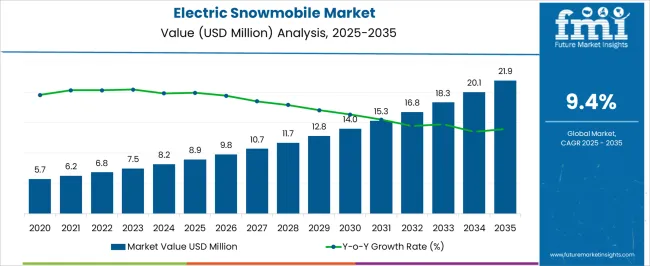

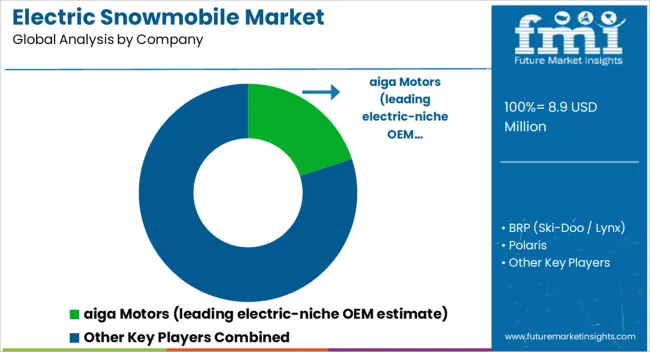

The electric snowmobile market is estimated to be valued at USD 8.9 million in 2025 and is projected to reach USD 21.9 million by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

The initial years from 2025 to 2027 demonstrate moderate growth as the market is shaped by limited consumer awareness, high upfront costs, and early-stage infrastructure availability. Early adopters, primarily environmentally conscious consumers, niche recreational users, and tour operators in regulated regions, are driving this phase. Technology validation, performance optimization, and charging accessibility represent critical focus areas during this introduction phase. Between 2028 and 2032, the market begins to transition into the growth stage.

Rising awareness of environmental benefits, supportive regulatory frameworks, and gradual improvements in battery range and reliability foster broader adoption. Snowmobile manufacturers expand electric portfolios to meet growing demand, and rental operators increasingly add electric models to fleets. Market acceleration is also influenced by regional policies aimed at reducing emissions in recreational and protected areas. By 2033 to 2035, the market is anticipated to approach the late growth stage, characterized by increasing consumer trust, declining costs, and wider availability across dealerships and leisure destinations. While the market has not yet reached maturity, its progression indicates that electrification in recreational mobility is steadily shifting from novelty to mainstream acceptance, supported by advancements in powertrain technologies and sustained policy encouragement.

| Metric | Value |

|---|---|

| Electric Snowmobile Market Estimated Value in (2025 E) | USD 8.9 million |

| Electric Snowmobile Market Forecast Value in (2035 F) | USD 21.9 million |

| Forecast CAGR (2025 to 2035) | 9.4% |

The electric snowmobile market is viewed as a fast evolving niche within powersports and outdoor mobility. It is estimated to hold 3.1% in powersports vehicles, as early adopters validate performance in cold climates. Within the snowmobile segment, an 8.9% share is assessed, supported by premium models and fleet pilots. In electric recreational vehicles, the share is 12.7%, driven by crossover interest from electric motorcycles and ATVs. Battery and power electronics for powersports account for 4.6%, due to compact high power systems.

Outdoor recreation rental and fleet services contribute 2.8%, as resorts and tour operators test low noise, low maintenance machines. Recent industry trends are defined by cold weather battery chemistry, lightweight chassis, and connected diagnostics. Groundbreaking moves include swappable battery sleds for rapid turnaround, integrated thermal management for subzero performance, and torque dense axial flux motors. Key players are partnering with cell suppliers for low temperature packs, with resorts for fleet trials, and with component firms for silent drivetrains. Strategies emphasize modular platforms, over the air updates, and regenerative braking tuned for snow traction. Aftermarket ecosystems are forming around fast chargers, heated storage, and telematics, which positions electric snowmobiles for broader consumer and fleet adoption.

The market is experiencing notable growth, driven by rising consumer interest in eco-friendly recreational vehicles and advancements in battery technology. Growing environmental regulations and incentives for zero-emission vehicles are accelerating the shift from traditional combustion engines to electric powertrains. Continuous improvements in battery capacity, charging infrastructure, and cold-weather performance are enhancing the practicality and appeal of electric snowmobiles.

Demand is further supported by the expansion of winter tourism activities and the increasing availability of electric snowmobile models across different performance categories. Manufacturers are focusing on integrating smart features, lightweight materials, and enhanced safety systems to cater to both professional and recreational users.

With consumer preferences shifting toward sustainable and cost-efficient solutions, the market outlook remains positive The ability of electric snowmobiles to deliver high performance with minimal environmental impact positions them as a critical component in the future of winter sports and utility operations, ensuring sustained growth in the years ahead.

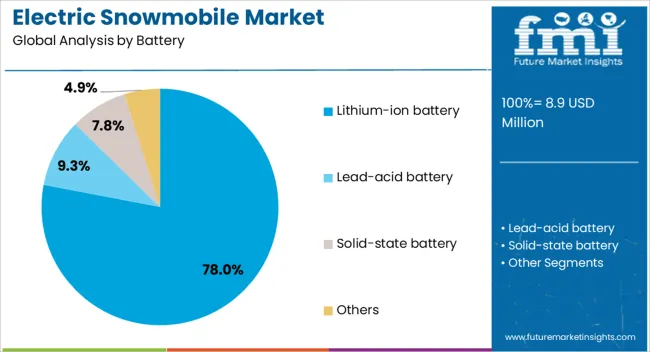

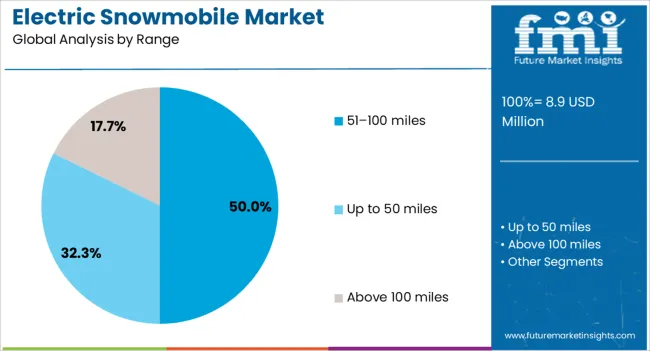

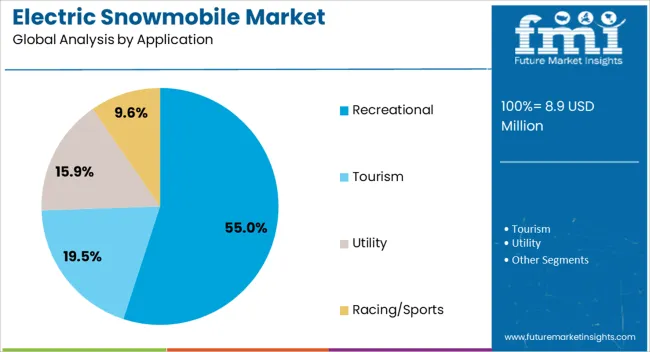

The electric snowmobile market is segmented by battery, range, application, seating capacity, sales channel, and geographic regions. By battery, electric snowmobile market is divided into lithium-ion battery, lead-acid battery, solid-state battery, and others. In terms of range, electric snowmobile market is classified into 51–100 miles, up to 50 miles, and above 100 miles. Based on application, electric snowmobile market is segmented into recreational, tourism, utility, and racing/sports. By seating capacity, electric snowmobile market is segmented into two-seater, single-seater, and multi-seater. By sales channel, electric snowmobile market is segmented into OEM (Direct Sales), aftermarket/dealers, and online sales. Regionally, the electric snowmobile industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lithium-ion battery segment is projected to account for 78% of the market revenue share in 2025, making it the leading battery type. This dominance has been supported by the high energy density, lightweight construction, and longer lifecycle of lithium-ion batteries, which significantly enhance snowmobile performance and range. Their superior cold-weather reliability compared to alternative chemistries has positioned them as the preferred choice for both recreational and utility applications.The ability to support rapid charging and maintain consistent output in sub-zero conditions has further strengthened adoption. Manufacturers have been investing in advanced battery management systems that optimize performance and ensure safety under demanding winter conditions.The declining cost of lithium-ion technology, coupled with advancements in recyclability and sustainability, has also encouraged broader market penetration As consumers increasingly prioritize range, performance, and environmental considerations, lithium-ion batteries are expected to remain the dominant energy source for electric snowmobiles.

The 51–100 miles range segment is expected to hold 50% of the market revenue share in 2025, emerging as the leading range category. This range capacity offers an optimal balance between performance, weight, and cost, making it suitable for the majority of recreational and light utility applications. The segment’s popularity has been driven by its ability to meet most riders’ needs without significantly increasing battery size or cost. Advancements in battery efficiency, regenerative braking systems, and optimized power management have made it possible to achieve reliable performance within this range category. The appeal is further enhanced by reduced charging times and compatibility with existing charging infrastructure in snowmobile-accessible regions. Additionally, this range supports extended recreational use while ensuring minimal environmental impact, aligning with the market’s shift toward sustainable winter sports solutions Manufacturers are continuing to refine this range category to provide even greater efficiency and value, reinforcing its leading position in the market.

The recreational segment is projected to command 55% of the market revenue share in 2025, maintaining its dominance as the primary application category. The growth of this segment has been fueled by the rising popularity of winter tourism, snow sports, and outdoor leisure activities. Increasing disposable incomes, coupled with a growing preference for eco-friendly recreational options, have led to greater adoption of electric snowmobiles for leisure use. The quiet operation, lower maintenance requirements, and zero emissions of electric snowmobiles have enhanced their appeal among recreational users. Manufacturers are tailoring product designs to deliver high performance, comfort, and style, catering to a wide range of skill levels and preferences. The integration of advanced features such as GPS navigation, mobile connectivity, and customizable ride modes has further enriched the recreational riding experience As environmental awareness and demand for sustainable tourism options continue to rise, the recreational segment is expected to sustain its leadership in the market.

The market has been influenced by technological progress, emission regulations, and growing interest in clean mobility for recreational and professional use in snow-dense regions. Traditional gasoline-powered snowmobiles have been increasingly replaced by battery-powered models offering reduced noise, lower emissions, and enhanced efficiency. The market has been reinforced by research into high-performance batteries, lightweight materials, and advanced drivetrain systems. Demand has been observed across tourism, sports, and utility applications, supported by regional policies and growing manufacturer investments in product innovation.

Government regulations addressing emission levels in sensitive snow-covered regions have been instrumental in shaping the adoption of electric snowmobiles. Traditional two-stroke and four-stroke engines have been linked with high emissions and environmental impact, driving stricter rules in national parks and protected areas. Electrified models have been promoted as cleaner alternatives, enabling reduced carbon output and enhanced environmental protection. In addition, noise restrictions have encouraged the adoption of quieter vehicles, making electric snowmobiles more suitable for both recreational and professional use. These factors have established regulatory frameworks as strong catalysts, creating a favorable environment for market expansion.

Technological improvements in lithium-ion batteries and battery management systems have played a crucial role in expanding the usability of electric snowmobiles. Challenges related to cold weather performance, range, and charging times have been gradually addressed through innovation in energy density, thermal management, and rapid charging solutions. Extended range and higher durability have enabled broader applications across long-distance recreational rides and demanding utility tasks such as patrolling and rescue operations. Continued advancements in solid-state battery development and modular battery swapping solutions are being researched to overcome range anxiety and improve operational practicality. These developments have made electric snowmobiles increasingly competitive with their gasoline counterparts.

Tourism and recreational activities have remained a dominant driver for electric snowmobile adoption. Winter resorts, tour operators, and sports enthusiasts have shown rising interest in electric alternatives due to their quiet operation, reduced operational costs, and suitability for use in environmentally protected landscapes. Electrified snowmobiles have also improved the visitor experience by offering smoother acceleration and reduced vibration. Operators of ski resorts and guided tours have increasingly adopted electric fleets to comply with environmental policies while enhancing customer satisfaction. These applications have highlighted the role of electric snowmobiles as a preferred choice for eco-conscious tourism markets in snow-intensive geographies.

The adoption of electric snowmobiles has been accelerated through collaborations between manufacturers, charging infrastructure providers, and local authorities. Investments have been directed toward the establishment of charging networks in ski resorts, mountain trails, and rural areas to improve operational convenience. Partnerships between OEMs and battery technology firms have resulted in optimized vehicle designs capable of handling extreme weather. Public-private initiatives have also supported pilot projects for fleet electrification, particularly for rescue, patrolling, and tourism applications. Such collaborations have reinforced the ecosystem required for widespread adoption, ensuring that both recreational and professional users can transition seamlessly to electric snowmobiles.

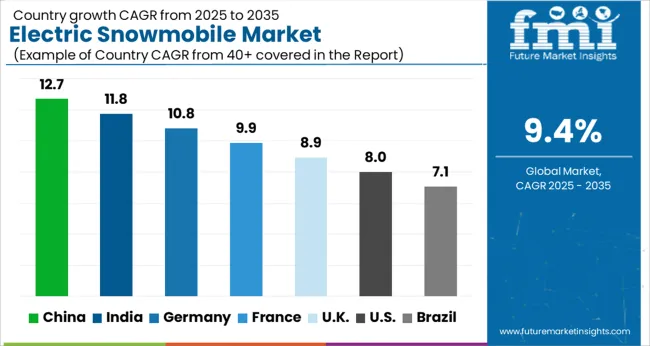

| Country | CAGR |

|---|---|

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| UK | 8.9% |

| USA | 8.0% |

| Brazil | 7.1% |

The market is forecasted to expand at a CAGR of 9.4% between 2025 and 2035, driven by emission-free mobility demand, advancements in battery technology, and government incentives for clean transport solutions. China, with a 12.7% CAGR, leads adoption through rapid development of electric recreational vehicles and large-scale manufacturing capabilities. India follows at 11.8%, supported by cost-effective production and growing consumer preference for sustainable mobility. Germany, at 10.8%, drives innovation with high-performance models and investments in research. The UK, growing at 8.9%, is experiencing adoption in tourism and recreational sectors, while the USA, at 8.0%, is advancing with increasing electrification of outdoor sports vehicles and infrastructure support. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is estimated to grow at a CAGR of 12.7%, influenced by increasing adoption of clean mobility solutions and government-backed incentives supporting electrification of recreational vehicles. Manufacturers are introducing advanced models with extended battery life, faster charging capability, and lightweight designs, catering to both tourism and sporting applications. Investments in electric mobility infrastructure, including charging networks in winter sports regions, are further promoting demand. Growing consumer preference for sustainable alternatives to gasoline-powered snowmobiles positions China as one of the most dynamic markets globally.

India’s market is projected to advance at a CAGR of 11.8%, driven by growing tourism in mountainous regions and a shift toward cleaner recreational mobility options. Although snowmobile usage is limited compared to Western countries, the increasing popularity of adventure tourism in northern states and government initiatives to promote electric vehicles create favorable conditions. Manufacturers are focusing on lightweight, durable designs to adapt to India’s terrain while integrating high-capacity batteries for longer usage. Collaborations with tourism operators are expanding access to electric snowmobiles in resorts and recreational hubs.

Germany is forecast to grow at a CAGR of 10.8%, supported by its strong commitment to low-emission mobility and winter sports culture. Adoption is being propelled by technological advancements in electric powertrains, improved charging networks, and strict emission regulations that encourage alternatives to gasoline-powered vehicles. Snowmobiles are increasingly used in alpine tourism, rescue operations, and sporting activities, creating multiple demand streams. Industry collaborations are also supporting innovation in design and performance, making electric models more attractive to both professional and recreational users.

The United Kingdom market is expected to expand at a CAGR of 8.9%, largely influenced by environmental regulations and increasing demand for electric recreational vehicles. Although snowmobile use is limited due to climate conditions, demand is emerging from tourism operators and sporting events abroad where British companies and travelers are active. Industry participants are also exploring partnerships with European ski resorts to provide electric models for sustainable tourism. Growing awareness of emission-free recreational activities supports gradual adoption in the UK market despite lower domestic usage.

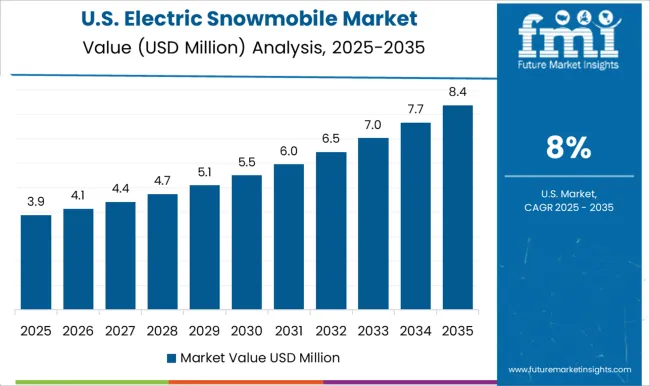

The United States market is projected to grow at a CAGR of 8.0%, with demand driven by the popularity of winter sports, strong outdoor tourism, and growing focus on low-emission alternatives. Manufacturers are introducing advanced models offering better speed, endurance, and efficiency to replace gasoline-powered snowmobiles. Regulatory support for electrification, combined with investments in charging stations in northern states and mountain resorts, is encouraging adoption. The market is also benefiting from increasing corporate investments in sustainable tourism infrastructure.

The market is witnessing transformation as established OEMs and emerging manufacturers compete to redefine winter mobility with advanced electrified models. Leading companies such as BRP with its Ski-Doo and Lynx brands, Polaris, Yamaha, and Arctic Cat are leveraging decades of engineering expertise to adapt their snowmobile portfolios toward electrification. These players are integrating efficient battery systems, high-torque motors, and durable chassis designs to ensure performance remains consistent in challenging terrains and cold climates. Their strong distribution networks, loyal customer base, and ability to scale production give them a strategic advantage in shaping adoption across recreational, utility, and tourism applications. Alongside these legacy powersport manufacturers, niche electric-focused companies such as Taiga Motors and other specialized startups are gaining traction with innovative designs that emphasize efficiency, lightweight construction, and sustainability.

These entrants often target markets that require silent and low-emission operations, such as national parks, Arctic research facilities, and eco-sensitive tourism regions. Their agility in product development and focus on emerging demand gaps enable them to compete against larger incumbents by offering unique value propositions. The convergence of innovation from startups and investment from traditional OEMs is fostering a dynamic competitive landscape, where product differentiation, charging solutions, and operational range are becoming primary success factors. This broad spectrum of competition is expected to accelerate overall market maturity.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 million |

| Battery | Lithium-ion battery, Lead-acid battery, Solid-state battery, and Others |

| Range | 51–100 miles, Up to 50 miles, and Above 100 miles |

| Application | Recreational, Tourism, Utility, and Racing/Sports |

| Seating Capacity | Two-seater, Single-seater, and Multi-seater |

| Sales Channel | OEM (Direct Sales), Aftermarket/dealers, and Online sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Taiga Motors (leading electric-niche OEM estimate), BRP (Ski-Doo / Lynx), Polaris, Yamaha, Arctic Cat, and Other OEMs / startups |

| Additional Attributes | Dollar sales by snowmobile type and power rating, demand dynamics across recreational, tourism, and utility sectors, regional trends in winter mobility adoption, innovation in battery performance, lightweight materials, and drivetrain efficiency, environmental impact of emissions reduction and battery recycling, and emerging use cases in eco-tourism, rescue operations, and remote transport solutions. |

The global electric snowmobile market is estimated to be valued at USD 8.9 million in 2025.

The market size for the electric snowmobile market is projected to reach USD 21.9 million by 2035.

The electric snowmobile market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in electric snowmobile market are lithium-ion battery, lead-acid battery, solid-state battery and others.

In terms of range, 51–100 miles segment to command 50.0% share in the electric snowmobile market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA