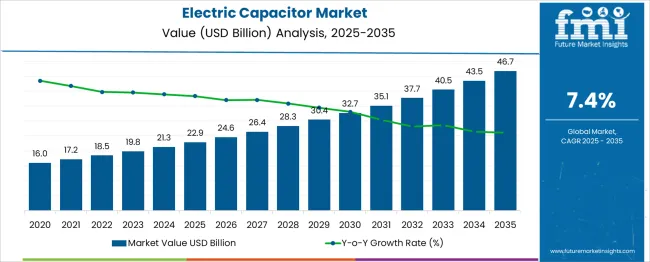

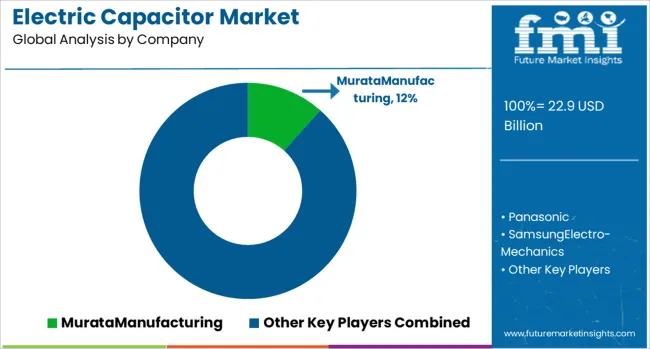

The Electric Capacitor Market is estimated to be valued at USD 22.9 billion in 2025 and is projected to reach USD 46.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. This early-phase growth is driven by increasing demand for capacitors in sectors such as electronics, automotive, and renewable energy, alongside advances in energy storage solutions and power electronics. The market will benefit from the growing adoption of electric vehicles (EVs), renewable energy systems, and advancements in smart grid technologies. The second half (2030–2035) will contribute USD 12.3 billion, representing 56.4% of the total growth, driven by further penetration in consumer electronics, industrial automation, and energy-efficient systems. Annual increments average USD 2.5 billion per year in the second phase, reflecting accelerating growth in high-capacitance, high-performance electric capacitors for power conversion, storage, and electric grid applications. Manufacturers focusing on environmentally friendly, compact, and high-capacity solutions will capture the largest share of this USD 22.7 billion growth opportunity as the market continues to evolve in line with global electrification and sustainability trends.

| Metric | Value |

|---|---|

| Electric Capacitor Market Estimated Value in (2025 E) | USD 22.9 billion |

| Electric Capacitor Market Forecast Value in (2035 F) | USD 46.7 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The electric capacitor market is witnessing substantial expansion owing to the growing integration of capacitors in electronic devices, electric vehicles, and power systems. As digital transformation accelerates across industries, the demand for compact, efficient, and high-performance capacitors has grown significantly.

Ceramic, film, and electrolytic capacitors are being utilized across a wide range of voltage and frequency applications, driven by the need for energy storage, signal filtering, and power conditioning in devices ranging from smartphones to electric powertrains. The shift toward renewable energy, 5G infrastructure, and IoT-enabled systems is pushing manufacturers to innovate with dielectric materials and software-controlled capacitor banks.

Moreover, the surge in consumer electronics manufacturing, particularly in Asia Pacific, coupled with the automotive industry's transition to electrification, is expected to sustain market growth in the long term. Regulatory trends promoting energy efficiency and the need for robust grid systems are further elevating the relevance of capacitors in next-generation electronic ecosystems.

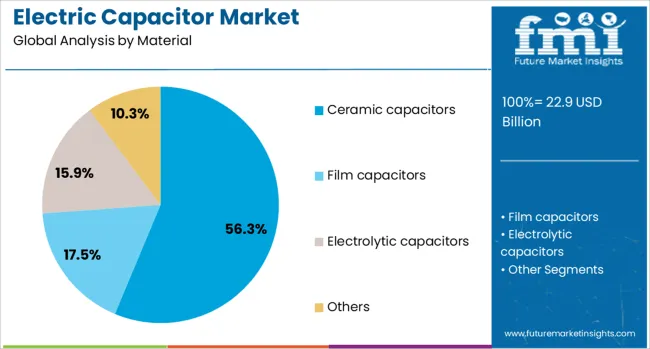

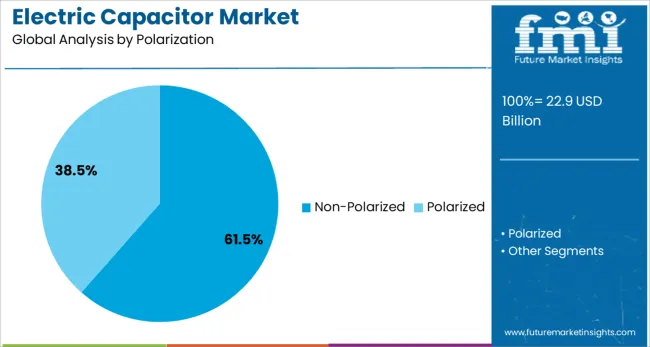

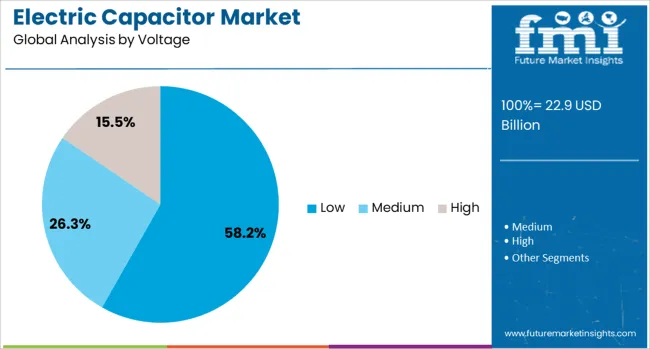

The electric capacitor market is segmented by material, polarization, voltage, end use, and geographic regions. By material, the electric capacitor market is divided into Ceramic capacitors, Film capacitors, Electrolytic capacitors, and Others. In terms of polarization, the electric capacitor market is classified into Non-Polarized and Polarized. Based on the voltage of the electric capacitor, the market is segmented into Low, Medium, and High. The end use of the electric capacitor market is segmented into Consumer electronics, Automotive, Communications & technology, Transmission & Distribution, and Others. Regionally, the electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ceramic capacitors are projected to hold 56.3% of the revenue share in the electric capacitor market in 2025, making them the most widely adopted material type. Their dominance has been attributed to their superior frequency response, high dielectric constant, and low equivalent series resistance, which have made them indispensable in compact and high-speed electronic circuits.

These capacitors have been widely used in consumer electronics, industrial automation systems, and communication infrastructure due to their reliability under thermal stress and ability to perform across a broad range of frequencies. Their miniaturization capabilities have supported the evolution of surface-mounted technology in devices such as smartphones, tablets, and medical electronics.

The use of multilayer ceramic configurations has further enabled space-efficient designs in complex circuit boards. As demand for high-density passive components rises in advanced semiconductors and autonomous mobility systems, ceramic capacitors have continued to meet performance, scalability, and cost-efficiency requirements across global manufacturing ecosystems.

Non-polarized capacitors are expected to account for 61.5% of the electric capacitor market's revenue share in 2025, reflecting their leading role in versatile AC and signal-processing applications. Their ability to function without polarity alignment has made them a preferred choice in alternating current systems and timing circuits, offering design flexibility and enhanced safety.

Non-polarized capacitors have been widely integrated into lighting systems, audio equipment, motor run circuits, and electric power conditioning units due to their consistent impedance characteristics. Their compatibility with bidirectional current flow and minimal leakage current has supported deployment in environments where stable operation and longevity are essential.

The use of non-polarized designs has also been aligned with evolving circuit protection standards and miniaturized board layouts in smart devices. As demand increases for capacitors that can support a wide range of voltage fluctuations and frequency ranges without risk of damage or performance degradation, the relevance of non-polarized capacitors has been firmly established.

The low voltage segment is anticipated to represent 58.2% of the total revenue share in the electric capacitor market by 2025, driven by the widespread use of low-voltage systems in consumer electronics, wearable devices, and LED lighting. The proliferation of portable electronic gadgets and compact embedded systems has accelerated the demand for capacitors that can operate efficiently at lower voltage thresholds while ensuring high reliability and long service life.

Low voltage capacitors have been adopted in battery-operated devices, power supply modules, and microcontroller circuits due to their energy efficiency and quick charge-discharge cycles. Their small size, affordability, and ease of integration have further strengthened their role in the miniaturization trend dominating modern electronic designs.

The growth of edge computing, personal healthcare electronics, and home automation has expanded the application scope for low voltage capacitors. As electronic designs continue to emphasize reduced power consumption and form factor, this segment is expected to remain vital in shaping next-generation component ecosystems.

The electric capacitor market is experiencing growth driven by the increasing demand for energy-efficient electronic devices. The growing adoption of electric vehicles (EVs) and renewable energy systems is fueling this demand. Opportunities lie in the expanding use of capacitors in energy storage solutions and power electronics. However, high material costs and technological complexities in capacitor manufacturing present significant challenges. The market will likely continue to evolve with increased emphasis on miniaturization, leading to better performance and energy efficiency.

The major growth driver in the electric capacitor market is the rising demand for energy-efficient and compact electronic devices. In 2024, advancements in consumer electronics and electric vehicle adoption significantly boost the need for high-performance capacitors. By 2025, as energy-saving technologies continue to dominate, the electric capacitor market is expected to expand, particularly in sectors such as telecommunications and power systems, where energy storage and power management are critical to performance.

The electric capacitor market presents significant opportunities in the renewable energy and electric vehicle sectors. With the increasing global shift towards renewable energy sources and the expansion of electric vehicle adoption, capacitors are integral to energy storage solutions and power regulation. As of 2024, capacitors are expected to play a pivotal role in the development of energy-efficient power electronics used in EVs and solar inverters, with the market expanding through 2025 as demand for clean energy rises.

Emerging trends in the electric capacitor market include miniaturization and enhanced performance characteristics. By 2025, capacitors will continue to evolve to meet the demands of smaller, more efficient electronic devices and power systems. These components are expected to become smaller, more powerful, and capable of delivering higher energy storage capabilities, especially as industries demand capacitors with faster charge/discharge rates and improved reliability for applications in EVs, consumer electronics, and power grids.

One major market restraint in the electric capacitor sector is the high cost of raw materials. In 2024, the rising prices of essential materials, such as tantalum and aluminum, impact the production costs of capacitors. This, in turn, leads to higher pricing for capacitors, making them less accessible in price-sensitive sectors. Additionally, the complexities involved in manufacturing advanced capacitors with specific performance characteristics may hinder widespread adoption, especially in emerging markets.

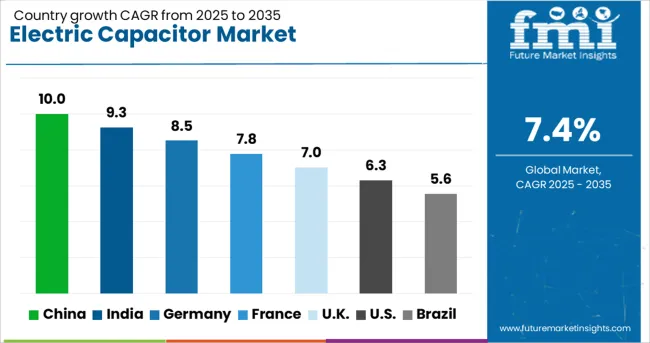

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

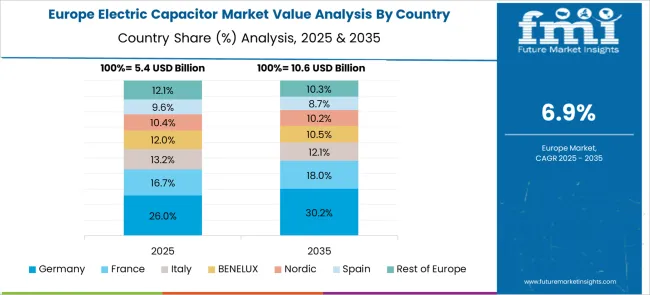

The global electric capacitor market is projected to grow at a 7.4% CAGR from 2025 to 2035. China leads with a growth rate of 10.0%, followed by India at 9.3%, and Germany at 8.5%. The United Kingdom records a growth rate of 7.0%, while the United States shows the slowest growth at 6.3%. These differences in growth rates are driven by factors such as increasing demand for capacitors in electronics, automotive, and renewable energy sectors, and regional advancements in technology and manufacturing. While China and India are witnessing strong growth due to rapid industrialization and expanding electronics and renewable energy markets, more mature markets like the USA and the UK show steady growth driven by established demand and technological advancements. This report includes insights on 40+ countries; the top markets are shown here for reference.

The electric capacitor market in China is growing rapidly, with a projected CAGR of 10.0%. China’s large manufacturing base, particularly in electronics, automotive, and renewable energy sectors, is driving the demand for capacitors. The country’s ongoing industrial expansion and the push for electric vehicles (EVs) and renewable energy integration are key growth factors. Furthermore, the government’s focus on advancing electronic technology and energy-efficient solutions is boosting the adoption of electric capacitors across various industries. With China being a major global supplier of electronic components, it remains the leader in the electric capacitor market.

The electric capacitor market in India is projected to grow at a CAGR of 9.3%. India’s growing manufacturing sector, particularly in consumer electronics, automotive, and renewable energy, is driving the demand for capacitors. The increasing adoption of electric vehicles and smart grid technologies, alongside the expansion of the country’s electronics industry, is significantly contributing to market growth. Additionally, the government’s push for sustainable energy solutions and the growth of the solar power sector are further accelerating the demand for electric capacitors, making India a key market in the Asia-Pacific region.

The electric capacitor market in Germany is projected to grow at a CAGR of 8.5%. As one of Europe’s industrial powerhouses, Germany has a strong demand for capacitors across various sectors, including automotive, industrial automation, and renewable energy. The country’s push toward electric vehicles, energy efficiency, and smart manufacturing technologies is contributing to market expansion. Germany’s leadership in automotive manufacturing, particularly in electric and hybrid vehicles, is a significant driver for electric capacitor adoption. The market is also benefiting from increasing investments in renewable energy projects and smart grids, which further support the growth of electric capacitors.

The electric capacitor market in the United Kingdom is projected to grow at a CAGR of 7.0%. The UK is experiencing steady demand for capacitors, driven by increasing investments in electric vehicles, renewable energy, and energy-efficient technologies. The country’s growing focus on reducing carbon emissions and expanding renewable energy capacity further contributes to market growth. The demand for capacitors in the automotive and telecommunications sectors is also rising, as advanced electronic systems become more prevalent. While the market is more mature, consistent demand from these sectors ensures stable growth over the forecast period.

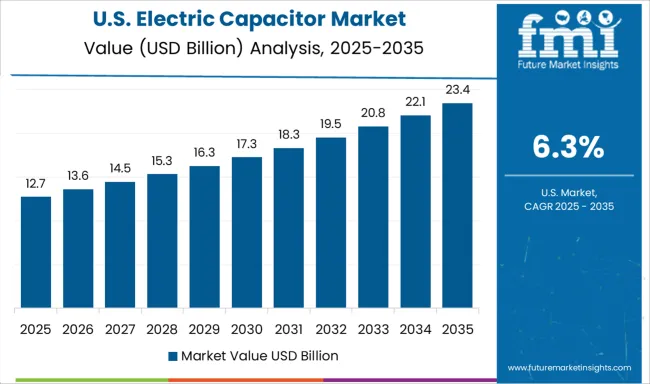

The electric capacitor market in the United States is expected to grow at a CAGR of 6.3%. While the USA market is mature, steady demand for capacitors continues, particularly in the automotive, electronics, and energy sectors. The growing adoption of electric vehicles, coupled with increasing investments in energy-efficient solutions and renewable energy, is expected to drive continued market growth. The USA remains a key player in the global market, with significant demand for high-performance capacitors in electronics, telecommunications, and power management applications. However, growth is slower compared to emerging markets due to market saturation.

Major players such as ABB, Siemens, Schneider Electric, Kemet, Murata, Panasonic, Samsung Electro-Mechanics, TDK, Vishay, Cornell Dubilier, and Elna compete globally by adopting strategies tailored to product categories and end-use applications. Kemet, supported by Yageo, has built its presence through a wide portfolio ranging from ceramic to supercapacitors, strengthened by acquisitions and consistent investment in high-temperature and high-voltage designs. Mersen has reinforced its positioning in high-performance applications through acquisitions in specialized capacitor production, complementing its broader electrical component expertise. Rubycon continues to focus on electrolytic and film capacitors, leveraging extensive Japanese manufacturing and regional supply capabilities to deliver efficiency and scale.

In the supercapacitor space, Skeleton Technologies has differentiated itself with graphene-based ultracapacitors, targeting energy recovery systems, grid storage, and automotive sectors while scaling production through new facilities. Nippon Chemi-Con and Nichicon are investing in hybrid polymer-aluminum electrolytic capacitors that combine the benefits of electrolytic and polymer technologies, offering compact, high-reliability solutions that address growing demands from automotive and industrial electronics. Panasonic, Samsung Electro-Mechanics, and TDK maintain a competitive edge through global scale, strong R&D pipelines, and integration of capacitors into larger component ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.9 Billion |

| Material | Ceramic capacitors, Film capacitors, Electrolytic capacitors, and Others |

| Polarization | Non-Polarized and Polarized |

| Voltage | Low, Medium, and High |

| End Use | Consumer electronics, Automotive, Communications & technology, Transmission & Distribution, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MurataManufacturing, Panasonic, SamsungElectro-Mechanics, TDK, VishayIntertechnology, KyoceraAVXComponents, Siemens, SchneiderElectric, ABB, Kemet, CornellDubilier, TaiyoYuden, Elna, Wima, XuansnCapacitor, and HavellsIndia |

| Additional Attributes | Dollar sales by capacitor type and application, demand dynamics across automotive, consumer electronics, and industrial sectors, regional trends in electric capacitor adoption, innovation in high-capacitance and energy-efficient designs, impact of regulatory standards on safety and performance, and emerging use cases in renewable energy systems and electric vehicles. |

The global electric capacitor market is estimated to be valued at USD 22.9 billion in 2025.

The market size for the electric capacitor market is projected to reach USD 46.7 billion by 2035.

The electric capacitor market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in electric capacitor market are ceramic capacitors, film capacitors, electrolytic capacitors and others.

In terms of polarization, non-polarized segment to command 61.5% share in the electric capacitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polarized Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Non-Polarized Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA