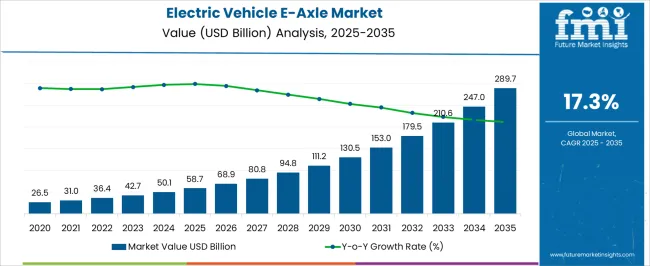

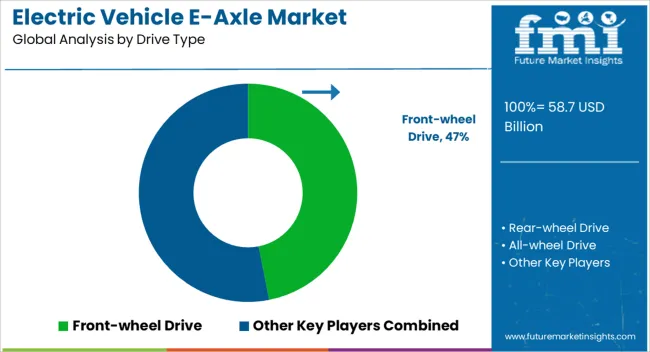

The electric vehicle e-axle market was valued at USD 58.7 billion in 2025 and is projected to reach USD 289.7 billion by 2035, reflecting a CAGR of 17.3%. The 10-year growth comparison indicates a consistent upward trajectory, with values rising from USD 68.9 billion in 2026 to USD 247 billion in 2034 before reaching the forecasted figure. This growth highlights the growing reliance on integrated e-axle systems to improve vehicle efficiency, torque management, and drivetrain performance in electric vehicles.

The comparison demonstrates how market expansion is being driven by the convergence of consumer demand for EVs and the need for compact, high-performance drivetrain solutions, positioning e-axle suppliers at the center of the evolving automotive value chain. The electric vehicle e-axle market stood at USD 58.7 billion in 2025 and is expected to advance to USD 289.7 billion by 2035, maintaining a CAGR of 17.3%.

Year-on-year increments highlight a structured growth pattern, with values moving from USD 80.8 billion in 2027 to USD 210.6 billion in 2033. The 10-year growth comparison reflects the adoption of e-axles in passenger, commercial, and performance EV segments, where integrated solutions are preferred over conventional drivetrain systems.

The sustained growth indicates that manufacturers who focus on high-efficiency e-axle designs, modular platforms, and supply chain integration are likely to capture a significant share of the market. The trend also suggests that the e-axle market is becoming a critical enabler of electric mobility and performance differentiation across vehicle segments.

| Metric | Value |

|---|---|

| Electric Vehicle E-Axle Market Estimated Value in (2025 E) | USD 58.7 billion |

| Electric Vehicle E-Axle Market Forecast Value in (2035 F) | USD 289.7 billion |

| Forecast CAGR (2025 to 2035) | 17.3% |

The electric vehicle e-axle market has been increasingly recognized as a strategic segment within several larger parent industries, each reflecting measurable adoption and operational influence. Within the electric vehicle drivetrain market, e-axles account for approximately 6.7%, driven by their role in integrating motor, power electronics, and transmission into a compact, high-efficiency unit that optimizes torque delivery and vehicle performance. In the automotive electric motor market, the share is estimated at 7.1%, reflecting the reliance on e-axle solutions to enhance propulsion efficiency, reduce mechanical losses, and simplify vehicle architecture. The vehicle transmission systems market records a penetration of about 5.8%, as e-axles streamline power transmission, reduce component count, and support modular drivetrain designs for various EV platforms. Within the automotive components market, e-axles contribute roughly 6.3%, highlighting adoption for compact packaging, weight reduction, and improved manufacturing efficiency. In the electric mobility market, the share is around 6.0%, driven by the growing integration of e-axle solutions in passenger, commercial, and utility electric vehicles to meet performance and reliability requirements.

Collectively, these parent sectors indicate that the electric vehicle e-axle market represents approximately 31.9% across these industries, underscoring its strategic relevance in modern EV architecture. Its adoption has been influenced by the need for efficiency, compactness, and operational reliability, prompting manufacturers to integrate e-axles as core components. The market has been shaping design strategies, production planning, and competitive positioning, establishing electric vehicle e-axles as pivotal enablers in the evolution of electric mobility and automotive electrification.

The electric vehicle e-axle market is witnessing robust growth, fueled by the accelerating global shift towards electrification and the push for higher drivetrain efficiency. Government incentives, emission regulations, and advancements in integrated propulsion systems have positioned e-axles as a pivotal technology in modern EV architecture.

The market’s current trajectory reflects increased adoption across both hybrid and battery electric platforms, with manufacturers focusing on modular, scalable designs to meet diverse vehicle specifications. Cost optimization through component integration, combined with reduced weight and improved power density, has strengthened the technology’s appeal in both premium and mass-market segments.

Rising production volumes in electric passenger cars and light commercial vehicles further contribute to demand stability. Looking ahead, continued investment in high-efficiency motors, compact gearing systems, and advanced thermal management solutions will underpin market expansion, making e-axles a central enabler in the global electric mobility ecosystem.

The electric vehicle e-axle market is segmented by propulsion, component, vehicle type, and geographic regions. By propulsion, electric vehicle e-axle market is divided into Hybrid and Electric. In terms of component, electric vehicle e-axle market is classified into Motor, Transmission, Power Electronics, and Others. Based on vehicle type, electric vehicle e-axle market is segmented into Passenger Cars and Commercial. Regionally, the electric vehicle e-axle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

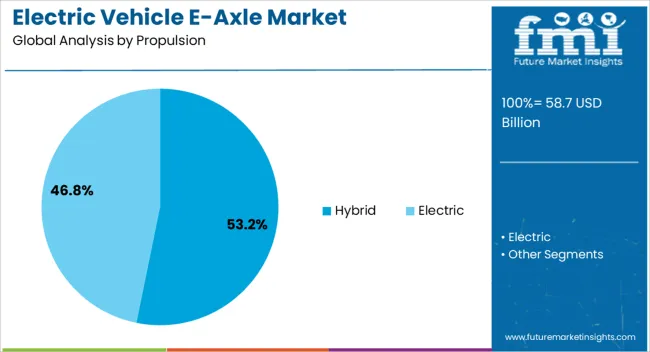

The hybrid segment accounts for approximately 53.2% of the electric vehicle e-axle market, driven by the strategic role hybrids play in the transitional phase towards full electrification. Adoption has been supported by their ability to deliver improved fuel efficiency and lower emissions while leveraging existing refueling infrastructure.

The integration of e-axles in hybrid configurations enables efficient torque distribution, regenerative braking, and optimized energy recovery, enhancing overall vehicle performance. Regulatory pressures in major automotive markets have accelerated hybrid deployment as a compliant yet cost-effective solution.

Manufacturers have increasingly adopted modular e-axle designs for hybrids to streamline production and reduce development costs. With consumer demand favoring practical electrification solutions and OEMs investing in hybrid lineups, the segment’s dominance is expected to persist during the forecast period, supported by continued global penetration in markets with developing EV infrastructure.

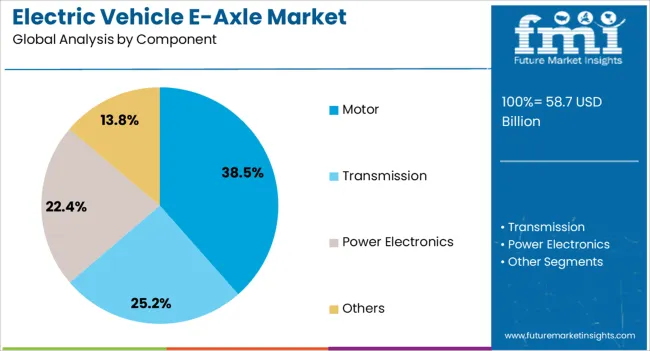

The motor segment leads the component category with a 38.5% share, reflecting its critical role as the primary driver of e-axle performance. The demand for high-efficiency, compact, and lightweight electric motors has intensified as OEMs seek to maximize range and minimize energy loss. Permanent magnet synchronous motors and induction motors have been widely adopted due to their high torque density and operational reliability.

Integration within the e-axle system reduces complexity by eliminating the need for separate motor housings and drivetrain linkages. Ongoing advancements in motor cooling, materials engineering, and power electronics integration have further enhanced their efficiency and durability.

The segment benefits from economies of scale as EV production volumes rise, leading to cost reductions and wider accessibility. With technological innovation and supply chain maturity, the motor segment is poised to retain its leadership position within the e-axle component landscape over the coming years.

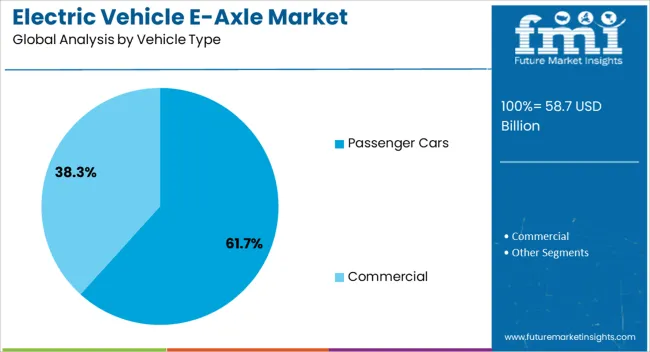

Passenger cars dominate the vehicle type category, holding a 61.7% share of the electric vehicle e-axle market. This leadership stems from the rapid electrification of the passenger vehicle segment, driven by consumer demand for efficient, low-emission mobility solutions. The adoption of e-axles in passenger cars enables improved cabin space utilization, reduced drivetrain weight, and enhanced vehicle handling dynamics.

The scalability of e-axle designs allows seamless integration into hatchbacks, sedans, and SUVs, broadening their application scope. Rising investments by global automakers in dedicated EV platforms have accelerated e-axle deployment in mass-market and premium passenger cars alike.

Additionally, supportive policy frameworks, urban clean-air initiatives, and expanding charging infrastructure have reinforced market penetration in this segment. With continuous improvements in energy efficiency, driving range, and affordability, the passenger car segment is expected to sustain its dominant position in the forecast period.

The electric vehicle e-axle market has been characterized by strong demand from automakers seeking compact, efficient, and integrated drivetrain solutions. Opportunities have been created through the rising adoption of battery-powered vehicles, modular designs, and scalable production strategies. Trends indicate an accelerating shift toward integrated motor-transmission systems, higher torque efficiency, and partnerships among suppliers and OEMs. However, challenges remain in the form of high development costs, supply chain disruptions, and performance concerns under varied driving conditions. The market has been positioned as highly dynamic yet competitive.

The demand for electric vehicle e-axles has been consistently reinforced by the preference for compact, integrated drivetrain systems that combine motors, power electronics, and transmissions into a single unit. Automakers have been seen turning to e-axle solutions to reduce vehicle weight, improve space efficiency, and enhance power output. Demand has grown not just from passenger EV manufacturers but also from commercial vehicle producers looking for better energy efficiency and longer driving ranges. The need for lowering production complexity while improving overall system reliability has further supported this demand. Battery-electric platforms have been observed requiring optimized axle solutions to deliver higher torque and smoother acceleration, making e-axles a preferred choice across multiple segments. As regulatory pressures for clean mobility tighten, the reliance on efficient drivetrain solutions has ensured that demand for e-axles remains on an upward trajectory.

Opportunities in the electric vehicle e-axle market have been shaped by modularity, scalability, and the ability to customize drivetrain components for different classes of vehicles. Manufacturers have been seen pursuing modular e-axle designs that can be adapted to both passenger and heavy-duty EVs, offering flexibility in deployment. Opportunities lie in scalable mass production models where economies of scale could bring down the cost of e-axle integration, making it more feasible for mid-range and budget EVs. Partnerships between automakers and specialized e-axle suppliers have also been identified as an expanding opportunity to accelerate platform development. Furthermore, the growing penetration of commercial fleets powered by electricity has opened avenues for higher-capacity e-axles that can support intensive usage. These opportunities underline how adaptability, scalability, and collaboration are reshaping the competitive dynamics of this market.

Trends in the electric vehicle e-axle market have pointed toward a clear move to higher efficiency, stronger torque output, and deeper integration with electronic control systems. Automakers have been observed placing greater importance on delivering smoother power transfer and extended battery ranges, supported by efficient e-axle configurations. The market is witnessing a trend toward combining multiple drivetrain functions into a single integrated housing, which reduces energy loss and manufacturing complexity. Lightweight materials, enhanced cooling systems, and advanced lubrication methods have further shaped these evolving trends. The shift toward integrated control electronics has allowed e-axles to deliver predictive performance adjustments, aligning with growing demand for intelligent mobility. These trends strongly suggest that the market is gravitating toward smarter, more compact, and performance-oriented solutions that redefine how EV drivetrains are engineered and deployed.

The electric vehicle e-axle market has encountered persistent challenges, particularly concerning high development costs, raw material shortages, and inconsistent performance across diverse driving environments. The complexity of integrating motors, transmissions, and electronics into a single housing has raised engineering costs, making adoption less feasible for smaller manufacturers.

Supply chain bottlenecks, particularly for rare earth magnets and high-performance semiconductors, have further intensified these challenges. Performance variability under high loads and extreme weather conditions has been identified as a significant concern, as it can impact efficiency and durability. The lack of standardized testing protocols across regions has also slowed global adoption. Smaller OEMs have struggled to absorb the costs associated with e-axle deployment, resulting in an uneven competitive landscape.

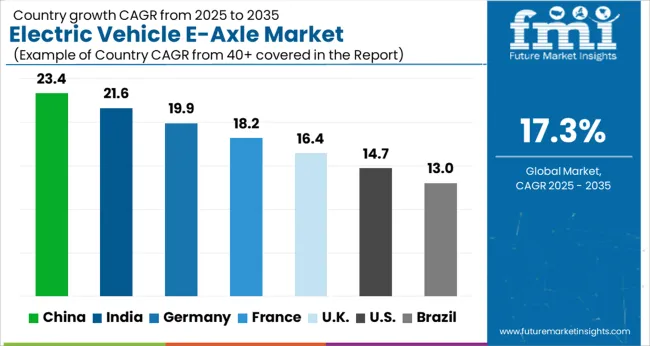

| Country | CAGR |

|---|---|

| China | 23.4% |

| India | 21.6% |

| Germany | 19.9% |

| France | 18.2% |

| UK | 16.4% |

| USA | 14.7% |

| Brazil | 13.0% |

The global electric vehicle e-axle market is anticipated to expand at a CAGR of 17.3% during 2025–2035. China leads with 23.4%, followed by India at 21.6% and Germany at 19.9%. The United Kingdom records 16.4%, while the United States grows at 14.7%. Market growth is being steered by rising EV adoption, cost optimization in drivetrains, and government support for cleaner mobility. Asian economies dominate through large-scale EV production, while European nations enhance their engineering expertise. The USA market progresses steadily with strong OEM participation. This report includes insights on 40+ countries; the top markets are shown here for reference.

The electric vehicle e-axle market in China is projected to grow at a CAGR of 23.4%, driven by its leadership in EV production and battery innovation. The country’s manufacturers are investing heavily in integrated e-axle systems that reduce vehicle weight, increase efficiency, and cut costs. Demand is reinforced by government subsidies, rising consumer acceptance of EVs, and strong commitments from domestic automakers to scale production. The competitive environment is further shaped by partnerships between global technology firms and Chinese OEMs, aimed at accelerating advancements in e-mobility.

The electric vehicle e-axle market in India is expanding at a CAGR of 21.6%, supported by government initiatives to boost EV adoption, rising fuel costs, and urban demand for clean transport. Domestic automakers are increasingly adopting integrated e-axle solutions to improve performance while reducing drivetrain complexity. Growth is reinforced by investments in localized manufacturing and the entry of international suppliers who are collaborating with Indian OEMs. With policies like FAME-II and state-level EV adoption incentives, the country is positioning itself as a fast-growing hub for e-axle deployment in two-wheelers, passenger cars, and commercial vehicles.

The electric vehicle e-axle market in Germany is advancing at a CAGR of 19.9%, underpinned by the country’s engineering expertise and global leadership in automotive manufacturing. German automakers are actively deploying e-axle systems to reduce drivetrain complexity and increase vehicle range. Growth is driven by rising investment in EV R&D, government support for emission reduction, and the strong presence of Tier-1 suppliers focusing on integrated solutions. The market also benefits from collaborations between OEMs and tech companies that are refining power electronics and motor integration for high-performance EVs.

The electric vehicle e-axle market in the United Kingdom is growing at a CAGR of 16.4%, with expansion supported by investments in EV production facilities, strategic collaborations, and policy frameworks encouraging clean transport. UK-based firms are adopting e-axle technologies to streamline vehicle assembly while reducing operational costs. Growth is reinforced by rising EV adoption in both passenger and commercial segments, supported by government targets to phase out internal combustion engines. The country’s position in the market is further boosted by R&D in lightweight materials and next-generation drivetrains.

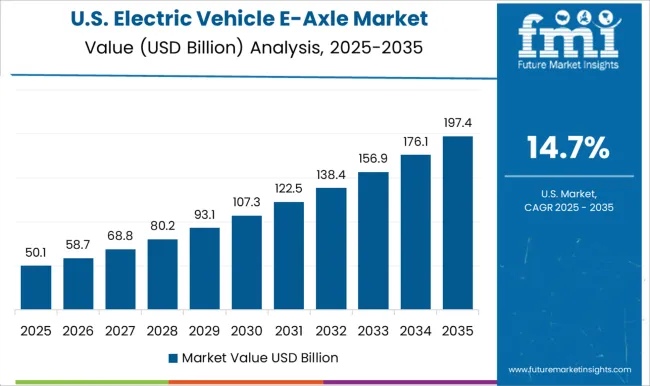

The electric vehicle e-axle market in the United States is recording a CAGR of 14.7%, driven by OEM commitments to electrification, rising consumer demand for EVs, and steady advancements in drivetrain technologies. Growth is reinforced by increasing collaboration between American automakers and global e-axle suppliers who are focusing on localized production. The market benefits from strong venture capital investment in EV technologies and government incentives promoting clean mobility. The adoption of e-axles is further supported by the expansion of EV charging infrastructure and rising demand for high-performance vehicles in both passenger and light commercial categories.

The electric vehicle e-axle market is being advanced by leading drivetrain and power electronics suppliers who are integrating motors, inverters, and gearboxes into compact, high-efficiency systems. BorgWarner Inc., ZF Friedrichshafen, and Dana Incorporated are being positioned as major players due to their long-standing expertise in drivetrain technology, which is now being directed toward electrified powertrains with scalable e-axle solutions for passenger and commercial EVs.

Continental AG and Robert Bosch GmbH are being recognized for engineering integration, embedding advanced motor control and inverter technologies that optimize energy conversion and extend range. Nidec Corporation is being noted as a core supplier of high-performance electric motors, with its compact solutions being deployed across multiple EV platforms. Siemens is being identified for its strong foothold in electrification infrastructure, leveraging its inverter and motor technology for robust e-axle systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.7 Billion |

| Propulsion | Hybrid and Electric |

| Component | Motor, Transmission, Power Electronics, and Others |

| Vehicle Type | Passenger Cars and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Front-wheel Drive, Rear-wheel Drive, All-wheel Drive, Company, BorgWarner Inc., Continental AG, Dana Incorporated, Nidec Corporation, Robert Bosch GmbH, Siemens, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by axle type (single-speed, multi-speed) and vehicle category (battery electric, plug-in hybrid, fuel cell) are key metrics. Trends include rising demand for integrated drivetrain solutions, growth in electric mobility adoption, and increasing use in passenger and commercial EVs. Regional adoption, automaker partnerships, and cost efficiencies are driving market growth. |

The global electric vehicle e-axle market is estimated to be valued at USD 58.7 billion in 2025.

The market size for the electric vehicle e-axle market is projected to reach USD 289.7 billion by 2035.

The electric vehicle e-axle market is expected to grow at a 17.3% CAGR between 2025 and 2035.

The key product types in electric vehicle e-axle market are hybrid, _hybrid electric vehicles (hevs), _plug-in hybrid electric vehicles (phevs), electric, _battery electric vehicles (bevs) and _vehicle cell electric vehicles (fcevs).

In terms of component, motor segment to command 38.5% share in the electric vehicle e-axle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Plastics Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Finance Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Communication Controller Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Cable and Plug Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Formation and Testing Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Relays Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Connector Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Reducer Market Growth - Trends & Forecast 2025 to 2035

Electric Vehicle Insulation Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA