industries. France experiences a 4.7% CAGR, driven by construction and home renovation projects that drive the demand for power tools. The UK achieves 4.3% growth, reflecting growing residential construction and DIY activities. The USA posts a CAGR of 3.8%, supported by demand in both professional and DIY sectors, as well as growth in home improvement trends. The study covers more than 40 countries, with these markets serving as key indicators for growth strategies, product innovation, and competitive positioning in the electric power tools industry.

China is projected to expand at a CAGR of 6.1% during 2025–2035, well above the global 4.5% baseline, as demand for electric power tools surges in the construction, automotive, and DIY sectors. In 2020–2024, growth of about 5.8% was driven by a rapid increase in infrastructure projects and the rising demand for high-performance tools across industries. The accelerated growth over the next decade is linked to continued urbanization, government-supported construction programs, and increasing use of cordless and battery-powered tools in various industries. Moreover, China's rapid industrialization and emphasis on energy-efficient products will drive further market growth. Companies are expected to focus on enhancing tool performance and expanding their product ranges to meet diverse needs.

India is projected to grow at a CAGR of 5.6% during 2025–2035, surpassing the global average. In 2020–2024, the market expanded at 5.2%, driven by the growing demand for electric power tools in both professional and DIY sectors. The upcoming period will benefit from rising disposable incomes, increased urbanization, and a focus on infrastructure development. Demand for high-quality tools, especially in construction, automotive, and home renovation, will continue to rise. E-commerce growth will further drive market accessibility, particularly in tier-2 and tier-3 cities, and the increased adoption of cordless tools will be a key growth driver. Domestic manufacturing and lower production costs are expected to further fuel market expansion.

France is projected to grow at a CAGR of 4.7% during 2025–2035, slightly above the global average. In 2020–2024, growth was around 4.3%, supported by the rising interest in home improvement, DIY activities, and construction projects. The upcoming growth will be driven by increasing investments in residential and commercial buildings, as well as rising demand for energy-efficient power tools. Consumers’ preference for cordless tools will also push market expansion. France’s focus on quality and eco-friendly products will increase the adoption of high-performance, durable electric power tools. Additionally, the growing interest in smart home technology is likely to boost demand for power tools in home automation projects.

The UK is projected to grow at a CAGR of 4.3% during 2025–2035. During 2020–2024, the market grew at a slower pace of 3.9%, driven by high demand in both the DIY and professional sectors. The expected rise in growth is attributed to increasing home renovations, residential construction, and DIY activities. The shift towards cordless power tools will drive demand, especially in residential and commercial sectors. Additionally, the rise of e-commerce platforms will boost market penetration, making power tools more accessible to consumers in urban and rural areas alike. The push for energy-efficient tools and the popularity of professional-grade tools among DIY enthusiasts will further enhance growth prospects.

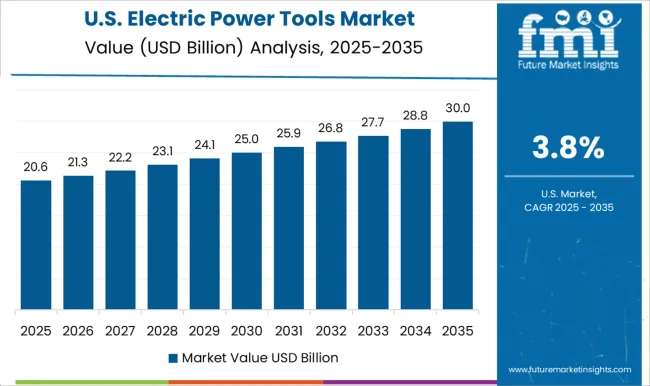

The USA electric power tools market is expected to grow at a CAGR of 3.8% during 2025–2035. During 2020–2024, the market grew at a CAGR of 3.5%, driven by increasing home improvement projects, commercial renovations, and DIY activities. The slower growth in the earlier period can be attributed to supply chain issues and fluctuating demand in the retail sector. However, the growth for 2025–2035 will benefit from a focus on smart homes, DIY activities, and increased adoption of advanced tools like smart power tools and cordless devices. Moreover, the market is expected to be supported by professional applications in construction, automotive, and repair industries.

The electric power tools market is characterized by intense competition among global and regional players offering a wide range of products for both professional and DIY applications. Techtronic Industries Co. Ltd. has established itself as a major player, known for its diverse portfolio of power tools under brands like Milwaukee and Ryobi. Atlas Copco AB holds a strong position with its industrial-grade tools and air compressors used across various sectors.

DeWalt continues to maintain a leadership role, driven by its extensive product range and global dealer network, particularly in construction and home improvement applications. Emerson Electric Co. is focusing on providing advanced power tools that incorporate smart technology, enhancing efficiency and user experience. Fein Power Tools Inc. has built a reputation for precision tools, catering to professionals in industries like automotive and metalworking. Festool Group stands out with its high-quality tools designed for woodworking, while Hilti Corporation excels in providing power tools for construction and civil engineering applications. Hitachi Koki Co., Ltd. is making strides in both professional-grade and consumer power tools, while Makita Corporation leads in cordless power tools with strong global distribution.

Milwaukee Electric Tool Corporation is known for its innovative cordless solutions, targeting professionals with heavy-duty tools. Panasonic Corporation produces high-performance tools, with a particular focus on advanced battery technology. Robert Bosch GmbH is a key player in the market, offering a diverse range of electric power tools across multiple industries. Snap-on Incorporated specializes in premium hand tools and automotive equipment. Stanley Black & Decker, Inc. holds a significant share with its extensive range of DIY and professional-grade power tools.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.5 Billion |

| Product | Drills and Fastening Tools, Hammers, Saws, Lawn Mowers, Vacuum cleaners, and Others |

| Type | Cordless and Corded |

| Application | Industrial, DIY, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Techtronic Industries Co. Ltd., Atlas Copco AB, DeWalt, Emerson Electric Co., Fein Power Tools Inc., Festool Group, Hilti Corporation, Hitachi Koki Co., Ltd., Makita Corporation, Milwaukee Electric Tool Corporation, Panasonic Corporation, Robert Bosch GmbH, Ryobi Limited, Snap-on Incorporated, and Stanley Black & Decker, Inc. |

| Additional Attributes | Dollar sales, market share by region and product category, and demand forecasts for different sectors like construction, automotive, and DIY |

The global electric power tools market is estimated to be valued at USD 50.5 billion in 2025.

The market size for the electric power tools market is projected to reach USD 78.4 billion by 2035.

The electric power tools market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in electric power tools market are drills and fastening tools, hammers, saws, lawn mowers, vacuum cleaners and others.

In terms of type, cordless segment to command 64.8% share in the electric power tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA