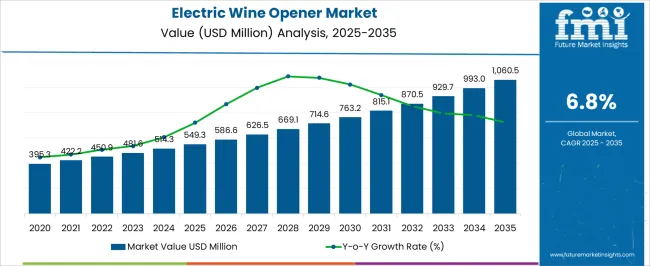

The Electric Wine Opener Market is estimated to be valued at USD 549.3 million in 2025 and is projected to reach USD 1060.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. During the initial phase from 2020 to 2030, the market value rises from USD 395.3 million to around USD 669.1 million, driven by growing consumer interest in convenience and innovative kitchen appliances.

The rising popularity of wine culture, the increasing number of wine consumers globally, and the desire for enhanced user experience in home and hospitality settings fuel market expansion. Technological improvements in battery efficiency, ergonomic designs, and ease of use contribute to higher adoption rates.

Additionally, increasing e-commerce penetration and digital marketing initiatives enable wider product reach and consumer awareness. From 2031 to 2035, the market accelerates, growing from USD 714.6 million to USD 1,060.5 million. This phase benefits from continued innovation, including smart and automated features integrated with Internet of Things (IoT) technology, enhancing product functionality and connectivity. Emerging markets exhibit rapid uptake due to rising disposable incomes and changing lifestyle preferences. Strategic collaborations, product diversification, and focus on sustainability in materials further boost market potential. Overall, the electric wine opener market is poised for robust and sustained growth through 2035, driven by evolving consumer demands, technological advancements, and expanding global wine culture.

| Metric | Value |

|---|---|

| Electric Wine Opener Market Estimated Value in (2025 E) | USD 549.3 million |

| Electric Wine Opener Market Forecast Value in (2035 F) | USD 1060.5 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The electric wine opener market is witnessing accelerated traction as consumers increasingly adopt automated tools to enhance convenience, particularly in home and hospitality settings. Shifts in lifestyle trends, growth in home dining, and the premiumization of kitchen accessories have created favorable conditions for product adoption.

Rising awareness around user safety, ease of use, and aesthetic integration with modern kitchen setups has driven the replacement of manual openers with powered alternatives. Additionally, the gifting culture surrounding wine accessories has supported steady demand across both online and offline retail channels.

Advancements in battery life, ergonomic design, and recyclable packaging are further contributing to the expansion of this market. Looking ahead, innovations in smart connectivity and noise reduction technologies are expected to play a key role in differentiating offerings and attracting experience-focused consumers.

The electric wine opener market is segmented by product type, body frame material, price, end-use distribution channel, and geographic regions. The electric wine opener market is divided by product type into Cordless electric wine openers and Corded electric wine openers. In terms of body frame material, the electric wine opener market is classified into Metallic and Non-metallic. Based on the price, the electric wine opener market is segmented into Medium, Low, and High. The end use of the electric wine opener market is segmented into Household and Commercial. The distribution channel of the electric wine opener market is segmented into Online and Offline. Regionally, the electric wine opener industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

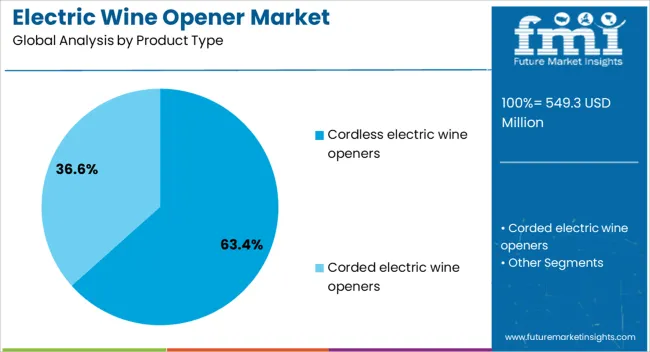

Cordless electric wine openers are projected to account for 63.40% of the total market revenue by 2025, establishing this as the dominant product type segment. The convenience of wireless operation, along with enhanced portability and minimal countertop clutter, has strengthened its preference among residential users.

The segment’s growth is also being influenced by compact form factors, rechargeable battery integration, and simplified one-touch mechanisms. These features have aligned with consumer expectations for user-friendly appliances and contributed to rising adoption, particularly in urban households.

Additionally, cordless designs are being positioned as premium lifestyle products, supporting their penetration in the gift and luxury accessory markets.

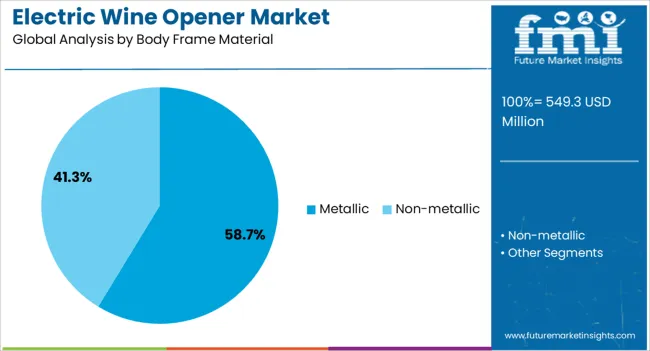

Metallic-bodied wine openers are expected to hold 58.70% of the market share by 2025, making them the leading material choice. This dominance is being driven by demand for long-lasting, visually premium, and durable appliances that reflect modern kitchen aesthetics.

Metal casings particularly stainless steel and brushed aluminum offer greater structural integrity and tactile appeal compared to plastic variants. The segment has also benefited from increasing interest in corrosion-resistant, eco-friendly, and recyclable components, which are key decision-making factors for environmentally conscious consumers.

As more brands adopt metal finishes for both performance and brand differentiation, the segment is expected to maintain its lead.

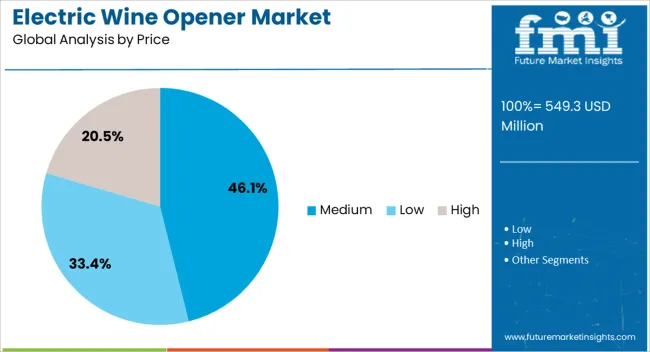

The medium-priced segment is projected to lead with 46.10% of the overall revenue share in 2025. This pricing tier balances affordability and feature-rich performance, appealing to both regular wine consumers and occasional users seeking value-added functionality.

The segment’s growth is being driven by rising middle-class disposable income, growing online product comparisons, and increasing preference for multifunctional yet budget-friendly gadgets. Consumers in this tier are typically drawn to durable builds, rechargeable systems, and integrated accessories like foil cutters and LED indicators.

Additionally, strong availability across e-commerce platforms and brand collaborations with lifestyle influencers have supported higher conversion rates within this pricing category.

Electric wine openers are thriving on at-home wine culture, functional enhancements, and growing hospitality adoption. Strategic branding and varied pricing continue to expand their reach across consumer and commercial segments.

The electric wine opener market is benefiting from the rise in at-home wine consumption, influenced by lifestyle changes and social dining trends. Consumers are increasingly seeking convenience and ease of use in wine-related accessories, making electric models a preferred choice over manual corkscrews. The ability to open bottles effortlessly appeals to both seasoned wine enthusiasts and casual drinkers. This demand is particularly strong in urban households, where space-saving, cordless designs fit well into compact kitchens. Gifting occasions, celebrations, and home entertainment setups have also fueled purchases, with electric wine openers often marketed as premium yet practical additions to a modern home bar. This shift has positioned them as a staple in home entertaining culture.

Manufacturers are focusing on combining functionality with modern aesthetics to cater to both practical and style-conscious buyers. Features such as built-in foil cutters, rechargeable batteries, LED indicators, and one-touch operation enhance ease of use and product value. Premium materials, sleek finishes, and ergonomic designs make these devices appealing as display pieces as well as functional tools. Limited edition models and collaborations with wine brands are being used to target niche customer segments. Compact, travel-friendly variants also serve consumers who enjoy wine outdoors or during events. The blend of performance and visual appeal strengthens their desirability across diverse consumer groups.

Electric wine openers are gaining adoption in restaurants, bars, wineries, and event venues where efficiency and consistency are essential. Their ability to open multiple bottles quickly without cork breakage improves service speed and customer experience. For sommeliers and bartenders, these tools reduce wrist strain and maintain bottle presentation standards. In the event catering sector, portable and high-capacity battery models are in demand for large gatherings. The hospitality industry’s emphasis on service efficiency and reliability makes electric wine openers a worthwhile investment. Bulk purchasing by commercial buyers also supports steady market demand, especially in regions with vibrant wine tourism and tasting events.

The competitive landscape includes both high-end brands offering premium designs and budget-friendly options targeting mass retail. Brand loyalty plays a role, with established kitchen appliance manufacturers leveraging their reputation to introduce wine accessory lines. E-commerce channels are expanding consumer access to varied price points and styles, encouraging impulse purchases and seasonal promotions. Differentiation is often achieved through packaging, product bundling, and after-sales support such as warranty extensions. Competitive pricing strategies help capture emerging markets, while luxury branding appeals to gift buyers. The segmentation across multiple price tiers allows the market to cater to diverse consumer needs while maintaining steady overall growth.

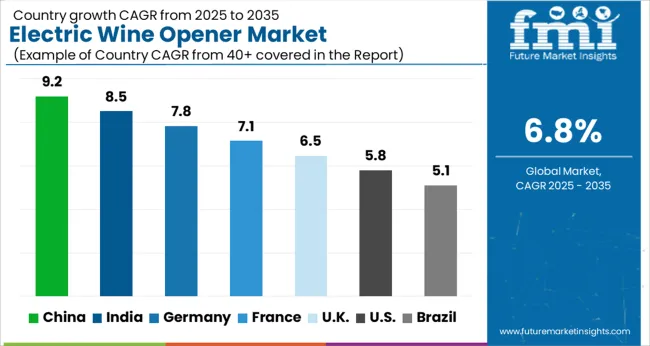

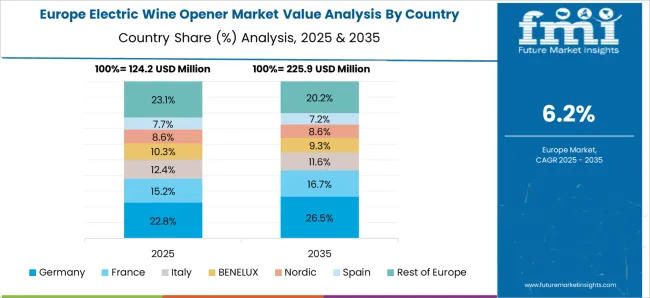

The electric wine opener market is projected to grow globally at a CAGR of 6.8% from 2025 to 2035, driven by increasing demand for convenience in wine opening, technological advancements, and rising consumer preference for premium kitchen gadgets. China leads with a CAGR of 9.2%, supported by the growing popularity of wine culture, rapid urbanization, and rising disposable incomes. India follows at 8.5%, fueled by expanding middle-class affluence, a growing wine market, and increased adoption of kitchen automation. France grows at 7.1%, benefiting from its strong wine culture and a shift toward modern kitchen appliances. The United Kingdom achieves 6.5%, driven by demand for premium and innovative kitchen gadgets in both the home and hospitality sectors.

The United States records 5.8%, influenced by steady demand in both residential and commercial settings, with a growing interest in high-tech wine accessories. This growth trajectory highlights the growing importance of convenience and quality in wine-related consumer goods across both emerging and mature markets.

The UK’s electric wine opener market grew at a CAGR of 5.1% from 2020 to 2024 and is projected to rise to 6.5% during 2025–2035. The market experienced moderate growth in the initial phase due to slower adoption, with most consumers preferring manual wine openers. However, the growth accelerated in the following decade, driven by increasing demand for convenience and the growing popularity of wine culture in the UK. Additionally, the rise of premium kitchen gadgets, greater consumer awareness about high-tech wine accessories, and the growing trend of gifting wine-related products have contributed to the market's expansion. In the upcoming decade, as more consumers embrace innovation in their kitchens and hospitality venues seek modern wine-related gadgets, the demand for electric wine openers will likely see further significant growth.

China’s electric wine opener market is projected to grow at a CAGR of 9.2% during 2025–2035, leading the global market with an impressive pace. The market expanded at a CAGR of 7.8% from 2020 to 2024, driven by rapid urbanization, rising disposable incomes, and a growing wine culture. In the coming decade, the growth rate is expected to rise further due to China’s increasing interest in premium consumer electronics, convenience products, and modern kitchen appliances. The strong rise in wine consumption, especially in urban areas, combined with the adoption of high-tech solutions in the food and beverage sector, will significantly fuel demand. Furthermore, the increasing gifting culture in China, particularly for premium items like electric wine openers, will contribute to higher market penetration.

India’s electric wine opener market is expected to grow at a CAGR of 8.5% from 2025 to 2035, above the global average of 6.8%. The market grew at 7.2% during 2020–2024, driven by rising disposable incomes, growing middle-class demand for convenience, and a slow yet steady rise in wine consumption. The rapid growth expected in the next decade is tied to India’s increasing exposure to international wine markets, a growing interest in modern kitchen gadgets, and expanding consumer preferences for premium lifestyle products. The increased focus on luxury living and the expanding gifting culture will further fuel the demand for electric wine openers. With more people investing in high-quality kitchen gadgets, the market for electric wine openers will continue to rise as convenience becomes a significant selling point.

France, with its rich wine culture, is set to see the electric wine opener market grow at a CAGR of 7.1% during 2025–2035. The market grew at 6.2% from 2020 to 2024, supported by the French affinity for wine and the increasing adoption of modern kitchen gadgets. As France continues to embrace innovation in its food and beverage sector, the demand for high-tech wine accessories such as electric wine openers will rise. The increasing popularity of wine-related products in both the home and hospitality sectors, along with the growing trend of offering premium kitchen gadgets as gifts, will significantly contribute to the market’s expansion in the coming years.

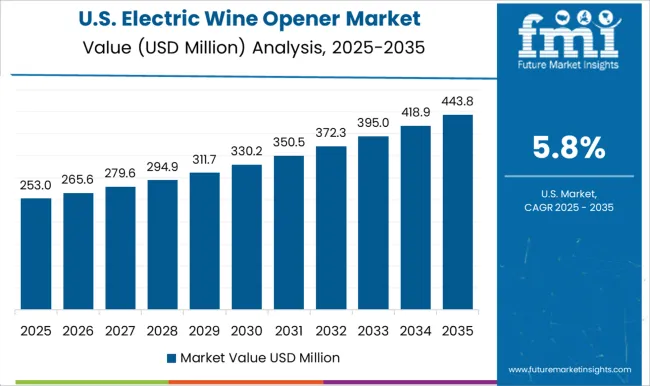

The electric wine opener market in the United States is forecast to grow at a CAGR of 5.8% during 2025–2035, slightly lower than the global average of 6.8%. During 2020–2024, the market grew at a CAGR of 5.2%, driven by steady interest in wine-related gadgets, both in residential and commercial sectors. The market is poised for growth in the coming decade, thanks to increasing demand for convenience and innovation in wine services. The trend of premiumization in kitchen gadgets, particularly in wine accessories, and the expanding use of electric wine openers in upscale hotels, restaurants, and events will further drive adoption. The preference for easy-to-use, durable, and stylish wine openers in home kitchens will contribute to continued market growth.

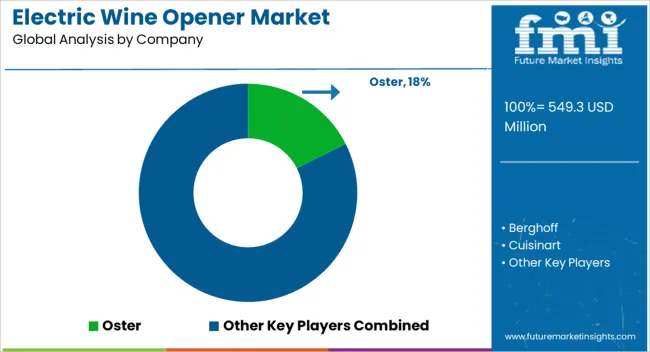

The electric wine opener market is shaped by a mix of established kitchen appliance brands and specialized wine accessory companies, each offering varied designs, features, and price points to appeal to both consumer and commercial buyers. Oster maintains strong visibility with widely distributed, affordable electric wine openers targeting everyday users. Berghoff and Cuisinart leverage their premium kitchenware reputations to offer high-quality, design-focused models. Hamilton Beach and Kalorik focus on functionality, affordability, and retail presence in mass-market channels. Mueller Living, Ozeri, and Secura emphasize ergonomic designs and rechargeable solutions for convenience-driven consumers. Rabbit Wine and Vacu Vin are recognized for their innovative approach to wine preservation and opening systems. Tescoma and Vinomax cater to regional markets with compact, stylish offerings. Waring Commercial serves the hospitality sector with durable, high-capacity openers. Wine Enthusiast positions itself as a lifestyle brand with upscale, gift-worthy designs, while Zyliss balances affordability with user-friendly features. Competitive strategies revolve around aesthetic differentiation, multi-functionality, bundled accessories, and targeted marketing through e-commerce, department stores, and specialty retailers. With gifting occasions and at-home wine culture driving sales, brands continue to focus on design innovation, portability, and battery life to capture a broader audience.

Manufacturers are developing wine openers with innovative cork removal mechanisms. These openers provide more efficient and consistent performance, preventing issues like cork breakage. Some devices use aerodynamic suction or twist-action mechanisms that ensure effortless cork removal with minimal effort. The incorporation of advanced gear systems allows for smoother extraction of both natural and synthetic corks, which is a major advancement over traditional manual corkscrews.

| Item | Value |

|---|---|

| Quantitative Units | USD 549.3 Million |

| Product Type | Cordless electric wine openers and Corded electric wine openers |

| Body Frame Material | Metallic and Non-metallic |

| Price | Medium, Low, and High |

| End Use | Household and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oster, Berghoff, Cuisinart, Hamilton Beach, Kalorik, Mueller Living, Ozeri, Rabbit Wine, Secura, Tescoma, Vacu Vin, Vinomax, Waring Commercial, Wine Enthusiast, and Zyliss |

| Additional Attributes | Dollar sales, share, regional demand growth, competitive landscape, pricing trends, product feature preferences, distribution channel performance, seasonal sales patterns, consumer demographics, gifting market potential, e-commerce penetration. |

The global electric wine opener market is estimated to be valued at USD 549.3 million in 2025.

The market size for the electric wine opener market is projected to reach USD 1,060.5 million by 2035.

The electric wine opener market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in electric wine opener market are cordless electric wine openers and corded electric wine openers.

In terms of body frame material, metallic segment to command 58.7% share in the electric wine opener market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA