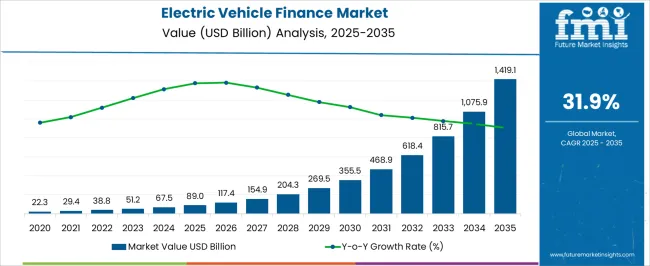

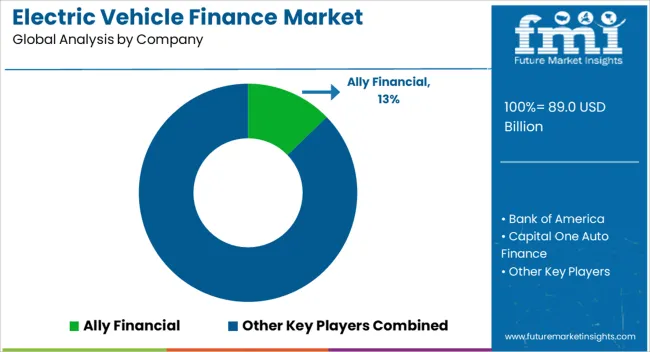

The electric vehicle finance market, valued at USD 89.0 billion in 2025 and forecasted to reach USD 1,419.1 billion by 2035 at a CAGR of 31.9%, demonstrates exponential scaling driven by rising electric vehicle adoption and supportive credit ecosystems. The cost structure of this market is shaped by capital outlays, interest rate management, risk assessment mechanisms, technology integration, and regulatory compliance. Financial institutions incur costs in customer acquisition, digital infrastructure, underwriting operations, and credit risk monitoring, while downstream expenses involve collections, customer support, and portfolio management.

The value chain begins with EV manufacturers and dealerships, which collaborate with banks, non-banking financial companies, and fintech players to design financing products such as loans, leasing, and subscription models. Financial intermediaries then manage credit evaluation, interest pricing, and repayment structures, while insurance providers and regulatory authorities form critical supporting links. Technology vendors enhance value through AI-driven credit scoring, blockchain-based contract security, and digital payment infrastructure. Post-financing, the chain extends to asset monitoring, refinancing, and resale markets, ensuring continued revenue streams.

From USD 89.0 billion in 2025 to USD 1,419.1 billion in 2035, growth reflects steep adoption curves and capital mobilization. Cost-efficiency through digitalization and optimized risk models is expected to determine profitability, making value creation reliant on integration between financial innovation and EV ecosystem expansion.

| Metric | Value |

|---|---|

| Electric Vehicle Finance Market Estimated Value in (2025 E) | USD 89.0 billion |

| Electric Vehicle Finance Market Forecast Value in (2035 F) | USD 1419.1 billion |

| Forecast CAGR (2025 to 2035) | 31.9% |

The electric vehicle finance market represents a distinct segment of the global automotive financial services industry, reflecting its essential role in accelerating electric mobility adoption. Within the broader automotive financing market, it holds about 7.1%, supported by the rising demand for flexible loan, lease, and subscription models tailored to electric vehicles. In the sustainable transportation finance sector, its share is around 6.4%, highlighting its position in enabling consumer affordability and fleet electrification.

Across the green investment and clean mobility funding space, it contributes about 5.2%, showing its role in bridging capital flows toward low-emission vehicles. Within the digital automotive finance ecosystem, the share is 4.6%, linked to technology-enabled platforms offering quick approvals and customized EV lending solutions. In the retail banking and automotive credit services category, the market accounts for 3.8%, emphasizing its alignment with institutional lending and evolving consumer credit dynamics.

Recent developments in this market focus on innovation in financial models, regulatory support, and partnerships between automakers and financial institutions. Subscription-based EV financing options have gained momentum, reducing ownership risk and improving flexibility. Green bonds and ESG-linked financing instruments are being directed toward expanding EV loan portfolios. Automakers and banks are collaborating on interest rate subsidies and low-cost loan packages to stimulate adoption.

Digital platforms are integrating AI-driven credit scoring and blockchain-based contract management to streamline approval processes. The government-backed guarantee schemes are emerging, lowering lending risks for financial institutions.

The electric vehicle finance market is witnessing accelerated growth, supported by increasing consumer demand for sustainable mobility and expanding access to structured financing products. Government-led incentives, tax rebates, and regulatory mandates promoting electric vehicle adoption are significantly influencing financing dynamics. As electric vehicles continue to gain popularity across both personal and commercial transportation, the role of tailored financial solutions has become critical in overcoming high upfront costs and encouraging mass adoption.

Financial institutions are innovating their lending models by offering lower interest rates, flexible repayment terms, and EV-specific loan products to attract a growing base of environmentally conscious consumers. The market is also benefiting from the emergence of digital lending platforms and fintech integrations, which are simplifying loan disbursement and approval processes.

Additionally, partnerships between OEMs and financial service providers are improving accessibility to credit, particularly in developing economies As the electric vehicle ecosystem matures and financing options become more inclusive and technology-driven, the market is expected to maintain a strong growth trajectory over the coming years.

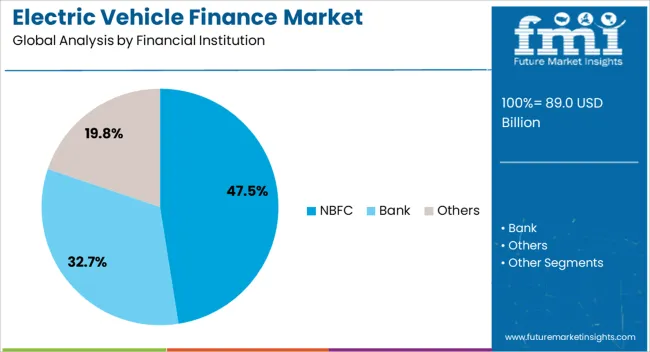

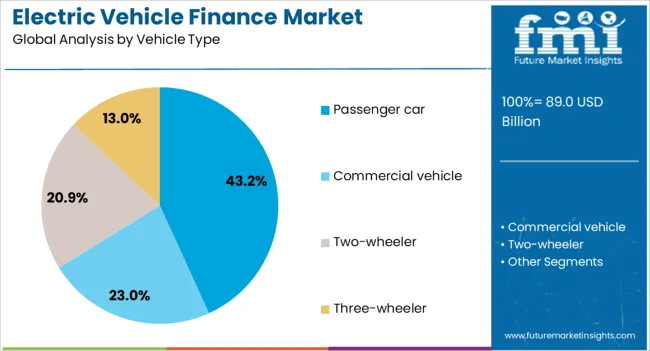

The electric vehicle finance market is segmented by financial institution, vehicle type, and geographic regions. By financial institution, electric vehicle finance market is divided into NBFC, Bank, and Others. In terms of vehicle type, electric vehicle finance market is classified into Passenger car, Commercial vehicle, Two-wheeler, and Three-wheeler. Regionally, the electric vehicle finance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The NBFC segment is projected to hold 47.5% of the electric vehicle finance market revenue share in 2025, establishing itself as the dominant financial institution category. This leadership is being driven by the flexibility and reach of non-banking financial companies, especially in underserved and semi-urban markets where traditional banks often have limited penetration. NBFCs are playing a pivotal role in increasing electric vehicle adoption by offering tailored loan structures with competitive interest rates and minimal documentation requirements.

Their ability to offer quick loan disbursement, simplified credit checks, and vehicle-specific financing solutions is enhancing consumer confidence and accessibility. The segment is also benefiting from strategic collaborations with electric vehicle manufacturers and dealerships, enabling end-to-end financing support at the point of sale.

Additionally, NBFCs are leveraging digital platforms to expand outreach and streamline customer onboarding, particularly among first-time vehicle buyers. With an increasing number of consumers seeking financing for electric mobility solutions, NBFCs are expected to maintain a leading position by addressing localized credit needs and offering customized lending options.

The passenger car segment is anticipated to account for 43.2% of the electric vehicle finance market revenue share in 2025, making it the leading vehicle type in terms of financed electric vehicles. This dominance is being fueled by the rising affordability of electric passenger cars, growing model availability, and heightened consumer awareness of sustainable transportation. Financial institutions are increasingly targeting this segment with customized loan products that align with evolving consumer preferences for eco-friendly and cost-efficient commuting options.

The segment is also gaining momentum due to government subsidies, zero-emission mandates, and favorable total cost of ownership compared to internal combustion engine counterparts. Improved resale value expectations and decreasing battery replacement concerns are further supporting financing for passenger EVs.

Additionally, the rapid development of EV infrastructure, including public and residential charging networks, is enhancing confidence among potential buyers. As personal mobility trends shift towards cleaner alternatives and urban transportation policies continue to favor electrification, the passenger car segment is expected to retain its position as the most financed vehicle type in the EV market.

The market is expanding as financial institutions, automakers, and governments introduce innovative solutions to support the rapid adoption of electric mobility. EV financing covers loans, leases, insurance, and subscription models tailored to reduce upfront costs and increase affordability. Rising global EV sales, coupled with incentives and subsidies, have stimulated the demand for structured financing. Financial players are designing products considering battery depreciation, resale value, and charging infrastructure costs. Strategic collaborations between automakers, banks, fintech firms, and energy companies are shaping this landscape.

The market has been driven by the introduction of diverse financing models that address consumer affordability. Traditional auto loans are being complemented by leasing schemes, battery leasing, and pay-per-use subscription programs. These models significantly lower upfront costs, enabling more consumers and fleet operators to switch to electric vehicles. Battery leasing, in particular, reduces depreciation concerns and provides flexibility for upgrades. Financial institutions are structuring EV loans with extended tenures and favorable interest rates to increase adoption. Leasing and fleet financing for ride-sharing, logistics, and last-mile delivery companies are becoming major growth drivers. By creating flexible financial pathways, these models enhance accessibility to EV ownership and strengthen overall market penetration.

Supportive policies and government-backed incentives are crucial to the expansion of EV financing. Subsidies, tax rebates, and reduced registration fees have encouraged lenders to design products that align with these schemes. In several countries, green financing frameworks and central bank guidelines promote favorable lending rates for EVs. Public-private partnerships are also being developed to expand credit access and enhance adoption in both consumer and commercial segments. Financing institutions are leveraging government guarantees and risk-sharing mechanisms to address credit concerns and improve loan approval rates. These policy interventions not only encourage affordability but also provide security for lenders, creating stability in the evolving EV finance ecosystem.

The growing integration of digital platforms and fintech innovation is reshaping EV finance. Online loan approvals, AI-based risk assessment, and blockchain-enabled smart contracts are improving transparency and efficiency. Subscription-based mobile applications are being launched by fintech firms to provide flexible usage and payment options for EV buyers. Integration with telematics and charging data helps lenders assess vehicle utilization patterns, enabling customized financial solutions. Predictive analytics and machine learning improve credit scoring, even for new borrowers in emerging markets. By digitizing lending, leasing, and insurance, fintech firms reduce processing times and lower transaction costs. This digital evolution enhances consumer experience, drives competition, and accelerates the scaling of EV financing solutions worldwide.

Despite growth opportunities, the EV finance market faces challenges linked to depreciation risks, uncertain residual values, and borrower defaults. Battery technology continues to evolve, creating uncertainties regarding the long-term resale values of financed vehicles. Lenders face credit risks, particularly in emerging economies with volatile interest rates and limited consumer credit histories. Fluctuations in government incentives can affect loan repayment capabilities and reduce market confidence. The higher upfront vehicle costs make defaults riskier for lenders compared to traditional vehicle loans. Financial institutions are mitigating these risks by integrating residual value guarantees, offering insurance-linked financing products, and forming partnerships with automakers to share depreciation risks. These measures provide stability but remain critical in securing long-term growth.

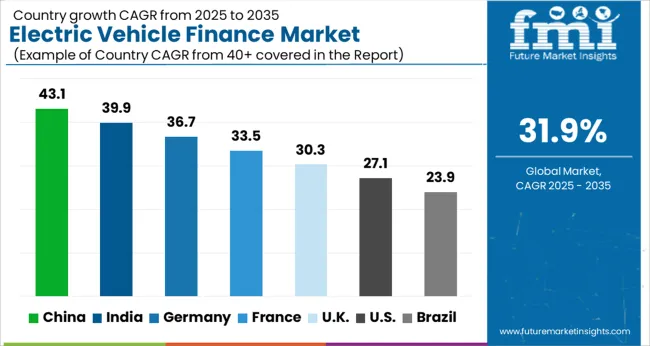

| Country | CAGR |

|---|---|

| China | 43.1% |

| India | 39.9% |

| Germany | 36.7% |

| France | 33.5% |

| UK | 30.3% |

| USA | 27.1% |

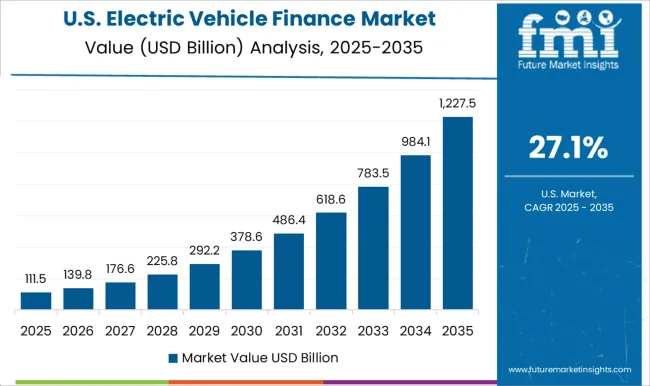

| Brazil | 23.9% |

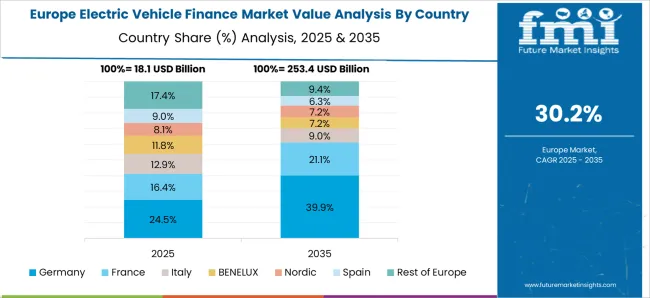

The market is forecast to advance at a CAGR of 31.9% between 2025 and 2035, supported by increasing EV adoption and the growing need for structured financing solutions. India marked 39.9%, showing strong demand driven by favorable policies and credit expansion for EV buyers. Germany recorded 36.7%, supported by automotive financial services and leasing models. China led with 43.1%, reflecting its dominant EV market and large-scale financing programs. The United Kingdom stood at 30.3%, benefiting from loan-based adoption schemes and leasing penetration. The United States accounted for 27.1%, with growth linked to private financing initiatives and specialized EV credit services. These nations represent the core regions advancing, scaling, and innovating financial structures for EV adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 43.1%, supported by rising EV penetration, favorable policies, and financial institutions offering tailored leasing and loan solutions. Demand has been reinforced by flexible repayment models and subsidies that reduce upfront costs. State owned banks and private lenders actively structure low interest financing programs to encourage adoption. Partnerships between automakers and fintech platforms are strengthening the financing ecosystem while increasing accessibility for individual buyers and fleet operators.

India is forecast to grow at a CAGR of 39.9%, driven by rapid EV adoption and supportive financing schemes. Public sector banks and non-banking finance companies are offering low interest loans with extended repayment cycles. Government backed credit guarantees and state incentives are making EV ownership financially viable. Rising adoption in the two wheeler and three wheeler segments increases the scope of microfinance and leasing solutions. Domestic fintech players are innovating by offering digital loan approvals and pay per use models.

Germany is expected to record a CAGR of 36.7%, supported by structured EV leasing programs and corporate fleet financing. Automotive banks and specialized leasing companies dominate the market with attractive monthly rentals. Federal incentives, including reduced company car taxes for EVs, drive leasing adoption among businesses. Digitization of loan processing by financial institutions improves market penetration. Increasing collaboration between German automakers and lenders ensures integration of financing within dealership sales channels.

The United Kingdom is forecast to expand at a CAGR of 30.3%, supported by personal contract purchase plans and green loan initiatives. Banks, credit unions, and auto finance providers are structuring flexible financing schemes with government backed incentives. Increased demand from ride hailing fleets and company car users supports broader financing adoption. Growth is reinforced by rising EV affordability and expanding financial product diversity.

The United States is projected to grow at a CAGR of 27.1%, supported by dealership financing, credit union programs, and federal incentives. EV adoption has been reinforced by tax credits and financing packages targeting both individuals and fleets. Leasing remains a strong segment, particularly for high end EVs, while fintech players are gaining ground with subscription based ownership models. Collaborations between automakers, banks, and digital lenders expand customer choice and improve affordability.

The market is evolving as automakers, banks, and financial service providers expand tailored financing solutions to accelerate EV adoption. Traditional banks such as JPMorgan Chase & Co, Wells Fargo, Bank of America, PNC Financial Services Group, and US Bank play a central role, offering auto loans and leasing options with competitive interest rates, incentivized by regulatory policies supporting clean transportation. Ally Financial, Capital One Auto Finance, Citizens Financial Group, and Santander Consumer USA emphasize flexible repayment structures, online lending platforms, and pre-approval systems to increase accessibility for EV buyers. Automaker-backed financial arms including Tesla Finance, Toyota Financial Services, Ford Credit, Nissan Motor Acceptance Corporation, and Volkswagen Financial Services provide integrated purchase and leasing packages tied to dealer networks. These institutions also extend specialized EV-related services such as charging infrastructure financing, battery leasing, and residual value guarantees.

TD Auto Finance and other niche players focus on digital-first lending platforms, enhancing consumer convenience and approval speed. The competitive landscape is influenced by digital transformation, green financing incentives, and partnerships between automakers and financial institutions. Players are prioritizing lower financing costs, subscription-based ownership models, and integration of carbon-neutral financial products to capture long-term market growth. Sustainability-linked loan structures and risk management around EV depreciation rates are becoming critical differentiators in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 89.0 Billion |

| Financial Institution | NBFC, Bank, and Others |

| Vehicle Type | Passenger car, Commercial vehicle, Two-wheeler, and Three-wheeler |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ally Financial, Bank of America, Capital One Auto Finance, Citizens Financial Group, Ford Credit, JPMorgan Chase & Co, Nissan Motor Acceptance Corporation, PNC Financial Services Group, Santander Consumer USA, TD Auto Finance, Tesla Finance, Toyota Financial Services, US Bank, Volkswagen Financial Services, and Wells Fargo |

| Additional Attributes | Dollar sales by financing type and end user, demand dynamics across leasing, loans, and fleet financing, regional trends in EV adoption support, innovation in digital platforms, credit assessment models, and subscription-based ownership, environmental impact of financing low-emission vehicles, and emerging use cases in shared mobility, battery-as-a-service models, and government-backed green financing programs. |

The global electric vehicle finance market is estimated to be valued at USD 89.0 billion in 2025.

The market size for the electric vehicle finance market is projected to reach USD 1,419.1 billion by 2035.

The electric vehicle finance market is expected to grow at a 31.9% CAGR between 2025 and 2035.

The key product types in electric vehicle finance market are NBFC, bank, and others.

In terms of vehicle type, passenger car segment to command 43.2% share in the electric vehicle finance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA