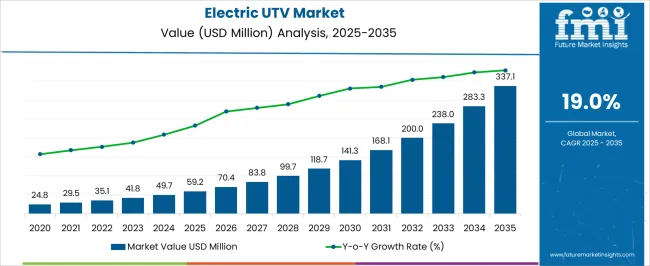

The electric UTV market is estimated to be valued at USD 59.2 million in 2025 and is projected to reach USD 337.1 million by 2035, registering a compound annual growth rate (CAGR) of 19.0% over the forecast period.

During this period, growth was concentrated among enthusiasts, small fleet operators, and niche recreational users. Early adopters tested performance, reliability, and operational feasibility, providing essential feedback for manufacturers. Adoption was gradual, with limited distribution networks and higher initial costs restricting widespread uptake. This phase established market credibility, enabling manufacturers to refine product offerings and prepare for broader acceptance in the next growth stage. From 2025 to 2030, the market enters the scaling phase, growing from USD 59.2 million to 141.3 million.

During this stage, adoption broadens across commercial, agricultural, and recreational segments, supported by expanded distribution, competitive pricing, and improved service networks. By 2030, as the market surpasses USD 141.3 million, it transitions into consolidation. Growth continues steadily to USD 337.1 million by 2035, driven by established players consolidating market share, standardizing production, and optimizing operations. This phase reflects a mature market with predictable demand, structured expansion, and a focus on efficiency rather than rapid adoption.

| Metric | Value |

|---|---|

| Electric UTV Market Estimated Value in (2025 E) | USD 59.2 million |

| Electric UTV Market Forecast Value in (2035 F) | USD 337.1 million |

| Forecast CAGR (2025 to 2035) | 19.0% |

The electric UTV market is experiencing accelerated growth, driven by increasing environmental regulations, rising fuel costs, and a growing shift toward electrified mobility in off-road vehicle categories. Market expansion is being supported by advancements in battery technology, improved powertrain efficiency, and increased demand for low-noise, low-maintenance vehicles in agricultural, recreational, and utility-based applications.

Original equipment manufacturers are focusing on developing performance-optimized electric models tailored for rugged terrains while reducing emissions and ownership costs. Rising adoption of electric vehicles in rural and industrial operations is contributing to the steady transition from internal combustion to electric UTVs.

Additionally, government incentives, improved charging infrastructure, and a growing emphasis on sustainable transportation are paving the way for wider commercial and private sector deployment As off-road electrification gains momentum across key regions, the Electric UTV market is positioned to benefit from both regulatory push and end-user preference for cleaner and more efficient vehicle solutions.

The electric UTV market is segmented by power range, application, price, and geographic regions. By power range, the market is divided into 10-30 kW, Below 10 kW, and Above 30 kW. In terms of application, the market is classified into utility, sports, recreation, and military. Based on price, the market is segmented into USD 20,000-30,000, below USD 20,000, and above USD 30,000. Regionally, the electric UTV industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 10-30 kW power range segment is projected to account for 46.3% of the electric UTV market revenue in 2025, making it the leading category in terms of power output. This leadership is being driven by the segment’s balance between energy efficiency and functional performance, meeting the demands of users requiring dependable torque for light to moderate off-road utility tasks.

These UTVs are well-suited for agricultural activities, light-duty hauling, recreational use, and rural property management, offering sufficient range and power while maintaining cost-effectiveness. The popularity of this segment has been reinforced by its compatibility with mid-capacity battery systems that deliver optimal runtimes without significantly increasing vehicle weight or cost.

Manufacturers have favored this range for its ability to offer multi-purpose capability while complying with most environmental and safety regulations Its dominance is expected to continue as users prioritize operational flexibility and affordability in electric vehicle ownership.

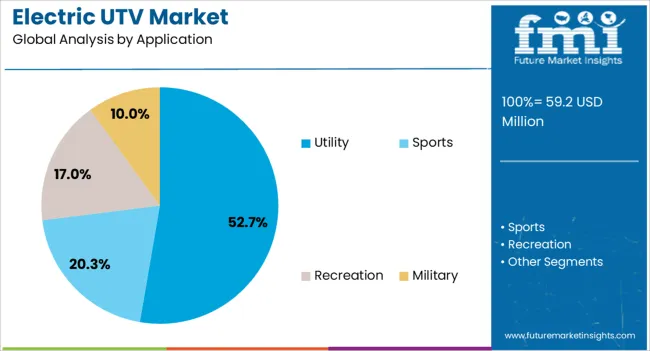

The utility application segment is anticipated to hold 52.7% of the market revenue in 2025, establishing it as the dominant use case within the market. This is being attributed to the increasing use of electric UTVs in municipal services, agriculture, construction sites, and industrial environments where routine transportation, towing, and cargo hauling are essential.

Growth in this segment has been supported by the vehicle’s ability to operate quietly and efficiently in populated or environmentally sensitive areas. Utility operations demand robust and reliable off-road performance, which electric UTVs are increasingly capable of delivering due to improved torque characteristics and better drivability.

In addition, fleet operators have shown growing interest in adopting electric utility vehicles to reduce fuel consumption, lower maintenance costs, and meet sustainability targets The flexibility of electric UTVs to serve multiple field-level applications with reduced environmental impact has made this segment the top contributor to market revenues.

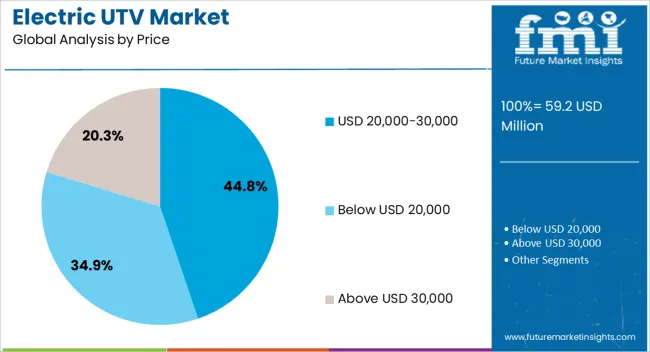

The price segment ranging from USD 20,000 to 30,000 is expected to represent 44.8% of the market revenue in 2025, making it the most significant price tier in the market. This dominance is being driven by the segment’s strong appeal to both commercial and recreational buyers seeking advanced features, longer battery life, and better build quality without entering premium pricing territory.

Vehicles in this price range often offer upgraded suspension systems, digital dashboards, enhanced safety features, and moderate off-road capability suited for varied terrains. The market’s shift toward value-based purchasing, where performance is balanced with cost, has positioned this price band as the preferred choice among mid-segment users.

Additionally, financing options, manufacturer-backed warranties, and rising availability of technologically competitive models within this range have further supported market growth As demand increases for cost-efficient electric UTVs that offer reliable utility and recreational usage, this price segment is set to maintain its leading position.

The electric UTV (Utility Task Vehicle) market is growing rapidly as consumers and commercial users seek eco-friendly, high-performance off-road vehicles. Increasing adoption is driven by environmental regulations, rising fuel costs, and a shift toward sustainable mobility solutions in agriculture, recreational, and industrial sectors. North America and Europe dominate due to early adoption of electric vehicles and supportive infrastructure, while Asia-Pacific is emerging as a key growth region. Market expansion focuses on battery innovation, extended range, and enhanced torque performance. Companies differentiate through durable designs, intelligent controls, and off-road capabilities, catering to both professional and recreational users.

Battery capacity, efficiency, and charging infrastructure remain major challenges for electric UTVs. Limited range and long charging times can restrict usability in commercial and recreational applications. Variability in battery quality, thermal management, and lifecycle affects performance and customer satisfaction. Manufacturers must optimize energy density, durability, and safety while complying with regulations on lithium-ion or alternative battery chemistries. Until advances in fast-charging and high-capacity batteries become mainstream, range limitations and charging constraints will continue to hinder widespread adoption and performance consistency.

Technological advancements are driving growth in the electric UTV market. Developments include high-capacity lithium-ion batteries, regenerative braking systems, lightweight materials, and advanced drivetrain technologies. Integration of intelligent controls, GPS-enabled navigation, and connected vehicle features improves operational efficiency and user experience. Innovations in torque optimization and suspension design enhance off-road capability. Companies investing in R&D for durable, high-performance electric UTVs create differentiation in both commercial and recreational segments. These technological improvements support extended range, improved safety, and increased adoption across diverse applications.

Electric UTVs face regulatory oversight related to vehicle safety, emissions, and road usage. Compliance with regional safety standards, battery disposal regulations, and off-road vehicle classifications is essential for market access. Some regions restrict electric UTVs on public roads, limiting operational flexibility. Certification requirements and evolving local regulations can delay product launch and market penetration. Manufacturers aligning vehicles with recognized safety and environmental standards gain credibility and smoother adoption. Until regulatory frameworks become consistent globally, companies must navigate complex compliance environments to ensure legal and safe deployment.

The electric UTV market is competitive, with established off-road vehicle manufacturers and new EV startups vying for market share. Supply chain challenges, including battery component availability, semiconductor shortages, and raw material costs, affect production scalability and lead times. Manufacturers investing in vertical integration, diversified sourcing, and local assembly facilities achieve greater reliability and cost efficiency. Competitive differentiation focuses on vehicle range, performance, durability, and innovative features. Until supply chain stability improves, production constraints and market rivalry will continue to influence adoption in recreational, industrial, and agricultural applications.

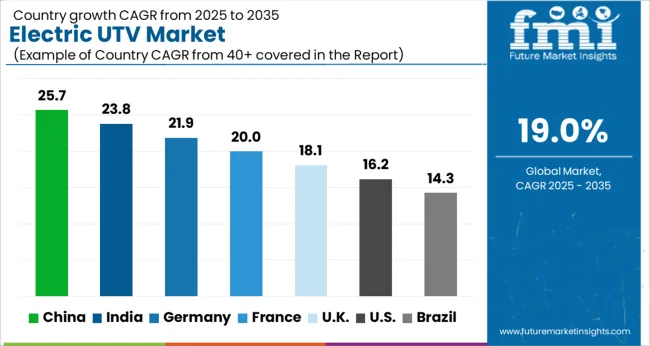

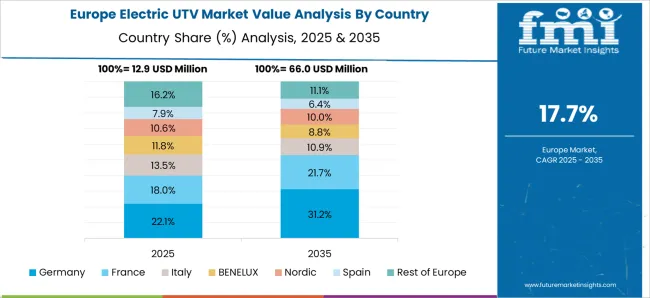

The global electric UTV market is projected to grow at a CAGR of 19.0% through 2035, supported by increasing demand across recreational vehicles, off-road utility operations, and commercial transport applications. Among BRICS nations, China has been recorded with 25.7% growth, driven by large-scale production and adoption in commercial and recreational sectors, while India has been observed at 23.8%, supported by expanding use in rural and industrial operations. In the OECD region, Germany has been measured at 21.9%, where production and deployment for off-road and utility applications have been steadily maintained. The United Kingdom has been noted at 18.1%, reflecting consistent adoption in recreational and industrial segments, while the USA has been recorded at 16.2%, with production and utilization for commercial and leisure applications being consistently increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The electric UTV market in China is growing at a CAGR of 25.7%, driven by the increasing adoption of electric off-highway vehicles across agriculture, construction, and recreational sectors. Rising environmental concerns, government incentives for electric vehicle adoption, and the push for zero-emission mobility support the market growth. Electric UTVs offer advantages such as reduced operating costs, low maintenance, and lower emissions, making them a preferred choice for industrial and recreational use. Technological advancements in battery efficiency, motor performance, and vehicle durability are further fueling adoption. Additionally, China’s focus on sustainable transportation solutions and the rapid expansion of EV infrastructure strengthen the market outlook. Growing consumer awareness and preference for eco-friendly vehicles also contribute to the rising demand for electric UTVs in China.

The electric UTV market in India is expanding at a CAGR of 23.8%, supported by increasing interest in electric mobility solutions in agriculture, construction, and off-road recreational activities. Electric UTVs provide low maintenance, reduced fuel costs, and eco-friendly operation, appealing to both commercial and recreational users. Government initiatives promoting EV adoption, subsidies for electric vehicles, and investment in charging infrastructure accelerate market growth. Indian manufacturers are developing advanced electric UTV models with improved battery performance and longer operating range to meet rising demand. The shift toward sustainable transportation and growing environmental awareness among consumers are expected to drive continuous expansion of the electric UTV market in India.

The electric UTV market in Germany is growing at a CAGR of 21.9%, fueled by industrial and recreational applications. Electric UTVs are increasingly adopted in agriculture, construction, and off-road leisure activities due to lower emissions, reduced operating costs, and high durability. Germany’s emphasis on green mobility, government incentives, and investment in EV infrastructure support market growth. Advanced battery technologies and efficient electric drivetrains enhance vehicle performance and range, meeting industrial and recreational requirements. The country’s robust automotive manufacturing ecosystem and research in electric mobility further accelerate market development. Consumer preference for sustainable and low-emission vehicles contributes to the adoption of electric UTVs in Germany.

The electric UTV market in the United Kingdom is expanding at a CAGR of 18.1%, driven by demand in recreational and industrial applications. Electric UTVs provide environmentally friendly mobility, lower operating costs, and quieter performance compared to conventional vehicles. Government policies promoting EV adoption, emission reduction targets, and financial incentives for electric vehicle buyers support market growth. Recreational activities, agriculture, and light industrial use are driving demand for electric UTVs in the UK. Technological improvements in battery range, durability, and vehicle safety enhance product appeal. As consumers and businesses increasingly prioritize sustainable transportation solutions, the electric UTV market in the UK is poised for steady growth.

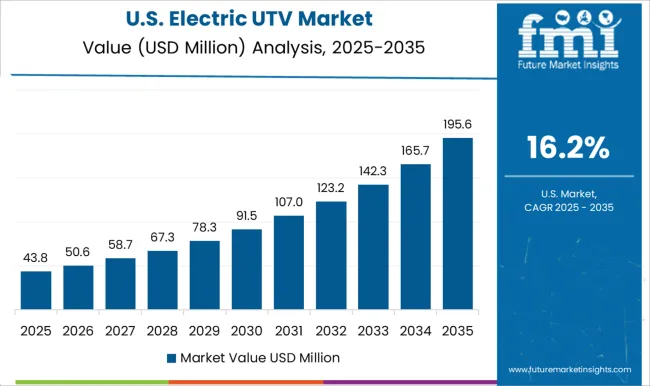

The electric UTV market in the United States is growing at a CAGR of 16.2%, with applications in agriculture, construction, and off-road recreation driving demand. Electric UTVs are valued for their low operating costs, eco-friendly operation, and quiet performance. Federal and state-level incentives for electric vehicles, coupled with growing awareness of environmental sustainability, support market expansion. Technological advancements in battery efficiency, motor performance, and vehicle durability make electric UTVs increasingly competitive with conventional models. Recreational off-road use, commercial applications, and a rising preference for zero-emission vehicles contribute to market growth. With continuous innovation and infrastructure support, the electric UTV market in the United States is expected to maintain steady growth.

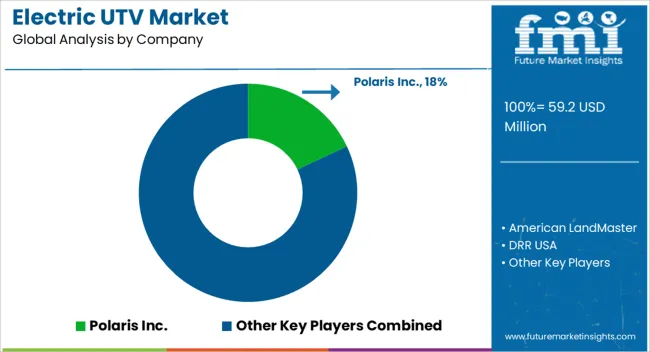

The electric UTV (utility task vehicle) market has witnessed significant growth driven by increasing demand for eco-friendly off-road vehicles, stricter emission regulations, and the rising popularity of recreational and utility vehicles for commercial applications. Electric UTVs offer benefits such as zero emissions, lower operational costs, quieter operation, and reduced maintenance compared to traditional internal combustion engine vehicles, making them suitable for agriculture, construction, recreational, and outdoor adventure sectors. Polaris Inc. is a key player in the electric UTV market, offering a range of high-performance vehicles designed for durability and versatility. American LandMaster provides electric utility vehicles with robust capabilities for both commercial and recreational use. DRR USA focuses on rugged off-road electric UTVs that combine power with eco-friendly performance. Hisun Motors Corporation USA delivers electric UTVs tailored for utility applications, while HuntVe offers electric models optimized for hunting and outdoor activities. INTIMIDATOR, LLC specializes in durable, high-capacity electric UTVs for industrial and recreational purposes.

Kaxa Motos and TRACKER OFF ROAD provide electric UTVs with innovative designs and enhanced battery efficiency for long-range performance. TUATARA VEHICLES focuses on advanced electric UTVs for extreme terrains, and Vanderhall Motor Works Inc. emphasizes compact, high-performance electric off-road vehicles. Volcon is recognized for its all-electric, high-torque off-road UTVs designed for both recreation and utility applications. As consumer interest in sustainable mobility continues to grow and technological advancements in batteries and electric drivetrains improve performance, these leading electric UTV suppliers and manufacturers are well-positioned to capitalize on the expanding market demand globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 59.2 Million |

| Power Range | 10-30 kW, Below 10 kW, and Above 30 kW |

| Application | Utility, Sports, Recreation, and Military |

| Price | USD 20,000-30,000, Below USD 20,000, and Above USD 30,000 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Polaris Inc., American LandMaster, DRR USA, Hisun Motors Corporation USA, HuntVe, INTIMIDATOR, LLC, Kaxa Motos, TRACKER OFF ROAD, TUATARA VEHICLES, Vanderhall Motor Works Inc., and Volcon |

| Additional Attributes | Dollar sales by type including recreational, utility, and sport UTVs, application across agriculture, construction, outdoor recreation, and military sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing adoption of electric mobility, rising demand for eco-friendly off-road vehicles, and technological advancements in battery and motor systems. |

The global electric UTV market is estimated to be valued at USD 59.2 million in 2025.

The market size for the electric UTV market is projected to reach USD 337.1 million by 2035.

The electric UTV market is expected to grow at a 19.0% CAGR between 2025 and 2035.

The key product types in electric UTV market are 10-30 kw, below 10 kw and above 30 kw.

In terms of application, utility segment to command 52.7% share in the electric UTV market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA